Gold's Summer Rally Includes Centerra Gold

HUI Gold Bugs index is up +40% since the end of May.

Centerra Gold is a low-cost producer with a strong balance sheet.

Risk factors that weighed on the stock are vanishing.

August Comex gold (GLD) hit a new high last week at $1,454. Below is a chart of the HUI gold bugs index. The index has crossed the 200-day MA and heading toward a break out that I show with the red line. So far this summer rally in gold stocks has the HUI up +40%. The most important observation on this chart is that the 200-day MA has turned up and the break above it is quite large. The (GDXJ) has a similar gain.

Centerra Gold (OTCPK:CAGDF) Recent Price $8.35

Shares outstanding 293 million, Market cap US$2.45 billion

I like Centerra for a number of reasons. They have low-cost production, strong cash flow, good balance sheet and have a strong growth profile. Construction on their new Oksut mine is 49% complete and they have another advanced project heading to production called Greenstone. The stock also has made a technical break out.

Centerra is a Canadian-based gold mining and exploration company engaged in the operation, exploration, development and acquisition of gold properties in North America, Asia and other markets worldwide. With two flagship assets, the Mount Milligan Mine, Canada and the Kumtor Mine, Kyrgyz Rebublic, Centerra's vision is to build a team-based culture of excellence that responsibly delivers sustainable value and growth. Their objective is to build shareholder value by maximizing the potential of current properties and leveraging their financial strength and experience to acquire new long-life, low-cost projects.

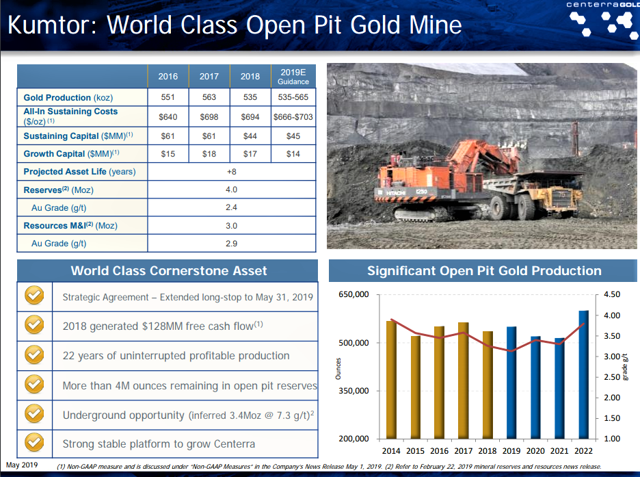

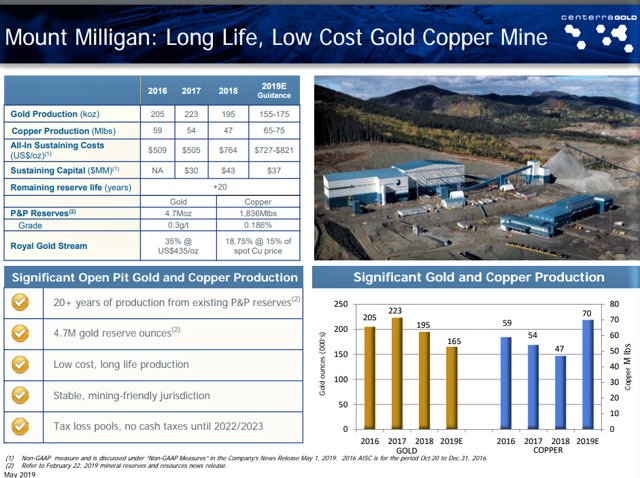

I will use a couple slides from their presentation to highlight their two main assets. Kumtor is producing around 550,00 ounces per year at $390/oz AISC and Mount Milligan is producing around 165,000 ounces gold per year at $770 per ounce AISC. Milligan also produces 70 million pounds copper per year.

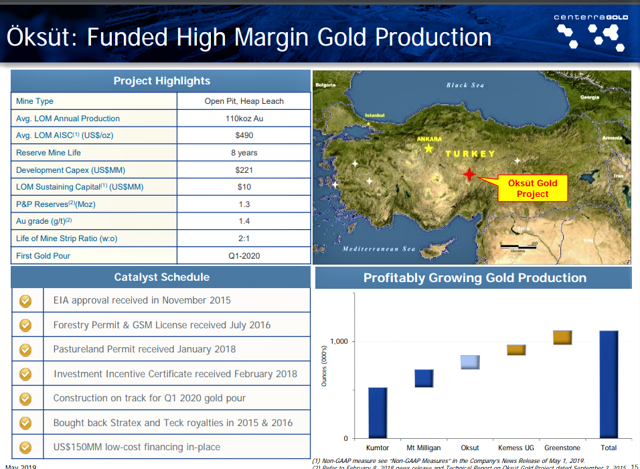

Their Oksut project in Turkey is funded to production and is projected to produce 110,000 ounces per year at a low cost of AISC $490 per ounce. Also note in the bottom right corner of the slide that highlights their growth profile to 1 million ounces per year production.

Their Greenstone project is a JV with Premier Gold and is one of Canada's largest undeveloped open pit gold mines. It's projected to produce 288,000 ounces per year at a low cost of $600 AISC per ounce. They have environmental approval and are progressing to a mine permit.

Centerra Gold Inc. had first quarter 2019 net earnings of $50.4 million or 17 cents per common share (basic) on revenues of $334.0 million. During the same period in 2018, the company reported net earnings of $9.0-million or three cents per common share (basic) on revenues of $235.4-million. Adjusted earnings in the first quarter of 2019 were $50.4 million or 17 cents per common share (basic), compared with $13.4 million or five cents per common share (basic) in the first quarter of 2018, which excludes charges relating to the acquisition of AuRico Metals Inc. All currency figures are in U.S. dollars.

Conclusion

Centerra has 14.2 million ounces of proven and probable gold reserves along with 2.465 billion pounds of copper. Plus they have an additional 11.338 million ounces gold in the measured and indicated category.

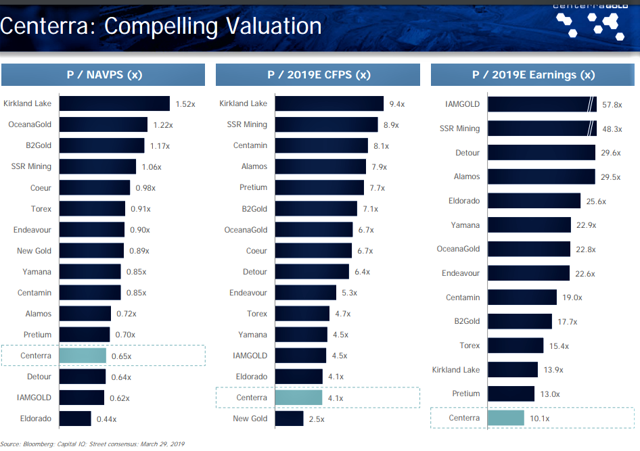

Centerra has about an equal amount of debt and cash so the enterprise value of their 14.2 million ounces gold reserves is US$175 per ounce and 25.5 million ounces of reserves and resources at only US$96 per ounce. I see the stock valuation as very inexpensive. Below is a slide form the presentation that makes very good comparisons to peers.

Centerra is projecting production in 2018 around 710,000 ounces of gold a $750 AISC per ounce. They also are projecting around 70 million pounds of copper production. The copper byproduct reduces the gold cost per ounce around $125 per ounce.

Risk Factors

There has been a couple risk factors that have weighed some on the stock. There's some geopolitical risk in Kyrgyzstan over a strategic agreement with the government, but an extension announced at the end of May for two months sounds positive. Centerra Gold agreed with the government of Kyrgyzstan to further extend the first "longstop" date under the strategic agreement for environmental protection and investment promotion previously entered into with the government on Sept. 11, 2017. The first longstop date is the date by which all conditions precedent to the completion of the strategic agreement are required to be satisfied and it has been extended from May 31, 2019, to July 31, 2019.

The processing rate at their Mount Milligan mine has been negatively affected because of insufficient water sources. At the end of February Centerra announced approvals for additional water licenses to obtain water for use in Mount Milligan's milling operation from Philip Lake 1, Rainbow Creek and Meadows Creek until Nov. 30, 2021, at rates that are protective of the environment. The company also will be permitted to access water from groundwater sources within a radius of six kilometers of the Mount Milligan mine for the life of the mine.

On the chart below I am using the C dollar trading price on the TSX as the stock trades much more volume there. The stock has built a long-term base since 2014, mostly between $5 and $8. It's positive that the stock has broken out above $8 and there was a bit of resistance around the 2017 high of $9. It has recently broke above $9 which is very positive and means a test of resistance just over $12 would be next. Positive news that could push through resistance, besides higher gold prices, would be a deal with the government of Kyrgyzstan. The company will probably have to prove that the water issue at Milligan is solved by showing the higher production levels.

Disclosure: I am/we are long CAGDF.

Follow Ron Struthers and get email alerts