June 25, 2021

Which juniors have performed best under pressure?

Author - Ben McGregor

Gold near flat after big drop last week

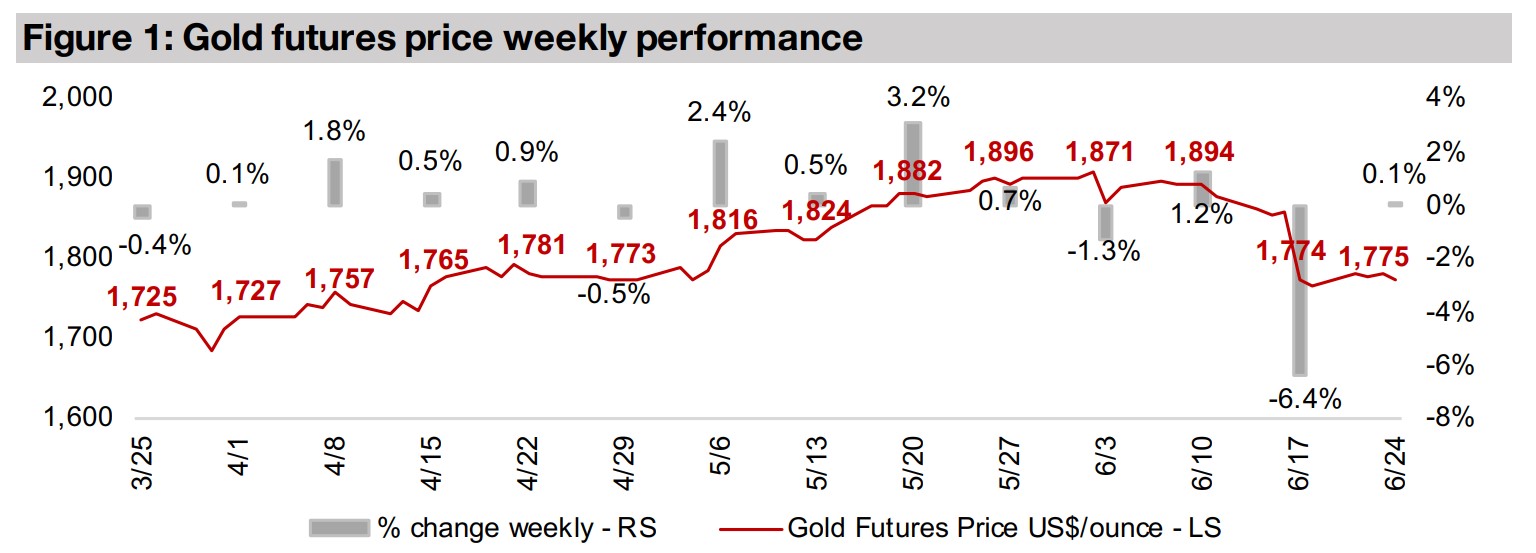

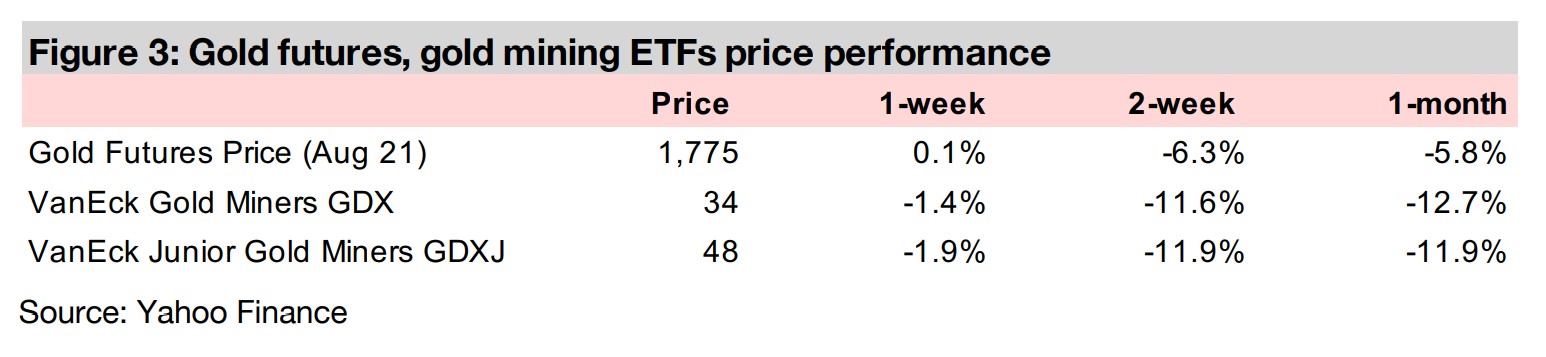

The gold price was near flat this week, up 0.1% to US$1,775/oz, after seeing a huge -6.4% decline last week, including one of its worst daily declines in history, on concerns of a taper of stimulus and rates hikes sooner than previously expected.

Decline in June of gold and other metals prices a test for juniors

This week we look at the performance of the gold, silver and base metal juniors in light of the decline in metals prices for June, with most of the hit from last week, to see which companies saw the largest declines, and which held up under pressure.

1) Putting last week's gold dip in context

Gold relatively flat after huge decline last week on taper and rate hike concerns

Gold was near flat this week, up 0.1% this week to US$1,775/oz, after huge -6.4%

drop in the previous week, including one of its worst single day drops ever. This was

driven by market concerns that between rising inflation and the conclusions from the

most Fed's most recent meeting that a taper of stimulus and then rate hates may be

becoming sooner than previously expected. However, comments from Fed board

members in recent weeks hardly suggest a particularly hawkish outlook, even as

many indicators, including inflation, employment and retail sales (see our last two

Weeklies for more on these indicators) point to an overheating economy.

There are unlikely to be any rate hikes until very late into 2022 at the earliest, and the

Fed is forecasting inflation of just 3.4% for this year and 2.1% for 2022, with the idea

that supply chain disruptions and a rebound off a low 2020 base have been critical in

driving the inflation rate, and both of these drivers should subside in the coming

months, leading to lower inflation. We are not so sure about this, and believe that it

is at least as much the massive monetary expansion unleashed by the Fed over the

past year that is responsible for the inflation spike than supply chains or the base

effect. We believe that the Fed may continue to 'play chicken' with inflation, which at

5.0% as of the most recent May 2021 data is already well over twice the Fed's 2.0%

mandate, that inflation could well continue to surprise to the upside. If it does, we are

likely to see gold once again pick-up.

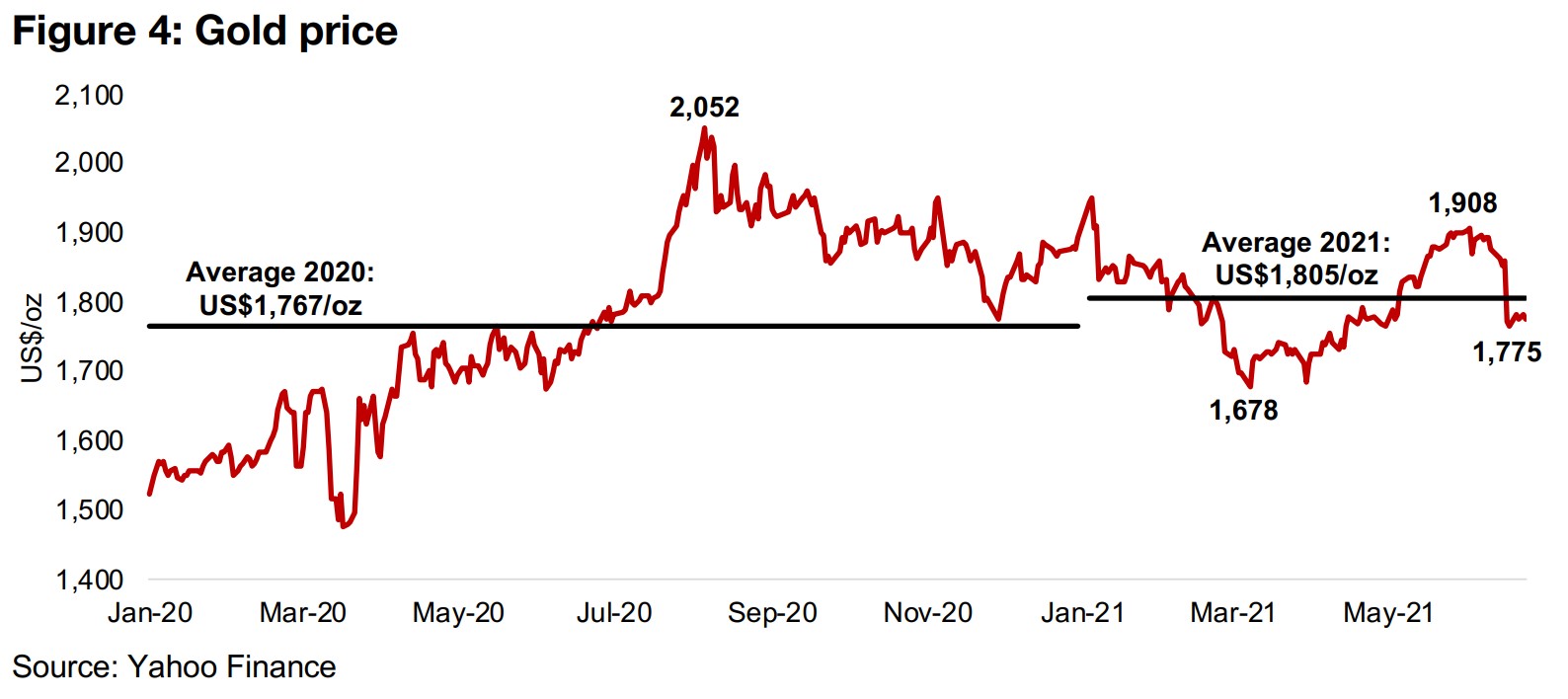

Gold just below 2021 average, and still above 2020 average after dip

Nonetheless, we could see how gold investors might be concerned by such an abrupt reversal in the past two weeks. In such a situation, it is probably a good time to pull back and consider the gold price in a more medium-term context, and it looks good in general. The price has dropped only moderately below the $1,805/oz average so far over 2021, and is still above the average of US$1,767/oz of 2020 (Figure 4), and far above the US$1,271/oz average of the gold bear market from 2013 to mid-2019. We could consider that the price has now settled around the reasonable and strong average since 2020-2021, and that the dip to a low of US$1,678/oz on March 8, 2021 and then the rise to US$1,908/oz June 2, 2021, may both have gotten away from the market's perception of a fair value for gold, to the downside and then to the upside.

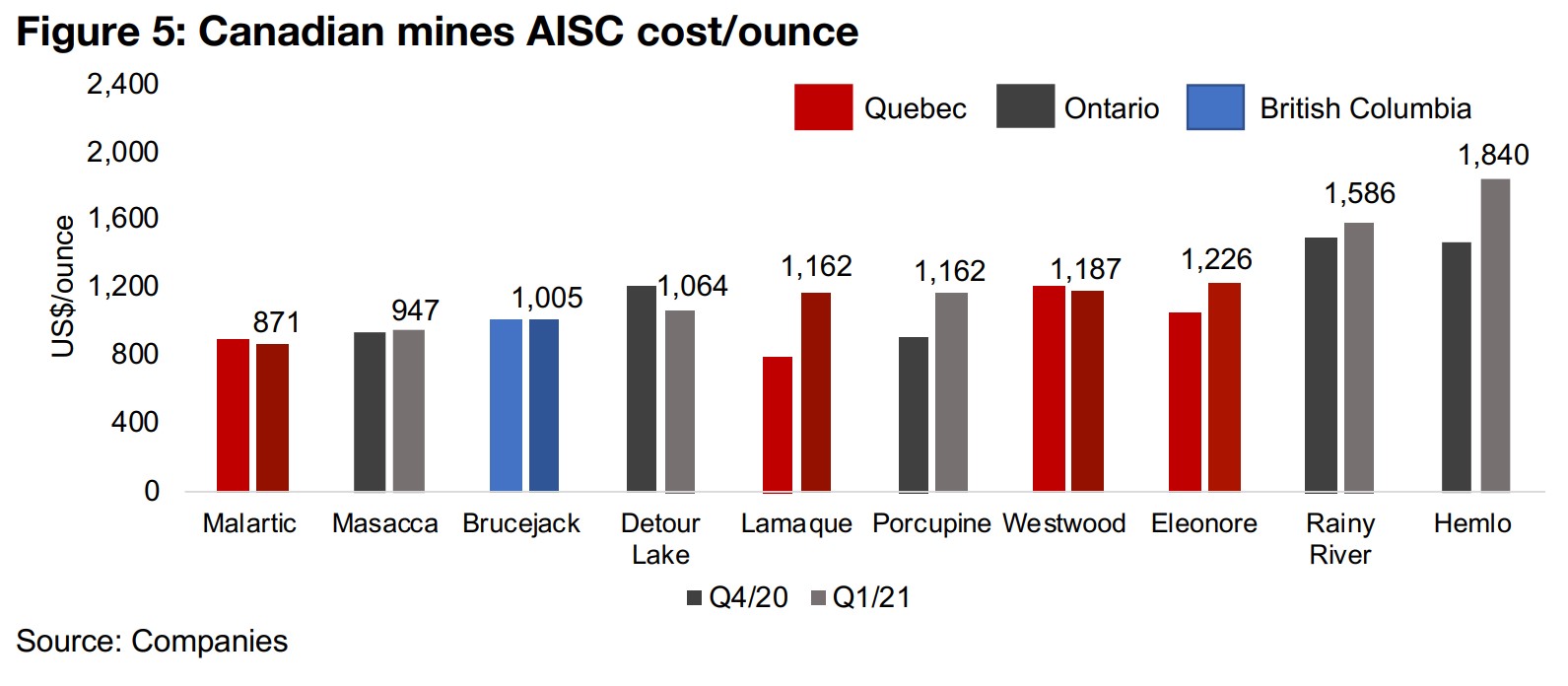

Gold price still well above major Canadian mine AISC costs

One key issue for the gold producers and developers, and the juniors that target one day advancing to production, is how high the gold price is versus the cost of production. For the major producing Canadian mines currently a gold price averaging $US1,787/oz puts all of them but one well above their US$/oz Au AISC costs, leaving the group still highly profitable overall. Also, we are not seeing any across the board major increase in costs for these mines quarter on quarter for the most recently reported Q1/21. However, we will need to see the Q2/21 figures to ensure that cost inflation has not risen significantly for the miners, as the big rise in inflation in the US CPI figures has been just over the past few months, and it is not clear that how much US inflation will transfer over to the cost of Canadian mines. Nonetheless, even with quite strong inflation, there would still be a substantial margin maintained for nearly all the major Canadian mines at average gold price of 2020-2021.

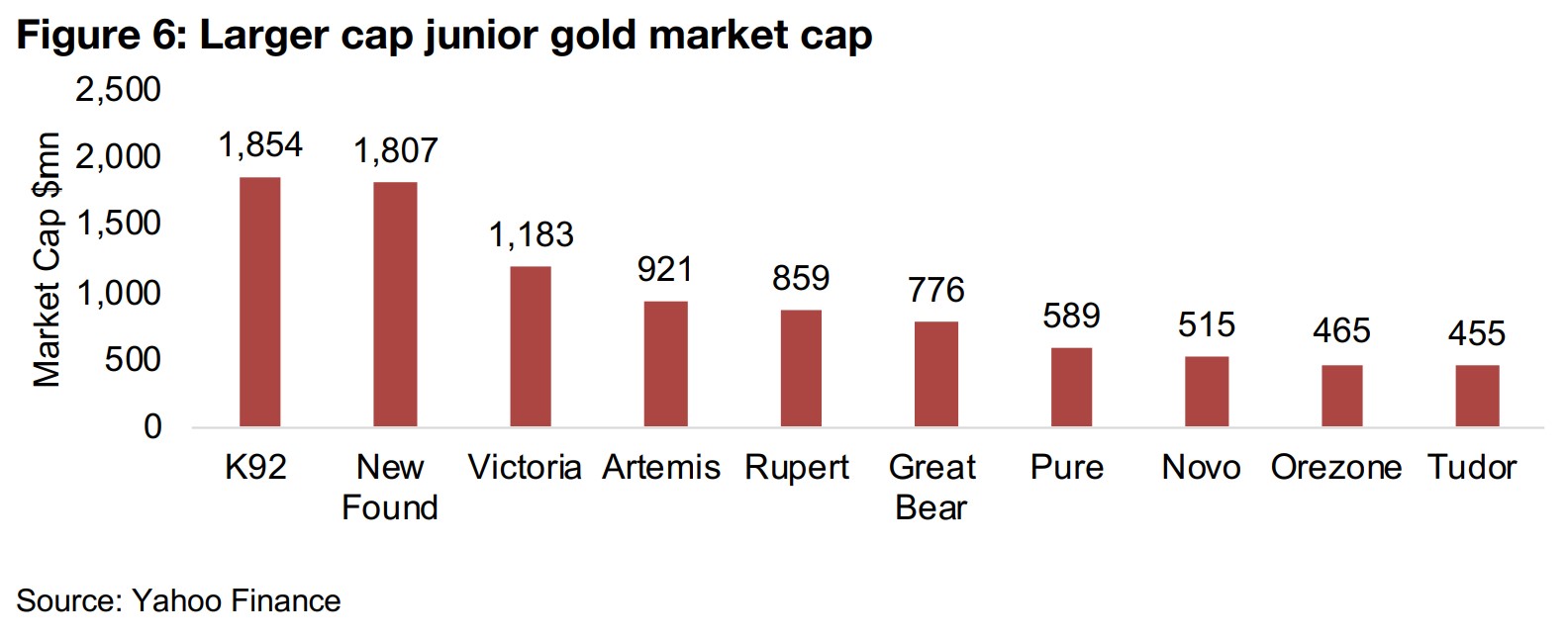

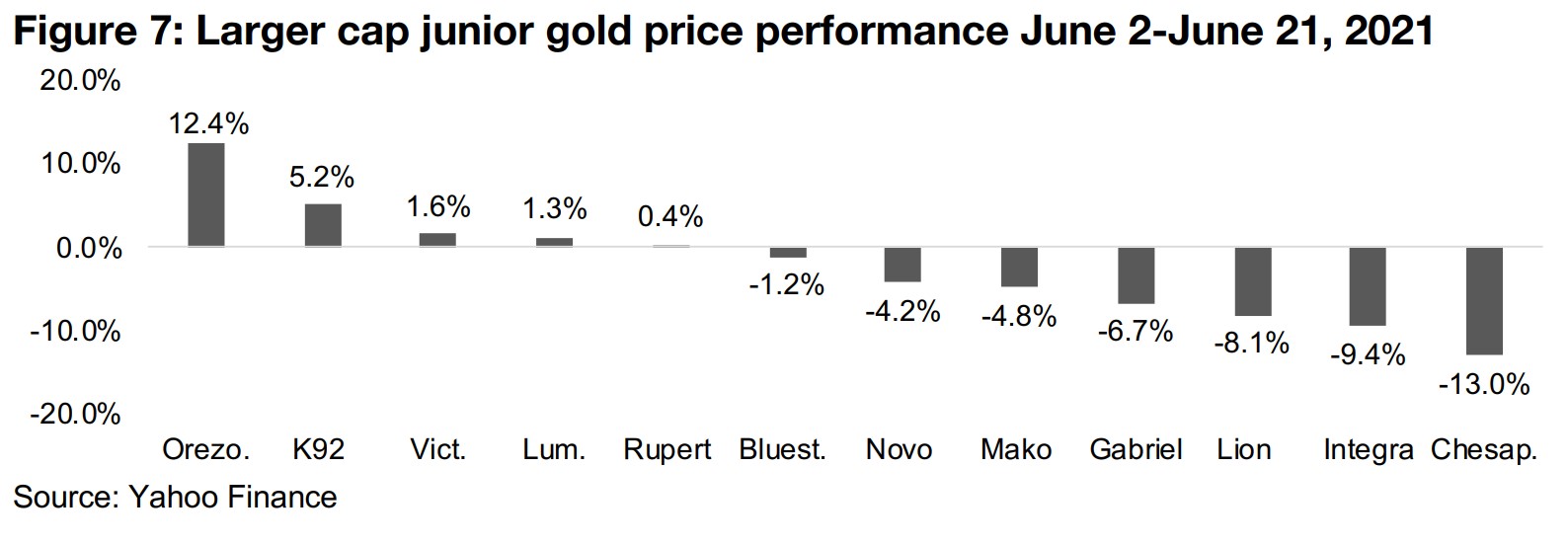

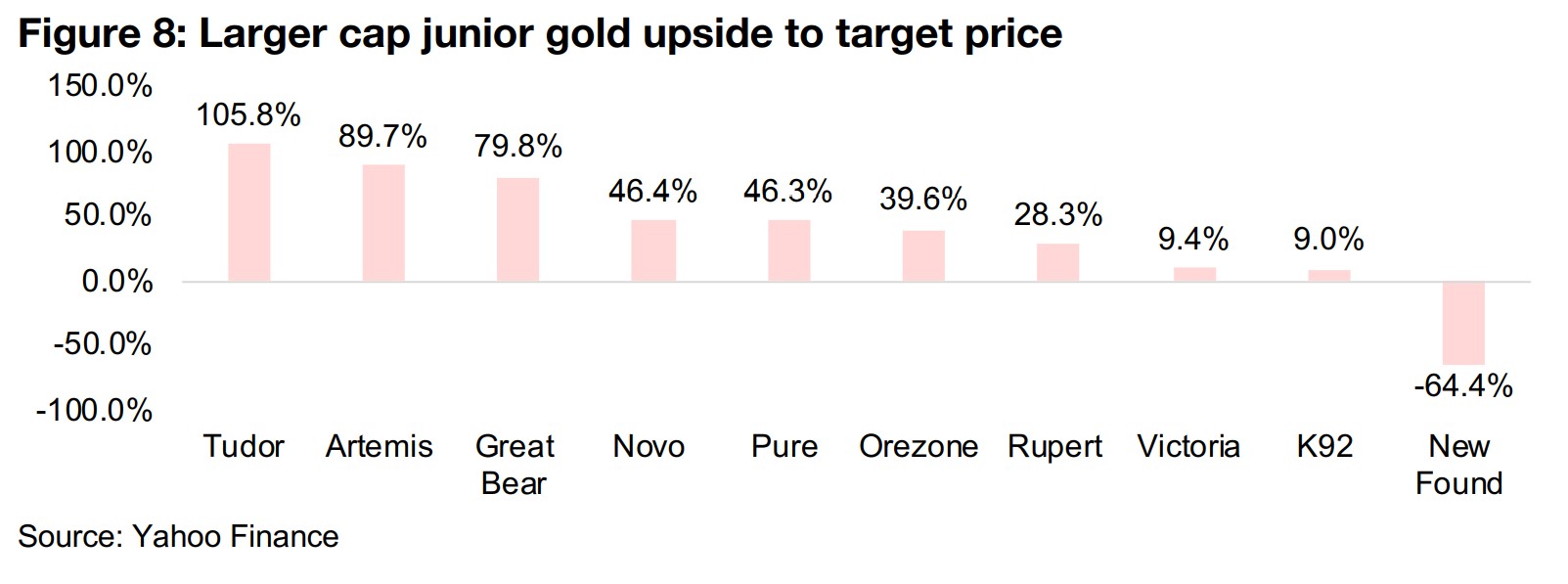

2) A test for the juniors with gold price decline

checking in on the juniors after major gold dip The big dip in gold offers a good test to see which junior gold companies are holding up under pressure and which took a major hit, showing the companies the market is likely viewing as the most risky. Of thirteen larger gold junior producers, developers and explorers (Figure 6), five have actually seen gains even as the gold price trended down off a recent June 2, 2021 peak to a trough around June 21, 2021 (Figure 7). Explorer Orezone Gold held up the best, with progress on financing for the construction of the Bombore mine, and two junior producers, K92 and Victoria, also gained given solid production this year and both implementing plans for deposit expansions. The stocks seeing the largest dips were Lion One Metals, facing global health crisis-related shutdowns and management changes, Integra Resources, where drilling results were released in early June, and Chesapeake, where the market is waiting to see whether a new technology can dramatically reduce the costs of the huge Metates project. Other stocks in the group had either slight gains or moderate declines. The market is still bullish on the sector, with all of the group except for New Found Gold having upside to their target prices, with the highest gains expected from Tudor, at 105.8%, Artemis, at 89.7% and Great Bear, at 79.8% (Figure 8).

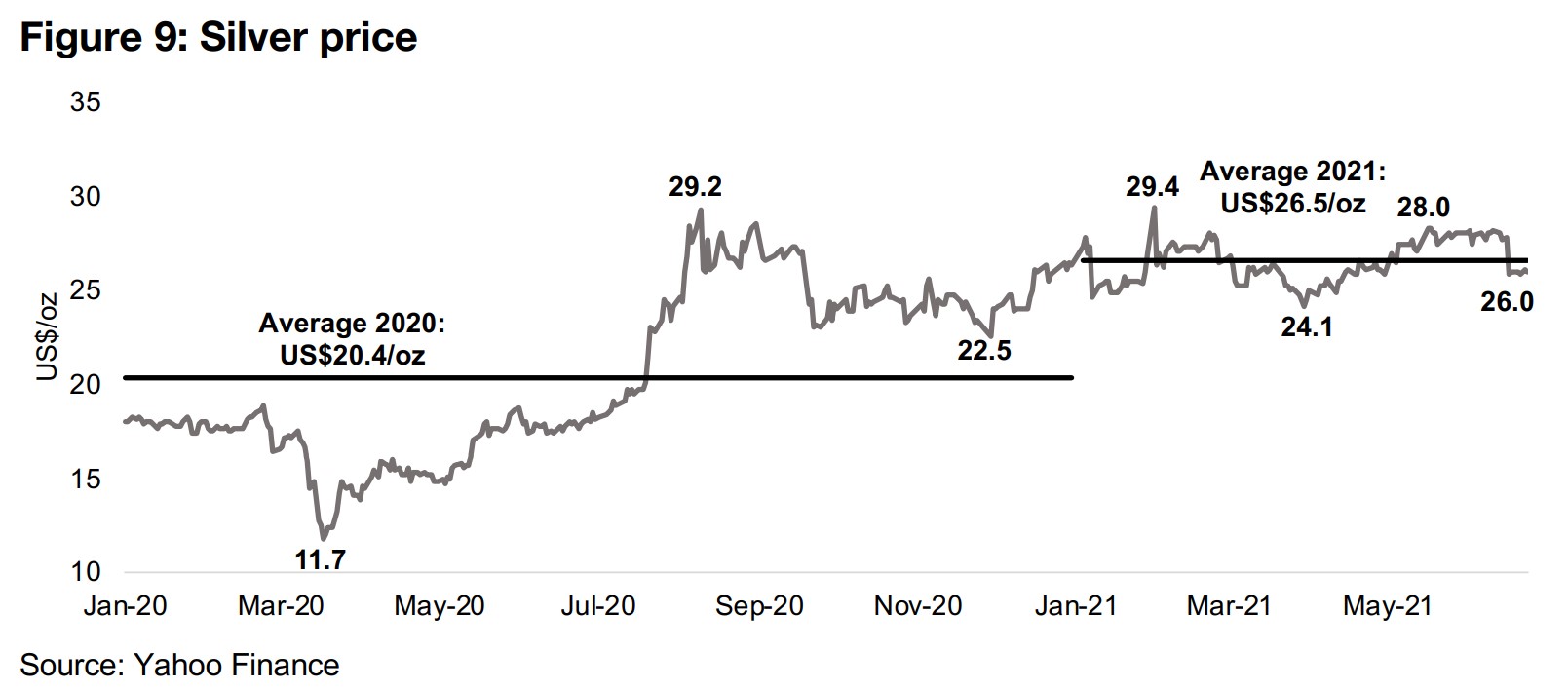

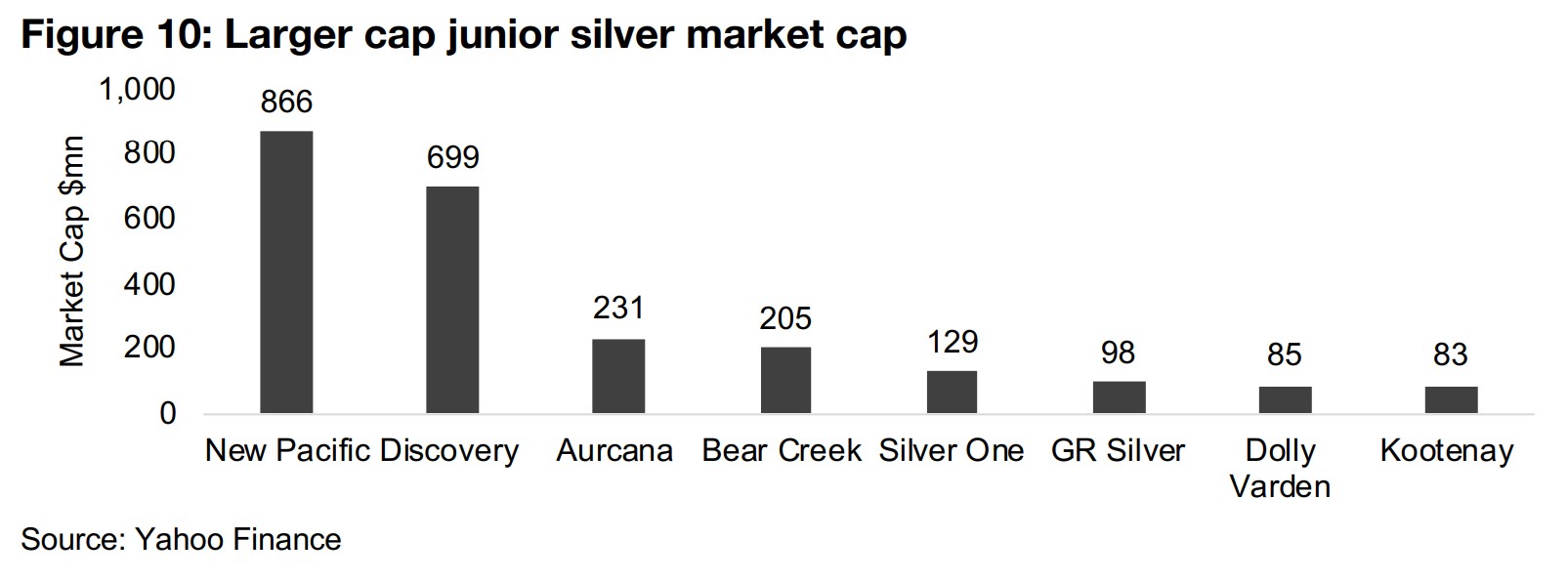

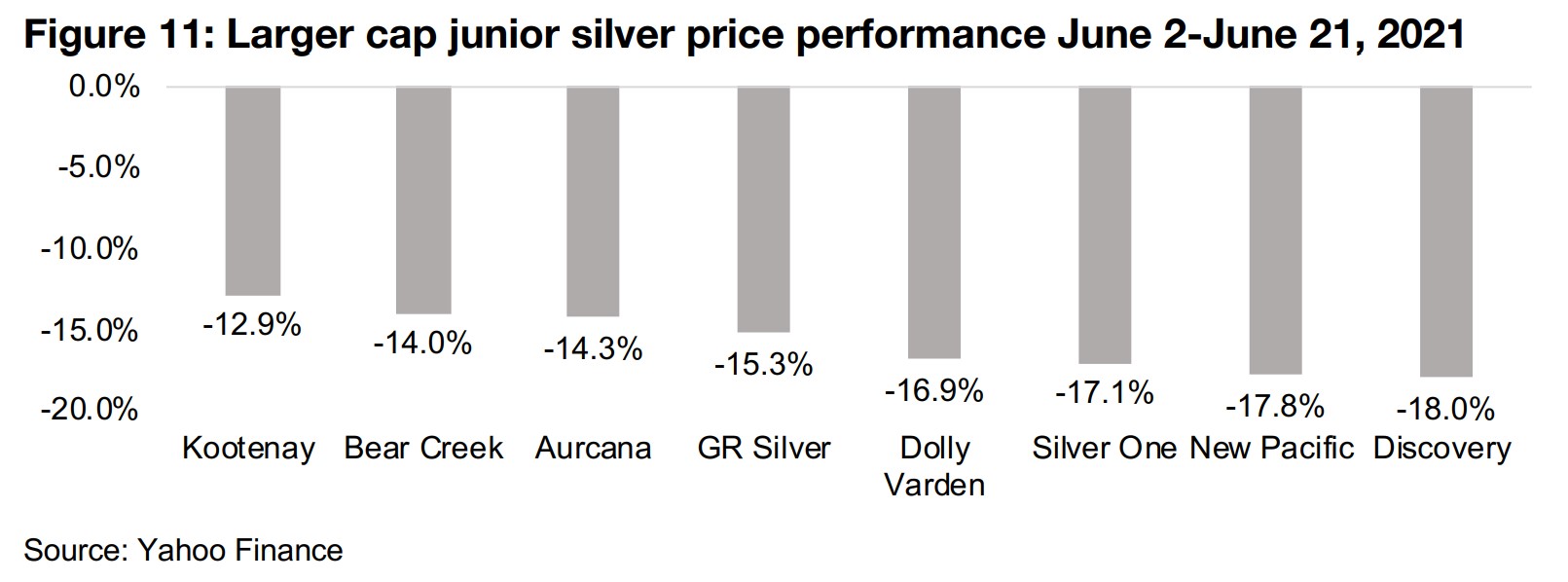

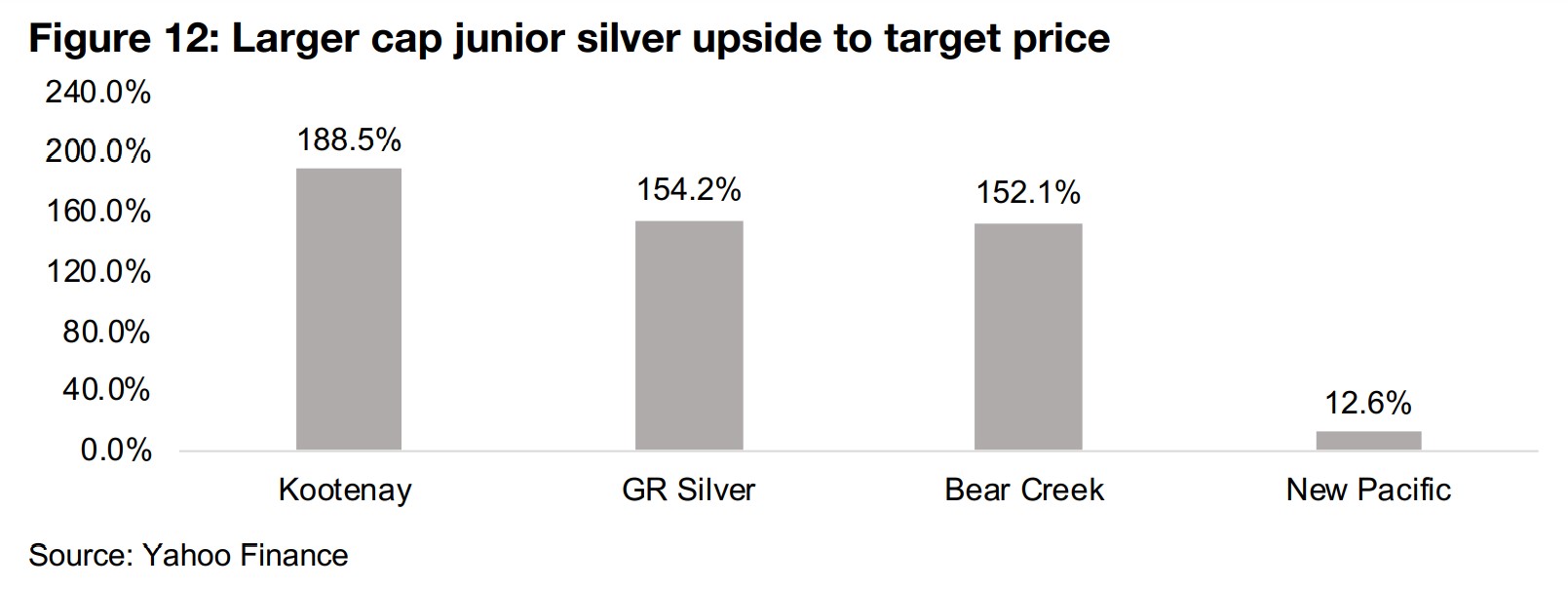

Silver also dips, and all major silver juniors see substantial declines

Gold was not the only metal to dip over the past month, with silver also sliding, and it saw a huge 7.0% one day drop on June 17, 2021, even more than gold's big decline (Figure 9). However, in contrast to the gold juniors, which were mixed, the largest eight silver developers and explorers on the TSXV (Figure 10), were almost universally hit by the decline in silver, dropping between -12.9% and -18.0% between June 2 and June 21, 2021 (Figure 11). While there are only consensus market targets for four of these, the market is looking for very strong upside to the target price for three, with 188.5% upside for Kootenay, 154.2% for GR Silver and 152.1% for Bear Creek, nearly twice the expected gains for the top three junior gold above, with only moderate gains of 12.6% expected for New Pacific (Figure 12).

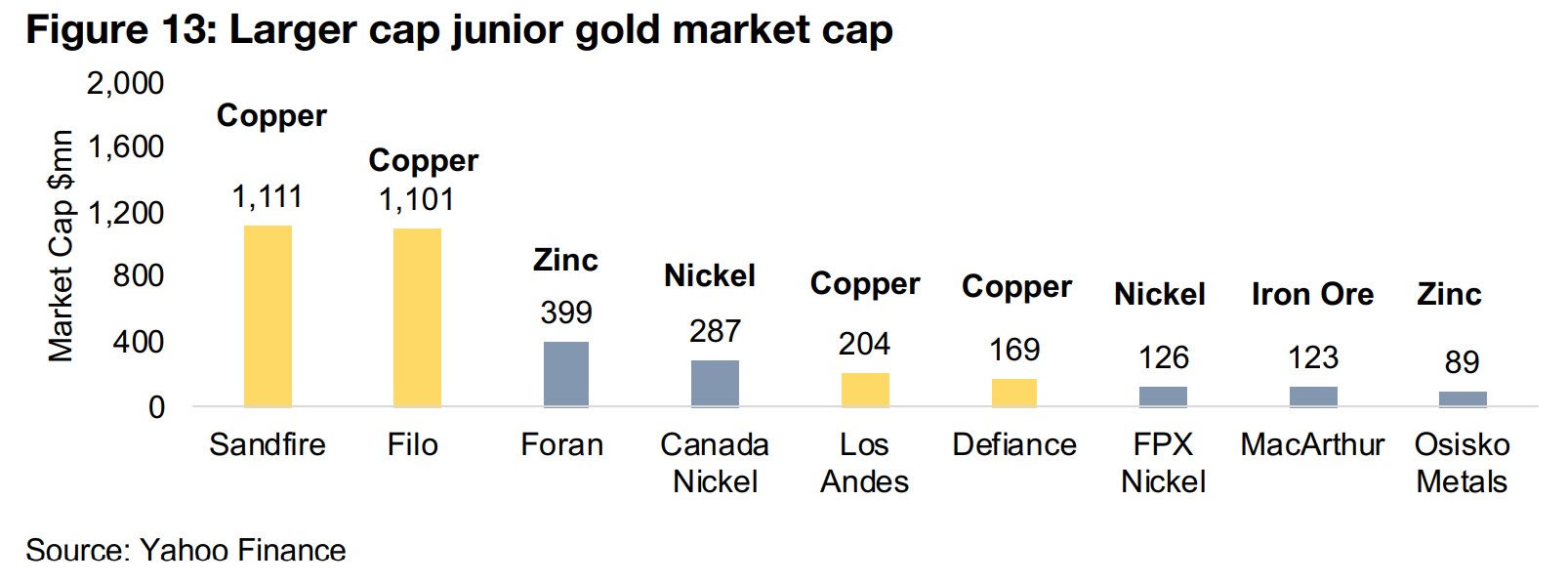

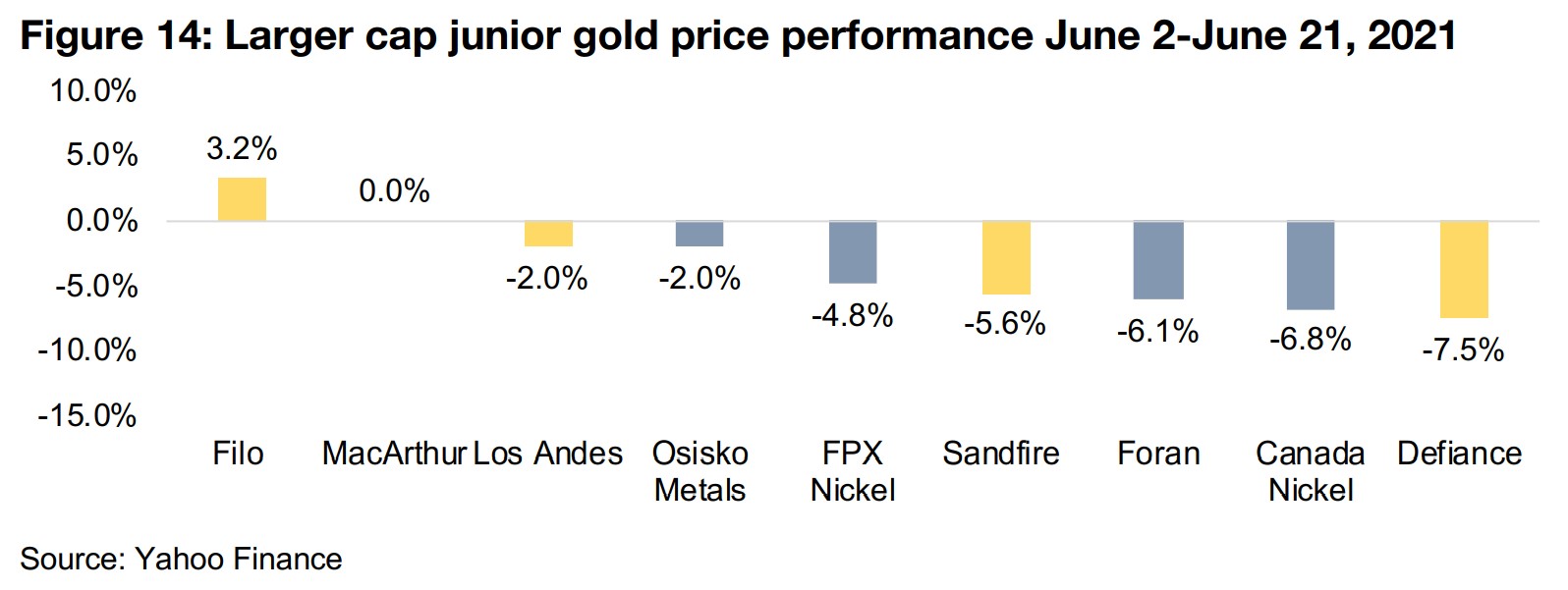

Base metal juniors most decline

In addition to gold and silver, there was a decline in most of the base metals on

potential US monetary-policy change concerns, and the larger TSXV base metals

juniors (Figure 13) were largely down from June 2, 2021 to June 21, 2021, with only

copper and gold miner Filo showing gains, the iron ore explorer MacArthur flat (Figure

14).

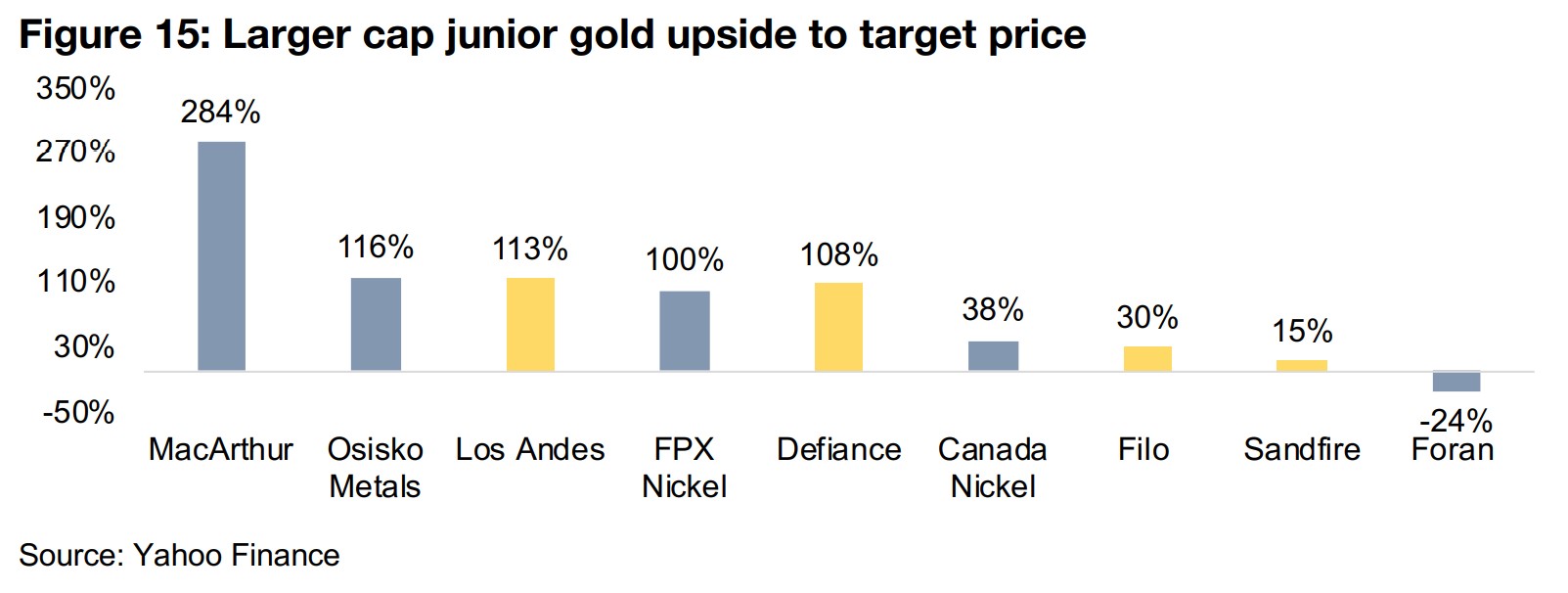

Given the huge surge in many of these stocks YTD overall, the past month has been

particularly weak, suggesting that the economic rebound of the past year may be

slowing, or at least taking a pause, as global supply chains start to become restocked.

The market is expecting a major 284% upside for Australian iron ore company

MacArthur, in the process of potentially securing access to a major port to ship its

potential ore, and downside, of -24%, only for Zinc producer Foran (Figure 15).

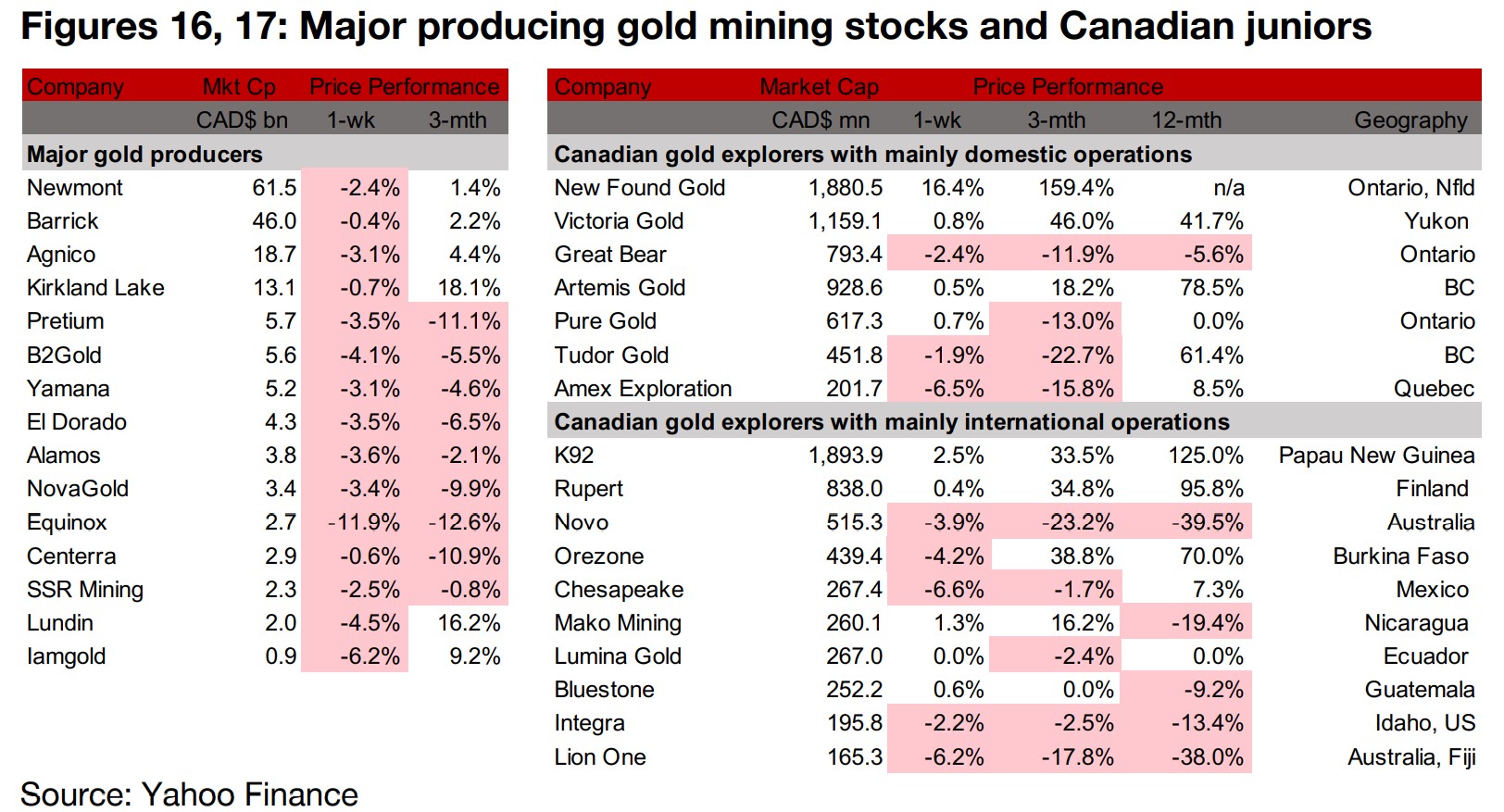

Producers all fall even as gold holds steady

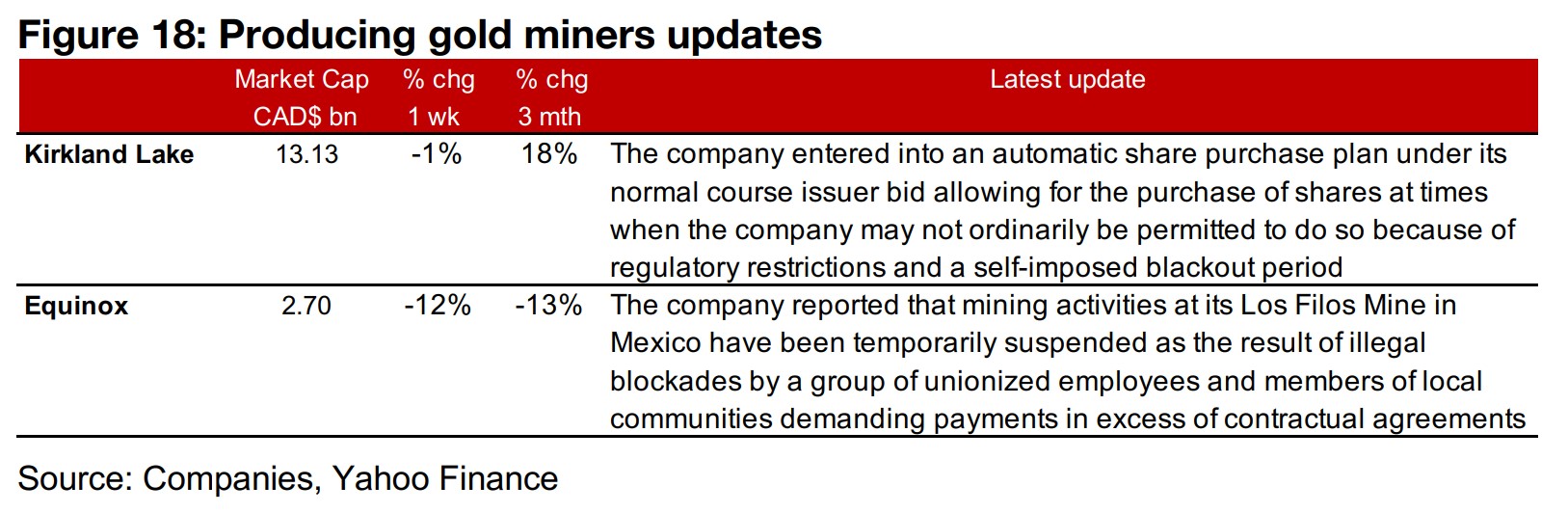

The major gold producers were all down even as the gold price held steady, possibly as bearish sentiment lingered from last week (Figure 16). News flows included Kirkland Lake entering an automatic share purchase program under its normal course issuer bid allowing for the purchase of shares even when the company is limited to do so from regulatory restrictions or a self-imposed blackout period. Equinox reported that mining activities at Los Filos had been temporarily suspended after illegal blockades by unionized employees and local community members demanding payments in excess of contractual agreements (Figure 18).

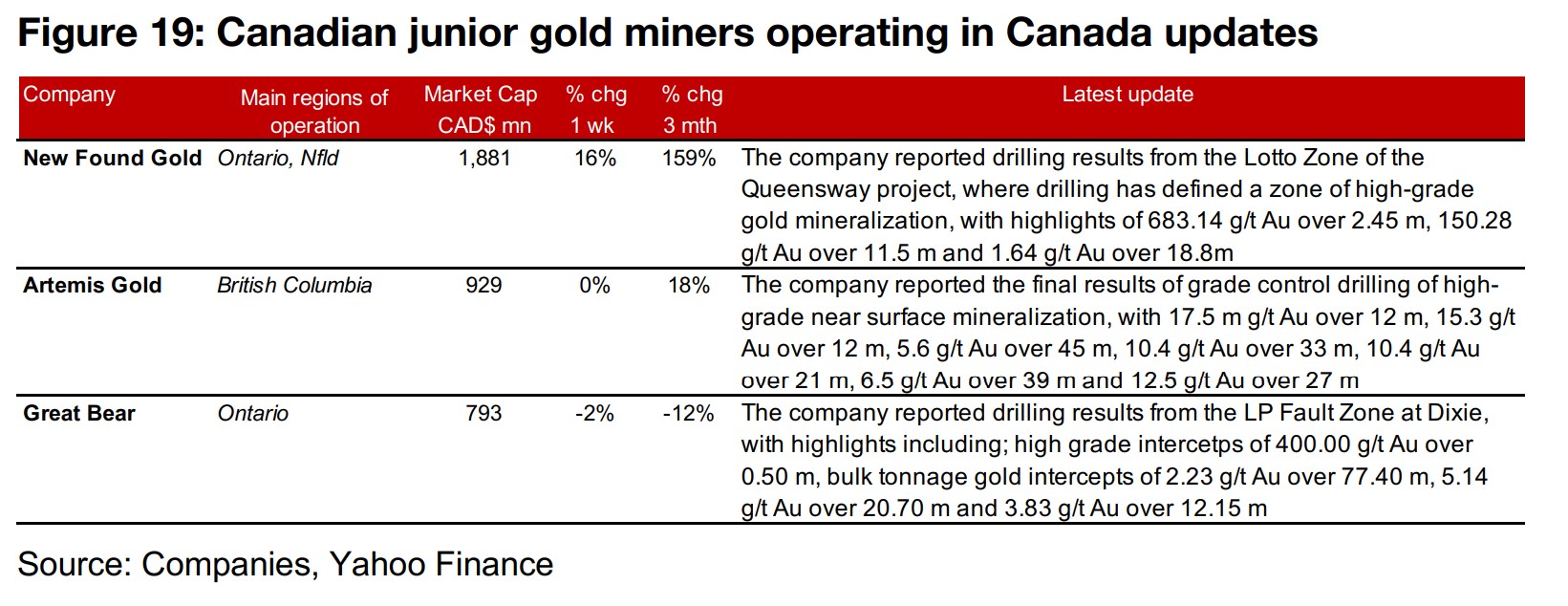

Canadian juniors mostly rise even with flat gold

The Canadian juniors mostly increased this week even as gold remained flat (Figure 17). For the Canadian juniors operating domestically, New Found Gold, Artemis and Great Bear Resources all reported drilling results, from the Lotto Zone at Keats, from Blackwater and from the LP Fault Zone at Dixie, respectively (Figure 19). For the Canadian juniors operating mainly internationally, there was no major news flow.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.