September 2022

The World is STARVED of This Critical Metal

- Demand Propped Up by BILLIONS and Billionaires

- Argentina Lithium & Energy (LIT.V, OTC:PNXLF)

- Management with Skin in the Game

- The Next Lithium Frontier is HERE

Electric vehicles are one of the biggest megatrends of this century.

From cars to trucks, boats, and even planes-pretty much anything that has to do with transportation is going electric.

But there is a problem.

To produce batteries powering these vehicles, you need lithium. A lot of it. It's the key component in EV batteries, and it will continue to be critical to the EV revolution for decades to come.

But while the demand for lithium is soaring, production hasn't kept up.

By 2027, the global demand for lithium could double. And the world's output will not catch up.

Macquarie Group, an investment bank, warns of a "perpetual deficit" in the lithium market. Citigroup says an "extreme" rally could be coming.

Over the past year, lithium has appreciated by over 300%. But we believe that the market conditions will support a multi-decade rally. As long as the market wants more lithium than it can get its hands on, the bullish setup for the metal will continue.

Demand Propped Up by BILLIONS and Billionaires

The electric vehicles megatrend has enjoyed support from almost every major investor and market actor.

The US government has just passed a $750-billion Inflation Reduction Act, which includes support for electric vehicles whose parts are produced in the United States.

Energy storage, too, will be part of the $369-billion package designed to tackle the climate crisis and strengthen US energy security.

Private investors haven't been sitting on the sidelines, either.

Bloomberg estimated that it will require $42 billion by the end of this decade to meet the EV battery demand.

Elon Musk, one of the world's richest men, said that getting into the lithium business is a "license to print money."

Stellantis, the $43-billion company that owns such automotive brands as Dodge, Ram, and Chrysler, invested tens of millions into a low-carbon lithium producer.

Car makers are hungry for lithium because to them it's an existential question. They can't continue making internal combustion engines forever. The writing is on the wall for ICE-powered cars.

But to switch to 100% electric vehicles, they need to access the critical elements that enable battery technology, like lithium.

We will not be surprised to see more public and private investment in the form of equity stakes, offtake agreements, and outright mergers and acquisitions.

And some companies will be better positioned to profit from this massive trend than others.

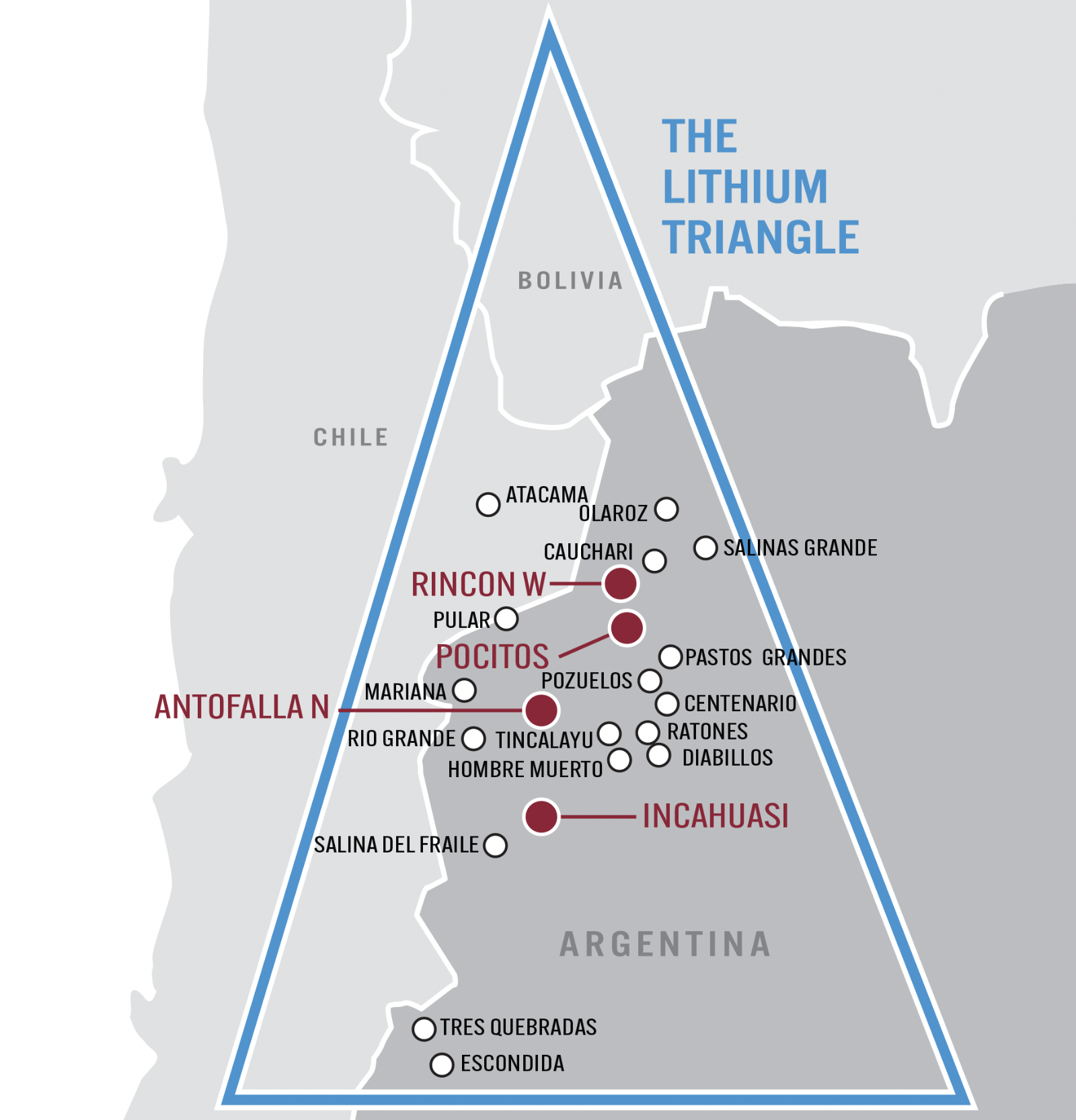

One of them operates in the region called "the lithium triangle."

This region is responsible for about 50% of the global lithium production, and it hosts almost 60% of the world's lithium resources.

Argentina Lithium & Energy (LIT.V, OTC:PNXLF)

Argentina Lithium holds a portfolio of projects in the heart of the "lithium triangle", which is responsible for the bulk of the world's lithium production and resources.

Unlike the neighboring Chile, which has seen quite a lot of lithium exploration and development, Argentina remains relatively unexplored. It means that it could have more exploration and production potential.

Argentina Lithium's projects cover about 700 square kilometers in the country's Salta and Catamarca provinces.

A survey conducted by the Fraser Institute, a think tank, says that Salta is one of the best provinces in Argentina for mining.

The company has recently acquired Rincon West, a relatively underexplored property with a lot of potential, according to its CEO.

The property sits close to two big and advanced lithium projects operated by the $92-billion mining giant Rio Tinto and an Australian mining company. Both projects have shown robust economics.

The company's exploration work accomplished so far indicates that there could be significant areas that host the valuable lithium brine aquifers.

Argentina Lithium is conducting a drilling campaign to follow up on the initial exploration work.

Some of the initial results were encouraging, with brine samples collected over a 70-meter interval with lithium grades of 225-380 mg/liter.

The company plans to prepare a resource estimate for Rincon West at the beginning of 2023.

The company is well-financed to conduct this campaign. To its advantage, brine exploration tends to be cheaper than others.

Management with Skin in the Game

The company's Chairman, Joseph Grosso, has been active in Argentina since 1993. In 2005, he was named the country's "Mining Man of the Year."

He has vast experience in corporate development, marketing, and negotiations. He is the founder of Grosso Group Management Ltd., which holds stakes in a diversified portfolio of resource-focused companies.

The company's President and CEO, Mr. Nikolaos Cacos, has been involved with Grosso Group since its inception.

The management has chosen a two-pronged strategy for its approach to discovering valuable lithium deposits.

First, it plans to continue building the company's portfolio of projects. Second, it aims at bringing these projects to a stage where their preliminary economics are outlined. At that point, it could be likely that mining majors or potential lithium buyers could present attractive M&A opportunities. The current supply-demand imbalance in the lithium market has already resulted in what S&P Global Market Intelligence described as an "M&A frenzy" in China.

Other regions could find themselves in a similar state, and, given the prominence of the "lithium triangle," we will not be surprised to see a lot of potential activity in that area.

It has excellent infrastructure, including easy access to rail, water, roads, and power.

Given that it's responsible for almost two-thirds of the global lithium resources, it is likely that it will be the next major hotbed of both production and M&A activity.

Argentina Lithium appears undervalued based on the amount of land it holds relative to its peers, according to Fundamental Research Corp, a research provider.

The Next Lithium Frontier is HERE

The EV revolution has begun, but to maintain its momentum it needs much more lithium than is currently available. This metal is badly needed, which means that there is a global rush for high-quality lithium projects in established jurisdictions.

Against this bullish backdrop, Argentina Lithium holds an attractive portfolio of properties in one of the world's best lithium regions.

The urgency to explore for and produce as much lithium as possible to satisfy the demand of the global EV megatrend is a massive tailwind for the company and its stockholders.

Go to ArgentinaLithium.com to learn more.

Sign up to receive our future articles and updates.

Disclaimer: This report is for informational use only and should not be used as an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.

The preceding Article is PROMOTED CONTENT sponsored by Argentina Lithium and produced in cooperation with CanadianMiningReport.com.