March 17, 2025

Three Thousand

Author - Ben McGregor

Gold hits three thousand briefly for first time

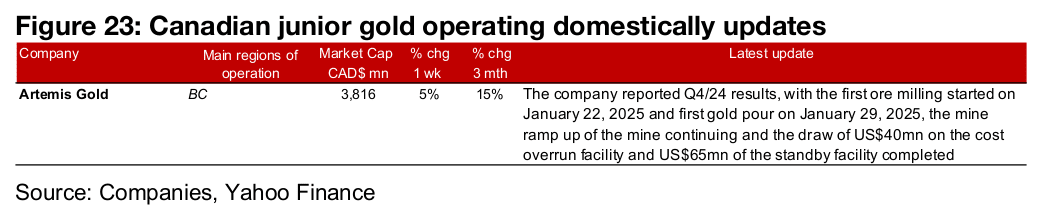

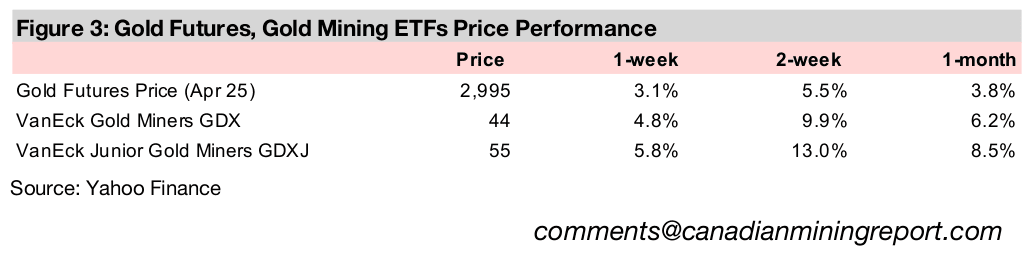

Gold rose 3.1% to US$2,995/oz this week and briefly touched US$3,000/oz for the first time ever, as the markets apparently continue to view geopolitical and economic risks as elevated enough to warrant this break through move for the metal.

Three Thousand

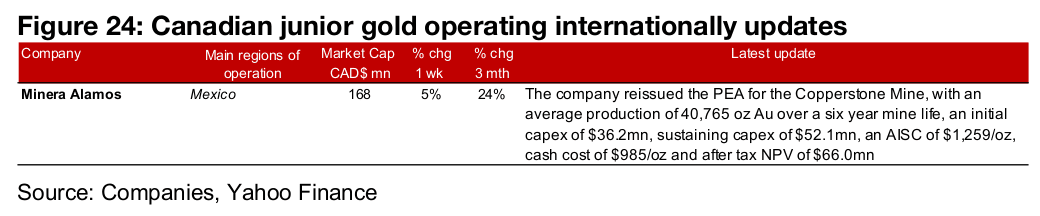

The gold price had a major breakthrough, briefly touching US$3,000/oz, and ending

the week up 3.1% at US$2,995/oz, driving gold stocks to new highs, with the GDX

up 4.8% and GDXJ rising 5.8%. The gold stocks have surmounted a critical hurdle in

continuing to make gains even as equities overall have declined. The sector far

outperformed the major equity indices, with the S&P 500 down -1.2%, the Nasdaq

off -0.5% and Russell 2000 down -0.7%, and all three have now entered corrections,

defined as a decline of more than -10% from their highs. In terms of short-term drivers

for gold, there was limited major economic data, and the upward driver of a fall in the

US$ was balanced by the downward driver of rising bond yields.

Gold could well make its first sustained push through this benchmark in the next few

weeks as its ratios very other key assets including precious metals, oil, the broader

commodities index and the global money supply are still only moderately above

recent averages. There also appears to be more than enough broad economic and

geopolitical risk to support a continued move into the metal as safe-haven. The

epicenter of this risk currently is clearly the US, given the extreme political shift this

year with the new administration. The biggest specific economic shock has been the

major hike in tariffs over the past two weeks, and the retaliatory measures taken by

many countries. It seems likely that the trade war could get worse before it gets better,

it certainly looks set to continue through 2025.

While there are some signs that geopolitical tensions could ease this is certainly not

guaranteed. We estimated last year that the premium in the gold price for the Russia

and Ukraine and Middle East conflicts combined was at least US$400/oz based on

the metal’s moves when these issues began. Even with the news pointing to a shift

towards resolution for the Russia and Ukraine conflict at least, there has been no sign

of strong market confidence in this with a pullback in the gold price. Also, even if the

market is pricing in a reduced premium for a potential reduction in geopolitical risk, it

may have been offset by a rise in the economic risk priced in on the trade war.

Gold stocks may continue to have support from relatively low valuations, but it

remains a question if they will need a constant further boost in the gold price to make

gains, or they can finally get some momentum and see an increase from a rise in

multiples. This would imply that the market is pricing in that high gold prices are

sustained over a reasonably long period. With a continued pullback in tech having

the potential to drag down the overall market, there is also a risk that investors shift

to broad selling across the market in the event of a major decline. This could even

see safe haven assets sold off, especially those that have seen substantial gains, to

cover losses in other assets. However, there could also be a scenario where the

market moves heavily into more defensive sectors in a downturn, which could see

gold stocks rise further, even with a broader decline in equities markets.

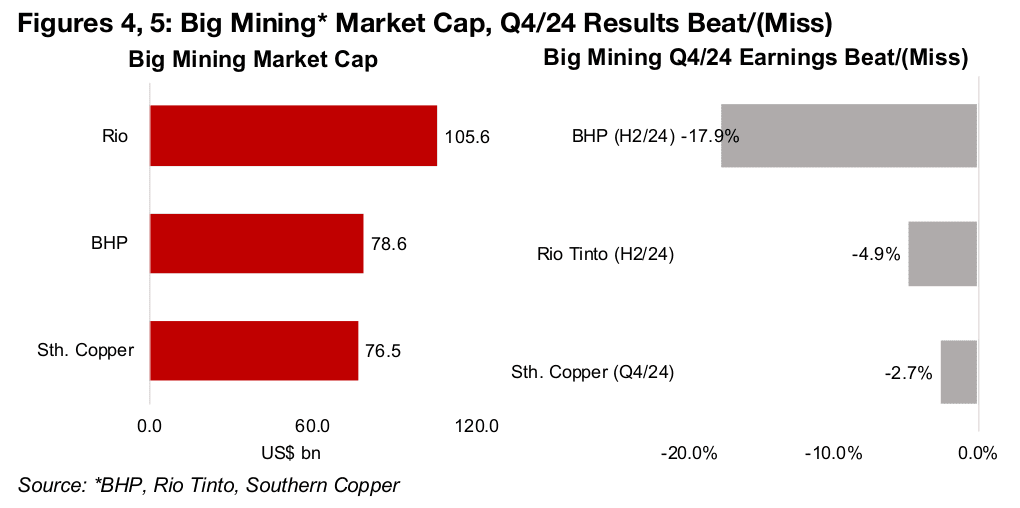

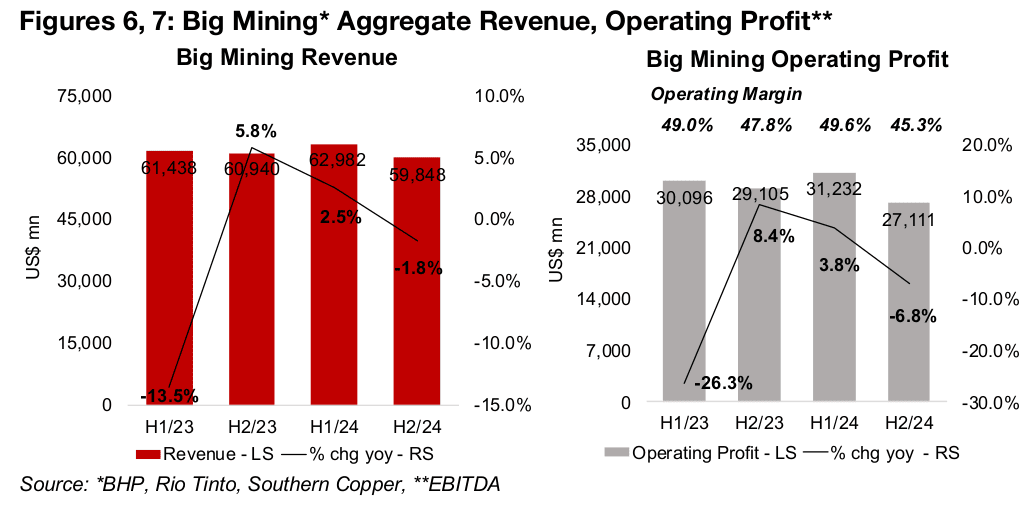

Big Mining slightly misses expectations, operating earnings edge down

The three Big Mining stocks have all reported results, with Rio Tinto and BHP announcing H2/24, and Southern Copper Q4/24, and all missing earnings estimates (Figures 4, 5). BHP saw the biggest miss, by -17.9%, with Rio Tinto and Southern Copper only slightly below expectations, by -4.9% and -2.7%, respectively. Aggregate revenue for the sector continued to trend down in H2/24 by -1.8% from 2.5% in H1/24 and 5.8% in H2/23, driven a decline in some realized product prices for the sector year on year (Figure 6). There was a similar downtrend in operating profit growth for the sector, with a decline of -6.8% in H2/24, after growth of 3.8% in H1/24 and 8.4% in H2/23 (Figure 7). The operating margin for the sector declined to 45.3% from a recent peak of 49.6% in H1/24.

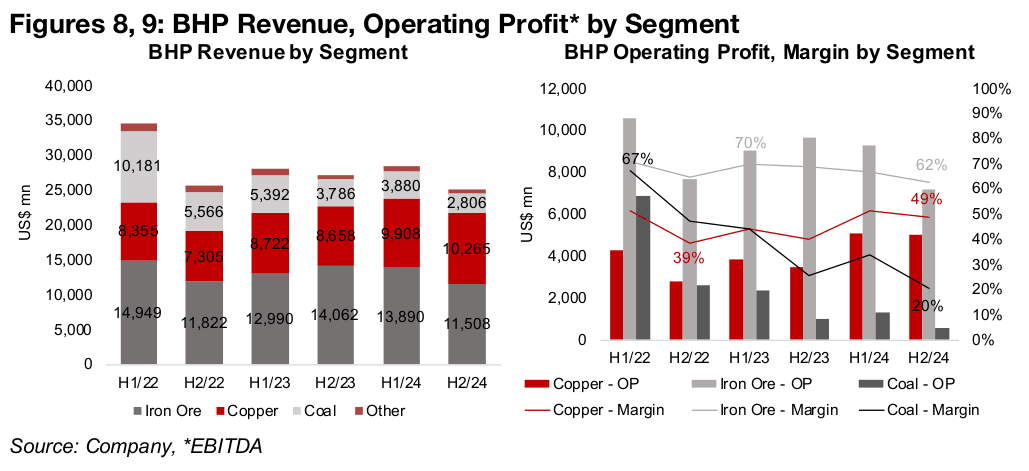

BHP sees decline in iron ore, coal, but gain for copper

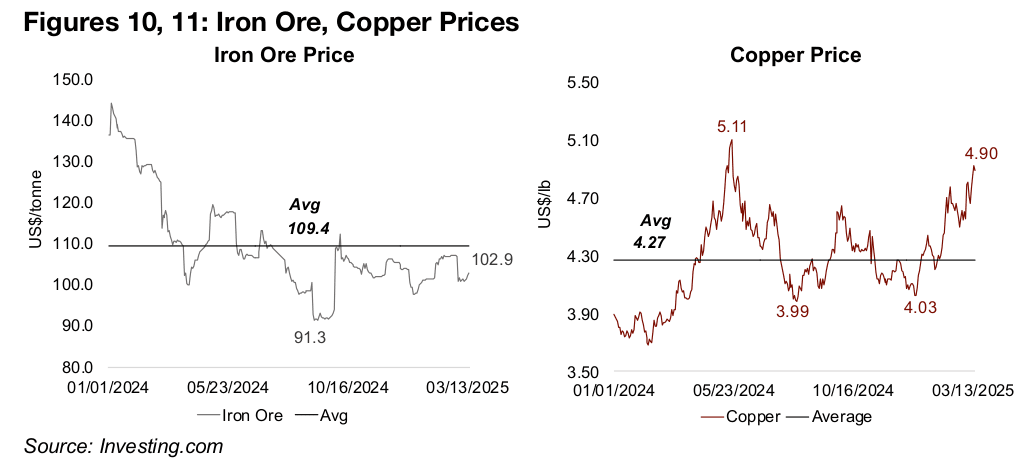

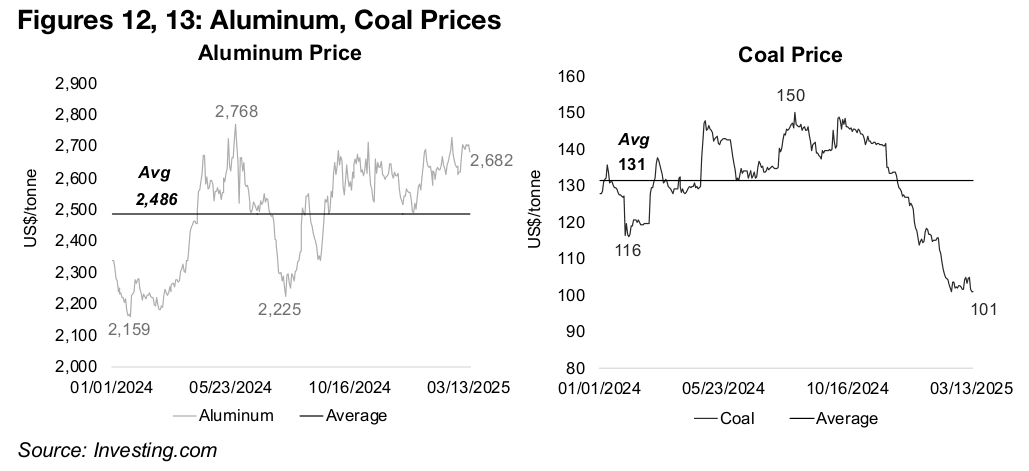

The largest company in Big Mining, BHP, faced a slowdown for its largest operating unit, iron ore, and its third largest segment, coal, but its second largest division, copper, saw gains for both revenue and operating profit (using earnings before interest tax and depreciation (EBITDA)). Iron ore revenue declined -18% yoy to US$11.1bn yoy in H2/24 on the drop in the metal price, and operating profit fell -26% to US$12.3bn (Figures 8, 9). Operating margins have trended down to 62% from their recent 70% peak in H1/23 (Figure 10). There was also a major contraction in coal revenue on a decline in the fuel price, by -26% yoy to US$2.8bn in H2/24, and operating profit for the segment slumped -42% to US$0.5bn, with margins at just 20%, down from 67% in H1/22.

The underperformance of these sectors was somewhat offset by a gain for copper, with revenue up 19% to US$10.3bn driven by a pickup in the copper price (Figure 11). Copper operating profit rose 44% in H2/24 to US$5.0bn, as margins have improved to 49% from 39% in H2/22. With the iron ore price remaining relatively flat, the coal price continuing to slide and copper surging back near highs of US$5.0/lb, it could be the latter sector that remains BHP’s main growth driver again in H1/25.

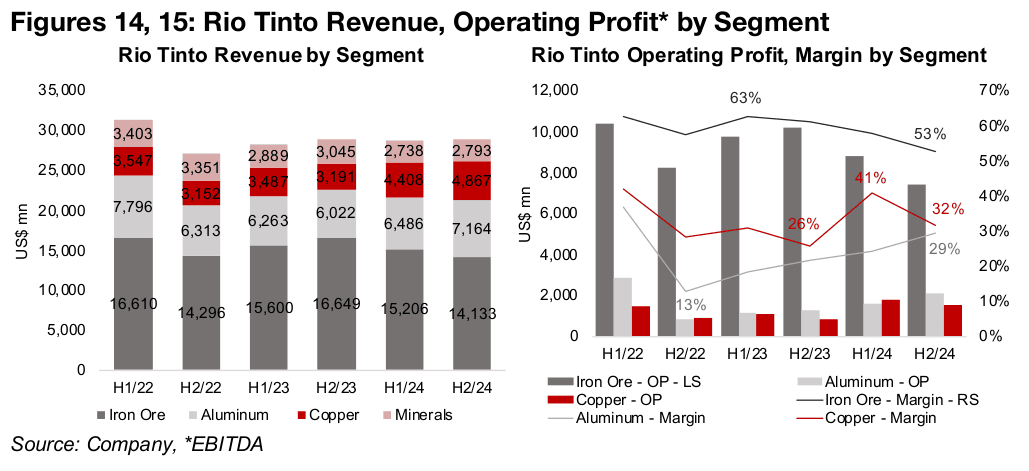

Rio Tinto dragged down by iron ore, with aluminum and copper up

Rio Tinto’s total revenue in H2/24 was exactly flat yoy although its operating profit declined -10.2%, with a decline in the iron ore segment offsetting gains for aluminum and copper. Revenue from iron ore, the company’s largest segment, declined -15% yoy to US$14.3bn and operating profit fell -27%, while margins declined to 53% from 63% in H1/23.

The second largest segment, aluminum, grew 19% to US$7.2bn in H2/24 as the metal price continued to pickup, with margins in the business trending up consistently to 29% in H2/24 from 13% in H2/22. The third largest segment, copper, had strongest performance, but is only 16% of total revenue, which rose 52% to US$4.9bn in H2/24 and operating profit jumped 88% to US$1.5bn, while margins declined to 32% from 41% in H1/24.

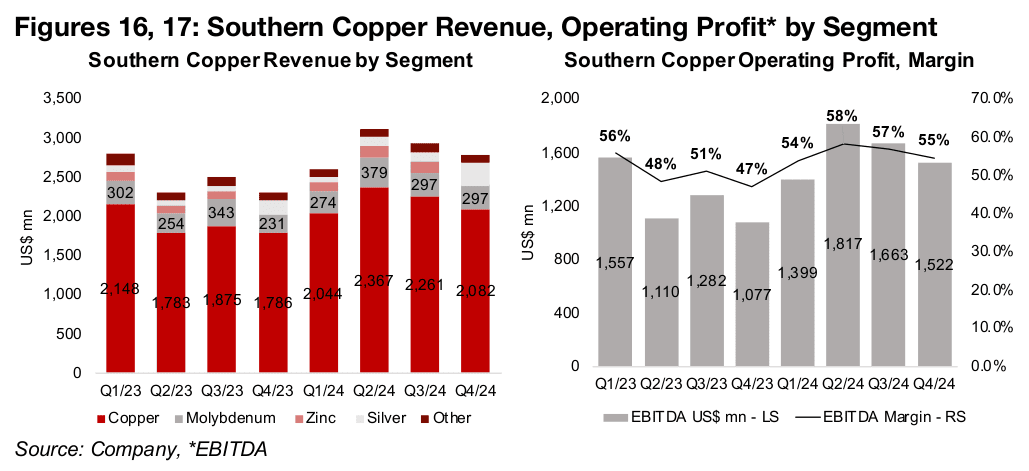

Southern Copper concentrated in strongly growing copper, but margins down

Southern Copper’s revenue is much more concentrated than the other Big Mining companies, with copper at 75% of revenue in Q4/24, with the second largest segment, molybdenum, at 11% (Figure 16). Copper revenue rose a substantial 17% in Q4/24, to US$2.1bn, on the gains in the metal price, while molybdenum grew 29%. Operating margins for the company have trended down to 55% in Q4/24 from 58% in Q2/24 (Figure 17).

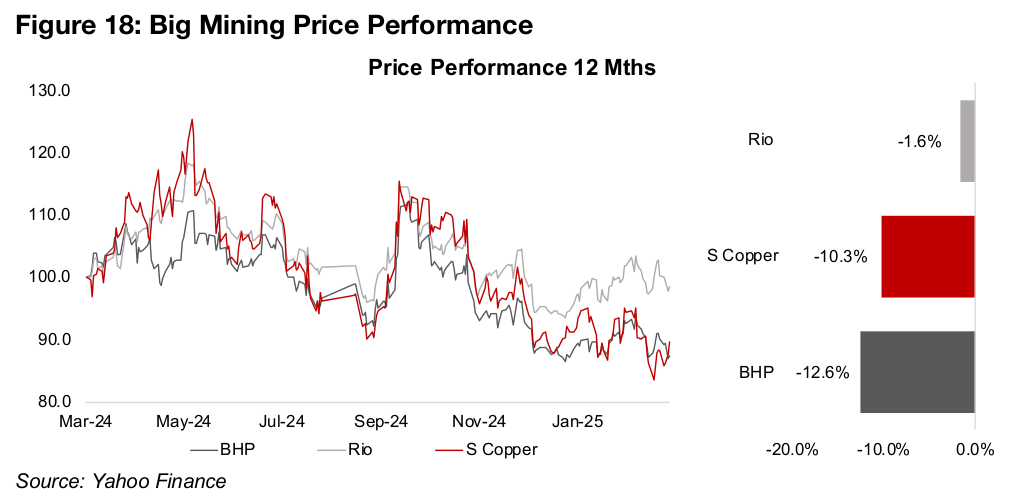

Big Mining’s shares and valuations continue to trend down

Big Mining share prices have trended down over the past year, with BHP off -12.6%,

as could be expected given its heavy weighting to the decline in iron ore and coal

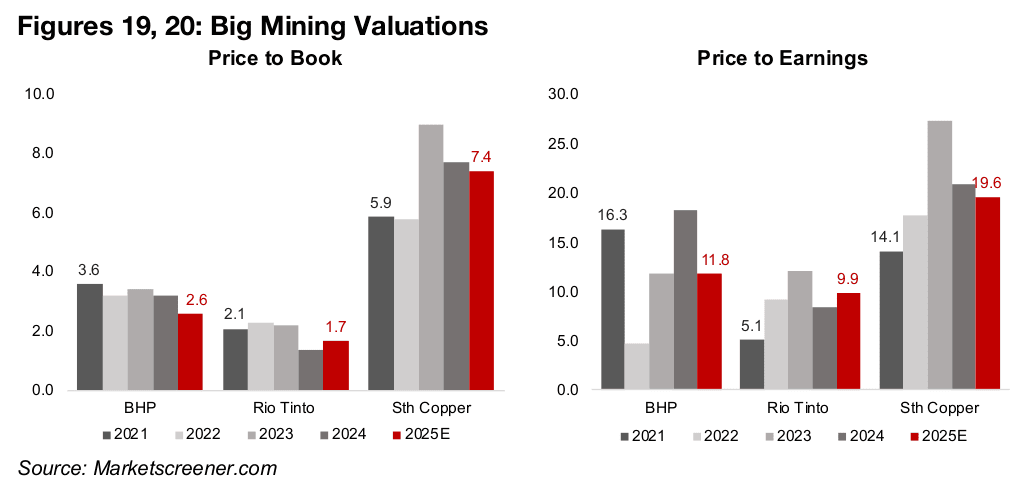

prices (Figure 18). BHP’s price to book valuations have trended down over the past

several years to 2.6x in 2025 from 3.6x in 2021, and its price to earnings to 11.8x

from 16.3x over the same period. Both multiples are reasonably low and appear to

have priced in a large amount weakness in two of its main sectors (Figures 19, 20).

Even though Southern Copper is exposed to the relatively strong copper sector, its

price has declined by -10.3%, which is a similar decline to BHP, even though the

latter is exposed to some much weaker sectors. However, this is likely because

Southern Copper’s valuations have shot up far above the other two Big Mining

companies.

Its price to book is 7.4x even after a decline from a peak at 9.0x in 2023. The

company’s price to earnings ratio is also far higher than the other Big Mining

companies, at 19.6x, and this is also down from highs of 27.4x in 2023.

Rio Tinto’s share price performance has been the strongest of the three Big Miners,

with only a -1.6% decline, even though it also has a large exposure to the weak iron

ore sector. This is likely because its valuations are the lowest of the three companies,

and may have priced in the risk of a continued weakness in iron ore and even other

sectors. The company’s price to book ratio was just 1.7x in 2025 and has edged

down from an already relatively low 2.1x P/B in 2021. The price earnings ratio is just

9.9x and this has increased from a particularly low 5.9x P/E in 2021.

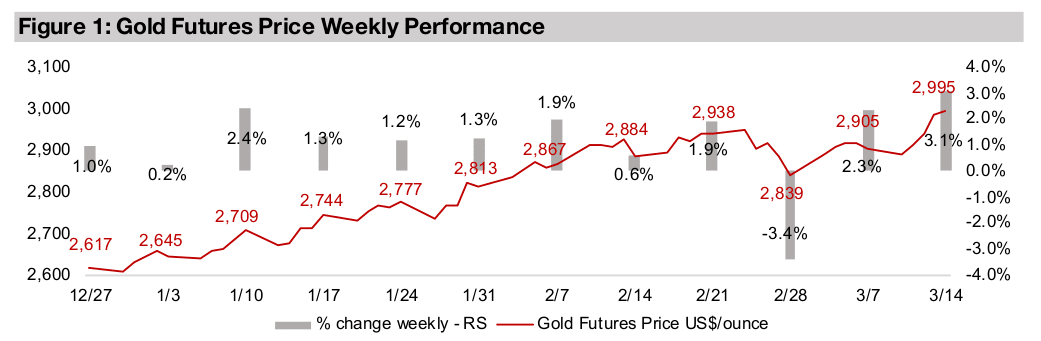

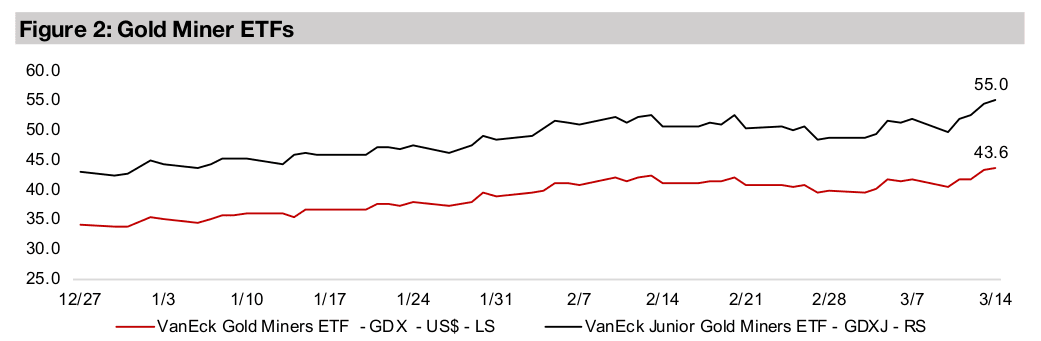

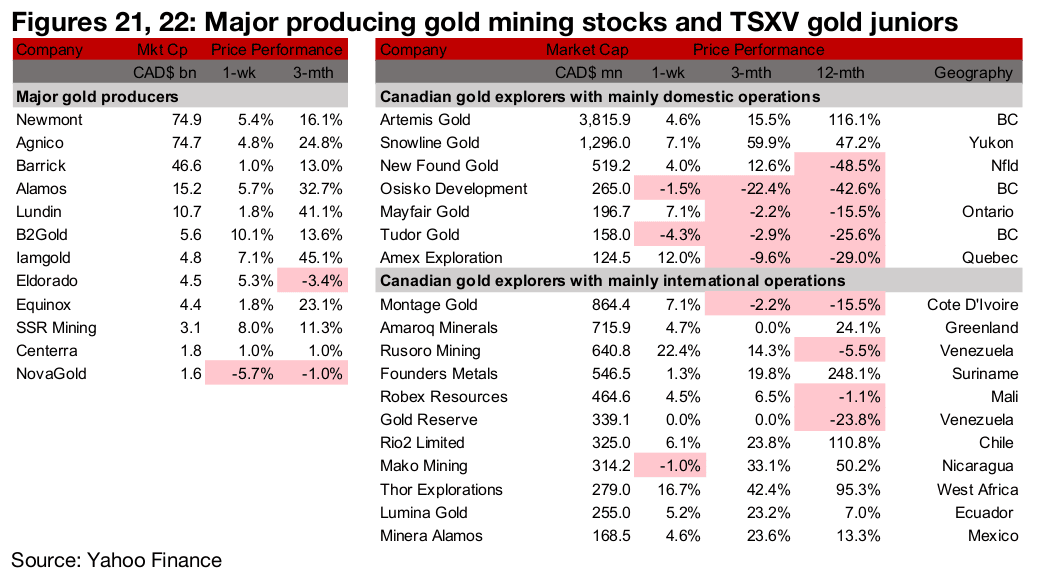

Gold producers and TSXV gold nearly all gain

The gold producers and large TSXV gold nearly all gained on the metal price’s continued rise (Figures 21, 22). For the TSXV gold companies operating domestically, Artemis Gold reported Q4/24 results, with its first gold pour coming after the reporting period on January 29, 2025 (Figure 23). For the TSXV gold companies operating internationally, Minera Alamos reissued the PEA for the Copperstone Mine (Figure 24).