Downgraded Boeing Drags on Dow Futures

February's CPI met analyst expectations

February's CPI met analyst expectations

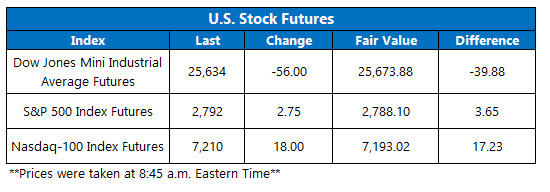

Dow Jones Industrial Average (DJI) futures are in the red this morning, under pressure once more from blue-chip heavyweight Boeing (BA). Not only did the aerospace name receive two downgrades on Wall Street this morning -- with DZ Bank issuing the stock's first "sell" ratings in nearly two years -- Malaysia, Singapore, and Australia joined the growing list of countries grounding the 737 MAX 8 aircraft. Futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are pointed cautiously higher, though, after data showed the U.S. consumer price index (CPI) rose 0.2% in February, on par with expectations.

Continue reading for more on today's market, including:

Schaeffer's Senior V.P. of Research Todd Salamone says a VIX close above this level could be a warning sign.Analysts called a top on this outperforming REIT.Why BMO downgraded Cronos Group.Plus, SFIX soaring after earnings beat; and two downgraded beverage stocks.

5 Things You Need to Know Today

The Chicago Board Options Exchange (CBOE) saw 1.04 million call contracts traded on Monday, compared to 594,619 put contracts. The single-session equity put/call ratio dropped to 0.57, and the 21-day moving average remained at 0.62. Stitch Fix Inc (NASDAQ:SFIX) stock is up 28.2% in electronic trading, after the company's fiscal second-quarter earnings and revenue surpassed expectations. The styling platform also upped its full-year guidance for 2019 on the back of an 18% jump in active clients. Five brokerages have issued price-target hikes this morning, including RBC to $52 from $39. Stitch Fix stock has a history of making big post-earnings moves, and has already added 58% year-to-date.The Coca-Cola Co (NYSE:KO) stock is down 0.8% ahead of the bell, after HSBC downgraded the Dow name to "hold" from "buy," while slashing its price target to $50 from $64. The analyst in coverage cited the company's weak guidance last month, which sent the stock gapping lower. The shares of Monster Beverage Corp (NASDAQ:MNST) are down 1.3% in electronic trading, after BMO slashed its outlook on the company to "market perform" from "outperform." The brokerage firm cited the stock's valuation as a cause for concern. MNST nabbed an annual high of $66.38 on Feb. 28, but has shed 4.1% already this month. The earnings calendar features Dick's Sporting Goods (DKS), Momo (MOMO), Overstock.com (OSTK), and Switch (SWCH).Trade Optimism Boosts Asia, Brexit Weighs on Europe

It was another positive session for Asian equities, with Chinese state media reporting on a phone call between U.S. trade representatives and Chinese Vice Premier Liu He overnight, again lifting hopes for a potential trade agreement. As such, China's Shanghai Composite rose 1.1%, and this was bested by a 1.5% gain in Hong Kong's Hang Seng. The Nikkei performed even better in Japan, closing with a 1.8% lead, and South Korea's Kospi added 0.9%.

Stocks in Europe are mostly in the red today. Traders are digesting news that British Prime Minister Theresa May has won support from the European Union for the most contentious parts of her Brexit deal, ahead of a vote in parliament today. London's FTSE 100 is up 0.2% so far, while France's CAC 40 is down 0.3%, and Germany's DAX is off 0.2%.