Fortescue best positioned to weather industry disruption - report

Fortescue Metals (ASX: FMG) leads in an Australia-heavy Top 10 listing of companies based on leadership in 10 areas that matter the most to the mining sector, GlobalData says in a news release.

The company, the fourth biggest iron ore producer globally, is the mining company best positioned to take advantage of future disruption in the industry, according to GlobalData analysts.

The scores are based on overall technology, macroeconomic and sector-specific leadership in the ten key thematic areas developed by GlobalData.

Fortescue Metals is followed by several gold mining firms - U.S.-based Newmont (TSX: NGT; NYSE: NEM), Russia-based Polyus, South Africa's Gold Fields, Australia's Newcrest Mining and Canada's Kirkland Lake Gold (TSX: KL; NYSE: KL; ASX: KL).

Click here to view an interactive chart comparing company ratings across the 10 themes in question.

Fortescue Metals leads an Australia-heavy Top 10 based on GlobalData research. Credit: Fortescue Metals.

South African Gold Fields was also highly ranked in GlobalData's thematic scorecard, announcing new digitizing mines and renewable power operations projects.

On a scale of one to five, Australian companies received an average score of 3.7, with Fortescue leading the country's scorecard with 4.5.

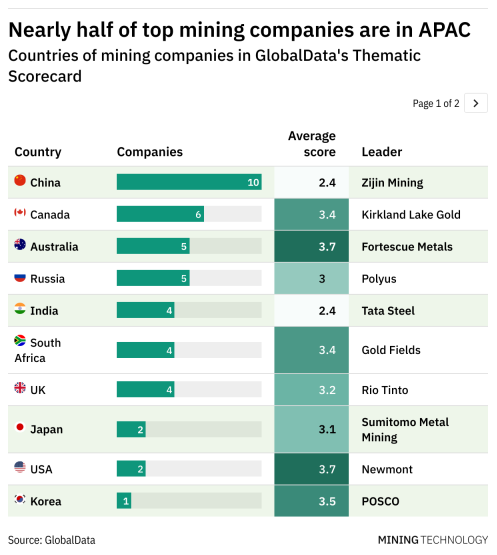

Australia also has one of the highest representations among top mining companies, being home to five out of 50 of the companies in the GlobalData analysis, only behind China and Canada. However, this number doesn't include multinational corporations such as Anglo-Australian Rio Tinto or companies that have significant operations in Australia, such as AngloGold Ashanti.

Overall, 44% of the top companies in the GlobalData thematic scorecard are from the Asia-Pacific region, including China.

In the case of Australia, where the five companies on the list shone brightest was the workplace safety theme, scoring an average of 4.4 out of five. Commodity markets and ESG, climate change, and capital raising were also among the most promising themes for Australian companies, while investment in lithium-ion batteries was below the scorecard average.

Companies based in other countries had their own strengths and weaknesses: Chinese corporations, for example, perform well on capital raising but poorly when it comes to climate change, while British companies are more ambitious when it comes to climate change and score well on commodity markets.

For the latter, Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO), for example, has benefited from the steep rise in iron ore prices over the last 12 months, and is looking to build its position in copper. The successful development of the Jadar project in Serbia would also improve its position in lithium-ion battery theme.

These scores are based on overall technology, macroeconomic and sector-specific leadership in 10 of the key themes that matter most to the mining industry and are generated by GlobalData analysts' assessments.