March 27, 2023

The Ides of March

Author - Ben McGregor

Gold continues run on banking system and rate hike pressure

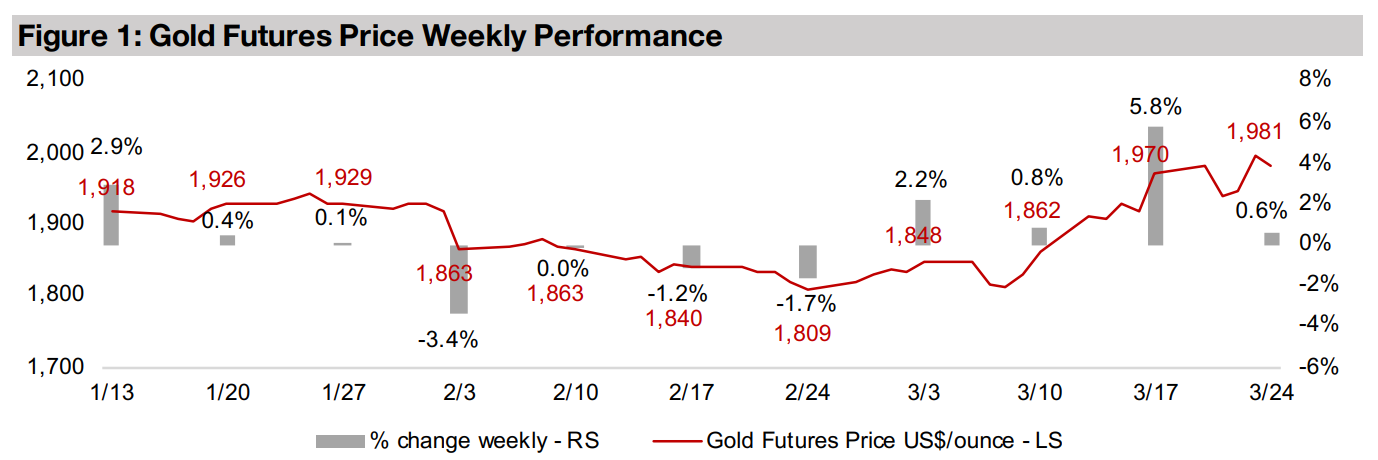

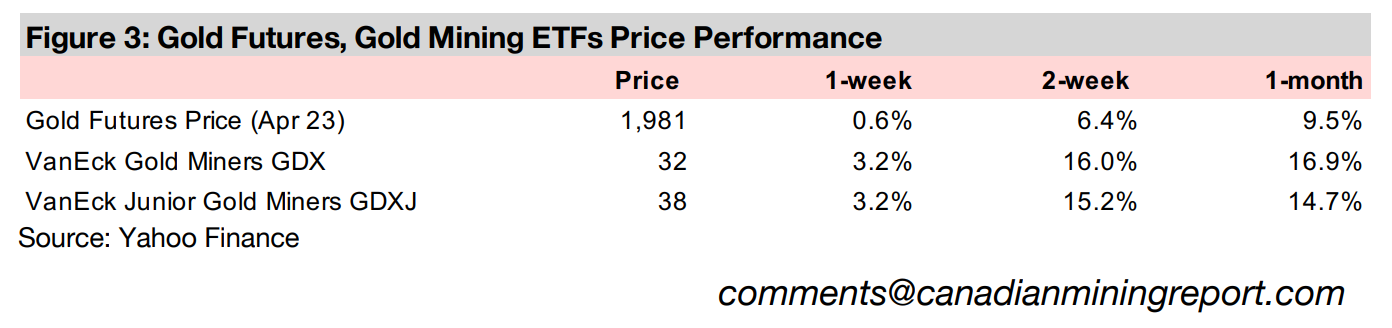

Gold rose 0.6% this week to US$1,981/oz, adding to its 5.8% surge last week, as pressure on the US and European banking systems continued and the Fed hiked interest rates, following suit with the ECB, with neither deterred by the recent crisis.

Thor Explorations meets guidance and increases resource estimate

This week Thor Explorations is In Focus, with its stock outperforming other large TSXV producers, with output at the Segilola mine in Nigeria reaching the top end of guidance for 2022, and a 144% increase in Resources for its Douta project in Senegal.

Gold stock rally continues as banking crisis persists

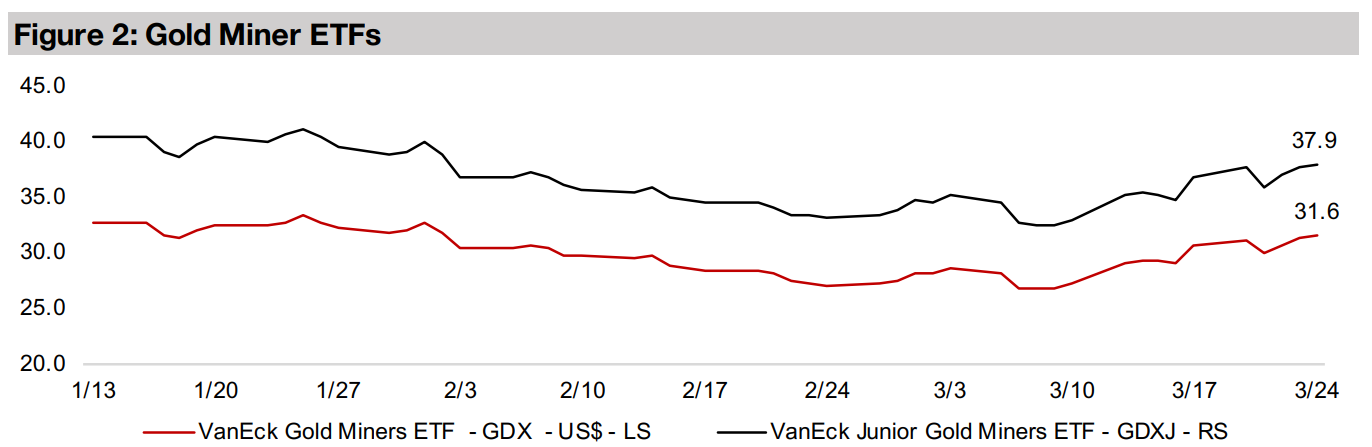

The gold stock rally continued for a second week, with both the GDX and GDXJ up 3.2% as gold continued to rise and investors increasingly shifted into safe havens as the US and European banking crises persisted even after significant interventions.

The Ides of March

The rally in gold continued for a second week, with the metal gaining 0.6% to

US$1,981/oz, after a 5.8% surge last week as the banking crisis continued and the

Fed raised interest rates 25 bps, following suit with an earlier hike from the ECB.

There was some slightly more dovish language from the Fed in comments following

the hike, which gave some lift to stocks on the day of the announcement, but this

was reversed by comments from Treasury Secretary Janet Yellen that it was not

considering guaranteeing all US bank deposits. However, Yellen's comments the

next day that the government would take emergency action in the banking sector if

necessary drove a rebound in equity markets, leaving them marginally up for the week.

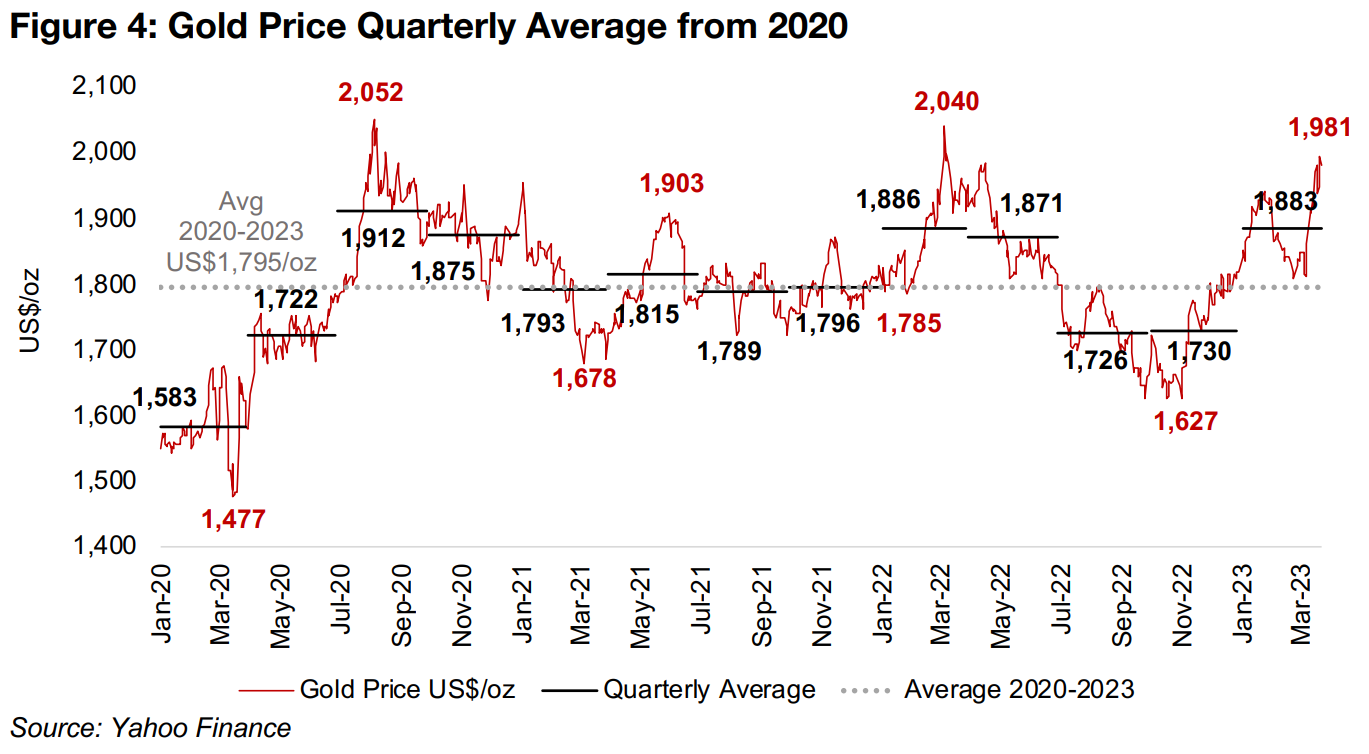

The gold price is heading for an average of over US$1,880/oz for the first quarter,

which will be its highest quarterly average since the first quarter of 2022 (Figure 4).

The severe dip in the gold price through the second half of 2022, with an average of

just US$1,726/oz in Q3/22 and US$1,730/oz in Q4/22 looks quite unsustainable in

retrospect given the recent crisis. During this period, there were still no signs that

anything had 'broken' from the severe surge in global interest rates and created the

illusion that central banks might just be get away with their hikes without any fallout.

March 2023 obviously put paid to that idea, with a banking crisis erupting in both the

US and Europe and major banks failing. It brings to mind the famous warning made

to Julius Caesar in Shakespeare's eponymous play that the Emperor should 'beware

the Ides of March' which has since come to mean a broader warning against an

impending crisis. Certainly in the banking sector, a tragedy continues to unfold.

Central banks unlikely to back down until inflation or employment cools

This banking crisis is directly related to rate hikes, as they drove a collapse in the value of the bonds banks hold as assets, threatening their solvency, driving depositors to withdraw funds and creating classic bank runs. That the central banks have kept hiking into this crisis could be viewed as impressive or reckless, as they have remain dedicated to their core mission of curbing inflation. It seems that only a major collapse in employment will see them pull back from this fight, especially in the Fed's case, given it dual mandate of price stability but also maximizing employment. However, so far these crises have yet to severely cool the jobs market in US or Europe.

All the chaos has been a boost for gold and gold stocks

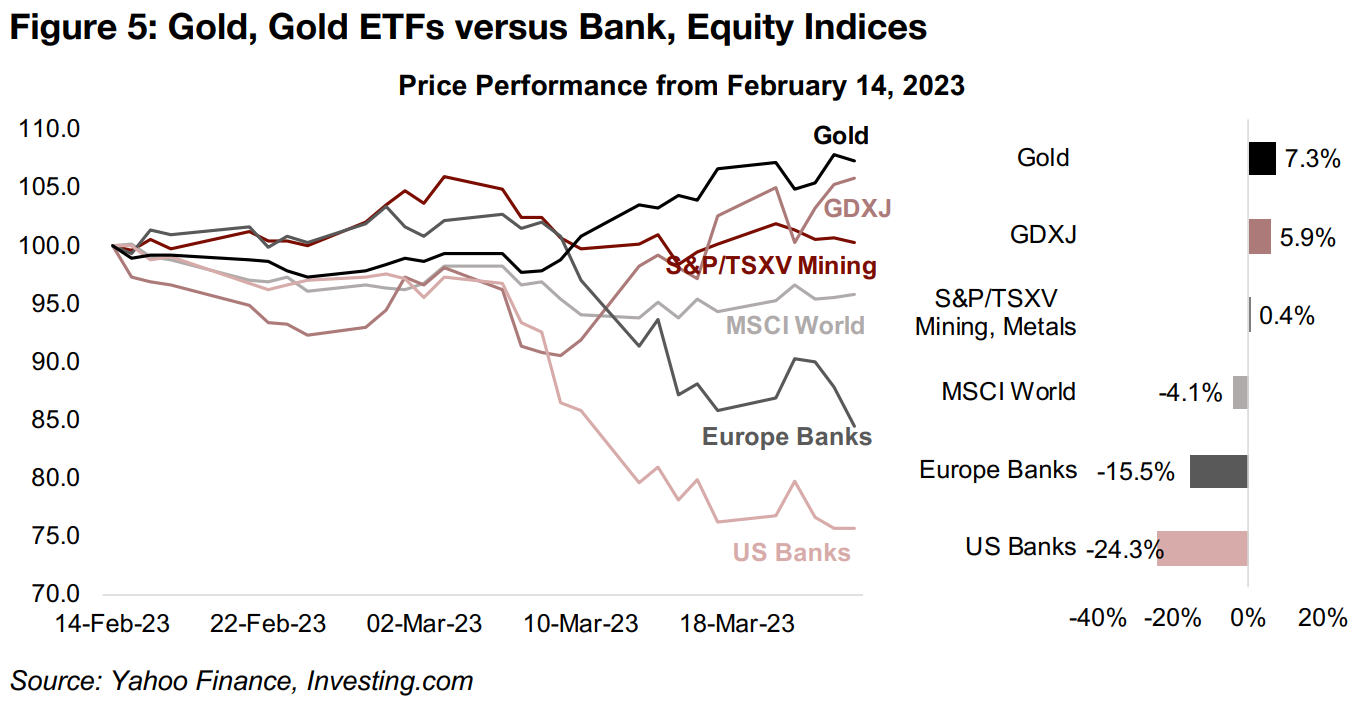

The banking sector's loss has been the gold sector's gain, with gold up 7.3% since

February 14, 2023, while European banks slumped -15.5% and US banks collapsed

-24.3%, compared to a moderate -4.1% decline in the MSCI World (Figure 5). The

S&P/TSXV Metals and Mining Index edged up 0.4%, as its large gold component was

offset by a heavy weighting to base metals and lithium, which have been under

pressure. The GDXJ, an ETF comprised of only junior gold stocks, is up 5.9%,

outperforming the MSCI World by 10.0%, and trouncing the US banks by over 30.0%.

We expect that there is more disruption to come, with the US Effective Federal Funds

rate at 4.83% after this week's hike, now up 60x off 0.08% lows just over a year ago.

Combining the continued fallout of the banking crisis, the likely eruption of additional

economic issues, and further geopolitical issues, some analysts' forecasts for

US$2,500/oz gold this year are not looking unachievable. Even a US$3,000/oz target,

which might have seemed far too aggressive at this time last year, while still a bit of

a stretch, no longer seems to be simply wishful thinking from perma-gold bulls.

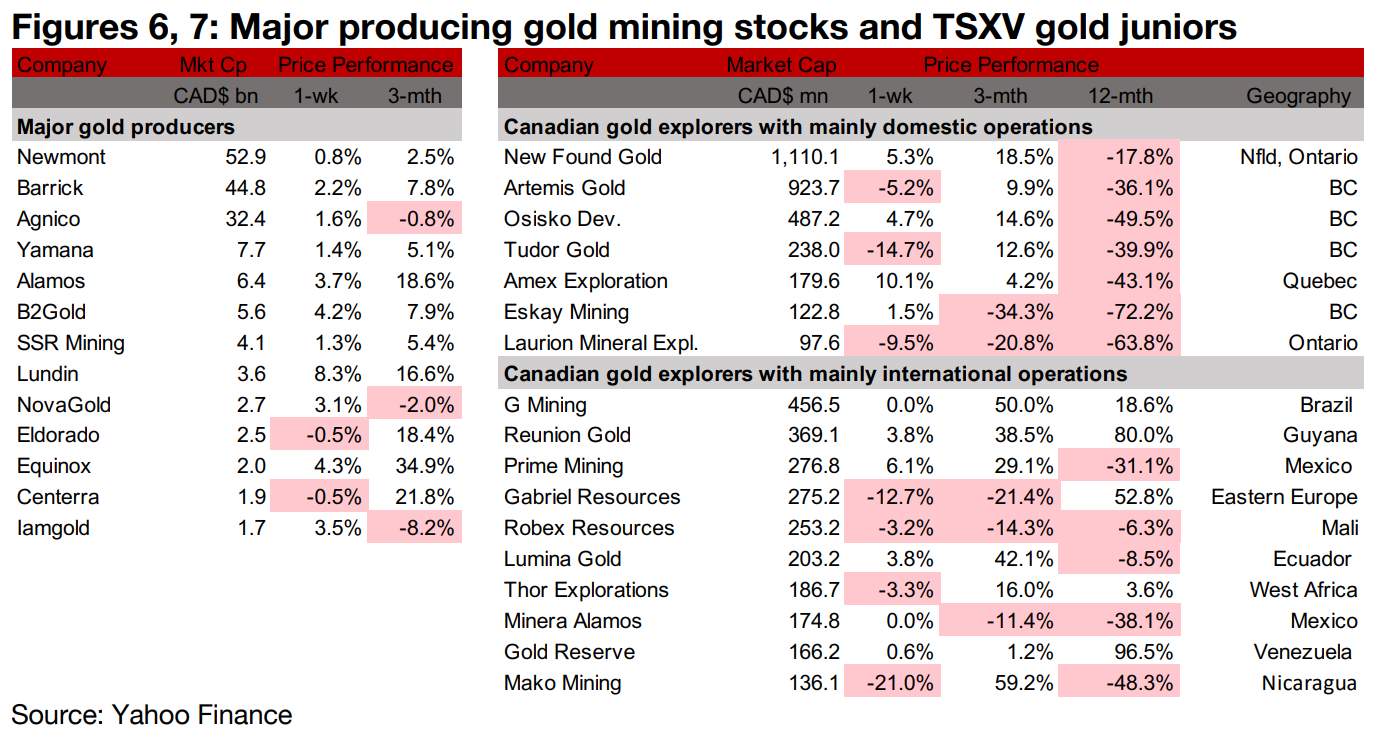

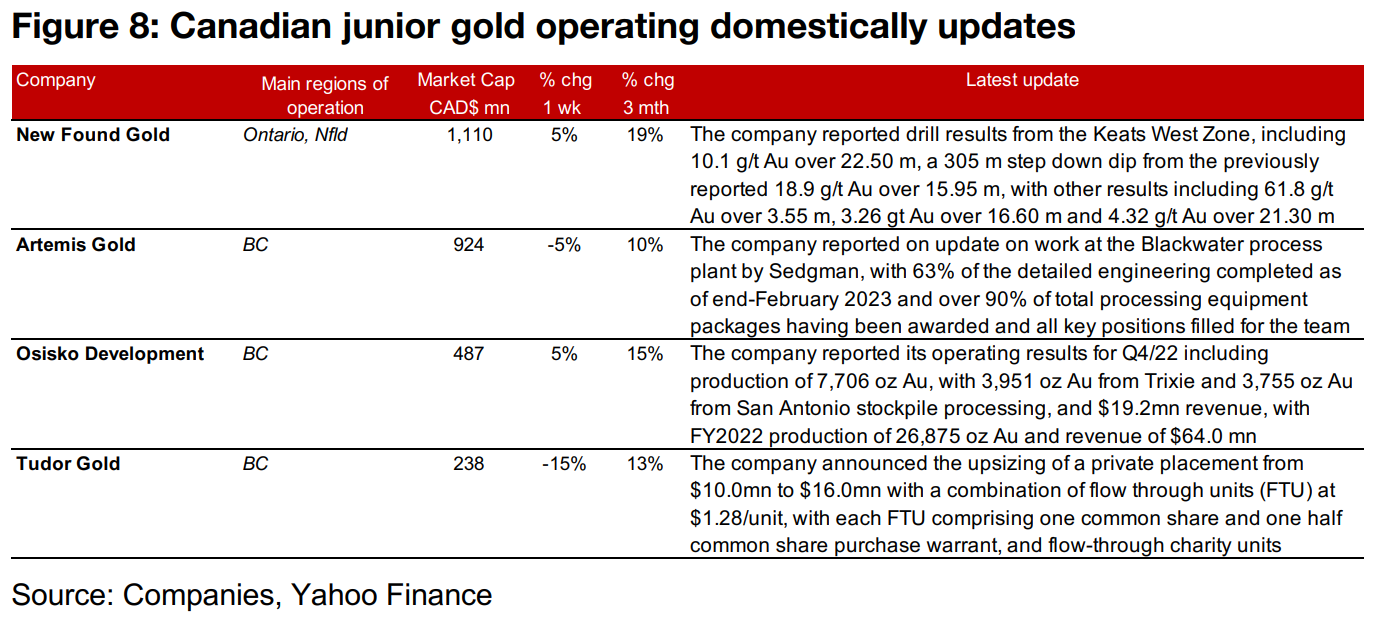

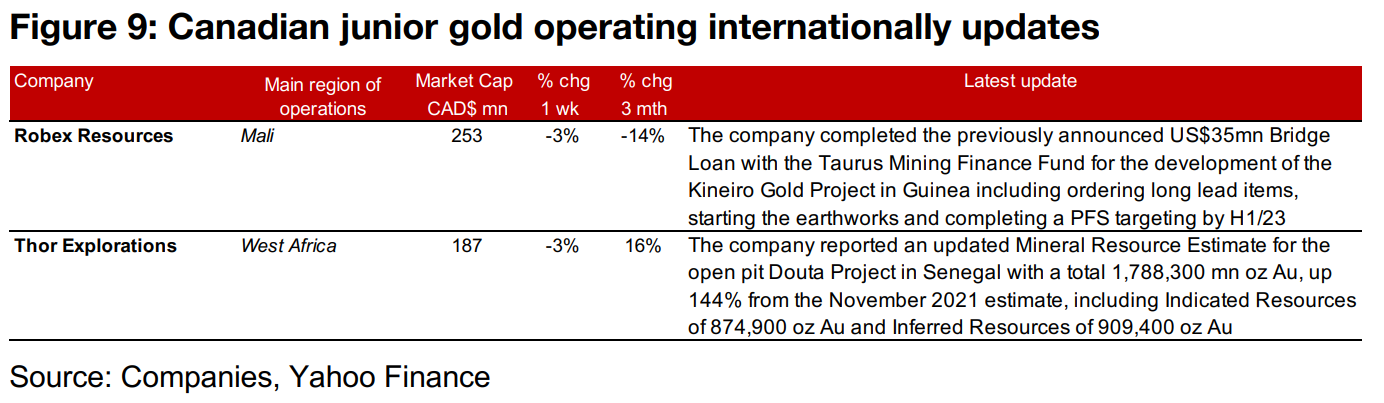

Gold producers mostly gain and TSXV gold mixed

The producing gold miners were mostly up and the larger TSXV gold stocks were mixed as gold and equity markets rose (Figures 6, 7). For the Canadian juniors operating mainly domestically, New Found Gold released drill results from Keats West, Artemis reported an update on work at Blackwater process plant, Osisko Development reported Q4/22 results and Tudor Gold announced a $16.0mn private placement (Figure 8). For the Canadian juniors operating mainly internationally, Robex Resources completed a US$35mn bridge loan with Taurus Mining Finance and Thor Explorations issued an updated Resource Estimate for the Douta project (Figure 9).

In Focus: Thor Explorations

Segilola 2022 production at top of guidance and Douta Resource up 144%

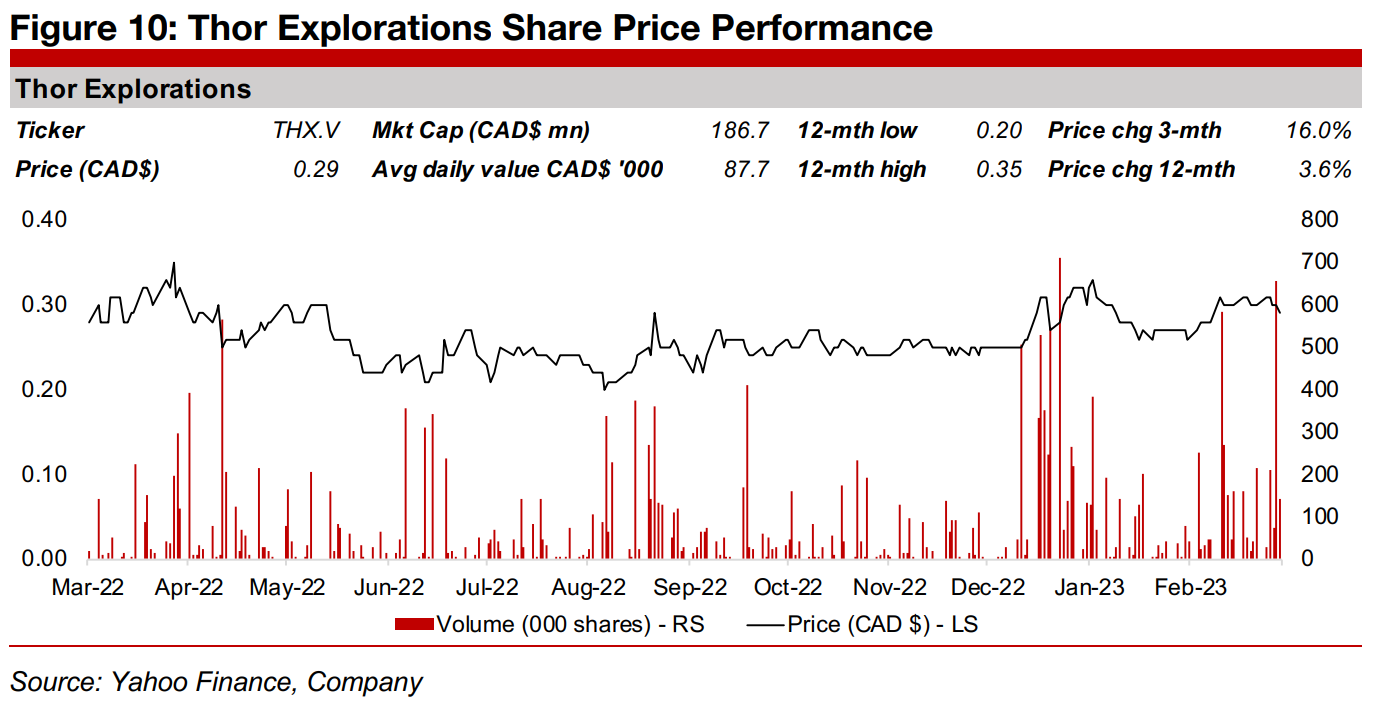

This week Thor Explorations is In Focus, one of the larger TSXV gold producers, at a

market cap of $186.7mn, with its stock is up 3.6% over the past year, a period when

many of the larger TSXV gold stocks saw substantial losses (Figure 10). The share

price has been supported by the Segilola mine in Nigeria, which has entered its

second year of commercial production, and its development stage Douta project in

Senegal, for which an updated mineral resource estimate was recently released.

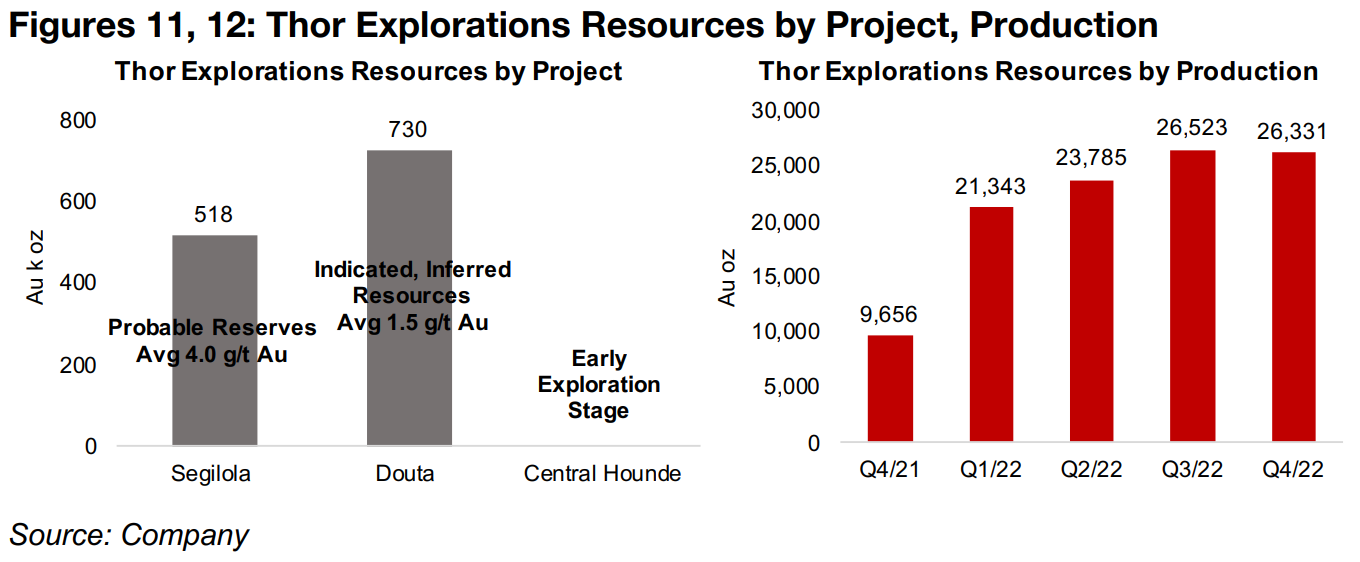

Segilola has Probable Reserves of 518k oz Au at 4.0 g/t Au, and produced 98k oz Au over 2022, near the top end of its 2022 guidance for 90k-100k oz Au, and the company is guiding for 85k-95k oz Au for 2023, an increase from an estimate in 2021 for just 76.9k oz for this year (Figures 11, 12). The Resource Estimate update for Douta was released in March 2023 with a 144% increase in total Resources to 1.78mn oz Au, comprising 0.87 mn oz Au in Indicated and 0.91 oz Au in Inferred Resources. The average grade for Douta, at 1.5 g/t Au, is considerably below Segilola, at 4.0 g/t Au.

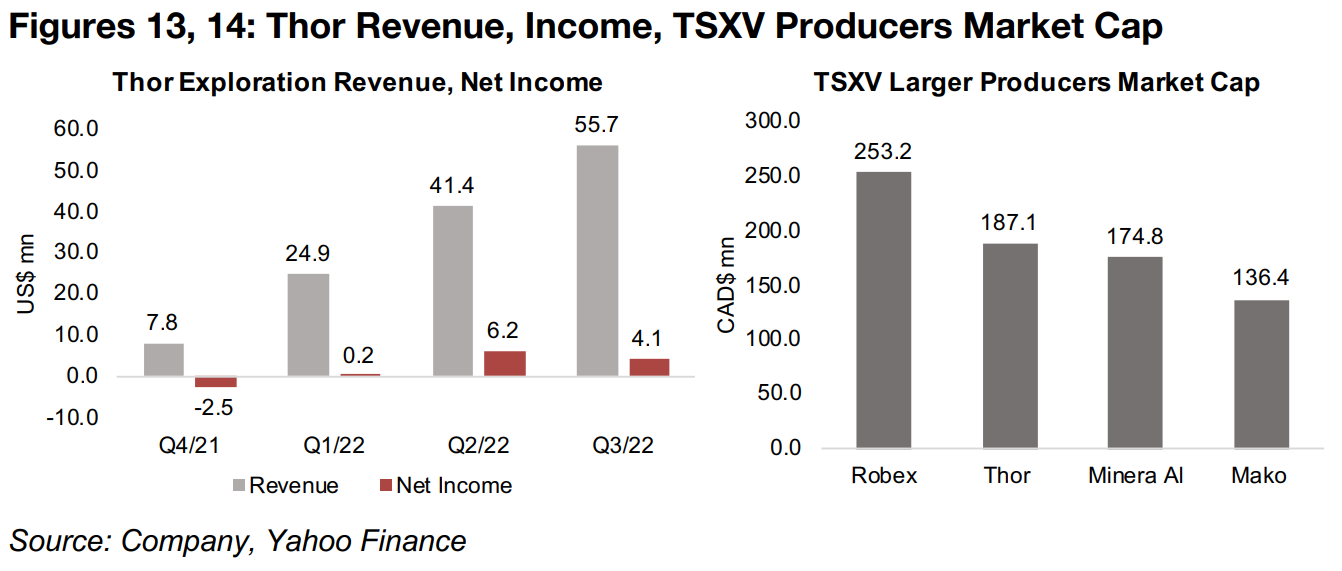

Internal cash generation funding project advancement and debt reduction

Rising production at Segilola has driven up revenue from US$7.8mn in Q4/21 to $55.7mn in Q3/22, and earnings from a $-2.5mn loss in Q4/21 to a $4.1 net income in Q3/22. Profitable gold companies on the TSXV are rare, and we could see investor interest shift more to this segment if markets cool further and raising capital becomes more difficult for pre-revenue juniors. Thor will be able to use its internal cash flow to continue to explore at Segilola and Douta, which remain open for expansion, as well as advance the latter towards a PEA. The company also has had sufficient cash to continue reducing its debt, which declined -30% year on year to $49.6mn as of Q3/22, with net debt to equity falling to 0.74x from 1.19x over the period.

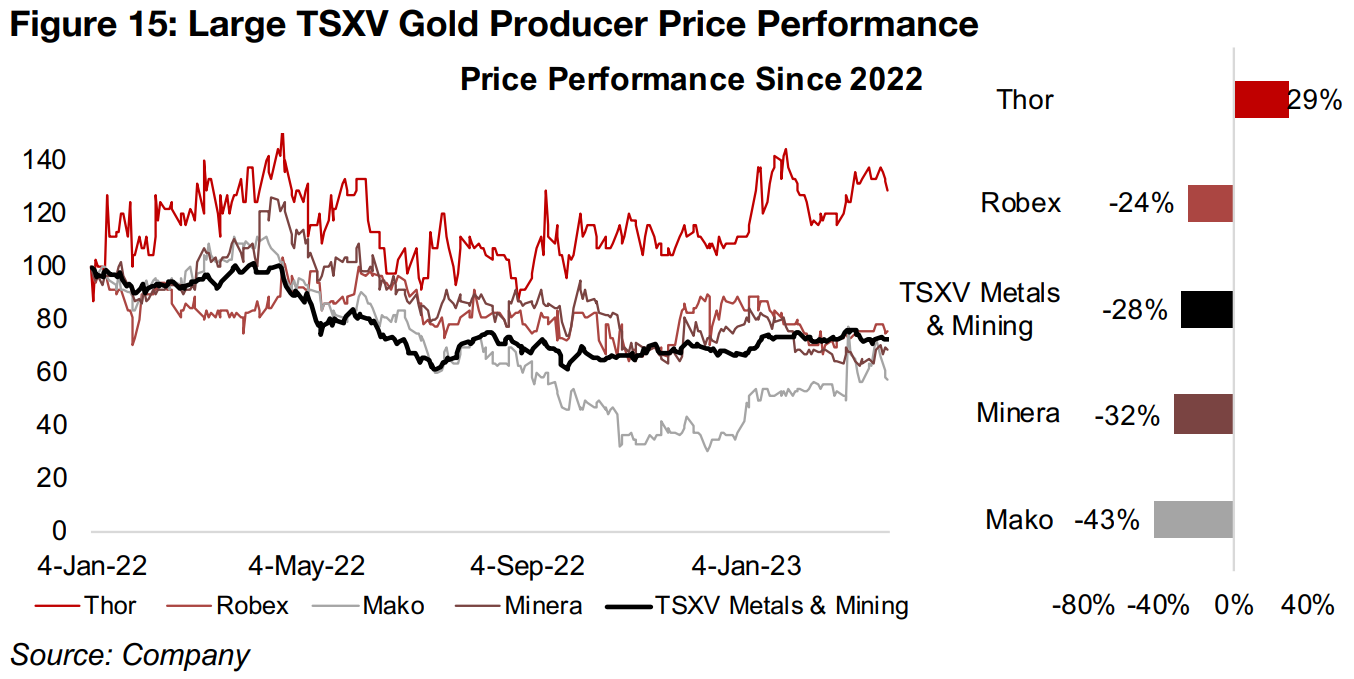

Thor Explorations' stock outperforming other large TSXV producers

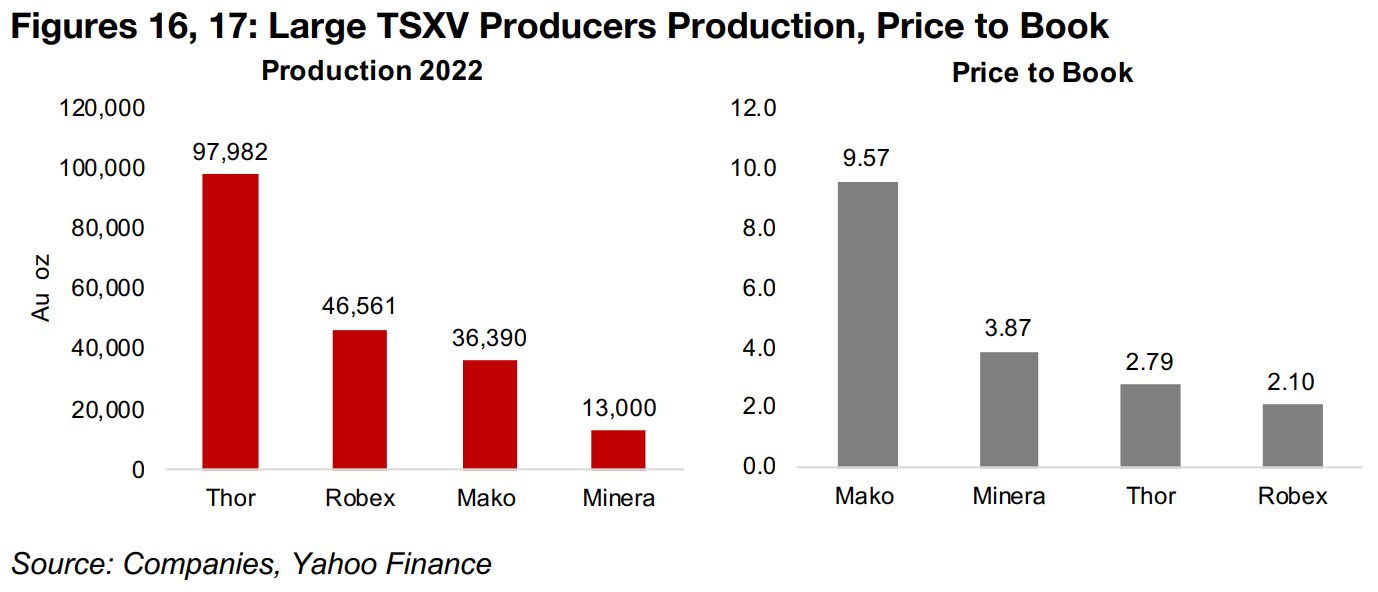

The strong operational progress of Thor Explorations has seen it outpace other large TSXV producers, with its stock up 29% over the past year, compared to more than a -20% decline for Robex, Minera Alamos, Mako and the S&P/TSXV Metals and Mining Index (Figure 15). Thor's 97.9k oz Au 2022 production is large compared to this group, with Robex at just about half this level, at 46.5k, Mako slightly below Robex at 36.4k oz Au, and Minera Alamos with the smallest output, at just 13.0k oz Au (Figure 16).

The company's price to book multiple is the third highest of the group, at 2.79x, but we note that both Mako Mining and Minera Alamos have particularly low equity bases from deficits in previous years, making these ratios skewed to the upside and not necessarily reflecting outsized support by the market (Figure 17). A 'normalized' price to book for the average small junior producer would be somewhere in the range of 1.5x to 3.0x, putting Thor towards the high end and Robex towards the middle.

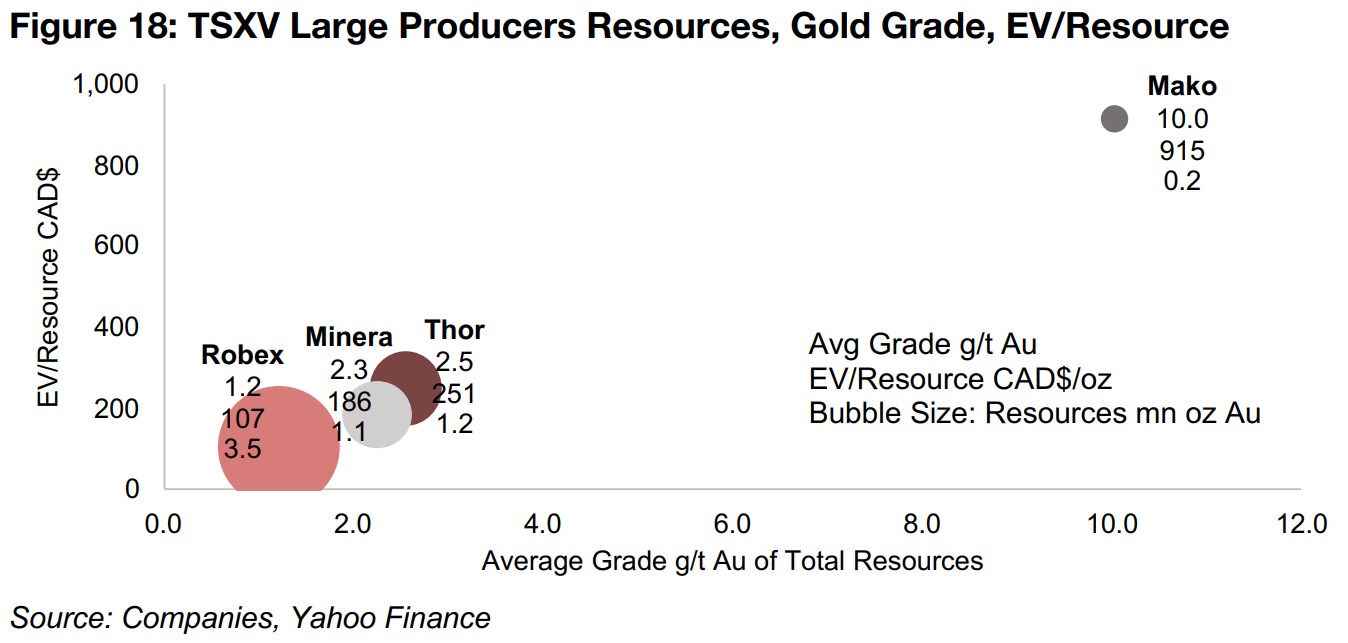

A clearer perspective on the relative valuation of the companies can be gained by comparing the average grade of their total Resources in g/t Au to their Enterprise Value/Resource, in CAD$/oz, with the Enterprise Value comprising the market cap and net debt. The market is paying an increasing amount in EV/Resource for higher grades, as expected, with Robex commanding $107/oz for an average grade of 1.2 g/t Au over its Resource base, Minera $186/oz for 2.3 g/t Au, Thor $251/oz for 2.5 g/t Au and Mako the outlier, with a $915/oz EV/Resource far above the others because of a grade of 10.0 g/t Au, four times that of Thor Explorations (Figure 18).

Thor's premium EV/Resource valuation versus comparable Minera Alamos

While the spread in the EV/Resource valuation between Robex and Mako versus Thor and Minera can be justified by the wide spread in grade, Thor and Minera have a similar grade and level of total Resources but Thor is afforded a substantial premium by the market. This could be attributed to Thor's strong operating news flow over the past year, including reaching the top end of guidance, a substantial increase in the Douta resource, and a large debt reduction, while Minera's production was limited over the past year because of drought conditions at its mine.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.