May 20, 2024

TSXV Mid-Cap Gold Movers

Author - Ben McGregor

Gold breaks through another key benchmark

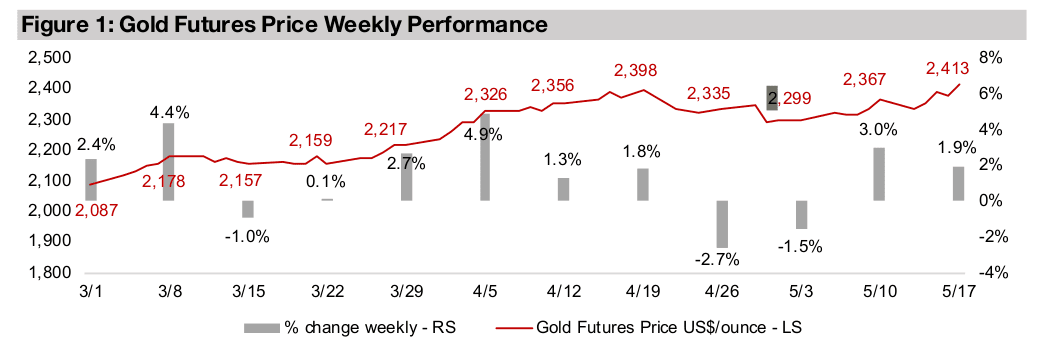

Gold rose 1.9% to US$2,413/oz, closing back above the key US$2,400/oz level, which it first breached only briefly in late April 2024, as US inflation data remained mixed and Fed comments hawkish, and markets continued to hedge the risk on rally.

TSXV Mid-Cap Gold Movers

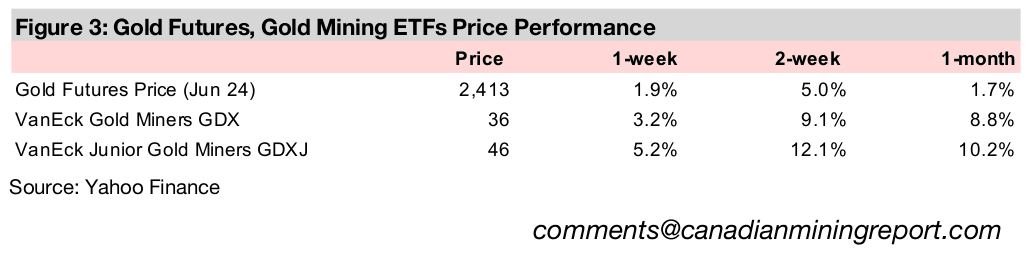

The gold price rose 1.9% to US$2,413/oz, closing above the key US$2,400/oz

benchmark for the second time, after briefly breaching this level in late April 2024.

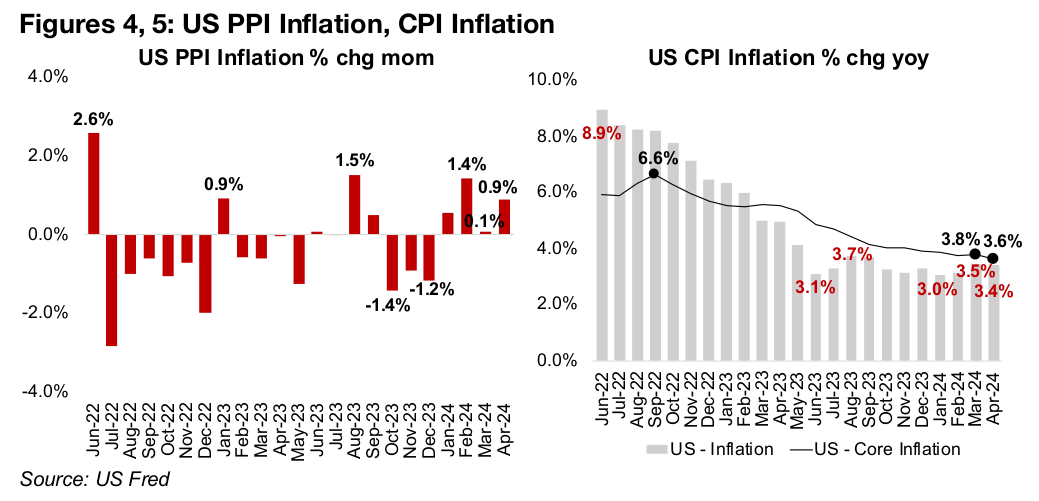

The main economic releases were related to US inflation, with hotter than expected

US PPI data announced earlier in the week followed by more dovish US CPI inflation

that came in broadly in line with estimates. The equity markets responded well to the

data, rising for a third week, with the S&P 500 up 1.3%, Nasdaq gaining 1.7% and

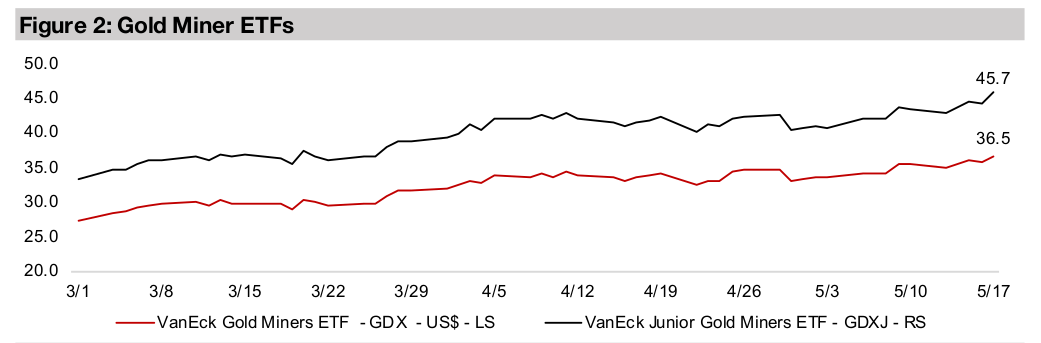

Russell 2000 increasing 1.1%. Gold stocks also gained on the combination of rising

gold and equities, with the GDX rising 3.2% and GDXJ seeing a 5.2% jump.

US PPI inflation, not seasonally adjusted, rose 0.9% month on month in April 2024,

jumping from near flat in March 2024 (Figure 4). This was one of the higher numbers

of the past twelve months, only surpassed by the rises of 1.4% in February 2024 and

1.5% in August 2023. US CPI inflation was more benign, with the headline figure

dropping to 3.4% year on year and core inflation down to 3.4% in April 2024 from

3.5% in March 2024 (Figure 5). This provided some relief to the markets after an

uptick in both of these measures in March 2024 raised fears of an inflation resurgence.

However, the US Fed is still concerned by headline inflation that has remained

stubbornly above 3.0% for almost a year now, and a core figure still well in excess of

the Central Bank’s 2.0% target. Fed Chairman Powell commented this week that

inflation was much higher than had been expected and could require rates to be

maintained at current levels for some time. Rate cut odds for the June 12, 2024

meeting are at just 9.1% and for the July 31, 2024 meeting at 27.9%. The probability

of a cut rises above 50% only by the September 18, 2024 meeting, at 65.4%, and

reaches 76.3% for the November 7, 2024 meeting.

In Focus: Montage Gold, Mawson Gold

Montage Gold, Montage Gold enter mid-cap TSXV gold ranks

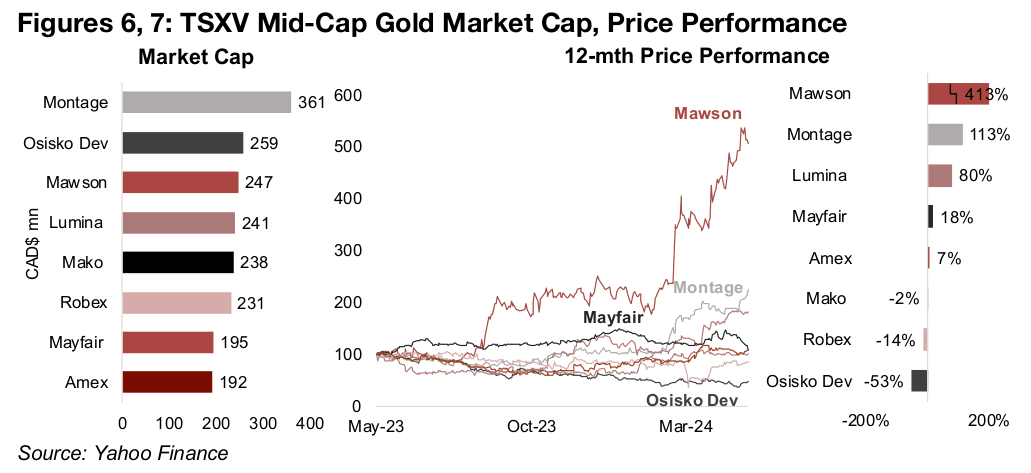

In Focus this week are two companies that have relatively recently moved up into the

mid-cap TSXV gold space, Montage Gold and Mawson Gold. The market cap of

Montage has reached CAD$361mn and Mawson CAD$247mn, after 113% and 413%

gains over the past twelve months, respectively (Figures 6, 7). This puts them at the

number one and three positions of a group of long-standing TSXV mid-cap gold

stocks, including the producers Mako Mining and Robex Resources, developers

Osisko Development, Lumina Gold and Mayfair Gold and explorer Amex Exploration.

Montage, operating Kone in Cote d’Ivoire, sees Lundin investment

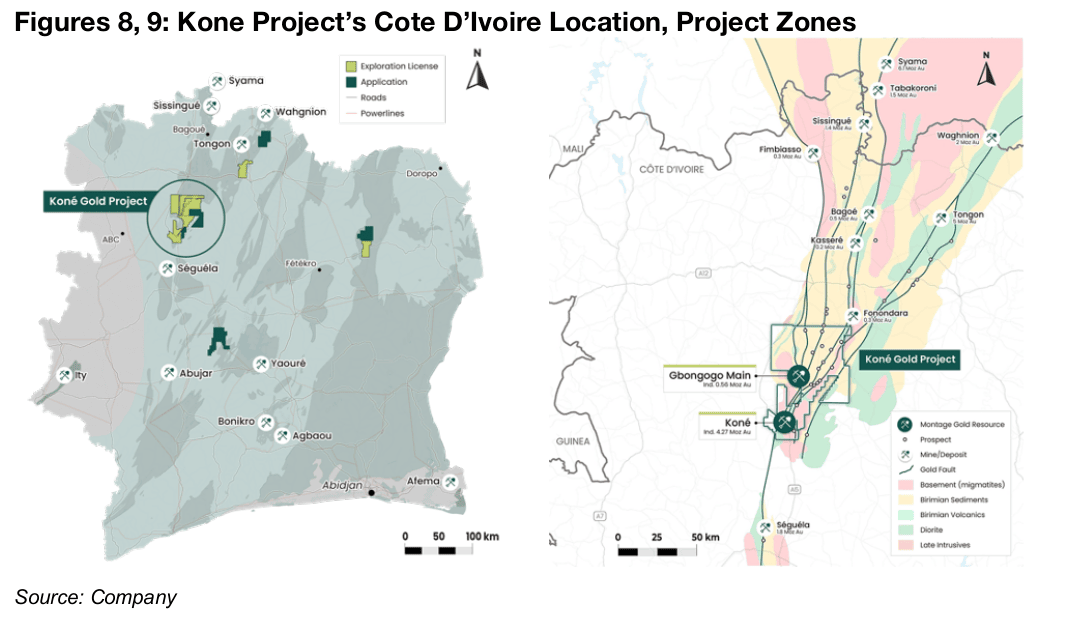

Montage Gold is the most advanced operationally of the two stocks, having

completed a Feasibility for its Kone Gold Project in Cote d’Ivoire this year. The project

is located in the northeast of the country (Figure 8), and comprises two deposits,

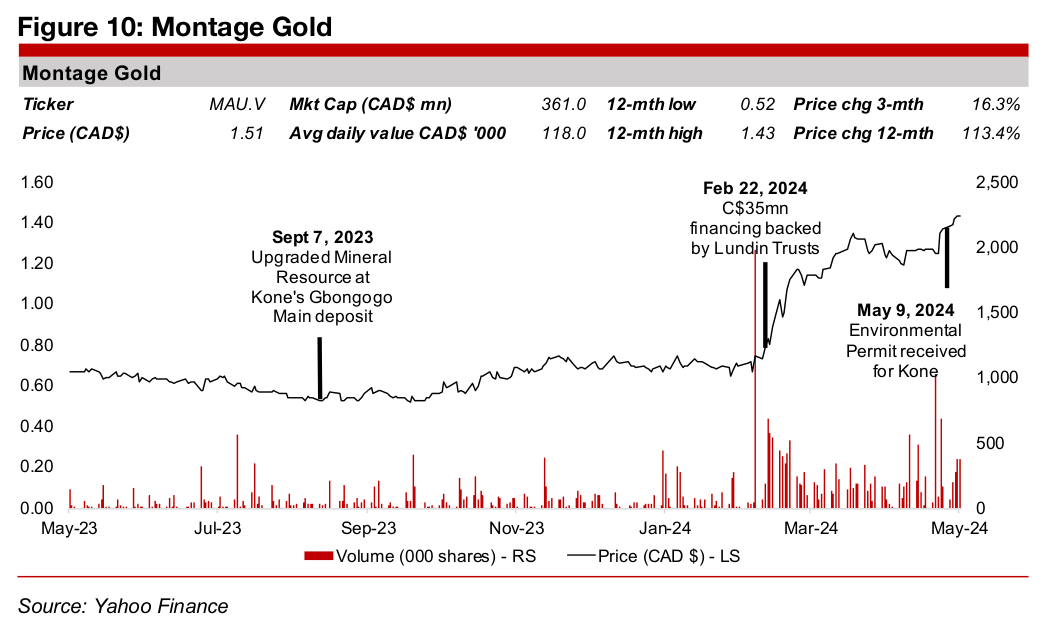

Kone and Gbongogo Main (Figure 9). The stock trended down overall through mid-

2023, but saw a pickup after a September 2023 announcement of an upgrade to the

total Resources at Gbongogo Main that lasted until November 2023 (Figure 10). The

share price then stagnated from December 2023 through to early February 2024.

However, the stock was again propelled by the announcement of a financing in late

February 2024 which was eventually upsized to C$35mn from an initially announced

C$20mn. Critically, the Lundin family, a major Canadian mining group, subscribed to

50% of the offering through its trusts, and this was seen by the market as a major

vote of confidence in the project. The most recent lift to the stock price was the May

2024 announcement that the company had received the Environment Permit for Kone,

a key milestone for the project.

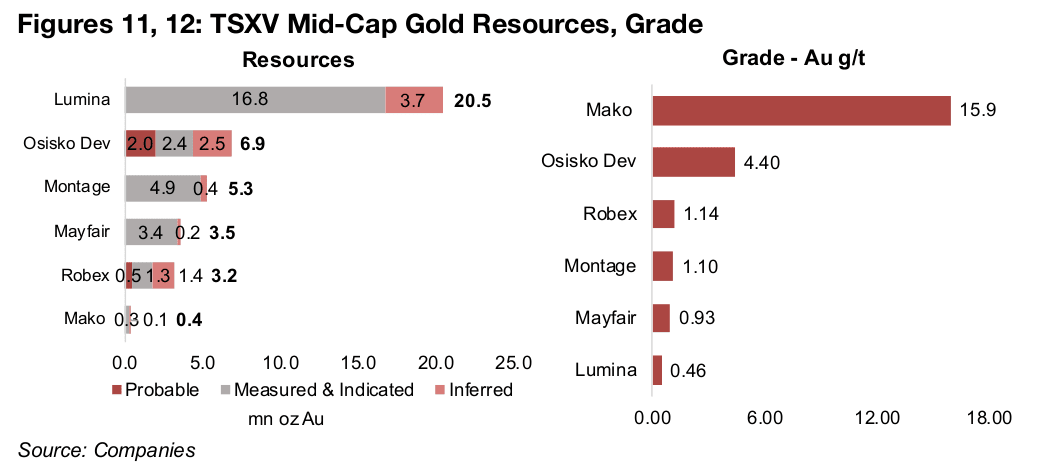

Montage is near the center of the mid-cap TSXV gold stocks in terms of Resources and grade (Figures 11, 12). The company’s Resources of 5.3mn oz Au, are below Lumina’s 20.5mn oz from its Preliminary Feasibility Study-stage Cangregos project in Ecuador and Osisko Development’s 6.9 mn oz, with 5.3mn oz from its Feasibility Study-Stage Cariboo project in British Columbia. Montage’s Resources are above Mayfair, with 3.5 mn oz Au from its Resource Estimate-stage Fenn Gibb project in Ontario, and the two producers, Robex and Mako. Robex has output from the Nampala mine in Mali and is developing the Kiniero project in Guinea, with total Resources of 3.5 mn oz Au, and Mako produces at San Albino in Nicaragua, with 0.4 mn oz in Resources.

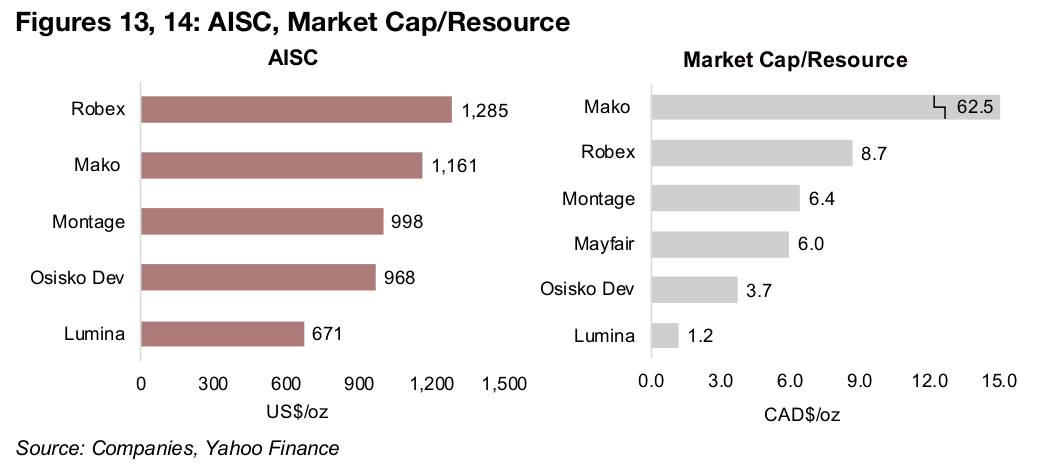

With Montage near the middle of the group for its grade, at a moderate 1.10 g/t Au,

all-in-sustaining cost, at US$998/oz and Resource size, it follows that its Market

Cap/Resource valuation, at CAD$6.4/oz is also near the center (Figures 13, 14). While

Mako has an extremely small resource, its grade is outstanding, at 15.9 g/t Au, driving

a Market Cap/Resource several magnitudes above the group, at CAD$62.5/oz. While

Lumina has a large resource, its low grade of just 0.46 g/t Au offsets a low AISC of

just CAD$671/oz, leading to the lowest Market Cap/Resource at CAD$1.2/oz.

Mayfair is only at the Resource estimate stage and therefore has no AISC estimate

but has a grade and Market Cap/Resource just below Montage at 0.93 g/t Au and

CAD$6.0/oz, respectively. Even with a grade only just above Montage at 1.14 g/t Au,

and relatively high AISC of US$1,285/oz, Robex still trades at a premium of

CAD$8.7/oz, justified partly by it already being in production. While Osisko

Development’s average grade of 4.40 g/t Au is quite high, with 23.2 g/t Au for the

Trixie project, with 0.9 mn oz Au in Resources, and 3.54 g/t Au for Cariboo, its Market

Cap/Resource is still towards the bottom of the group, at CAD$3.7/oz.

Mawson driven by Sunny Creek exposure through SXG holding

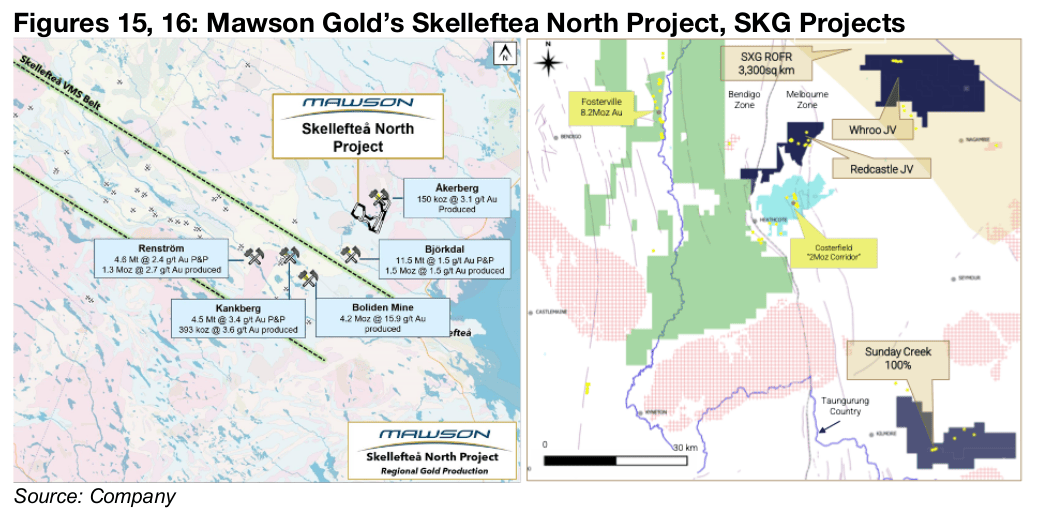

Mawson is at a much earlier stage than Montage, being still in exploration. The company is officially focused on Sweden and the Skelleftea North Project. The project is an area where there have been multiple producing gold mines and the company also plans to explore for uranium in the country (Figure 15). The company also owned the Rajapalot gold-cobalt project in Finland, but it was sold this year to its shareholders, leading to the formation of a new company, Mawson Finland. However, the main driver of its share price by far has been its 51% holding of Southern Cross Gold (SXG), an Australian company operating the Sunny Creek Gold Project (Figure 16). Extremely high grade drill results from Sunny Creek have been the main material news flow driving the stock over the past year.

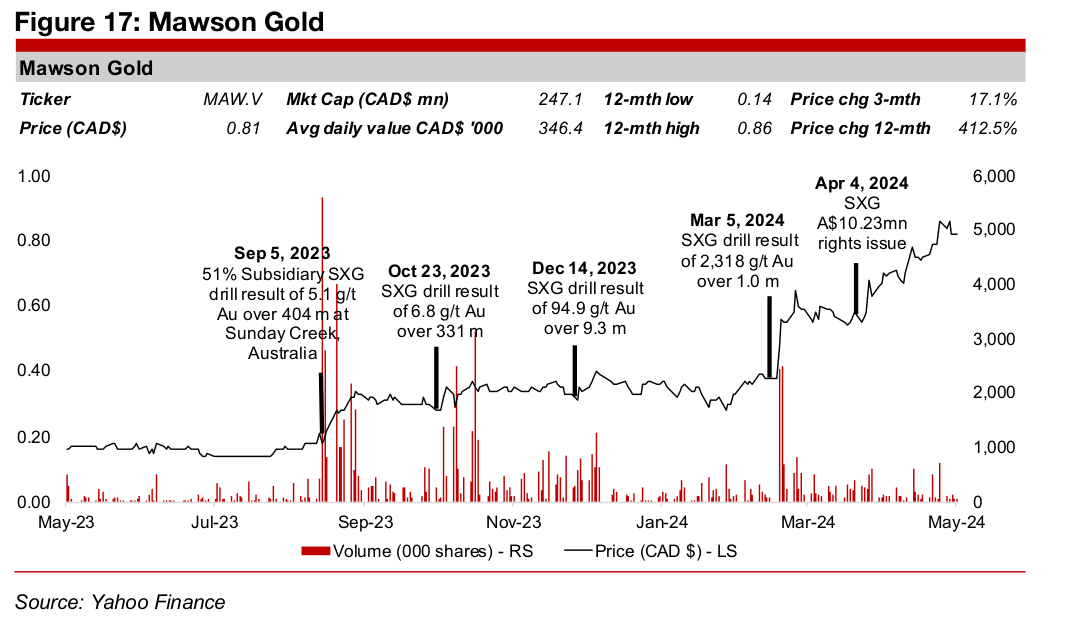

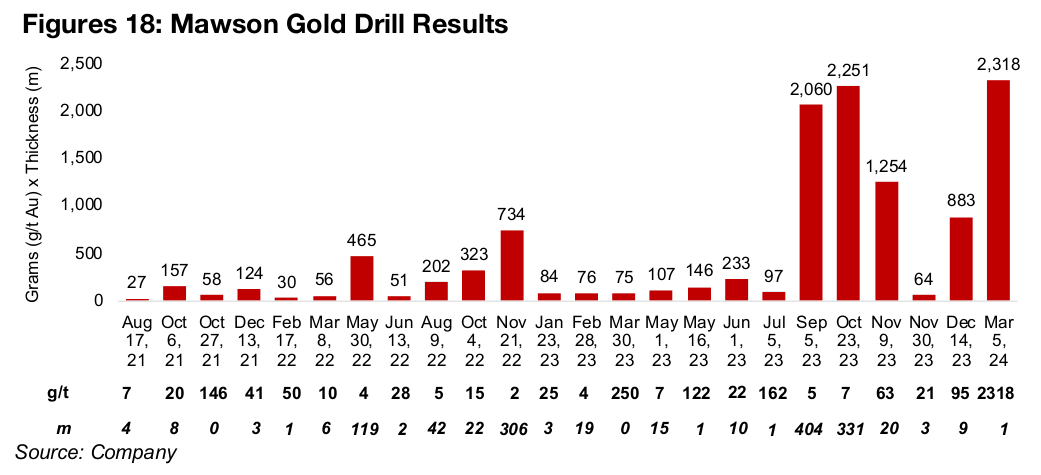

Sunny Creek’s drill results were moderate through 2020 and 2021, with hints of strong finds in May 2022 and November 2022 (Figure 17). The first outstanding result was released in September 2023, with 5.1 g/t Au over 404 m, for a grams-thickness of 2,060, leading to a near doubling of the stock (Figure 18). Additional strong results were released in October, November and December of 2023, with grams-thicknesses of 2,251, 1,254, 883, respectively, but share price gains were limited. There was another upswing in the stock on the strongest grade yet from Sunny Creek at 2,318 g/t Au over 1.0 m in March 2024. An April 2024 SXG A$10.23mn rights issue, with Mawson participating, further propelled the stock, which has trended up since.

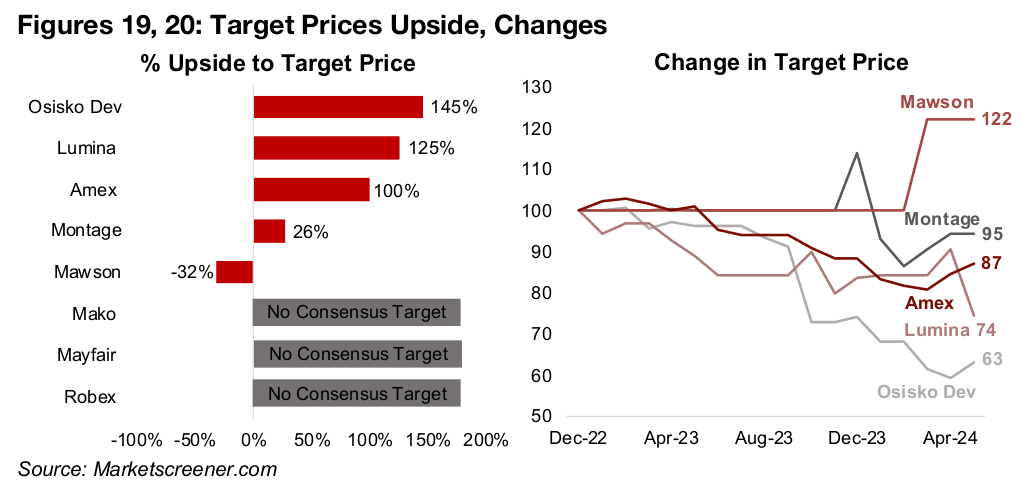

Moderate upside for Montage, downside for Mawson, to target prices

The market expects a moderate 26% upside for Montage to its target price (Figure 19), which had was been flat through most of 2023 before some volatility this year drove an overall 5% downgrade (Figure 20). The market sees Mawson as having become overvalued, and even after an over 20% upgrade of its target price this year, is still expecting -32% downside. Even though the market has downgraded the targets of developers Lumina, Osisko, and explorer Amex since 2023, there are still expectations for extremely strong upside for all three, by 145%, 125% and 100% respectively. There are no consensus targets for Mako, Mayfair or Robex.

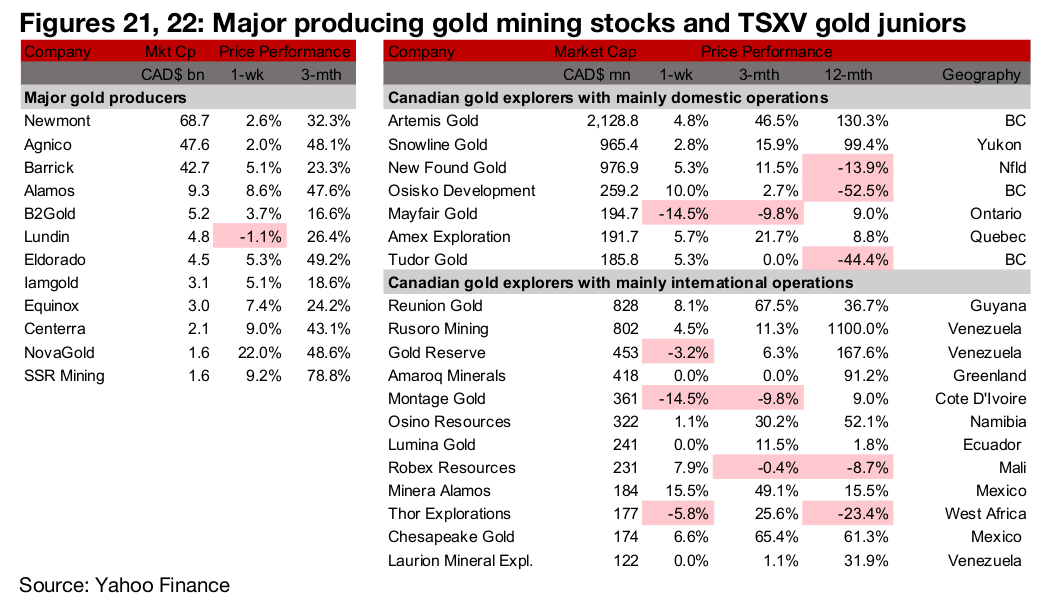

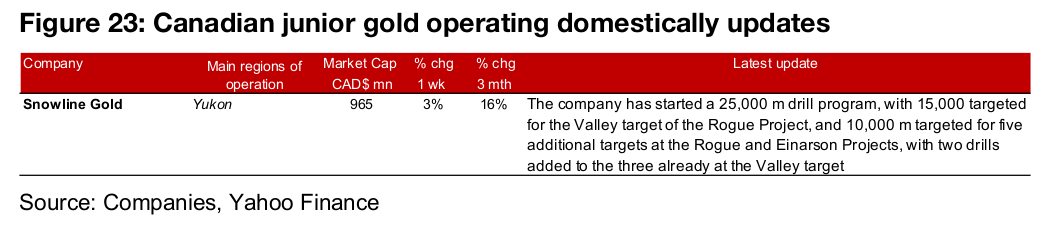

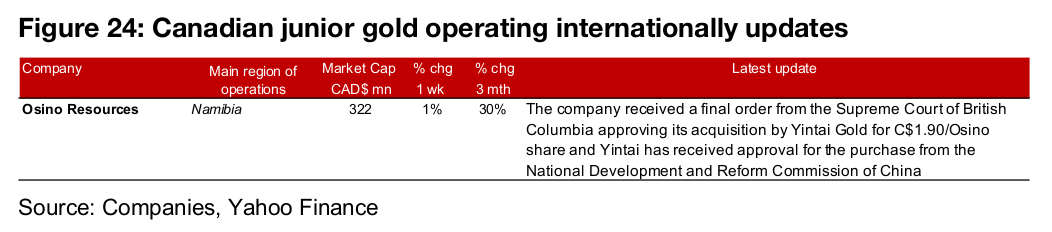

Most major gold producers and TSXV gold rise

Most of the major gold producers and TSXV gold rose (Figures 21, 22). For the TSXV gold companies operating domestically, Snowline announced the start of a 25,000 m drill program at Rogue and Einarson (Figure 23). For the TSXV gold companies operating internationally, Osino Resources received a final order from the Supreme Court of British Columbia for its acquisition by Yintai Gold (Figure 24).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.