September 2022

The ONLY Way to Profit from THIS Economy

- Billionaires LOVE Gold, and You Should Listen

- The BEST Way to Profit from Gold... Is THIS

- Case Study: Golden Arrow Resources (GRG.V, OTC:GARWF)

- Lessons from Golden Arrow's Success for 2022

The recession is here. The economy is shrinking, and prices are out of control.

Inflation is at levels not seen in decades. It destroys living standards and the value of your savings.

Mainstream investors are losing their minds. They don't know where to go. And they can't even sell everything and hold cash. The value of that cash will go down as inflation continues.

If you feel like you have no good options, you're not alone. And it's not your fault. Millions feel the same way.

But they may not know that there is a way to protect your capital even in this crazy market. And using history as a guide, we discovered that there is one asset that can deliver market-beating returns.

Since 1971, it has acted as a safe haven. In 1973, as the S&P 500 lost 13% of its value, this asset soared by 87%.

During the Financial Crisis of 2007-2008, it protected investors' portfolios with a 16.3% appreciation. Meanwhile, the S&P 500 lost over 37%.

The list goes on... When it looks like the world is coming to an end, this asset kicked into high gear and outperformed the market.

We are talking about gold.

Billionaires LOVE Gold, and You Should Listen

Take it from one of the most prominent VALUE investors, Seth Klarman. This year, he said in an interview: "I'm a fan of gold. I think gold's valuable in a crisis."

Julian Robertson, one of the founding fathers of the global hedge fund industry, said: "if you own one ounce of gold for an eternity, you will still own one ounce at its end." An ounce of gold today is an ounce of gold in 1,000 years. Unlike fiat currency, gold has held its value for generations, and will continue to do so.

Rick Rule, the legendary Canadian investor, says: "gold is the ultimate cash."

Owning gold is a must for investors. As the global economy tips into recession, gold could prove once again that it's the only asset that can protect your portfolio.

The BEST Way to Profit from Gold... Is THIS

Everybody should own gold for protection, but there is a hidden way that you can use to unlock the true potential of this precious metal.

This often-overlooked corner of the gold market doesn't get much coverage from the mainstream media.

It prefers to chase the latest trends instead of delivering tangible value to investors like you.

But you should know THIS. To leverage the safe-haven status of gold, you may want to put a certain group of stocks on your radar.

The companies exploring for and producing it.

This leverage works in a simple way. And here is why it can provide more upside to your portfolio than gold itself.

When the price of gold rises by a dollar, you make a dollar. But for the companies exploring for and producing gold, every extra dollar added to the price of the metal itself turns into two or three—or five, or more—dollars added to their market value.

That's the magic "leverage" factor gold investors talk about. And here is how you can apply it to your own portfolio.

Case Study: Golden Arrow Resources (GRG.V, OTC:GARWF)

Let's take a look at Golden Arrow Resources. The company is an established player in the massive South American resource space.

It has been developing gold, silver, cobalt, and copper deposits in Argentina and Chile since the 1990s. It is a member of the Grosso Group, which has been active in Argentina since 1993 and made four major discoveries.

As a mining junior, it's leveraged to the price of the commodities it explores for. And this leverage delivered massive upside during the latest bull run.

From the depths of the Covid selloff in early 2020 to early 2021, Golden Arrow outperformed virtually all the benchmarks you could compare it to.

In that time frame, the price of gold rose by 28%.

The S&P 500 index appreciated by 37%.

GDX, an exchange-traded fund that tracks the largest gold mining companies, soared by 102%.

Some junior mining companies performed even better.

Lessons from Golden Arrow's Success for 2022

First, the company focuses on the commodities that are in high demand. Gold and silver are safe-haven assets that investors appreciate during hard times. And as recession fears spread, the market will likely turn to gold and silver as "monetary metals" again. Decades-high inflation is a tailwind for companies like Golden Arrow.

Second, the company is also focused on copper and cobalt. These metals are needed for the multi-trillion "green transition" megatrend.

Bloomberg says that for copper and "battery metals" such as lithium and cobalt, there is "soaring demand [that] comes up against supply constraints."

Adding in-demand metals to its portfolio could help Golden Arrow profit not only from the coming recession, but also from the "green transition" that has already seen hundreds of billions of dollars in government support and investment.

Third, the company's team has vast experience both in raising funds and negotiating with the biggest names in the industry. Mr. Joseph Grosso, the company's CEO & President, has negotiated with the likes of Barrick, Teck, Newmont, and other major mining players. This experience is particularly relevant for an early-stage company like Golden Arrow that could potentially see interest from the major players in the future.

Finally, mining juniors' share prices follow both the prices of the underlying commodities and their own exploration successes.

Golden Arrow has been steadily supplying the market with news and updates.

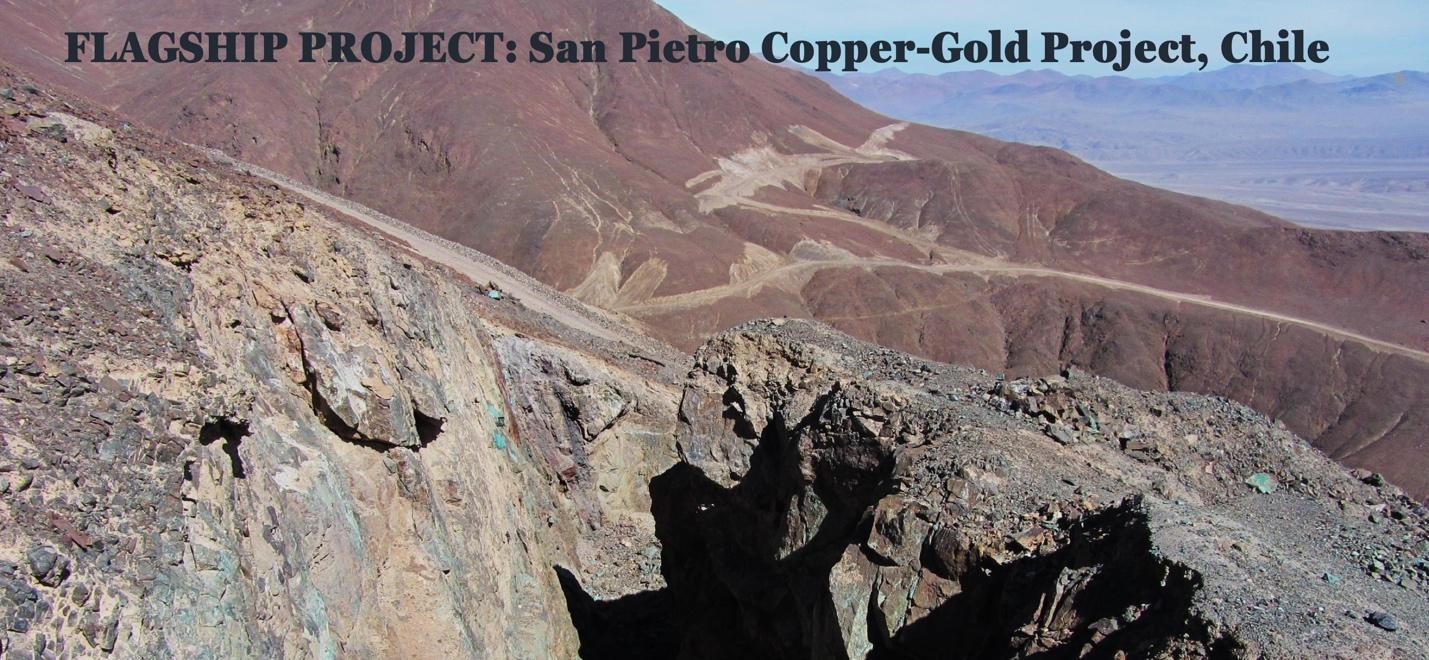

Recently, it announced that it had started an exploration campaign at its 100%-owned San Pietro copper-cobalt-gold project in Chile. The company bought it back in March for just $3.35 million. It was a bargain, given that the project's previous owners had invested at least $15 million in exploration work there.

Adding to that, San Pietro is located in one of Chile's most established mining districts, right next to Capstone Copper's Santo Domingo project which has a $1.6-billion net present value (NPV), including the cobalt component.

The other nearby project, Mantoverde, produced 13,100 tonnes of copper in the second quarter of 2022 alone.

Golden Arrow has engaged in surface mapping and sampling, as well as re-logging its historic drill core at San Pietro. When the company purchased the project, it obtained access to a database containing over 34,000 meters of past drilling. In 2023, Golden Arrow plans to commence an aggressive drilling campaign to bolster its database. From there, it will proceed to outline a resource estimate for San Pietro.

Past work at the project delivered excellent drill results, such as the ones from hole RA-12-DH-003. It delivered a 28-meter interval averaging 1.14% copper, 0.12 g/t gold, and 335 parts per million cobalt.

This exposure to in-demand metals and constant progress at its properties has been the "secret leverage" that Golden Arrow Resources used to its advantage during the past global crisis.

Disclaimer: This report is for informational use only and should not be used as an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.

The preceding Article is PROMOTED CONTENT sponsored by Golden Arrow Resources and produced in cooperation with CanadianMiningReport.com.