Gloomy investors ignore the good news at Great Bear Resources and Osisko Metals

When it comes to resource stocks, John Kaiser believes investors are in capitulation mode. In his Tuesday Discovery Watch interview, Mr. Kaiser suggests that may be the overriding reason why Great Bear Resources (Mixed; GBR) and Osisko Metals (Sunny; OM) stocks seemed unimpressed with the good news from both companies over the past week.

Mr. Kaiser described a state of despondency hanging over the junior resource market. He has reviewed 1,400 Canadian resource companies and he believes the picture is quite distressing.

Companies that had good projects going, good stories, they all have a ski slope heading down, it doesn't look like a bottom.

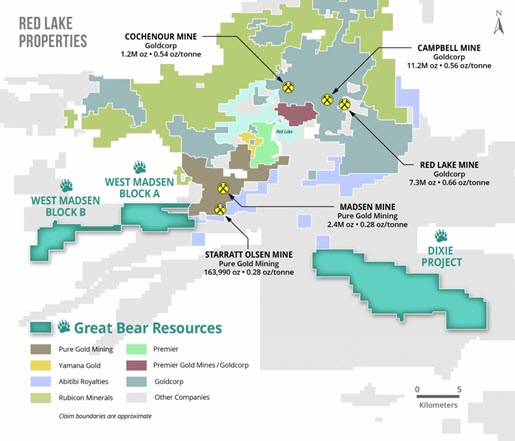

While not all junior mining companies are facing an avalanche of doom, none seem to be escaping the malaise hanging over the junior market. Great Bear Resources stock fell 12.5% Tuesday after it released the results from 19 holes totalling 4,290 meters at its Dixie project in Ontario. Results included 27.36 g/t gold over 3.65 metres Including 153.73 g/t gold over 0.5 metres. However, Mr. Kaiser believes the setback in the market is simply due to the overall mood, investors selling believing they can probably buy it back cheaper. But Mr. Kaiser says the news was not negative in any sense. In terms of the project's future, he suggests:

It still remains having potential for developing a high-grade resource in the 1- to 2-million-ounce range

Mr. Kaiser also commented on the recent Osisko Metals December 6th resource estimate for its Pine Point lead-zinc deposit in the Northwest Territories which reported an inferred resource of 38.4 million tonnes grading 6.58% zinc equivalent. He estimates the resource has an average US$158 per tonne rock value which should be more than adequate for open pit mining. In contrast to the Great Bear experience, the stock advanced on the day, up 6.25%. However, it closed Tuesday at 54 cents, well below the 90-day high of 67 cents. Mr. Kaiser suggests the news is going in the right direction:

Last week's news release was an important step in establishing that they have about 6.5% zinc equivalent in 38.4 million tonnes. Their goal is to deliver 50 million tonnes of similar grade.

So, if Osisko Metals is delivering, why is the market not reacting more positively? In addition to the overall gloomy mood of investors, Mr. Kaiser muses that earlier flow through (FT) share financing may be a factor. On November 6th, the company closed a FT financing of 9,946,369 common shares at $0.75 apiece. Earlier on September 12th, the company closed a FT deal for 10,870,000 common shares at $0.92 per share.

For those speculators who do not believe we are the cusp of a global economic apocalypse, Mr. Kaiser believes Osisko Metals is an excellent bottom fishing opportunity.

Mr. Kaiser is also offering a bottom fishing opportunity of own, planning to reduce the annual price for full access to KaiserResearch.com which he explains in the interview.

INK Research or Canadian Insider is not affiliated with Kaiser Research. This article is provided as information and no compensation has been received from any third party.