Elliott Wave View: Gold Looking to break 2018 High

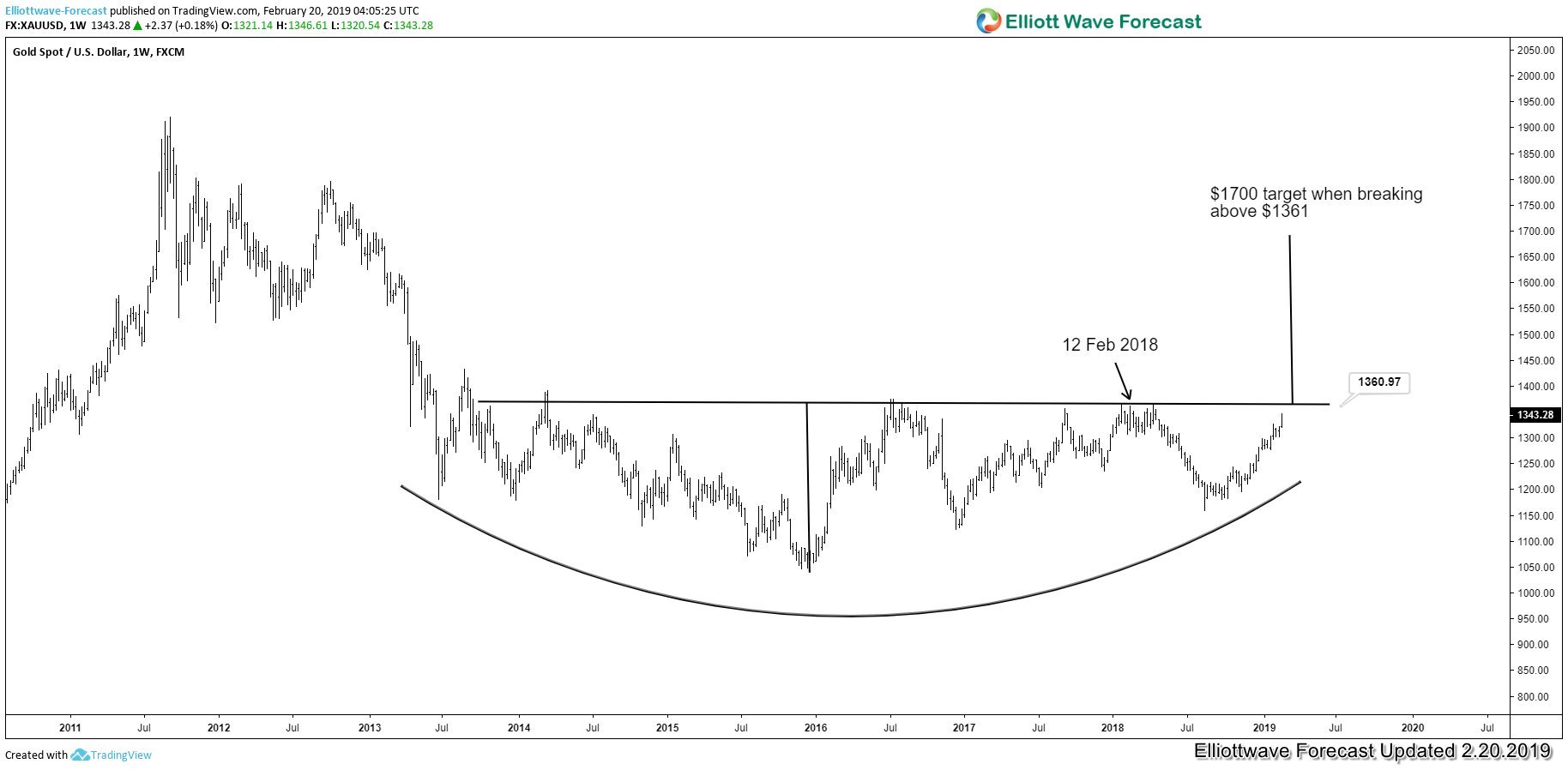

In our previous article, we have highlighted the possibility that Gold can quickly retest the high in 2018. The chart below shows the yellow metal has broken above a long term bearish channel from Sept 5, 2011 high. In addition, it has successfully closed above the ascending trend support from December 3, 2015 low.

We mention that the next logical swing target for the yellow metal is to retest 2018 high at $1360 area. This level has provided resistance for the past 5 years and thus is a significant level to watch. A decisive break and close above $1360 suggests a more bullish implication with next swing target to as high as $1700. The chart below shows the 5 year rounding bottom formation in Gold.

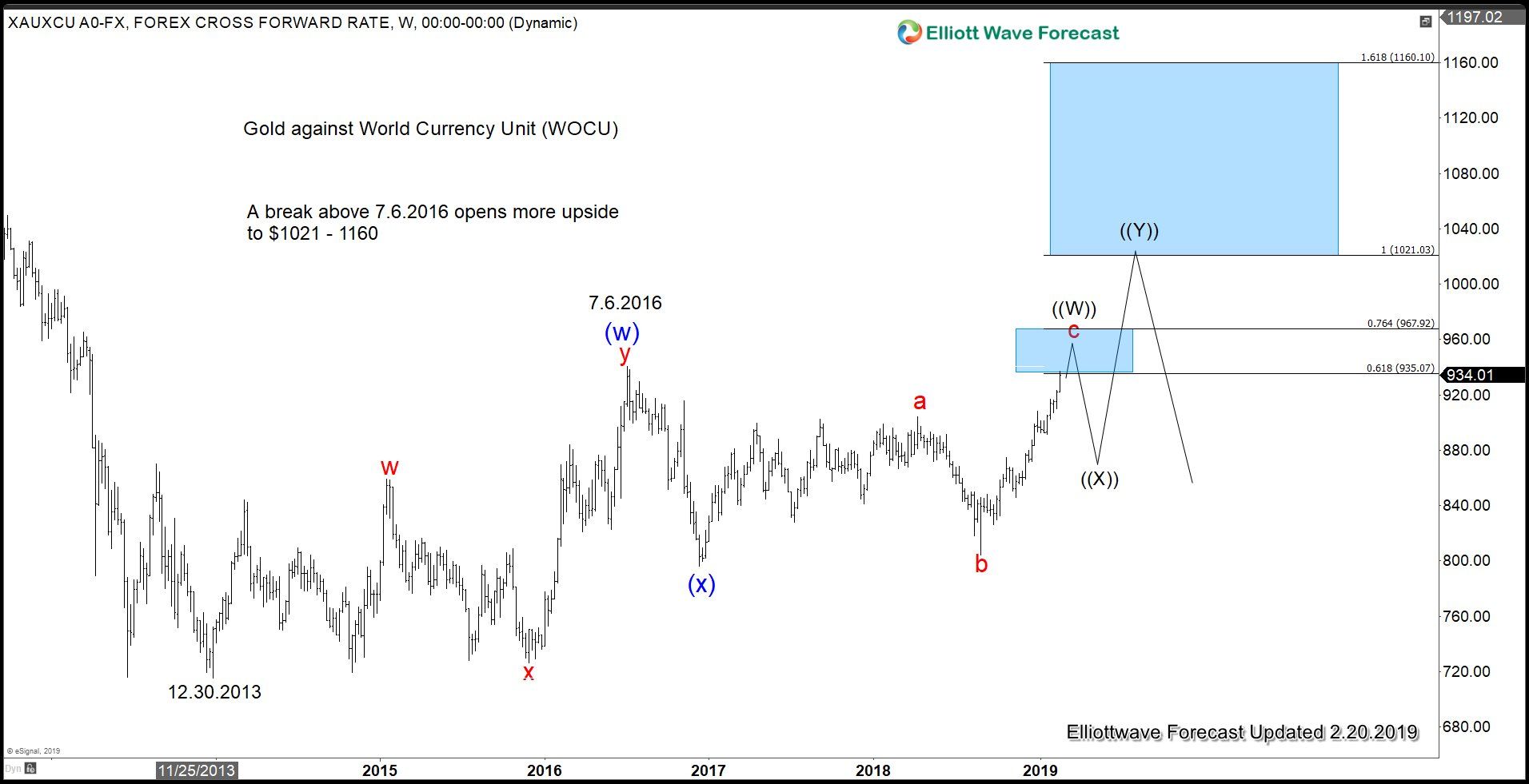

An Elliott Wave analysis of Gold against World Currency Unit (WOCU), a weighted basket of 20 fiat currency pairs covering top 20 world economies, also suggests a breakout.

In the chart above, a break above 7.6.2016 high will create 5 swing bullish sequence from 12.30.2013 low and opens up more upside to $1021 – $1160 area.

Gold 1 Hour Elliott Wave Chart

In this article, we will look at the short term 1 hour chart for Gold. The rally from Aug 16, 2018 low is still in progress as an Elliott Wave Impulse structure. We propose the current rally is still within wave (3) from Aug 16, 2018 low as momentum remains strong. Focusing on the shorter cycle, the rally from 1/21/2019 low ($1276.40) is unfolding in 5 waves of lesser degree. Wave ((i)) ended at $1326.30 and wave ((ii)) ended at $1302.16. Wave ((iii)) remains in progress and while short term pullback stays above $1302.11, expect Gold still to extend higher. Caution is warranted once Gold does retest $1360 as this level provides resistance in the past 5 years. We expect the 5 waves up from Aug 16, 2018 low to end between $1360 – $1400.

Become a Successful Trader and Master Elliott Wave like a Pro. Start your Free 14 Day Trial at - Elliott Wave Forecast.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITYAND LIABILITYTrading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk.However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level ofxperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal,analysis, or content.Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted onthe website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s).In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else.Please understand and accept the risk involved when making any trading and/or investment decision.UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization.UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one yearsubscription to our Premium Plus Plan at $1,799.88 for EACH person or firmwho received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.