Fed Embraces Higher Inflation. Will It Embrace Gold, Too? / Commodities / Gold & Silver 2020

Fed adopts a new strategy that opens the door for higher inflation. The change is fundamentally positive for gold prices.

Fed adopts a new strategy that opens the door for higher inflation. The change is fundamentally positive for gold prices.

So, it happened! In line with market expectations, the Fed has changed its monetary policy framework into a more dovish one! This is something we warned our Readers in our last Fundamental Gold Report:

the Fed could change how it defines and achieves its inflation goal, trying, for example, to achieve its inflation target as an average over a longer time period rather than on an annual basis.

And it turned out that our worries were justified. On Thursday, the FOMC announced the approval of updates to its Statement on Longer-Run Goals and Monetary Policy Strategy. The change was timed for Fed Chairman Jerome Powell’s speech to the Jackson Hole economic symposium.

Generally speaking, the Fed declared that it will focus more on the job market and won't worry about higher inflation. This is because “a robust job market can be sustained without causing an unwelcome increase in inflation”,as Powell explained in his remarks discussing the policy shift.

Being more specific, the most significant changes to the framework document are:

•The Fed explicitly acknowledges the decline in the neutral interest rates and challenges for monetary policy in an environment of persistently low interest rates, in particular the effective lower bound. And, of course, these challenges will create excellent excuse to adopt even more dovish policies than currently implemented. After all, to overcome these challenges, the Fed is prepared to “use its full range of tools to achieve its maximum employment and price stability goals”,

•On maximum employment, the FOMC announced that its policy decision will be informed by the shortfalls rather than deviations of employment from its the maximum level. Oh boy, this is such a radical change! It means that the Fed will cease to worry about the overheating of the economy. In other words, the U.S. central bank drops the Philips curve. You see, in the past, the strong labor market meant that higher inflation could be just around the corner, which would be a reason to hike the federal funds rate. Now, the Fed could print money and ease its monetary stance like there’s no tomorrow! A great triumph of doves!

•And finally, on price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2 percent by noting that it “seeks to achieve inflation that averages 2 percent over time.” It means that after periods of inflation rates below the target, the Fed would accept inflation rates above the target! As the revised statement states “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.” It’s a great change (at least in rhetoric, as we doubt whether the Fed ever worried about inflation since Volcker left the U.S. central bank), as it means de facto adopting price-level targeting. Undershoots of inflation are not forgotten, but they are made up for later. Of course, we are yet to see whether the Fed will manage to trigger higher official inflation rates (as successfully as asset price inflation), but shift allows the Fed to ease its monetary policy even further and to implement its dovish bias even stronger!

Implications for Gold

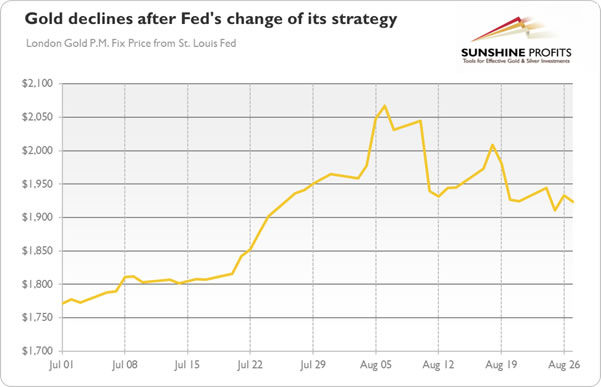

What does it all mean for the gold market? Well, the updated Fed’s strategy opens the door for easier monetary policy, ultra low interest rates for longer, and higher inflation. So, the shift is fundamentally positive for the gold prices. Actually, it could be the trigger that gold needed to continue its rally further north. However, the initial gold’s reaction has been negative (i.e., after a spike, there was a sharp reversal), as the chart below shows.

Of course, investors should remember that the updated strategy does not mean that we will see double-digit inflation tomorrow. The inflation has been under the Fed’s target for years, so it does not have to rise just because the Fed changed its monetary framework. And the FOMC wrote about inflation “moderately” above the target – yeah, we know that they couldn’t write otherwise, but we really doubt whether the Fed officials really want to see double-digit inflation rates.

However, as we have repeated many times, the current economic crisis is more inflationary that the Great Recession. The recent fast increase in the broad money supply increases the risk of higher inflation in the future. Now, the Fed’s announcement that it will welcome and embrace the rise in inflation, should increase inflation expectations, increasing the demand for gold as an inflation-hedge. Higher inflation expectations would also lower the real interest rates, also supporting the gold prices. Thank you, Mr. Powell!

Thank you for reading today’s free analysis. We hope youenjoyed it. If so, we would like to invite you to sign up for our free goldnewsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all ourpremium gold services, including our Gold & Silver Trading Alerts. Signup today!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.