March 05, 2021

The Revenge of the Bond Yield

Author - Ben McGregor

Gold dips below US$1,700/oz for first time since June 2020

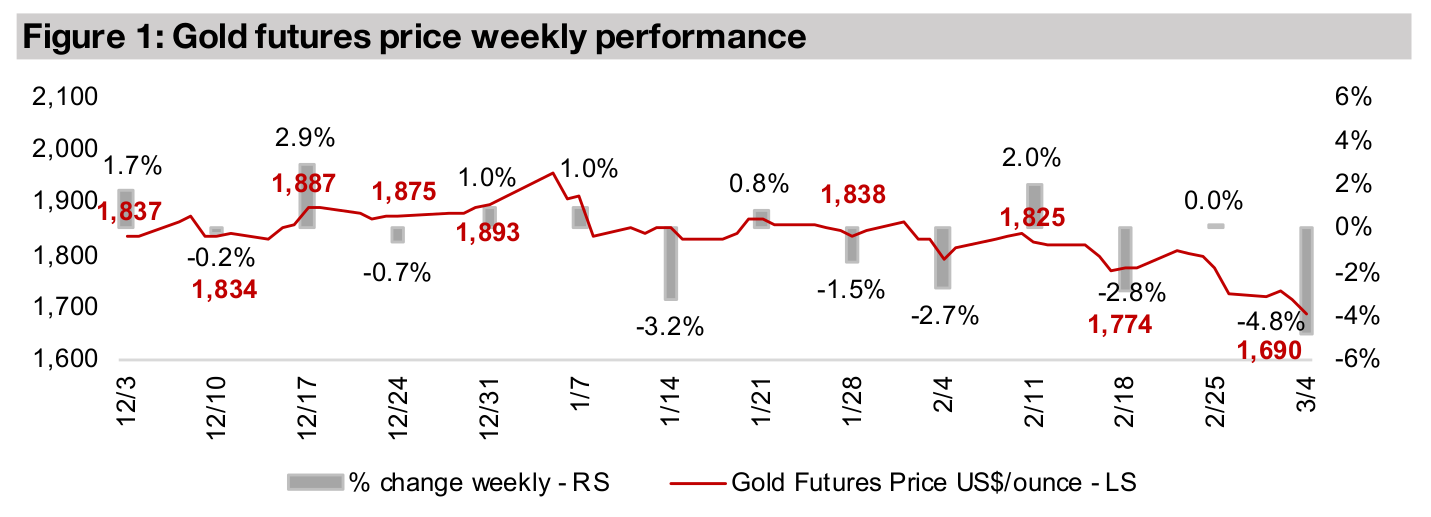

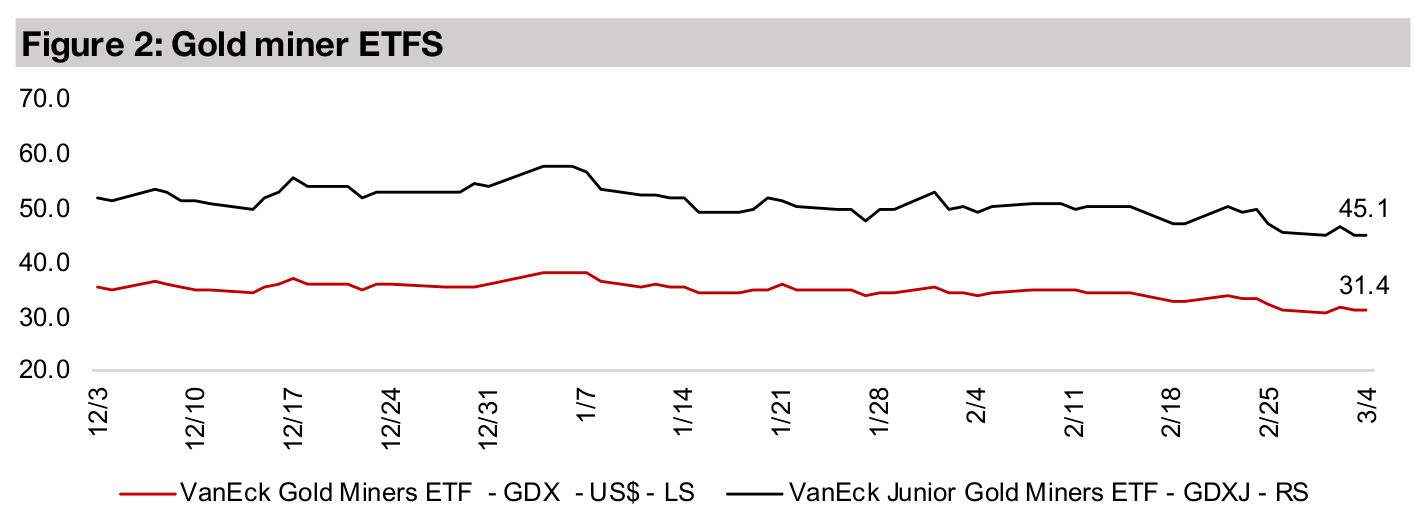

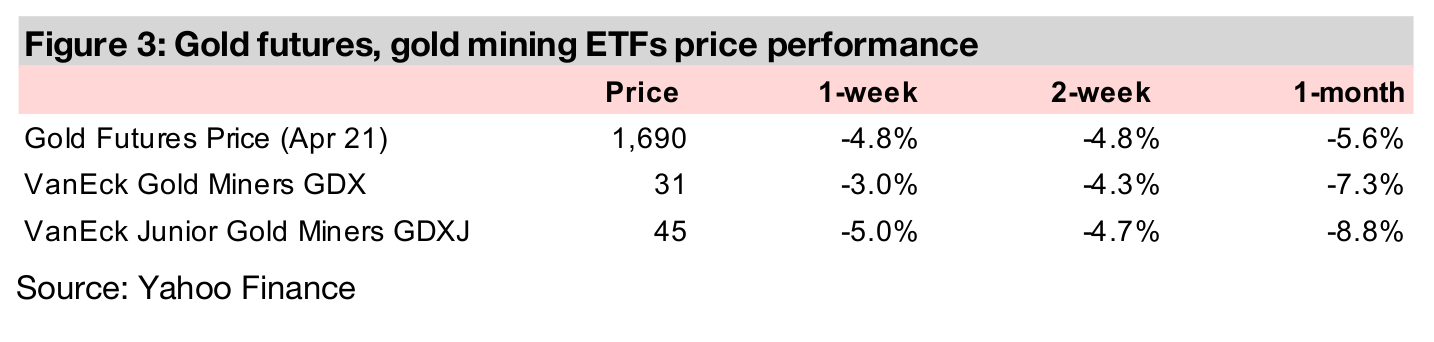

Gold dropped -4.8% this week to US$1,690/oz driven mainly by a surge in global bond yields, its first time at these levels since June 2020, implying that the market is now pricing in risk similar to the early days of the global health crisis.

Yield rise driven by surging bond supply, rising inflation expectations

The rising yields have been driven by surging global bond issuance over the past year, and recently rising inflation expectations; we believe that both of these should be supportive of gold, not drive it down, and expect that this dip could be short-lived.

Gold slides to lowest levels since June 2020

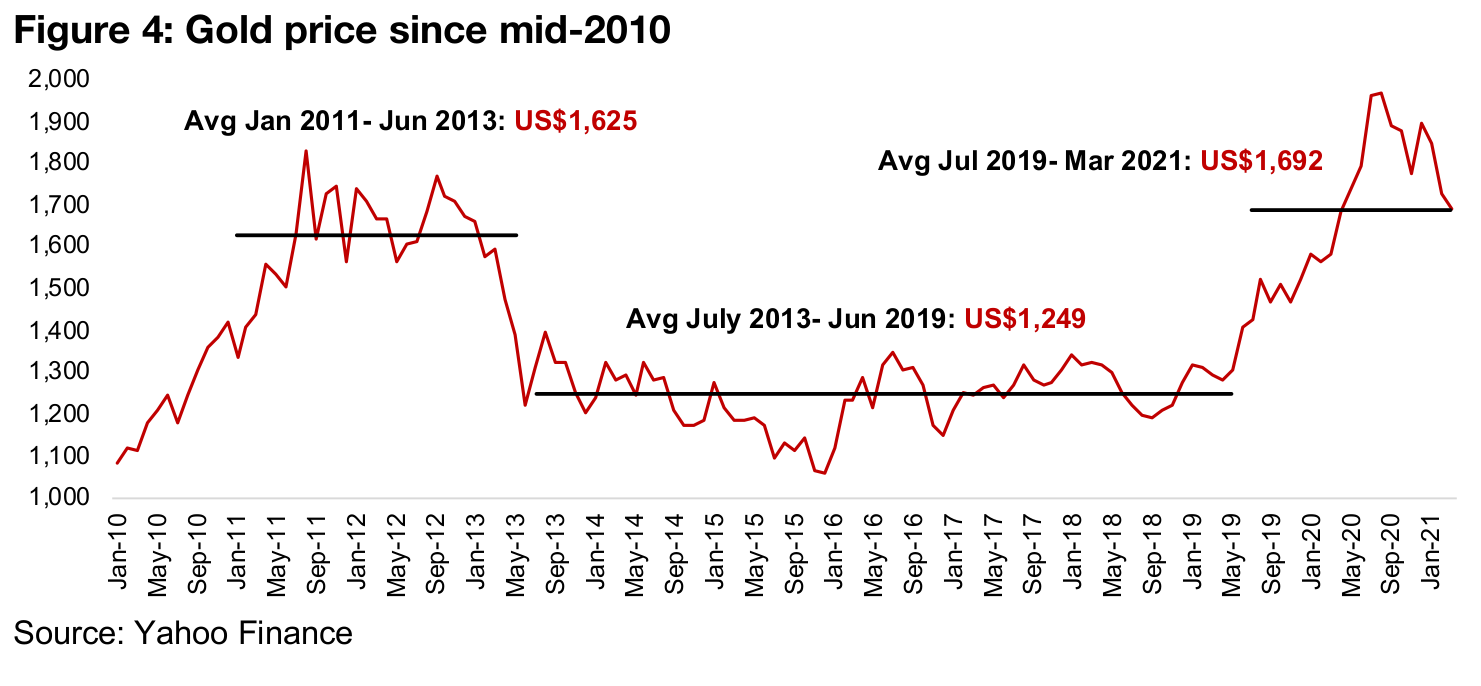

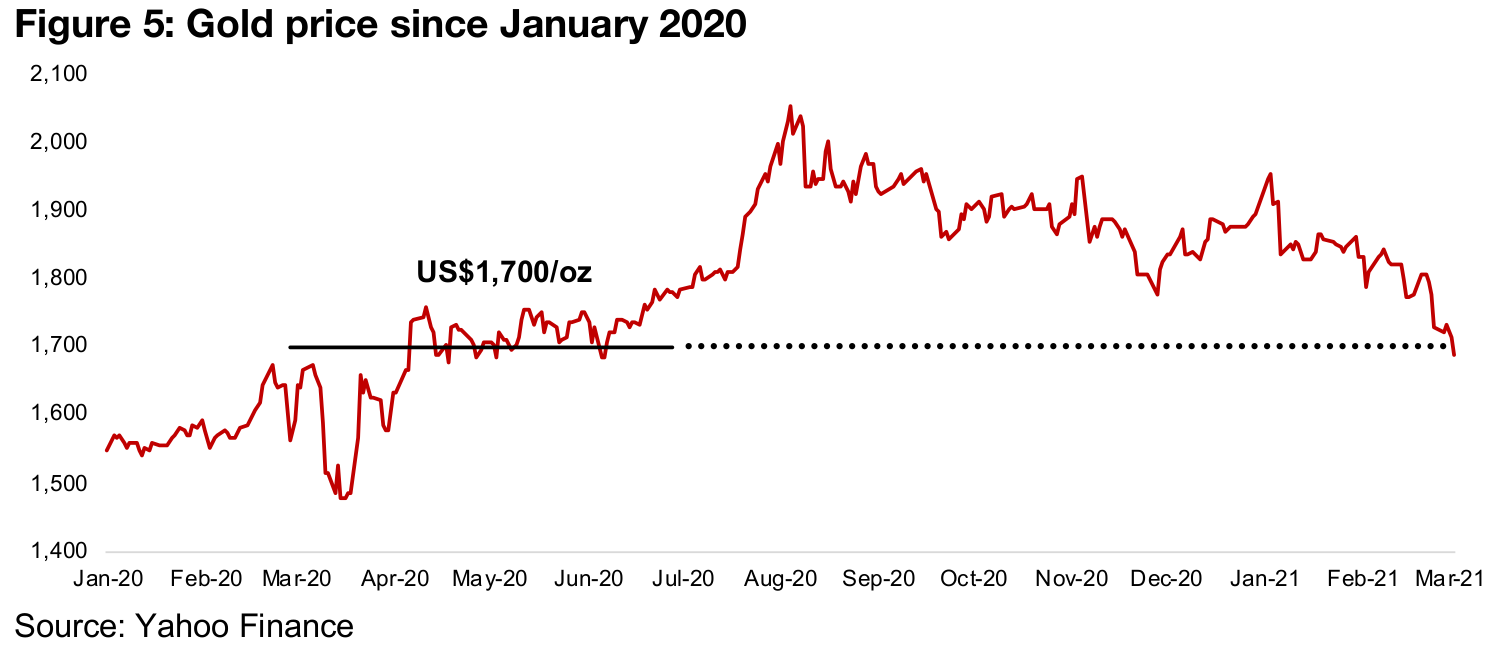

The gold price slid to US$1,690/oz, its lowest levels since June 2020, mainly on a continued surge in bond yields. While the move is concerning short-term, we still believe that there is strong fundamental support for gold, as we cover in detail below. However, it is a good time to step back and consider the move in a longer-term context. Figure 4 shows the gold price since mid-2010, where we show three phases of the gold price; an average of US$1,625/oz in the post-financial crisis boom from around January 2011 to June 2013, the long gold bear market from July 2013 to June 2019, with an average US$1,249/oz, and the most recently the gold resurgence, from July 2019 to March 2021 with an average of US$1,692/oz. Figure 5 shows the performance since the start of 2020, showing that the last time the current levels were reached was in the early stages of the reaction to the global health crisis; after the initial market crash, but before the mid-year peak panic.

A pickup in demand in the US driving up inflation...

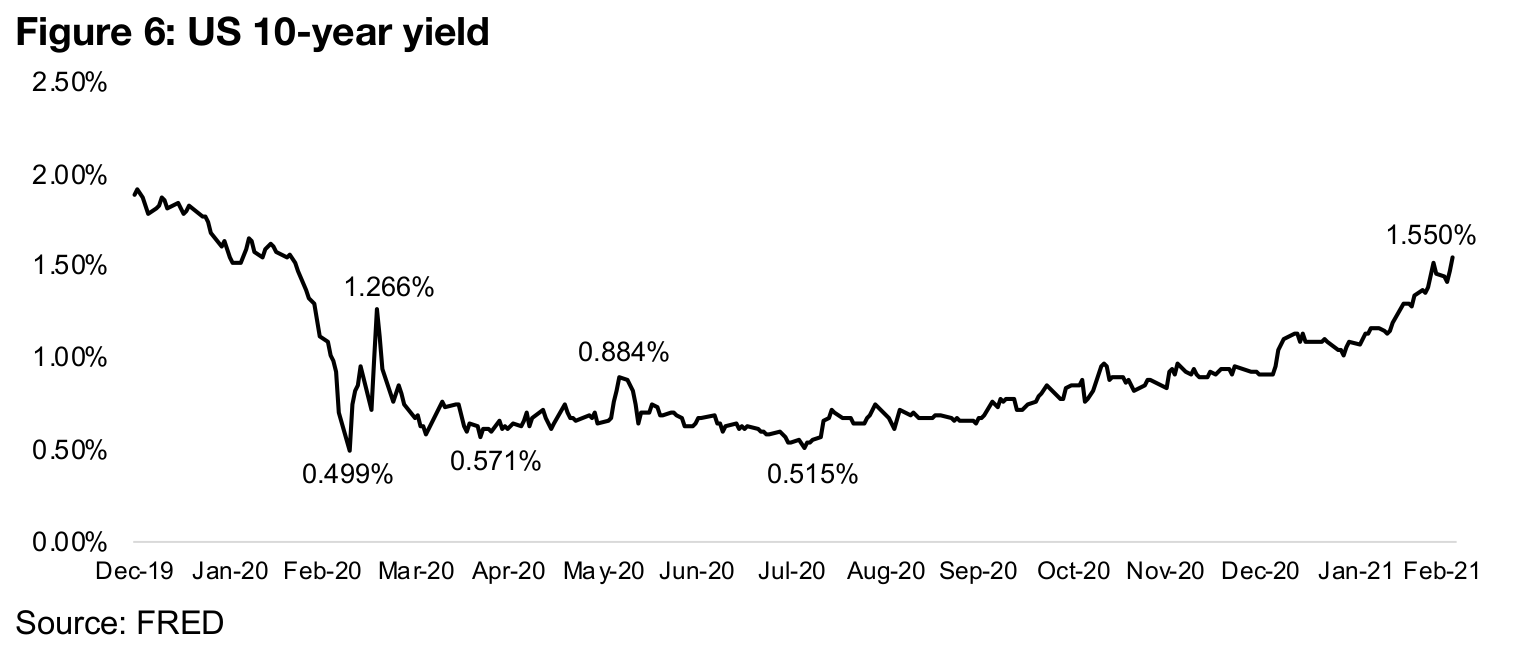

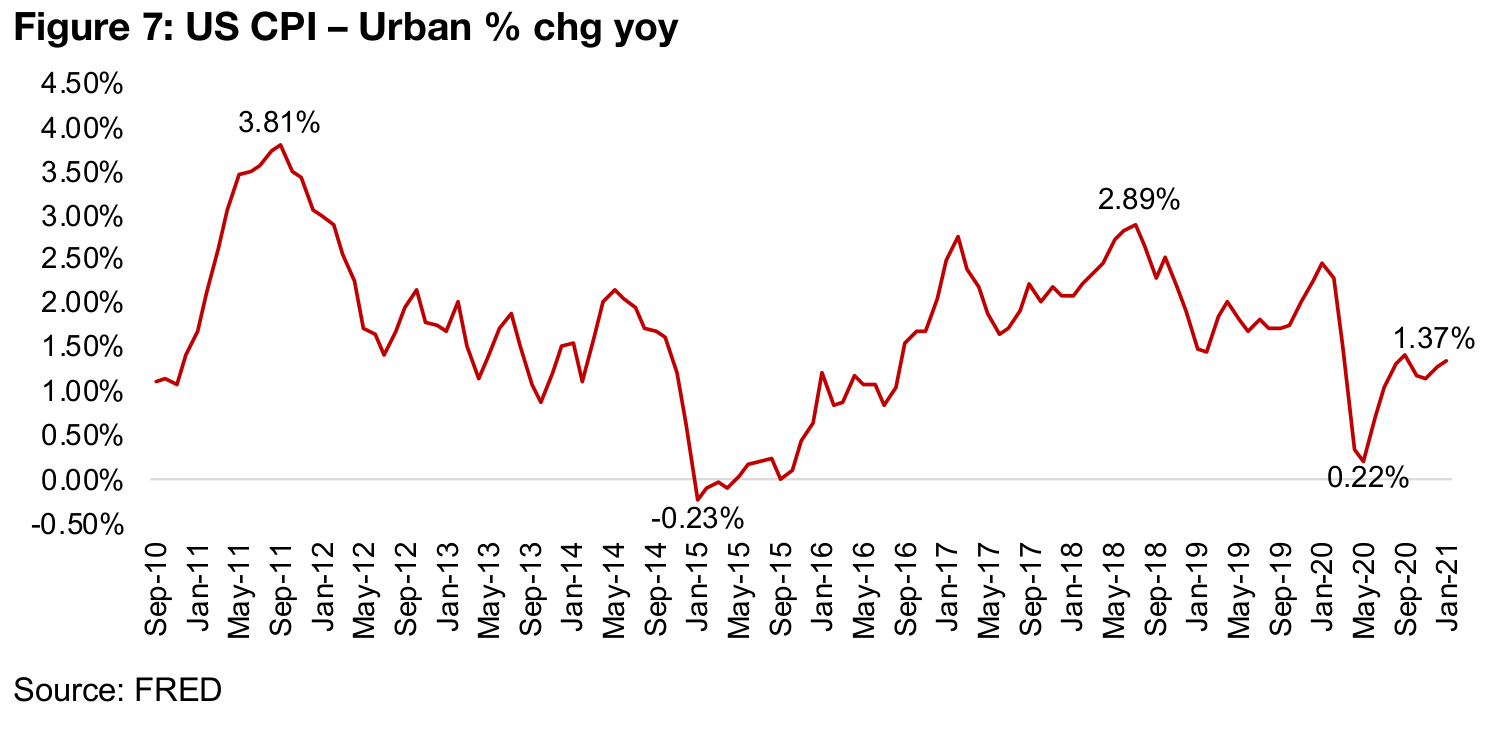

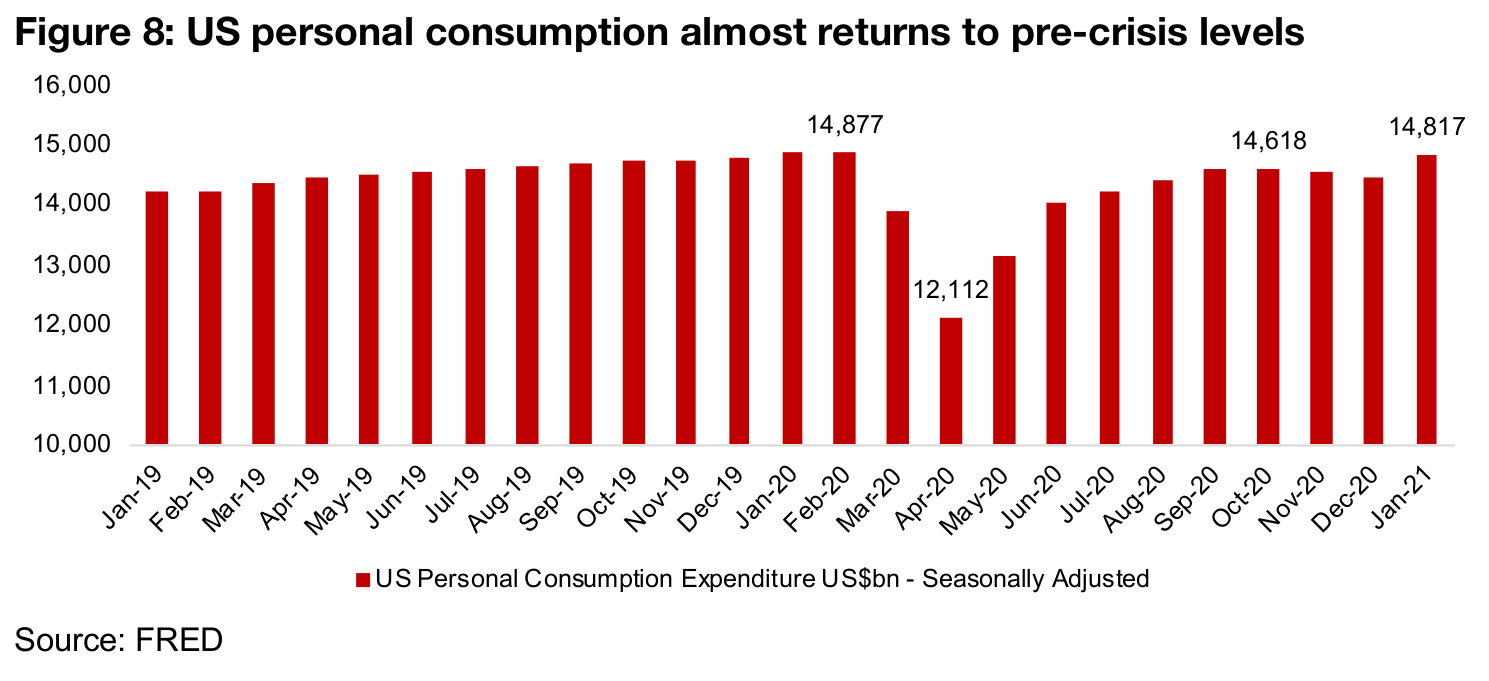

The market is clearly focusing on the rising bond yield as its main reason for the gold sell-off, and this will likely continue to be a major factor. Bond yields have certainly been picking up, and have tripled from lows of 0.515% in August 2020 to 1.550% currently, which is at pre-crisis levels last seen in February 2020 (Figure 6). Ostensibly this has been because of a pick-up in inflation expectations, with the US CPI been rising off of lows of 0.22% in May 2020 to 1.37% as of the most recent January data (Figure 7). This in turn has been driven by a continued pickup in the US economy since the crisis, with some factors, like personal consumption expenditure, having now almost recovered to pre-crisis levels, suggesting that the economy has already started to shake off the crisis (Figure 8).

...but huge increase in bond supply also a factor driving up yields

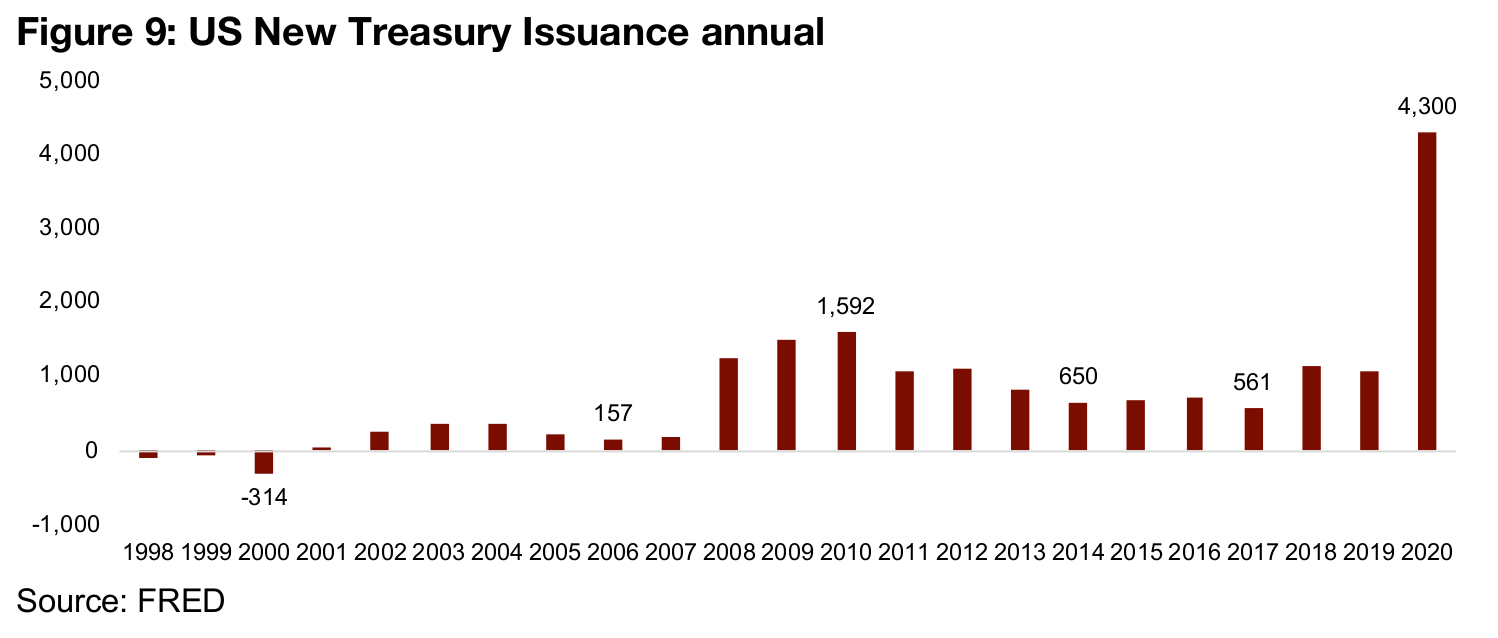

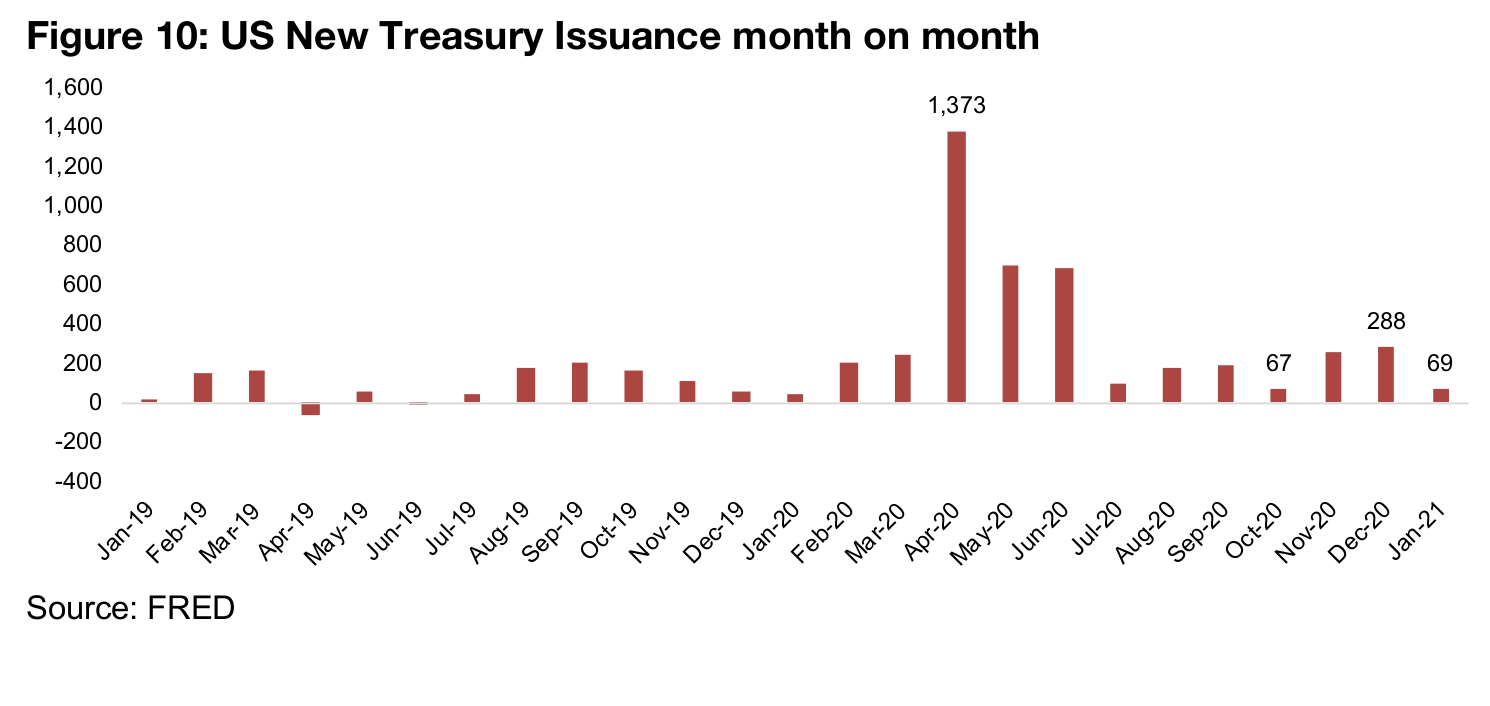

Of course, this would have not been possible were it not for the absolutely epic in increase in the money supply and new bond issuance. So while the market seems focused on the demand side argument for rising yields, we should also consider the supply side. The bond market has been flooded with new supply, with issuance in 2020 dwarfing even that of the aftermath of the 2008 financial crisis (Figures 9, 10). Assuming that demand has not risen at anywhere near the rate of the increased bond supply, this drives down the value of the existing supply and therefore increases yields (as mathematically, bond yields go up as bond prices decline). So we believe that the rising yields may not be so much because of a rosy outlook on the demand side, as it has been because of the huge supply increase.

Last gold bear market was driven by an absence of inflation

So if inflation is starting to come through, and yields are rising in reaction, what does this mean for gold? We would argue that inflation should be good for gold, as it has long been considered an inflation hedge. Possibly the main factor driving the previous gold bear market was that there was a bull market in risk and strong economic growth without any inflation, which is a very rare occurrence, and unlikely to be repeated in this cycle. Secondly, there wasn't money printing at anywhere near the current levels from 2013-2019, certainly in the US, and in general for the rest of the major developed economies. The ongoing monetary mania therefore actually offers very strong fundamental support for gold, especially if it leads to major inflation.

What's the worst-case level for gold given the fundamentals?

The recent price movement shown in Figure 5 shows that we are back to levels for gold that held from around April to June 2020, or a time of still moderate concern regarding the health crisis, but when the massive monetary expansion had yet to be unleashed. It is questionable whether gold should even really be valued this low, in our view, given the fundamentals. But to fully consider a worse-case scenario, we would need to move back to pre-March 2020 levels. We can see that gold was already breaching US$1,650/oz when the global health was only a blip on the media's radar. But let's just say that some global health crisis risks were starting to be baked into gold by February. This brings us back to around US$1,550 as a possible worst- case low. However, we believe that surely the fundamental drivers, including; 1) continued global economic pressure from the crisis, well beyond just US consumption data, 2) the massive increase in the money supply since this period, 3) the short-term inflation risk from rising consumption and medium to long-term inflation risk from this money supply increase, and 4) the rise in other alternative monetary assets like Bitcoin, indicate a premium should be baked into gold well above the pre-crisis US$1,550/US level. This takes us up to US$1,650 as a trough in our view, but we still expect that US$1,800/oz will remain an important benchmark, and that given the myriad factors we have outlined, a gold price at this level is more than reasonable.

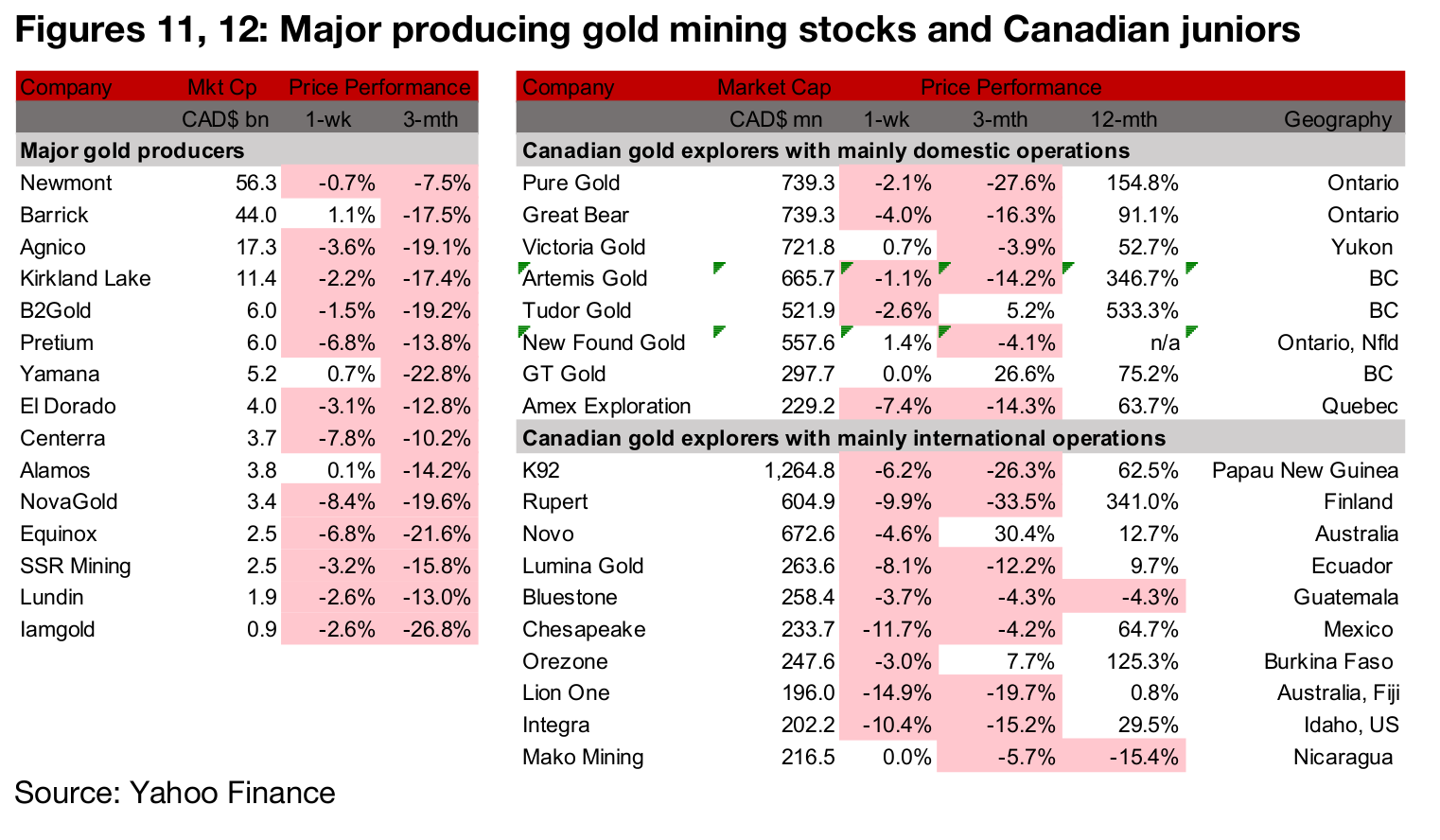

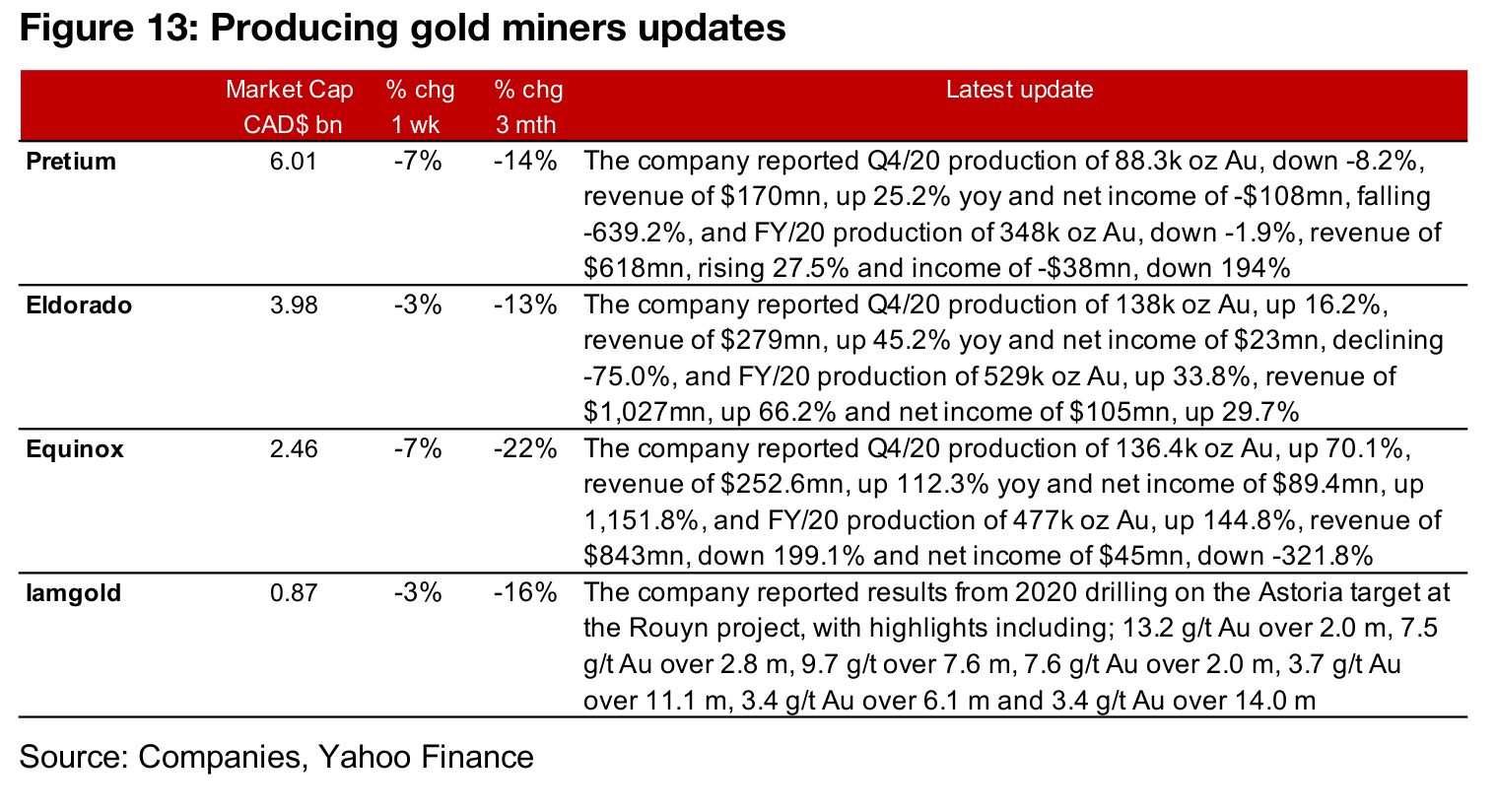

Producers drop on gold decline as last Q4/20 results come in

The producing miners were nearly all down this week on the major drop in gold, with only Barrick able to eke out a gain of 0.8% as it continued to ride the glow of strong results (Figure 11). The last of the results from the large producers came in, with Pretium, Eldorado and Equinox all reporting Q4/20, and Iamgold reported results from the 2020 drilling program on the Astoria target (Figure 13).

Canadian juniors mixed on gold decline

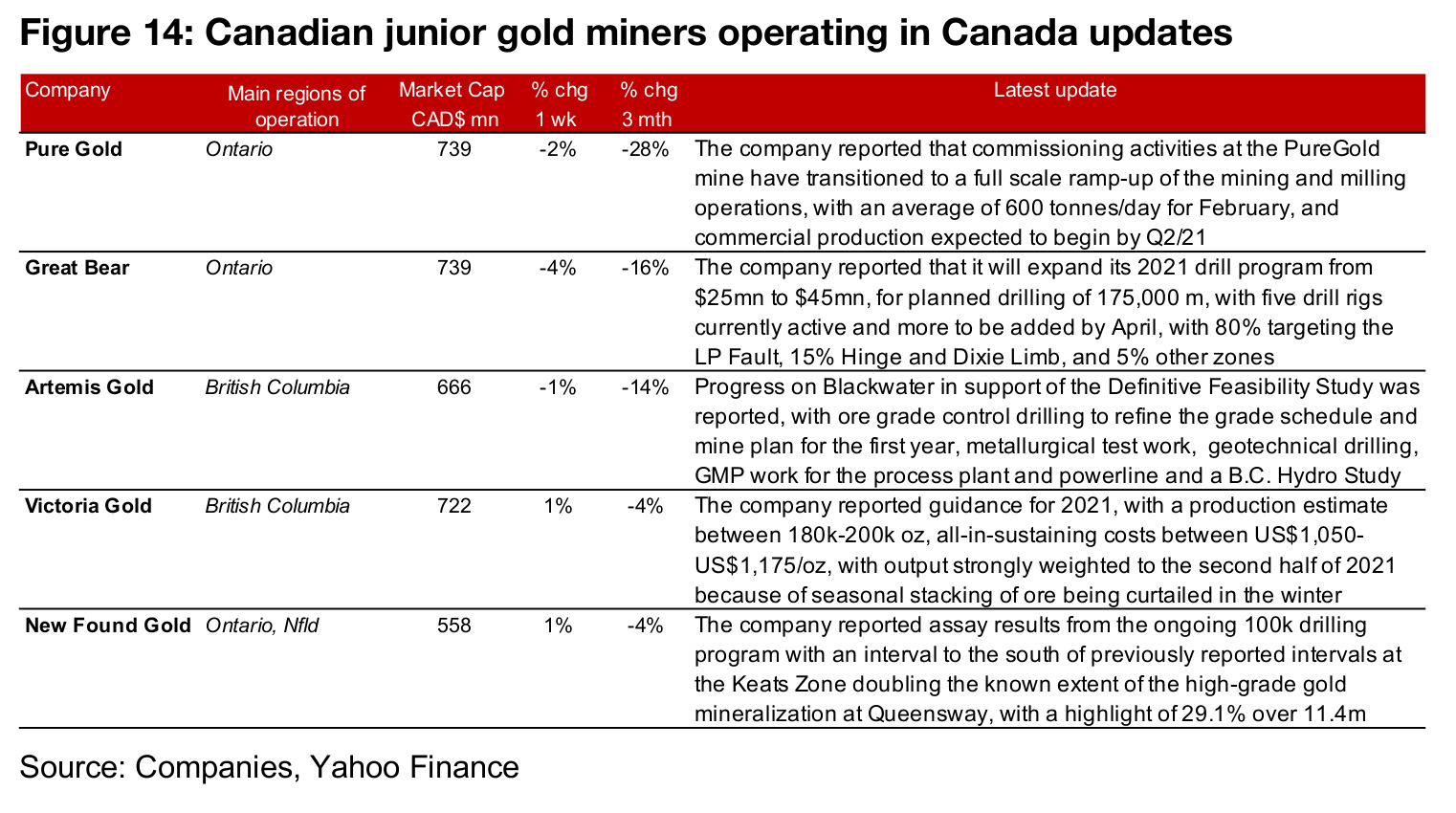

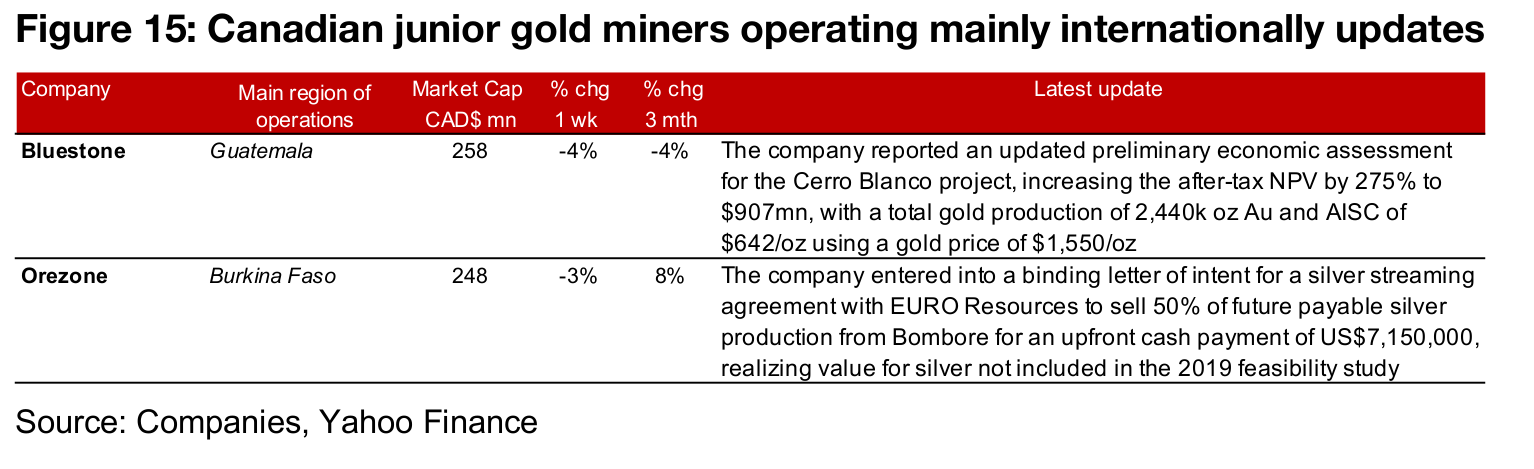

The Canadian junior miners were mixed this week even as gold declined (Figure 13). For Canadian juniors operating mainly domestically, Pure Gold gave an update on the ramp up of its mine to commercial production and Great Bear reported a major expansion of its 2021 drill program. Artemis reported progress on its Definitive Feasibility Study, Victoria Gold announced guidance for 2021 and New Found Gold reported assay results from the drilling at the Keats Zone of Queensway (Figure 14). For the Canadian juniors operating largely internationally, Bluestone reported an updated PEA on Cerro Blanco, and Orezone entered a binding LOI for a silver streaming agreement with EURO Resources to sell 50% of future payable silver production from Bombore (Figure 15).

In Focus: Bluestone Resources (BSR.V)

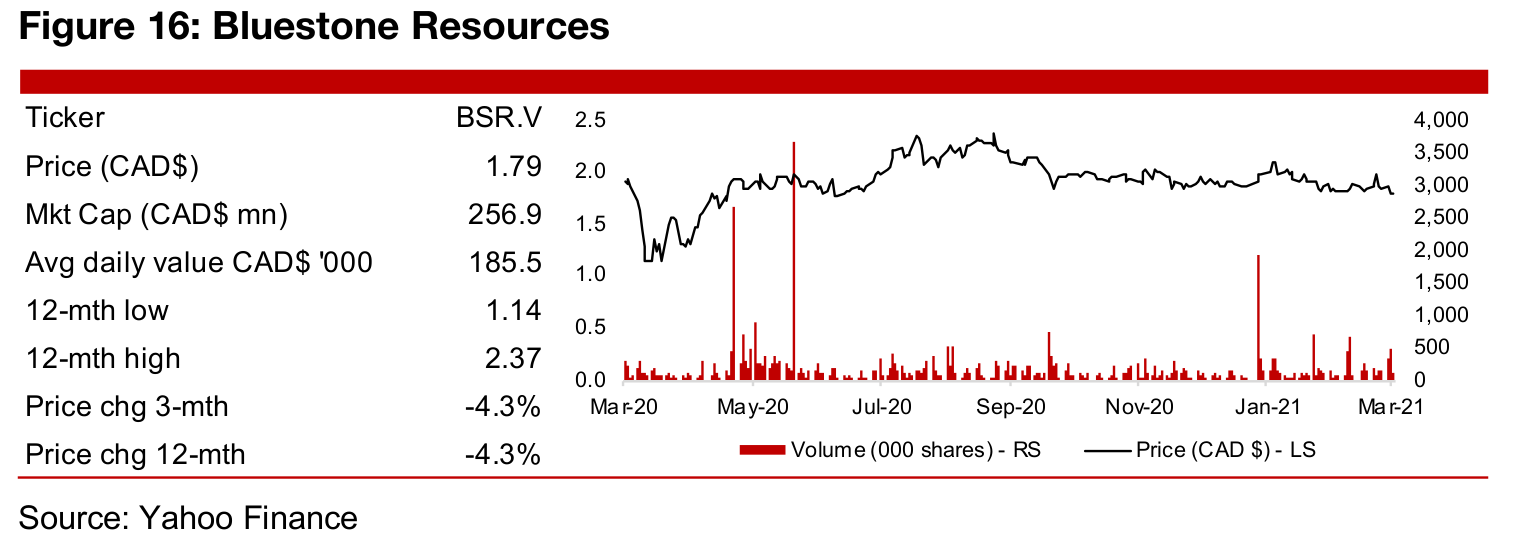

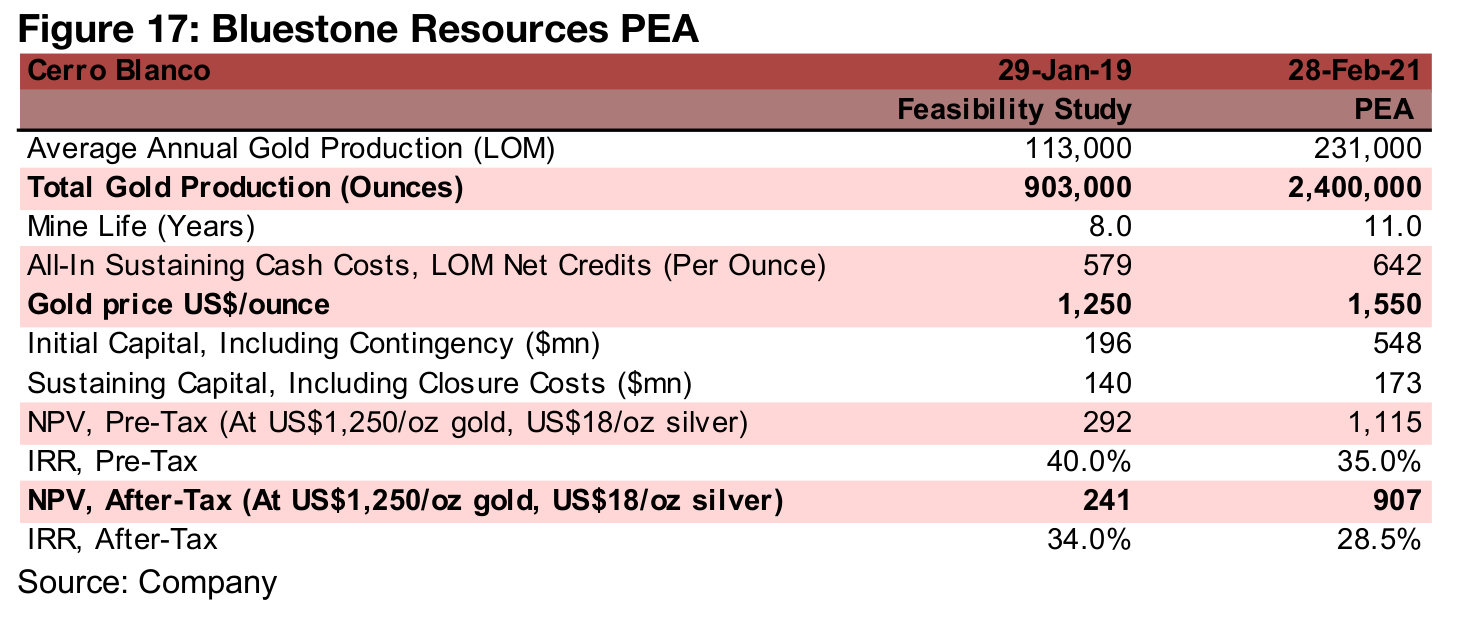

Cerro Blanco new PEA nearly triples value, but share price muted

Bluestone Resources released an updated PEA for its Cerro Blanco, near tripling the

after-tax value from the previous Feasibility Study of $241mn (as of January 2019) to

$907mn. The main drivers have been an increase in the total LOM gold production

from 903k to 2,400k, an increase in the estimated gold price from US$1,250/oz to

US$1,550/oz, and an increase in the initial capital to $548mn.

The share price edged up just 1.1% on the first trading day after the announcement,

suggesting that the new PEA was not a major surprise to the market. Year-to-date,

the company is down -10.5%, slightly outperforming the -11.9% decline in the gold

price. The share price is down -6.3% since June 2020, around the time of the gold

peak, which shows that while the market is not heavily bearish on its prospects, it

has certainly anticipating a better outlook for other Canadian juniors like the Red Lake

plays, Pure Gold and Great Bear, up 34.1% and 23.6%, or Rupert, up 100%.

In Focus: Red Lake plays Pure Gold, Great Bear

Pure Gold ramping up to commercial production

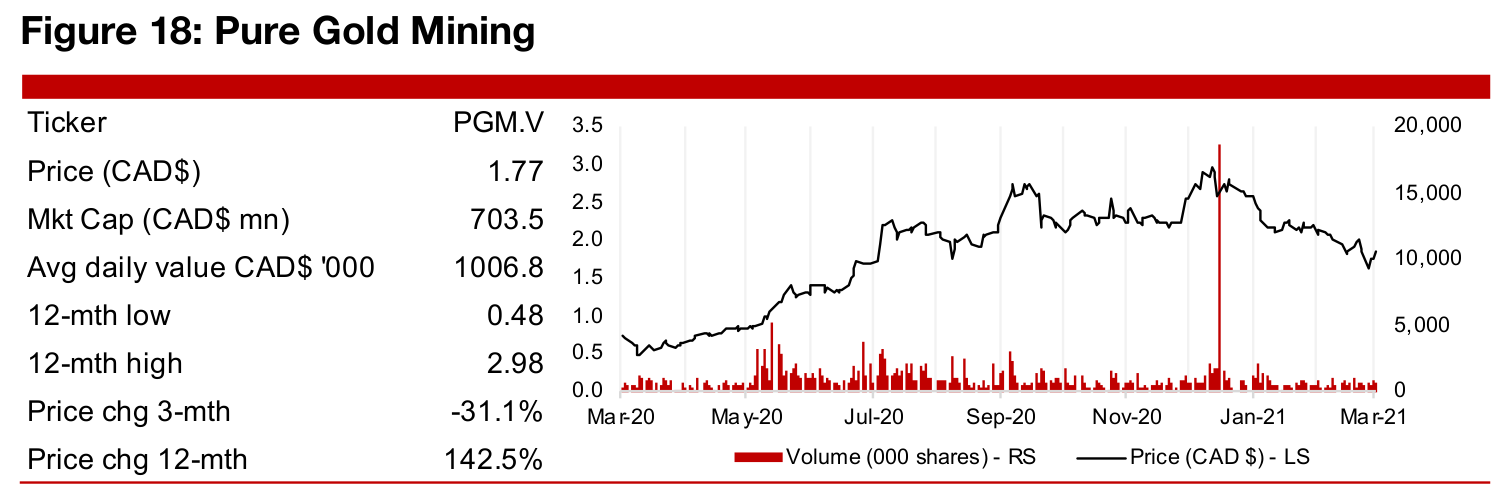

Both of the major junior plays at Red Lake, Ontario, have continued to make strong operational progress this week. Pure Gold reported that it continues to ramp up towards full commercial production, which is targeted for Q2/21. The stock price has declined -31.1% as the gold price has declined, as its potential value is more certain, given its later stage, compared to, for example, the earlier stage Great Bear.

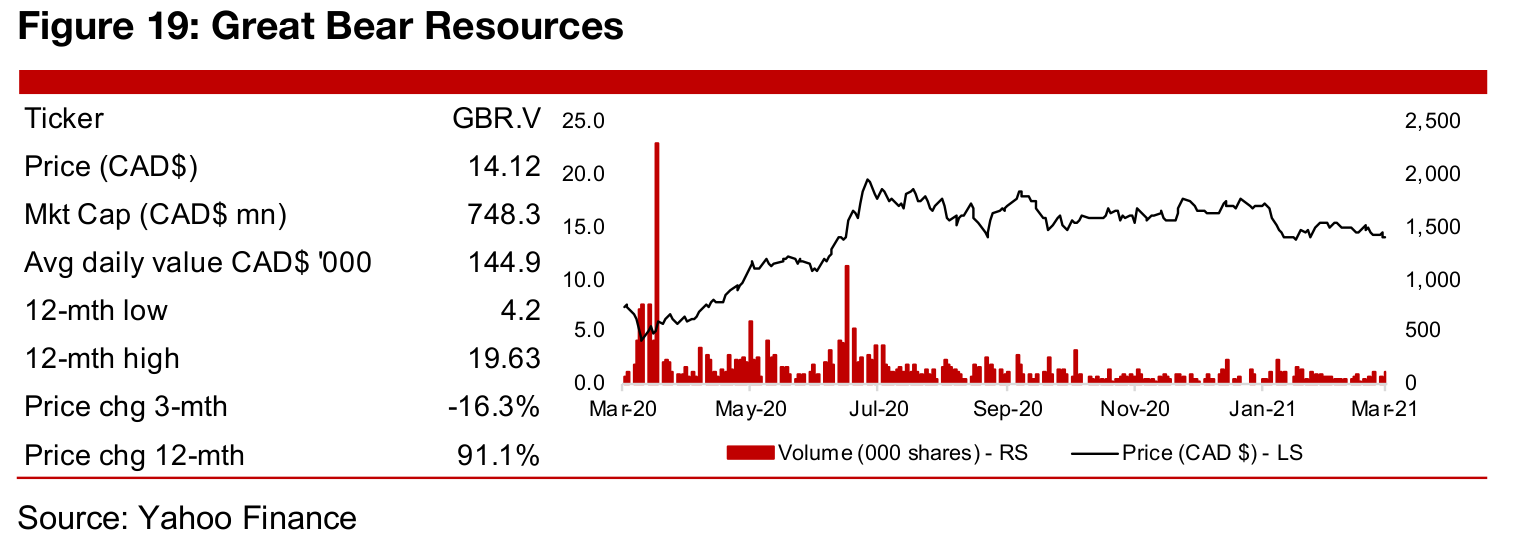

Great Bear expanding their drilling program

Great Bear reported a major expansion of its 2021 program at its Dixie Project, from US$25mn to US$45mn, with the company continuing reporting a consistent series of strong drilling results from the project over the past year. It has continued to hold off on the announcement of an initial mineral resource as it expects to be able to further expand the resource significantly with the current drilling campaign.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.