January 16, 2023

TSXV Lithium's Position in Global Supply Chains

Gold continues up on weakening inflation and US dollar

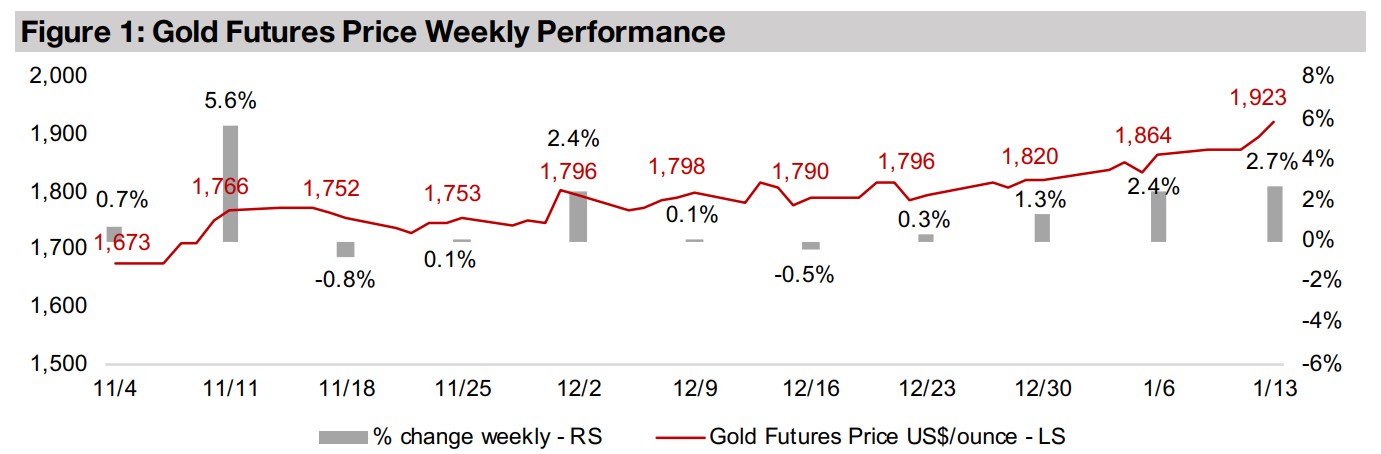

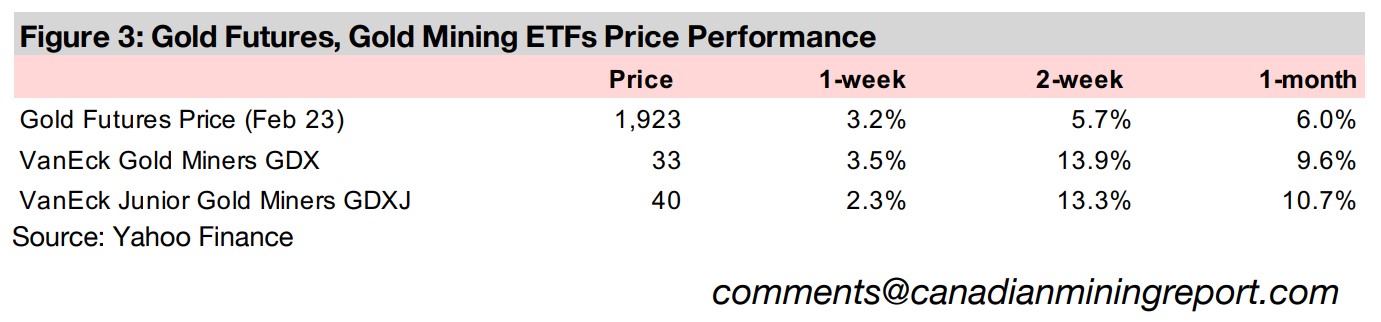

Gold jumped another 2.7% to US$1,923/oz after gaining 2.4% last week, buoyed by a continued decline in US CPI inflation shown in the December 2022 report, boosting the market's expectations for a rate pullback by the Fed, and a falling US dollar.

A look at TSXV lithium companies' position in global supply chains

First, we give a basic overview of the global lithium supply chain from mine to EV batteries, which will soon become the majority of end demand for the metal, and then look at how the large TSXV lithium companies are positioned within this matrix.

TSXV Lithium's Position in Global Supply Chains

Gold jumped 2.7% to US$1,923/oz, marking its third week of gains, with the metal

now up 5.6% since the end of 2022, buoyed by a combination of economic data and

continued rise in broader risk in markets moving into 2023. The big driver this week

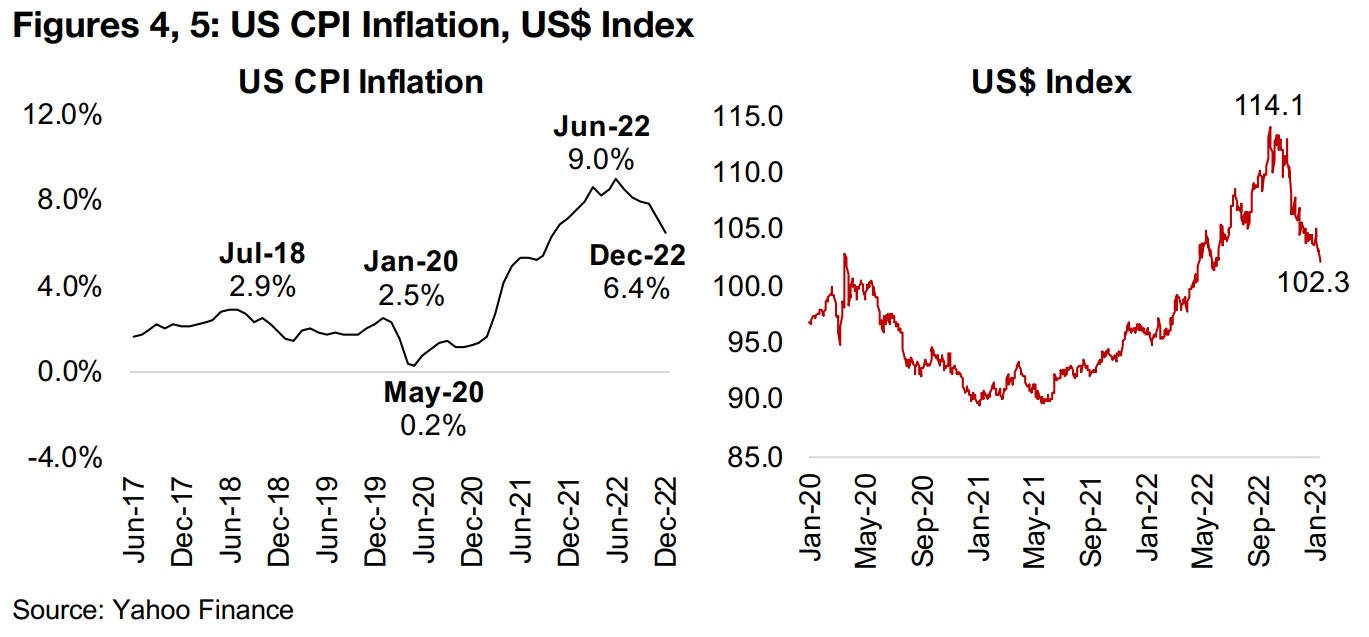

was the US CPI inflation for December 2022, which showed a drop below 7.0% for

the first time since December 2021, to 6.4%, which drove yet another round of

excitement that this would bring the Fed one step closer to a less aggressive

monetary policy (Figure 4). It was interesting that the gain in the equity markets on

this news was less pronounced than for the last two releases showing a fall in inflation,

indicating that a large part of 'declining inflation story' may have been priced in.

The other major driver has been the abrupt and continued fall in the US$ Index, which

is now down around -10% from its peak at 114.1 in September 2022 to 102.3

currently (Figure 5). We do believe that gold could continue to have a strong year,

propelled by rising economic and political risks, expectations for an eventual

loosening monetary policy and a falling dollar. However, we still remain concerned on

the equity markets overall, with recent abrupt upward moves more indicative of a

bear market rally than the more gradual gains of a sustainable bull market. Continued

high interest rates for over half a year are already driving contracting valuation

multiples, and could soon also hit earnings if they cause an economic slowdown.

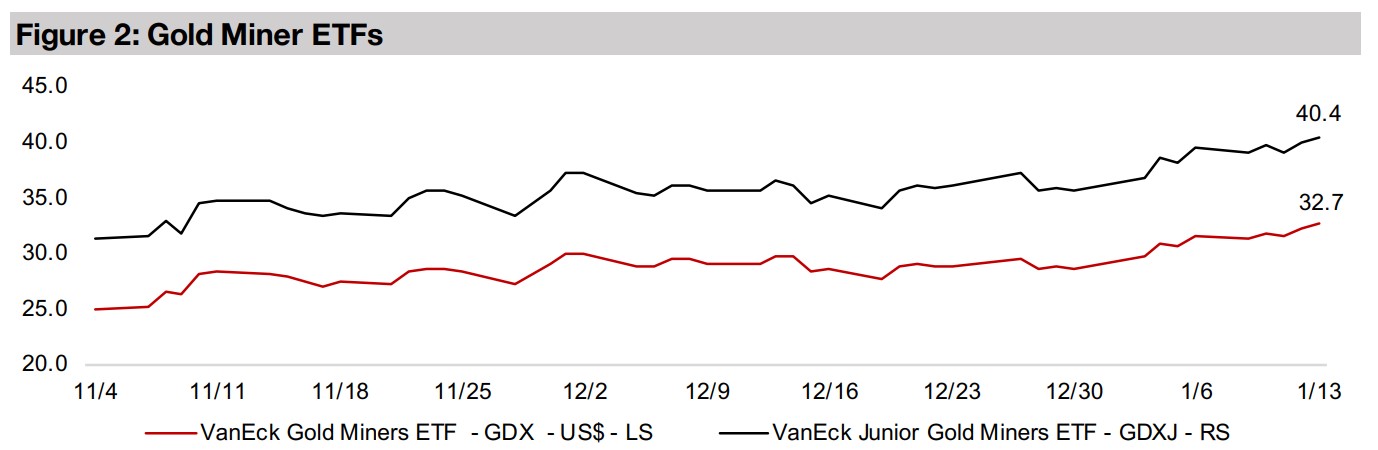

The big question for gold stock investors is whether the rise in gold can offset

continued equity market pressure. This is especially an issue for the juniors, with an

overall risk-off stance likely to hit the smallest stocks, and especially those without

any earnings, the hardest. What will really be needed to test this is a period where

gold is flat or rising during a reversal of a bear market rally in the overall equity market,

to see if investors hold their gold stocks, or sell them off along with everything else.

Lithium price continues to slide, but how much will it affect TSXV juniors?

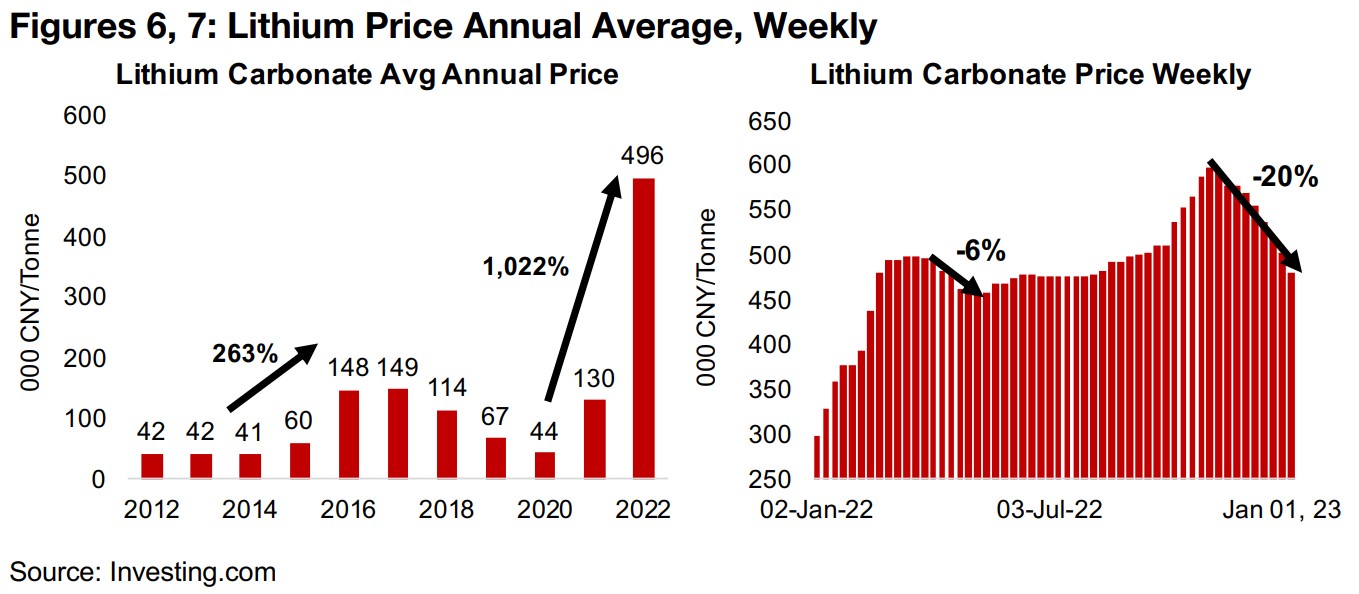

In light of ongoing lithium price volatility, this week we look at the large TSXV lithium juniors in the context of their industry's supply chains from mines to electric vehicle batteries. The average annual lithium price has rocketed up over 1,000% from 2020 to 2022 as far higher than expected electric vehicle demand outpaced supply, with the situation exacerbated by the global health crisis (Figure 6). However, the price seems to have peaked, and is down 20% since the start of November 2022, on expectations the EV demand could ease on high unit prices and a slowing economy pressuring consumers, as well as new supply expected for this year (Figure 7).

The lithium supply chain from mine to EV batteries

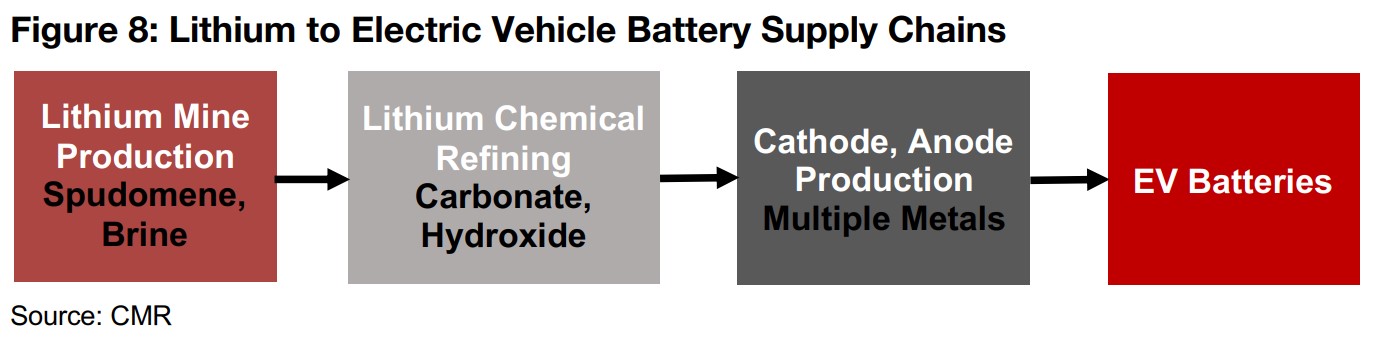

Figure 8 shows the lithium supply chain from mine production to what will increasingly be the majority of its end demand, electric vehicle batteries. Mine production takes two main forms; 1) hard rock, which is mainly spudomene, with the lithium in high concentration in these rocks and extracted, which is a less expensive process, and 2) brine, with saltwater containing lithium pumped through a series evaporation ponds to extract out the salt, leaving an increasing amount of lithium in the liquid at each subsequent stage, which is a higher cost process. The raw lithium is then processed into two main forms, lithium carbonate and lithium hydroxide. Lithium is then combined with other major battery metals including nickel and cobalt to produce cathodes and anodes, the core components of EV batteries.

Mine supply and reserves mainly from Australia and Chile

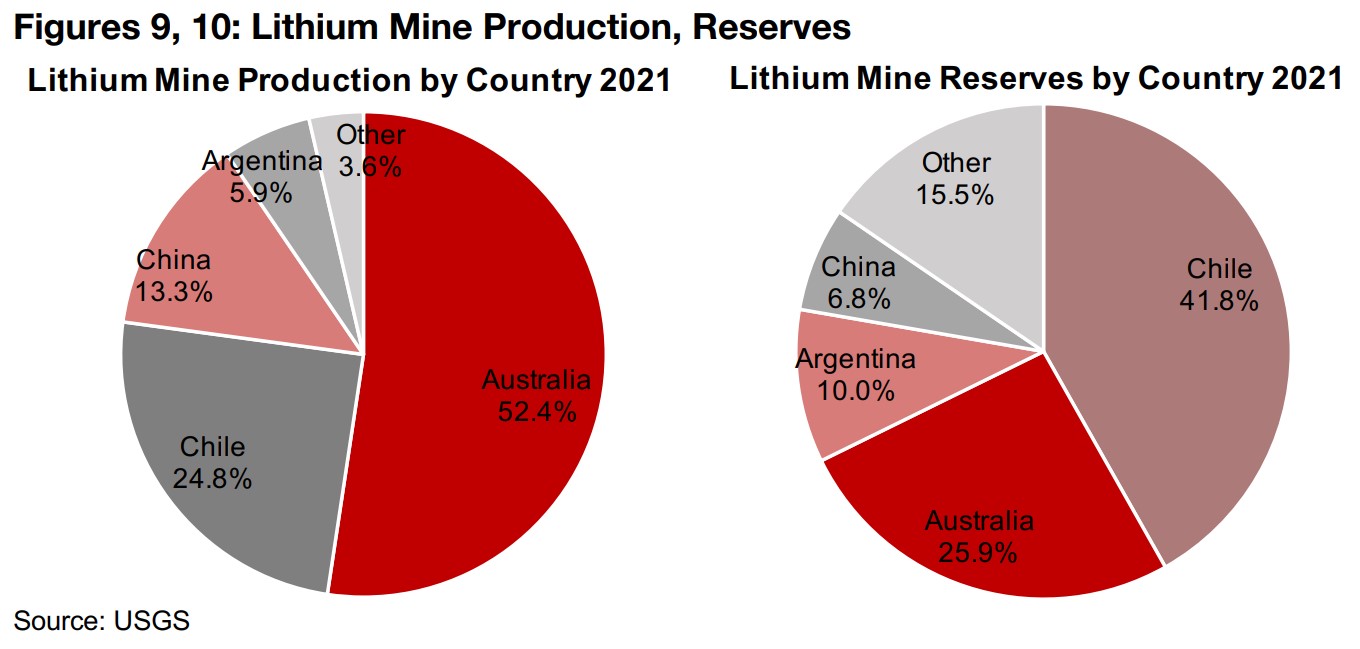

Currently lithium production is almost entirely from just three countries, Australia, at 52.4% of the total in 2021, Chile, at 24.8% and China at 13.3%, with both Australia and China having mainly hard rock production and Chile's supply mainly coming from brines (Figure 9). However, this balance of production will shift more towards brine over time, as over half of the world's lithium reserves are in South America, with Chile having 41.8% and Argentina 10%, with lithium in the region mainly coming from brines (Figure 10).

Demand shifting towards EV, hydroxide, processing concentrated in China

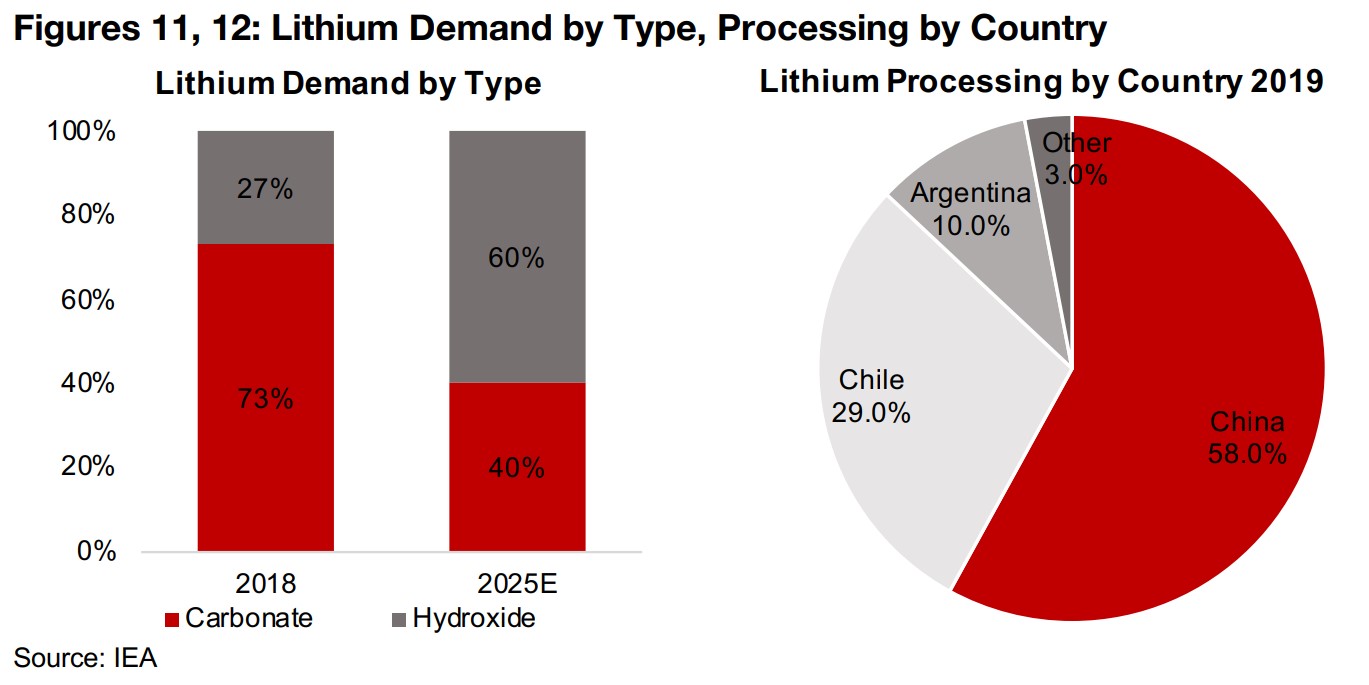

Moving up the supply chain to processing, while lithium carbonate has comprised the

majority of demand in recent years, at 73% of the total in 2018, this is expected to

drop to just 40% by 2025, with hydroxide rising to 60% (Figure 11). Lithium hydroxide

battery cathodes give batteries more capacity, a longer life, and higher safety, thus

driving the expected rising demand. This shift also effects the earlier parts of the

supply chain, with hard rock spudomene allowing for direct production of lithium

hydroxide, while the brines generally are processed into lithium carbonate first, and

then into lithium hydroxide, lengthening the process and adding cost.

Processing of lithium remains concentrated in China, at 58% of the total, with most

of the rest of the processing in South America, with Chile at 29.0% and Argentina, at

10.0% (Figure 12). China has an even larger share of cathode and anode production,

at 70% and 85%, respectively, and also produces the majority of EV batteries, at

56%, with Korea at 26% and Japan at 10%.

Shift to EV battery demand, slight surplus short-term under base case

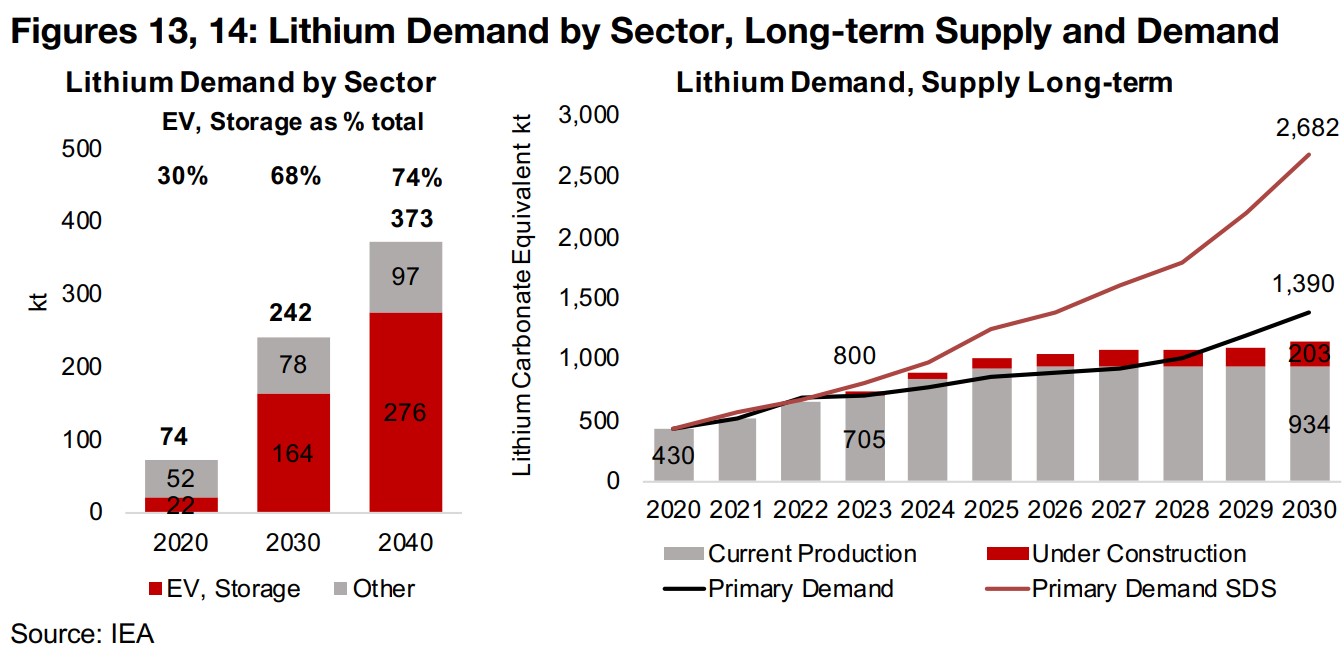

Only a minority of lithium demand even in recent years was from EV batteries, at just 30% of the total in 2020, but this is expected to rise to 68% by 2030 and 74% by 2040 (Figure 13). Under a base case scenario the International Energy Agency forecasts that current production could meet demand this year and even outpace it if new projects under construction are completed (Figure 14). Current production sources alone are also expected to surpass demand from 2024 to 2026, and adding projects under construction could send the lithium market into surplus. However, even under the base scenario, a reasonably large deficit is forecast to emerge by 2029. Under the IEA's sustainable development scenario, the demand is far higher, and could significantly outpace supply by 2025, increasing to a massive deficit of 1,545 kt of lithium carbonate equivalent on 1,137 kt of supply by 2030.

Substantial long-term opportunities for the TSXV lithium juniors

The IEA's two scenarios give a mixed outlook for lithium prices in the short-term, with the potential for a moderate surplus or a deficit over the next two years, which could mean some major swings in the price as market forces work this out. However, within the next five years, lithium producers should see reasonably strong demand and high prices for their output as the electric car revolution seems unlikely to be reversed over this period, pointing to sustained high demand for electric batteries and the lithium that goes into them. This timing appears to work well for most of the large TSXV junior lithium miners, most of which are already at a reasonably advanced stage, which will see them most likely enter production within two to three years, just as a deficit in the market could potentially be developing.

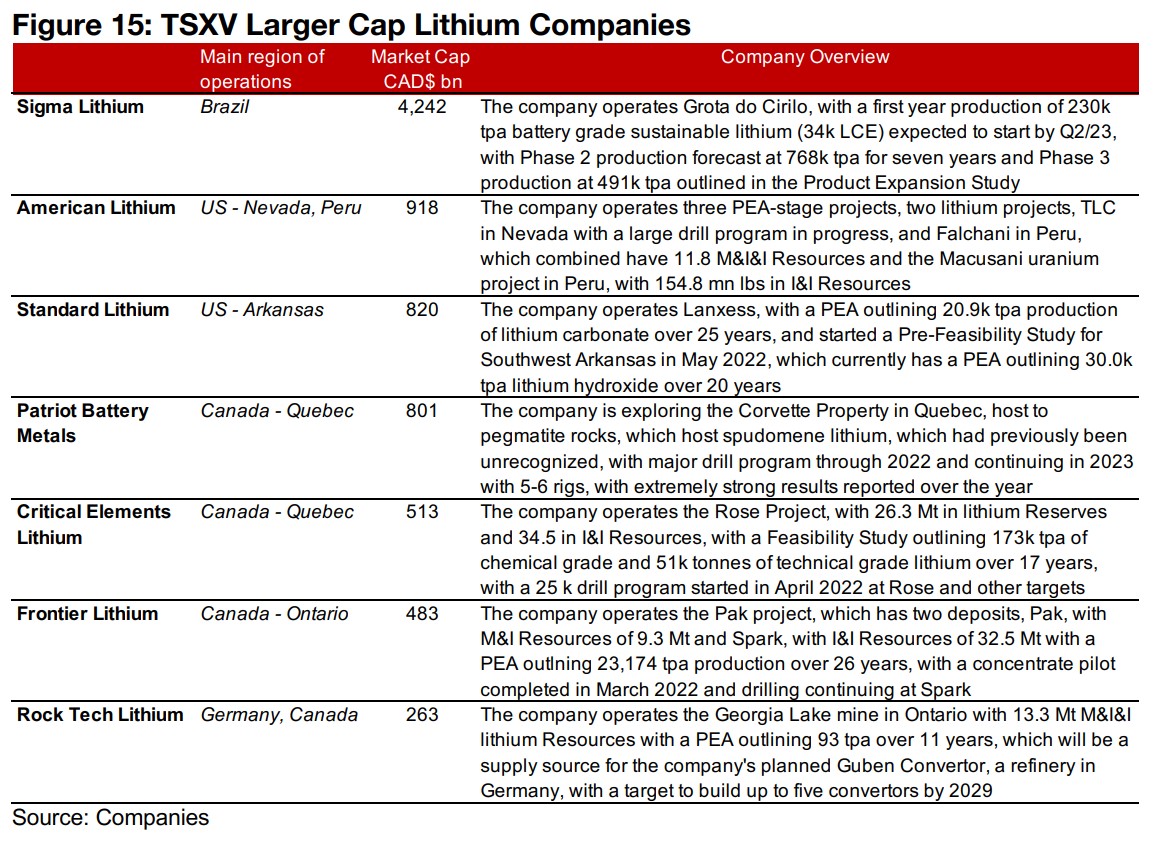

Most TSXV lithium stocks at advanced stage with PEA or Feasibility Study

The most advanced TSXV lithium junior is Sigma Lithium, with its large Grota do Cirilo

project expected to begin operating this year, making it the largest market cap mining

stock on the TSXV by a wide margin (Figure 15). Production at the project will be

lithium hydroxide, allowing it to capitalize on the market shift towards this product,

and from hard rock spudomene, differentiating it from much of South American

production, which is from brines.

The next largest company is American Lithium, with two PEA-stage projects, both

hard rock spudomene production of lithium carbonate, TLC in Nevada and Falchani

in Peru. Standard Lithium operates two PEA-stage projects in Arkansas in the US,

covering both of the major types of lithium, Lanxess, expected to produce lithium

carbonate for 25 years, and the Southwest Arkansas project, forecast to produce

lithium hydroxide over 20 years. Critical Elements Lithium is at the Feasibility Study

stage for its 17-year lithium spudomene Rose Project in Quebec, and Frontier Lithium

in Ontario is at the PEA-stage for its planned 26-year Pak Project.

Rock Tech Lithium is vertically integrated, with its 11-year, PEA-stage Georgia Lake

mine in Ontario to provide supply for the company's planned refinery in Germany.

Patriot Metals is a newcomer to this larger cap group over the past year, still in the

exploration phase at its Corvette Project, with strong drill results over the past year

driving its market cap up 1,289% from microcap territory at the start of 2022

(Figure 16).

While this has seen Patriot's performance outpace the other big TSXV lithium

companies, the rest of the group had made their micro to small cap transition in earlier

years. Sigma Lithium, already sizeable in terms of market cap at the start of 2022 did

see major gains though this year, up 231%, as it is on the verge of production. The

only other stock to see strong gains was Critical Elements, with the rest of the group

either flat or substantially down since 2022.

TSXV lithium producer performance quite divorced from lithium price recently

This range of share prices performance certainly does not correlate to the jump in lithium price. While the rise in lithium will have been incorporated at least to some degree in these prices, the market has clearly been focused much more on company specific drivers, possibly assuming that the lithium price will not be sustained at 2022 levels. Another major factor is that the markets are becoming more risk averse in general and selling down small caps, with junior miners without revenue overall seeing more scrutiny from the market. While a PEA or Feasibility Study, which most of the TSXV lithium group have, reduces this risk, it still does not eliminate it, and there are still many hurdles to surmount, and much financing to raise, especially entering what appears to be a global economic slowdown.

TSXV lithium juniors have unique models within the global supply chain

The TSXV lithium producers all have quite unique models with the context of the global lithium supply chain that we have covered here. The primary differentiating advantage is their geography; while lithium mining is dominated by Australia, Chile and China, these companies have projects in Peru, Brazil, Canada and the US. Having projects in the latter two countries is becoming more important geopolitically given North America's still small share of lithium globally, and rising security concerns. The projects are mostly reasonably large with long mine lives, and cover both hard rock spudomene and brine, and lithium carbonate and lithium hydroxide, for those looking to make investments leaning toward either side of the shifts in these markets.

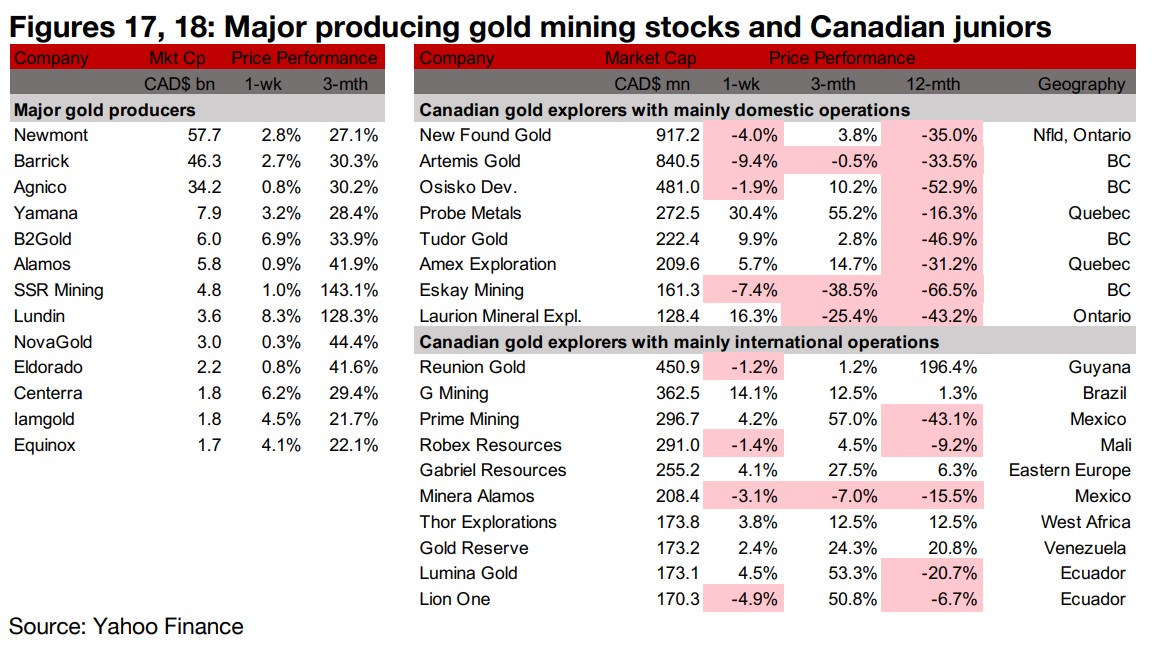

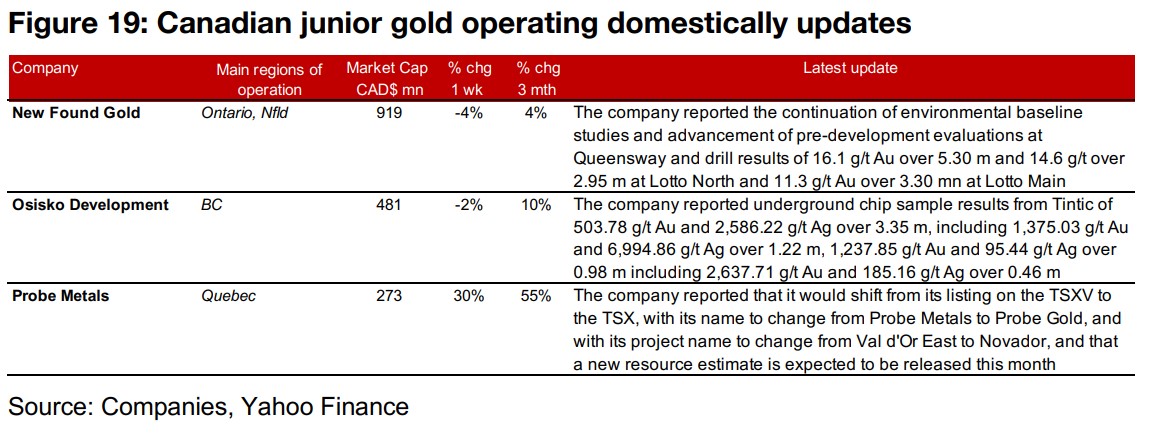

Gold producers rise and TSXV gold stocks mixed

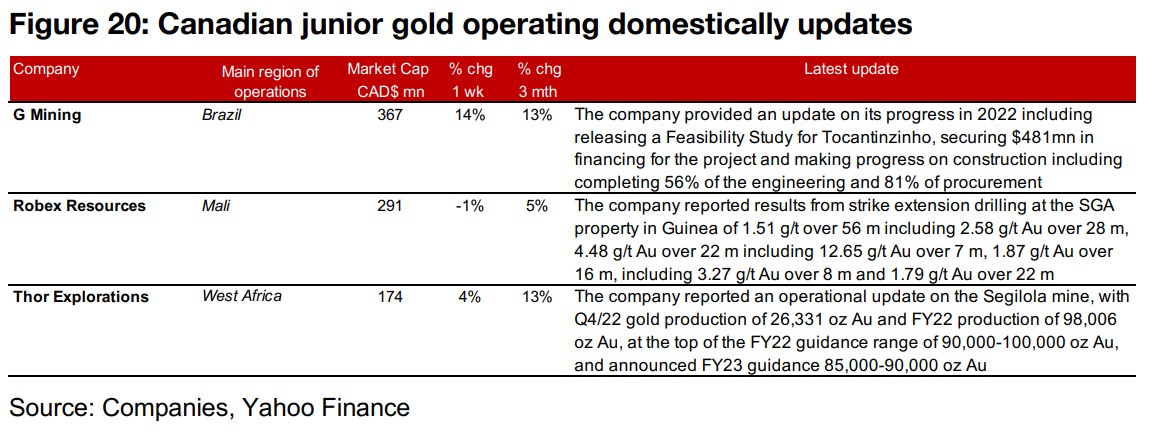

The producing gold miners all gained and the TSXV junior gold miners were mixed as gold and equity markets rose (Figures 17, 18). For the Canadian juniors operating mainly domestically, New Found Gold reported the continuation of environmental baselines studies and pre-development evaluations at Queensway and drill results from the Lotto Zone, Osisko Development reported chip samples from Tintic and Probe Metals reported its shift to a TSX listing, name change to Probe Gold and project name change to Novador (Figure 19). For the Canadian juniors operating mainly internationally, G Mining provided an update on its progress in 2022, Robex reported results from drilling at the SGA property in Guinea, and Thor reported an operational update on the Segilola mine including Q4/22 production and announced FY23 production guidance (Figure 20).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.