October 22, 2021

The TSXV Top 20 Junior Gold Stocks

Author - Ben McGregor

Gold edges down from previous week's gains

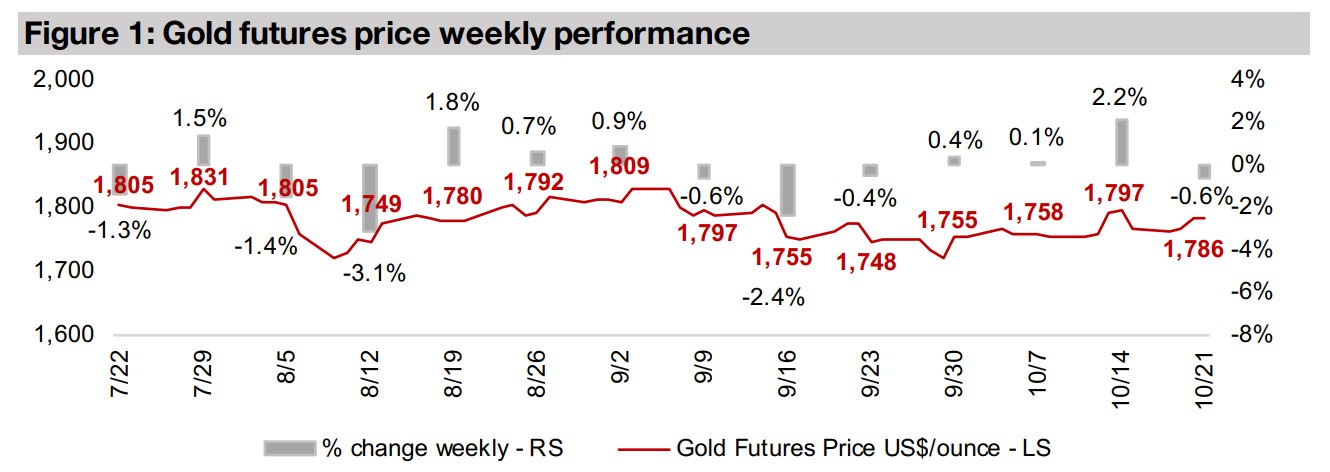

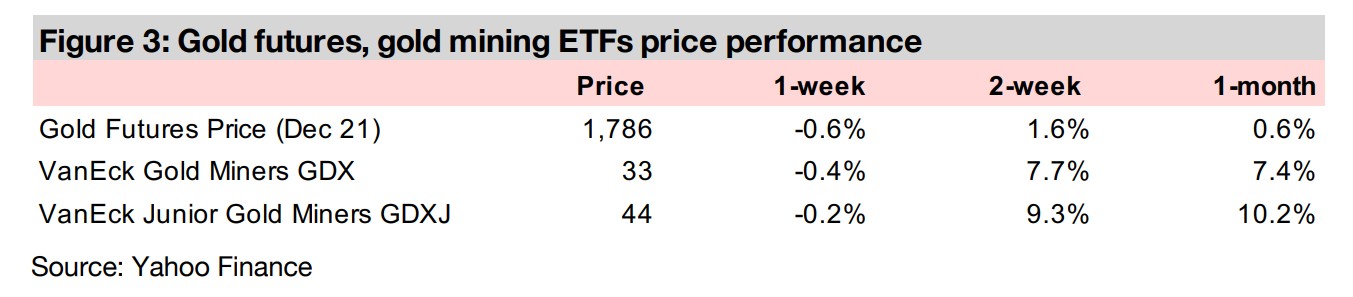

The gold priced dipped -0.6% to US$1,786/oz this week, after last week's 2.2% gains, the strongest in months, as gold has remained in a relatively tight range for most of the year, with a potential inflation risk boost to gold offset by planned tapering.

Performance of the Top 20 TSXV gold juniors

This week we look at the performance of the Top 20 TSXV gold juniors, which has been quite muted overall with the holding pattern in the gold price and especially in comparison to the very strong 2020, with a small market cap gain and P/B sliding.

Top 20 TSXV gold juniors' performance in 2021

Gold declined -0.6% this week to US$1,786/oz, with the market consolidating after

a 2.2% gain last week, its highest in months. The gold price has traded in a

reasonably tight range all year, as the market apparently is viewing the risks of a

continued rise in inflation, which would boost gold, as roughly evenly balanced with

the downside pressure that could results from the Fed's taper, planned to begin in

November 2021, and eventual interest rate hikes, which are expected by 2023. We

expect that inflation will continue to surpass market expectations and that the Fed's

taper could be very gradual, given the continued high risks in the US and global

economy, with many distortions created by the reaction to the global health crisis

persisting. We believe that the recovery of the past year would actually be shown to

be quite fragile without continued monetary and fiscal stimulus, and that removing

these supports could quickly show cracks forming in the growth edifice. The likely

reaction to this, in turn, would be a flight to safety, and a return to stimulus, driving

up inflation, which should both be supportive of gold.

Economic news this week remained mixed as to the direction of the economy. The

continued supply chain disruption has been curbing global prospects, and US

industrial production fell 1.3% in September, partly on the after-effects of hurricane

Ida. However, even with the weakening growth indicators, other data point to

continued high inflation. These include a recent rise in US retail sales above the

market's expectations, and jobless claims falling below 300k for the first time since

the crisis in the week to October 9, 2021, indicating both consumer price and wage

pressure. Taken together, recent data does point to some degree of stagflation

developing, which would create a difficult situation for the Fed, where a reduction

stimulus might limit inflation, but could curb already weakening growth further.

A look at the performance of the Top 20 TSXV-listed gold juniors

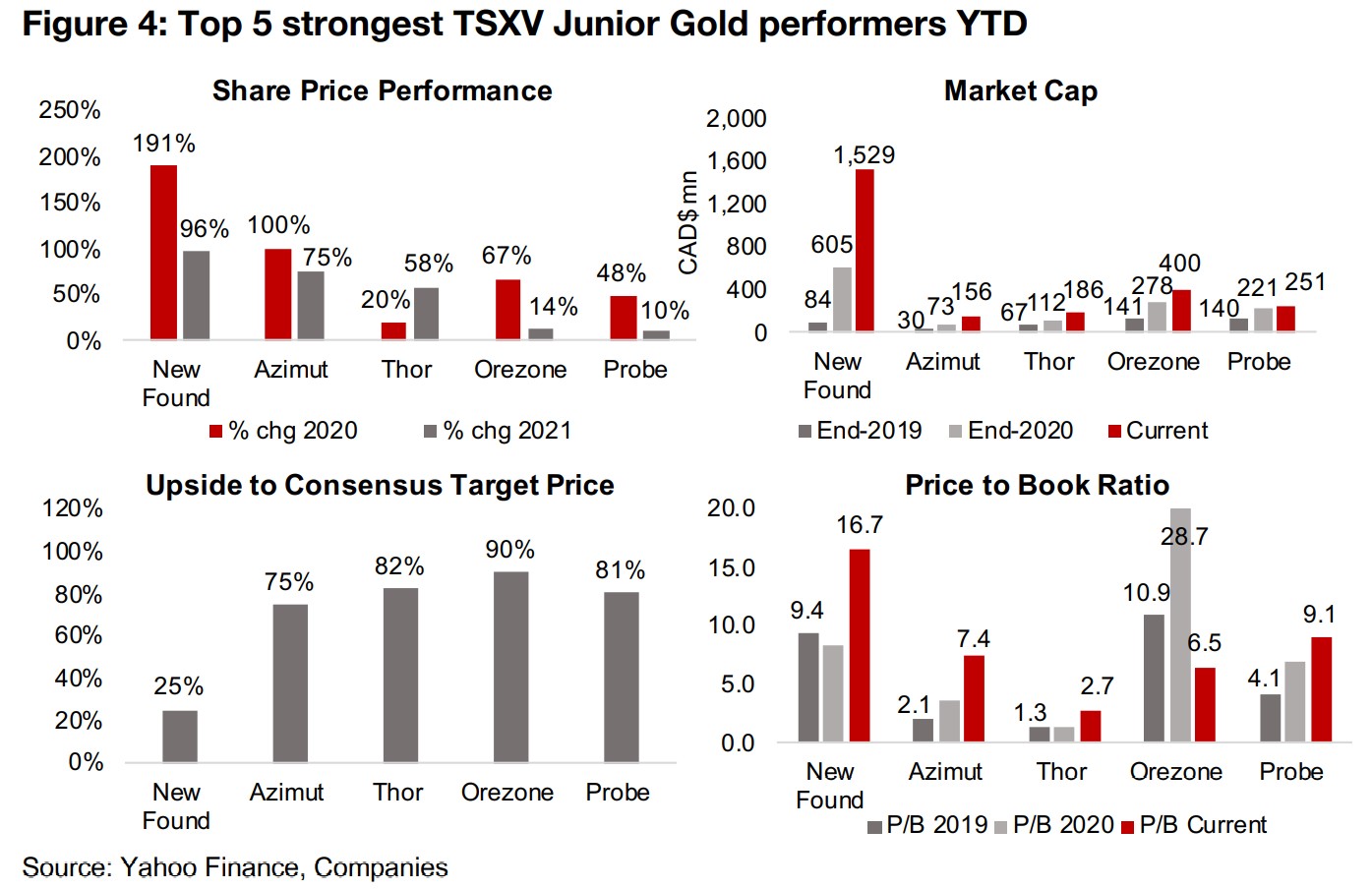

This week we take a detailed look at the performance of the Top 20 TSXV-listed gold juniors by market cap. We split the stocks by share price performance year-to-date into four groups of five, considering the gains in share prices and market caps from 2019, 2020 and 2021 YTD, to put the moves in the context of the boom in 2020, and the consolidation so far in 2021. We also include the upside to target prices for each stock, and Price/Book (P/B) valuations. While price to book is not necessarily the perfect valuation measure, other metrics like price to earnings or EV/EBITDA are not available for these juniors because they have no earnings yet. Price/Book is also simpler than a price to NAV valuation, which can be difficult for juniors still in the exploration stage without even a mineral resource estimate. In general, we are seeing the market cap in 2021 still expanding, but only by mid-single digits, compared to nearly 200% in 2020, and valuations have contracted from their most recent highs last year, but overall do not look particularly excessive.

TSVX Top 20 Gold Juniors: Top 5 strongest performers

There have only been really three big gainers of the TSXV Top 20 gold companies in

2021, compared to 2020, when many saw major gains. The top performer, and the

largest TSXV-listed gold junior by market cap, New Found Fold, is up 96% this year,

after a 191% gain last year, as it continues to show the strongest drill results of the

group from its Queensway project in Newfoundland (Figure 4). The market sees the

company as moderately undervalued, with 25.0% upside to its target, and its price

to book is relatively high, having nearly doubled this year to 16.7x.

The other two large gainers are smaller explorers with market caps below US$200mn,

Azimut, with the Elmer project in Quebec, and Thor Explorations, with the Segilolo

project in Nigeria, up 75% and 58%, respectively. The market targets 75% and 82%

upside for the two, and while Azimut's P/B multiple is getting relatively high at 7.4x,

Thor is still trading at a reasonably low 2.7x. The level of gains drops considerably

beyond these three, with Orezone, operating the Bombore project in Burkina Faso,

which has reached mine construction, up just 14%, after 67% gains in 2020. Probe

Metals, operating the Val-d'Or East project in Quebec, is up 10%, after 48% gains in

2020. The market still sees value to be unlocked, however, with 90% upside for

Orezone to its target and 81% for Probe. Orezone's P/B multiple had shot up to 28.7x

in 2020, but after boosting its capital declined to a more reasonable 6.5x, and Probe's

multiple picked up to a reasonably high 9.1x.

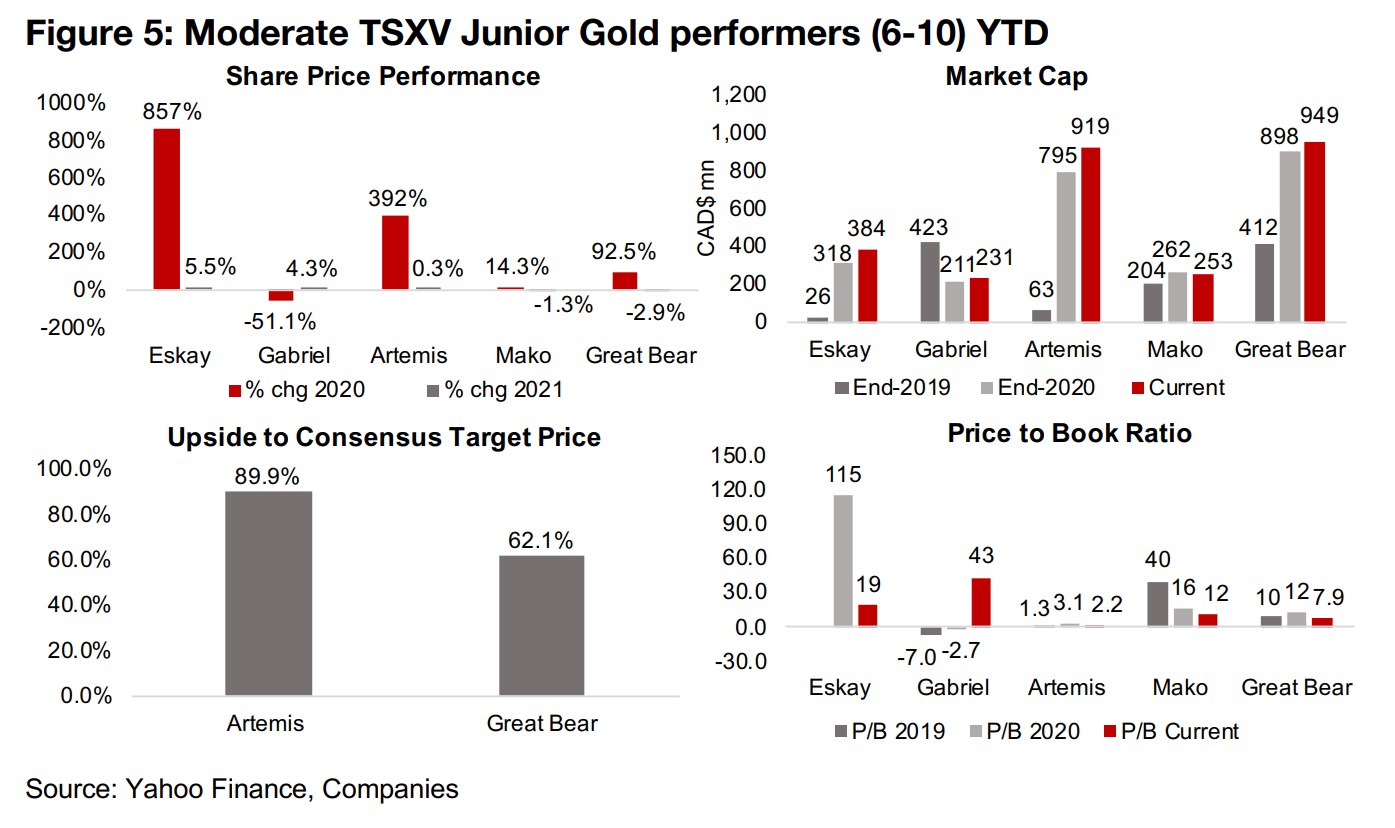

TSVX Top 20 Gold Juniors: Moderate performers (6-10)

After Eskay Mining saw by far the highest gains of the group in 2020, up 857%, the

company, exploring a large land package in British Columbia's Golden Triangle, has

gained just 9.5% this year (Figure 5). Eskay has no consensus target price yet, but its

P/B multiple is among the highest of the Top 20, at 19x. Gabriel Resources has gained

just 4.3% gain this year, after declining -51.1% last year, as the company remains

stuck in arbitration over the Rosia Montana project in Romania. While the company

has raised some cash this year, its equity was negative in 2019-2020 and remains

low, driving its P/B multiple up to a very high 40x. Next is Artemis, near flat at 0.3%

this year after a 392% gain in 2020 on progress at its Blackwater project in British

Columbia, with its 11.3mn oz Au in estimated resources the second highest of the

Top 20. The market is targeting 89.9% upside for the company, and its P/B multiple,

at 2.2x, remains low versus the group average, and has contracted from 3.1x in 2020.

Mako had edged down -1.3%, after gaining 14.3% in 2020, with its San Albino project

beginning commercial production in mid-2021. Mako has no consensus target price,

and while its P/B has come down since 2019, it is still relatively high, at 12.2x. Great

Bear Resources is down -2.9% this year, after a 92.5% gain in 2020, with its Dixie

Project in Red Lake, Ontario, having shown some of the strongest drilling results over

the past year. The market is awaiting its initial resource estimate, which may have

limited gains this year, and the stock has 60.7% upside to its target price, and its P/B

multiple at 7.9x is moderately high versus the Top 20, and has come down from 12x

last year.

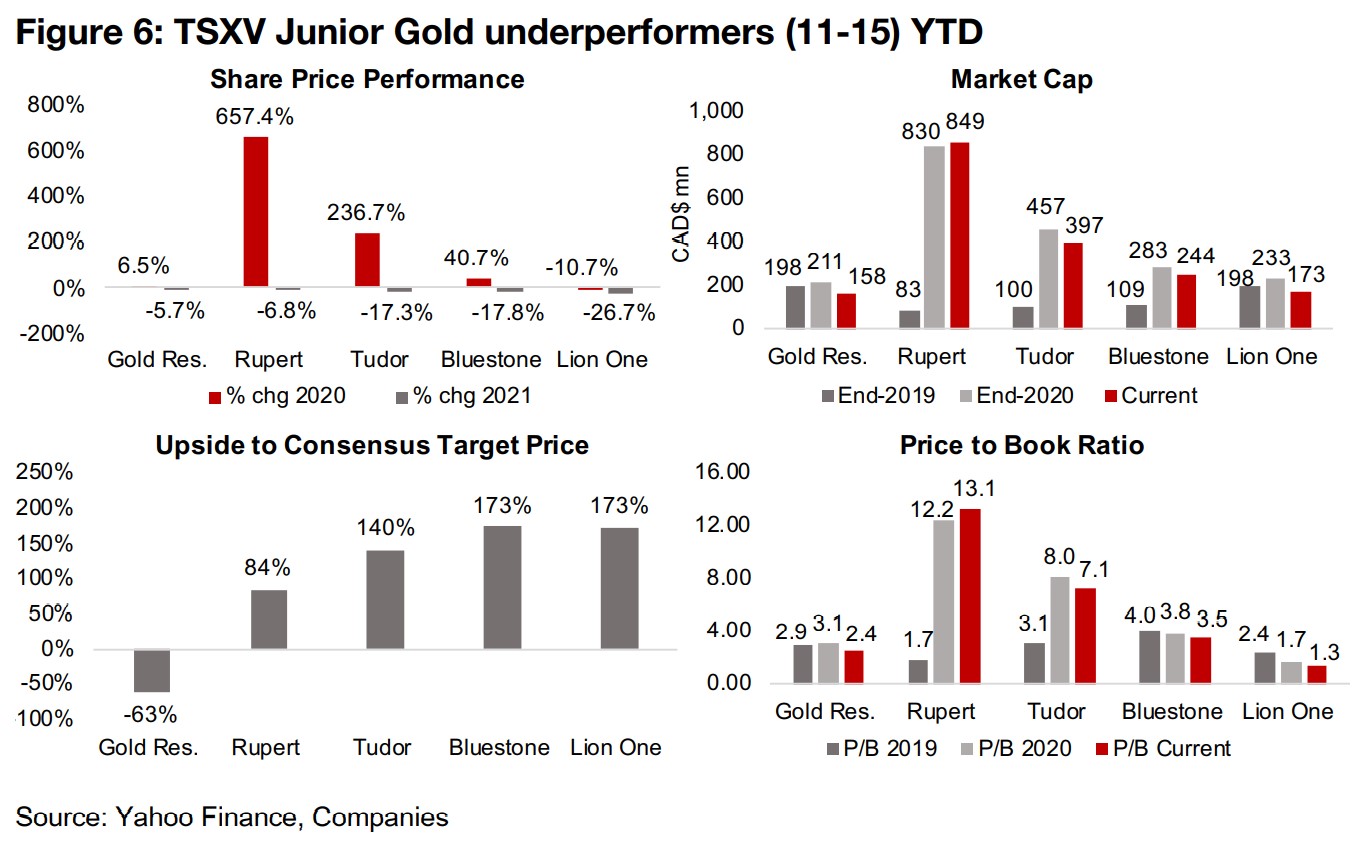

TSVX Top 20 Gold Juniors: Moderate underperformers (11-15)

Starting the bottom half of the price performance for the group is Gold Reserve, a

smaller company below CAD$200mn in market cap, developing the LMS project in

Alaska, down -5.7% in 2021 after a 6.5% gain in 2020 (Figure 6). The company is the

only one of the Top Twenty with downside to its target price, at -63%, and its

valuation remains low at a 2.2x P/B. Rupert Resources, another star performer of the

sector in 2020 on strong drill results from the Ikkari zone at the Pahtavaara project in

Finland, gained 657.4% in 2020, but has slid -3.9% this year, even as the company

issued its mineral resource estimate. The market sees 78.2% upside, and its P/B

multiple, at 13.1x, is quite high versus the group.

Tudor Gold has declined -17.3% this year, after a 236.7% gain in 2020, as its Treaty

Creek project has continued to deliver solid drilling results over the past year. The

market expects 140% upside to its target price, and its P/B, at 7.1x, is just below

Great Bear, another explorer with strong drilling results over the past year. Bluestone

Resources is down -17.8%, after a 40.7% gain in 2020, with its Cerro Blanco project

in Chile at the PEA stage. The market is targeting 173% upside to its share price,

among the highest of the top twenty, and its P/B multiple has eased over the past

three years to 3.5x. Lion One, which has been drilling at the Tuvatu project in Fiji, has

had a weak couple of years, declining -26.0% in 2021 and -10.7% last year. The

market sees 173% upside to its target, and its P/B has declined to 1.3x, the lowest

of the Top 20.

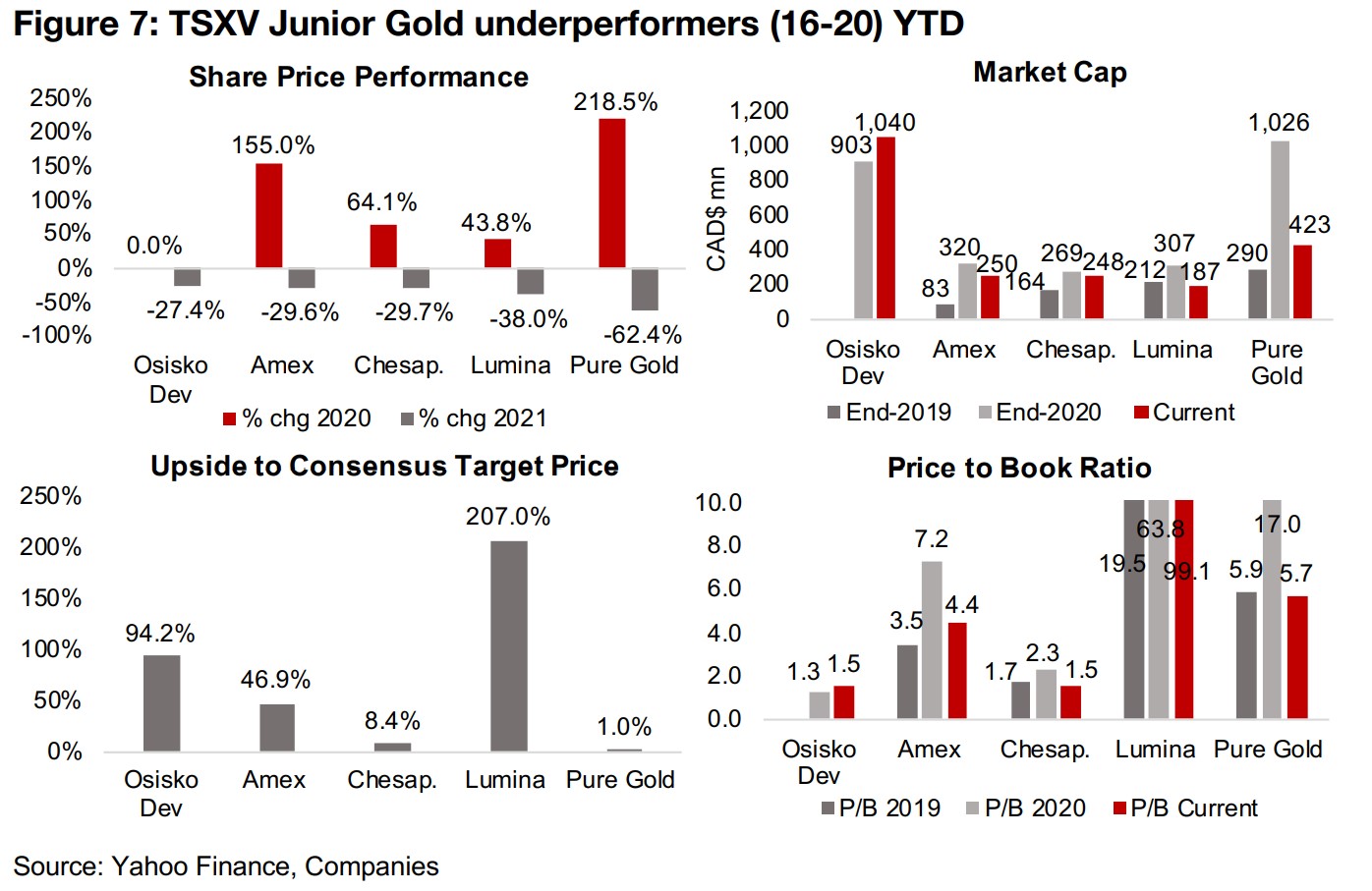

TSVX Top 20 Gold Juniors: Underperformers (16-20)

The weakest performers have declined more than 25% this year. Osisko

Development, with the second largest market cap of the Top 20, developing the

Cariboo project in British Columbia, is down -27.4% (Figure 7). The market sees 94.2%

upside for the stock, and it trades at a low P/B of 1.5x. Chesapeake Gold, down -

29.7%, is developing Metates, the largest project of the Top 20, with 18.3mn oz Au

and 591mn oz Ag in resources. However, high costs have held back its development,

and while new technology to reduce costs is being investigated, the market does not

appear convinced yet, with just 5.8% upside to its target, and a low P/B of 1.5x.

Amex Exploration is down -29.6%, after a 155.0% jump in 2020, with drilling results

at its Perron project in Quebec not driving up the share price, although it has 49.1%

upside to its share price, and its P/B multiple has contracted to 4.4x. Lumina is down

-38.0% this year, as the company has had very limited news flow on its Cangrejos

project in Colombia this year, although the market sees value there, with a 207%

upside the share price. While the Lumina has the highest multiples of the group, these

numbers are not really meaningful given the company's very low equity. Pure Gold,

operating in Red Lake, Ontario, has been the worst performer this year, after a strong

218.5% gain in 2020, as the company shifted from strong drill results to early

production, a situation which can often put pressure on the share prices of junior

miners. The market sees the company as fully valued, with only 1.0% upside to its

target, while its P/B multiple has declined to 5.3x from 17.0x in 2020.

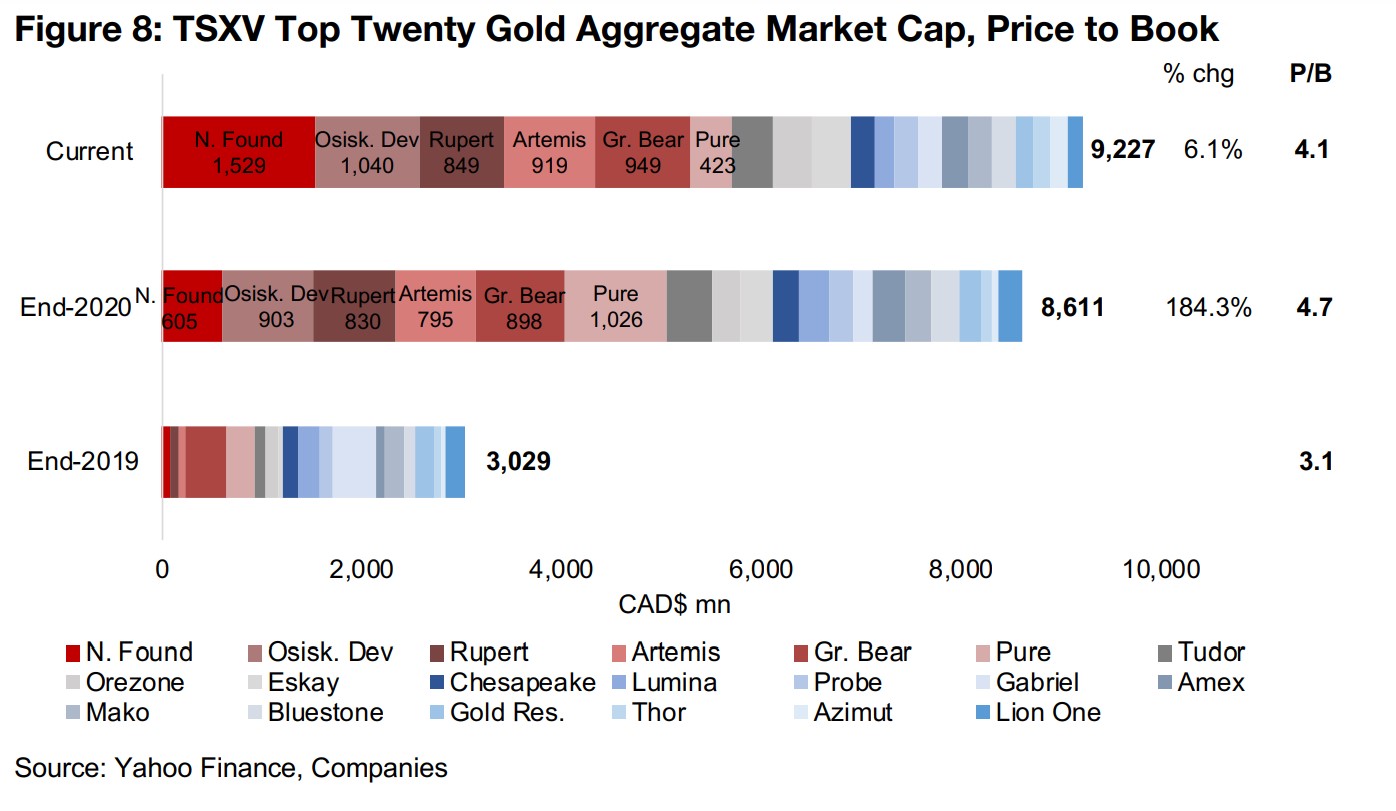

Overall 2021 has been a year of consolidation after the 2020 surge

Overall for the Top 20 TSXV-listed juniors this year has been one of consolidation,

with the market cap of the group rising just 6.1%, after the 2020 surge in market cap

by 184.3% (note that this figure is a bit overstated by Osisko Development which was

only listed in 2020). New Found Gold alone has been the major driver of the market

cap this year, and gains are certainly not as widespread as they were in 2020. The

average price to book for the sector has declined to 4.1x in 2021 from 4.7x in 2020,

after a major jump from 3.1x in 2019. This is understandable given that through 2020

investors were starting to price in that a gold ramp up could continue through to

US$2,500/oz or more, while in reality we were heading for a consolidation around the

US$1,800/oz.

We view this level as sustainable, especially given ongoing high risks, comprising

post-global-health-crisis distortions, continued high monetary and fiscal stimulus and

already very high inflation. We also expect the US Fed's planned taper to likely be

very gradual, and we would suspect, abruptly reversed, should economic growth

falter or the equity markets decline. The current gold price is more than enough for

the industry to remain highly profitable and keep a strong flow of capital available to

the junior miners. And then there is the upside, of course, for the sector, if the gold

price does start to head to US$2,000/oz or higher. Overall, the sector is in quite good

shape, even with the stagnation in 2021, especially compared to the bear market of

2013 through to mid-2019.

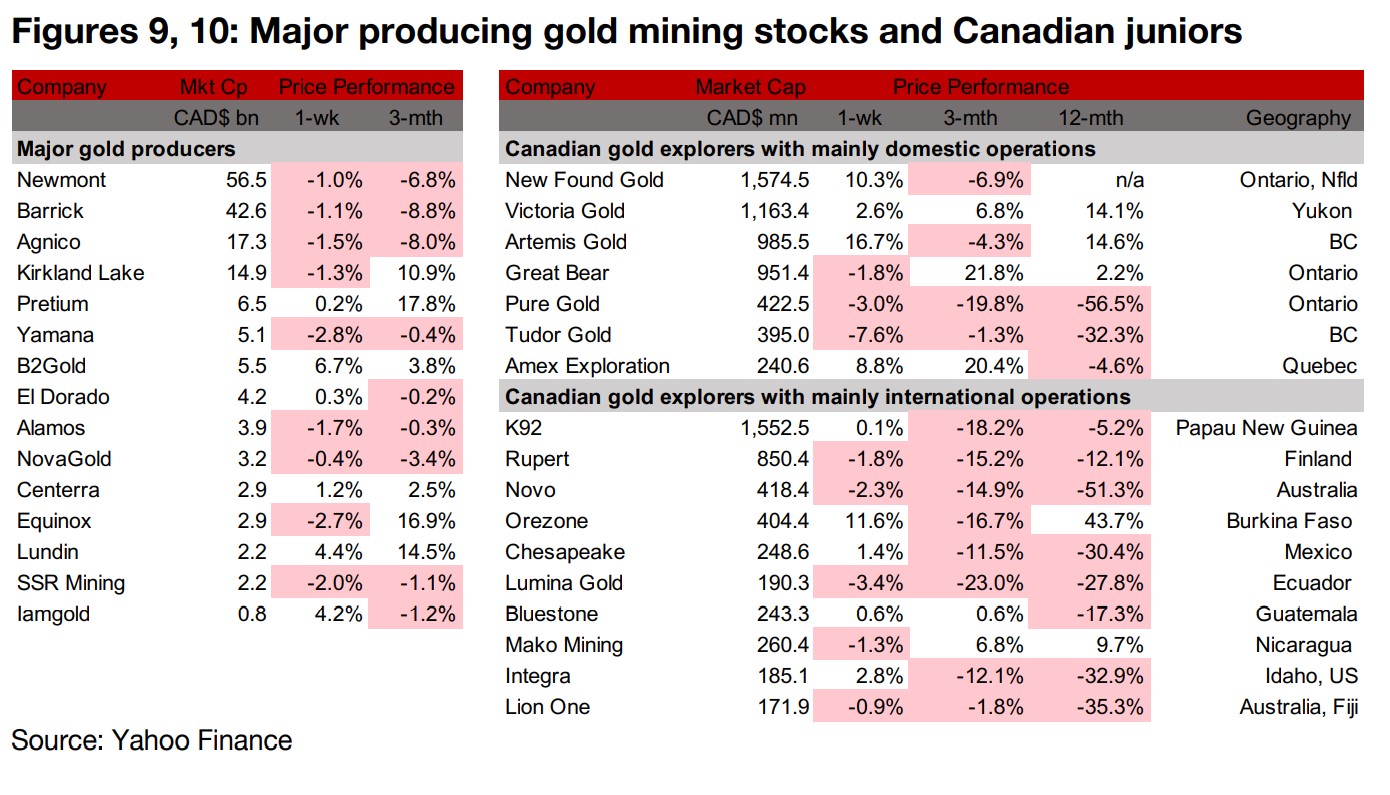

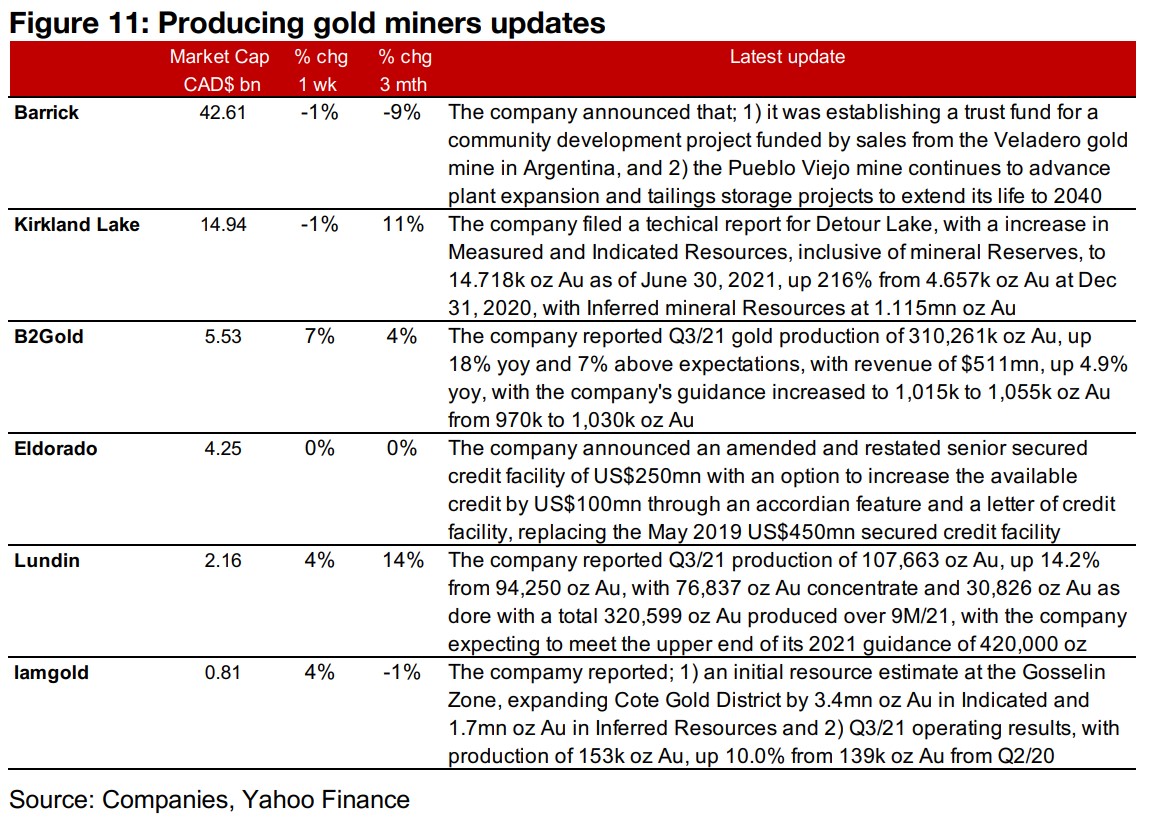

Producers mixed as gold declines

The producing gold miners were mixed as gold declined (Figure 9). Barrick reported that it had established a community development project funded by sales from its Veladero gold mine in Argentina and plans to extend the mine life of Pueblo Viejo to 2040. Kirkland Lake reported a new technical report for Detour Lake, with a 216% increase in its M&I Resources, B2Gold reported its Q3/21 production, Eldorado announced an amended and restated senior credit facility, Lundin reported its Q3/21 production, and Iamgold reported an initial resource estimate from Gosselin and Q3/21 operating results (Figure 11).

Canadian juniors mixed on gold dip

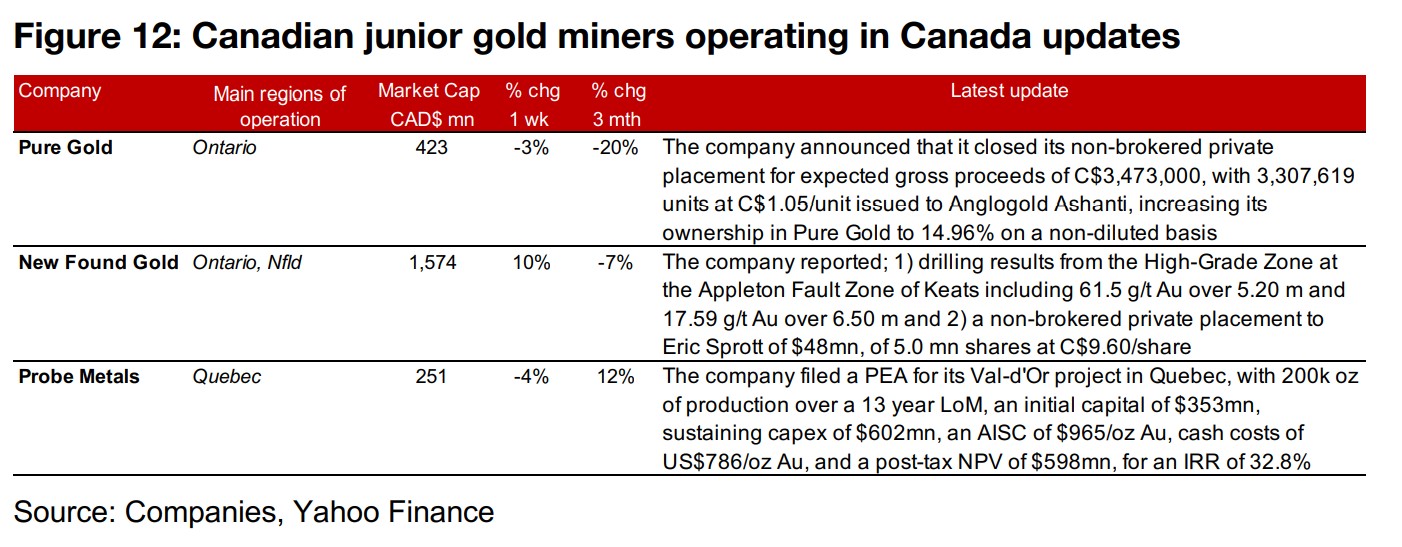

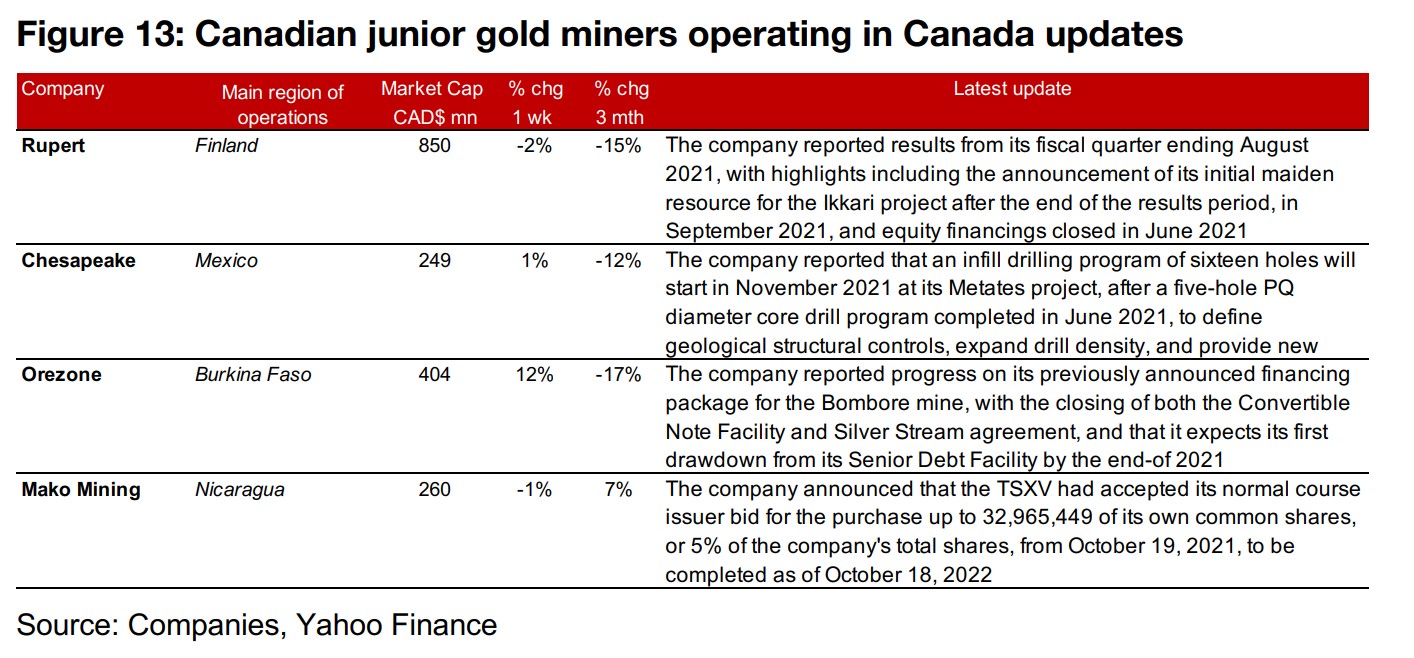

The Canadian juniors were mixed on the dip in gold after last week's major gains, with many up of the stocks up by double digits (Figure 10). For the Canadian juniors operating mainly domestically, Pure Gold reported the closing of its C$3.473mn private placement to Anglogold-Ashanti, New Found Gold reported drilling results from Keats and a $48mn private placement to Eric Sprott, and Probe Metals reported its PEA for its Val-d'Or project (Figure 12). For the Canadian juniors operating mainly internationally, Rupert reported results for its fiscal quarter ending August 2021, Chesapeake announced a planned infill drilling program, Orezone reported progress on the financing package for its Bombore mine and Mako Mining reported that its normal course issuer bid had been approved by the TSXV (Figure 13).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.