July 24, 2023

TSX Mid-Cap Gold Producers Guiding Strong

Author - Ben McGregor

Gold price edges up on light economic news flow

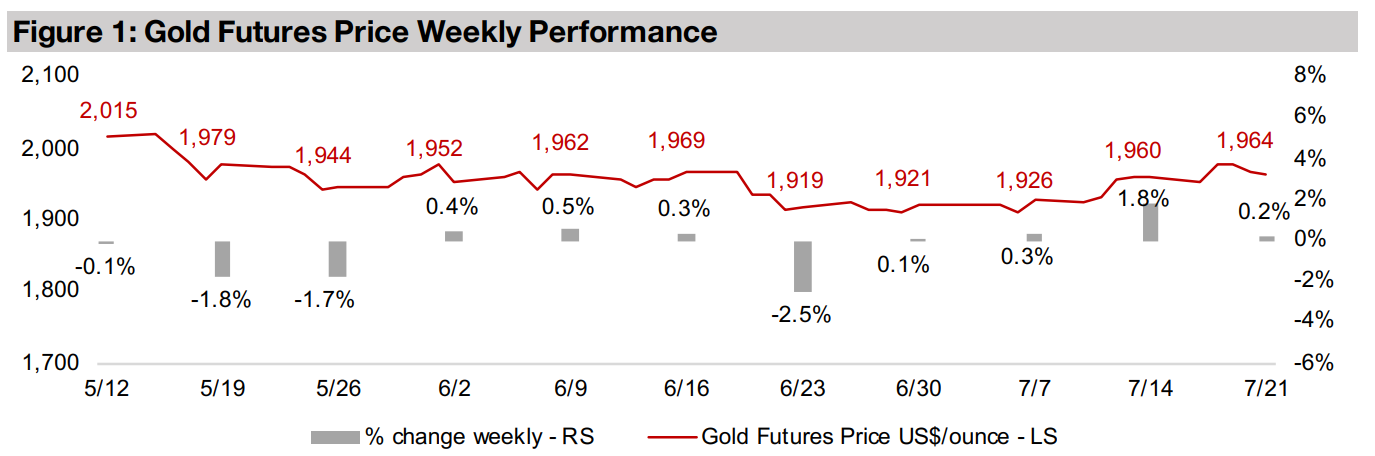

The gold price edged up just 0.2% after a 1.8% surge last week, its strongest gain in months, on relatively light economic news flows compared to the major releases last week, as markets remained relatively subdued with the S&P 500 gaining just 0.61%.

TSX Mid-Cap Gold Producers Guiding Strong

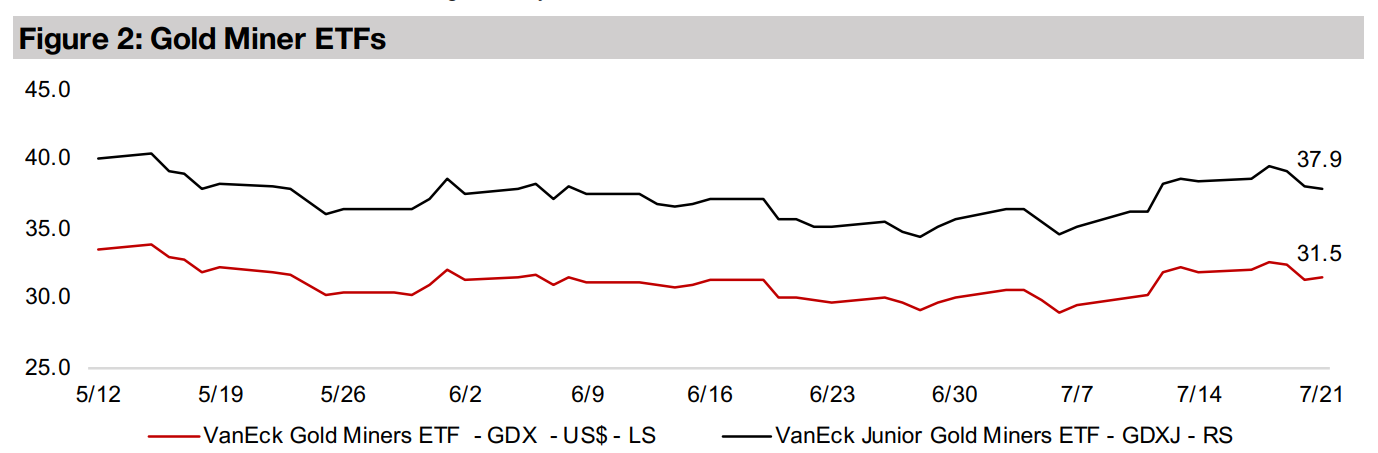

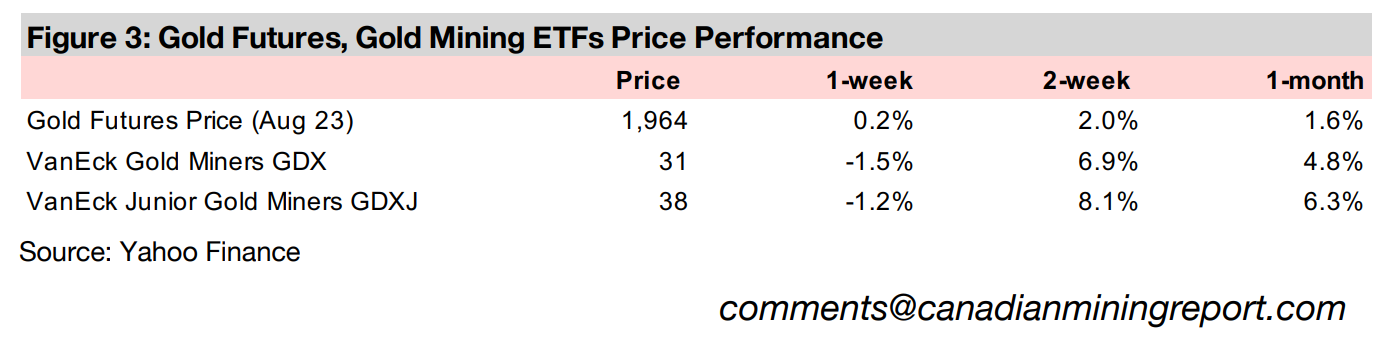

Gold edged up just 0.2% to US$1,964/oz this week, a subdued move in contrast to last week's 1.8% rise, its strongest gain in several months. Economic news flow remained light in terms of broader impact, especially in contrast to the market moving inflation data released last week. The markets were subdued given a relative lack of drivers, with the S&P 500 gaining just 0.6%, and the risk-on rally of the past few months seemed to be faltering towards the end of the week. Small cap stocks outperformed, with the Russell 2000 up 1.6%, but this failed to buoy the gold stocks, with the GDX down -1.5% and the GDXJ down -1.2% after a strong two week run.

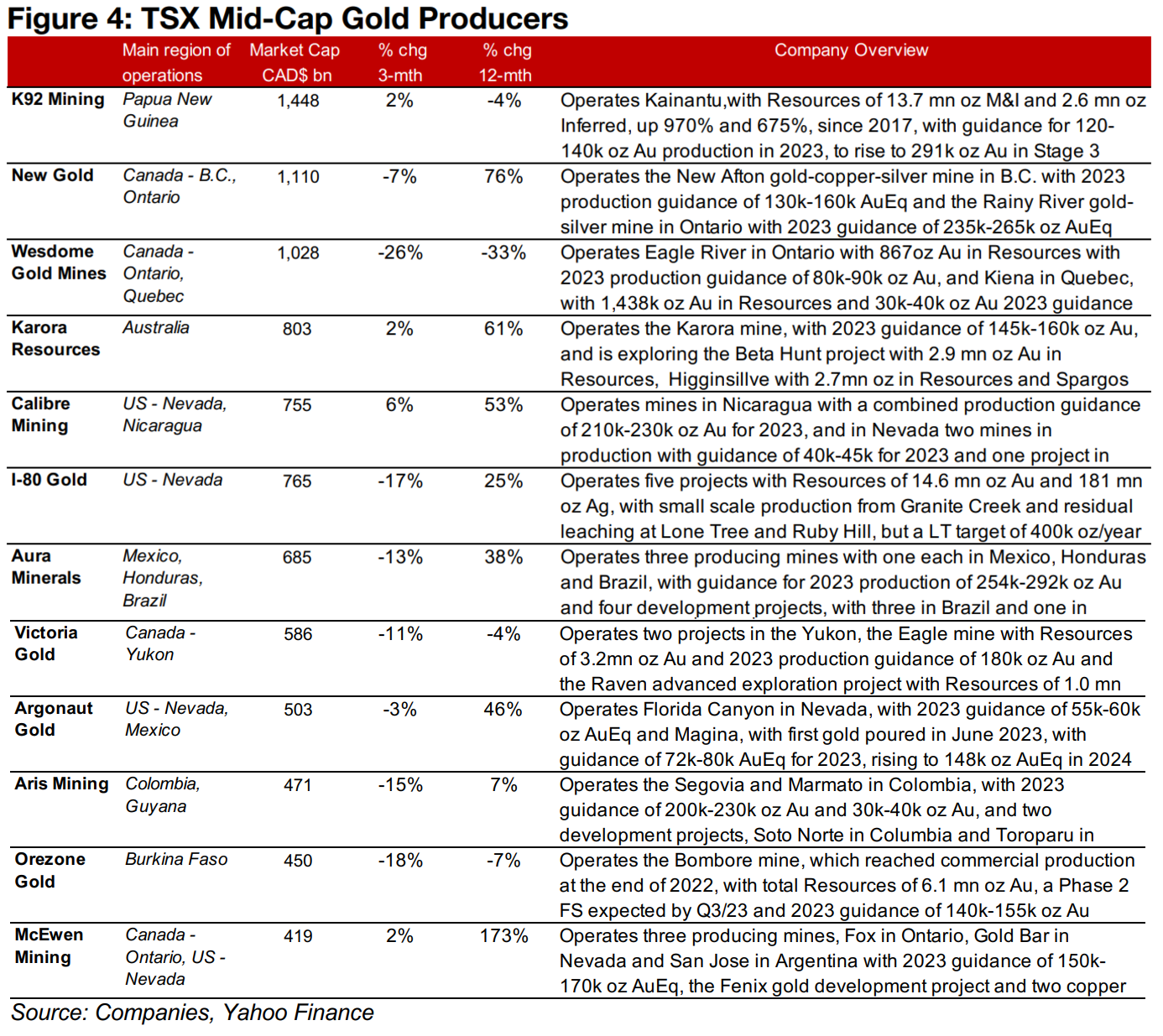

TSX mid-cap gold producers guiding for substantial rise in 2023 output

This week we look at the TSX mid-cap gold producers, defined as companies with

market caps from around US$1.5bn down to US$400mn, and excluding developers

with no output in 2022. This group comprises twelve stocks, K92 Mining, New Gold,

Wesdome Gold Mines, Karora Resources, Calibre Mining, I-80 Gold, Aura Minerals,

Victoria Gold, Argnonaut Gold, Aris Mining, Orezone Gold and McEwen Mining

(Figure 4). The group overall has had a mixed performance in terms of production

year on year in the four quarters to Q1/23, with only three stocks really seeing

substantial growth.

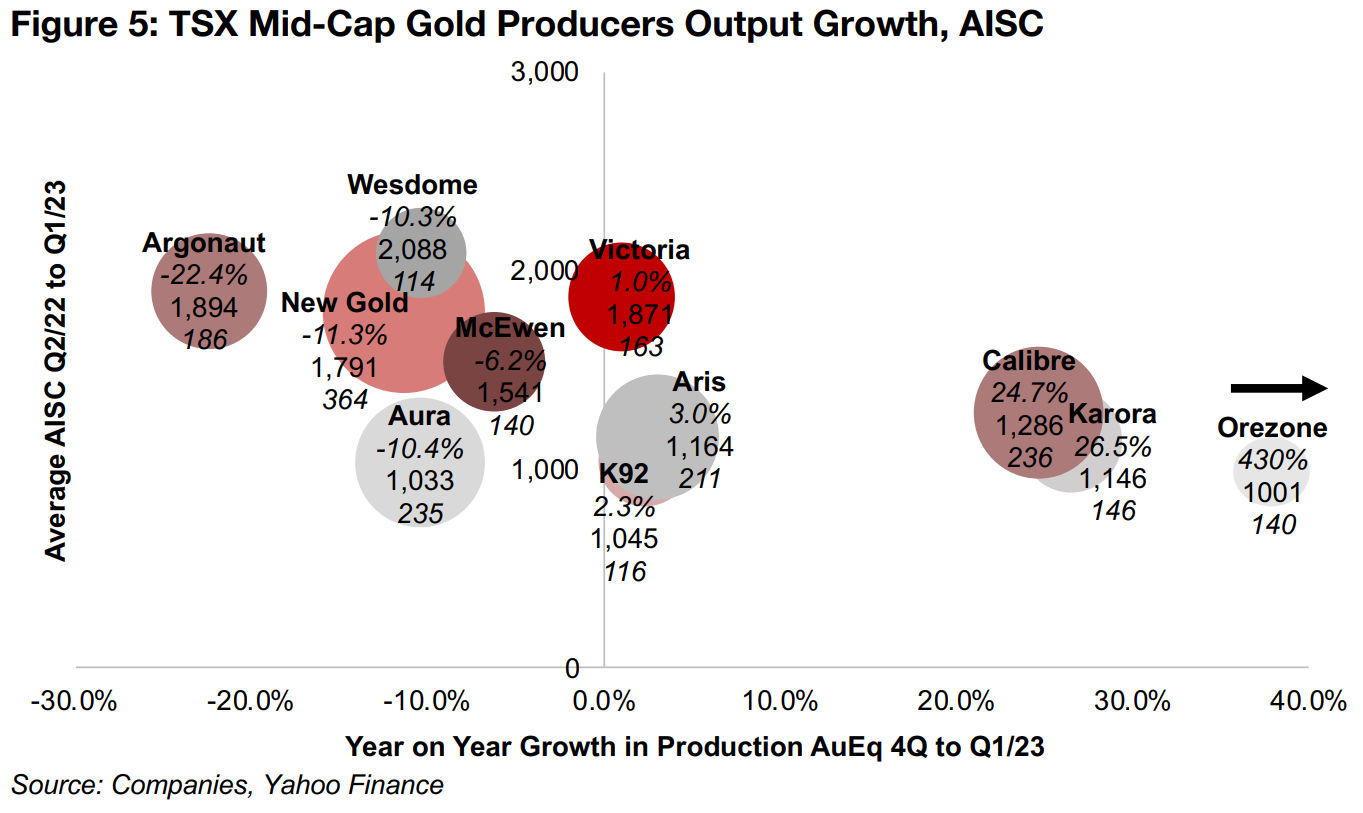

Calibre, operating in Nicaragua and Nevada, and Karora, producing in Australia, are

the main standouts, with production rising 24.7% and 26.5%, with both companies

also running at a relatively low cost, with an average AISC over the four quarters to

Q1/23 of US$1,286/oz and US$1,146/oz (Figure 5). Robust growth is expected to

continue for both into 2023, with the Calibre guiding for an 18% rise in production

and Karora 14% (Figure 6). The strongest growth is likely to come from Orezone,

operating in Burkina Faso, up 430% as it entered commercial production in

December 2022, and was only ramping up with a small level of production in 2022.

Three companies saw marginal production growth, including Aris, operating in

Columbia and Guyana, K92, producing in Papa New Guinea, and Victoria, with mines

in the Yukon, up 3.0%, 2.3% and 1.0%, respectively. Production for the five

remaining companies declined, with output for Argonaut, New Gold, Aura, Wesdome

and McEwen down -22.4%, -11.3%, -10.4%, -10.3% and -6.2%, respectively.

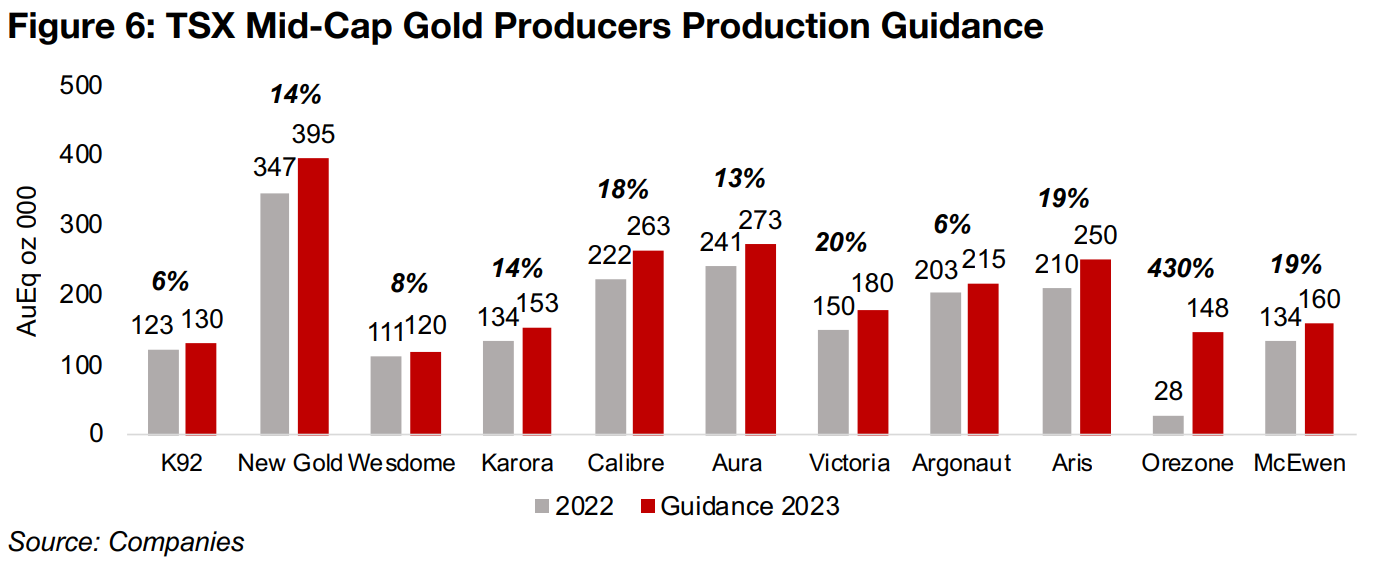

However, all the companies are guiding for increases in production for 2023 compared to 2022, with even the lowest estimates for K92, Argonaut and Wesdome all at mid-single digits. Eight of the group are guiding for production growth of at least 13% of more, with the biggest organic gains expected from McEwen and Victoria, rising 19% and 20%. This excludes the exceptional gain from Orezone, and we have also excluded I-80 Gold from this chart, which had very small-scale production of 11.8k oz Au in the four quarters to Q1/23 from a new mine coming online and some residual heap leaching in 2022 but did not provide guidance for 2023.

Mid-cap TSX gold producers' revenue, operating profit to recover in 2023

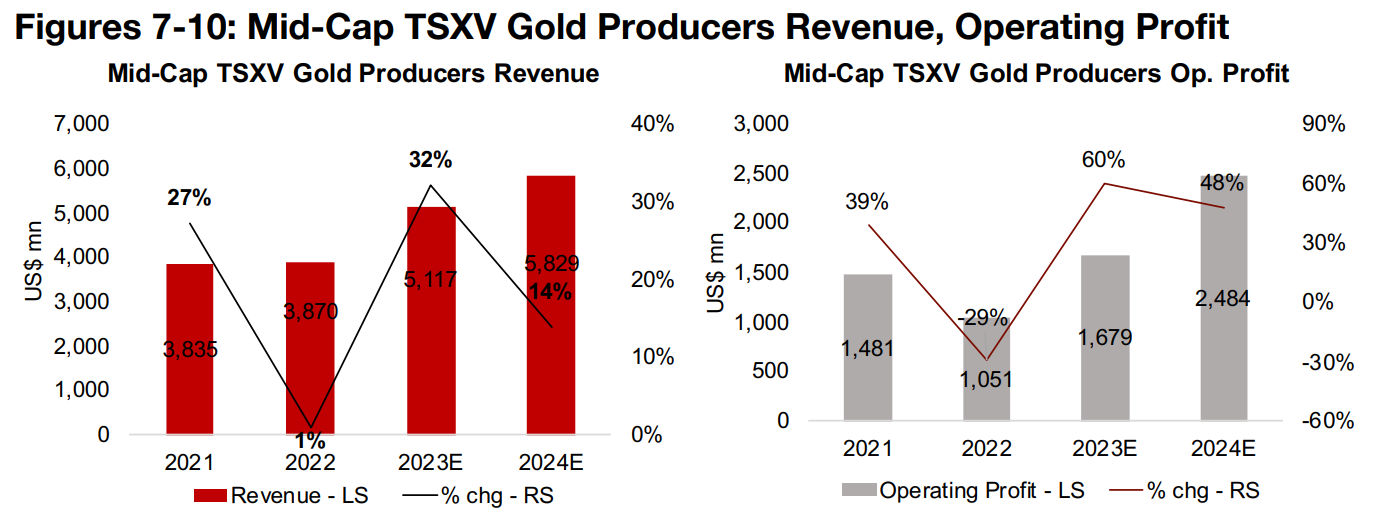

The market is expecting the mid-cap TSX gold producer's aggregate revenue growth

to improve significantly to 32% in 2023 from just 1% in 2022, especially driven by

production gains after a relatively weak rise in output overall in 2022 (Figure 7). It

forecasts the pickup to continue into 2024, but at a more moderate 14% growth rate.

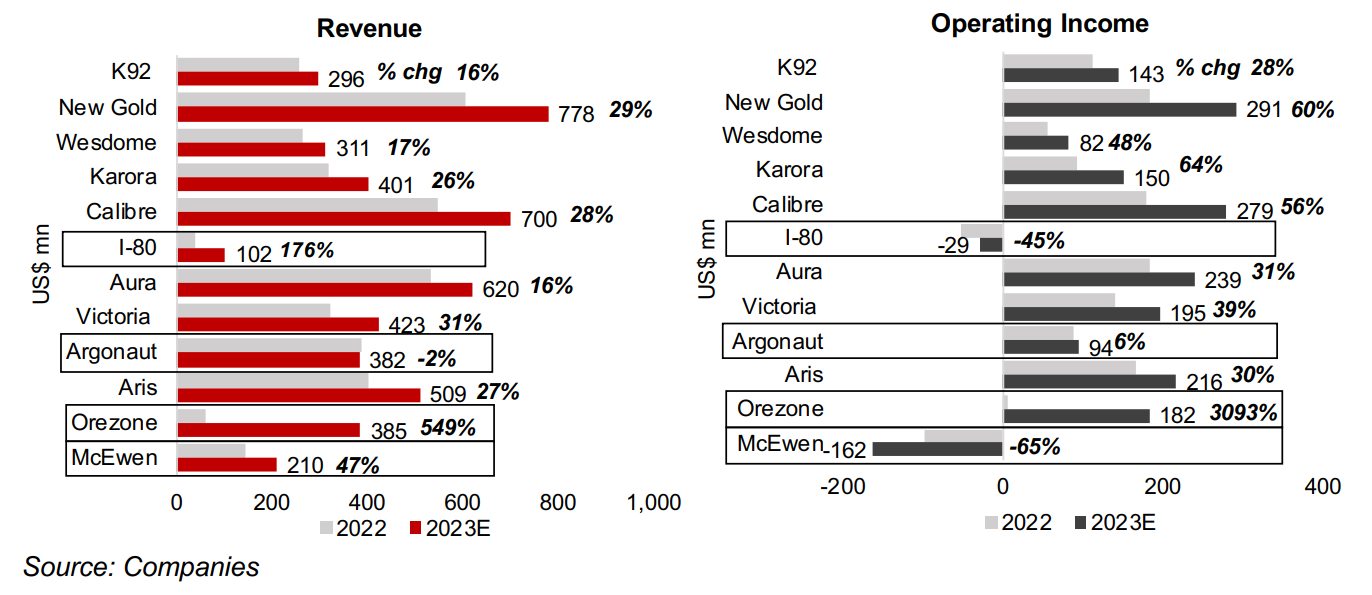

Revenue growth is expected to be strong across most of the companies, with the

strongest gains from I-80 and Orezone, which both have mines only in their first full

year of production in 2023. McEwen Mining, with producing mines in Ontario, Nevada

and Argentina, is forecast to the see the strongest revenue growth at 47%, and

Argonaut the weakest, with a -2% decline (Figure 9).

There is an even greater forecast rebound in operating profit, from a -29% decline in

2022 to a 60% surge in 2023, with another strong year of 46% growth expected in

2024 (Figure 8). Most of the TSX mid-cap gold producers are expected to do well,

with the only losses forecast to come from I-80 and McEwen, and the only other

company with below 25% operating profit growth being Argonaut, with a 6% increase

estimated (Figure 10). Orezone has the largest expected rise, up from a slight loss in

2022 to becoming a substantial contributor to the group in 2023, with the fifth highest

level of operating profit.

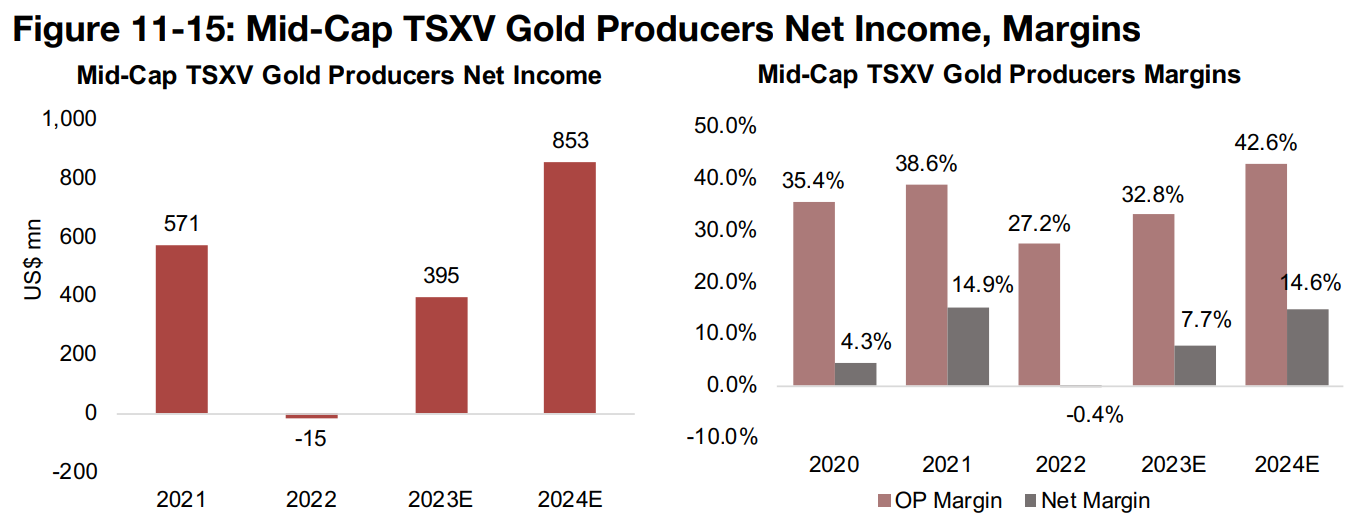

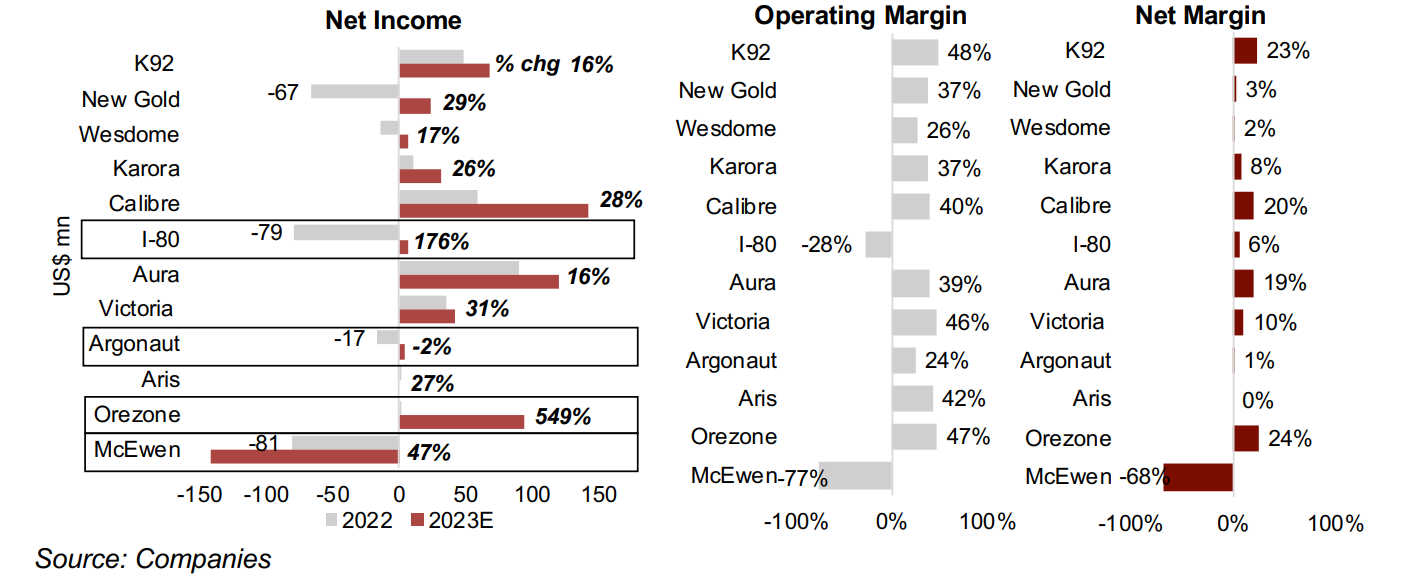

Net income to rebound from 2022 loss as margins recover

The improved operating performance is expected to drop to the bottom line for the

mid-cap TSX gold producers, with net income surging from a marginal net loss of

US$-15mn to net income of CAD$395mn, although the sector is only forecast to

surpass the level of 2021 by 2024, rising to CAD$893mn (Figure 11). The net loss in

2022 was driven mainly by three firms, New Gold, I-80 and McEwen, while Orezone

was pre-production and not profitable for most of 2022 (Figure 13). However, New

Gold, I-80 and Orezone are all forecast to turn significantly profitable in 2023, with

McEwen the only one expected to continue to be substantially loss-making.

Operating profit margin for the group is expected to recover from a dip to 27.2% in

2022 down from 38.6% in 2021 to 32.8% by 2023, and continue rising to 42.6% by

2024, which could imply higher gold prices especially for next year (Figures 12, 14).

While net margins are also forecast to rebound this year and next, they are not

expected to reach new highs in 2024, at 14.6%, remaining below the 14.9% of 2021

(Figure 15). The biggest drag on both operating and net margins remains McEwen,

given large continued forecast losses.

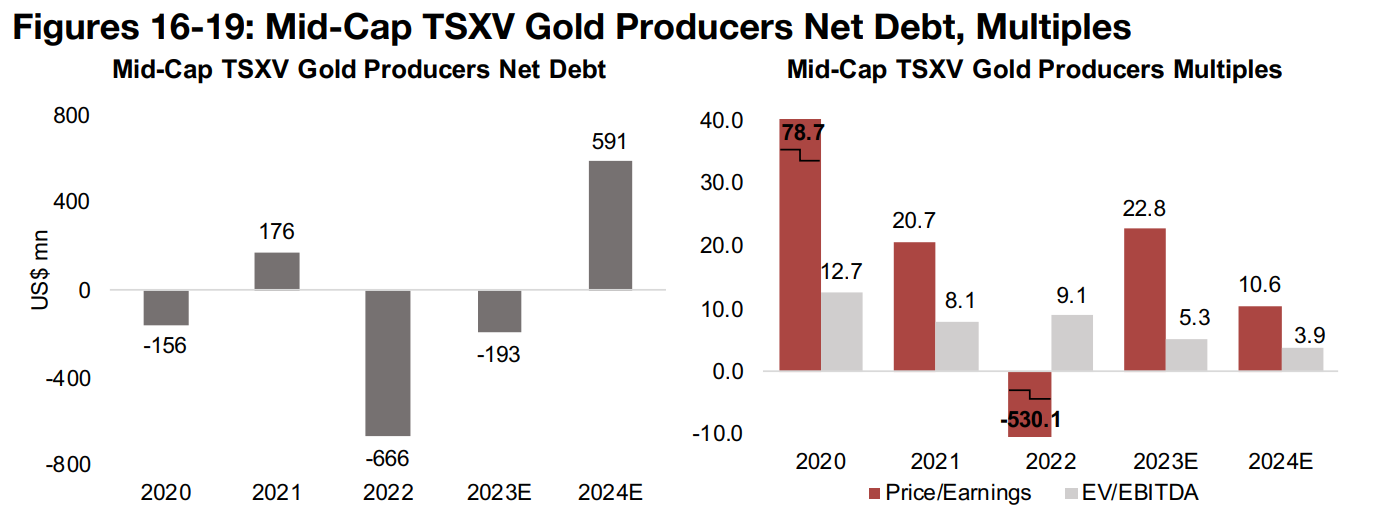

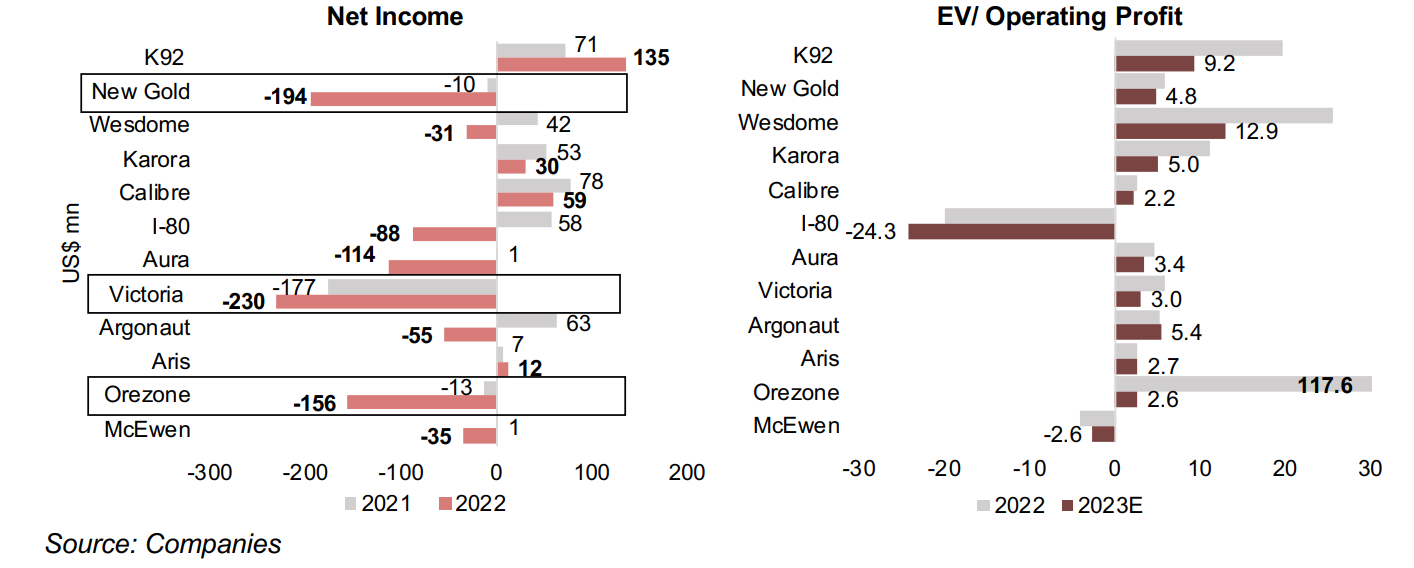

Debt levels and operating multiples declining

There was a large rise in leverage for the sector in 2022, with net debt (total debt

minus cash and equivalents) at CAD$-666mn, down from net cash of CAD$176mn in

2021 (Figure 16). However, net debt is expected to drop about 70% to CAD$193mn

in 2023, and turn to net cash of CAD$591 by 2024. Most of the rise in net debt in

2022 is attributable to two companies, New Gold and Orezone, and while Victoria's

debt is also high, it did not change that much from 2021 to 2022 (Figure 18).

Operating multiples have been declining for the sector, with EV/EBITDA (Enterprise

Value, or the Market Cap plus Net Debt/Earnings Before Interest, Taxes, Depreciation

and Amortization, or operating earnings) trending down from 12.7x in 2020 to 9.1x in

2022 and just 5.3x for 2023E (Figure 17). Multiples are expected to decline for most

of the group in 2023, with Orezone the major outlier in 2022 as it was not yet in

commercial production while I-80 has a negative multiple given its expected losses

(Figure 19). The price to earnings multiple is less meaningful given excessive readings

in 2020 and 2022, but it is expected to be moderately higher in 2023 at 22.8x than it

was in 2021 at 20.7x, although a large decline to 10.6x is forecast for 2024E.

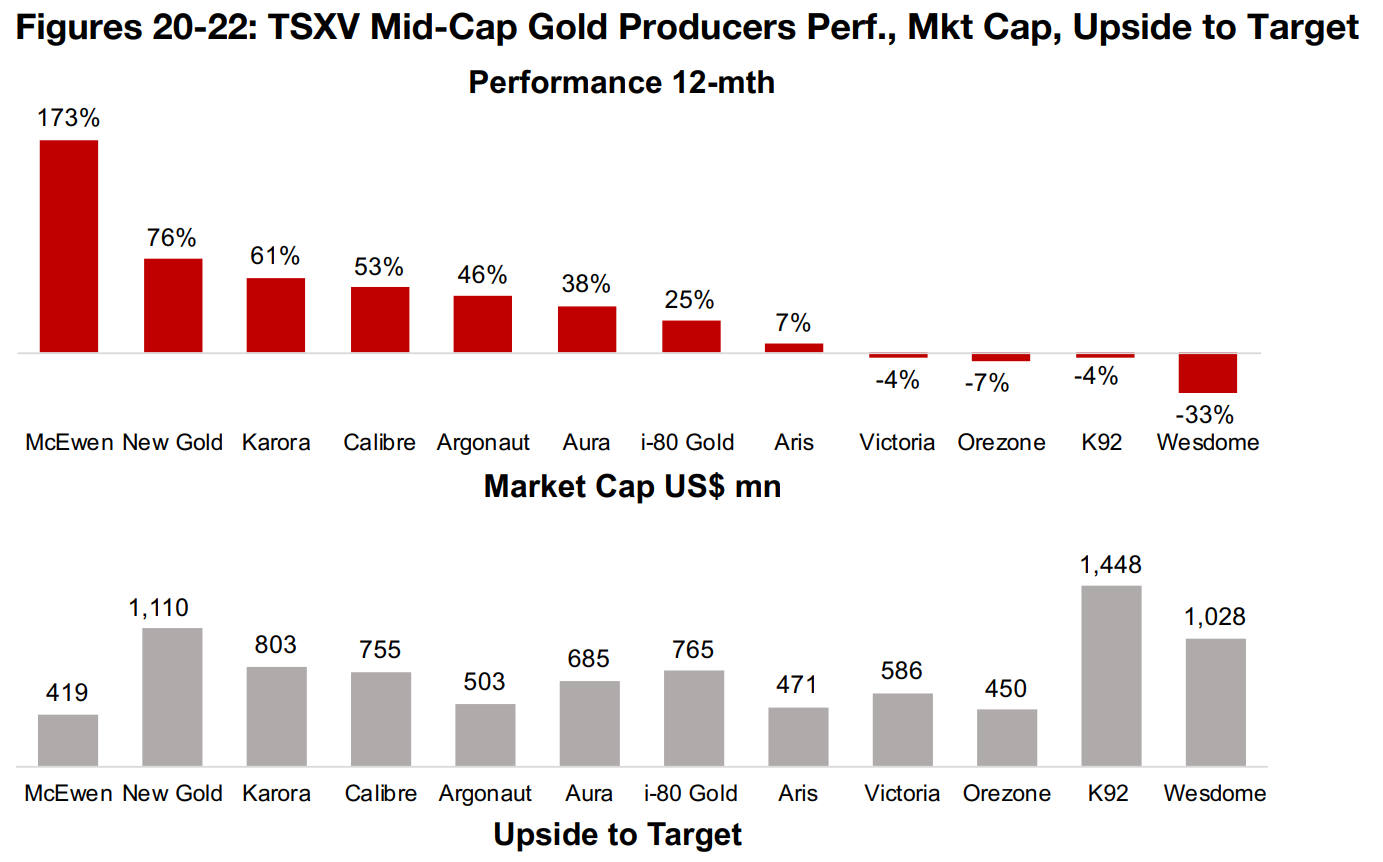

Most TSX mid-cap gold producers gain over past year, strong upside to targets

The mid-cap TSX producers have performed reasonably well over the past twelve

months, with eight of twelve stocks rising, seven gaining 25% or more, and the only

stock down more than 10% being Wesdome (Figure 20). The biggest gainer has been

McEwen Gold, with a 173% rise seeing it just enter the group at the bottom in terms

of market cap, at CAD$419m (Figure 21).

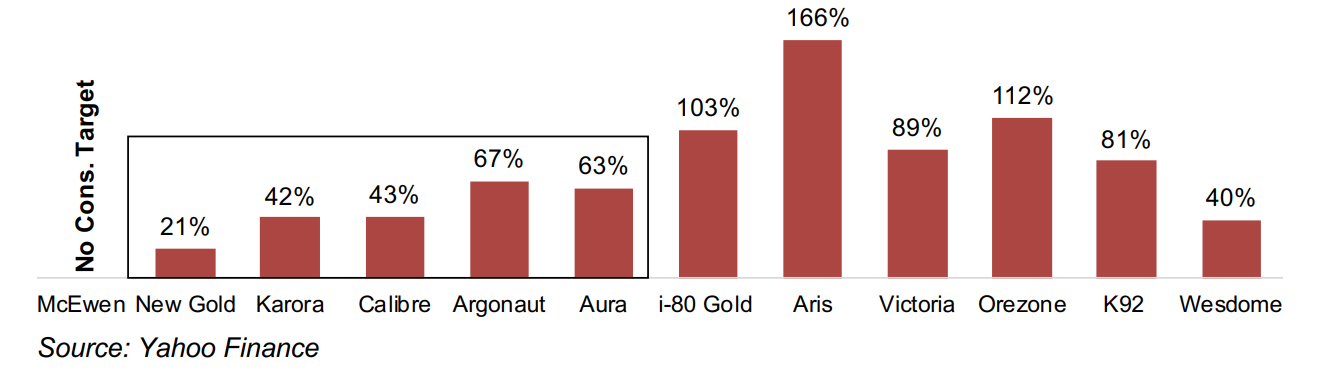

The top gainers have converged towards their consensus target prices, apart from

McEwen which has no consensus target (Figure 22). New Gold now has just 21%

upside, Karora and Calibre just over 40%, and Argonaut and Aura over 60%. The

other weaker performers still have 80% or more upside to their targets, apart from

Wesdome, with just 40% upside, even after its substantial decline over the past year.

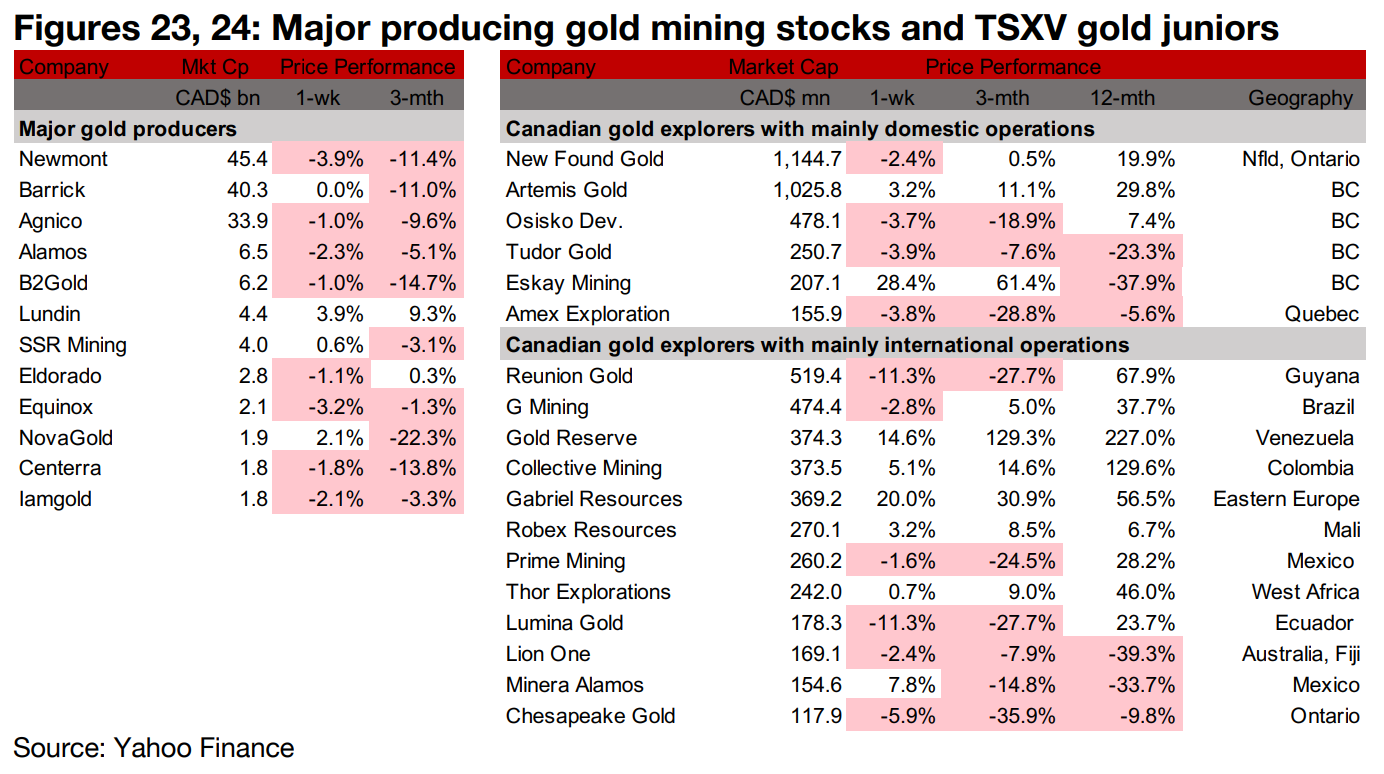

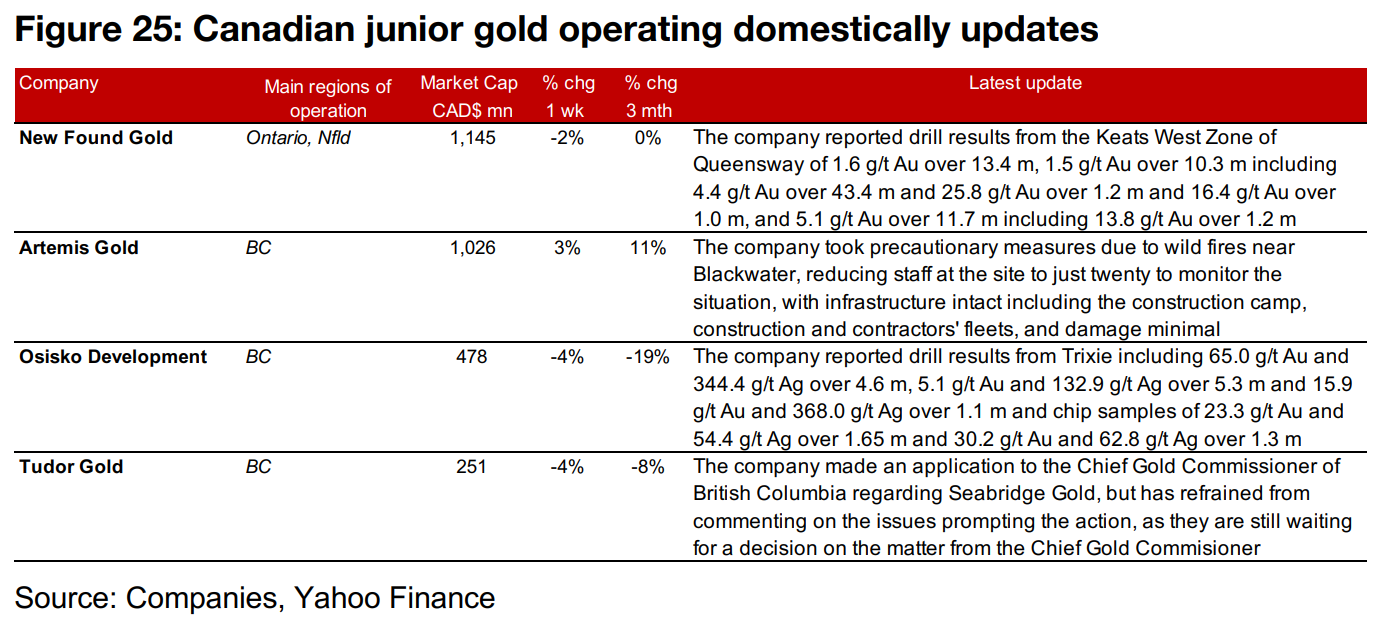

Producers mostly down and TSXV large gold mixed

The large gold producers were mostly down and TSXV larger gold mixed (Figures 23, 24). For the TSXV gold companies operating domestically, New Found Gold reported drill results the Keats West Zone, Artemis Gold announced precautionary measures because of wild fires near Blackwater, Osisko Development reported drill results and chip samples from Trixie and Tudor Gold announced an application to the Chief Gold Commissioner of British Columbia regarding Seabridge Gold (Figure 25).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.