July 24, 2020

The wind at gold's back

Author - Ben McGregor

Surging right through US$1,800/oz and heading for US$1,900/oz

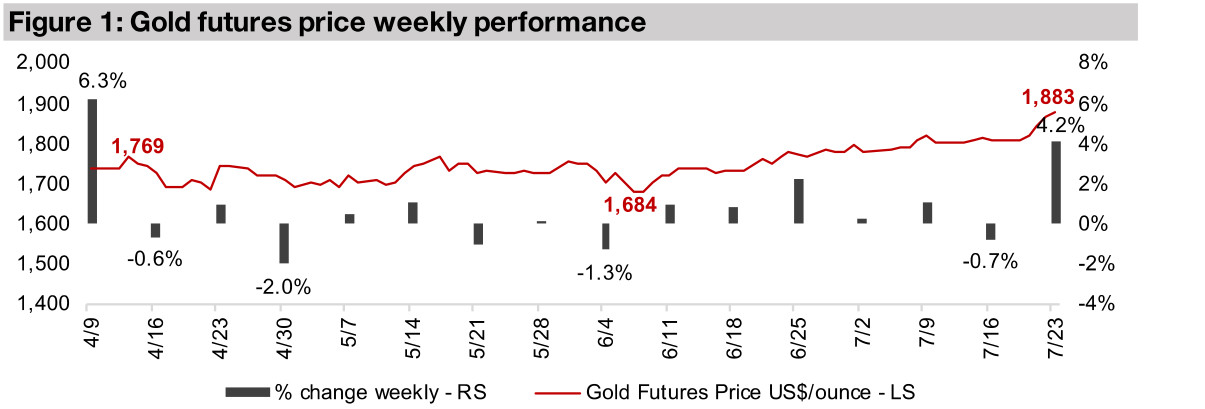

The gold futures price blew through any resistance at US$1,800/oz, to peak at US$1,883/oz this week, as a falling US$, global stimulus, a potential vaccine and new MPC member were all wind at gold's back, putting the US$1,921 all time high in reach.

Producing miners up on gold surge

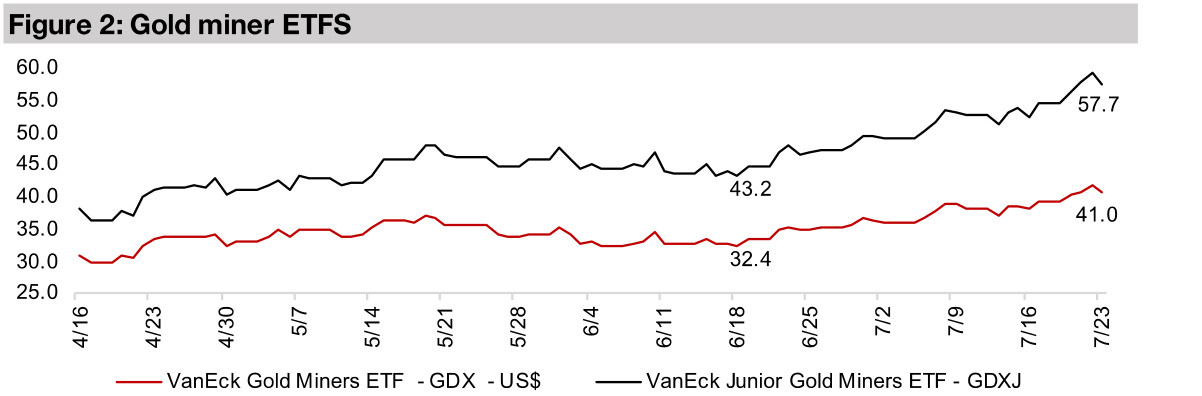

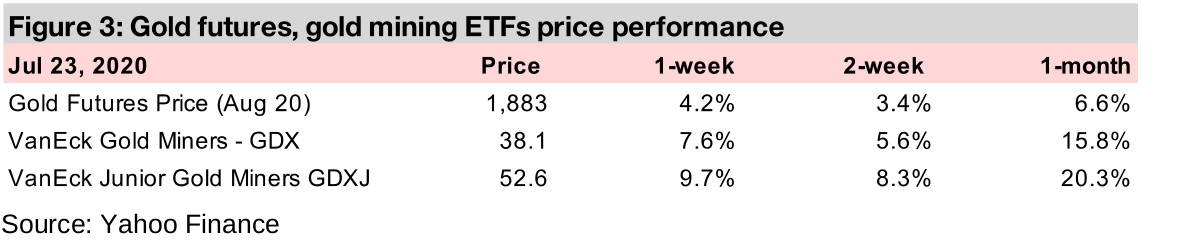

The producing gold miners saw a strong week, spurred on by the 4.2% rise in the gold price, its strongest week since early April, with the GDX up 7.6% and nearly all of the major listed producing miners rising.

Canadian junior miners mixed after strong run for most names

While the global junior gold miners were strong this week, with the GDXJ up 9.7%, the Canadian juniors were mixed, as many names have seen profit taking after a substantial three month run, including Lumina Gold, which is In Focus this week.

A real bull run emerging for gold, as it heads towards US$1,900/oz

The gold futures price has blasted through US$1,800/oz with little resistance and ended the week at US$1,883/oz, hitting nine year highs, and is now heading for its US$1,921 all time high set in 2011. There have been multiple drivers for this, including; 1) a fall in the US dollar, 2) the approval of a massive stimulus package by the EU which points to further monetary expansion, 3) progress on a vaccine that could help drive an economic recovery, which while reducing the safety motive for holding gold, could unleash the recent monetary expansion into the economy more quickly than expected, and drive inflation, and 4) the potential election of Judy Shelton, who supports sound money and a gold standard, to the US Federal Reserve Board's monetary policy committee member (MPC).

Figure 4: Gold performance in major currencies

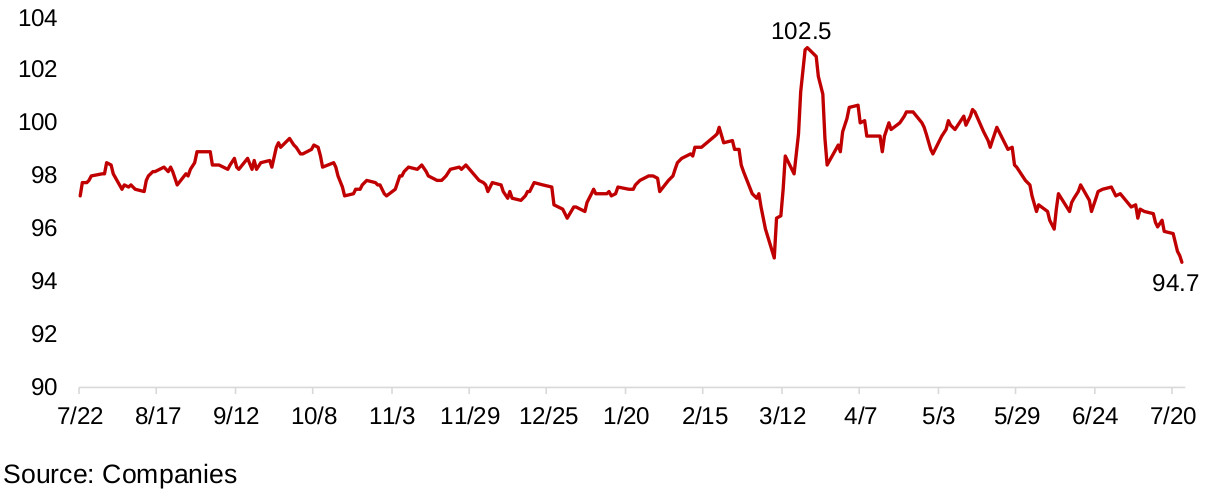

Figure 5: US Dollar index

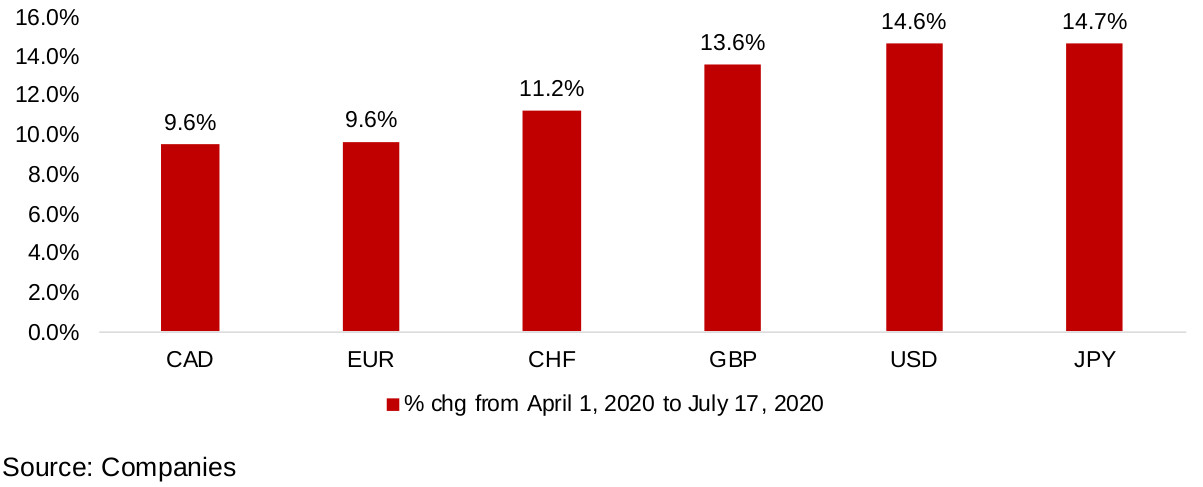

Gold not only being driven by the fall in the US dollar

One of the major drivers for the rise in gold focussed on in the press has been a decline in the US$. While the US$ has depreciated against gold by 14.6% since April 2020, it is clearly not the only factor driving gold, as other currencies, including the CAD, EUR, CHF, GBP and JPY have all depreciated significantly against gold, by 9.6%, 9.6%, 11.2% 13.6% and 14.7%, respectively (Figure 4). This points to not only a US dollar story, but one of fiat currencies more broadly losing ground to gold. Nonetheless, the US$ weakness will likely be one of the leading drivers of gold in the coming weeks, as after a brief jump in the US$ following the March crash, the US$ index, or DXY, has been on a downward slide since, and this has accelerated over the past week, down to 12 months lows of just 94.7 (Figure 5).

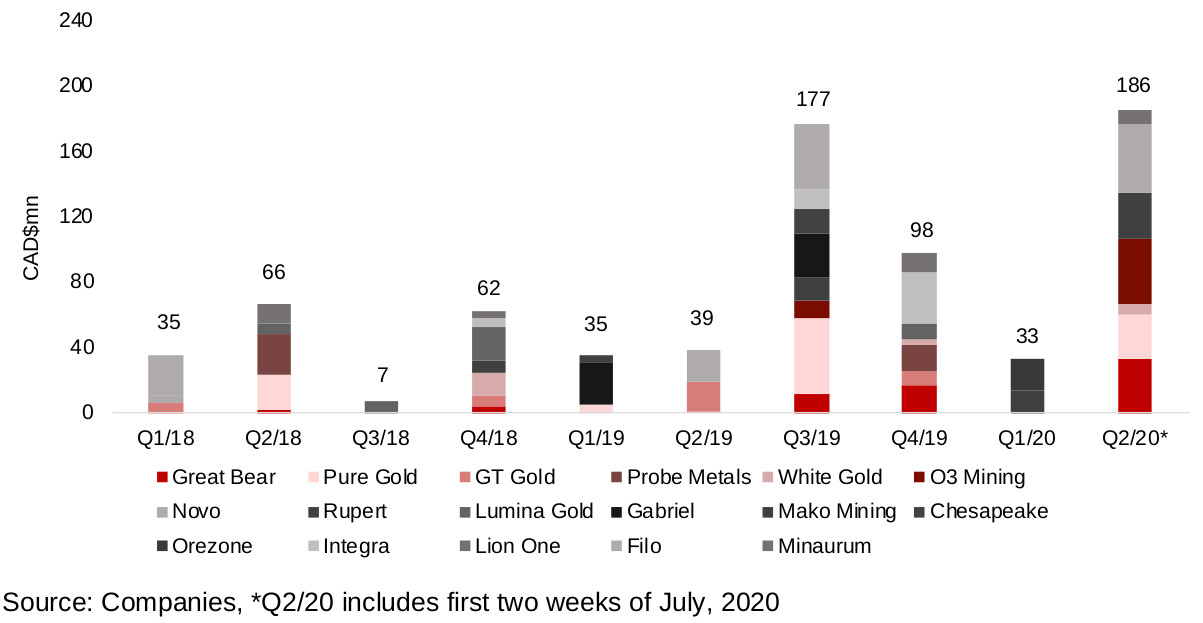

Canadian junior gold mining stocks see capital raising boost

While the macro picture remains very supportive of the gold price, micro drivers, like capital raising, are starting to improve at the junior miner level. Figure 6 shows the quarterly capital raising done by the main Canadian junior gold mining stocks that we track, which has been mostly private placements, but also includes some exercise of stocks options. We can see that capital raising has surged over the past year, beginning in Q3/19, when the first big advance in the gold price in several years lead to CAD$177mn raised. While this fell to CAD$98mn in Q4/19, this figure was still strong compared to any quarter from Q1/18 to Q2/19. While capital raising declined in Q1/20, it surged in Q2/20 to $186mn (we note that this data is slightly inflated as we have included capital raising up to the first two weeks of July 2020). It appears likely that Q3/20 will also be strong, given a gold price nearing all time highs.

Figure 6: Capital raising for Canadian junior miners jumps

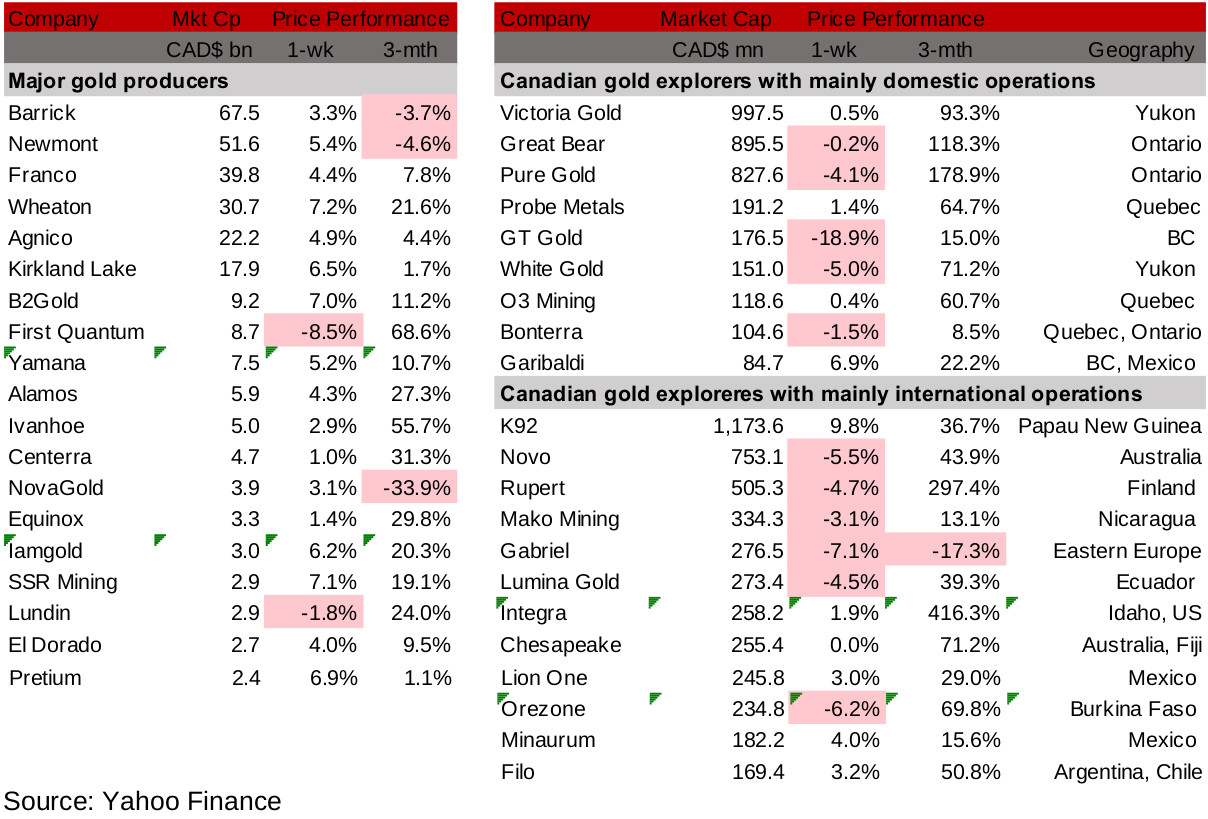

Figures 7, 8: Major producing gold mining stocks and Canadian juniors

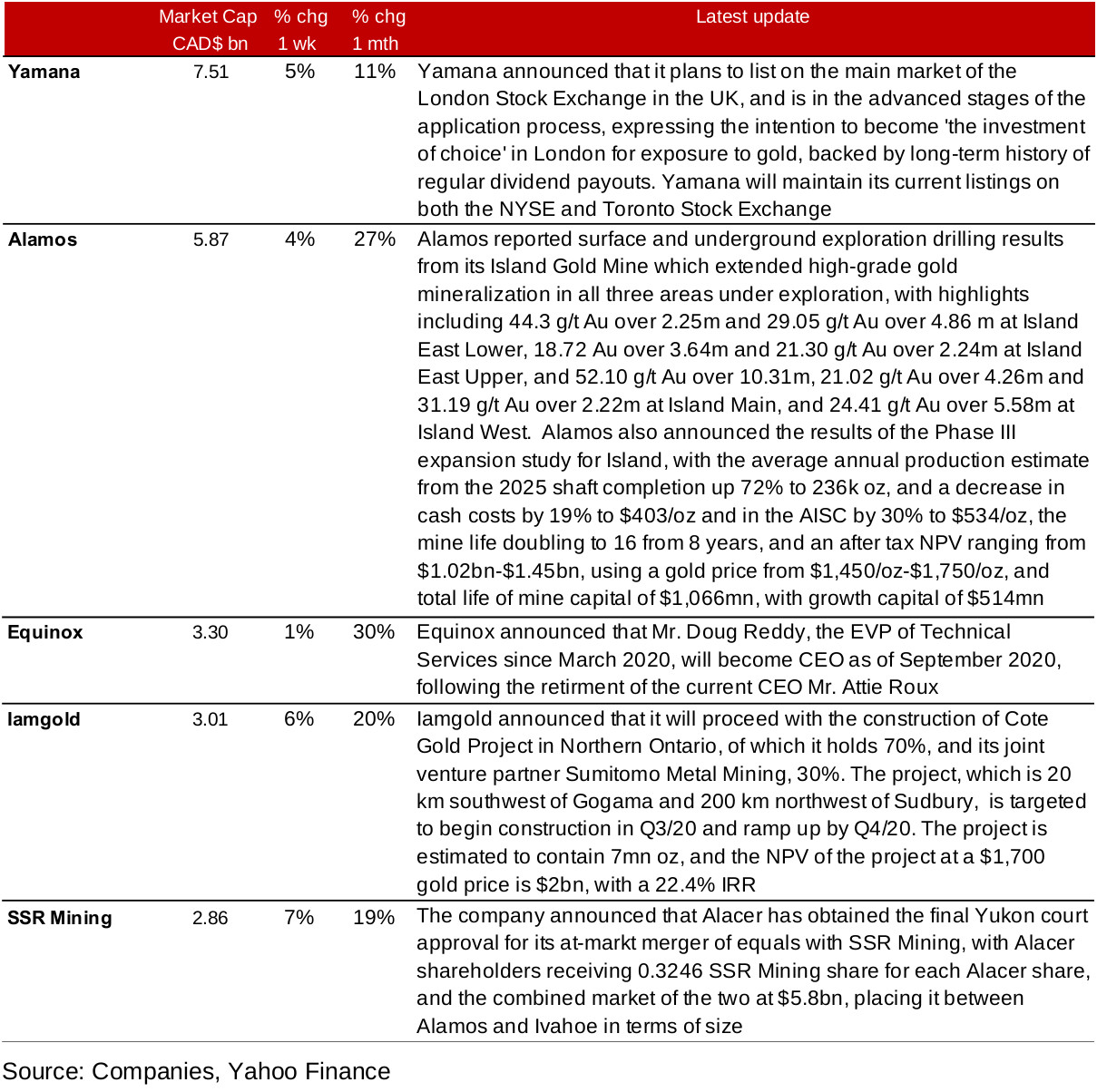

Producing miners decline after strong month-long run

The major producing miners mainly gained this week, with most of the group up over 5%, mainly driven by the continued rise in the gold price (Figure 7). Key company news included Yamana Gold's plans to expand its listing to include the London Stock Exchange in addition to its current listings on the NYSE and TSX (Figure 9). Alamos Gold announced results from its Island Gold Mine which extended high grade mineralization at the property, and the results of its Phase III expansion study for Island, including a significant increase in potential production after completion of a new shaft in 2025. Iamgold announced that it will proceed with the construction of its Cote Gold Project in North Ontario, its 70% held joint venture, with Sumitomo Metals holding 30%. Alacer Gold received final approval for its merger of equals with SSR Mining, creating a $5.8bn firm, between Alamos and Ivanhoe in size. Equinox Gold announced the appointment of a new CEO, Mr. Doug Reddy, as of September 2020, and the retirement of the current CEO, Mr. Attie Roux.

Figure 9: Producing gold miners updates

Canadian domestically operating juniors mixed even on strong gold

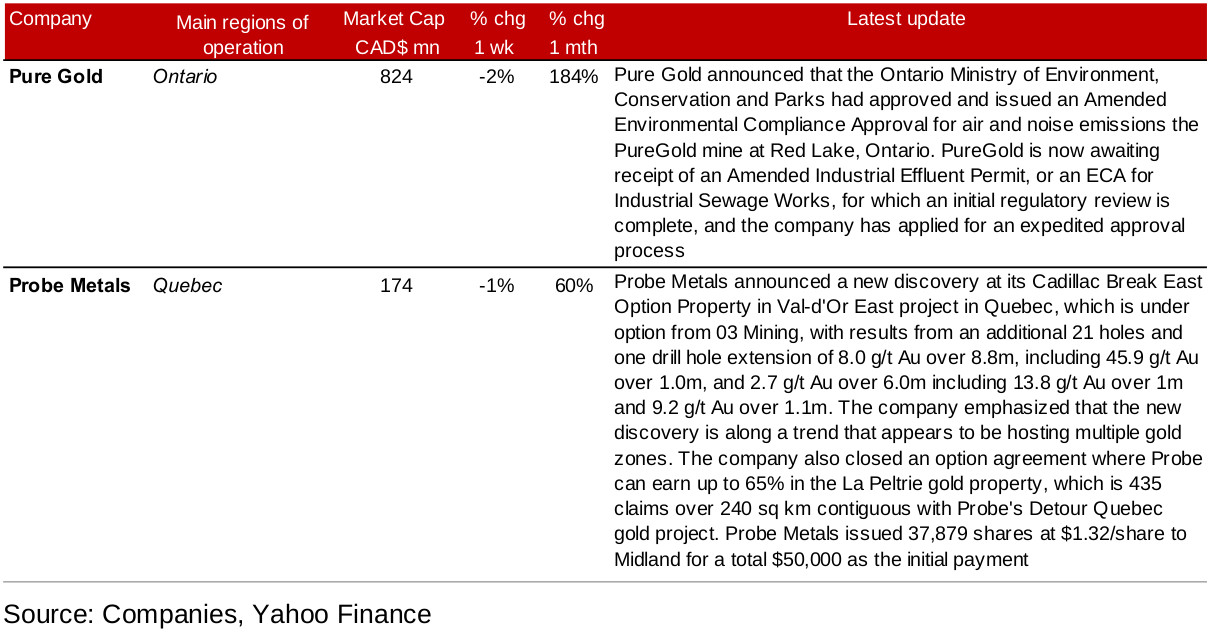

Even with the surge in gold, several all of the Canadian operating junior mining stocks declined this week, as some of the names are seeing moderate declines after large gains over the past three months (Figure 8). Pure Gold was an example, down -4.1% this week even after announced that it received a key air and noise emission environmental permit and is awaiting another effluence permit for its Pure Gold mine at Red Lake, but is still up 178.9% over past three months (Figure 10). Other key news flow was from Probe Metals, which reported a new discovery along a trend that appears to be holding multiple gold zones at its Val-d'Or East project in Quebec, and also completed an option agreement for 65% of the La Peltrie gold property.

Figure 10: Canadian junior gold miners operating in Canada updates

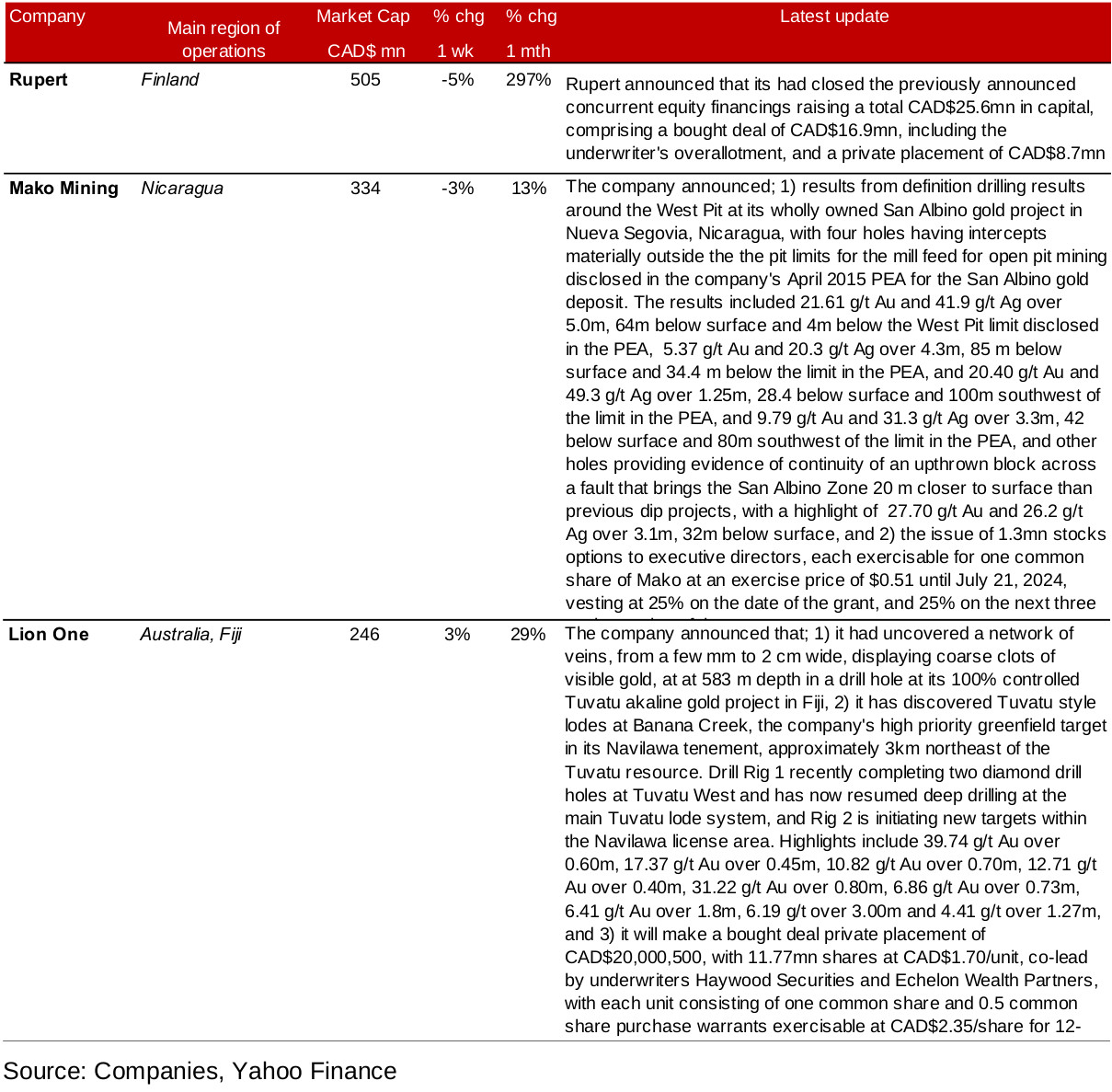

Several Canadian internationally operating juniors decline

Several of the internationally operating Canadian junior mining stocks also saw declines this week, even as the gold price ramped up, with many pausing after major gains over the last three months (Figure 8). There was news flow from Mako Mining, which reported definition drilling results around the West Pit at its wholly owned San Albino gold project in Nicaragua, and the issue of stock options to directors (Figure 11). Lion One made three announcements; 1) that it had found a network of gold veins at its Tuvatu gold project in Fiji, 2) that it had discovered a new potential resource at Banana Creek, its high priority greenfield target at its Navilawa tenement, and 3) that it has arranged a bought deal private placement of CAD$20,000,500.

Figure 11: Canadian junior gold miners operating mainly internationally updates

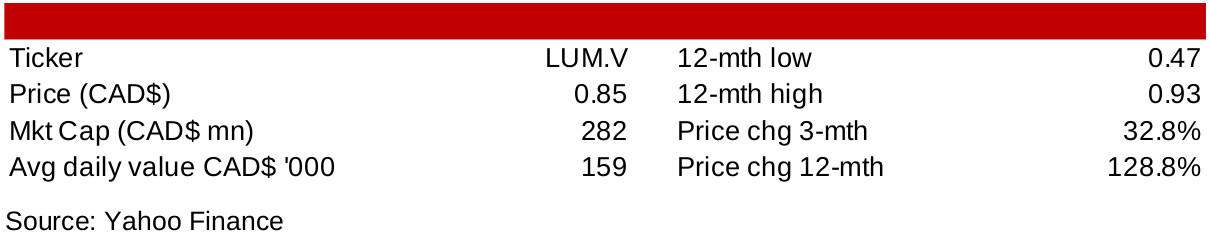

In Focus: Lumina Gold

Figure 12: Lumina Gold

Lumina Group has strong history of project development

Lumina Gold's current main project is the Cangrejos project in Ecudaor, where the industry has only recently been active, with a Ministry of Mines established in 2015, and the concession system reopened in 2016. However, the Lumina Group has an extensive history of developing strong projects, mainly in South America, with eventual acquisition by large players over the past 15 years. The company developed and sold seven projects and one portfolio of royalties from 2006, for a total $1,619bn, compared to a total $275mn capital raised for these projects (Figure 13).

Figure 13: Lumina Group's past project development

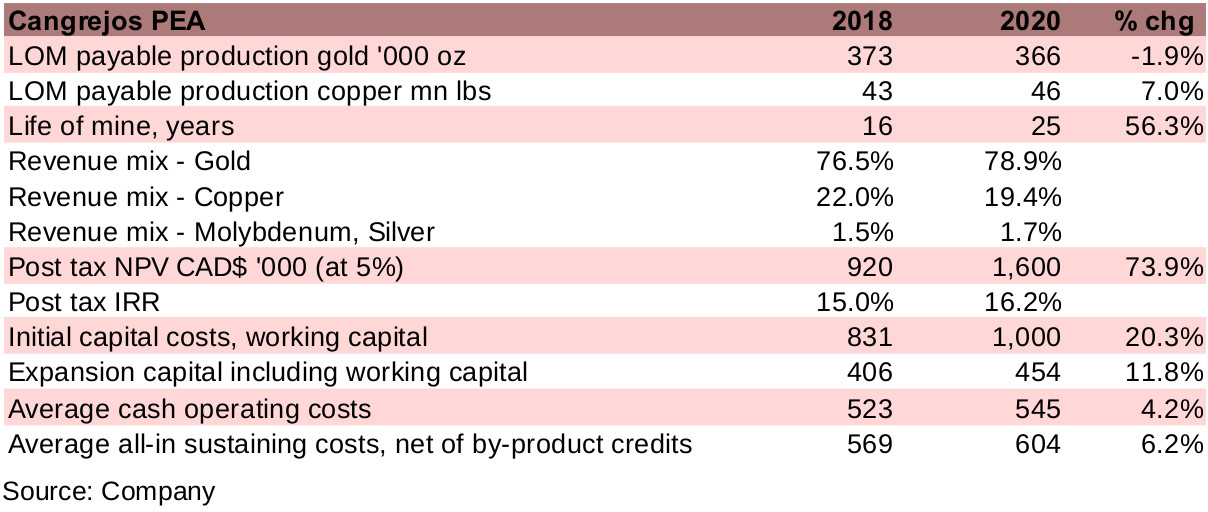

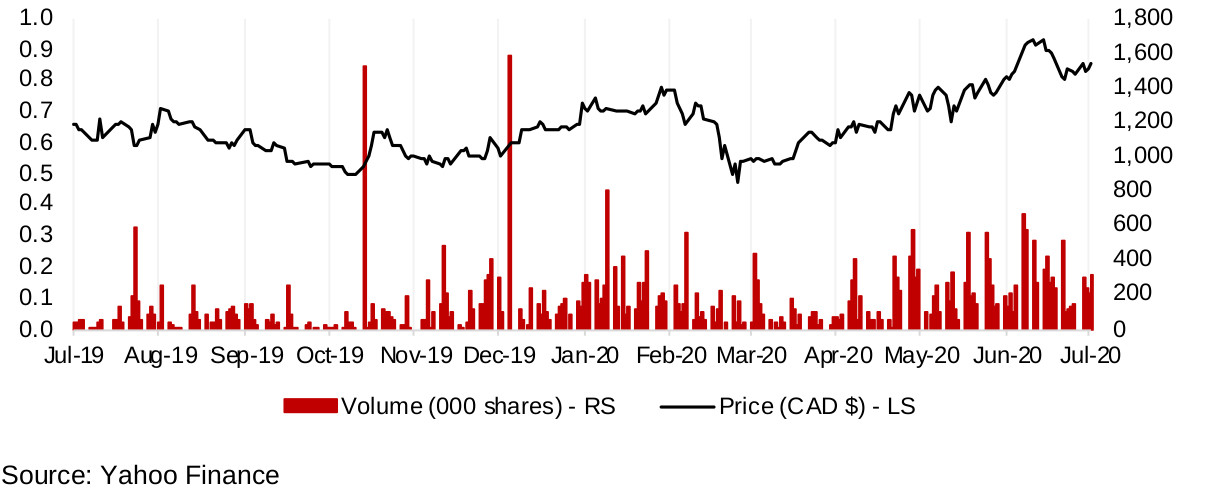

A pullback after updated Cangrejos PEA

The company's most key recent press release was the June 2020 update of the PEA for the Cangrejos project, compared to the 2018 PEA, the details of which are shown in Figure 14. While the project's NPV increased by a substantial 73.9% to $1.6bn from the previous PEA, this was mainly because of the rise in gold price estimates. The expected production actually edged down, and costs increased in the new PEA, which was met with some disappointment from the market, with the stock price declining 11.3% to CAD0.80/share in the three trading days following the updated PEA announcement, but edging back up 6.3% since to CAD$0.85/share.

Nonetheless, taken in the context of the past 12 months, the stock performance has been strong, up 128.8%, and rebounding 78.7% off March 18, 2020 lows. Apart from the PEA update, news flow for Lumina in 2020 has been limited to two press releases, first the completion of trade off studies for Cangrejos in January 21, 2020, showing potential changes to milling and processing methods to enhance recoveries and decrease costs, and the second ZTEM geophysical surveys results from Cangrejos on May 13, 2020, that showed two thirds of the area had not been tested and had a coincident anomaly of gold in soils, suggesting potential to expand the resource.

Figure 14: Cangregos PEA changes

Figure 15: Lumina Gold share price, volume

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.