December 24, 2021

The Mining M&A Wave

Author - Ben McGregor

Gold jumps as another indicator points to high inflation

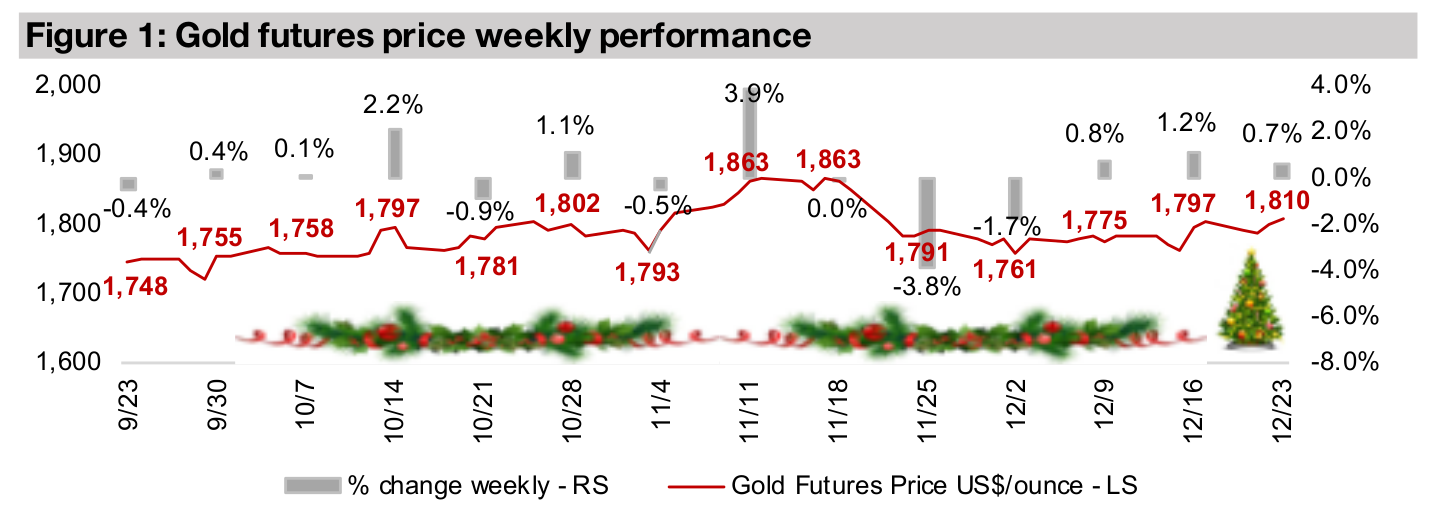

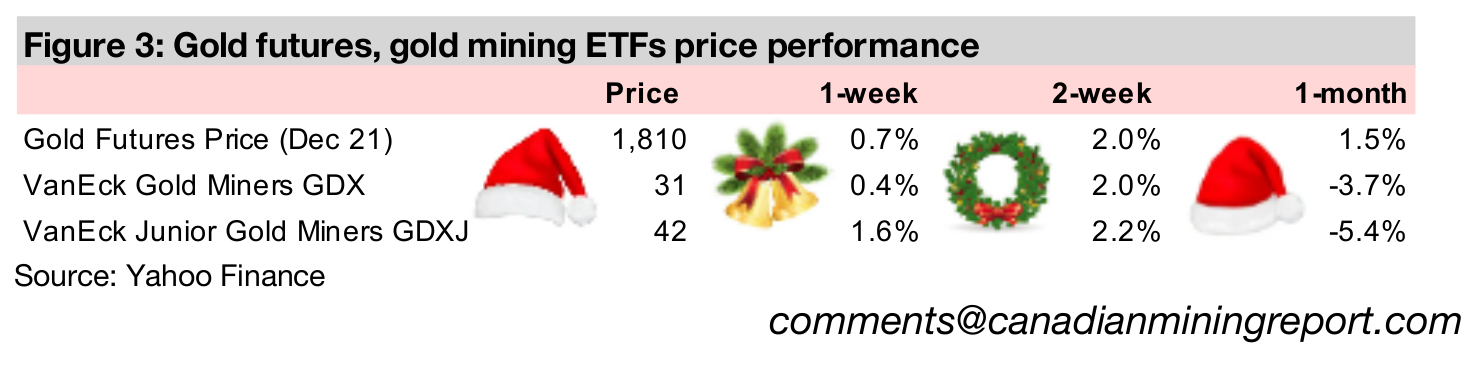

Gold rose 0.7% this week to US$1,810/oz, jumping above the average for the year of US$1,797/oz on concerns of high inflation, as the increase in the US Personal Consumption Expenditure index rose yoy to the highest level in nearly four decades.

Mining stock merger and acquisition activity rising

This we look at how the large increase in the cash balances of many mining companies, including major gold producers, has started to drive a wave of merger and acquisition activity that appears to have picked up pace in recent months.

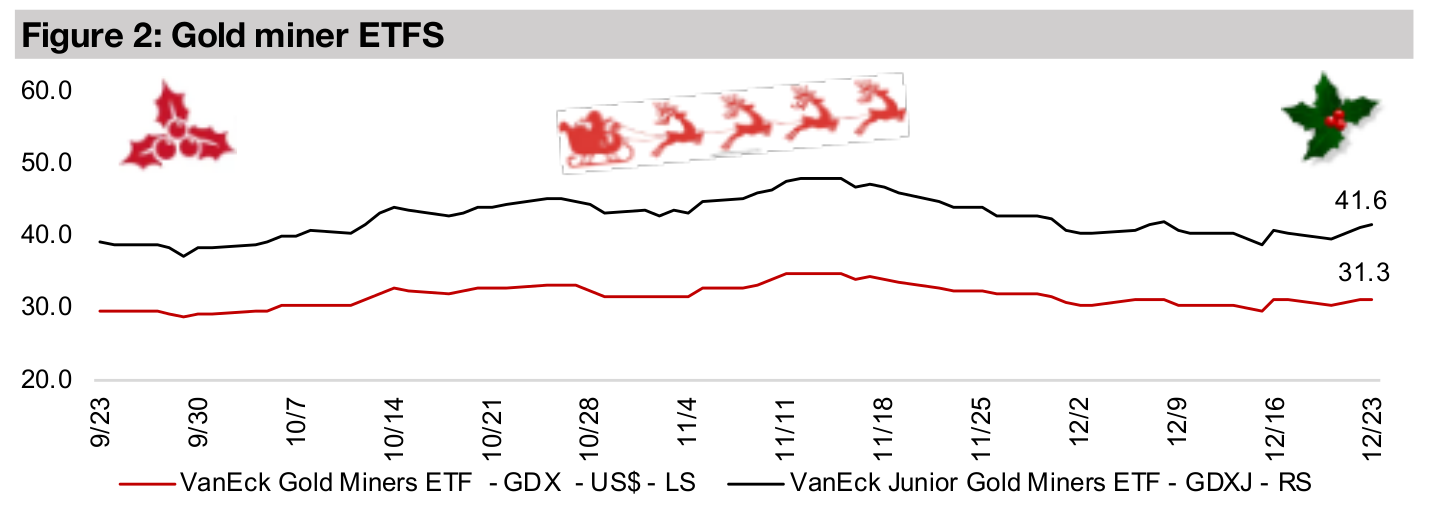

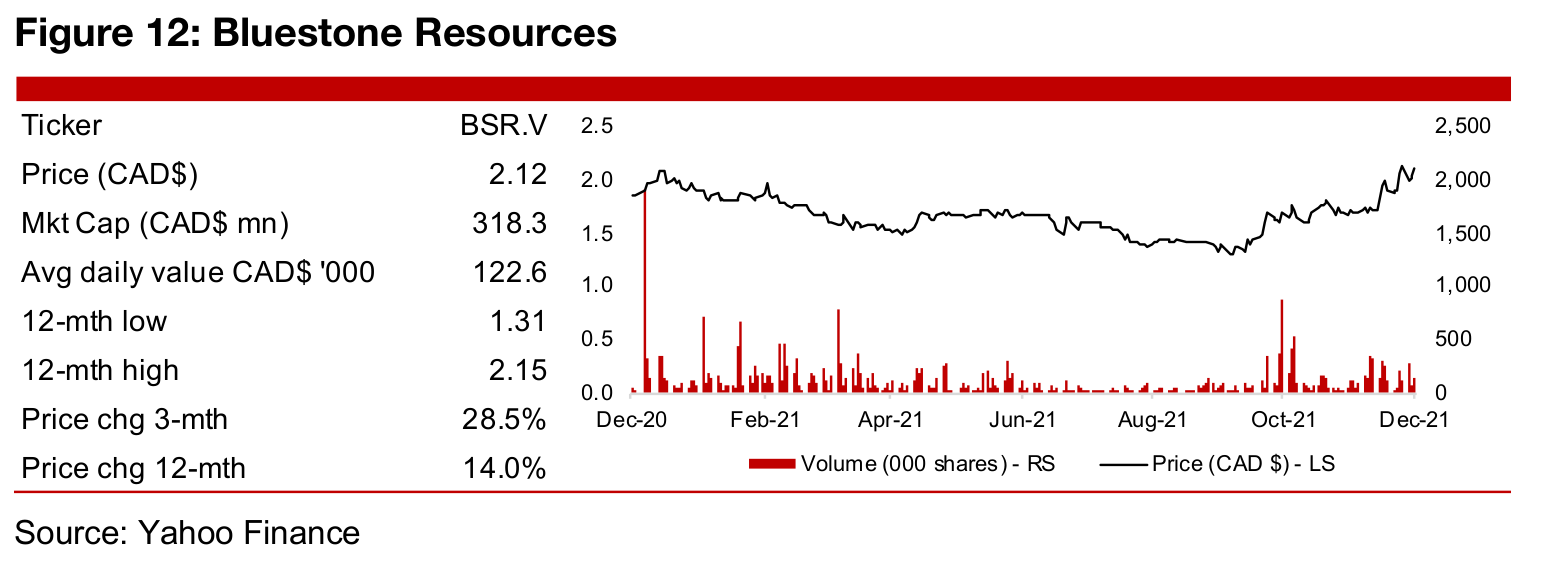

Producers and juniors gain, Bluestone Resources In Focus

The producing miners and the junior miners gained with the GDX up 0.4% and the GDXJ rising 1.6%, and Bluestone Resources in In Focus this week with the stock rising considerably over the past month, but with no major press releases driving it.

The Mining M&A Wave

Gold rose 0.7% to US$1,810/oz, at its highest level in over a month, jumping above the average of US$1,797/oz for 2021, as it looks set to trade within a reasonably tight range through all of 2021 as we head towards the end of year, and we wish all of our readers a Happy Holiday season. Inflation was again the big driver, with the US Personal Consumption Expenditure price index, a key inflation indicator, up 5.7% in November 2021, its highest growth since 1982, following the shock CPI inflation for the same month at 6.8% yoy that was released two weeks ago.

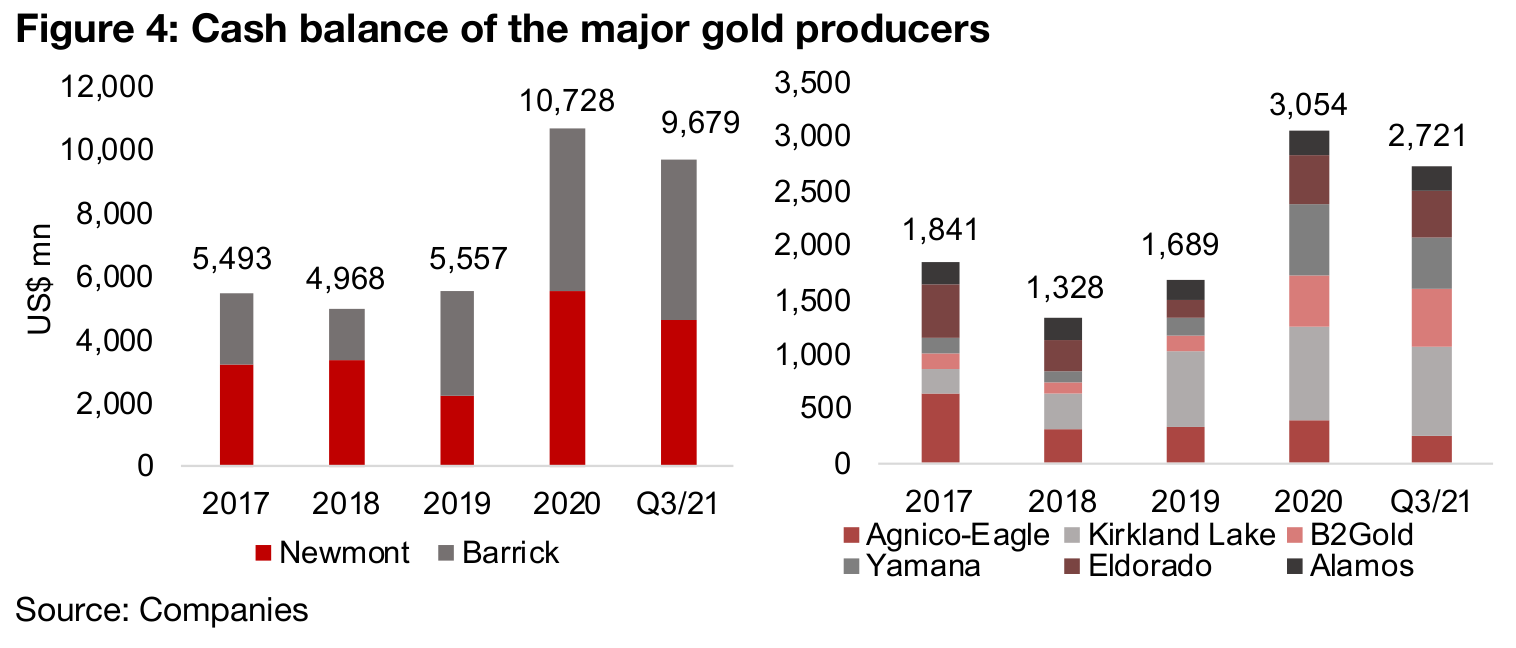

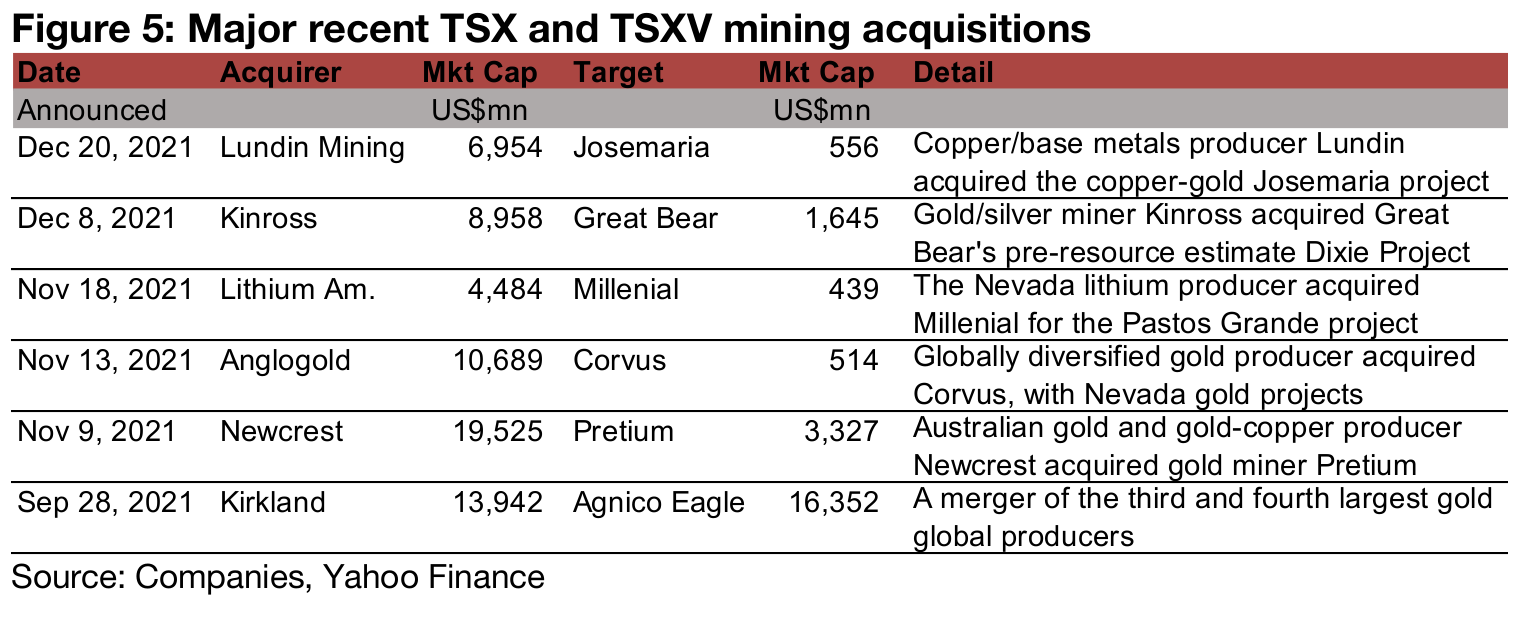

As inflation pressures the economy and propels the gold price, over the last few

months we are starting to see the rise of a mining mergers and acquisitions wave,

with a number of high-profile deals with several TSX and TSVX firms as targets, with

much of the action in the gold sector. M&A activity in the gold and other mining

sectors may be set to continue into 2022, especially as the major producers are now

sitting on twice as much cash as of Q3/21 as they were at the end of 2019 (Figure 4).

The two gold market giants Barrick and Newmont have seen cash increase from

$US5.6bn in 2019 to US$10.7bn as of Q3/21, and the aggregate cash of the mid-tier

players Agnico-Eagle, Kirkland Lake, B2Gold, Yamana, Eldorado and Alamos rose

from US$1.7bn at end-2019 to US$2.7bn as of end-Q3/21. The largest recent deal

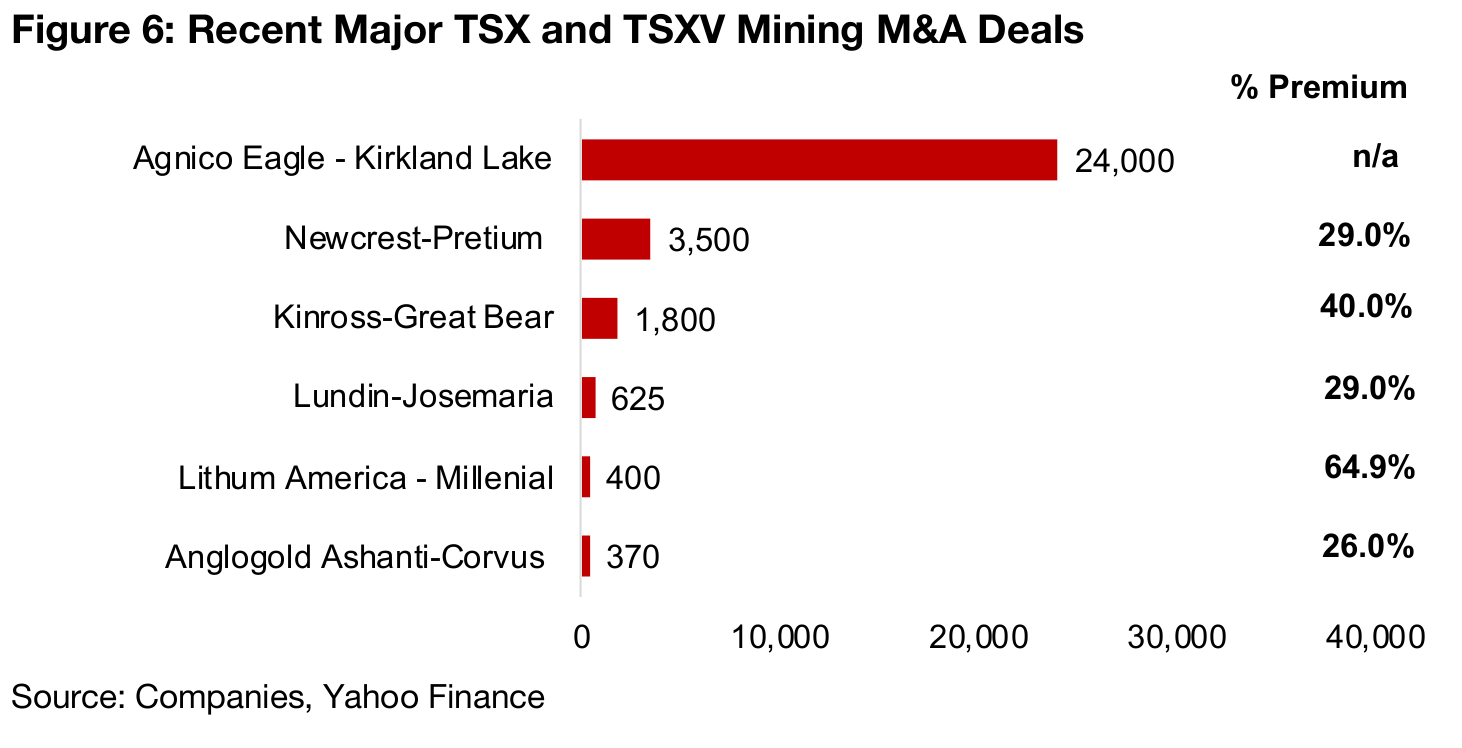

by far was the merger of equals by Kirkland and Agnico-Eagle, which at the time of

the announcement on September 28, 2021, was valued at $24bn, with the combined

market cap now at $30bn (Figure 5). The next largest was another gold deal,

Newcrest's acquisition of Pretium for $3,500mn, announced on November 9, 2021,

at a 29% premium to its price leading up the announcement (Figure 6).

Kinross announced on December 8, 2021, that it would acquire Great Bear Resources,

now the most highly valued gold company on the TSXV, for US$1,800mn, at a 40%

premium. Base metals company Lundin Mining announced the acquisition of copper-

gold company Josemaria on December 20, 2021, for a 29% premium. Lithium

America announced that it would acquire Millenial Lithium for $400m on November

18, 2021, after previous bids from Ganfeng and CATL, with the price now 64.9%

above its level prior to the escalating bidding. Anglogold Ashanti Gold announced the

purchase of Corvus for $400mn on November 13, 2021, at a 26% premium.

With many major mining firms having strong cash positions after the run up in prices

of many metals over the past two to three years, and these companies perpetually in

search of reserves replacement, we expect that strong merger and acquisition activity

could continue into 2022. This could occur even with a dip in equity markets, as a

reduction in price could make the companies even more attractive targets, especially

in the gold space, as we expect gold to remain strong even if stock markets take a

hit. There are about twenty larger gold companies with sizeable projects on the TSXV,

many at advanced stages, that could be potential takeover targets.

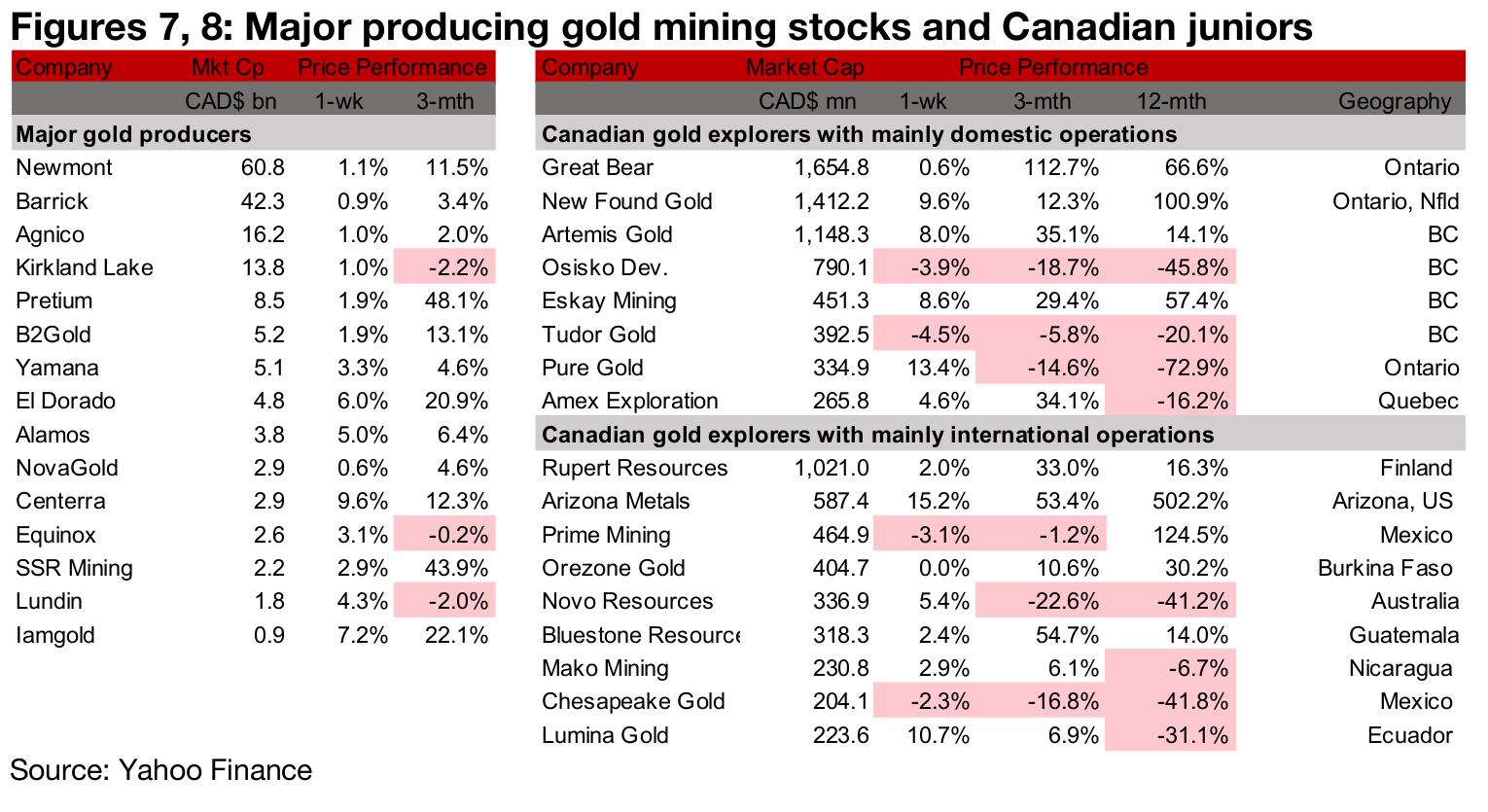

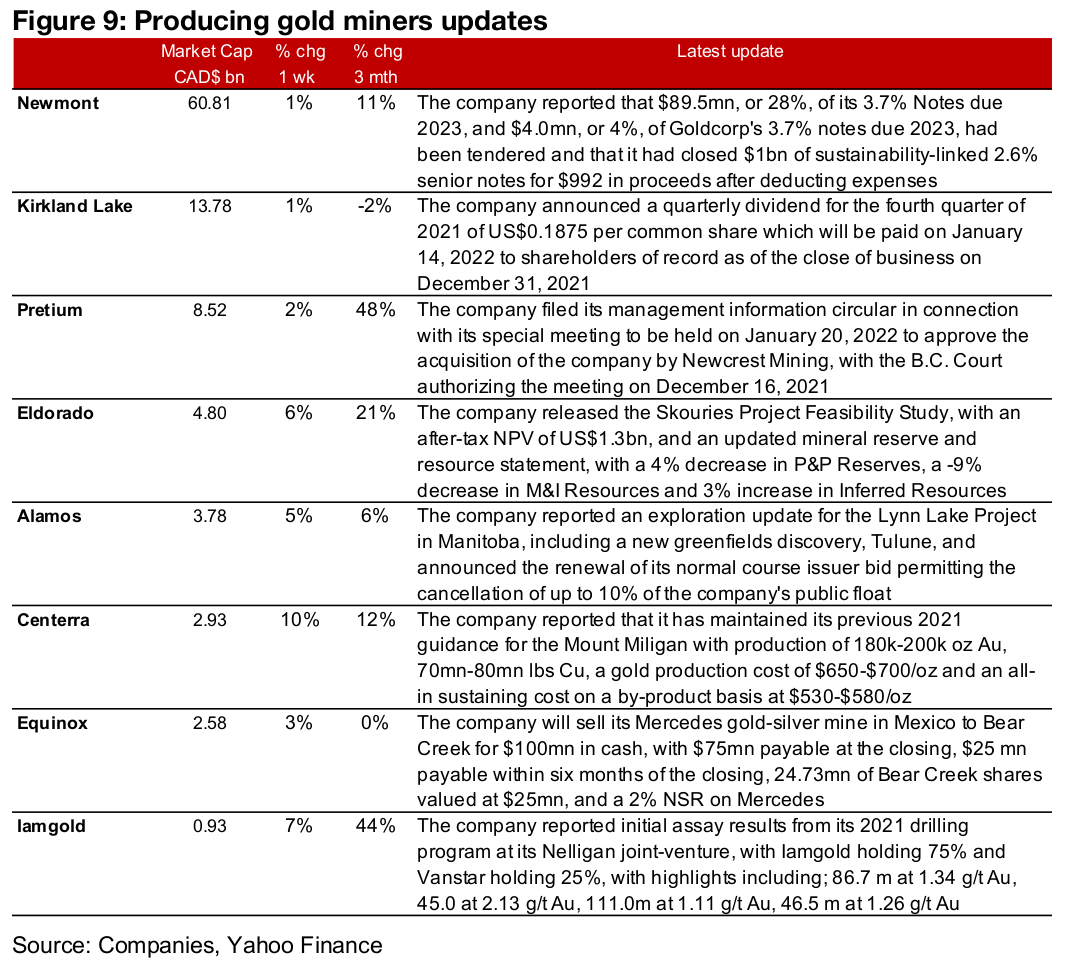

Producers all up as gold rises on inflation spike

The producing gold miners were all up as the spike in inflation continued (Figure 7). Newmont reported results from the tender of its and Goldcorp's 2023 notes and its sustainability-linked senior notes. Kirkland Lake announced a quarterly dividend of US$0.1875/share and Pretium filed its management circular in connection with its special meeting on January 20, 2022, to approve the acquisition by Newcrest Mining (Figure 9). Eldorado released its Skouries Project Feasibility Study and an updated mineral reserve and resource statement and Alamos reported an exploration update for the Lynn Lake project in Manitoba. Equinox announced that it would sell its Mercedes gold-silver mine in Mexico to Bear Creek, Centerra reported that it would maintain its previous 2021 guidance for Mount Milligan and Iamgold reported initial assay results from its drilling at its Nelligan joint-venture with Vanstar.

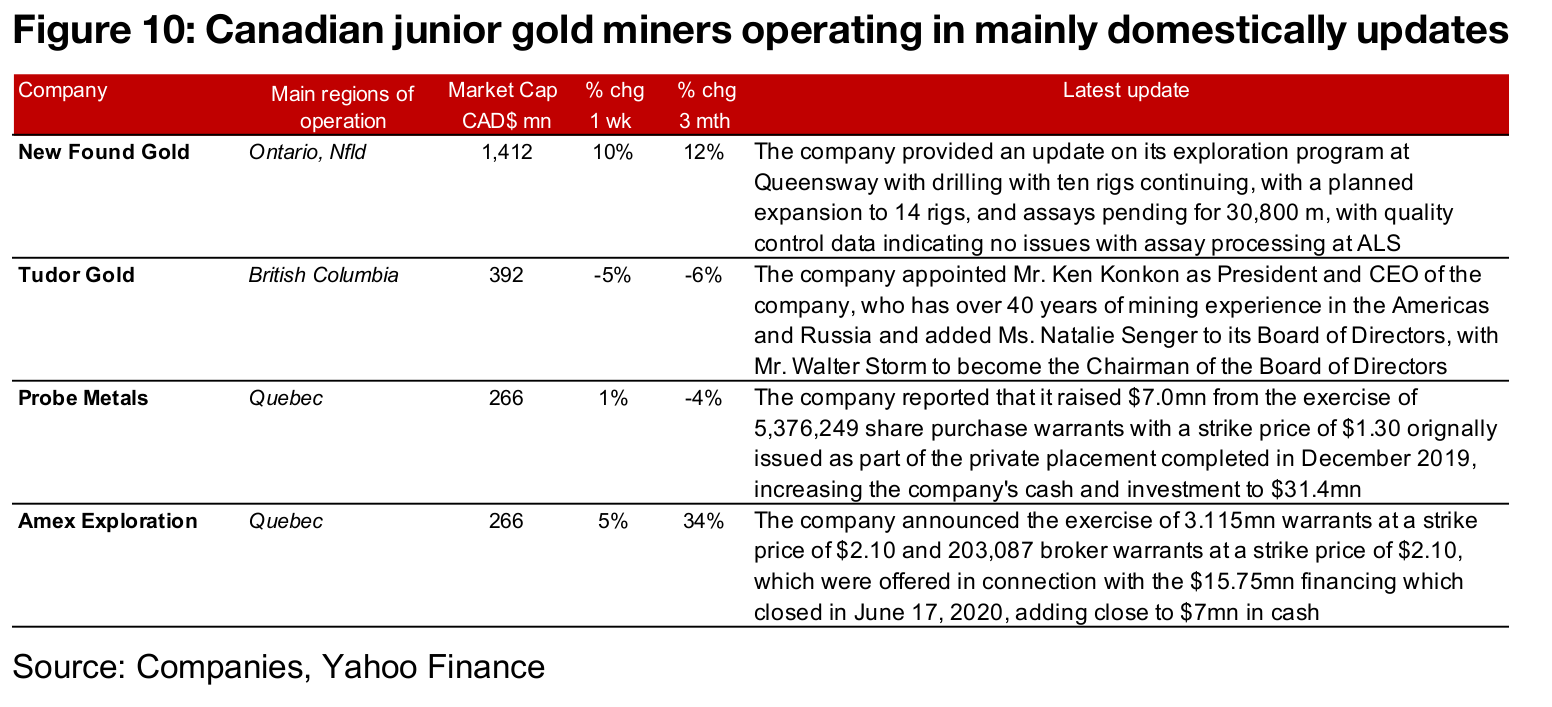

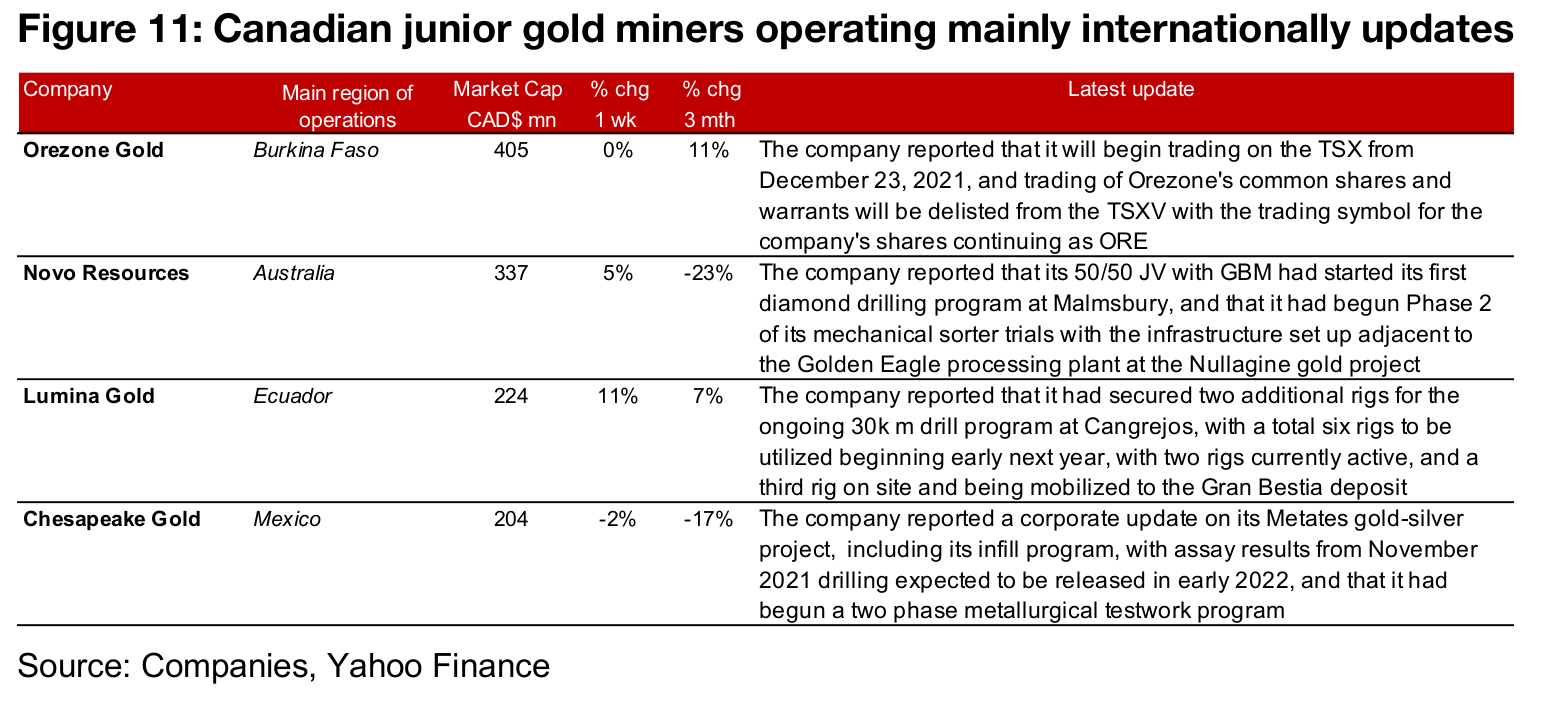

Canadian juniors mostly rise as inflation continues to jump

The Canadian juniors mostly rose as the gold price was driven up by rising inflation (Figure 8). For the Canadian juniors operating mainly domestically, New Found Gold provided an update on its exploration program at Queensway, Tudor Gold announced the appointment of Mr. Ken Konton as President and CEO and other management changes, and Amex and Probe reported cash raised from the exercise of warrants (Figure 10). For the Canadian juniors operating mainly internationally, Orezone reported that it would begin trading on the TSX on December 23, 2021, Novo Resources that its 50/50 JV with GBM started its first diamond drilling program at Malmsbury, Lumina secured two additional rigs for drilling at Cangrejos, with a total six to be operating by early 2022, and Chesapeake Gold provided a corporate update on its Metates project (Figure 11).

In Focus: Bluestone Resources (BSR.V)

Bluestone's price up over past month on no major news

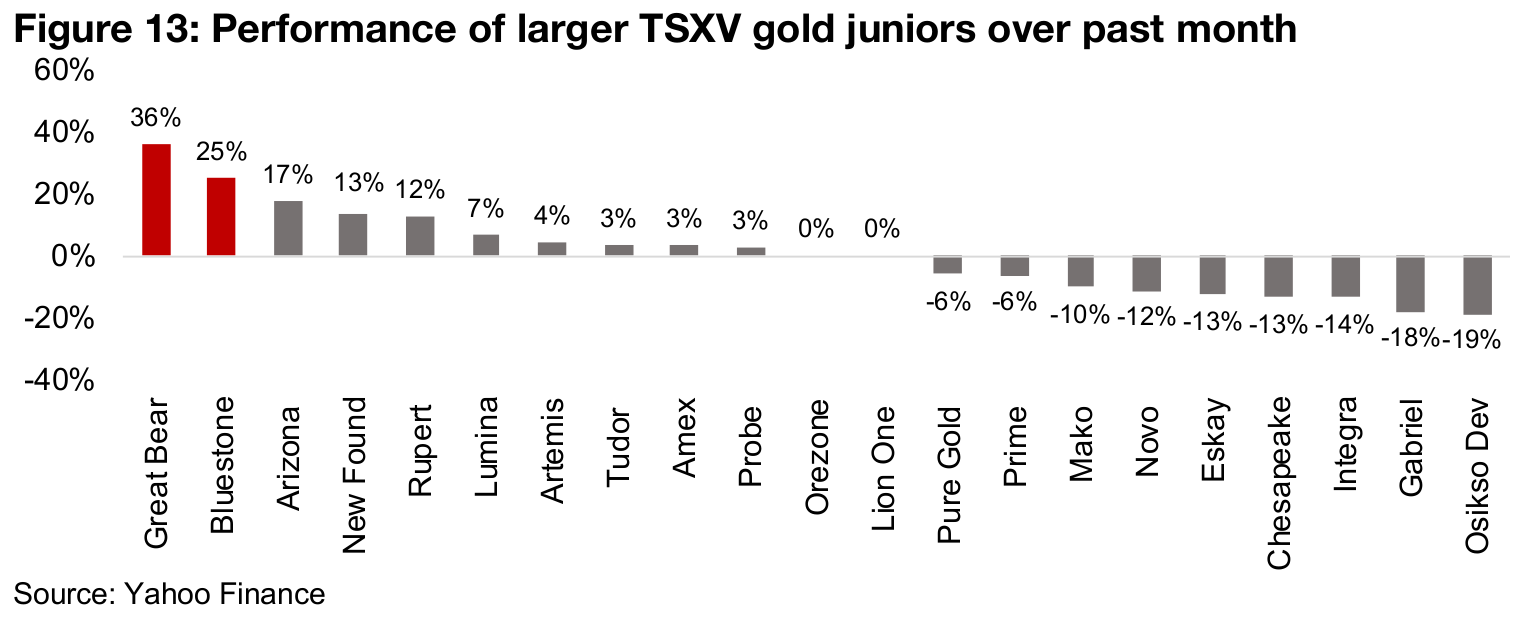

Bluestone Resources, which is developing its flagship Cerro Blanco project in

Guatemala, has seen some strong price action over the past month, rising 25%,

standing out considerably from most of the other TSXV gold juniors, most of which

have seen only marginal gains, while several have faced losses (Figure 13). The only

other major gainer of the TSXV over the past month has been Great Bear Resources,

driven by the announcement of Kinross's acquisition of the company.

There have been no recent press releases that could be viewed as the major catalyst

for this move. The last release from the company was on October 29, 2021, regarding

a final base shelf prospectus, allowing the company to raise up to $400mn in

financing. The press release prior to that was months ago, on July 19, 2021, reporting

the company's Resource estimate upgrade to 3.1 m oz Au and 13.4 mn oz Ag for

Cerro Blanco. While this price rise could be driven because of a range of factors, one

could be Bluestone's potential to become an acquisition target, similar to Great Bear.

Bluestone as a potential takeover target

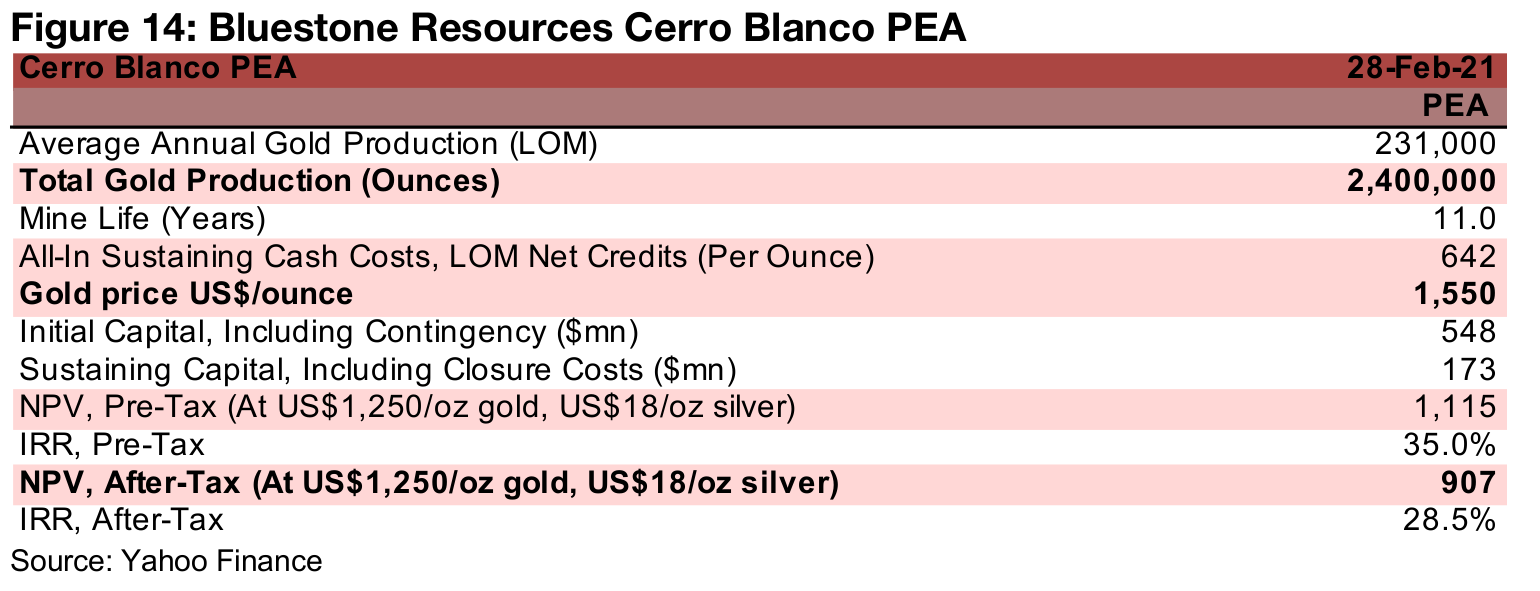

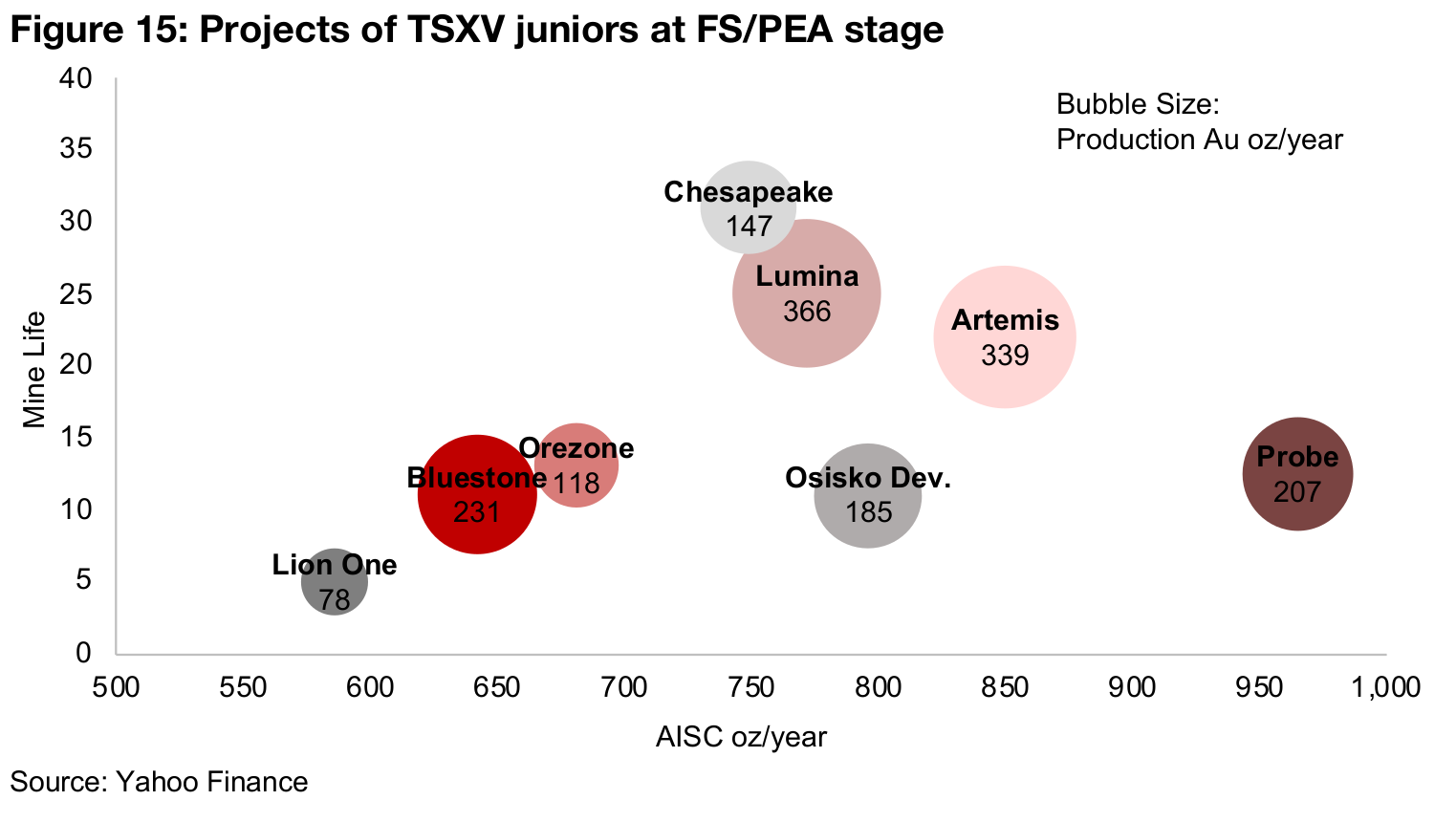

Bluestone could be a potential takeover target, with project large enough to be interesting to a larger acquirer, but with only a moderate initial capex and a low cost per ounce. The project was previously small based on its 2019 PEA, but was increased substantially in February 2021 PEA, to 2.4mn oz from 0.9mn oz, and its after-tax NPV increased to $907mn from US$241mn. This is reasonably large in the context of other TSXV junior gold developers, with only the estimated production of Lumina's Cangrejos and Artemis's Blackwater higher. Bluestone does, however, have a relatively low mine life, at 11.0 years, compared to the projects of comparable companies (Figure 15). However, it is also by far the lowest cost in terms of AISC/oz of the large projects in the group, at US$642/oz, and has only a moderate initial capex of US$548mn, compared to $1,418mn for Artemis and $1,000mn for Lumina.

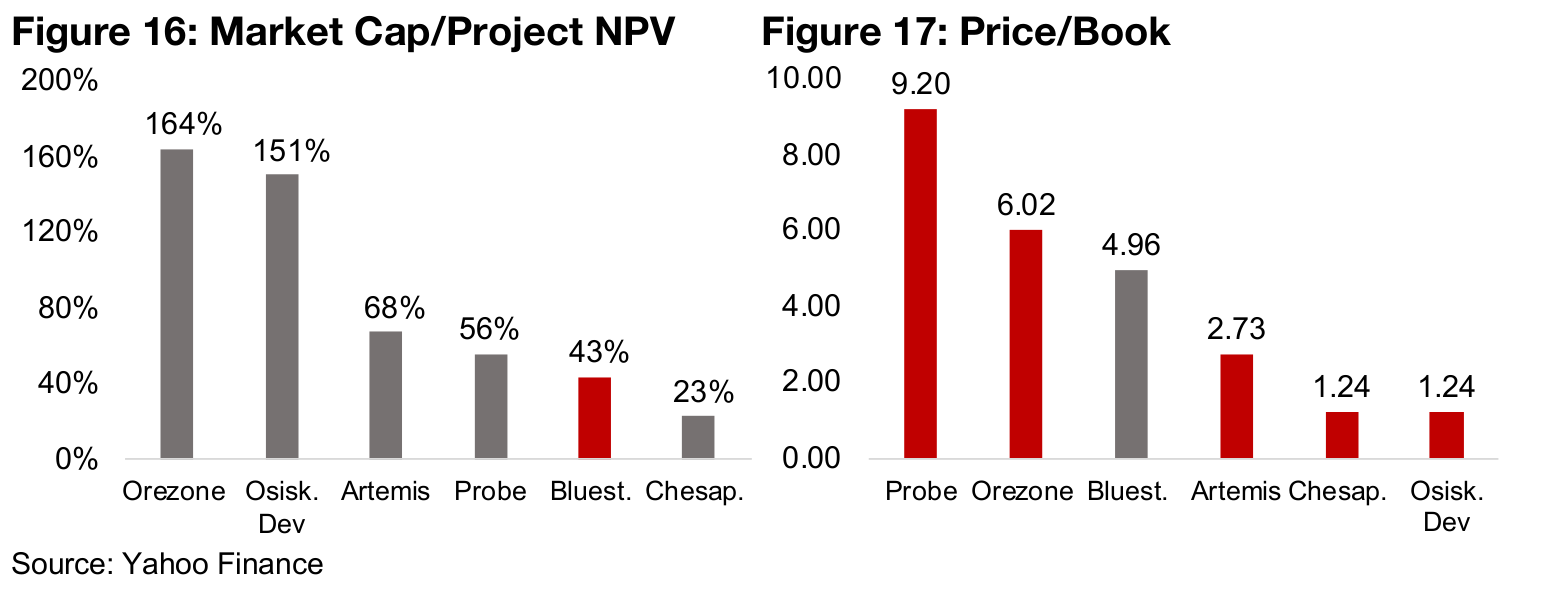

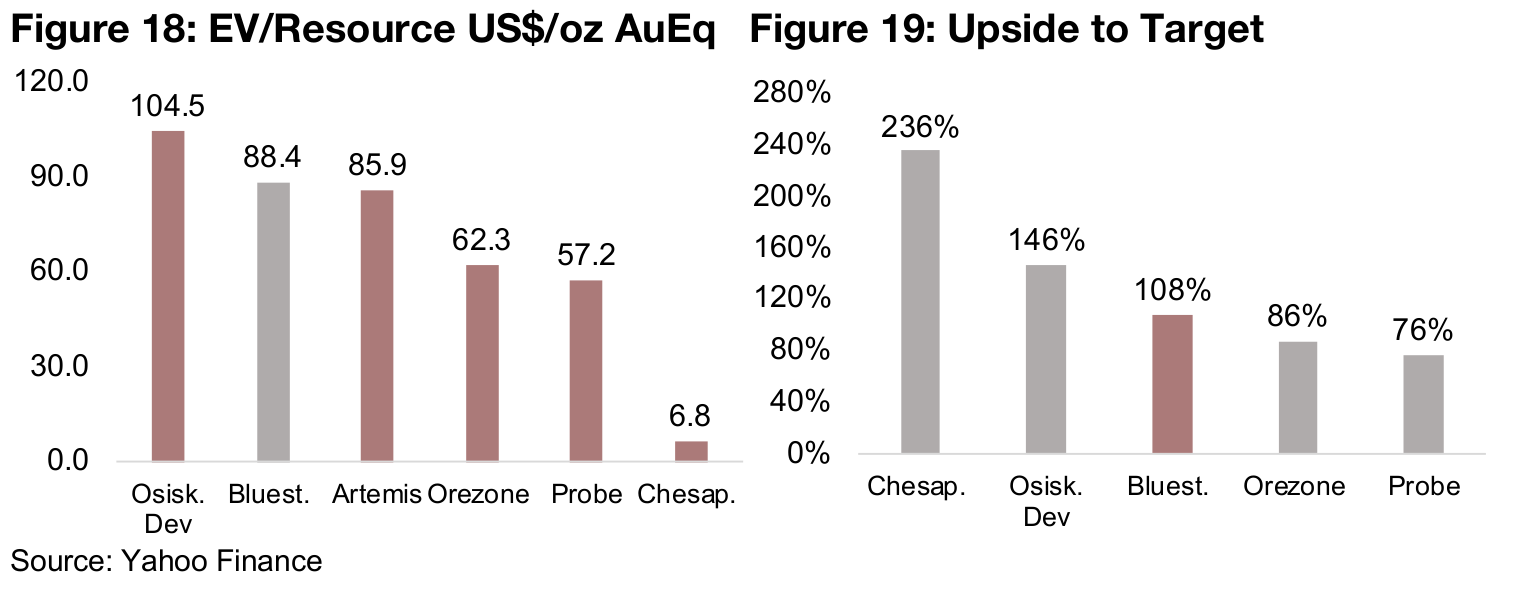

Trading below comparables on market cap to NPV

The company trades at a considerable discount to its comparables based on its market cap versus the NPV of its project, at 43%, moderately below Artemis and Probe, while Orezone and Osisko Development both now trade at premiums to the NPVs of their main projects (Figure 16). On price to book, the company leans towards the higher end of the group, at 4.96x (Figure 17), and is trading at the second highest on an EV/Resource basis at US$88.4/oz, possibly justified by the low cost per ounce of the project (Figure 18). Even after the recent run up in the share price, the market is still looking for 128% upside to the current target price (Figure 19). Overall the valuations do not seem excessive versus the peer group, and the company could prove an attractive asset to some acquirers, especially those with experience in the Americas. However, the reason behind the recent ramp up could also be from other factors unrelated to acquisition speculation, which are not yet public information and remain to be seen.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.