January 23, 2023

TSXV Gainers in the Gold Rebound

Gold rally continues at a slower pace

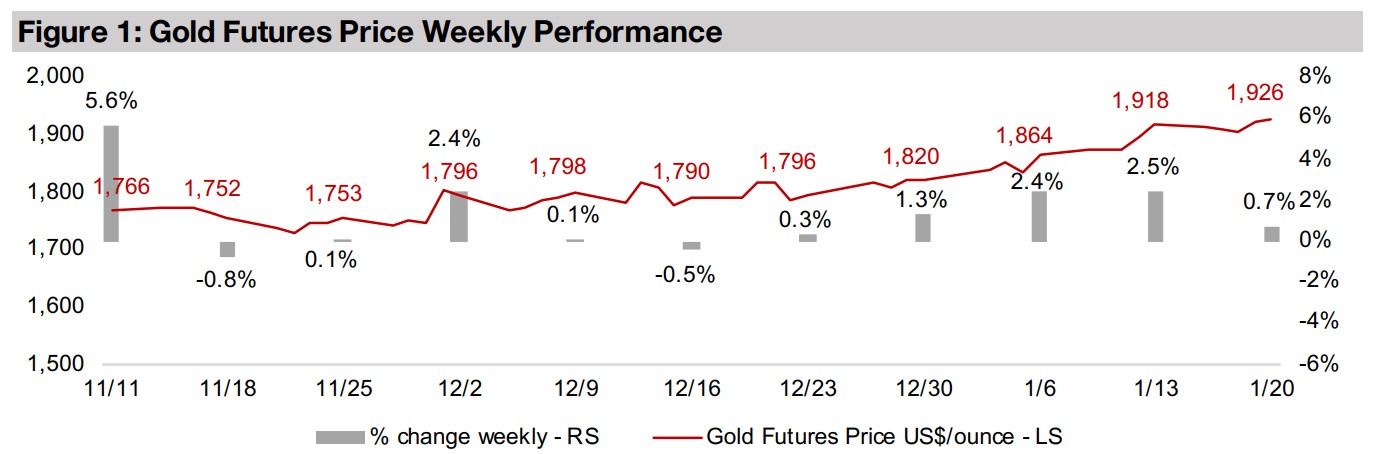

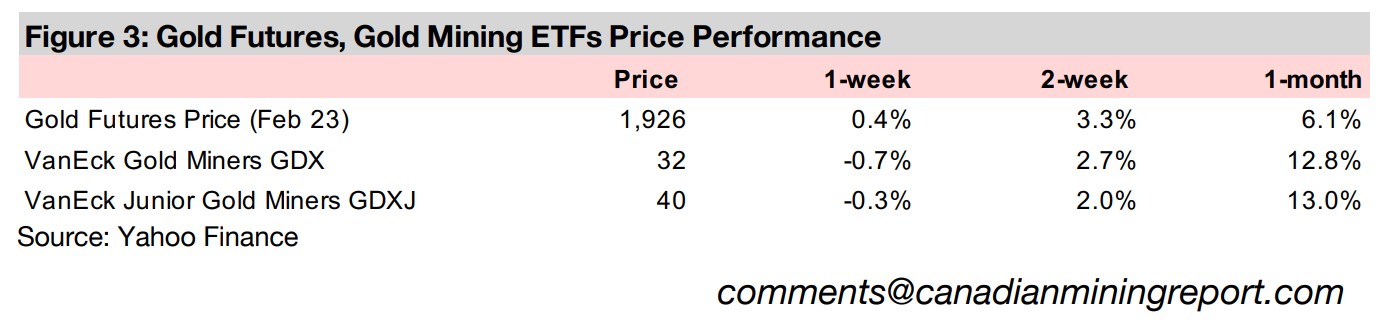

Gold gained 0.7% to US$1,926/oz, rising for the fifth consecutive week, but with the place slowing a bit especially after particularly large jumps over the past two weeks, as the 'falling inflation means a more dovish Fed' story continued, but with less steam.

A look at TSXV gold stocks' performance in the rally since October

This week we look at the performance of the TSXV gold stocks in the sector's rally since October 2022, which has been quite subdued compared to the big rebounds in the GDX and GDXJ, as small caps have remained under pressure.

TSXV Gainers in the Gold Rebound

Gold rose 0.7% to US$1,926/oz, marking the fifth consecutive week of gains,

although the pace of the rise eased compared to well over a 2.0% increase over each

of the past two weeks. It has been a good start to the year for the gold, with an

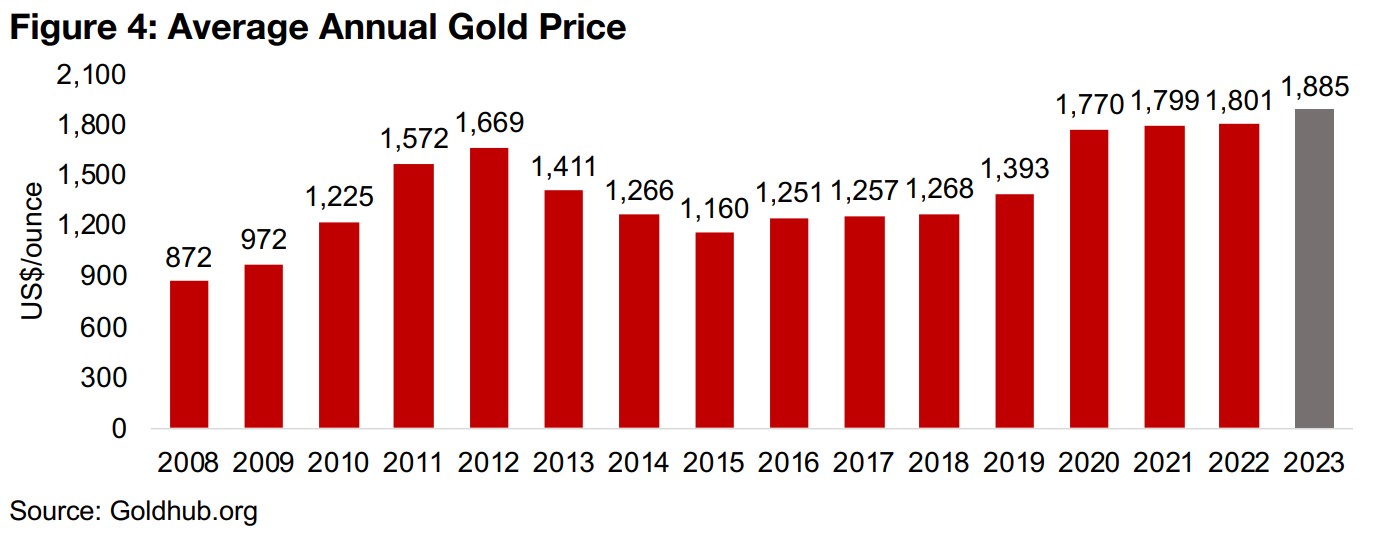

average US$1,885/oz so far in January 2023 seeing it at its highest level ever. If it can

sustain these levels, this year it could finally move above the average of almost

exactly US$1,800/oz that it had maintained over 2021 and 2022 (Figure 4). We believe

that there is certainly enough economic and geopolitical risk lurking that an average

for 2023 of US$1,900/oz could not be considered an aggressive target, and that

levels much higher may be possible.

This could see gold move into the third phase of a bull market that actually began as

far back as 2016, with nearly a US$100/oz gain above the 2015 lows. However, even

as gold eked out gains in 2017 and 2018, this first phase was still certainly perceived

as every bearish at the time. It was only in the transition to the 'second phase' in 2019,

especially in the second half of that year, that the bull market really gained traction,

reaching US$1,770/oz or nearing the 'new normal' of US$1,800/oz of the following

two years. It is still unclear whether we have entered 'phase three' yet, but we see a

larger probability that the gold price surprises to the upside than the downside this

year, whereas we saw these risks as roughly balanced through 2022.

Overall equity market has been struggling since December 2022

The big gains in gold and equity markets over the past few months have been driven

partly by expectations that cooling inflation and some other weak economic data may

lead to a more dovish US Fed which will begin to pullback sooner on its current

aggressive rate hike path. We still suspect that the equity markets may be getting a

bit ahead of themselves overall, and that the benefits of lower rates could be offset

by the economic fallout and consequent company earnings declines caused by rates

already being so high for so long.

The rally in the S&P 500 ran from late-October 2022 through to November, but has

lost steam since. While there have been market jumps on the last three declining US

inflation releases, each has been less sustained, with gains after the January release

of the December 2022 inflation data entirely reversed in just five trading days. We

suspect that we may still be in a bear market rally for equity markets overall, and if

the falling inflation story is increasingly priced in, the next driver is not clear. The Fed

has shown no signs of backing down on rates, and been clear that it will maintain

them at high levels even once inflation has faded, to entirely crush inflation

expectations. Meanwhile economic data is starting to slow, which ironically is what

is supplying the markets with their hopium in the first place, but could mean that

company earnings decline even as interest rates and inflation remain high, certainly

in terms of the past forty years. Hardly a recipe for a sustainable bull market rally.

Gold stock rally has continued even with weakening equity markets

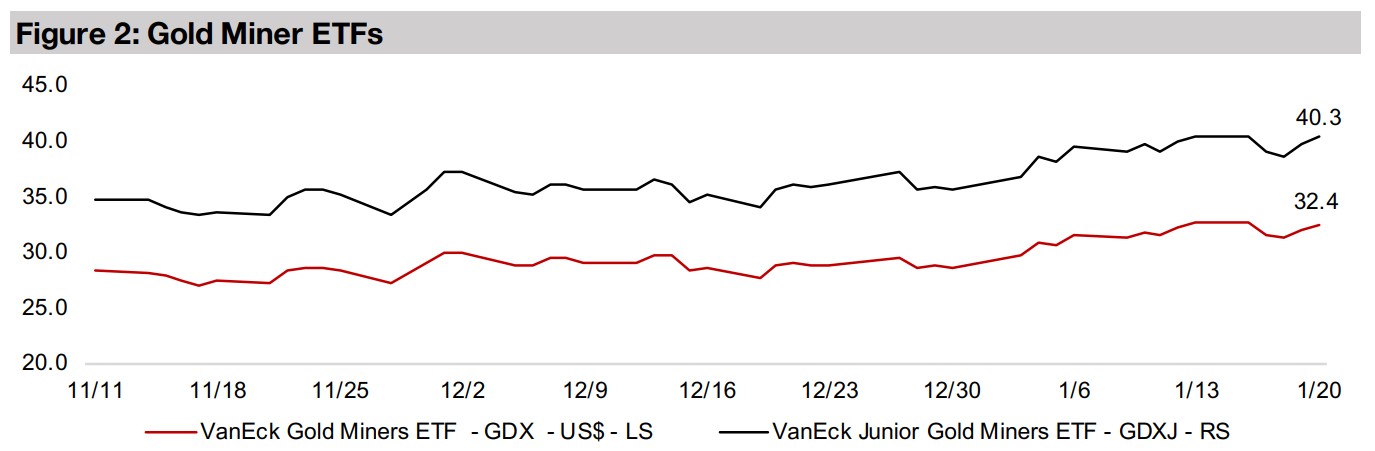

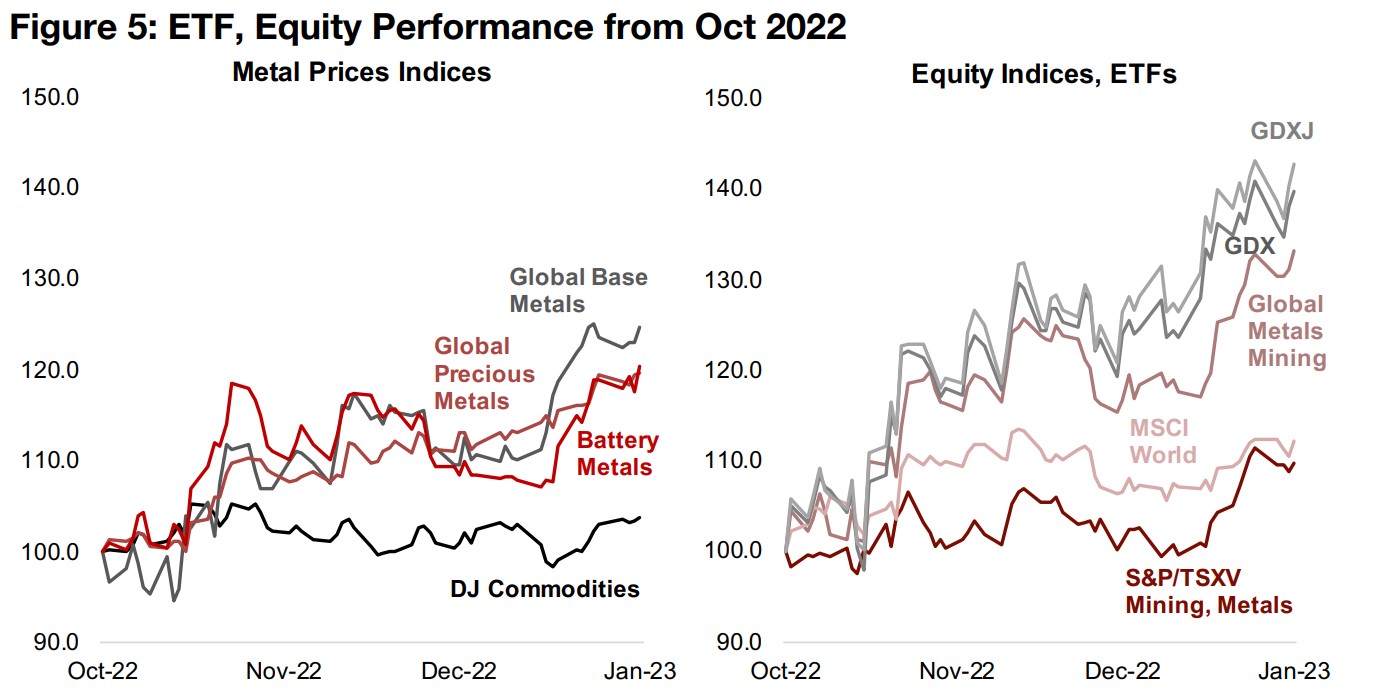

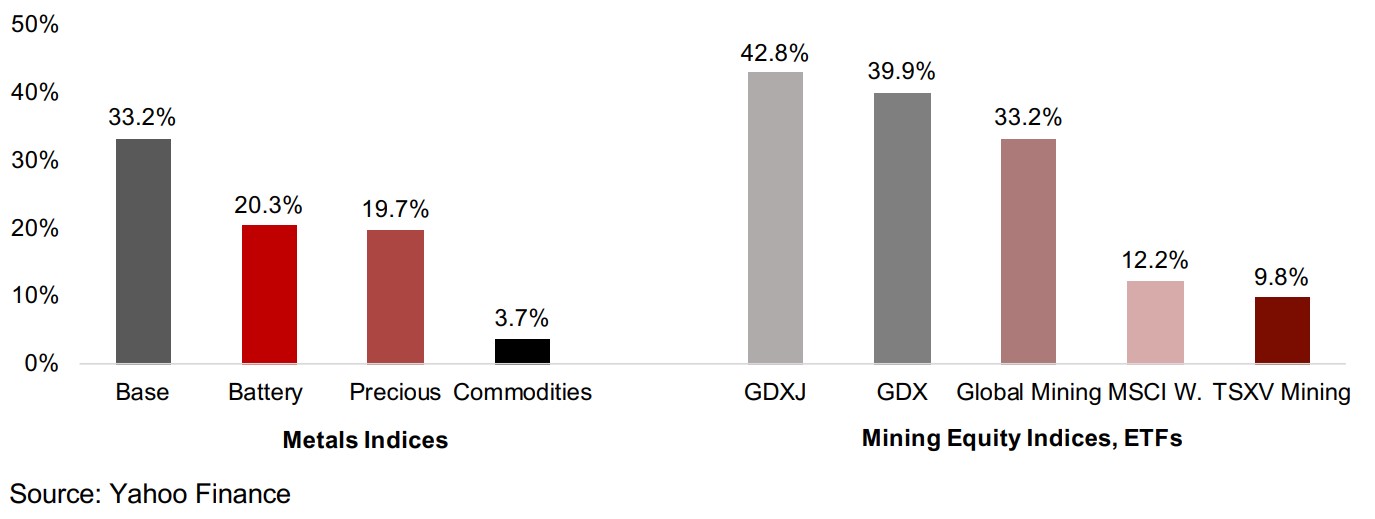

It might seem with the quite bearish picture we have outlined here for equity markets overall, that gold stocks could also face downward pressure. We had previously been concerned that gold stocks could be hit by an overall decline in stock valuations, but acknowledged that this could be offset by a heavy move into a gold as a risk hedge given the dark economic clouds gathering. It seems that the latter driver has won out so far, with the GDX ETF of producing gold stocks jumping 39.9% since late-October, 2022 and the GDXJ ETF of junior miners gaining even more, up 42.8% (Figure 5). This has roundly trounced the performance of the MSCI World, up just 12.2% over the past three months, and the DJ Commodities Index, up just 3.7%.

Gold stocks outpacing broader resurgence of base metals

This rise has been part of a broader rise in metals in general, with precious metals up 19.7%, base metals up 33.2%, battery metals up 20.3%, and the index of Global Metals and Mining Stocks gaining 33.2%, with the base metals rise likely driven by the reopening of China, However, the gold stocks have dramatically outpaced all of these, as gold’s main driver is its function as a hedge against monetary expansion and political risk, quite different to base metals, driven by the industrial cycle. We see the rise in the base metals as precarious given the weakening economic situation, which could hit demand in the sector quite hard. However, with the monetary or geopolitical risk situation unlikely to improve substantially this year, we could see relatively more support for gold and gold stocks versus base metals.

Crypto likely no longer stealing gold's fire

Another 'new' driver for gold that may be coming through this year is the absence of a cryptocurrency boom. At this time last year, the cryptocurrency sector was still the rage, peaking for the year in March 2022, and then devolving into worsening scandals for the rest of the year, with many coins evaporating completely and even the systemic infrastructure brought into question by the FTX collapse. Cryptocurrency from 2020 through to early 2022 had almost certainly been drawing away funds that might have otherwise flowed into gold, at the time being touted as ‘digital gold’ and also a comparable, or even better, store of value than the metal. All these ideas were shown as flawed in the crypto crash of 2022, with crypto exposed as a high risk asset, and we suspect that some of the fund flows that would have otherwise gone into cryptocurrency had the boom continued will have been diverted into gold in 2023.

Still risk that profit taking or overall equity decline could hit gold stocks

Even with all this wind at the back of gold stocks, we do need to acknowledge that 40% gains in the space of just three months like that seen for the GDX and GDXJ are quite extreme, and even if the macro situation does remain supportive of gold, short-term profit taking still remains a risk. We could need to see gold head towards US$2,000/oz to keep this party going, and a hard reversal in equity markets overall could still see the gold stocks take a hit in absolute terms, even if they continue to outpace the overall market.

Small cap TSXV Metals and Mining Index lags larger gold stocks

Interestingly, the performance of the S&P/TSXV Metals and Mining index has not tracked the gains of the GDX and GDXJ, rising just 9.8% since late-October 2022, just a quarter that of these two industry bellwether ETFs. While part of this is because the index is not entirely a gold index, with a large weighting of lithium and copper stocks, gold is still the big driver. The lithium price's decline in recent months has actually not had that much of an effect on the TSXV lithium stocks, which have been recently driven more by company specific factors than their metal price. The main reason that we see for the underperformance is that the TSXV Metals and Mining Index is populated by small cap stocks at early exploration stages.

Small cap gold explorers are certainly no risk hedge

The reason that investors have been flooding into gold stocks is because they view

them as a hedge against risk, as they have both reserves and current production of

a commodity that has been steadily gaining in value for several years and is expected

to continue to do so. The GDX ETF of producers certainly only comprises stocks like

this, and the GDXJ, while comprising junior mining stocks, has a large contribution

from companies that are already in production. In distinct contrast, most of the

companies in the TSXV Metals and Mining Index are in the early exploration stage,

with very few having entered production.

Also, even those junior miners on the TSXV at relatively advanced stages of

exploration still have no revenues, and require large upfront capital to get projects

into production at a time when raising cash is getting more difficult. Many earlier stage

juniors have not even released an initial mineral resource estimate, and therefore have

little proof to keep investors injecting capital, and often only a year or so of cash

runaway. So this is not really a group of stocks investors will pile into when they are

looking for a strong risk hedge.

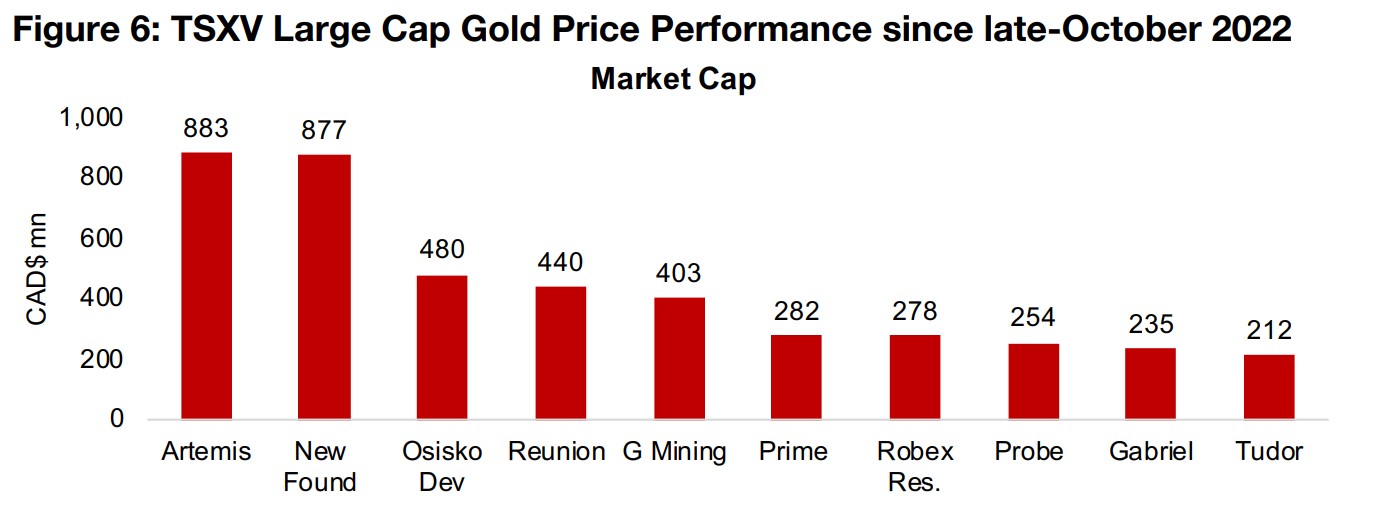

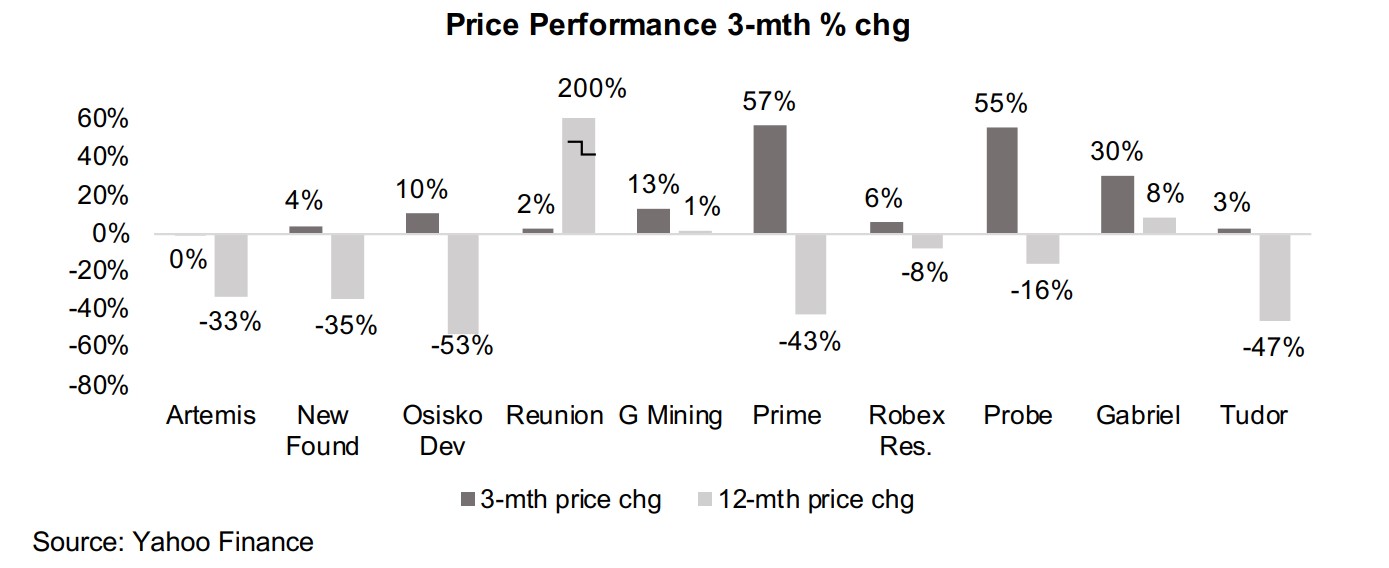

Most large cap TSXV gold explorers seeing moderate gains in rally

Nonetheless, while investors are not moving aggressively into large cap TSXV gold

stocks over the past three months, they have not been selling them off either. All of

the Top 10 TSXV market cap gold stocks have gained since late October 2022, mainly

by mid-single to low-double digit percentages (Figure 6). The top three by market cap

are holding up after considerable losses over the past twelve months; the market

sees value in Artemis's large, advanced, Blackwater project, on the verge of

production, New Found Gold's pre-Resource Estimate, but extremely high grade

Queensway project, and Osisko's recent release of a Feasibility Study for its Cariboo

project and Initial Mineral Resource estimate for the Trixie deposit at its Tintic project.

The fourth largest, Reunion Gold, has seen a slight gain since late October 2022 after

a huge rise over the past year on strong drill results from its exploration-stage project

Oko West in Guyana.

Three other stocks have seen moderate gains, G Mining, on the verge of production

at Tocantinzinho, Robex Resources, which is already in commercial production at its

Nampala mine, offering protection in this risk off environment, and Tudor Gold, at the

resource estimate stage at Treaty Creek, with its share price holding up more recently

after a large 12-month decline. Only three stocks have seen substantial gains, with

all seeing outstanding recent operational progress, Prime Mining, propelled by

exceptionally strong recent drill results at Los Reyes, Probe Metals, which just

announced a major increase in its Resources, and Gabriel Resources, which expects

to soon see an award from its ongoing arbitration with Romania overseen by the UN.

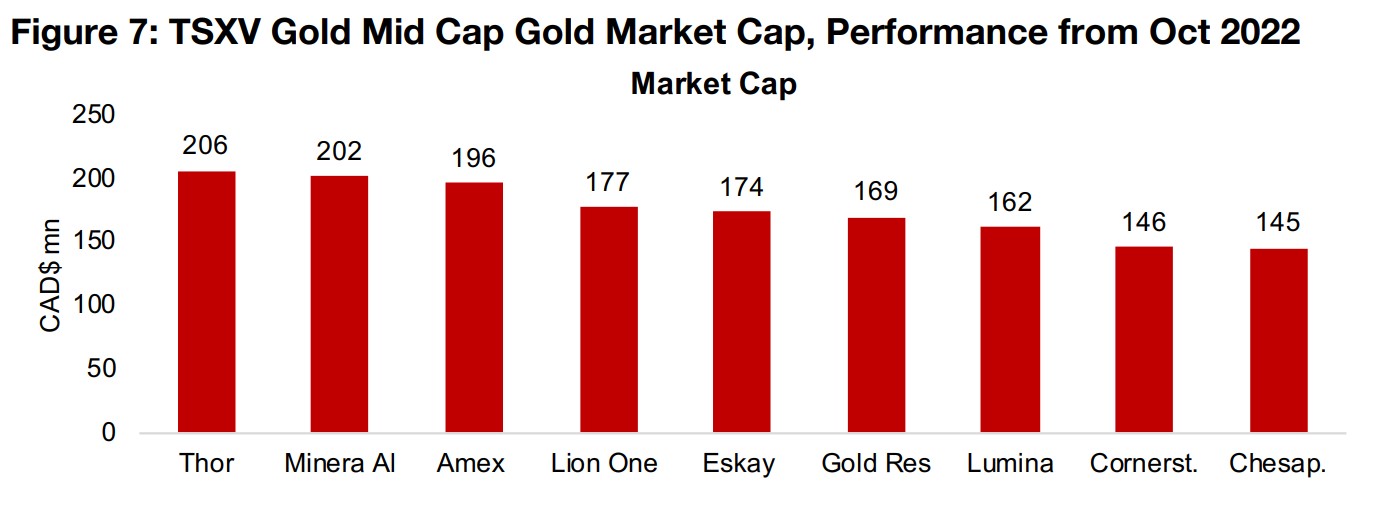

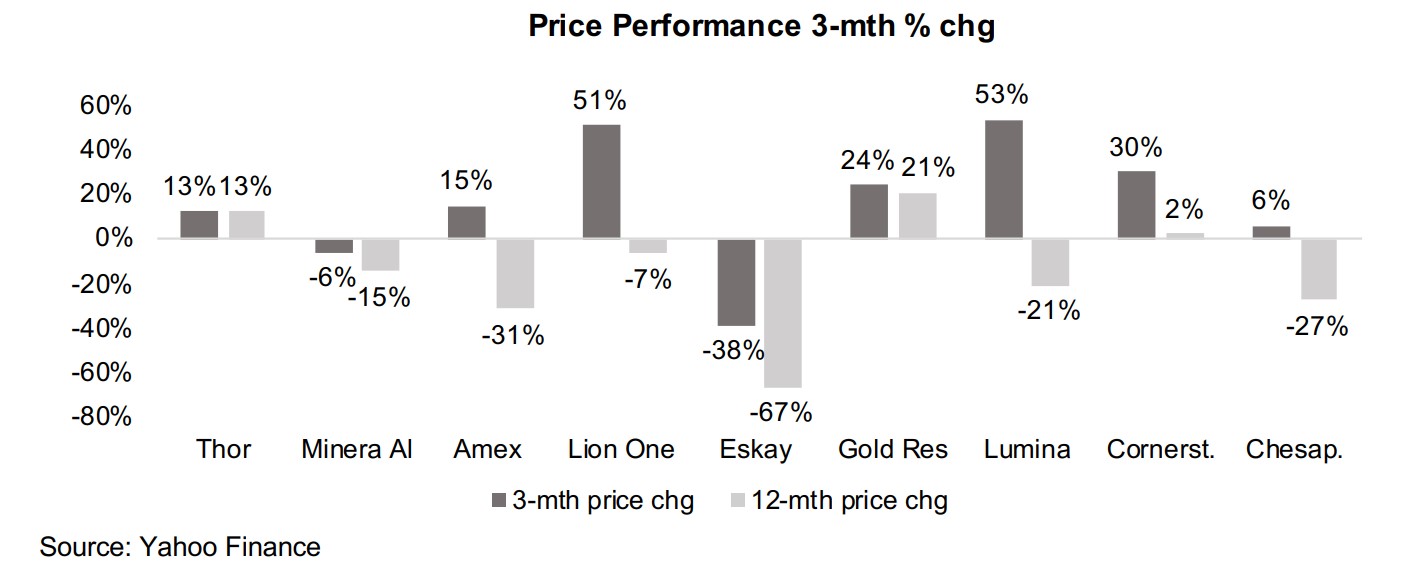

Midcap TSXV gold seeing moderately better outcomes than Large Cap

The midcap TSXV gold stocks are seeing moderately better outcomes overall over

the past three months than the large cap group, with six gaining ten percent or more,

and four with over twenty percent gains (Figure 7). The largest two by market cap,

Thor Explorations and Minera Alamos, have projects already in production, and while

the former had gained and latter has declined, both have been less volatile than the

rest of the group, given the lower risk afforded by their cash flow generation.

The big gainers over the past three months have been Lion One, on the discovery of

new high grade mineralized zones near its Tuvatu project, and Lumina Gold,

operating the Cangrejos project, for which there has been limited new flows other

than securing some financing, both up over 50%. Gold Reserve, which has had

limited news flow other than the appointment of a Director to its Board, and

Cornerstone Capital, which in the process of being acquired by SolGold, have also

seen substantial gains. The remaining two are up moderately, with Amex Exploration

reporting strong drill results from a new zone at Perron and Chesapeake Gold seeking

methods to reduce the costs of its large PEA-stage Metates project.

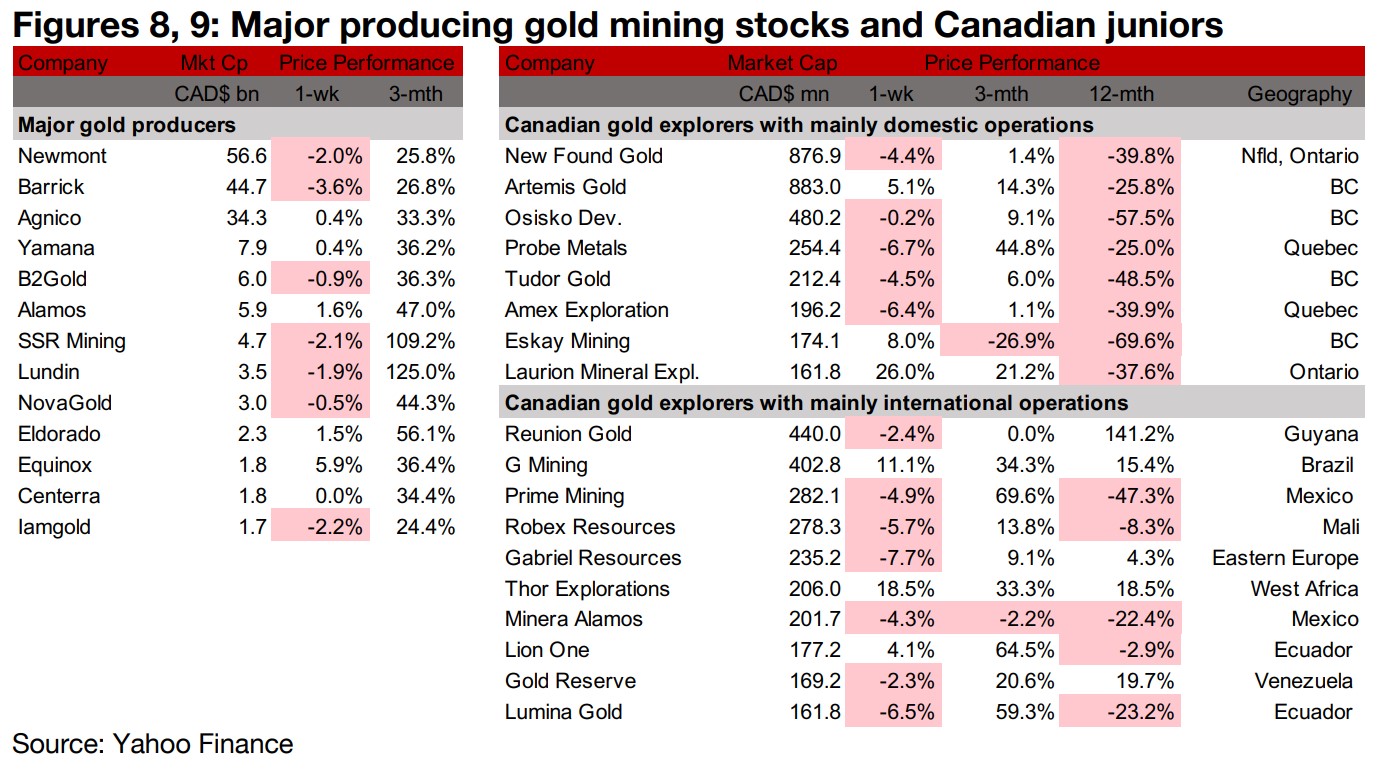

Gold producers and TSXV gold stocks mixed

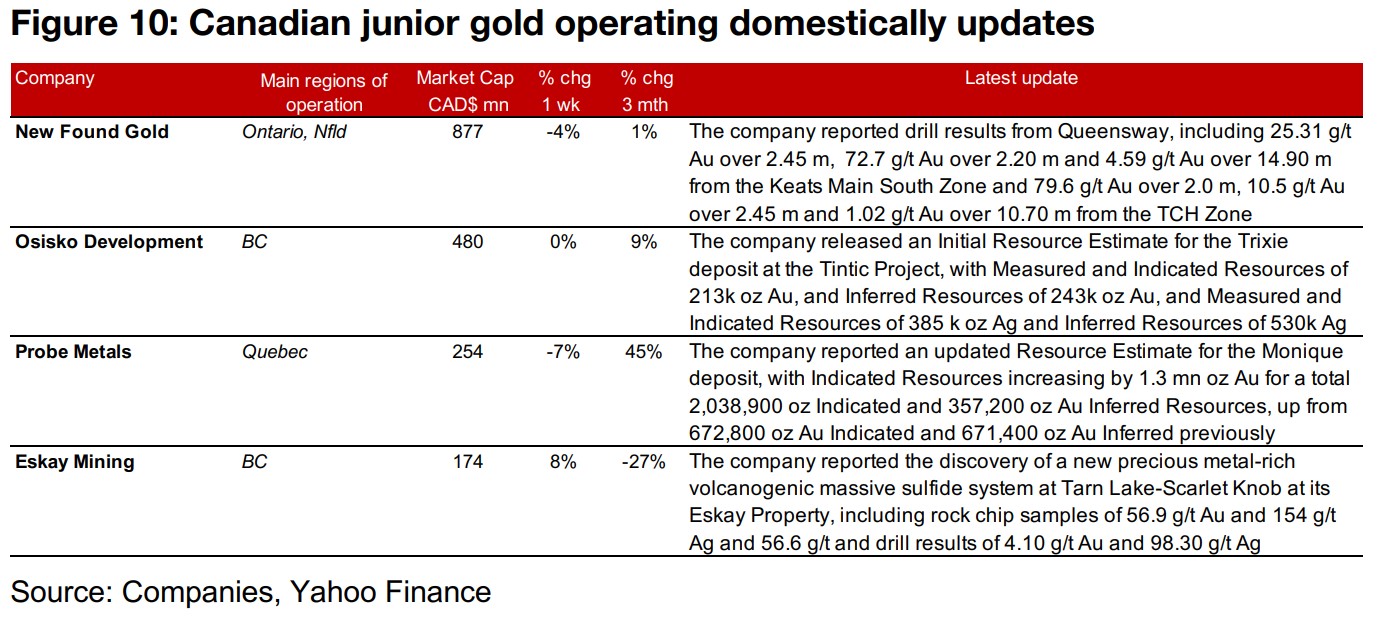

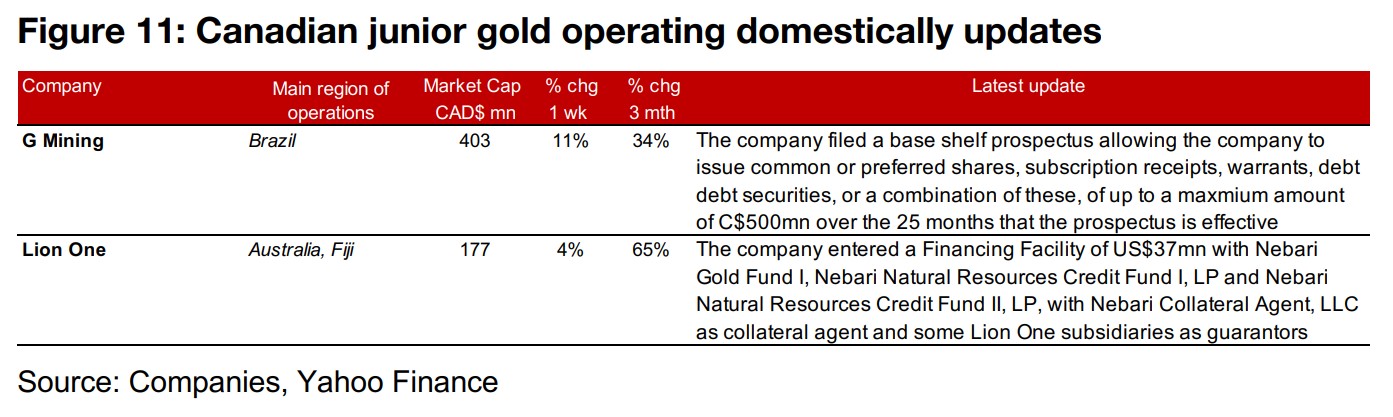

The producing gold miners and the TSXV junior gold miners were mixed as the gold price rally continued, but at a slower pace, and the equity market edged up (Figures 8, 9). For the Canadian juniors operating mainly domestically, New Found Gold reported drill results from the Keats Main South and TCH Zones of Queensway, Osisko Development released an Initial Resource Estimate for the Trixie deposit at Tintic, Probe Metals reported an updated Resource Estimate for the Monique deposit and Eskay reported rock chip samples and drill results from a newly discovered VMS system at Tan Lake-Scarlet Knob on its Eskay Property (Figure 10). For the Canadian juniors operating main internationally, G Mining filed a base shelf prospectus allowing the issuance of up to C$500mn in securities over 25 months, and Lion One entered a US$37mn financing facility with several Nebari funds (Figure 11).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.