March 24, 2025

TSX/TSXV Mining Capital Raising Starts Year Strong

Author - Ben McGregor

Gold lifted by dovish Fed comments after rates held flat

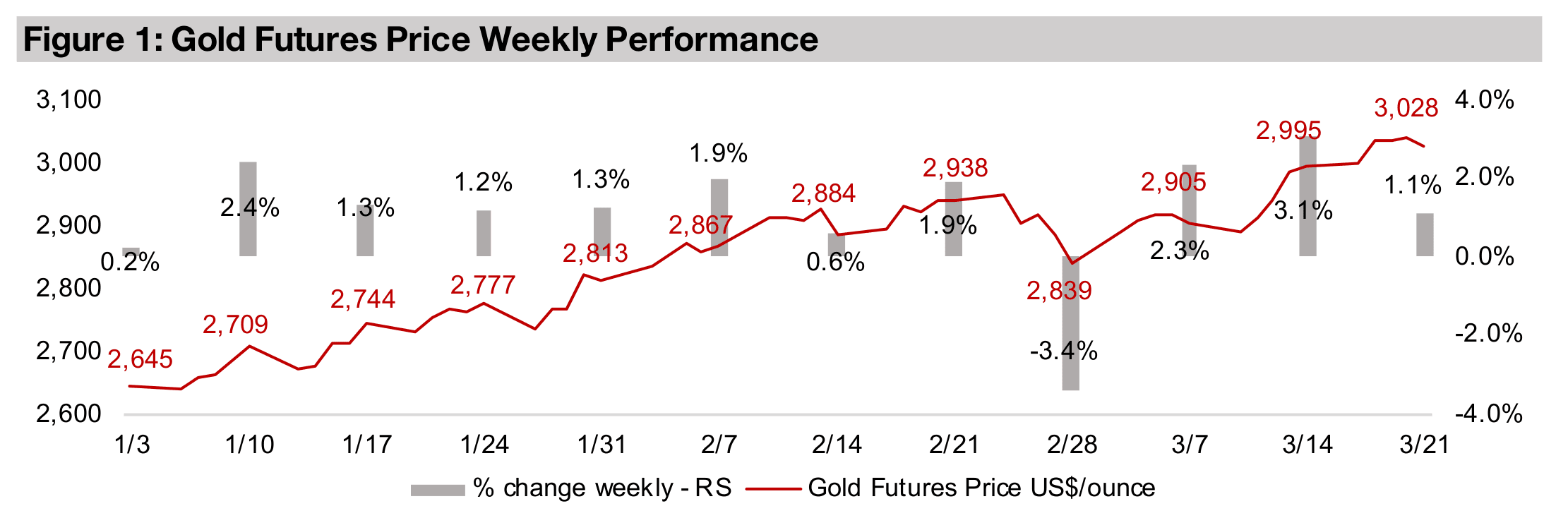

Gold rose 1.1% to US$3,028/oz and spent its first full week above the key US$3,000/oz benchmark level following comments from the US Fed which were taken by markets as relatively dovish after it held rates flat at its meeting this week.

TSX/TSXV mining capital raising strong in first two months

The TSX has reported equity capital raising data through to February 2025, which has a shown a strong start to the year for the mining sector, with strength for both the TSX and the TSXV, with large financings for companies across several of the metals.

TSX/TSXV Mining Capital Raising Starts Year Strong

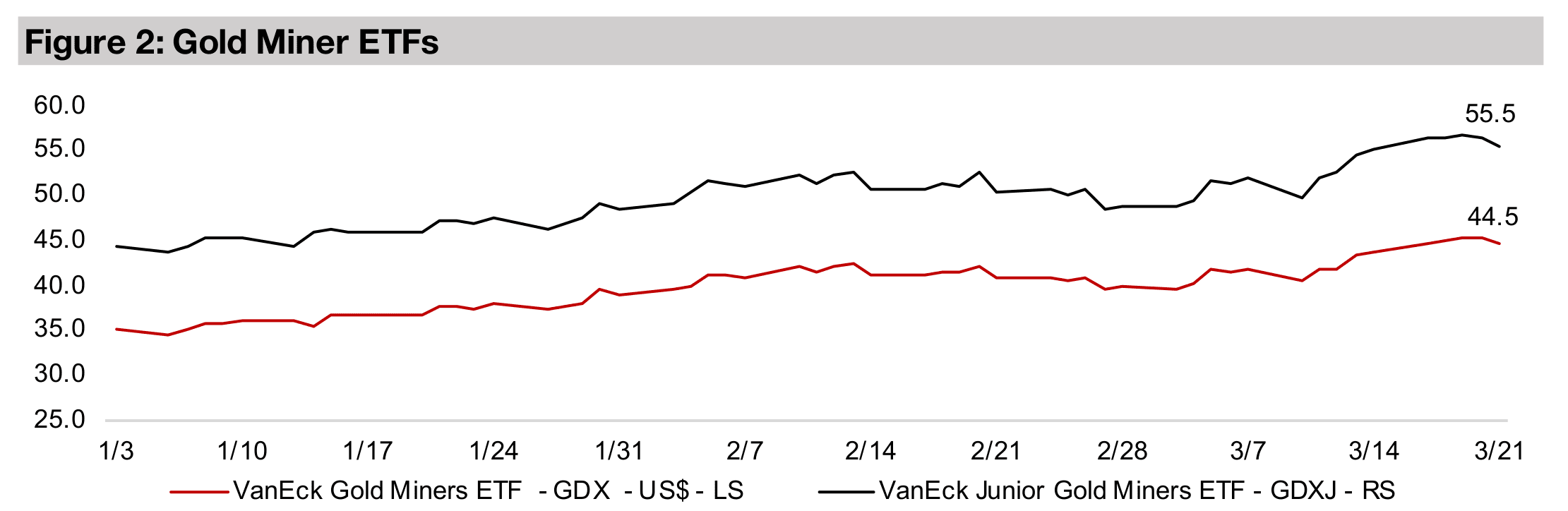

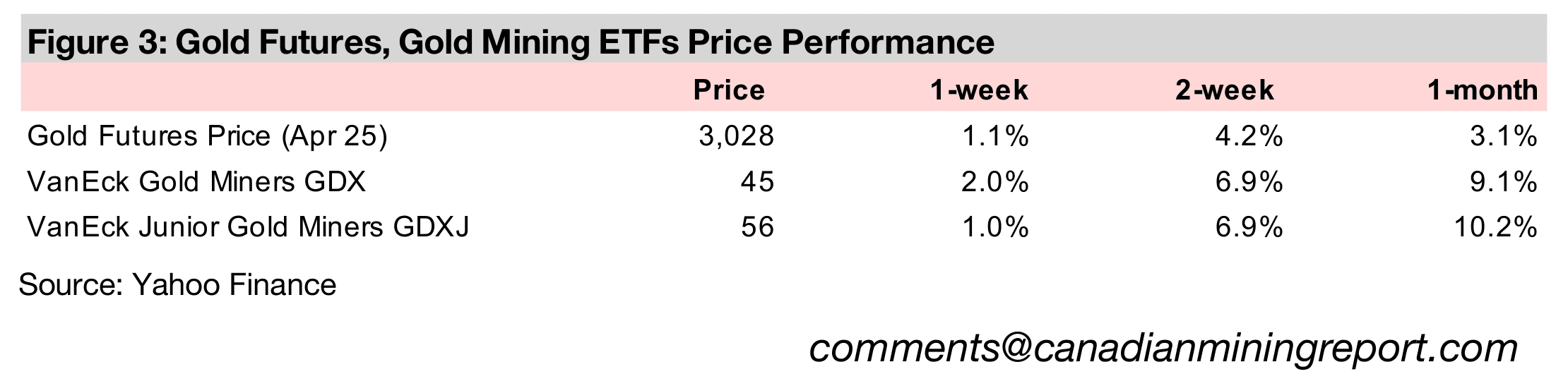

Gold rose 1.1% to US$3,028/oz, and spent its first week ever entirely above US$3,000/oz. This was partly driven by dovish comments by the US Fed after it held rates flat at its meeting this week. This supported equity markets, with the S&P 500 up 0.6%, Nasdaq rising 0.5% and Russell 2000 gaining 0.8%, although all three remain down year to date, with the former off -3.4% and two latter slumping -7.8%. This shows that the risk-off sentiment that took hold in 2024 continues, with tech and small caps hit hard. The defensive sectors have outperformed, with utilities and healthcare up 7.0% and 7.3% YTD, and gold stocks are the biggest standouts, with the GDX up 25.9% and GDXJ rising 23.8%, after 2.0% and 1.0% gains this week.

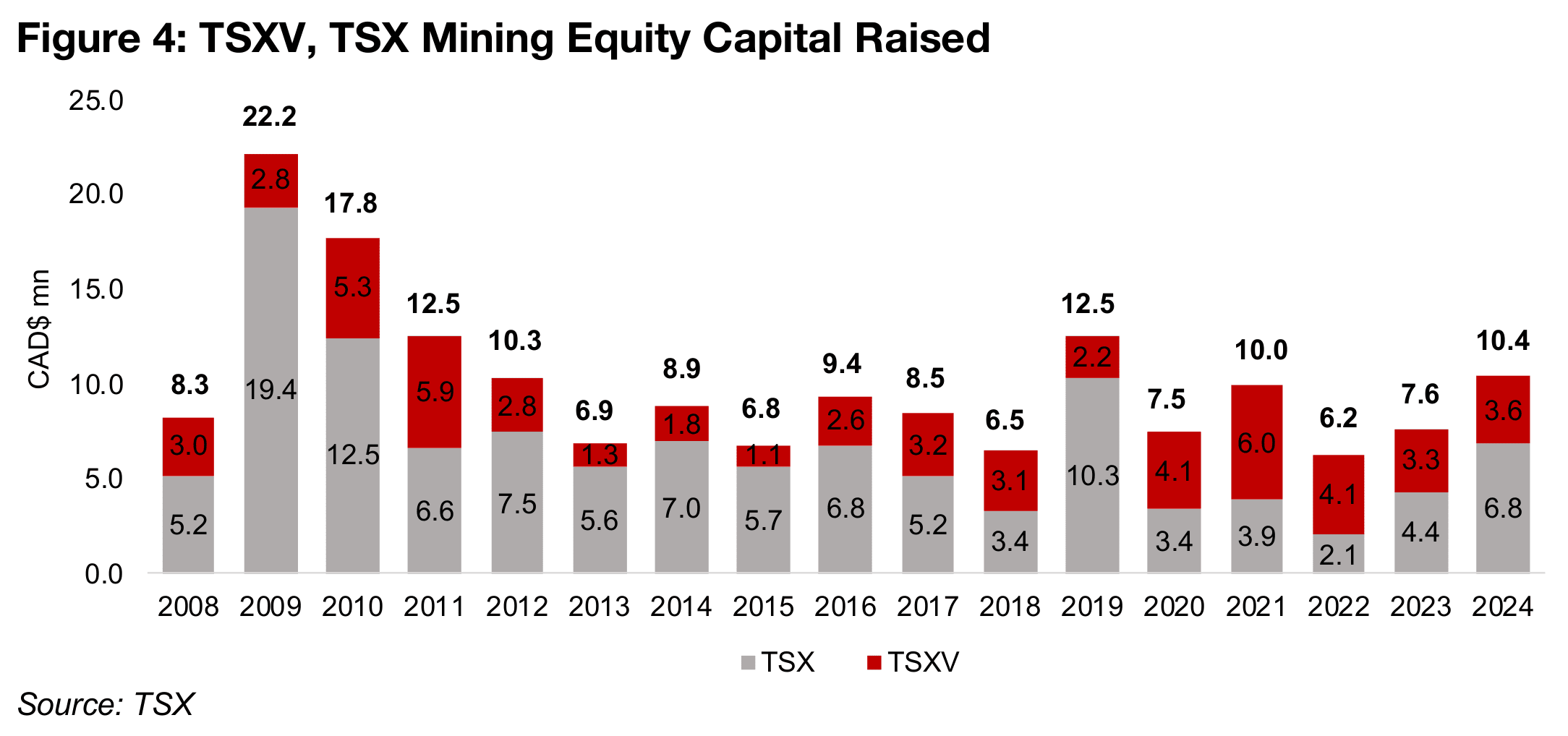

TSX/TSXV equity capital raising strong in 2024

The TSX has released data on equity capital raised through to February 2025, with

the full year 2024 data showing significant growth year on year for the mining sector.

This was partly driven by the continued strength in the gold sector, which comprises

the largest component of the TSXV mining cap by far, and is a significant contributor

to the TSX mining market cap. The total equity capital raised for both combined

jumped 36.8% yoy to CAD$10.4bn in 2024 up from CAD$7.6bn in 2022, and is well

off the most recent trough of CAD$6.2bn in 2022 (Figure 4). However, this remained

down from the recent highs of CAD$12.5bn in 2019 and is still only around half the

peak of CAD$22.2bn and CAD$17.8bn in 2009 and 2010.

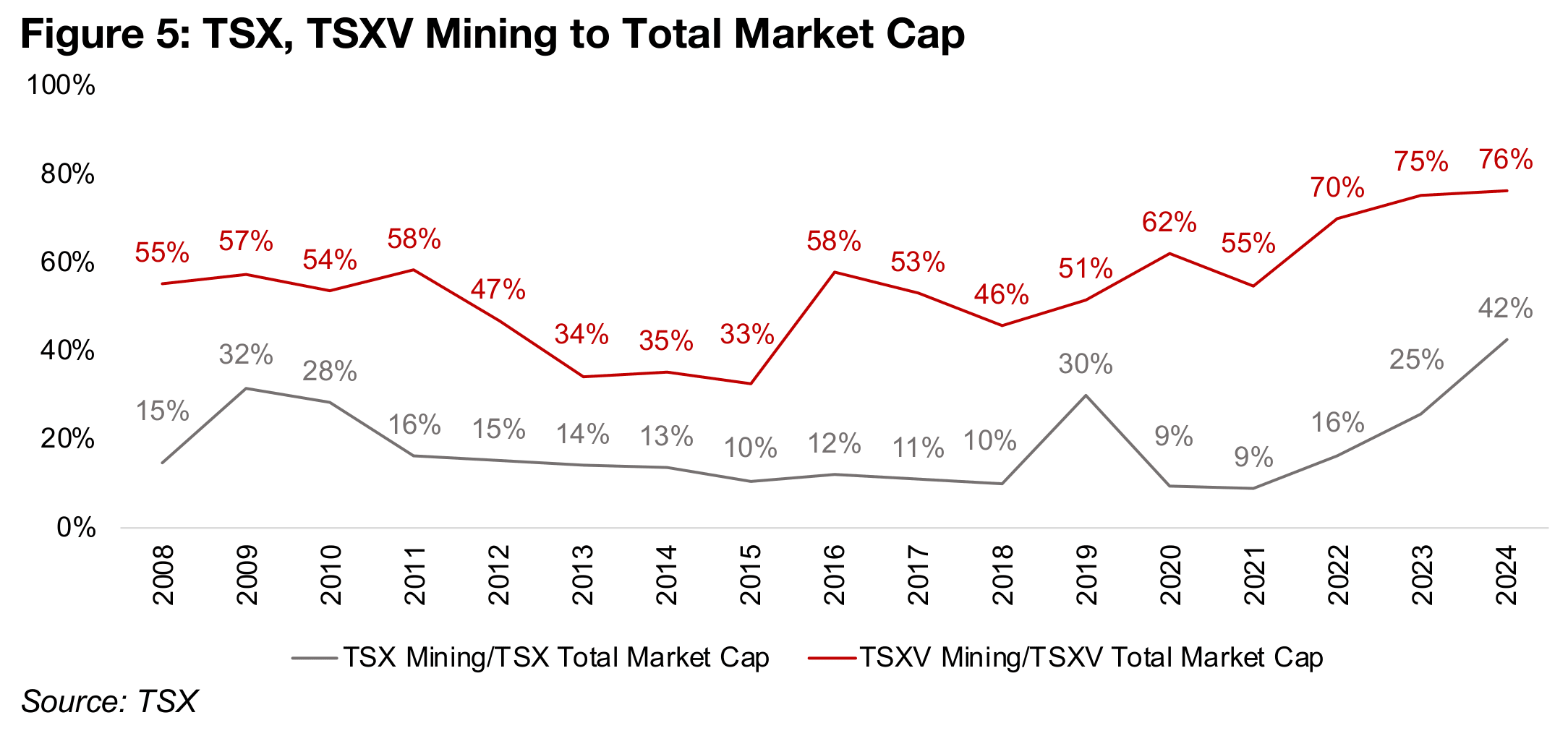

Mining has increased its dominance of the TSXV, reaching 76% of the market cap,

up from just 33% at the lows in 2015 (Figure 5). This is also well above the highs in

the previous bull market, when the sector hit 57% and 58% of the total in 2009 and

2011. Mining has also taken a far larger share of the TSX, rising to 42% in 2024, up

from lows of 9% in 2021 and by far the highest level in over fifteen years. This ratio

could hit 50% if the gold and copper runs continue and other metals flatten or recover.

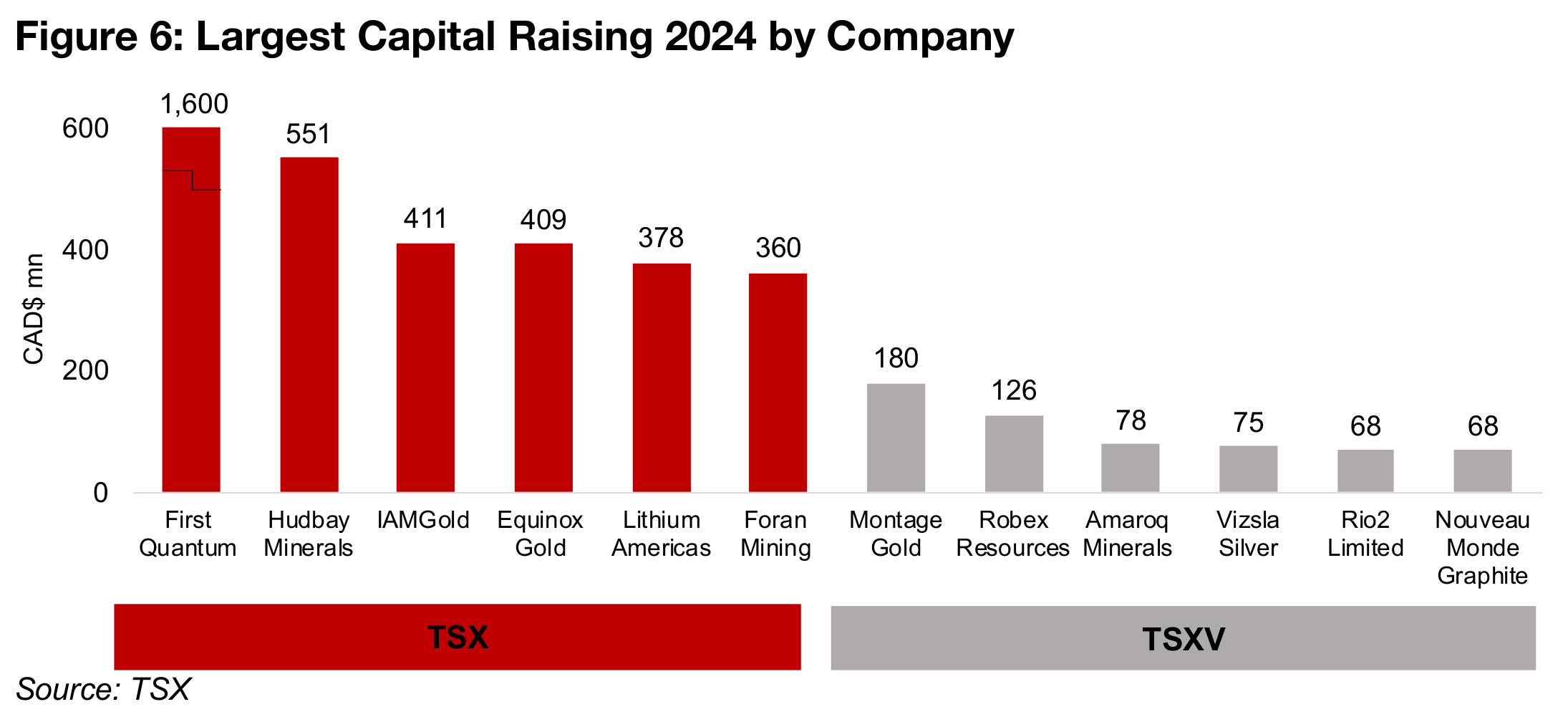

The most capital raised by far in 2024 was by TSX copper producer First Quantum at US$1,600mn, with the other large financings ranging from US$360mn to US$551mn including three gold, one lithium, and one copper company (Figure 6). The largest capital raised on the TSXV was from Montage Gold at CAD$180mn followed by Robex Resources, at CAD$126mn, with the other four largest financings ranging from CAD$68mn to CAD$78mn with two gold, one silver, and one graphite company.

Strong start to 2025 for TSX/TSXV mining equity capital raising

The TSX and TSXV had a strong start to the year for mining equity capital raising, with CAD$1,015mn in February and CAD$707mn in January, after a weak December 2024 at CAD$444mn (Figure 7). The February figure was the highest since CAD$1,593mn in May 2024, and considerably above the 2024 average of US$868mn/month, which was up from near flat averages of US$636mn in 2022 and US$637mn in 2023.

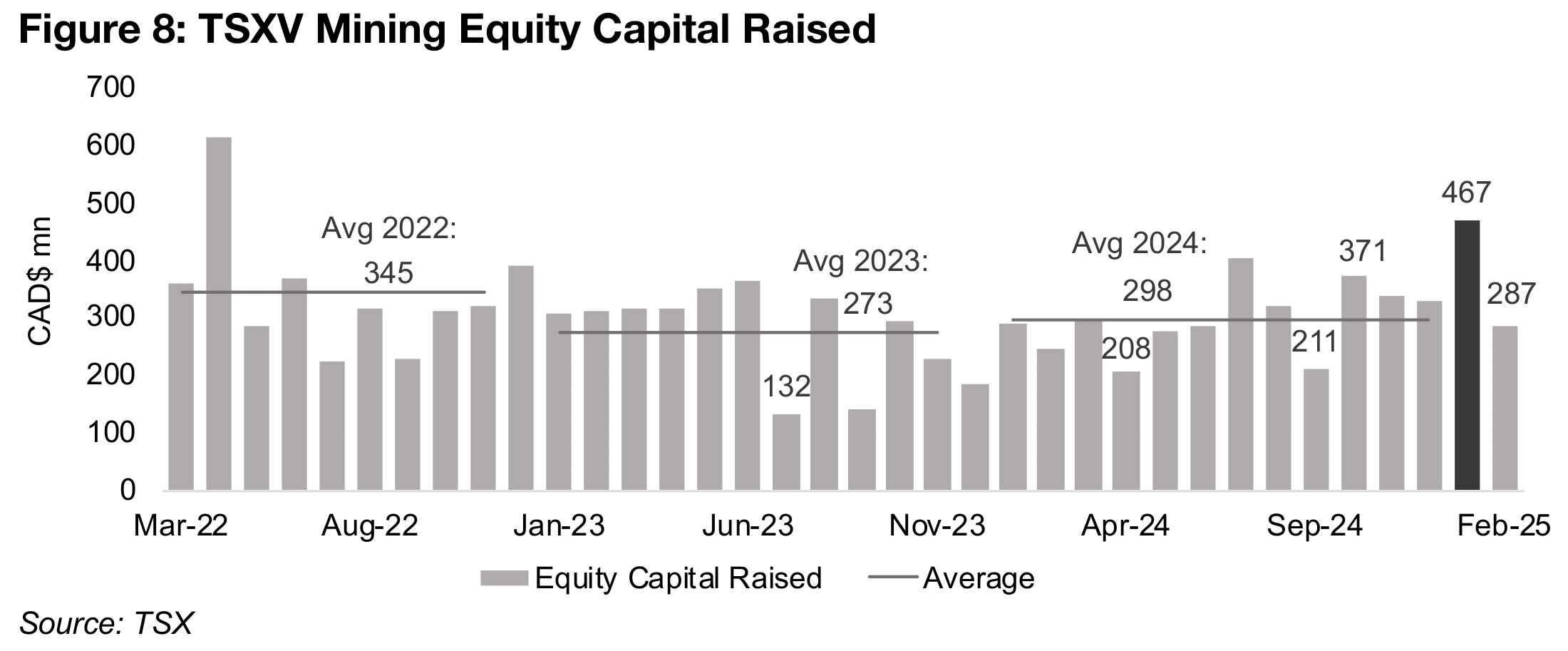

For the TSXV, January capital raising was stronger, at CAD$467mn, the highest level since CAD$613mn in March 2022. The CAD$287mn in February 2025 was broadly inline with the CAD$298mn per month average for 2024, and moderately above the CAD$273mn average for 2023 (Figure 8). While it is still too early to project the average for the first two months of CAD$377mn forward for the entire year, this would put it ahead of the relatively strong average in 2022 of CAD$345mn.

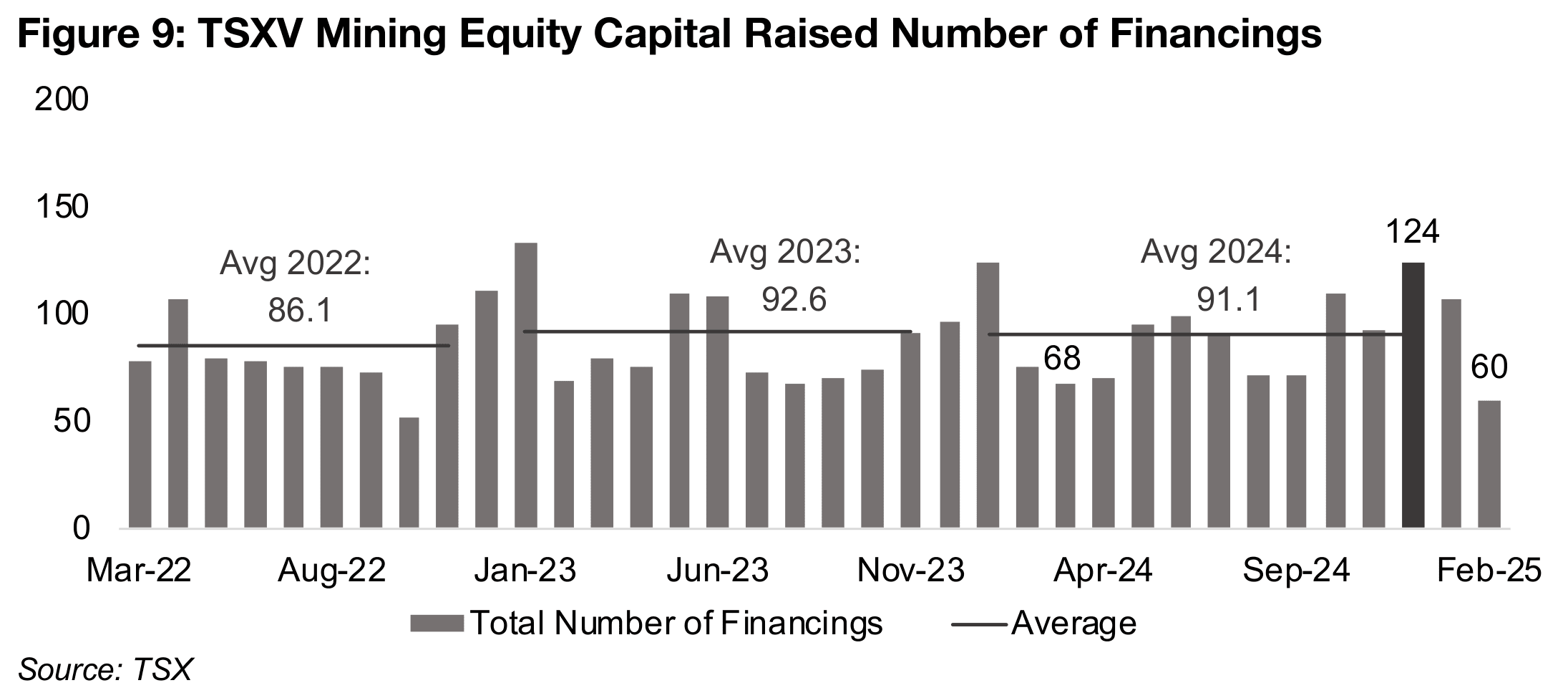

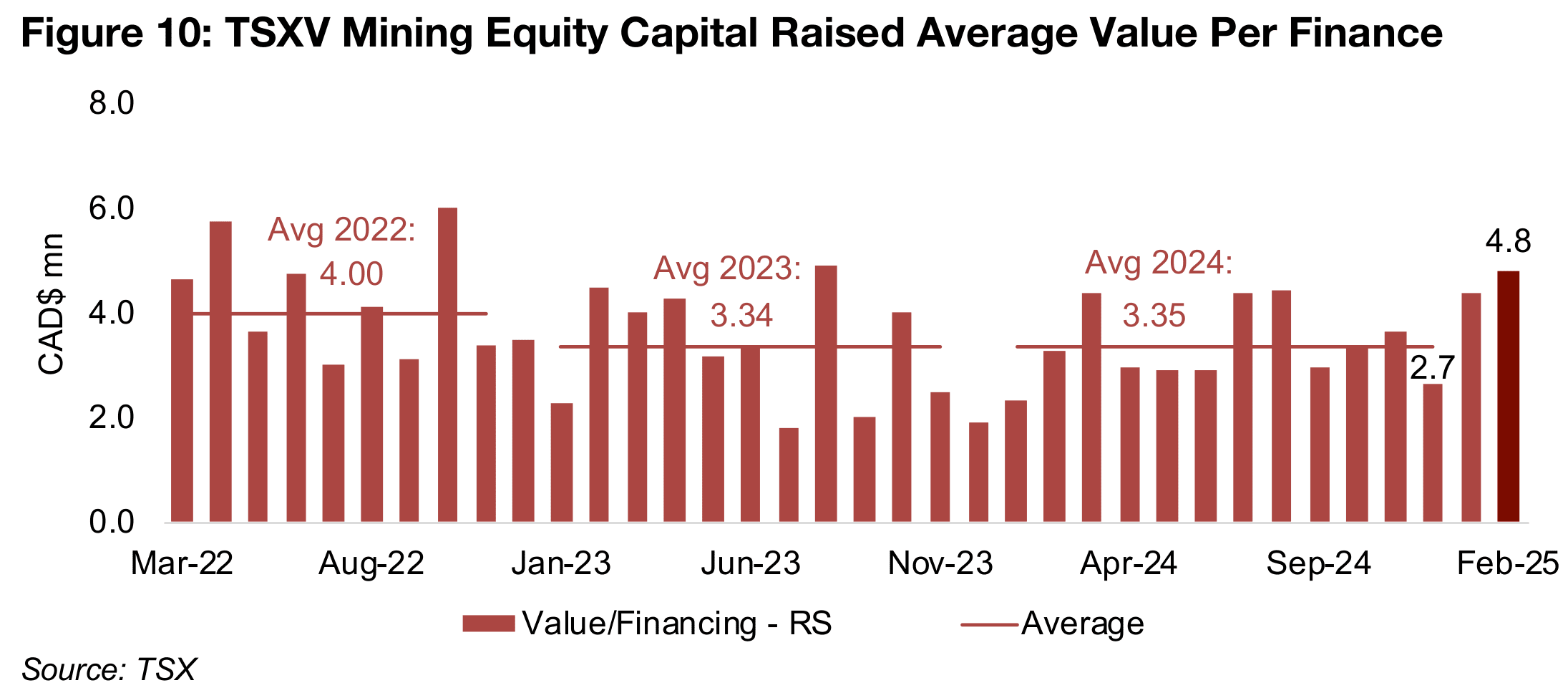

The number of TSXV mining financings dropped from 124 in December 2024, which was the highest of the past three years, to 107 in January 2025 and 60 in February 2025, which was the lowest level since late 2022 (Figure 9). However, this was offset by a rise in the average value per financing, from just CAD$2.7mn in December 2024 to CAD$4.4mn in January 2025 and CAD$4.8mn in February 2025 (Figure 10). The average value in February 2025 was the highest since August 2023, and well above the monthly averages for the past three years.

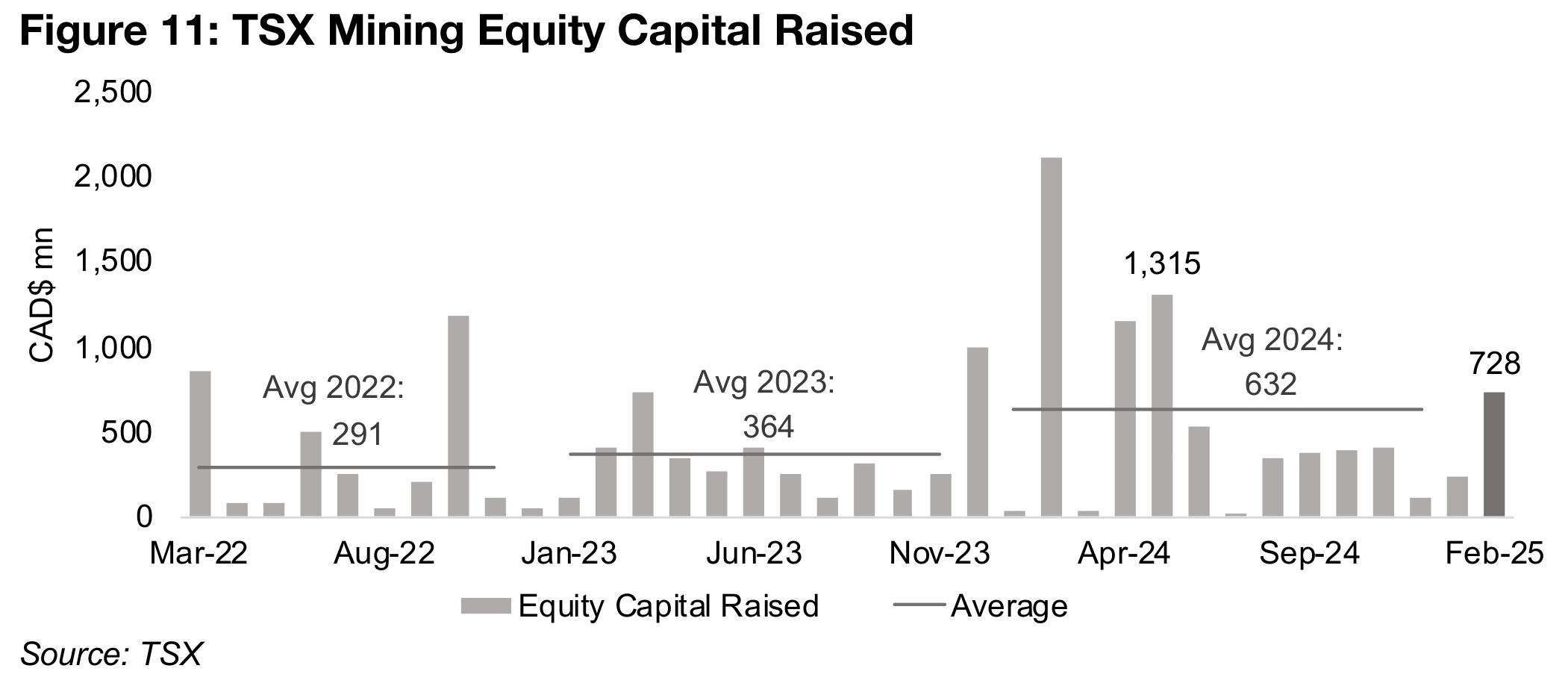

The TSX mining capital equity raised jumped to CAD$728mn in February 2025, after

a weak January 2025 and December 2024 at CAD$240mn CAD$114mn, and was the

highest since CAD$1,315mn in May 2024 (Figure 11). The strength in February was

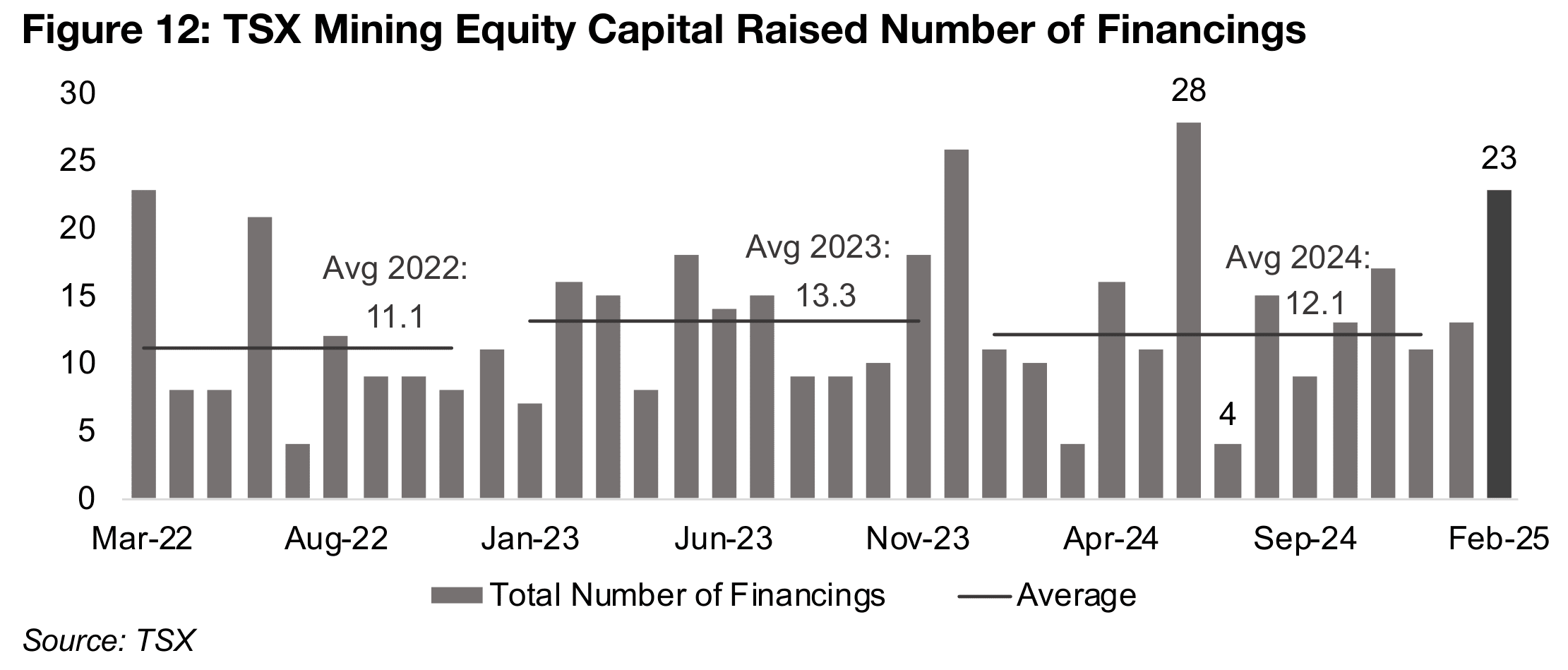

driven by a relatively high number of financings at 23, up from 13 in January, and

nearly two times the average 12 financings monthly in 2024, which was similar to the

average 13 per month in 2023 (Figure 12).

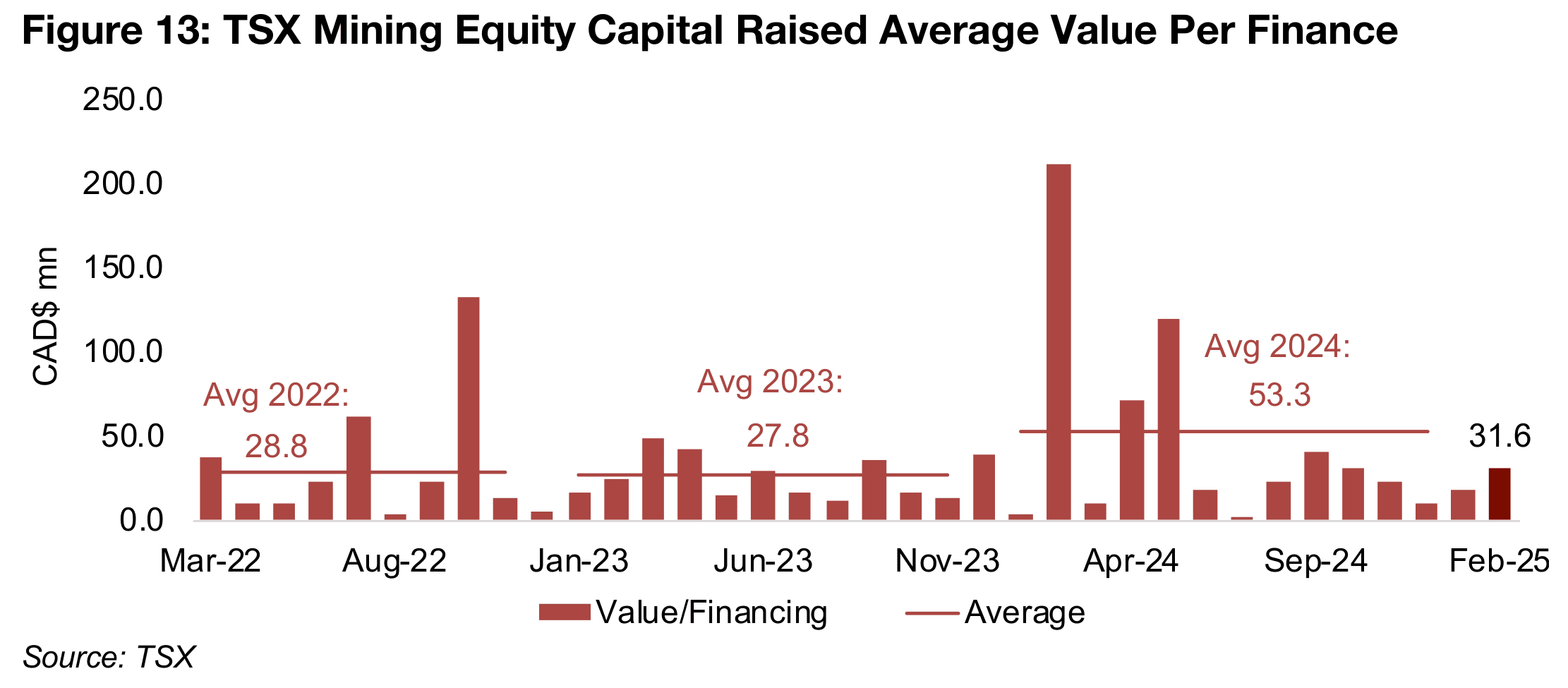

The average value per financing also rose significantly in February to CAD$31.6mn,

up from CAD$18.5mn and CAD$10.4mn in January 2025 and December 2024 (Figure

13). While this was considerably below the average monthly value of 2024 at

CAD$53.3mn, last year had a few particularly strong months with very large

financings that pulled up the average. The February 2025 level was moderately above

the averages for 2023 and 2022 of CAD$27.8mn and CAD$28.8mn.

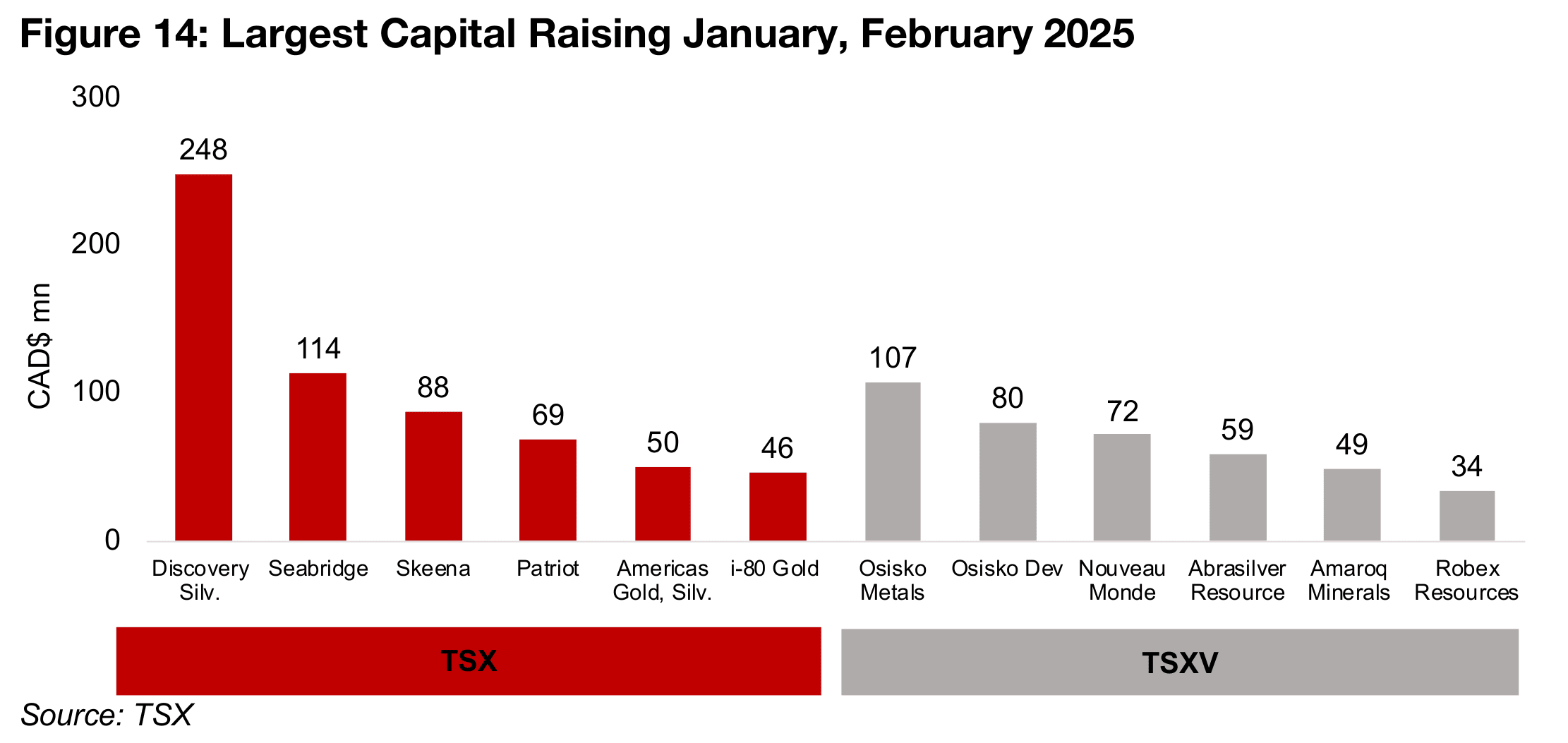

The largest mining equity capital raisings by company on the TSX and TSXV for January and February 2025 were relatively widely spread across the metals sectors. For the TSX, the largest financing was a silver company, Discovery Silver, raising CAD$248mn, four of the other largest amounts raised were for gold companies, and one lithium company saw a significant investment (Figure 14). The equity capital raised on the TSXV was also concentrated in gold companies, at four out of the six, with a graphite and silver company also seeing major equity capital raised.

TSX/TSXV mining could continue to see strong equity capital raising 2025

The TSX/TSXV mining sectors could continue to see strong capital raising in 2025,

and there appears to be a shift across the political spectrum towards increased

support for the industry. Also, the recent political rhetoric within North America does

not change the economic reality that the US and Canadian resources sectors will

remain heavily interdependent. This could see increased investment in mining

between the two countries, as the more critical competition with other large global

political blocks overshadows regional conflict. A trend towards deglobalization and

resource nationalism, which was already underway, and has been catalyzed by the

policies of the new US administration, is as likely to drive North American economic

integration, as it is division, longer-term.

Even given the rising risk aversion in markets of the past year, equity capital raising

for the juniors on the TSXV in 2024 was still quite strong in overall. Smaller companies

with more promise than delivery may be seeing less interest than they would have

during the initial recovery of the sector in 2019-2020. However, juniors with strong

operational progress were clearly getting financed in 2024, and there has been a shift

in the TSXV market cap towards larger caps. While gold could see a large proportion

of the capital raised given the surging metal price, there has also been large

investment in other metals which could continue this year.

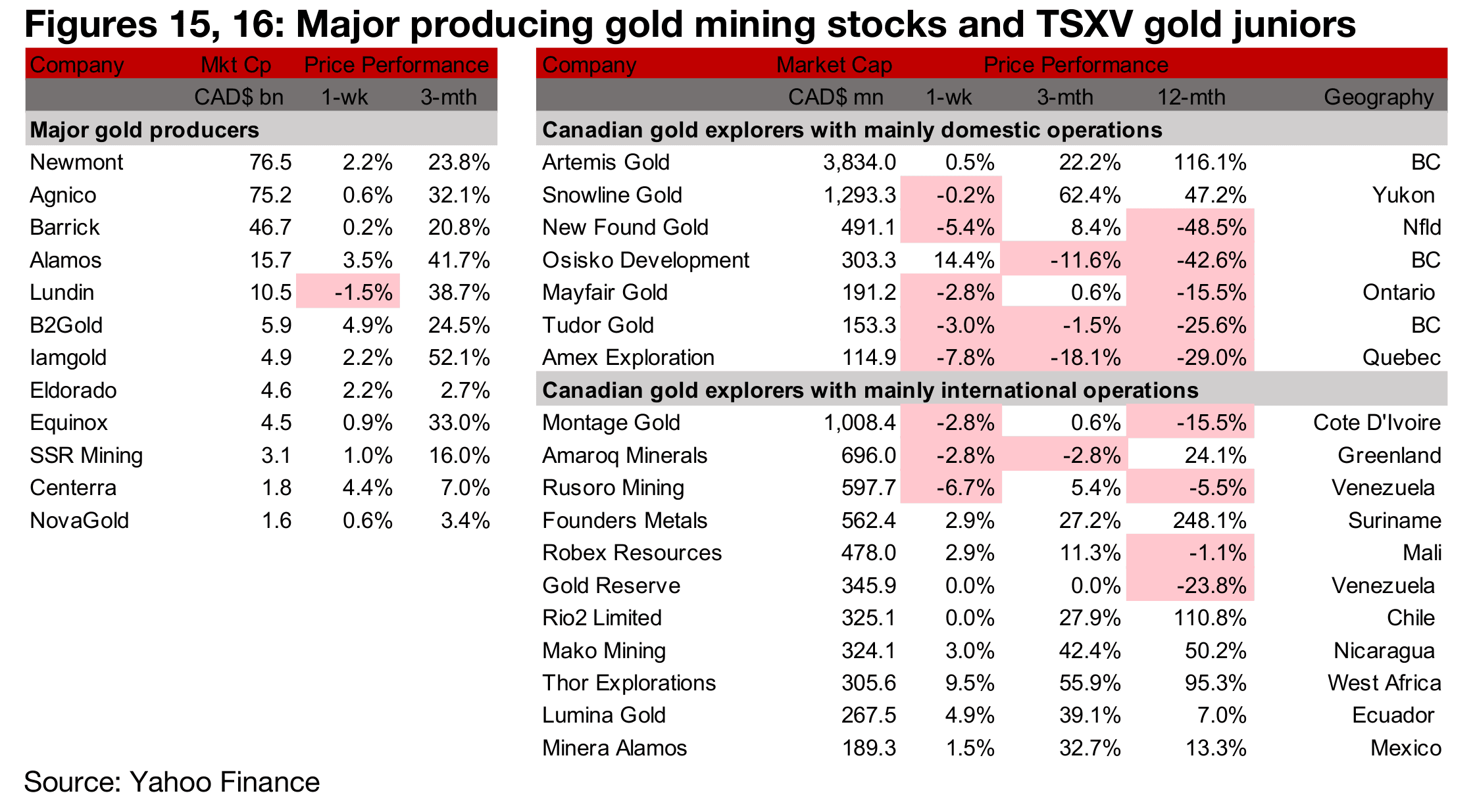

Most producers rise while large TSXV gold mixed

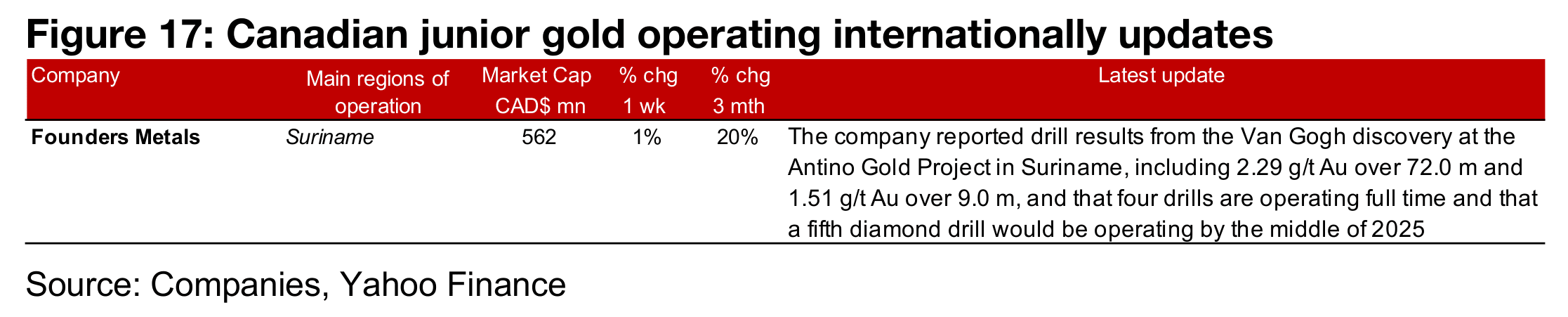

Most of the major producers rose and large TSXV gold was mixed (Figures 15, 16). For the TSXV gold companies operating domestically, there was no major news flow. For the TSXV gold companies operating internationally, Founders Metals reported drill results from the Van Gogh discovery at the Antino Gold Project (Figure 17).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.