March 19, 2021

Silver Since the Squeeze

Author - Ben McGregor

Gold continues to pick up off six-month lows

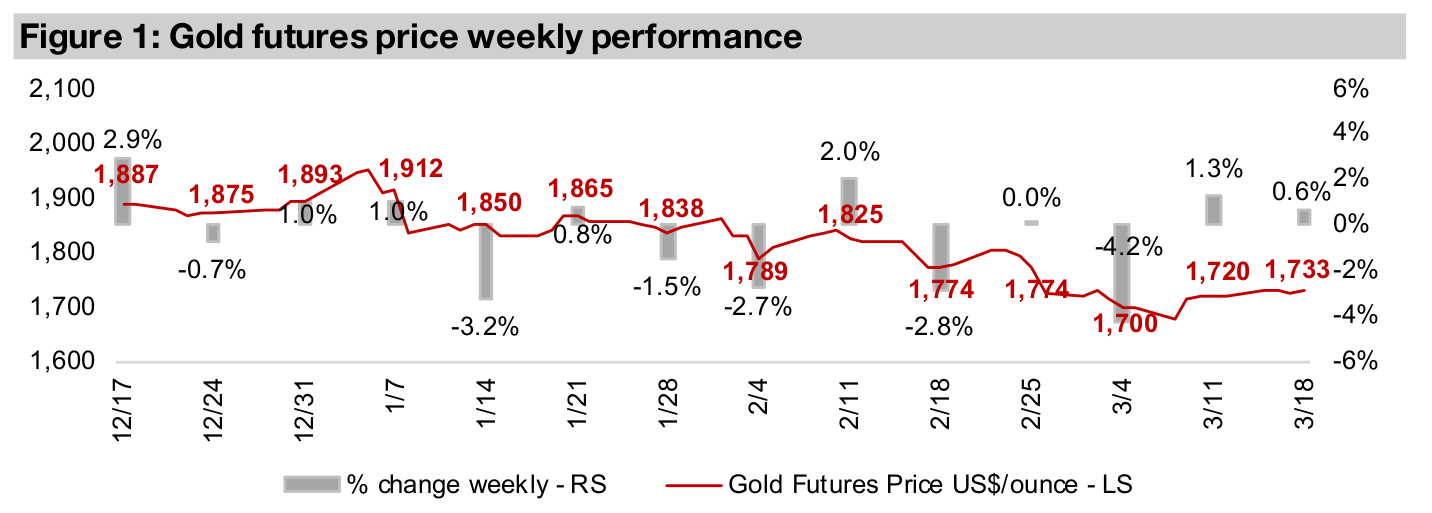

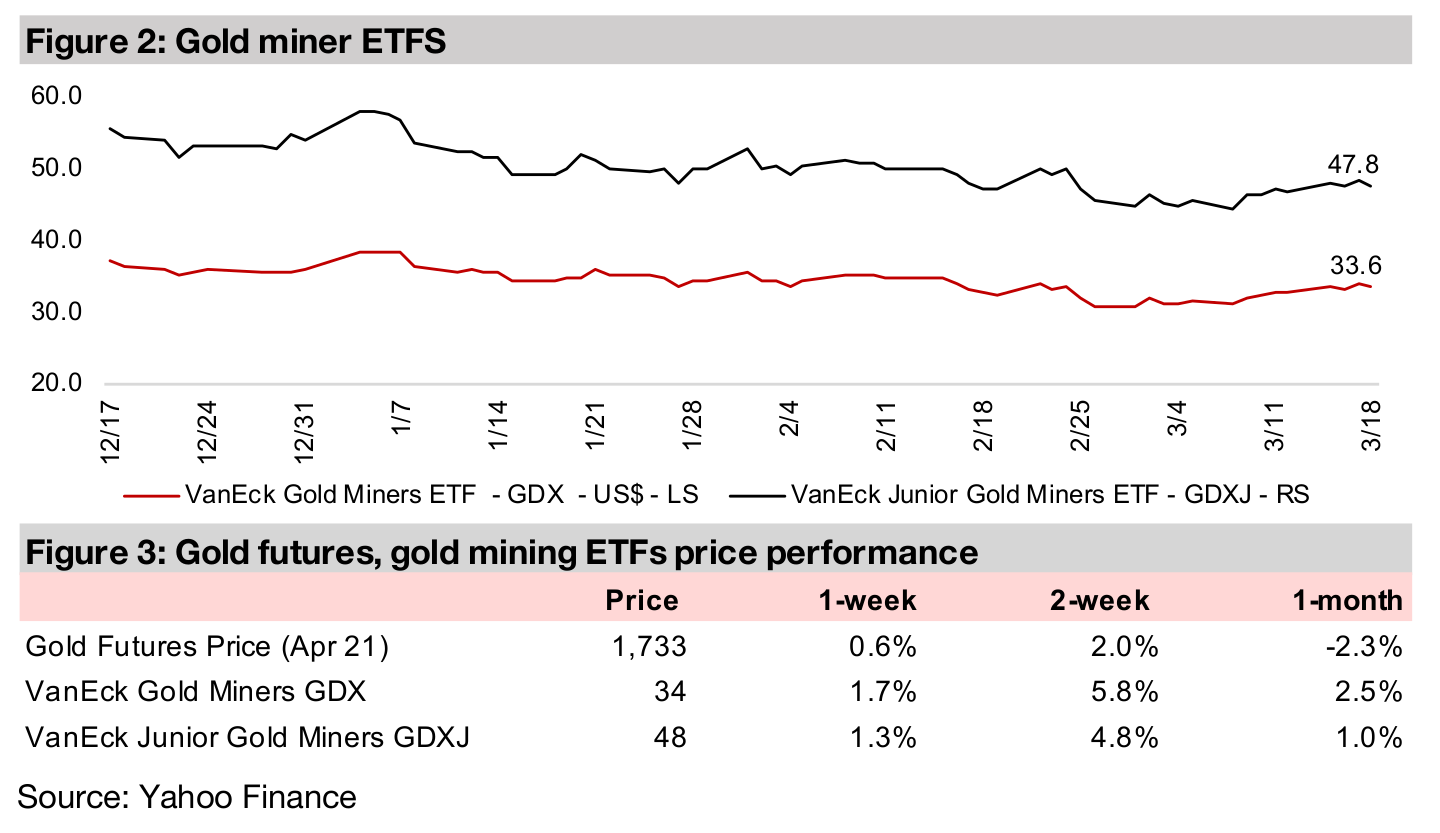

Gold gained 0.6% this week to US$1,733/oz, as it continued to pick up off six-month lows hit in the last two weeks, even with a continued rise in bond yields, which had been pointed to in recent months as a major driver for the decline in gold.

A look at silver since the Wallstreetbets jump

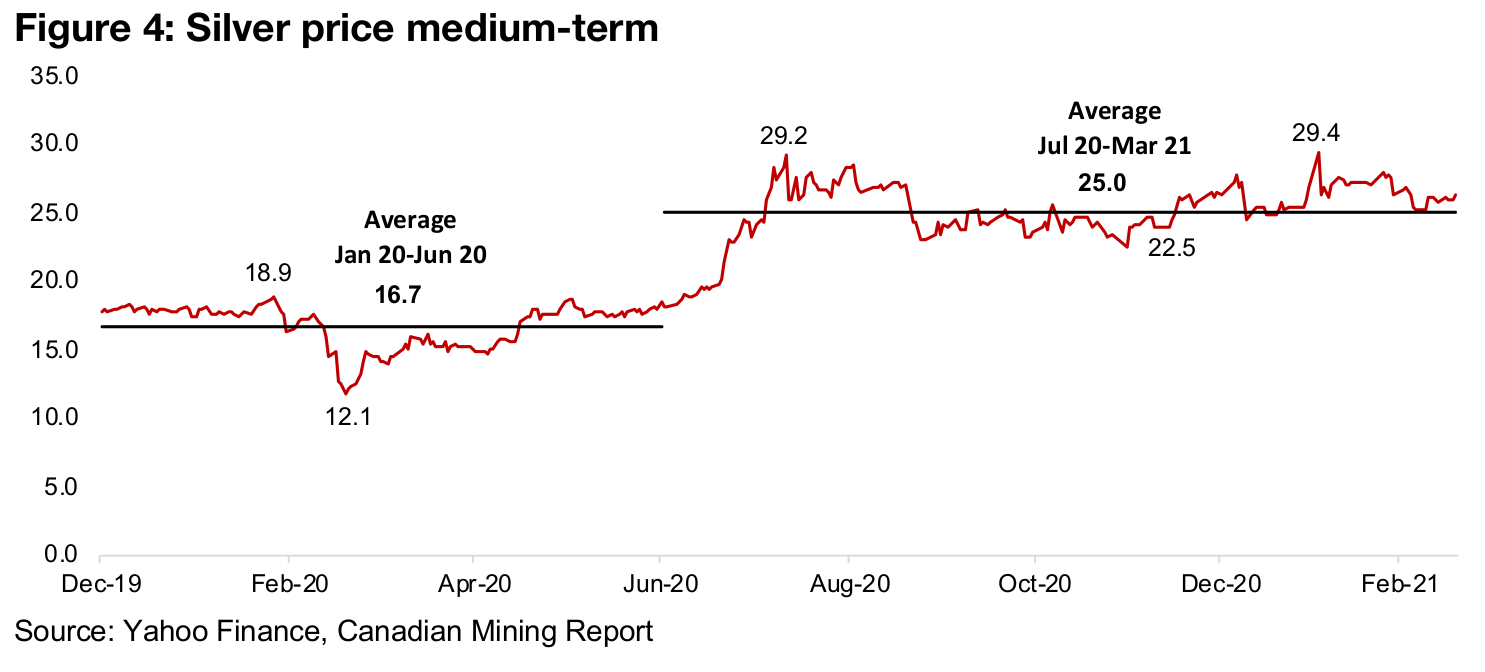

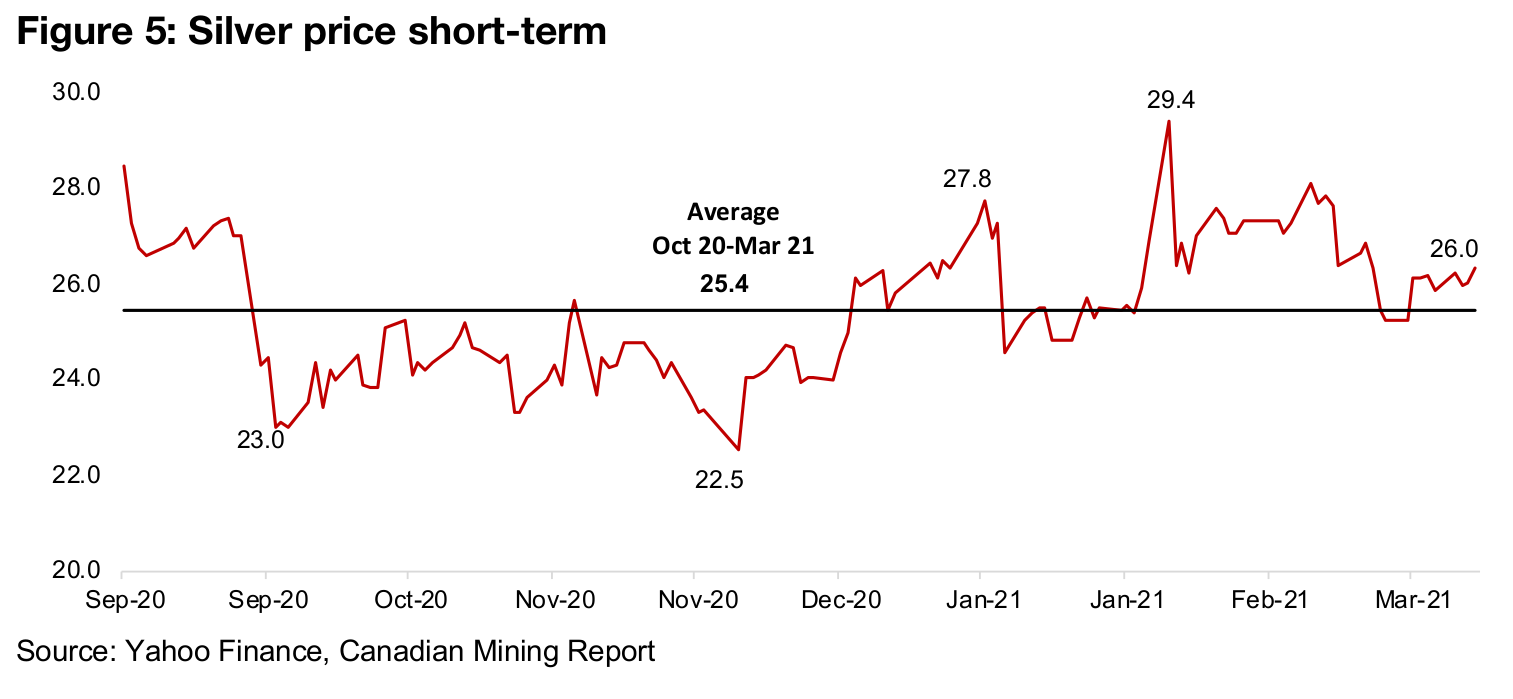

This week we look at the performance of silver since a brief jump above US$29.0/oz from Wallstreetbets related speculation in late January-early February 2021, with the price having eased back down near its average since July 2020 of US$25.0/oz.

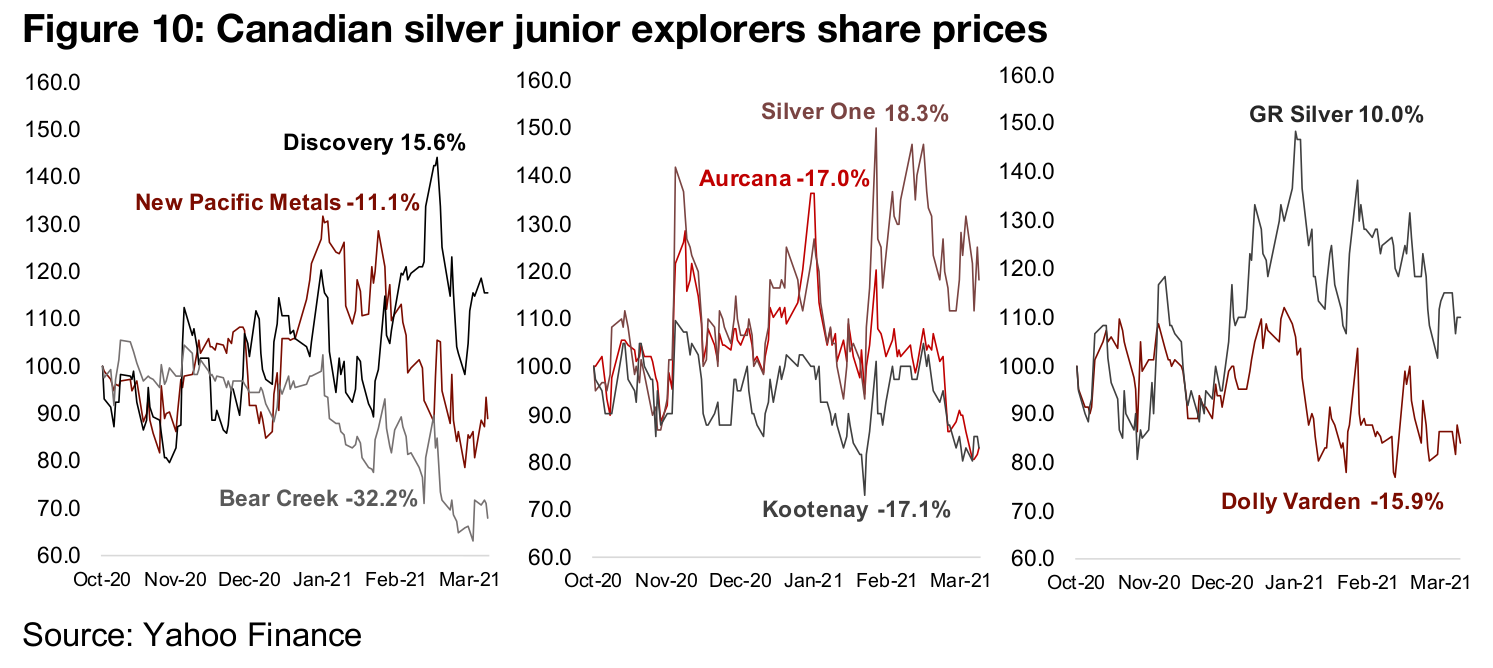

Canadian silver juniors see mixed performance since October

The gold producers and juniors were up this week on the continued gold price rebound. After a jump in mid-2020, the major Canadian junior silver stocks have had a mixed performance since October 2020, as strong operational progress continues.

Gold price gains ground for second week, off six-month lows

The gold price gained ground for the second week in a row, up 0.6% to US$1,733/oz, after touching six months lows of US$1,678/oz in the past month. Rising yields have been pointed to as the main driver of gold's decline over the past few months, propelled in turn by rising inflation expectations. In 'normal' times, rising yields and inflation expectations might be a sign of a healthy and improving economy. However, we don't see this as the situation currently, and don't view the economic gains as coming from an organic structural improvement in the economy. Instead, the inflation expectations are a product of extreme monetary expansion, and the yield spike because of a massive bond issuance flooding the market, driving down bond prices, and pushing up yields. Nonetheless we are still faced with the market's apparent view that investors will sell gold to: 1) chase yield in bond markets, or 2) move into risk in equity markets. We expect that that the market will eventually see these strategies as risky, at best, and ill-advised, at worst, and while gold may stagnate short-term, medium-term it will return to previous highs, and long-term, well beyond.

Silver Since the Squeeze

This week we take another look at silver and the larger Canadian juniors exploring for

silver, in the aftermath of its Wallstreetbets related spike (see our report, Silver

Suppression?! from February 1, 2021, for more details). Wallstreetbets is a reddit

forum that is a collective of small but aggressive investors known for going after what

they believe are large institutions unfairly shorting decent companies. They buy these

target companies up, driving the stocks to very high levels to 'squeeze' out the

institutions with the shorts, forcing them to buy back the stock to cover their positions,

and very likely face major losses. Briefly in late January-early February 2021, there

was talk that Wallstreetbets had turned its attention to the silver market.

Actually this idea made little sense. First, there was obviously not really any major

unfair shorting of either silver or silver stocks ongoing at the time. Silver and silver

stocks had not really been under any pressure at all since mid-2020, and had instead

held up well through most of H2/20. Second, taking on the entire silver market is quite

a different story than driving up the value of a single stock, which what Wallstreetbets

had focussed on in its previous 'attacks'. So there wasn't really a major short squeeze

needed to 'save' silver, because while it had edged down from its peak as of January

2021, it was hardly heavily out of favor. In the end, the whole affair was a brief blip

lasting a couple of trading days, with outsized effects only on a handful of larger silver

producers, with most gains quickly reversed.

We can see the brief spike to US$29.4/oz for silver on February 1, 2021, and it has

now come back down to US$26.0/oz, or very close to the average since July 2020 of

US$25.0/oz (Figure 4). The big gains for silver seem to have been mainly in July 2020,

when the market appears to have rebased from an average of US$16.7/oz that held

from Jan 2020-June 2020 to an average of US$25.0 from July 2020 to Mar 2021.

Since September 2020, there have been two brief dips and two short blips, but the

price has not deviated to extensively for long from the nine-month average.

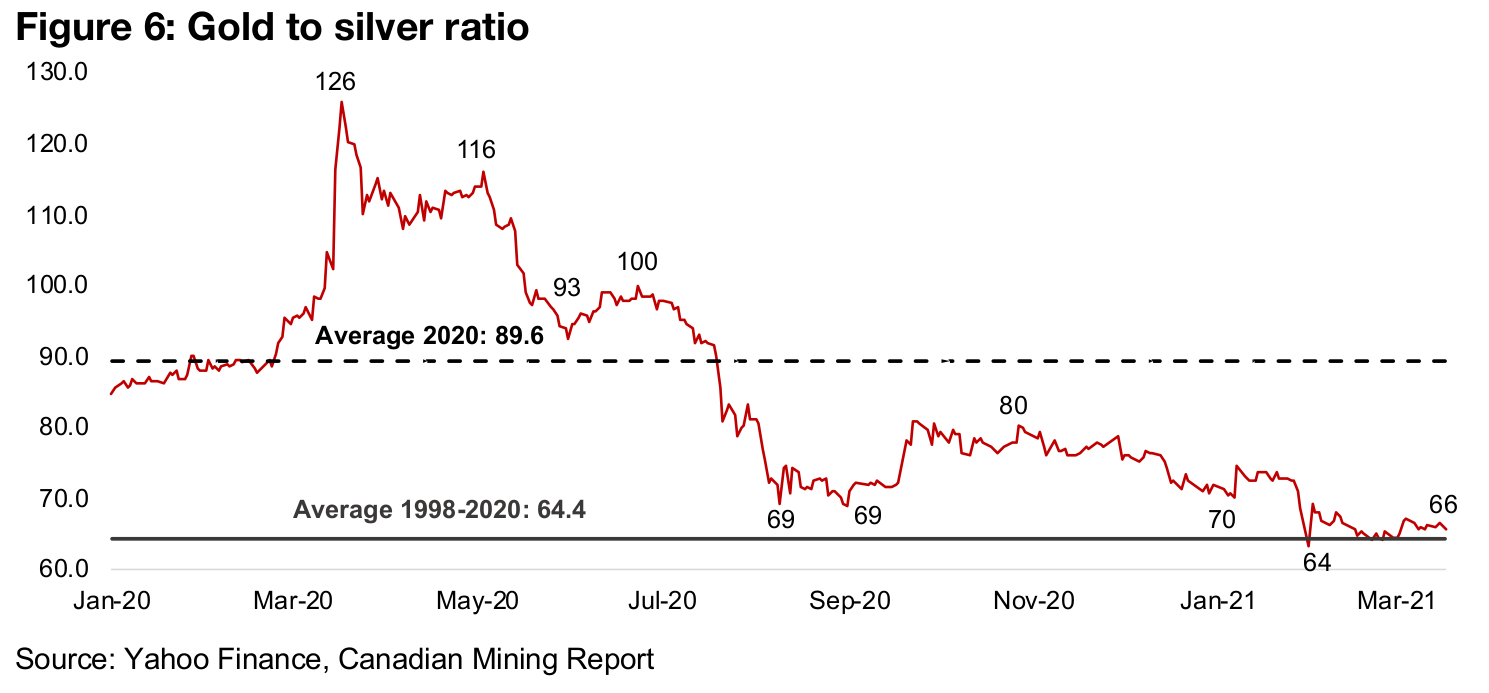

Silver's short-term direction is a bit unclear, as it is hugging closely to its own recent price average, giving us little to go on. The gold to silver ratio is also not giving a clear signal, as it has come down to 66, almost right at its medium-term average since 1998 of 64x (Figure 5). While the prior to the March 2020 crash, it was clear that the gold to silver ratio was far too high, at extreme historical highs of 126x, currently we cannot really make such a clear call. Many in the market suggest that gold to silver ratio should revert to even longer-term historical averages, which from 1915-2020 was 52.8, suggesting an additional pick up in silver, as we don't expect gold to languish at its current low prices for long.

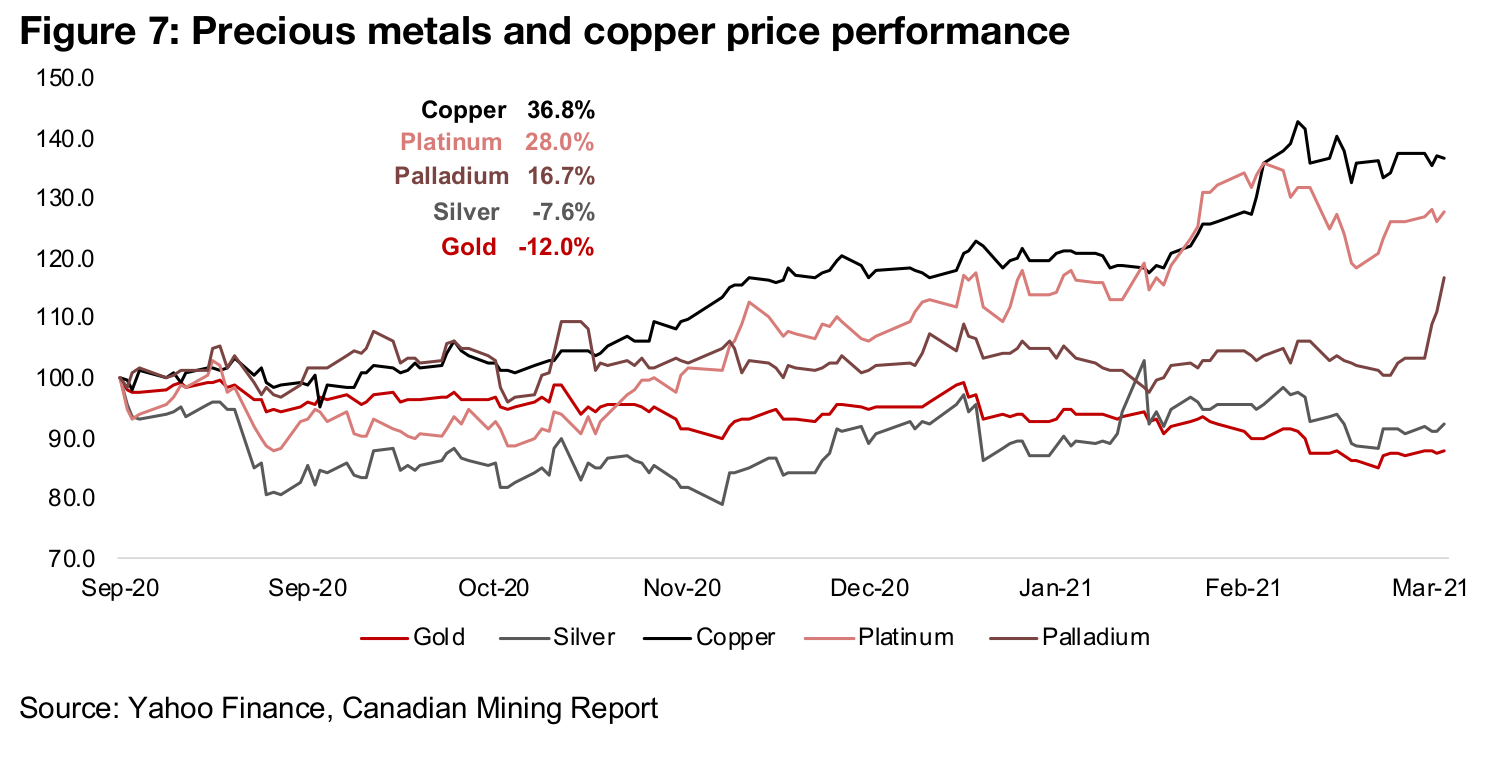

Gold for H1/20, silver for H2/20, copper for Q1/21

Of the larger metals' markets, while gold was the star of H2/20 and silver the champ in H2/20, copper has stood out in Q1/21, up 36.8% since September 2020, compared to a -7.6% decline for silver and -12.0% drop for gold (Figure 7). Base metals have outperformed in general over the past several months as the global economy recovers, however artificial this recovery may be, given the massive monetary and fiscal stimulus (See our Weekly from March 12, 2021 for more on the rise in base metals). Platinum has picked up in recent months versus palladium, which had been very strong in 2020. This is especially interesting given that Palladium had previously outgained platinum on the electric vehicle story, with the catalytic convertors in them expected to shift to using more palladium than platinum. However, the recovery has increased demand for platinum for its other industrial uses apart from electric vehicles.

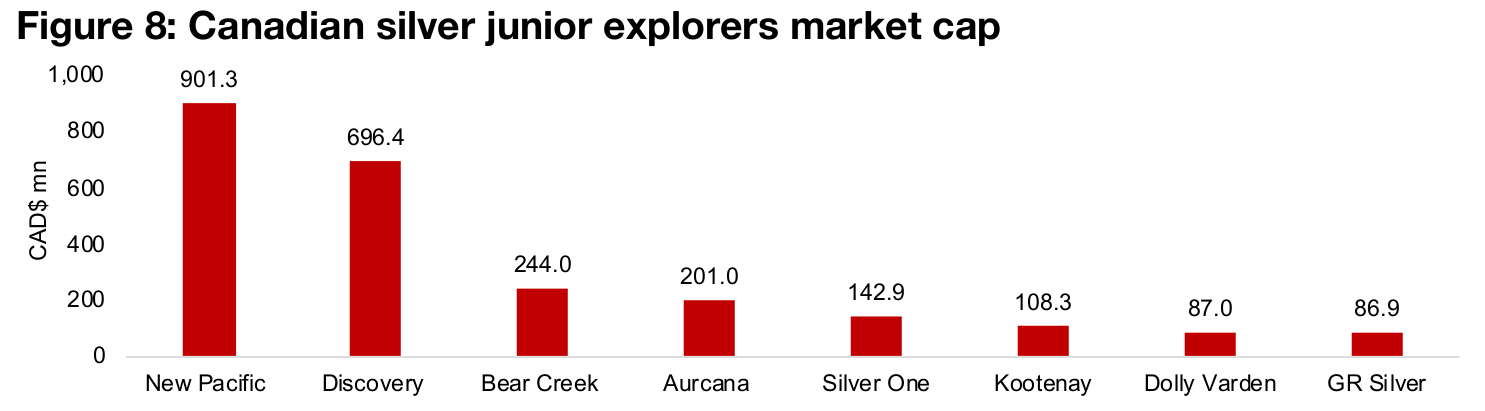

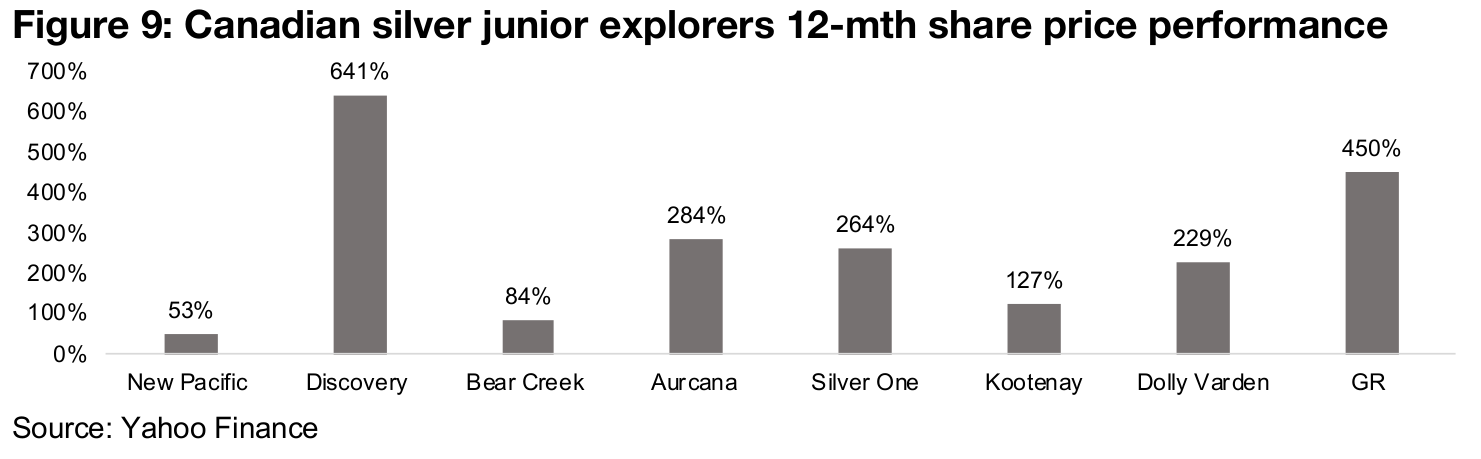

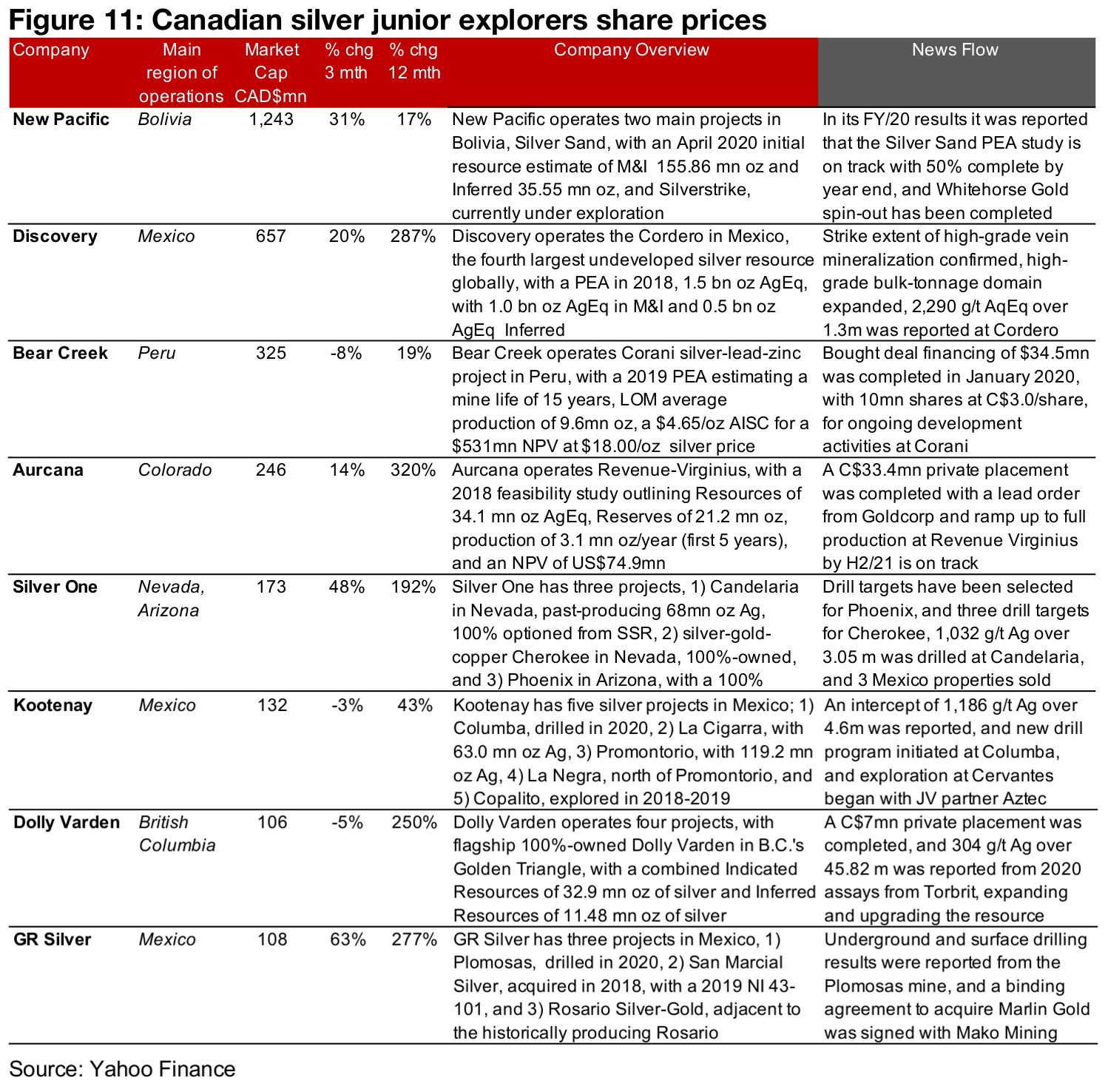

Canadian junior silver stocks see mixed gains for past six months

While the leading Canadian silver junior stocks (Figure 8) have had a strong performance over the past twelve months, most of the gains occurred mid-year, especially with the June 2020 silver price surge (Figure 9). The biggest gains have been by Discovery Metals, up 641%, GR Silver, gaining 450%, with Aurcana, Silver One and Dolly Varden all gaining over 200%. Even the weaker names, Kootenay, Bear Creek and New Pacific are all up 50% or more. However, over the past six months, the performance of these stocks have been mixed as the silver price has consolidated around the US$25/oz level (Figure 10).

Even with limited share price gains in recent months, the group has continued to make considerable operational progress (Figure 11). New Pacific is progressing its Silver Sands PEA, with 50% complete and a release targeted by 2021, and Discovery has confirmed the strike extent of high-grade vein mineralization and expansion of its bulk-tonnage domain. Both Bear Creek and Aurcana completing financings, and Aurcana is on track to ramp up Revenue-Virginius to production by H2/21. Silver One selected new drill targets for two projects and reported drilling results from another project and the sale of three Mexico properties. Kootenay reported results from, and initiated a new drill program at, Columba, and started exploration at Cervantes with JV partner Aztec, Dolly Varden completed a private placement and released drill results from Torbrit, expanding the resource, and GR Silver reported results from the Plomosas mine and signed an agreement to acquire Marlin Gold with Mako Mining.

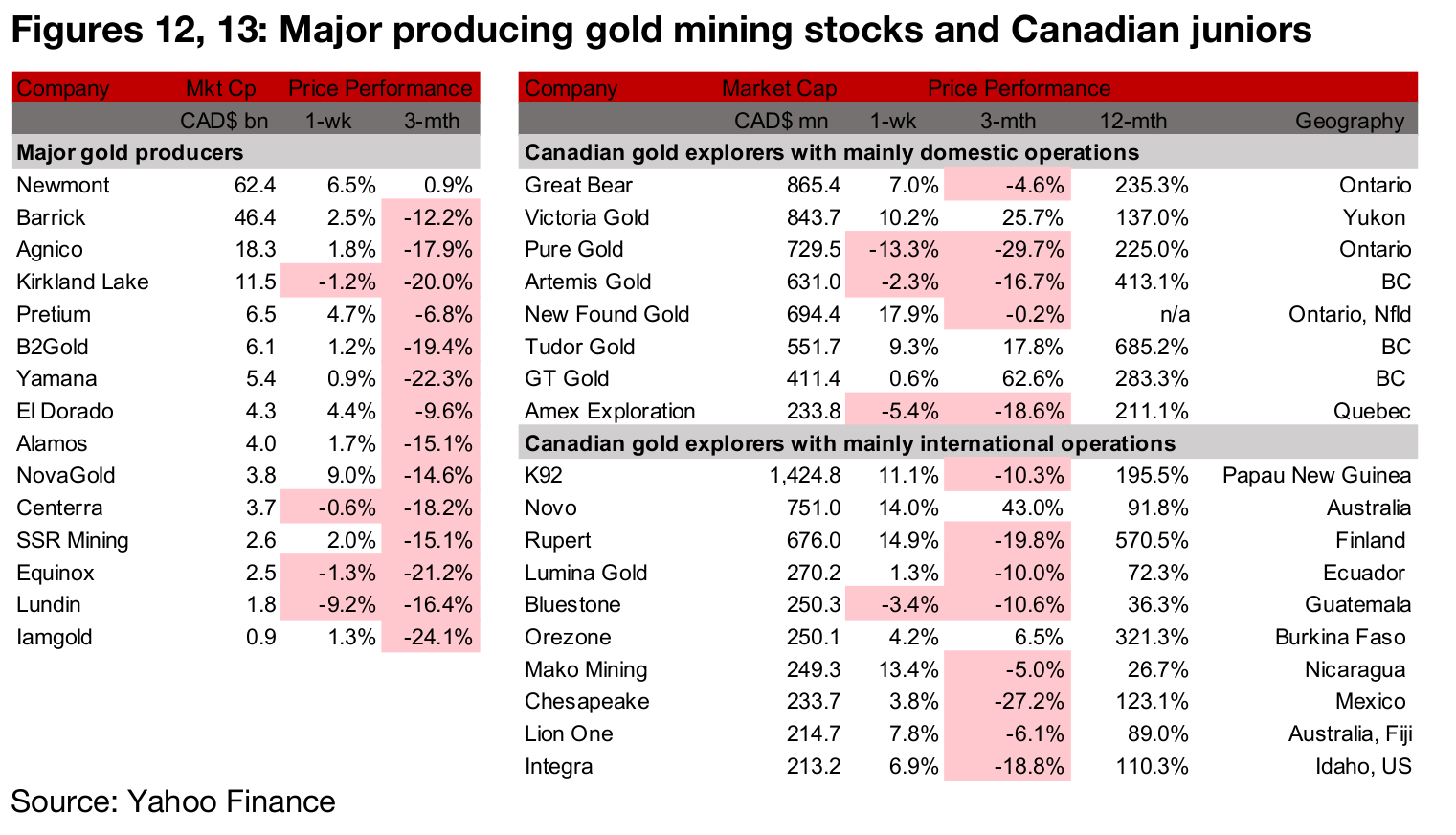

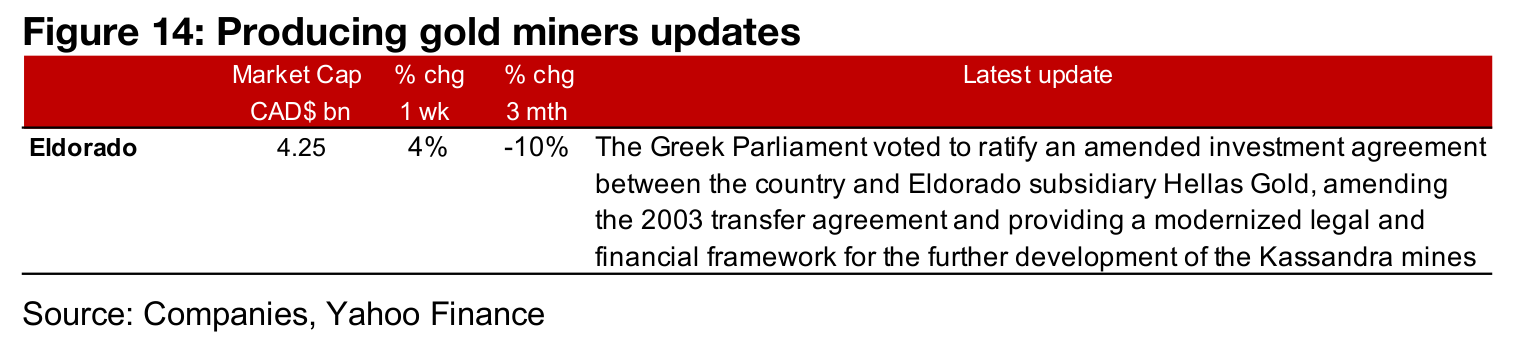

Producers mainly up on gold price pick up

The producing miners were mainly up on the gold price (Figure 12), and news flow was limited to just one press release, from Eldorado, with the Greek parliament amending an investment agreement to allow for the company to further develop the Kassandra mines (Figure 14).

Canadian juniors mostly rise on the gold price

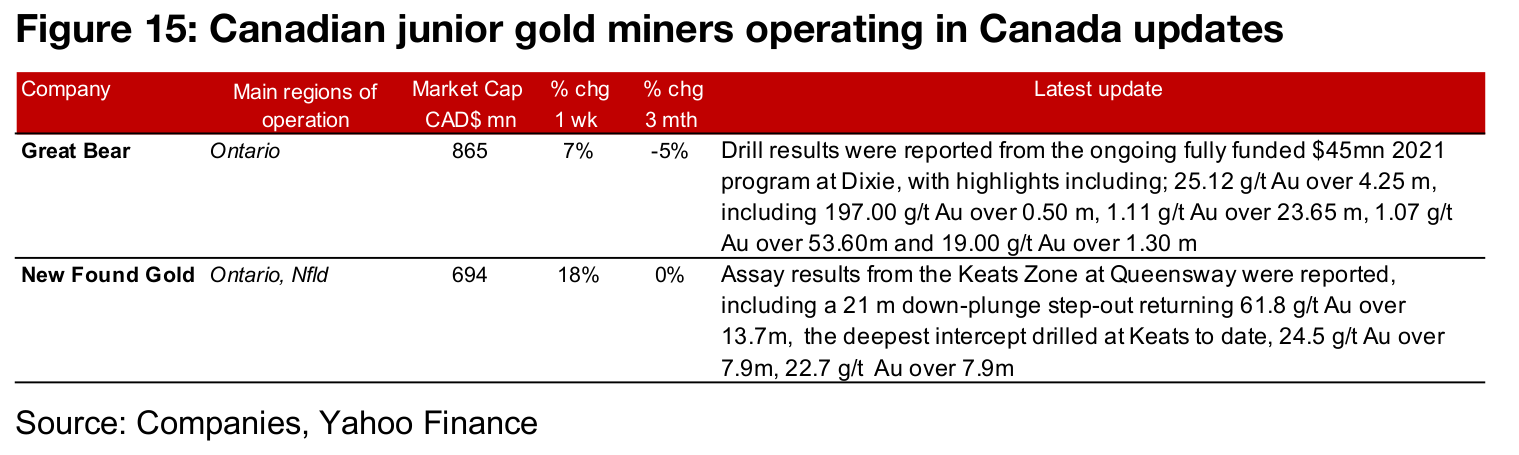

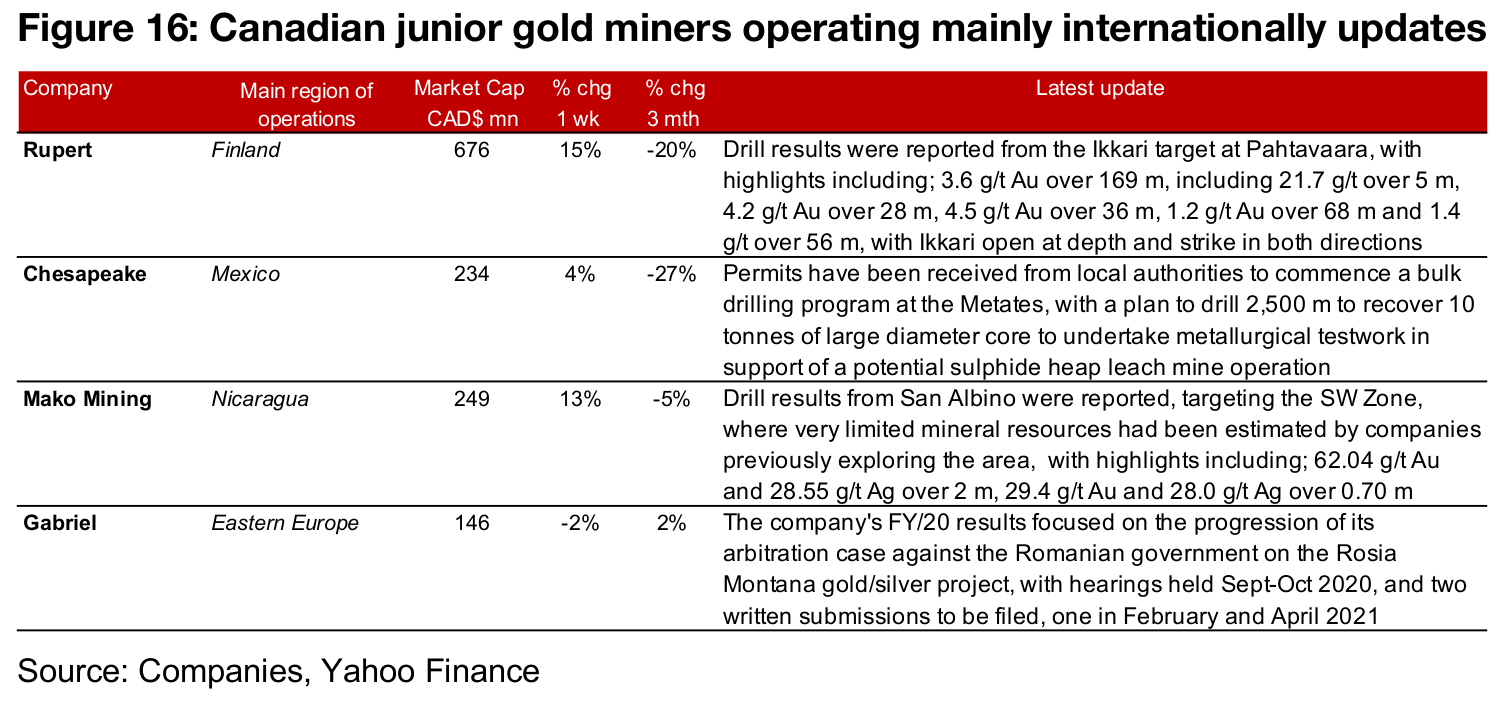

The Canadian juniors were mainly up on the rise in the gold price this week (Figure 13). For the Canadian juniors operating domestically, drill results were reported by Great Bear from its Dixie Project and by New Found Gold from the Keats Zone of its Queensway project (Figure 15). For the Canadian juniors operating mainly internationally, drill results were reported by Rupert Resources from Pahtavaara and by Mako Mining from San Albino, while Chesapeake reported that they had received permitting to proceed with a bulk drilling program at Metates and Gabriel released FY/20 results, mainly focused on its ongoing arbitration with the Romanian government on the Rosia Montana project (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.