February 02, 2021

Silver Suppression?!

Wallstreetbets Reddit speculators set their sights on silver

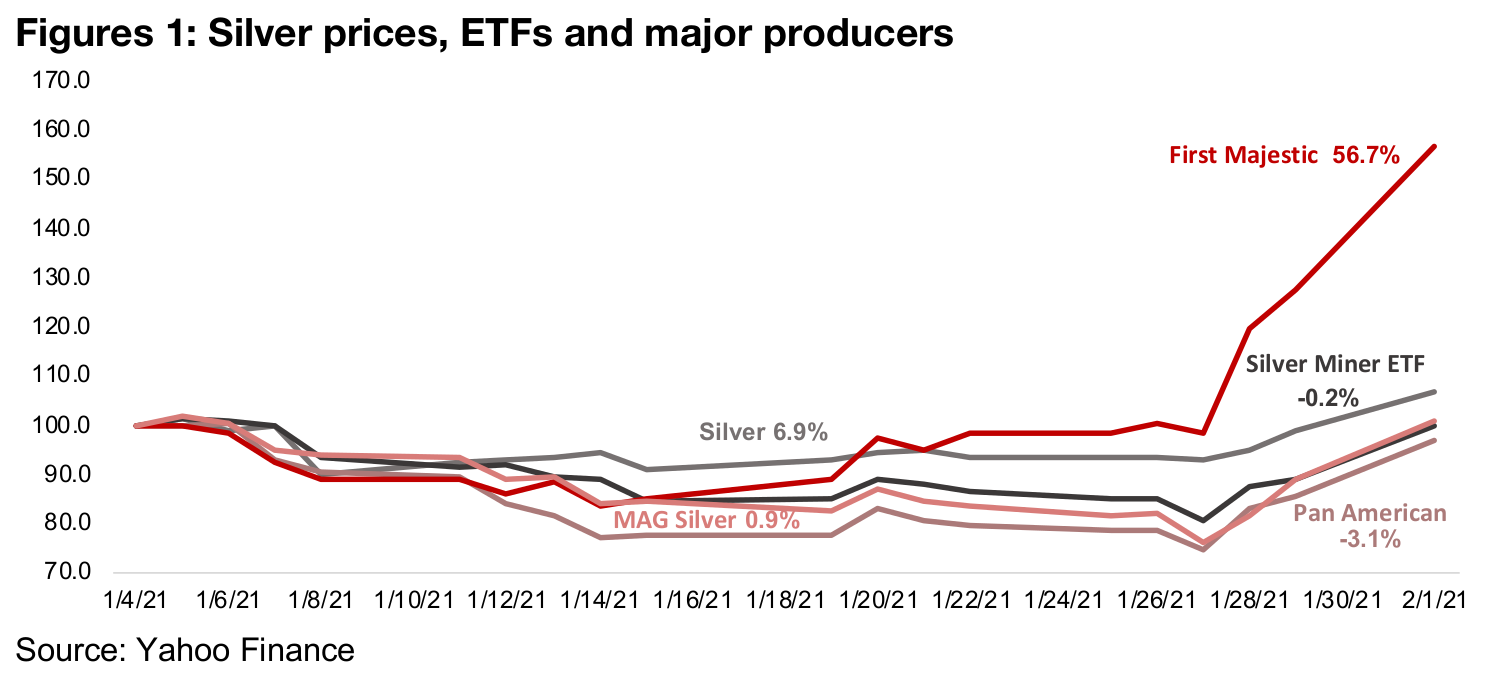

The WallstreetBets (WSB) Reddit speculators made major headlines over the past month going against hedge funds, shorting the company Gamestock, sending it soaring so high that even the US Congress is looking into the situation. These traders have now apparently set their sights on the silver market. In general, WSB has been backing stocks and markets they perceive as being unfairly manipulated by large market players, either funds or investment banks. There has been price action this week suggesting that WSB may be at work, with silver and SIL, a main silver miner ETF, picking up. However, so far really only a single name, First Majestic, has shown signs of a major pump, with it now up 56.7% for the month, with most of the gains in just the past couple of trading days, and the company confirming no fundamental developments warranting such a move (Figure 1). With silver jumping again in Monday's trading, other silver stocks are starting to rise, although it remains unclear whether WSB will push other stocks as high as they ostensibly have First Majestic.

WSB raising questions about short selling and market manipulation

It is clear that the WSB boost really can't be sustained over the long-term, and the fundamentals will eventually reign. Pumping up a single stock like Gamestop is one thing; manipulating the much larger silver market for any length of time is another issue altogether. However, these recent incidents do raise interesting questions about the nature of short-selling, and the degree of manipulation of markets in general. WSB's position is that large players in the market 'bully' companies with short positions, creating self-fulfilling prophecies unnecessarily driving stocks well below fundamental values, and for markets like precious metals, they suppress prices below fundamental levels. While we believe that WSB-generated froth will settle down eventually, it does lead us into a discussion of the opinions of many long-term champions of precious metals that these markets are manipulated by major players like investment banks and hedge funds.

Silver is a very small market compared to gold

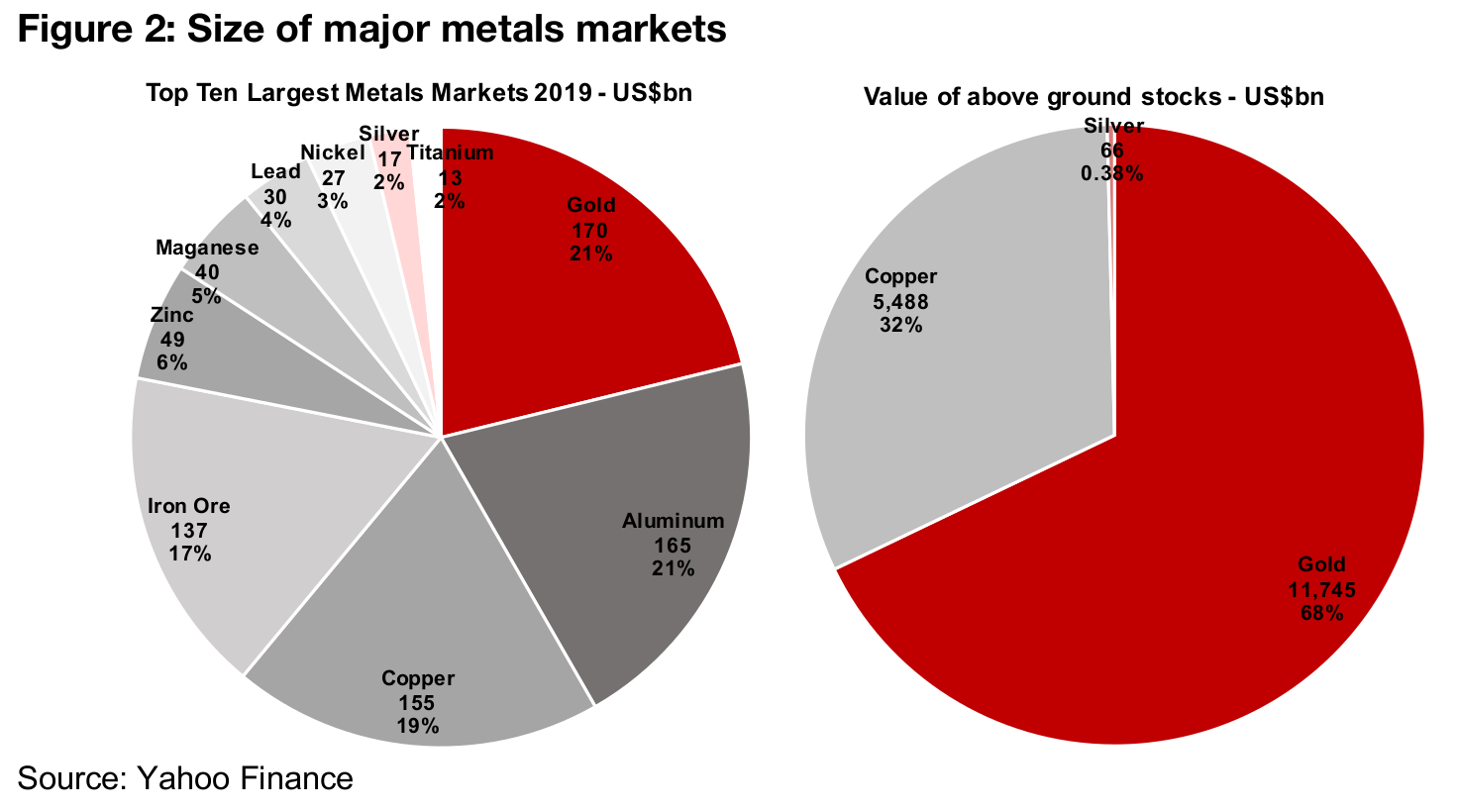

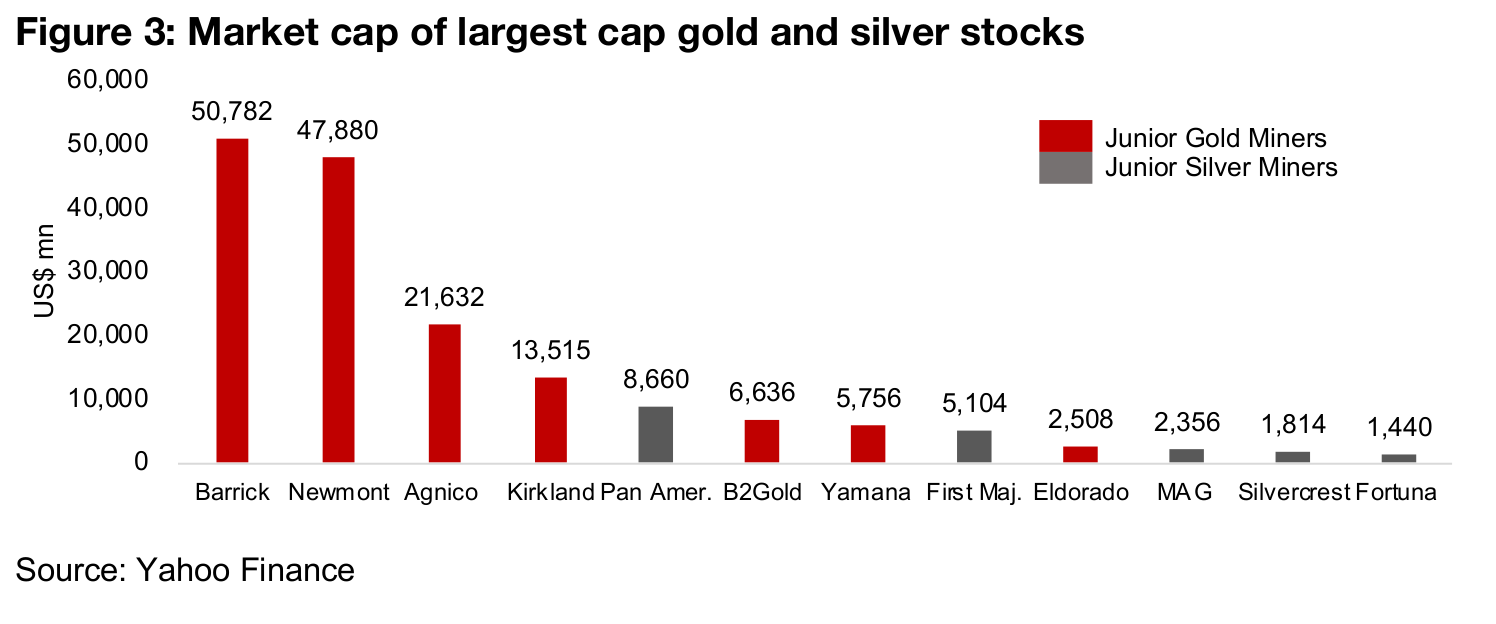

While there are claims of manipulation of both the gold and silver markets, it is only silver that is heavily in play now, in contrast to gold, which had a subdued week, and is way too big of a market for WSB to make a convincing run at. The silver market is very small compared to gold, ostensibly leaving it more amenable to manipulation. The value of the gold market was US$170bn market in 2019, or 21% of the top ten metals, versus silver, at just one-tenth the size, at just $17bn, or 2% of the top ten (Figure 2). Above ground stocks of gold are 197,756 tonnes, or 6,352mn oz, for a current market value of US$11,745bn, or 68% of the combined gold, copper and silver stocks, compared to just 2.457mn oz for silver, for a market value of US$66bn, or just 0.34% of the total value of these three. The market caps of the major silver stocks are also just a fraction of the major gold stocks (Figure 3).

Arguments for precious metals' price suppression

It's actually not really even a question of whether large institutions manipulate the gold and silver markets, and currency markets in general. Many court decisions and a series of fines from regulators have proven repeatedly that they do. There have also been historical cases of obvious attempts to corner the market. One example is the Hunt brothers, who in the early 1980s reportedly controlled one third of the silver market, although in the end the silver price collapsed, and the brothers lost massively. The real question is how much the manipulation is really able to move the prices of gold and silver away from fundamental values long-term, and for how long. Academic research does not show extensive manipulation of the precious metals markets over time, suggesting that such actions may work for a while, but that fundamentals always eventually reign. The current ramp up in silver and silver stocks by WSB is a case in point, as it is unlikely that moves based on momentum only will hold for long. Gamestop, their first target, has risen to completely unsustainable valuations, and is now likely to crash, however noble the intentions of WSB were at first.

The gold to silver ratio is key baseline fundamental metric

This all brings us back from the current speculation to the long-term fundamentals.

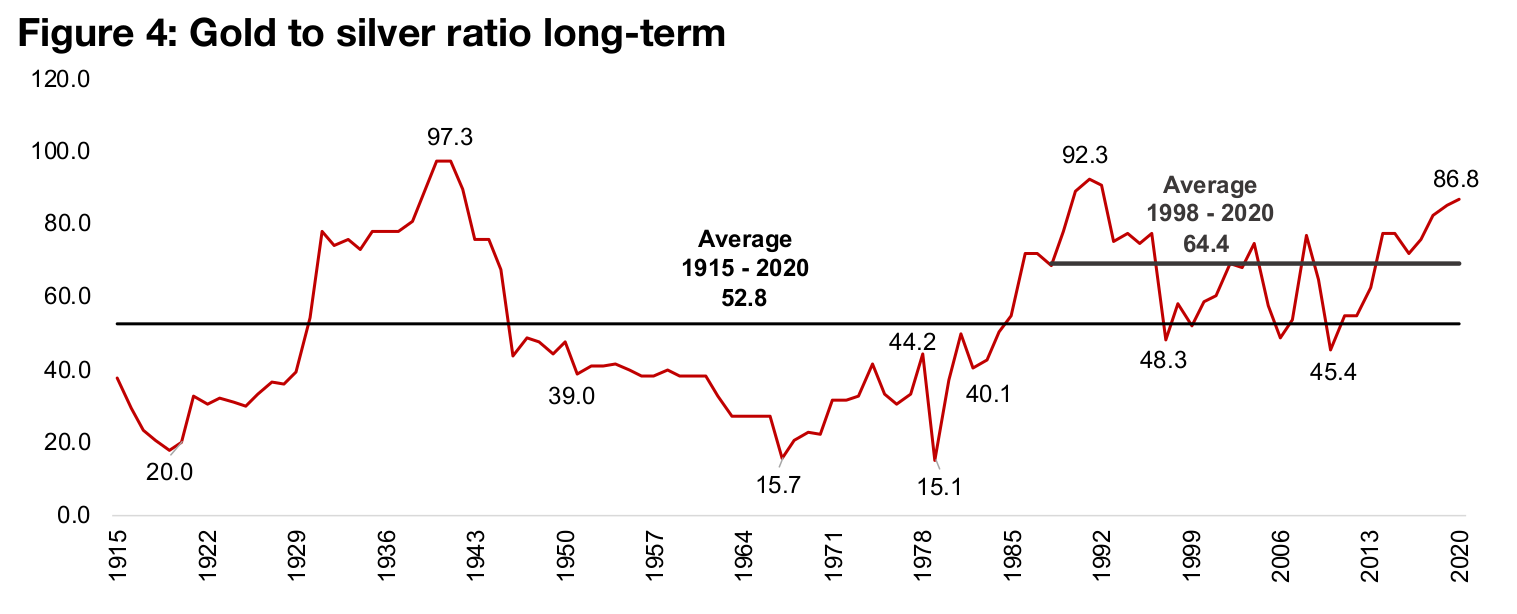

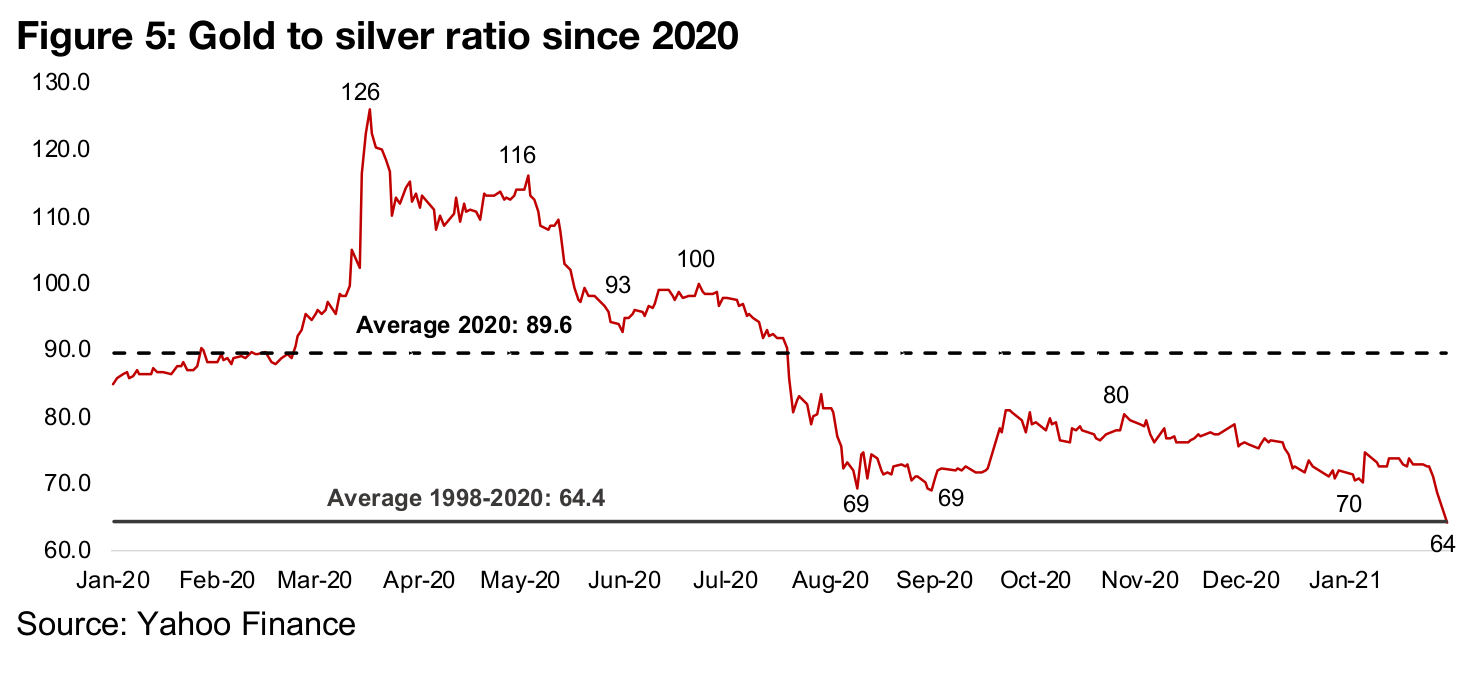

One key measure for precious metals markets is the gold to silver ratio, shown long-

term from 1915 to 2020 in Figure 4 and short-term since 2020 in Figure 5. The 1915-

2020 average has been 52.8x, but the medium-term average from 1998 is 64.4x, and

the 2020 average was 89.6x. Certainly the 2020 average was unsustainable, being at

historical highs, with gold having surged in H2/19 while silver had stagnated, and a

rebalancing becoming increasingly likely as 2020 went on. The ratio has now dropped

to just 64.4x, or exactly in-line with the medium-term average.

However, some analysts argue that even the medium-term or long-term ratios we

show are far too high. They believe that for past forty years there has been an

extended overvaluation of gold, and that the fundamental value of the ratio should be

as low as 16.0x, which had held historically for hundreds of years, or even 8.0x, the

actual mining ratio between gold and silver. While this may be theoretically justified,

we don't believe that the ratio will go anywhere near this low medium-term, although

the underlying idea of an increase in silver to bring the ratio down seems reasonable.

We believe that the ratio is unlikely to correct from a major decline in gold, however,

as gold is underpinned by an extremely strong fundamental factor. This is that gold

forms a major component of the reserves of global central banks. There is no way the

tiny stock of silver (or any other currency) could be substituted for gold in this function,

as it is generally considered the base of any country's money supply, especially

because its value cannot be eroded by money printing. This critical demand from

central banks could help explain at least some part of the high gold to silver ratio over

the past four decades.

Money supply and Bitcoin exploding higher, but not gold and silver

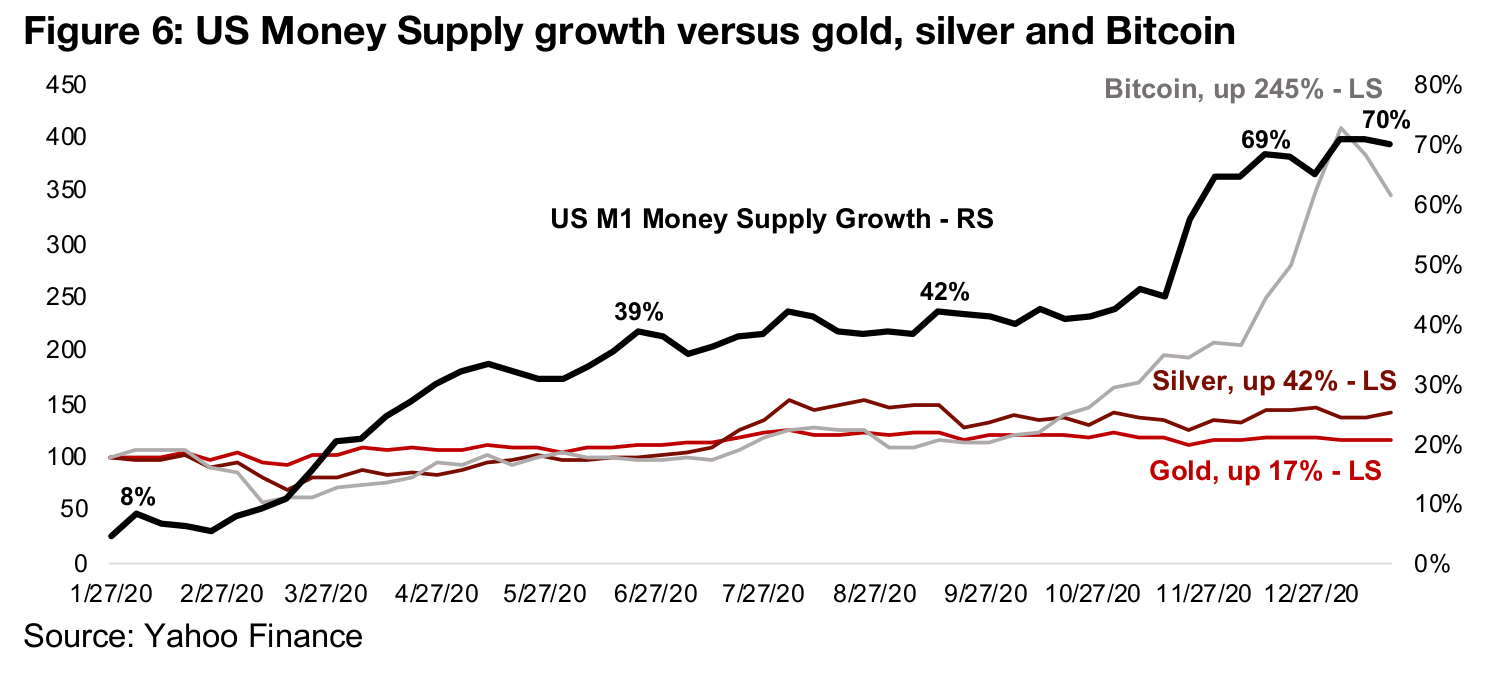

Moving from the very long-term big picture to some more recent fundamental

changes, is the current extreme growth in the US money supply, that seems to

suggest, in our view, that both gold and silver could be trading well below their

fundamental levels. M1 growth shot up from just 8% yoy prior to the March 2020

crisis to around 40% through the middle of 2020, and has now surged as high as 70%

in recent weeks, a completely unprecedented level historically (Figure 6).

We would expect that currency substitutes like gold and silver, given that their

supplies are reasonably fixed compared to government currencies, would surge in

this case, but actually, their increase appears quite moderate given the context, with

gold up just 21% and silver up 42% over the past year. This massive surge in liquidity

is certainly finding its way into some other currency substitutes, like cryptocurrencies,

with Bitcoin surging 245% over the past year, with most of the move happening quite

rapidly after the second jump in M1 growth from around 40% to around 70%.

Manipulation always gives way to underlying value long-term

Does this all point to some suppression of the gold and silver price right now? Maybe.

But again, this is probably a short-term phenomenon only, and it seems very likely

that gold and silver will eventually get a boost, even if with a bit of a lag. The

fundamentals at this point simply demand it, given the ongoing monetary mania, and

as history shows, the manipulators can really only win short-term, whether they are

the perceived 'renegade heroes' like WSB, or the 'dastardly villains' like the

investment banks or hedge funds. And while it might seem on the surface that the

WSB speculators can drive up any asset they choose right now, would they have

been able to drive up gold and silver in 2015, at the bottom of the precious metals

downturn?

It seems unlikely that they would have been able to pull this off without the monetary

mania which is now overflowing into multiple markets, and that every uptick would

have just been sold by a market heavily bearish on precious metals from 2013 to 2018.

The point being, that even the actions of WSB are really only made possible because

of a change in underlying fundamentals, in this case, a massive monetary expansion.

In our view, currently these fundamentals certainly indicate upside for gold and silver,

and while between the two, there is possibly greater upside potential for silver, this

has a fundamental basis which is entirely apart from any fun WSB has in the markets

short-term.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.