January 22, 2021

Silver versus Gold; Prices, ETFs and Junior Miners

Author - Ben McGregor

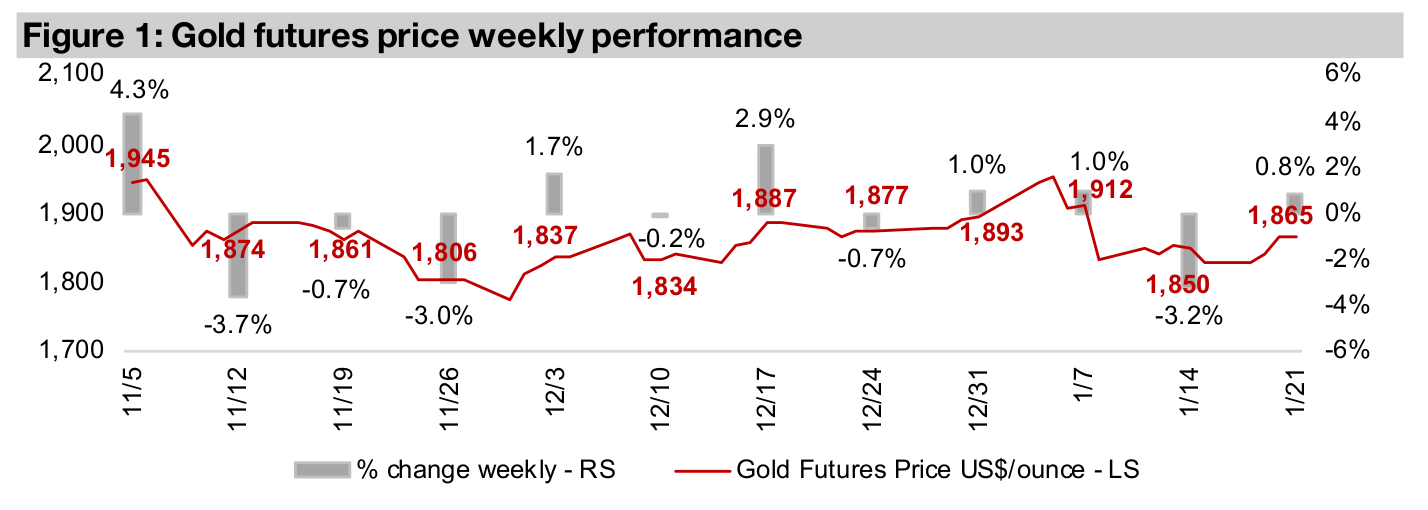

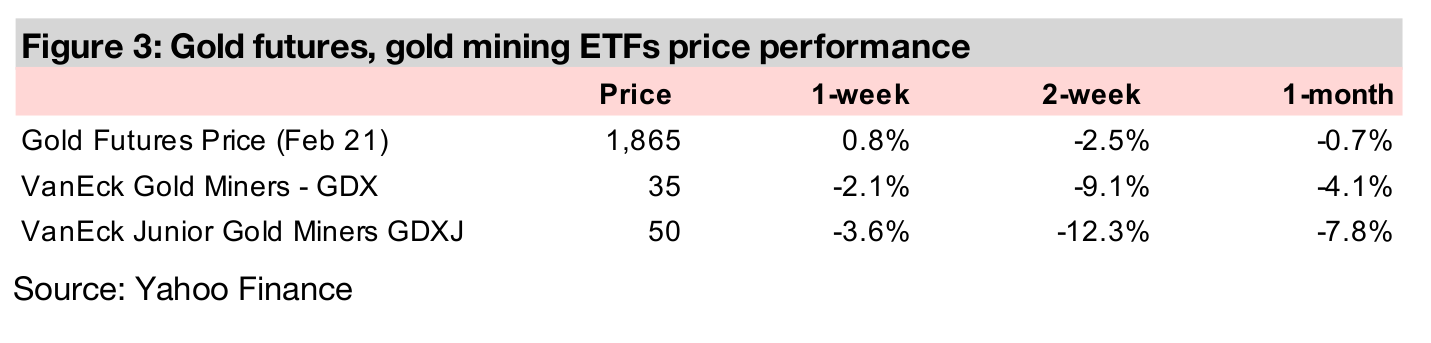

Gold edges up off ten-week lows

Gold edged up from ten-week lows hit last week, rising 0.8% to US$1,865/oz, as the new administration in the US started and there were comments from the new Treasury Secretary that low rates and high state spending were likely to continue.

A look at silver versus gold including prices, ETFs and junior miners

This week we take a look at the performance of silver versus gold over the past year, the performance of the major ETFs for each metal, and give updates on the major Canadian silver junior miners and their performance relative to Canadian gold juniors.

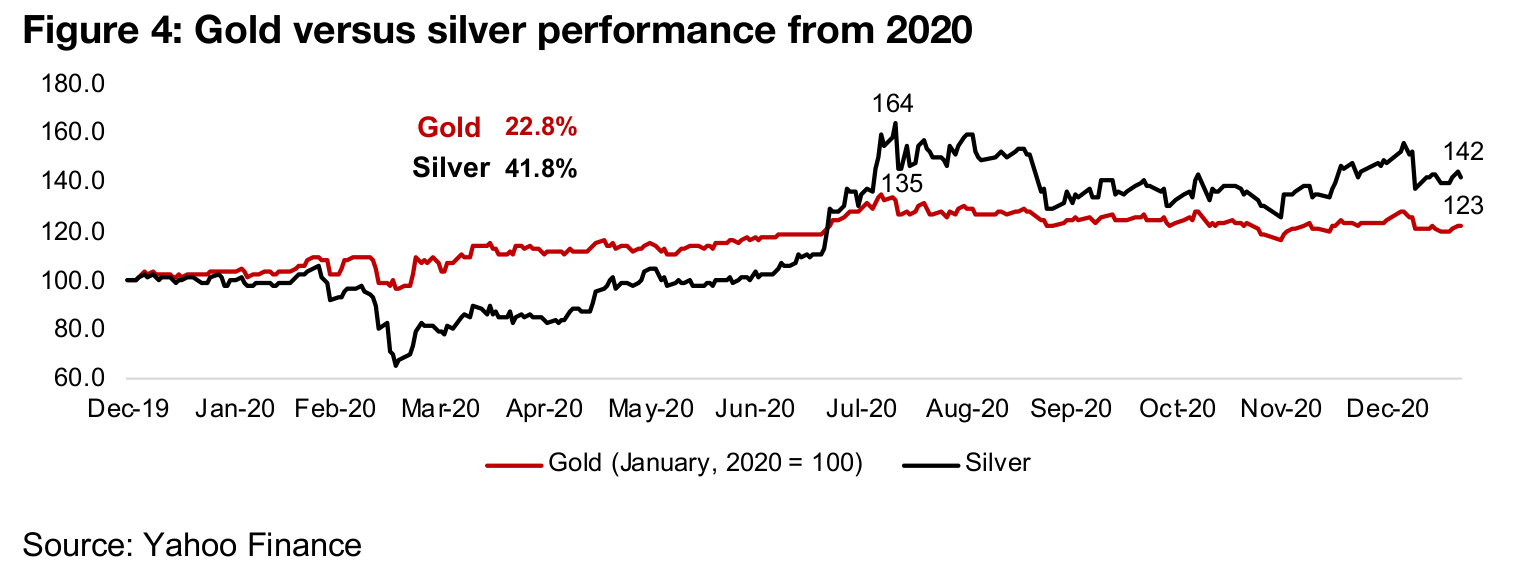

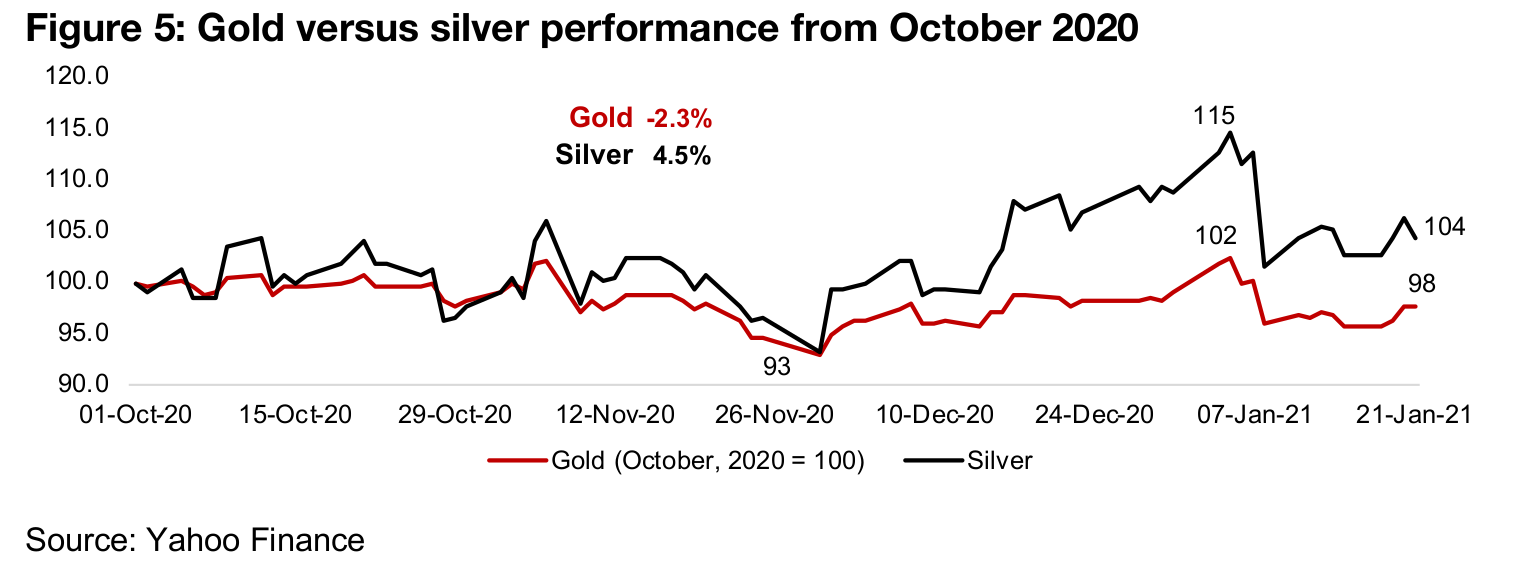

Silver outpacing gold moderately, gold-silver ratio in balance

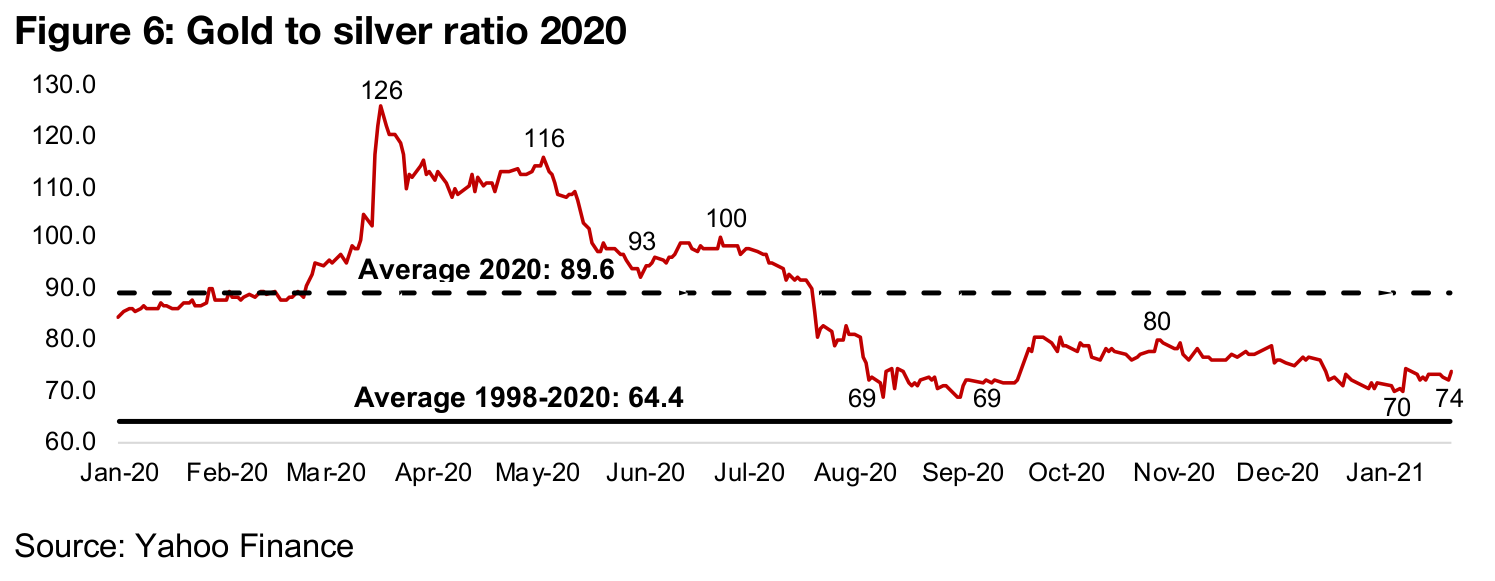

While gold had a big year in 2020, up 22.8%, it had 'split' some of its gains with the previous year, as it started to take off from mid-2019 (Figure 4). Silver, in contrast, really was a 2020 story, gaining 41.8%, and more specifically a second half of 2020 story, with most of the gains happening from July 2020. Silver's lead has continued over Q4/20 to the present, rising 4.5%, while gold declined -2.3%, although these moves are muted compared to those in the first three quarters of 2020 (Figure 5). One reason for these relatively subdued shifts could be that the gold to silver ratio has come much closer inline with historical averages at 64.4 from 1998 to 2020.

Heading into 2020, this ratio had already been high, above 80, because of gold's pick up in H2/19, and it spiked to historical highs of 126 in March 2020 (Figure 6). This suggested that either gold was due for a retracement, or silver for a spike, and in the end, silver jumped, and the gold to silver ratio contracted to just 69 by mid-2020, or around the medium-term average. The ratio picked up again to 80 by November, this time on a pull-back in silver, but has come down to just above 70 currently. This leaves it in a somewhat neutral state as regards the relative gold to silver price, without substantial over or under valuation on a historical basis, so the question of 'where to next' for gold and silver in relative terms is not particularly clear.

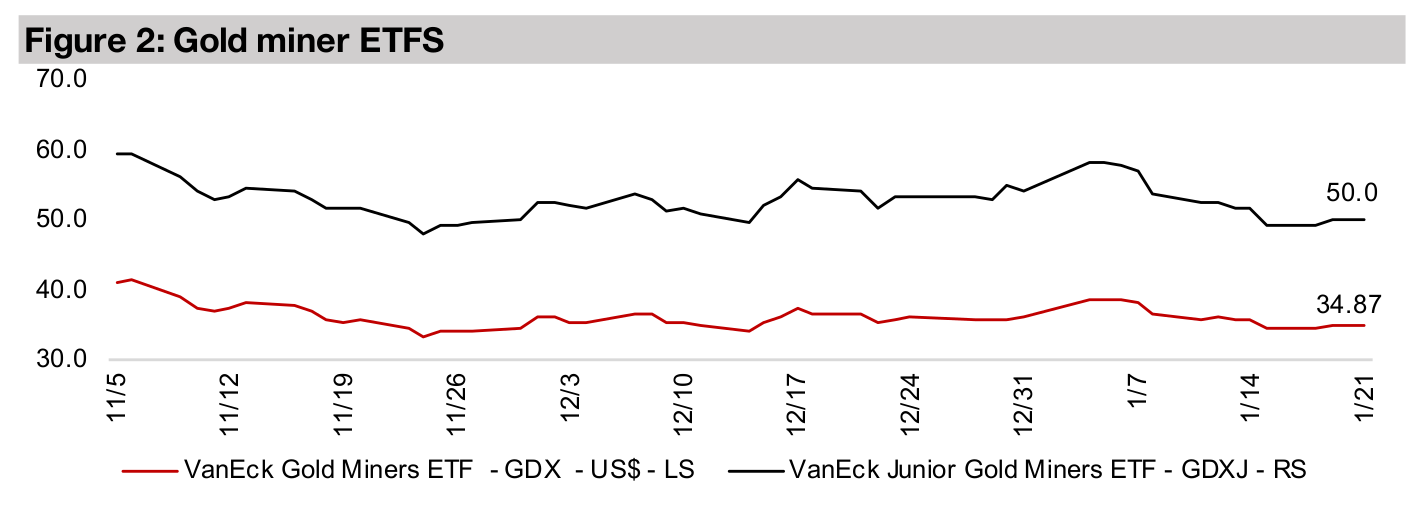

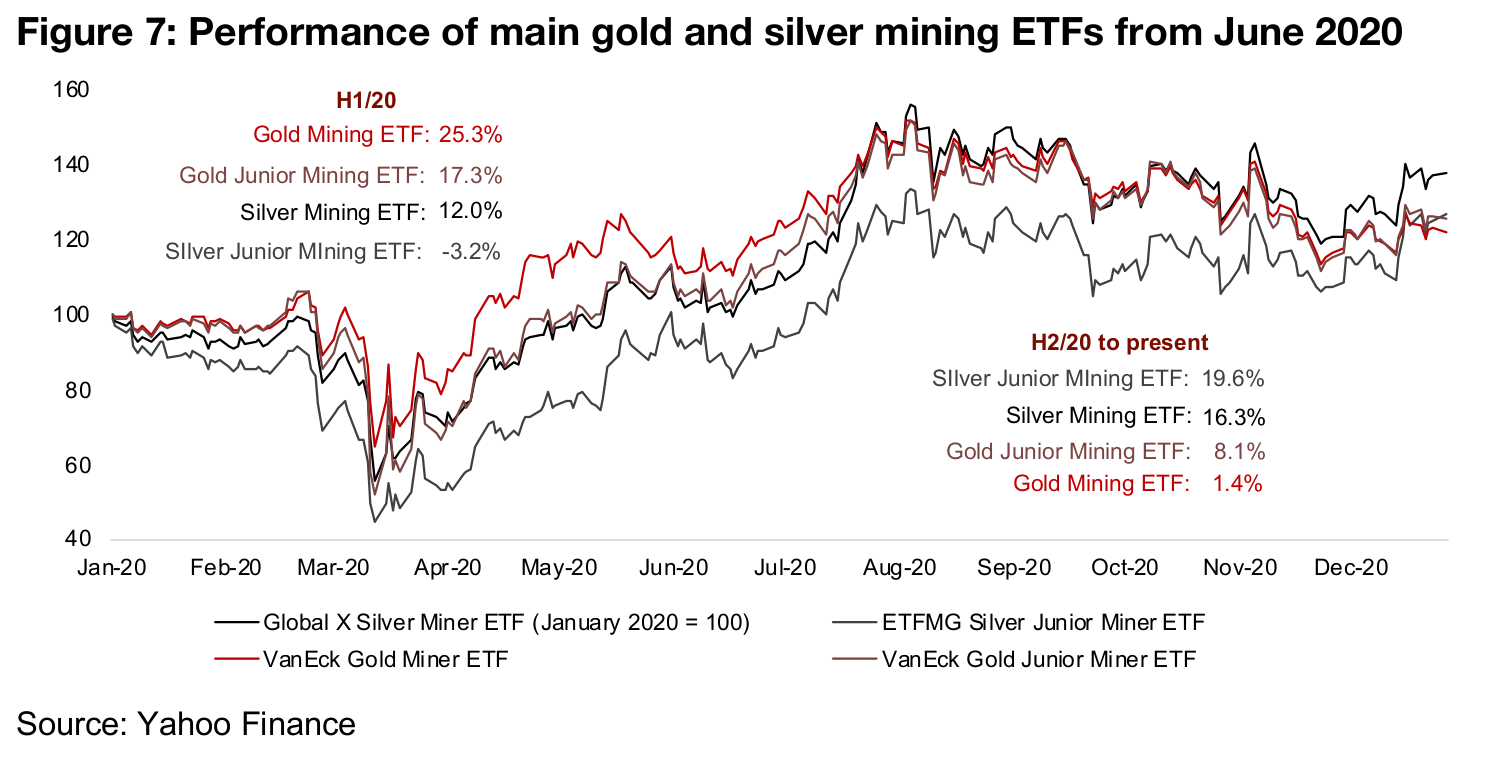

Total reversal of gold and silver ETF winners from H1/20 to H2/20

If we order the gold and silver ETFs in order of risk at the start of 2020, especially in the context of rising gold, we would have probably ranked it gold miners, gold juniors, silver miners and then silver juniors (Figure 7). As of mid-2020, this order would have definitely provided the highest gains, with the gold miner ETF gaining 25.3%, the gold junior miner ETF 17.3%, the silver miner ETF 12.0%, and the silver junior miner ETF declining -3.2%. However, this was entirely flipped in H2/20 from the surge in silver, with the silver junior miner ETF the big winner, up 19.6%, the silver miner ETF up 16.3%, the gold junior miner ETF up 8.1%, and H1/20's big winner, the gold miner ETF, eking out just a 1.4% gain. However, a lot of these imbalances from 2020 now seem to be worked out, and while we expect both gold and silver ETFs are likely to do well in 2021 the relative winner between gold and silver remains a bit unclear. We would lean towards both the riskier junior miner ETFs possibly seeing the chance for outperformance if the strong metals prices continue.

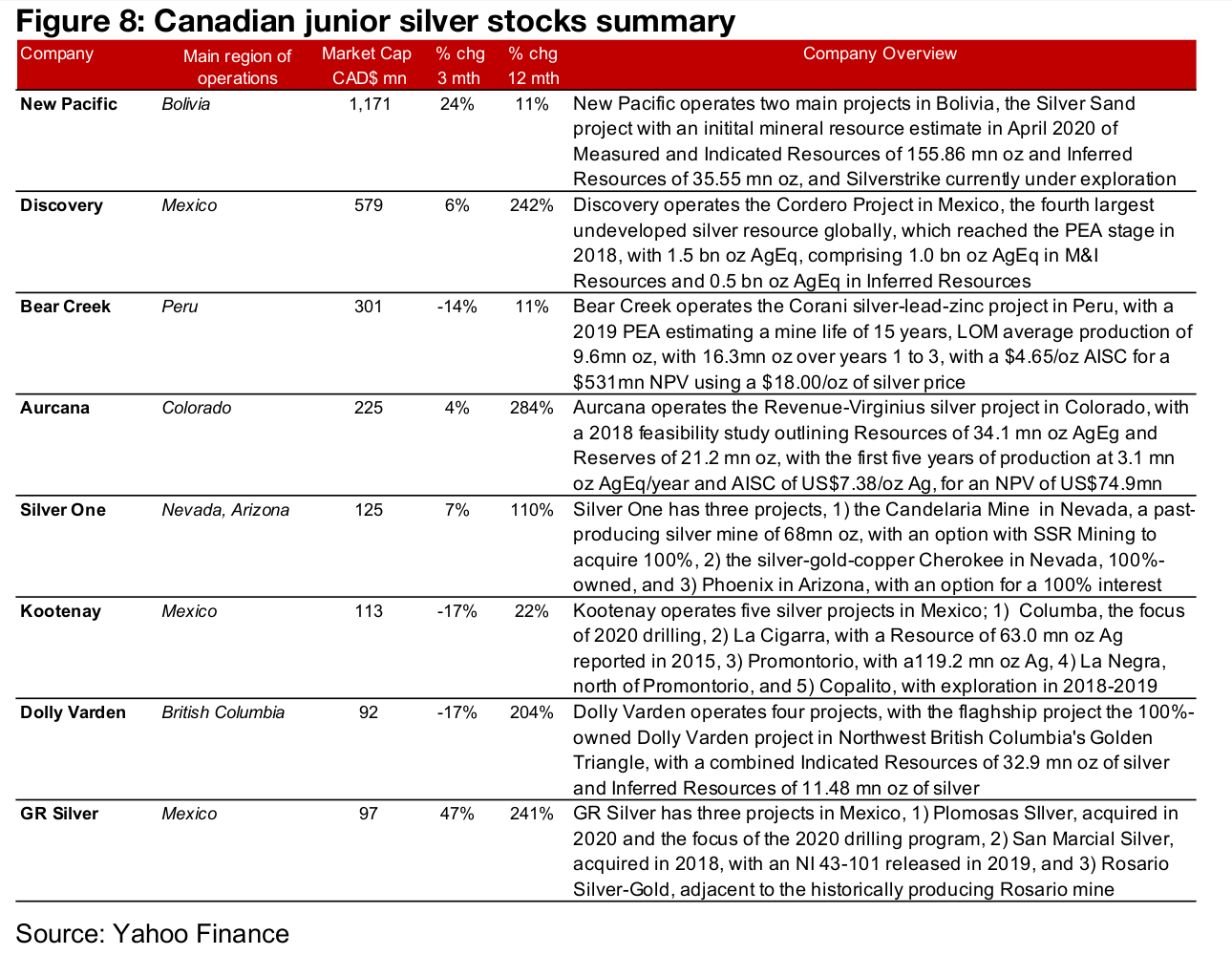

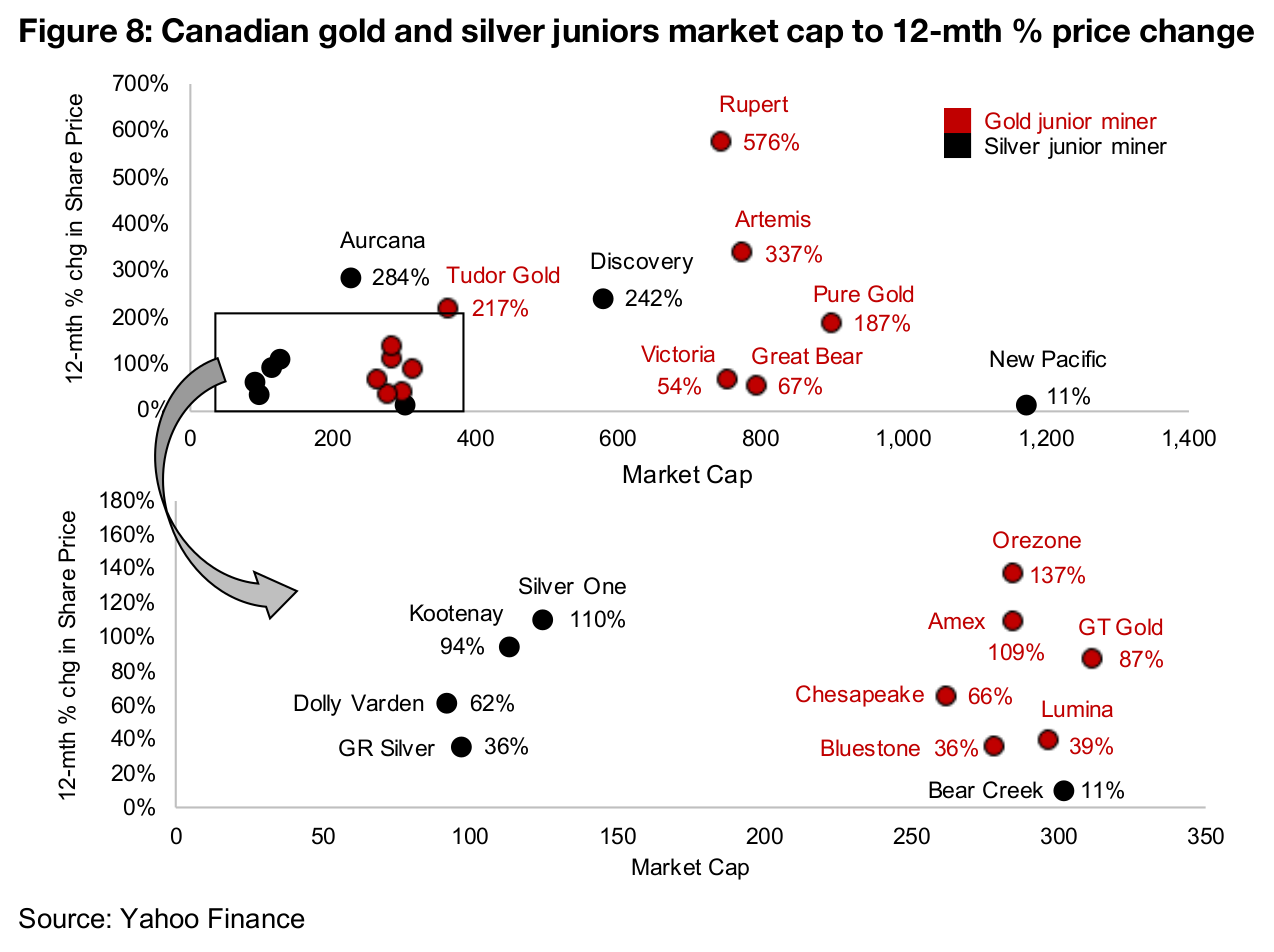

Large cap silver juniors split between big gains and quite flat

Given the surging silver price over the past year, all of the major Canadian silver

juniors made gains. However, anything below around 100% actually looks a bit weak

in the context of this group. One example is New Pacific Metals, the largest cap

Canadian junior silver stock, operating the Silver Strike project in Bolivia, which was

up just 10% over the past year (Figures 8, 9). While the company had substantial

news flow over 2020, including an initial Resource Estimate and continued

exploration results from Silver Sand, it did see a replacement of its CEO in April, 2020,

and the market saw opportunities for better gains elsewhere. Bear Creek is another

example of a company that has not been able completely ride the silver wave, up just

15% since 2020, as it had very limited news flow over most of 2020 on progress on

its main Corani project, which saw a Feasibility Study released in 2019.

The biggest gainer for larger cap silver juniors was clearly Aurcana Metals, surging

284% since 2020, as the company continued to make progress on bringing the

Revenue-Virginius project in Colorado in the US, where a Feasibility Study was

released in 2018, into production. This included a series of capital raisings totalling

$20.6mn and a US$28mn term-loan secured at the end of 2020. Discovery Metals

has also seen a strong performance, up 242%, as it continued to advance the

Cordero project in Mexico, which reached a Feasibility Study in 2018, with drilling

results reported in nine out of the twelve months of 2020, and $50mn in financing

raised over the year.

Most mid-cap silver juniors see substantial gains since 2020

The four mid-cap Canadian silver junior miners have generally been strong over the

past year. GR Silver, with three mid-stage exploration projects in Mexico, has seen

the strongest performance of the four, up 241%, as it reported a continued series of

decent drilling results over 2020 from Plomosas and San Marcial projects. Dolly

Varden, operating four projects, including its Dolly Varden project in B.C.'s Golden

Triangle, was up 204%, with a 10,000 m drill program started in August, and a total

$24.7mn in financing raised in 2020.

Silver One rose 94% as it announced exploration progress at all three of its projects,

Candelaria and Cherokee in Nevada, and Phoenix in Arizona, raised financing of

$11.7mn, agreed to sell off its previously held Mexican silver assets, and began

trading in the US over the counter. Kootenay, the operator of five projects in Mexico,

including two with Resource estimates, was the laggard of the group, rising only 22%

over the past year, as a series of drilling results from the Columba and Copalito

projects, a joint venture with Aztec for the Cervantes project and $7.0mn in cash

raised lead to only a relatively moderate gain in the share price.

Gold juniors still seeing the really big market caps and gains

While the second half of 2020 did belong to silver, and the major Canadian silver juniors are seeing some impressive gains and rising to substantial market caps, the Canadian gold juniors are still seeing the really big market caps and gains, as shown in Figure 8. In terms of market cap, while New Pacific Metals does stand out as the largest market cap of the group, there are seven Canadian gold juniors that are above $350mn in market cap, while most of the silver juniors are between $50mn to $150mn. In terms of gains, Canadian gold juniors are also outpacing silver juniors, with stand outs including five stocks that have gained over 100% since 2020; Rupert, Artemis, Pure Gold, Orezone and Amex, compared to just two for silver, Aurcana and Discovery. Given the continued high silver price, and the fact that it really only began to pick up substantially in mid-2020, where gold had started to takeoff from mid-2019, there does seem to be room for some catch up in investment for junior miners on the silver side into 2021.

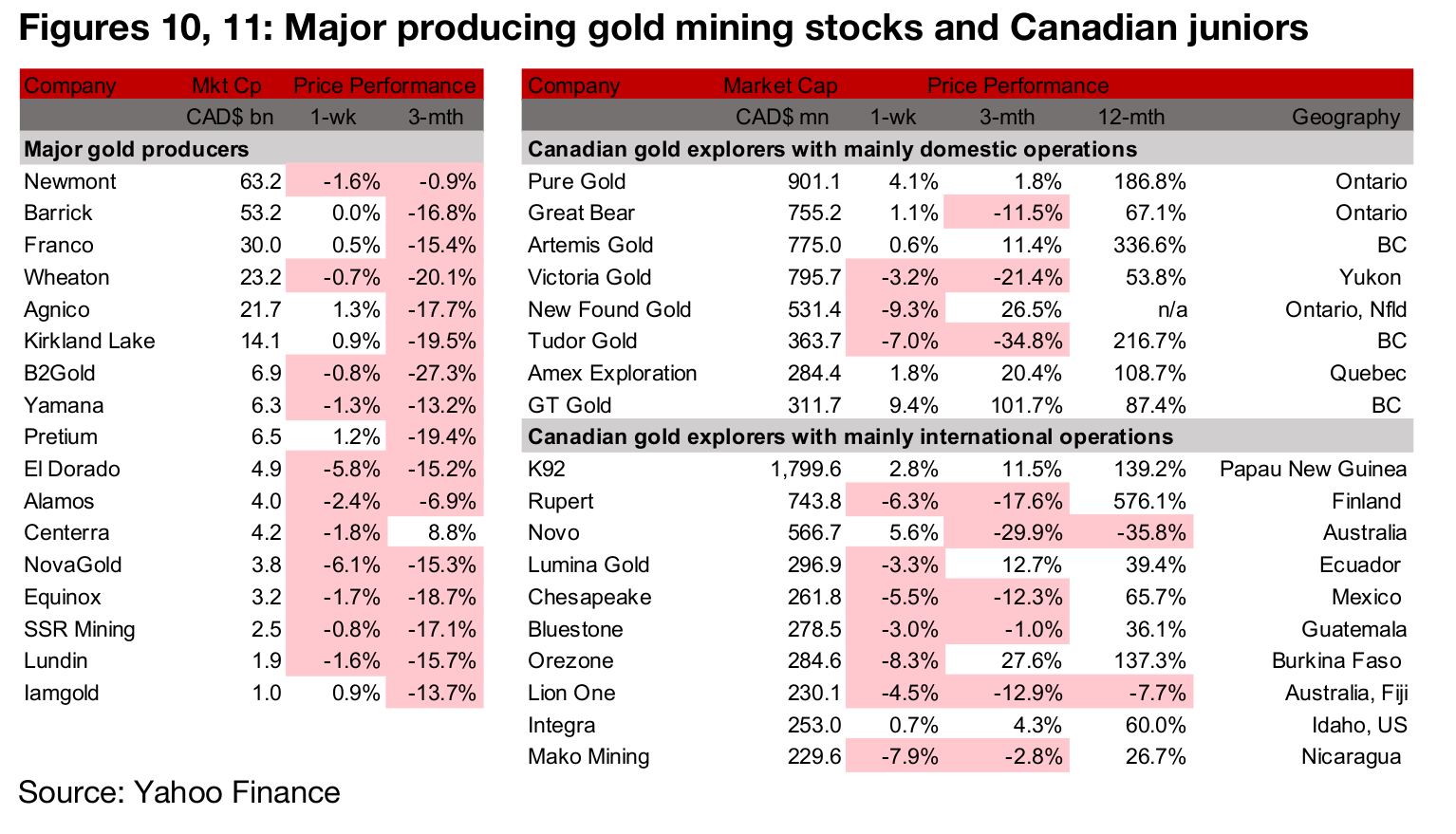

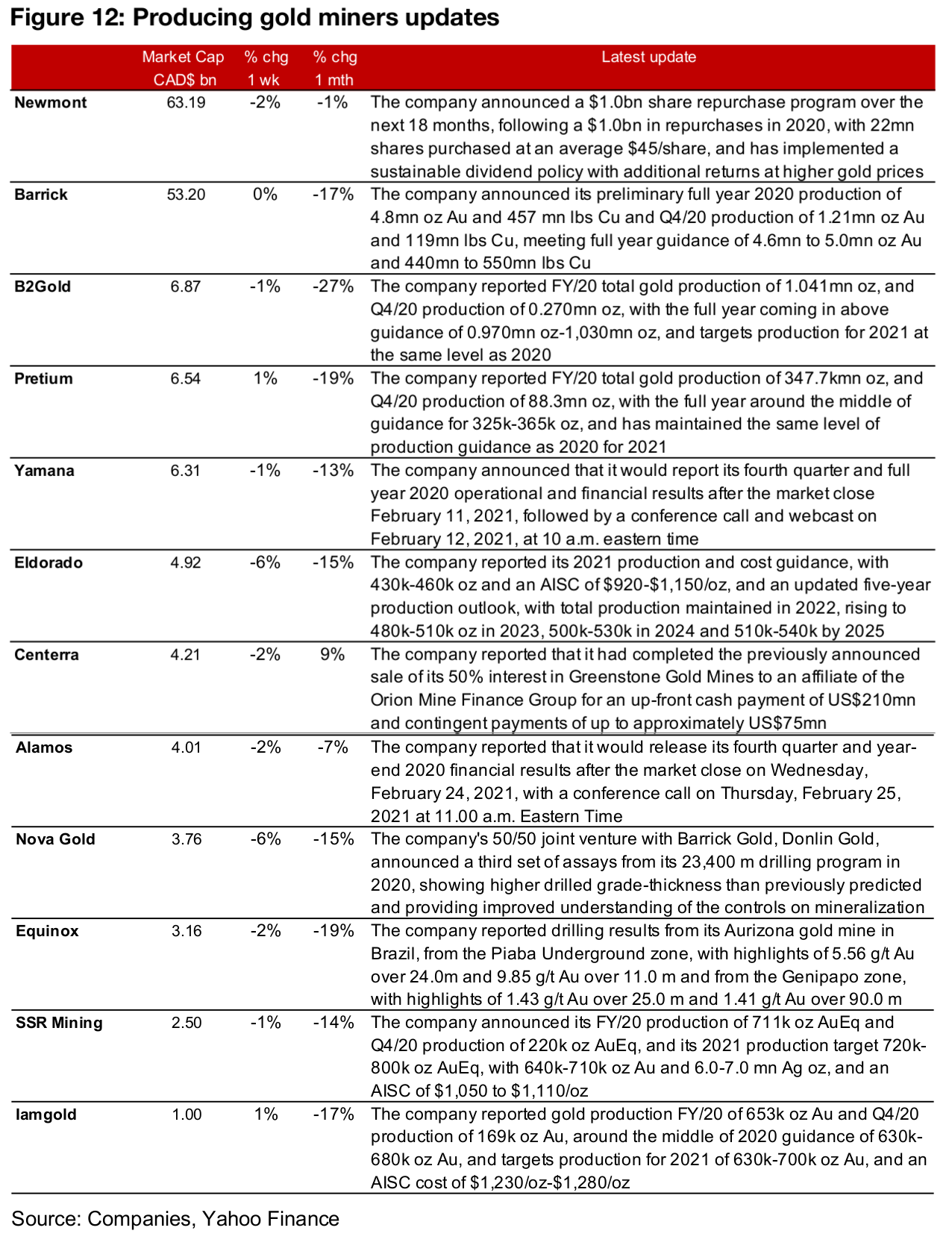

Producers begin reporting Q4/20 preliminary production

The producing miners were mixed this week as gold edged up (Figure 10). While Newmont reported details of its share repurchase program for 2020, most news was regarding preliminary gold production for full year 2020 and Q4/20, guidance for 2021 or upcoming Q4/20 results releases. Barrick, SSR Mining and Iamgold reported preliminary gold production, B2Gold and Pretium reported both preliminary gold production and 2021 guidance, Eldorado reported both 2021 and five-year guidance, and Yamana and Alamos gave details of upcoming Q4/20 results releases. Centerra reported the completion of the sale of its 50% holding of Greenstone Gold mines, Nova Gold reported new drilling results from its Donlin Gold joint-venture with Barrick, and Equinox reported drilling results from its Aurizona gold mine in Brazil (Figure 12).

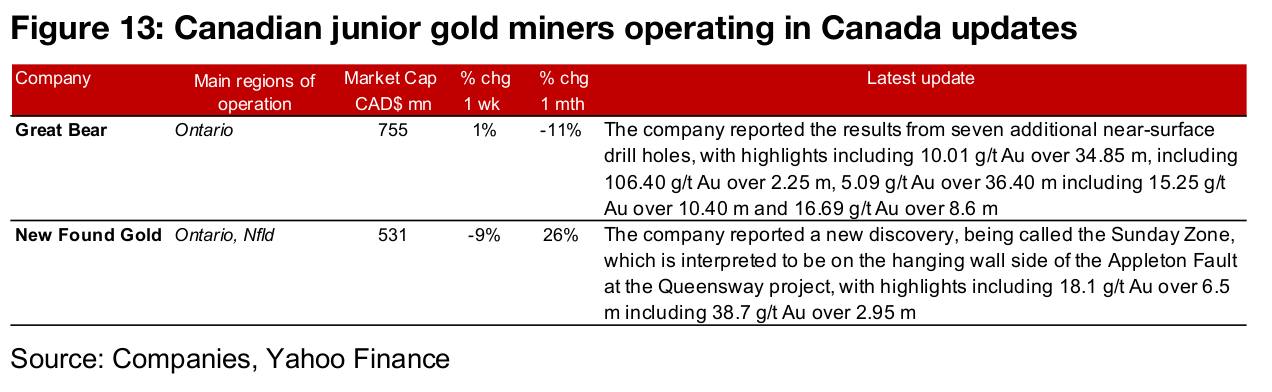

Canadian juniors mixed on gold uptick

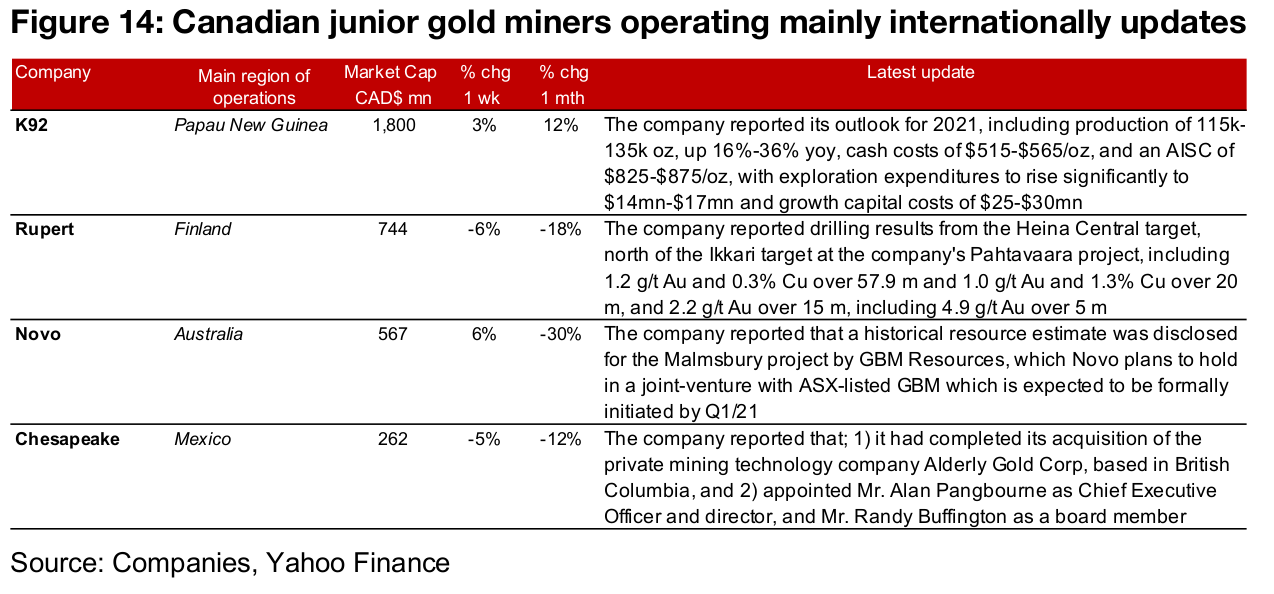

The Canadian juniors were mixed this week on the moderate uptick in gold (Figure 11). News flow from the Canadian juniors operating domestically was focussed on drilling results, from both Great Bear and New Found Gold (Figure 13). For the Canadian juniors operating internationally, K92 reported its outlook for 2021, Rupert reported drilling results from a new target, Heina Central, at its Pahtavaara project, Novo reported that historical resource was announced for the Malmsbury project, by its soon to be joint venture partner for the project, ASX-listed GBM, and Chesapeake reported that it had completed its acquisition of Alderly and announced a new CEO and other management appointments (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.