May 29, 2023

Uranium Outpacing Most Metals

Author - Ben McGregor

Gold slides for second week as US debt ceiling lifted

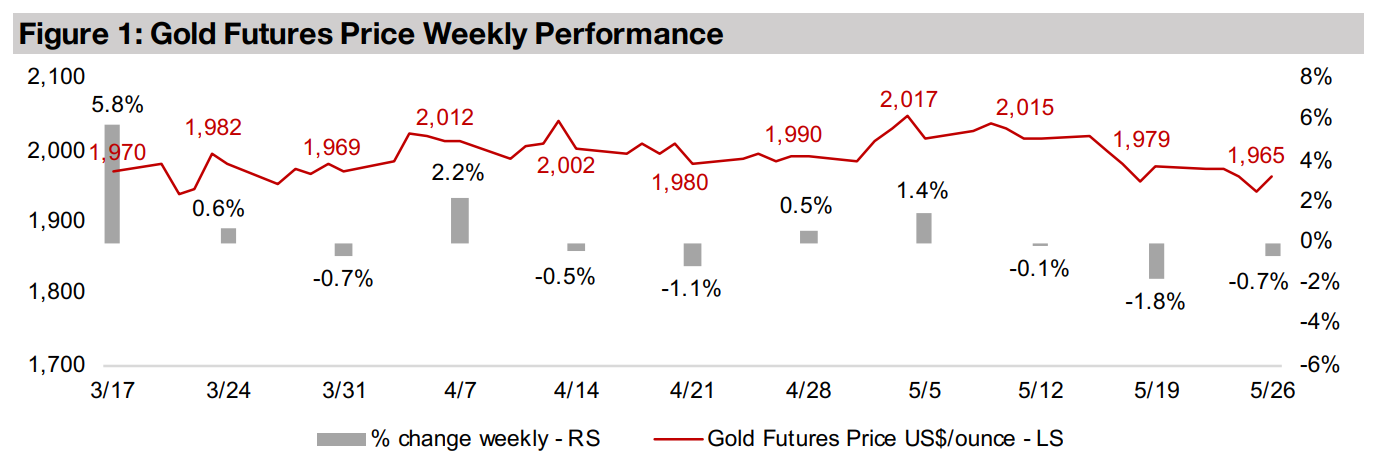

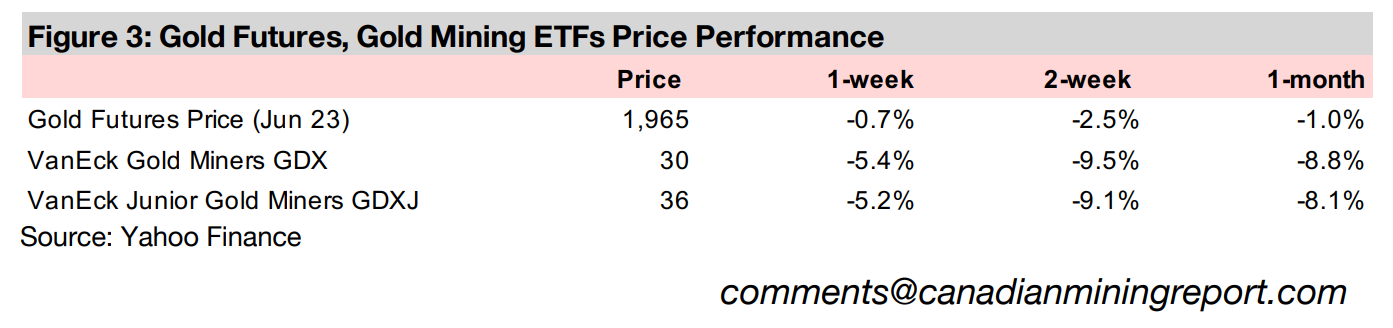

Gold dropped -0.7% this week US$1,965/oz, after declining -1.8% last week, on progress towards a deal for the US government to raise its debt ceiling and avoid a default which drove relief in equity markets and a shift out of safe havens.

Uranium Outpacing Most Metals

Gold dropped -0.7% to US$1,965/oz, down for a second week in a row, as the markets has shifted away from safe havens for the time being. The main driver has been progress towards an agreement by the US government to increase its debt ceiling and avoid a default. While this did provide some relief to equity markets, the S&P 500 actually only gained 0.35%, rebounding from a mid-week dip. The big stock gains were focussed on tech, with a continued move into AI-related companies, and the Nasdaq up 2.46%. We are not necessarily convinced that this wave of exuberance will be sustainable, however, and still see plenty of potential economic and geopolitical risks that could arise, which could again provoke a shift back into safe haven assets like gold and silver, and their underlying stocks.

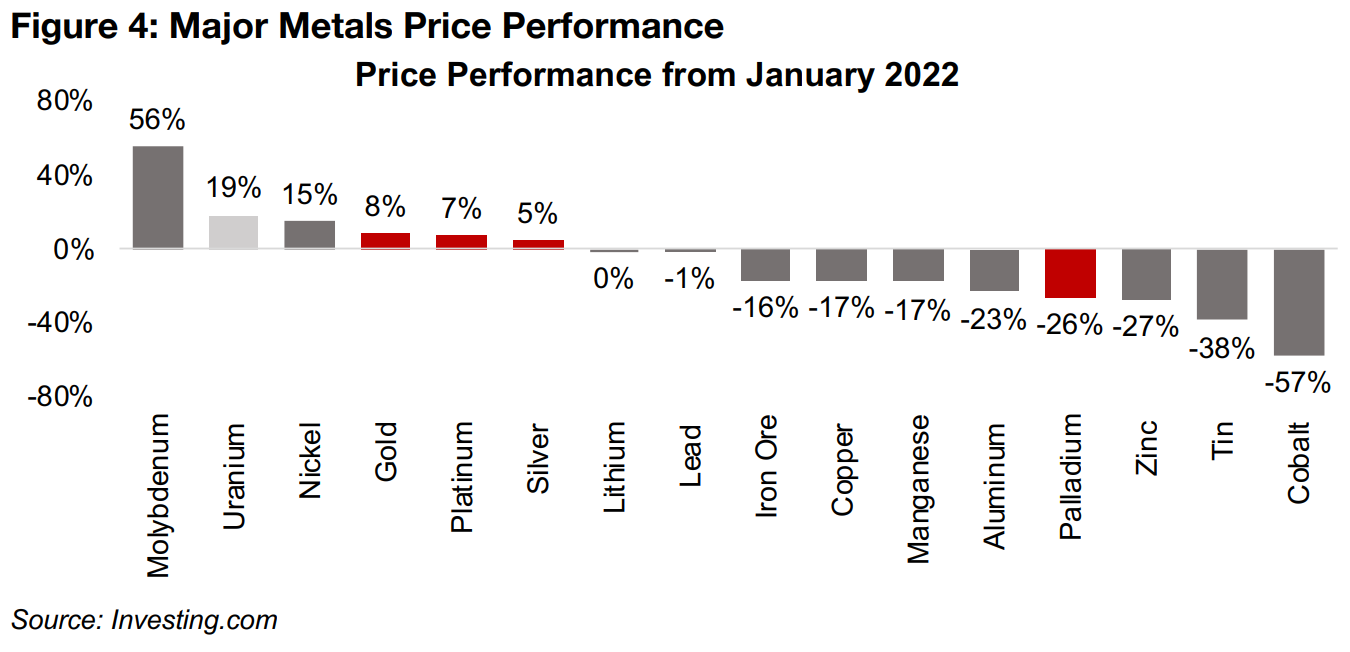

Uranium the second-best performer of major metals since 2022

While the precious metals have been under some short-term pressure, they have held

up relatively well since 2022, with gold, platinum and silver gaining 8%, 7%, and 5%

respectively (Figure 4). While this has trounced the performance of most of the major

base metals, with seven of twelve down by 16% or more, one metal that has certainly

stood out for strength over the past two years has been uranium, up 19%.

While uranium was significantly outpaced by molybdenum, up 56%, and is only

moderately ahead of nickel, up 15%, both of these markets have faced particularly

challenging supply side issues driven by shutdowns during the global health crisis,

and shocks from Russia's war on Ukraine, respectively. In contrast, the rise in the

uranium price could be considered part of a more secular long-term shift towards

support for the industry. This has come as governments have started to consider

nuclear as an important part of the planned transition towards green energy.

Support for nuclear power rising in Japan

One of the most recent, and critical, moves in this direction has been Japan's new

policy from December 2022 for greater use of nuclear energy. This is planned to

include restarting idled plants, extending the life of operating plants and developing

new reactors to replace those that will be decommissioned. This shift could drive

increased demand for uranium relatively quickly, as it will not require the nearly

decade long-process for new builds, and only needs existing capacity to be restarted.

This is a particularly crucial shift because Japan saw the most recent nuclear disaster,

in Fukushima in March 2011, leading to a major pullback in nuclear power use in the

country. Nuclear power provided less than 10% of the country's electricity in 2021,

about a quarter the prior to the crisis. Japan has 33 reactors, a reasonably large share

of a total 449 globally, with none operating from 2011 to 2014 after the disaster, ten

restarted from 2015 to 2021, and seven more reactors to be restarted by mid-2023.

Even some 'green' EU parties seeing advantage of nuclear power

Meanwhile, the EU is also seeing a major change in political opinion on nuclear, with even some 'green' parties, historically in opposition to nuclear power, now turning towards support for the industry, having realized that transforming to a low carbon energy system may not be possible without its use. The conflict between Russia and Ukraine has also highlighted Europe's heavily reliance on gas from the former to meet its energy requirements, shedding a new political light on the potential advantages of using nuclear power to increase energy security for the region.

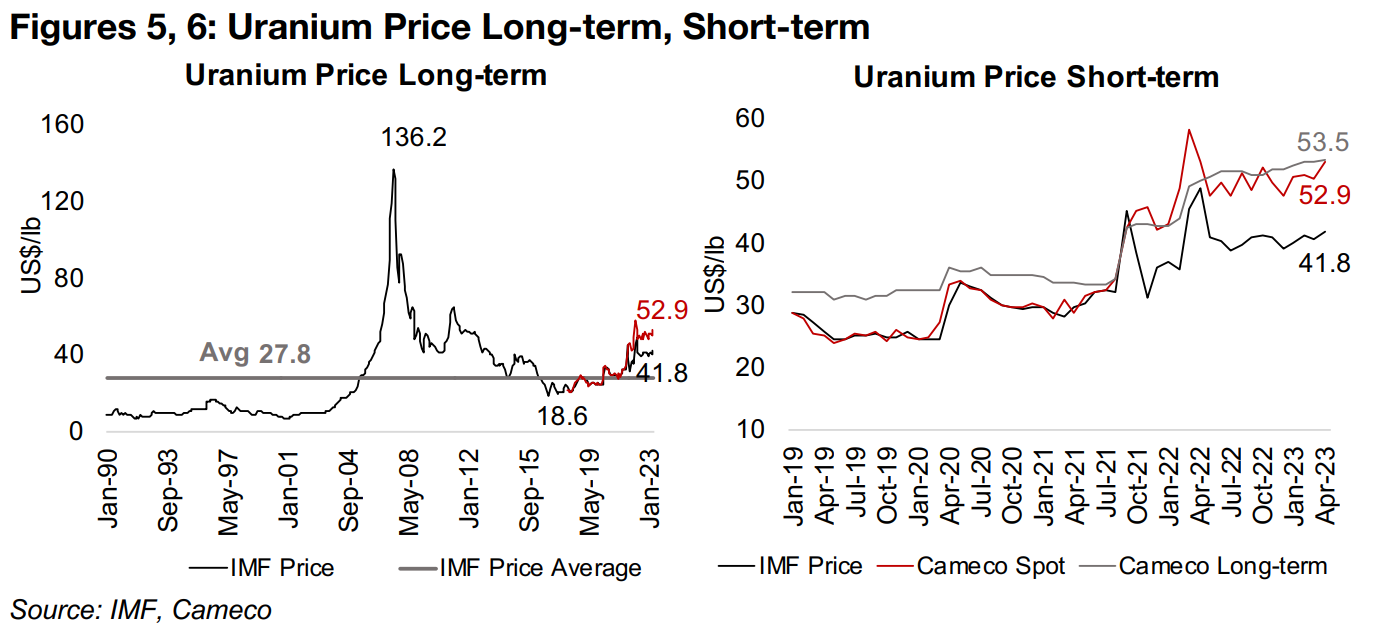

Uranium price in a gradual uptrend since 2018

The gradual rise in support for nuclear power has seen the uranium price rise from

lows of US$18.6/lb in November 2016 to US$41.8/lb currently, and above the 1990-

2022 average of US$27.7/lb, based on data from the IMF (Figures 5, 6). The price

peaked at US$136.2/lb in June 2007, a short-term boom driven mainly by a flooding

of the Cigar Lake mine in Canada, one of the largest global uranium mines, driving

concerns of temporary supply constraints. The bubble popped and the price declined

to US$40.8/lb in June 2010, recovered to US$65/lb in February 2011 and was then

hit by Japan's Fukushima disaster, starting a seven-year bear market from 2011-2018.

The rise in uranium since 2018 has not been a short-term parabolic move like in 2007,

but reasonably gradual, typical of a sustainable bull market and often suggesting

backing by solid fundamentals. As there is no liquid active market for uranium, with

contracts for the metal being private, pricing estimates can diverge considerably, with

the prices reported by Cameco, which are in turn sourced from UxC and Trade Tech,

showing a US$53.5/lb long-term and US$52.9/lb spot price in April 2023, at a

considerable premium to the IMF price of US$40.8/lb.

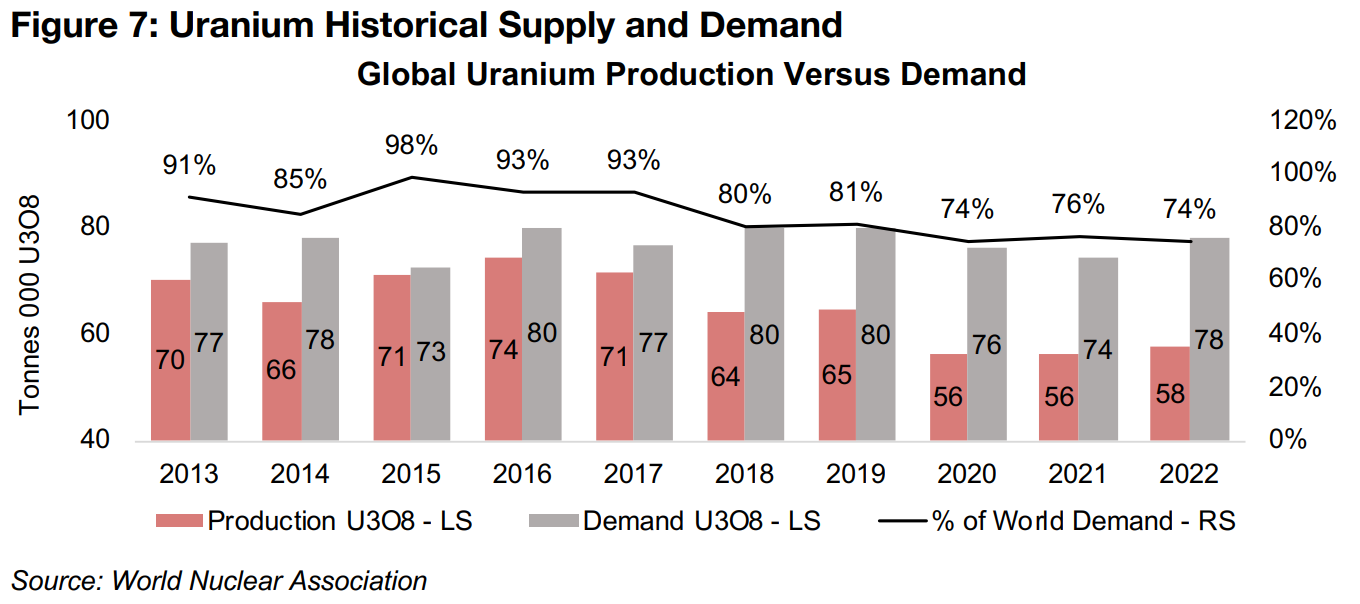

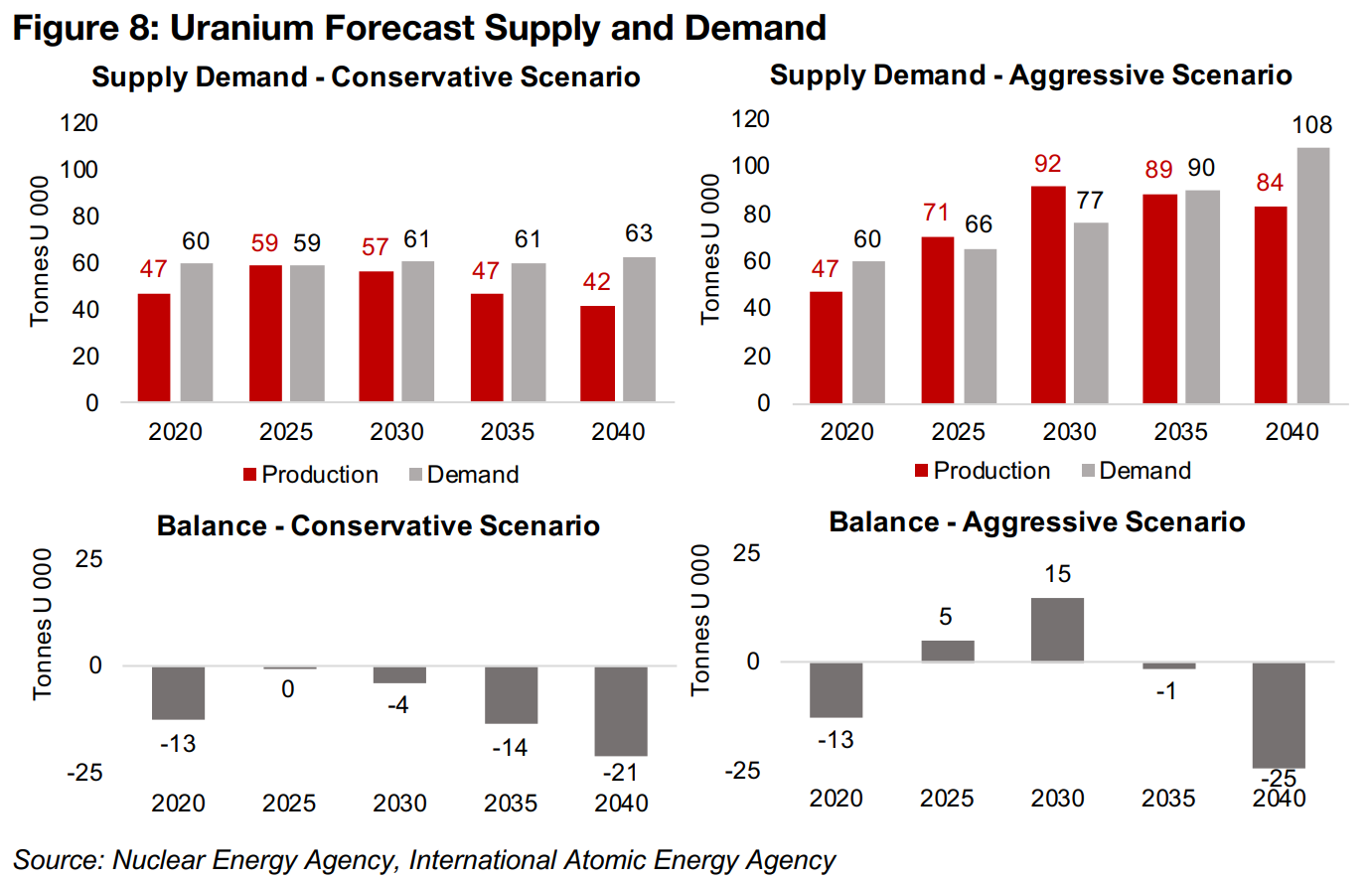

Uranium demand has been steady over the past decade, at 77k tonnes of U308 in 2013 and 78k tonnes in 2022, with a peak in 2018-2019 at 80k. However, mine supply has declined over the period, from 70k tonnes in 2013 to just 58k tonnes in 2022, dropping from 91% of total global demand to just 74% with a substitution towards secondary sources including recycling and inventories (Figure 7). The Nuclear Energy Agency and International Atomic Energy Agency forecast supply and demand for uranium to 2040, starting with 2020 as a base year, with 47k tonnes U of production and 60k tonnes U of demand (Figure 8). This can be converted to the 56k tonnes of U3O8 refined production and 76k tonnes of demand in Chart 7 by multiplying by the standard conversion factor of 1.1792.

Widening deficit for uranium under conservative scenario

Using the lower estimates from these agencies for both production, which includes existing, idled and committed nuclear plants, and demand, indicates a balanced market in 2025, but then a deficit of -4k tonnes by 2030, widening to -14k tonnes in 2035 and -21k tonnes in 2040. A more aggressive scenario includes the same supply as the conservative scenario plus planned and prospective nuclear plants and sees demand growing to nearly twice the conservative scenario by 2040. Under this scenario, there would actually be surplus production of 5k tonnes in 2025 and 15k tonnes in 2040, a rough balance by 2025 and a major deficit only developing by 2040.

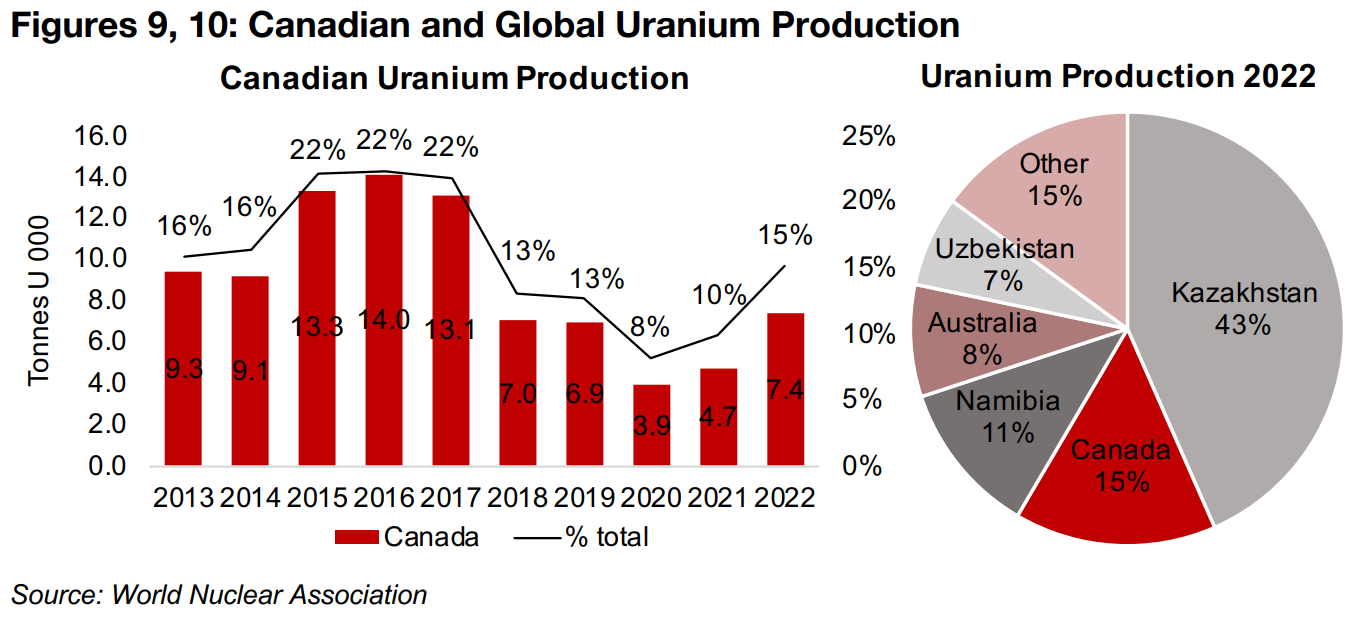

Canadian uranium production rebounding off crisis lows

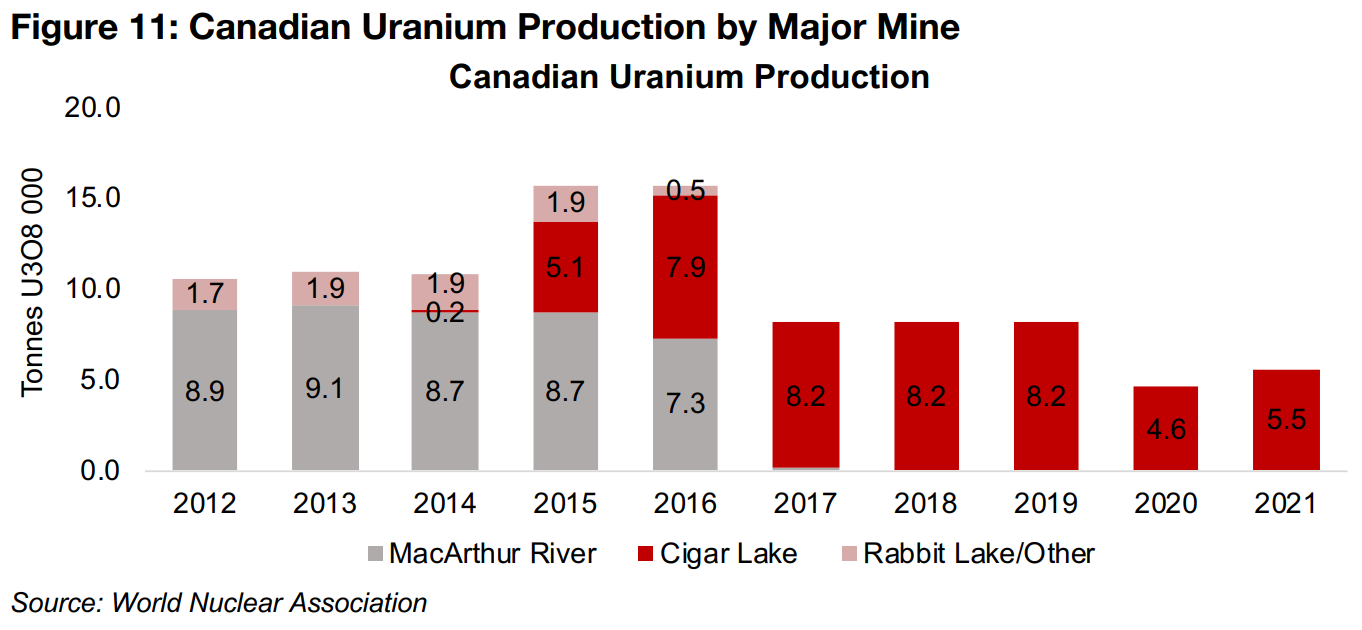

Canadian uranium production has rebounded off global-health-crisis generated lows of 3.9k tonnes U in 2020, nearly doubling to 7.4k tonnes U in 2022 (Figure 9). Canada is critical to global uranium production, at 15% of the total in 2022, second to industry giant Kazakhstan, which was 43% of total global output (Figure 10). Canadian production in 2022 is still down off a recent peak from 2015-2018 when it reached 22% of the world total. This decline was partly driven by the 2017 shutdown of the Cameco's MacArthur River Mine, which had comprised 48% of total production in 2016 (Figure 11). The other major mine, Cameco's Cigar Lake, comprised 52% of production in 2016 and all Canada's uranium production from 2017 to 2022. However, Cameco restarted the MacArthur River mine in November 2022, which should see Canada's percentage contribution to world production increase considerably in 2023.

Canada has second largest global uranium reserves

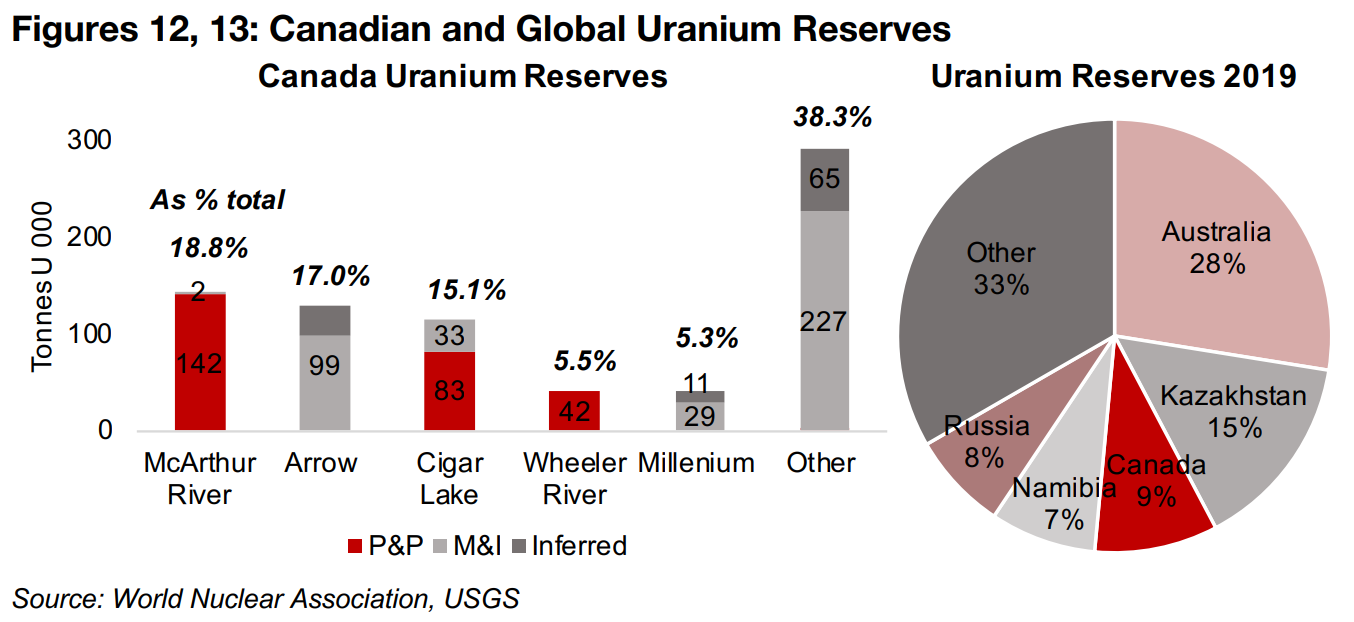

Canada will remain a major uranium producer long-term, given that it has 9% of global uranium reserves, the third largest in the world after Australia, with 28% of reserves, and Kazakhstan, with 15% of the total (Figure 13). The bulk of Canada's uranium Reserves and Resources come from the currently producing Cigar Lake and MacArthur River, which account for 18.8% and 15.1% of the total, with most of this Proven and Probable Reserves (Figure 12). The next largest source of Resources is Arrow, at 17% of the total, but these are mainly Indicated Resources, which have a lower probability of recovery than P&P Reserves. Wheeler River has the fourth largest reserves in Canada, at 5.5% of the total, all P&P reserves, and Millenium is fifth, at 5.5%, mostly Indicated Resources, with all of Canada's other uranium projects combined at 38.3% of the total, with the majority Indicated Resources.

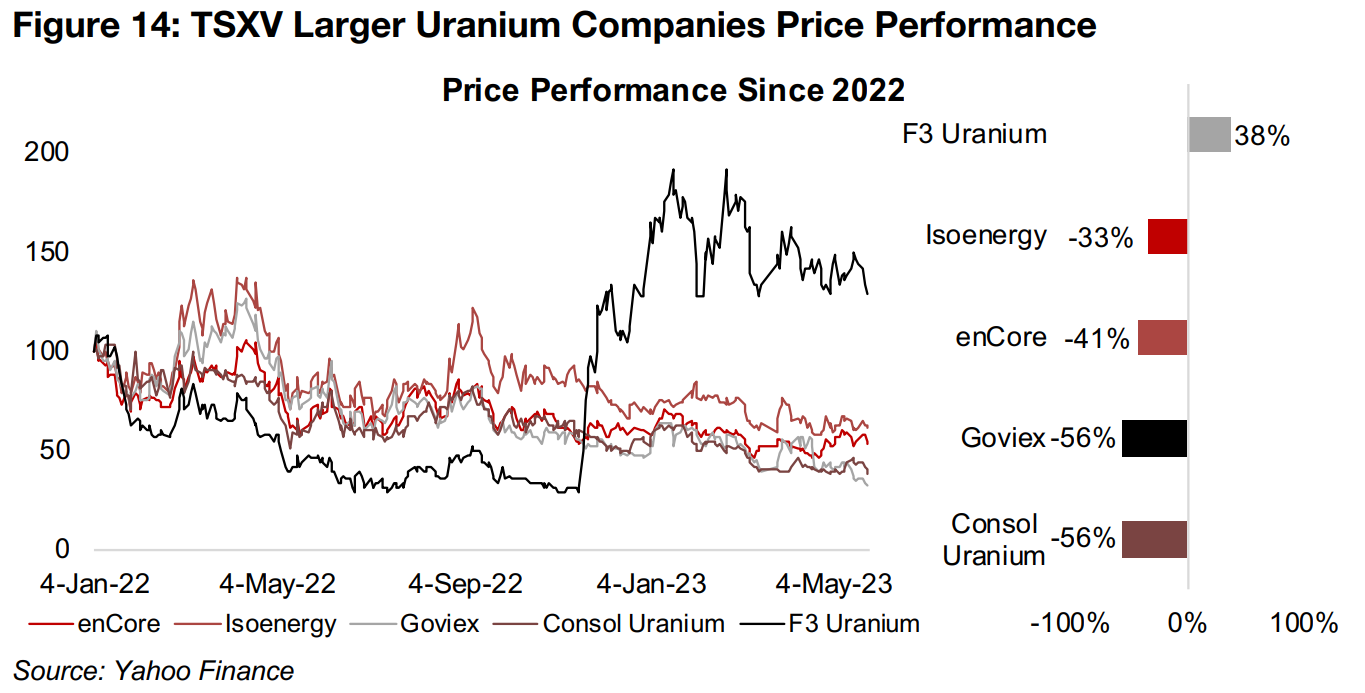

Most larger TSXV uranium stocks struggling over past year

Canada's position as a global leader in uranium production looks set to support junior miners in the sector long-term, as they will be looking to continue to acquire new resources as existing major mines become depleted. However, even strong potential domestic demand coupled with the robust trends for nuclear energy globally which have propelled the uranium price have not been enough to support the larger TSXV uranium juniors over the past year. Four out of five are down -30% since January, 2022, with only one seeing a substantial gain (Figure 14). We suspect that this is mainly because of the risk off sentiment pervading markets since 2022, with smaller companies seeing less interest. The junior mining sector overall, and especially the base metals stocks, have been particularly hit by this, although many junior gold and silver stocks have held up, with their underlying metals considered safe havens.

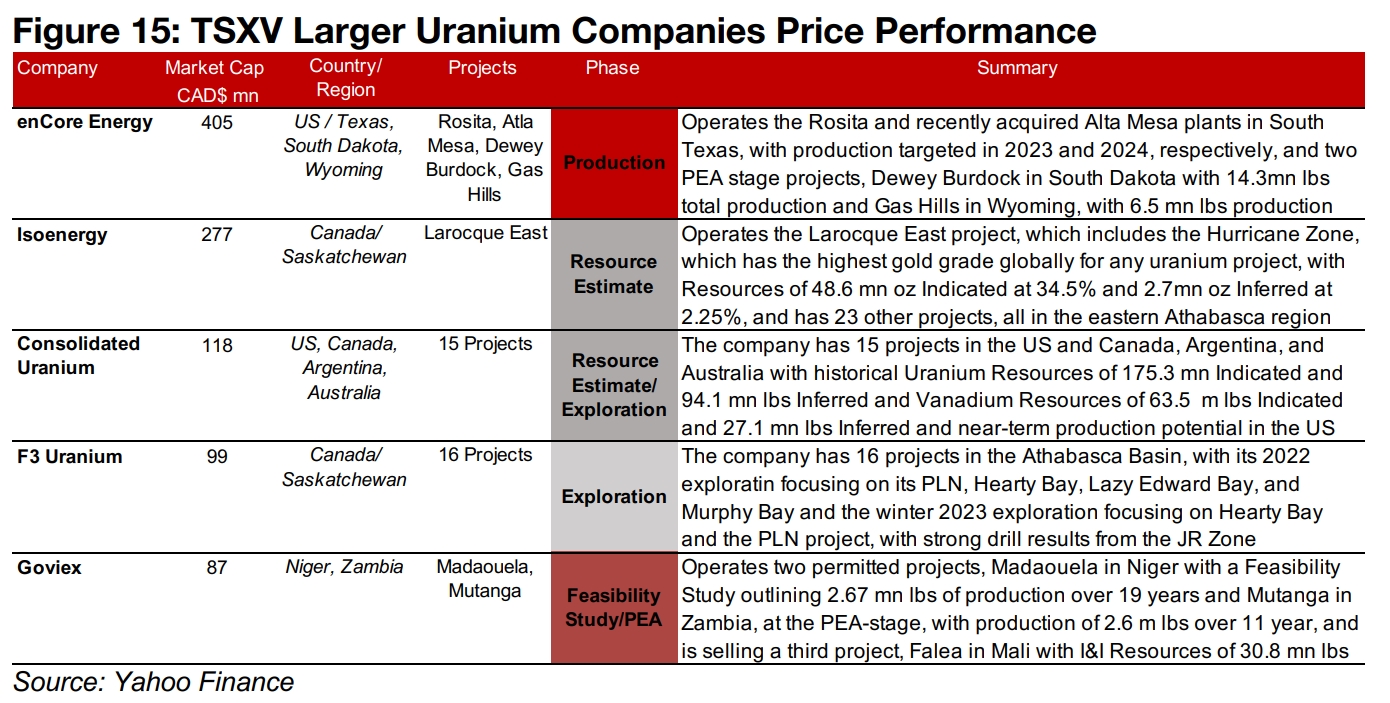

Operational progress continues for larger TSXV uranium stocks

While these broader macro drivers continue to pressure this group, their company

specific drivers remain strong, with all five showing decent operational progress. The

largest by market cap, enCore Energy, at $405mn, targets production at two plants

in South Texas, in 2023 and 2024, respectively, and it also has two PEA stage projects,

in South Dakoka and Wyoming (Figure 15) Isoenergy with a $277mn market cap,

operates the Laroque East project in Saskatchewan, in the Athabasca region, with its

Hurricane zone showing the highest grade for any uranium project globally.

Consolidated Uranium, with a $118mn market cap, has fifteen projects globally with

uranium and vanadium Resources, many with historical production, and potential for

near-term production at some US properties. The stand-out gains of F3 Uranium,

jumping to a $99mn market cap, with 16 projects in Athabasca, have been driven by

outstanding drill results from the JR Zone of its PLN project. Goveix has the smallest

market cap, at $87mn, operating projects in Niger and Zambia at the Feasibility Study

and PEA-stage, respectively, with a plan to sell its third project, Falea, in Mali.

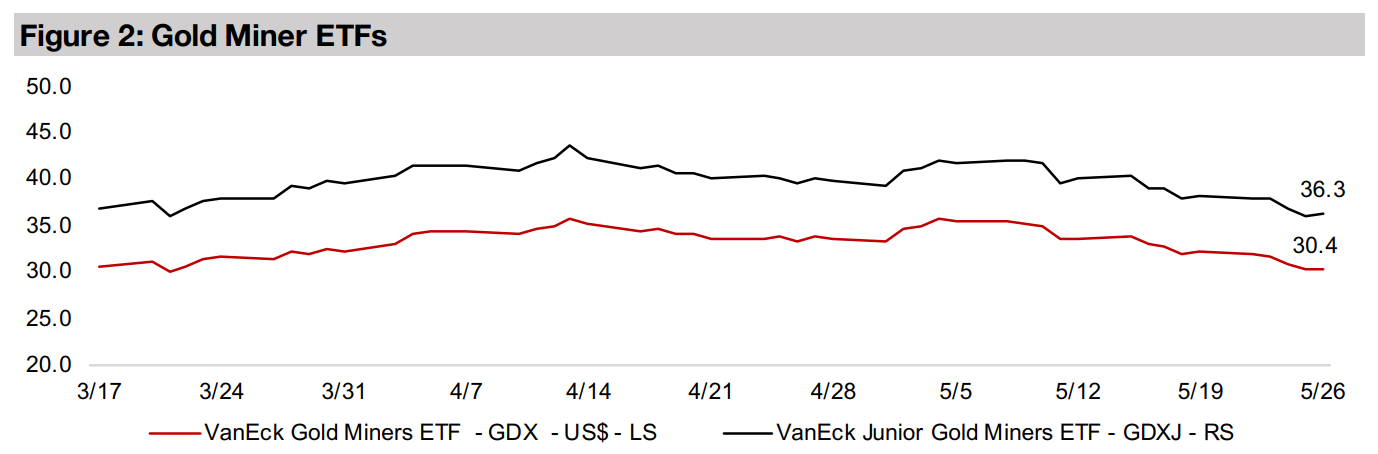

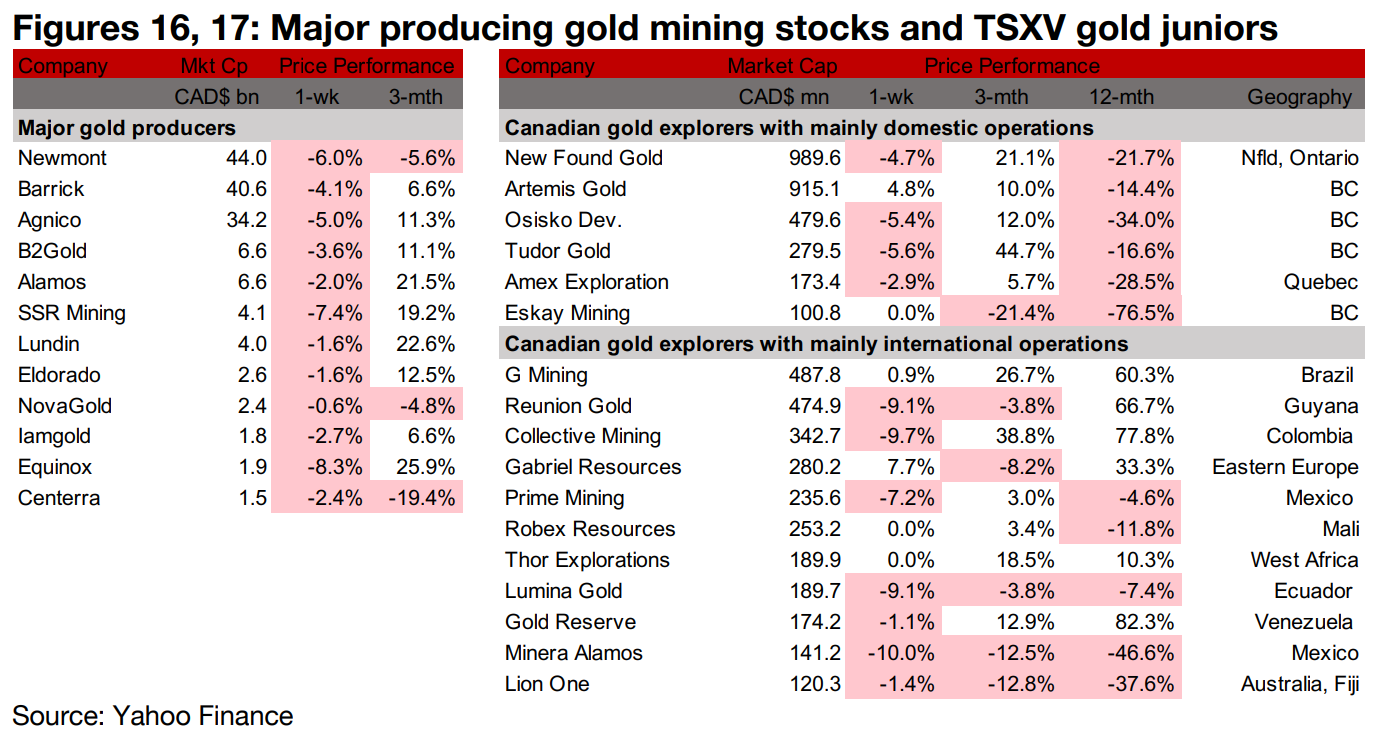

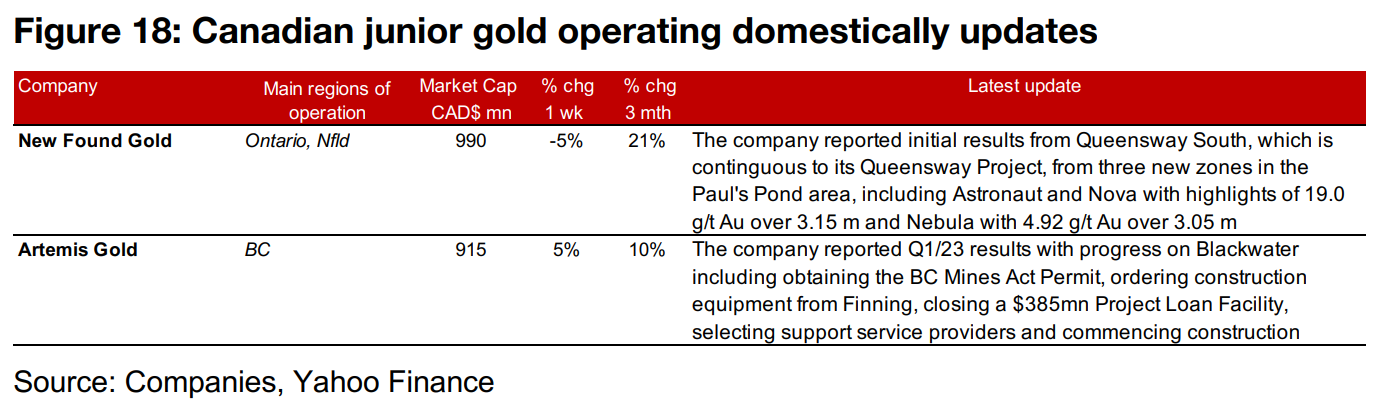

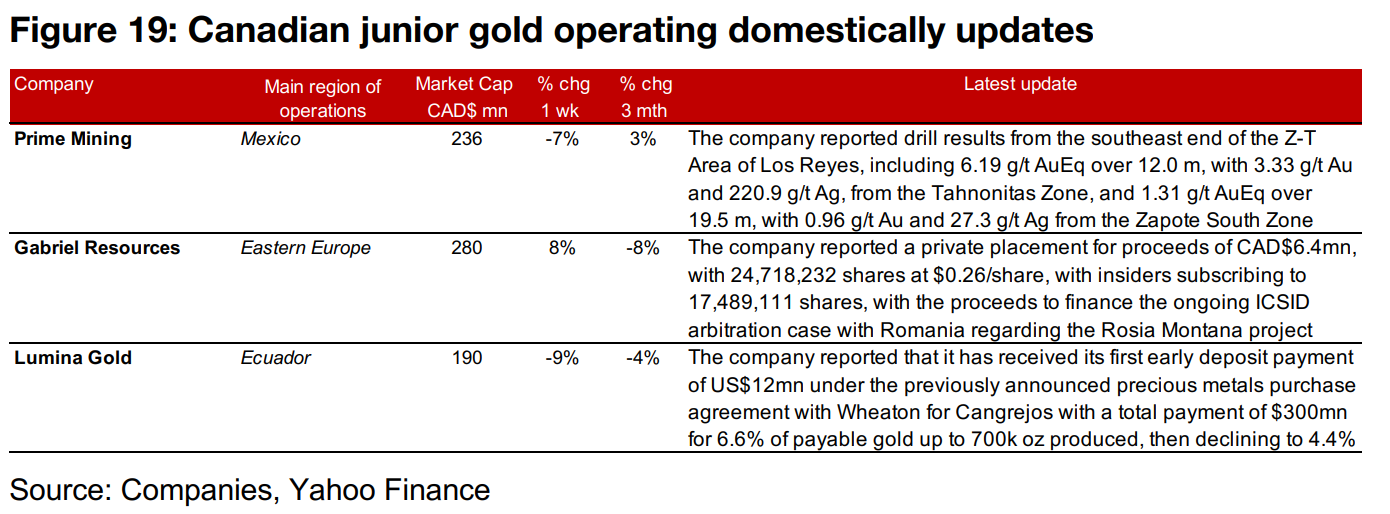

Producers all decline and large TSXV gold mixed as gold declines

The gold producers all declined and large TSXV gold was mixed as the gold price dropped and a shift away from safe havens continued (Figures 16, 17). For the TSXV gold companies operating domestically, New Found Gold reported drill results from Queensway South and Artemis Gold reported Q1/23 results (Figure 18). For the TSXV gold companies operating internationally, Prime Mining reported drill results from the Z-T Area of Los Reyes, Gabriel Resources announced a CAD$6.4mn private placement and Lumina Gold received its first early deposit payment under its precious metals purchase agreement with Wheaton for Cangrejos (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.