February 05, 2021

Silver's Short Supernova

Author - Ben McGregor

Gold drops while silver supernovas

Gold dipped at the end of week, as an improved US employment situation sent the US$ and bond yields up, but the real story this week was silver's supernova, with it surging 9.3% on Feb 1, only to collapse by 10.0% on Feb 2, in a speculative frenzy.

WSB's (very brief) play in the silver market

While the move was ostensibly driven by wallstreetbets Reddit speculators, who had previously driven short sellers out of Gamestop, other market operators were probably also involved; regardless, the attempted move on silver didn't last long.

Gold's dip overshadowed by short-term silver speculative frenzy

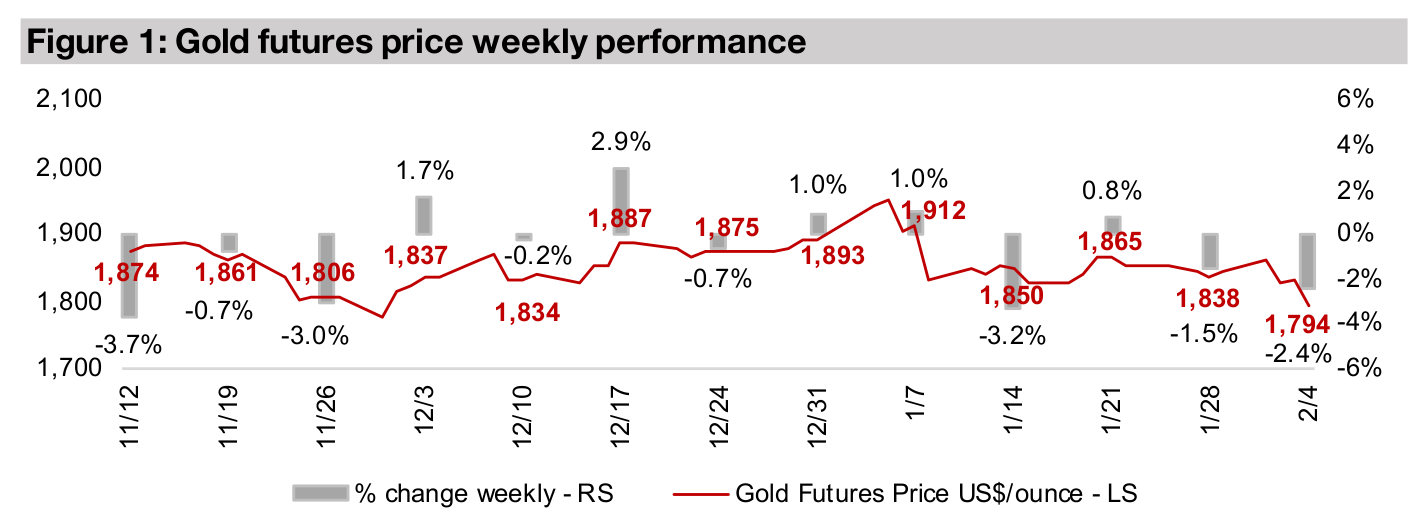

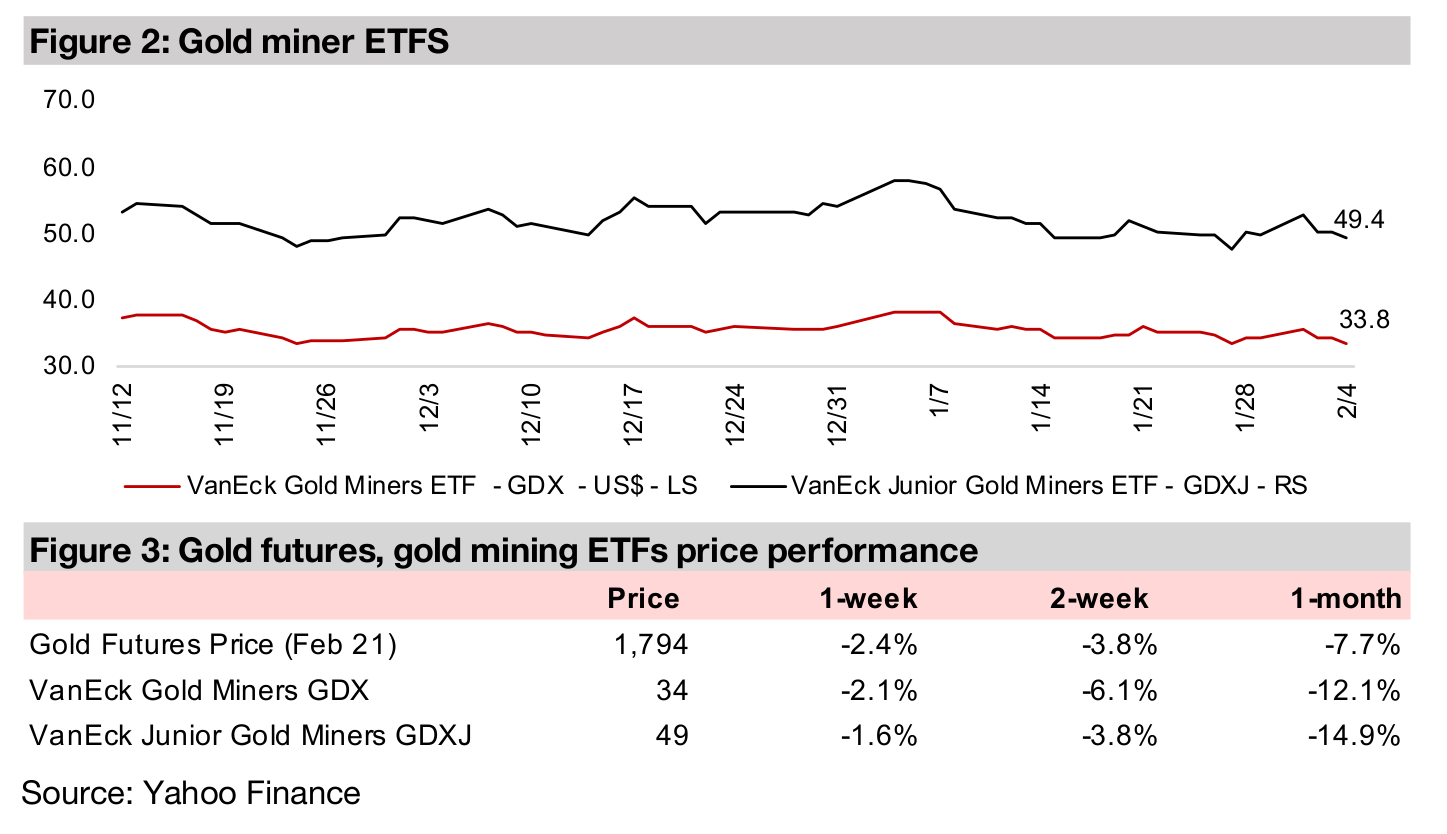

Gold had quite a rough week, declining -2.4% to US$1,794/oz, and is down -7.7% over the past month off the most recent highs of US$1,945/oz set on January 4, 2021. This was driven by US unemployment claims that came in above forecasts, leading to increasing faith in a continued rebound from the ongoing crisis as vaccines begin to be administered globally. This has led to expectations of higher inflation coming through, and in turn pushed up the US$ and bond yields, which generally move inversely to gold. This drove gold below its 200 day moving average, a key resistance level, and if the perception of falling risk continues, we could continue to see some short-term pressure on gold. However, we believe that gold will continue to be fundamentally supported by the historically unprecedented growth in the US money ongoing by the US Federal Reserve. While in a regular week, this gold news would have stood out, it was completely overshadowed by the frenzied short-term price in action in the silver market this week.

Mr. Silver's Wild Ride

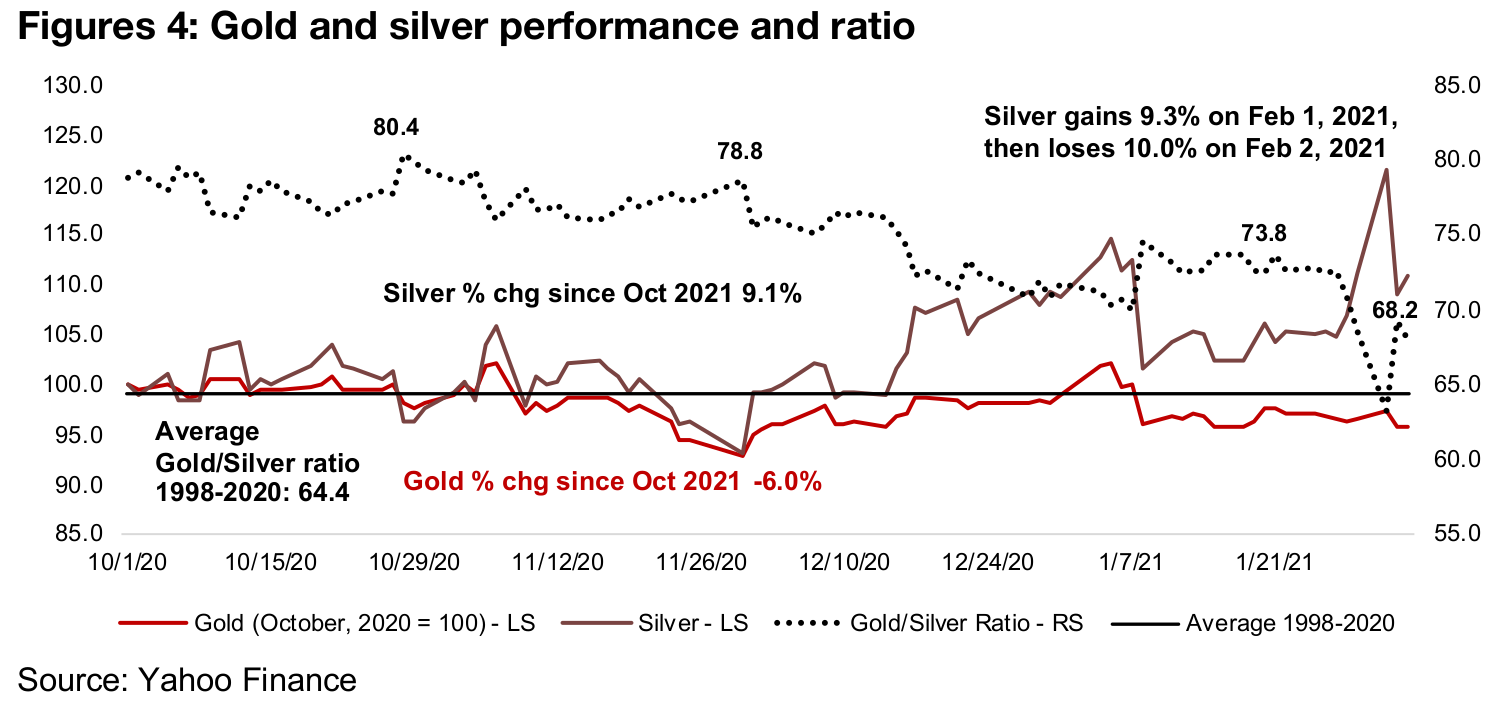

Silver and many silver stocks exploded upward at the start of the week, and then immediately collapsed the following day. Figure 4 shows the jump in silver, up 9.3% on Feb 1, 2021 and then falling 10.0% on Feb 2, 2021, certainly not a normal move. It was also only silver in play, not precious metals overall, as gold edged up just 0.7% on Feb 1, and then fell 1.6% on Feb 2. The silver move sent the gold to silver ratio down to 64.1x on Feb 1, just below its medium-term average over 64.4x, but by Feb 4 it had risen back to 68.2x as silver contracted. This was all driven ostensibly by the Reddit group wallstreetbets (WSB), a group of retail investors that tend to focus on the analysis and trading of smaller cap stocks. However, it is likely it was not only wallstreetbets that was involved in the move, but also other institutions, and the broader market, chasing momentum on both the upswing and the downswing.

Wallstreetbets' David to Wallstreet's Goliath

Philosophically, WSB appear to have a David versus Goliath type of mentality in their stance towards large market players like hedge funds and investment banks. They believe that the size of these institutions allows them to take short positions, where the bet is that a company is overvalued and will decline, and effectively 'bully' companies, creating a negative downward spiral in a stock price and potentially sending it well below its fundamental value. One such stock was Gamestop, a retailer of video games and other products, which some prominent hedge funds had short positions against. WSB, many of whom are gamers and long-term Gamestop customers, took particular affront to this. The group decided to, on principle, as much as for capital gains, take on the hedge funds, and swarm into Gamestop, driving out the short-sellers. And it worked, with some prominent hedge funds seeing massive losses, and needing to be bailed out (ironically by other hedge funds).

The silver market story not as clear as Gamestop play

Have stomped out Gamestop short sellers, it was reported that WSB had announced last week that it would take a run at silver, although the motive was not as clear. This week we saw the outcome of this, with the plan collapsing abruptly for a few reasons;

1) The silver market is huge compared to a single stock: One is the sheer size of

the silver market, which is huge compared to a single stock like Gamestop (and the

gold market is ten times the size of the silver market, making a run at the gold market

even less feasible)

2) The run at silver might not have been only by WSB: A second was that it was

not completely clear that the silver play was entirely driven by wallstreetbets, and that

outside players might have been trying to use WSB's recent momentum and huge

news coverage to drive short-term traders outside of WSB into silver and make some

quick profits. The price action this week seems to support this somewhat. This is in

distinct contrast to what we saw in Gamestop, where the core WSB contingent seem

to be holding Gamestop for a long period on principle; it was clearly not a pump and

dump

3) Silver stocks were doing just fine without WSB: The third issue is that the clear

story of the 'good' wallstreetbets saving Gamestop by buying it up, versus the 'bad'

hedge funds trying to drive it down, just didn't apply in the case of silver. The metal

had just had a fantastic year, up over 40% last year, and silver stocks had seen their

strongest performances in about a decade in 2020. And while precious metals

investors might debate the fundamental accuracy of gold to silver ratio, silver and

gold investors could hardly be considered antagonists, and many investors in

precious metals own both. This is in distinct contrast to the clear stockholders versus

short sellers antagonism of Gamestop, which was a zero-sum game. Holding either

gold or silver, or both, over the past year, was really a win-win.

Our view is that there while there are episodes of manipulation in the gold, silver and

other markets, they tend to be short-term, and over the medium to long-term, prices

return to fundamental levels. The movement this week showed a rapid-fire version of

this. For more detail on our take on manipulation in the gold and silver markets

overall, see our report 'Silver Suppression?' released on February 1, 2020.

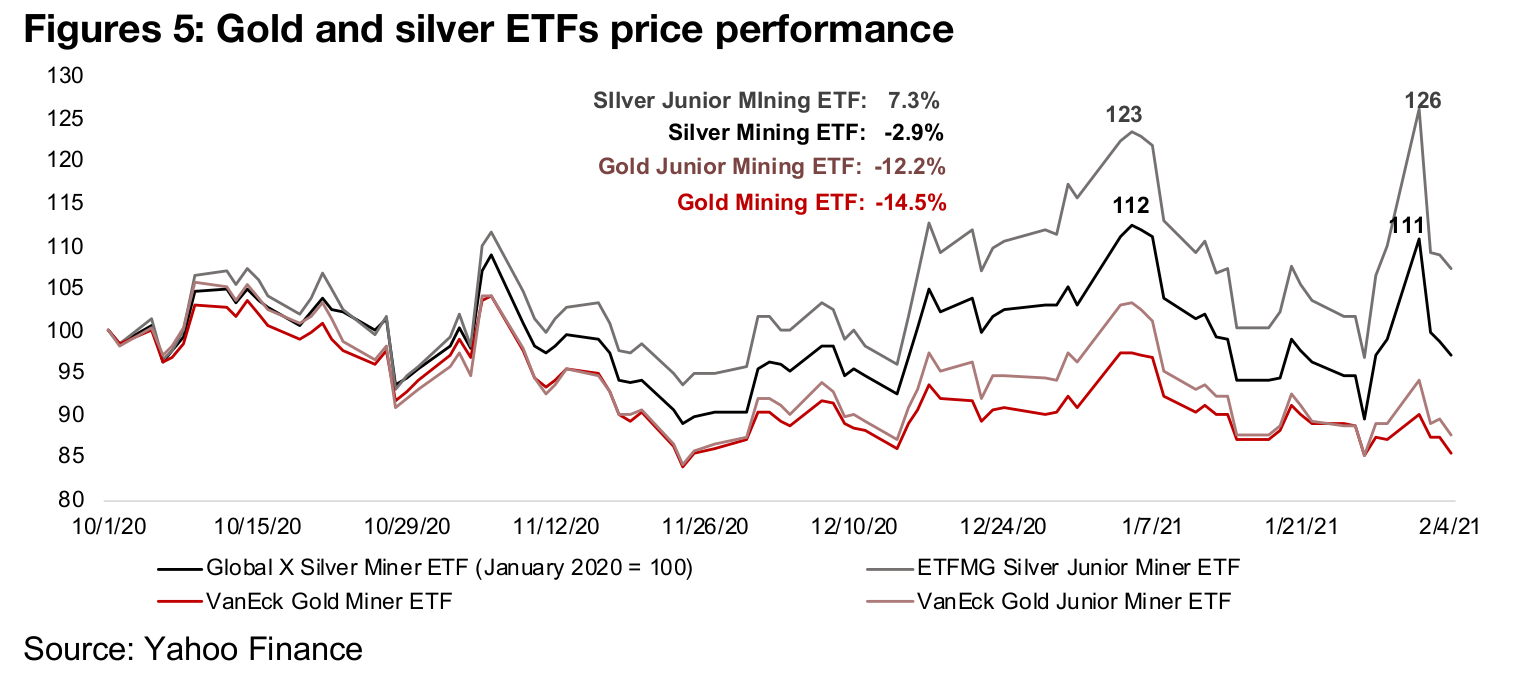

Major silver ETFs and stocks supernova, but maintain some gains

The silver price action drove up both of the major silver mining ETFs on Feb 1, with

the junior silver mining ETF SILJ, the strongest performer of the major gold and silver

ETFs since October, seeing the biggest jump, up 14.5% on the day, although it only

edged above the highs set in early January 2021 at the peak this week (Figure 5). The

silver producing miner ETF SIL, up 12.1%, actually did not quite touch its January

highs, and both collapsed on Feb 2, with SIL ending the week up 0.2% and SILJ up

0.8%. Even with the collapse on Feb 2, the major producing silver stocks were still

up 13.1% on average as of Feb 4 compared to Jan 27, the day before the WSB plan

became well known the markets, although it remains to be seen how long even these

remaining gains from the speculation will hold.

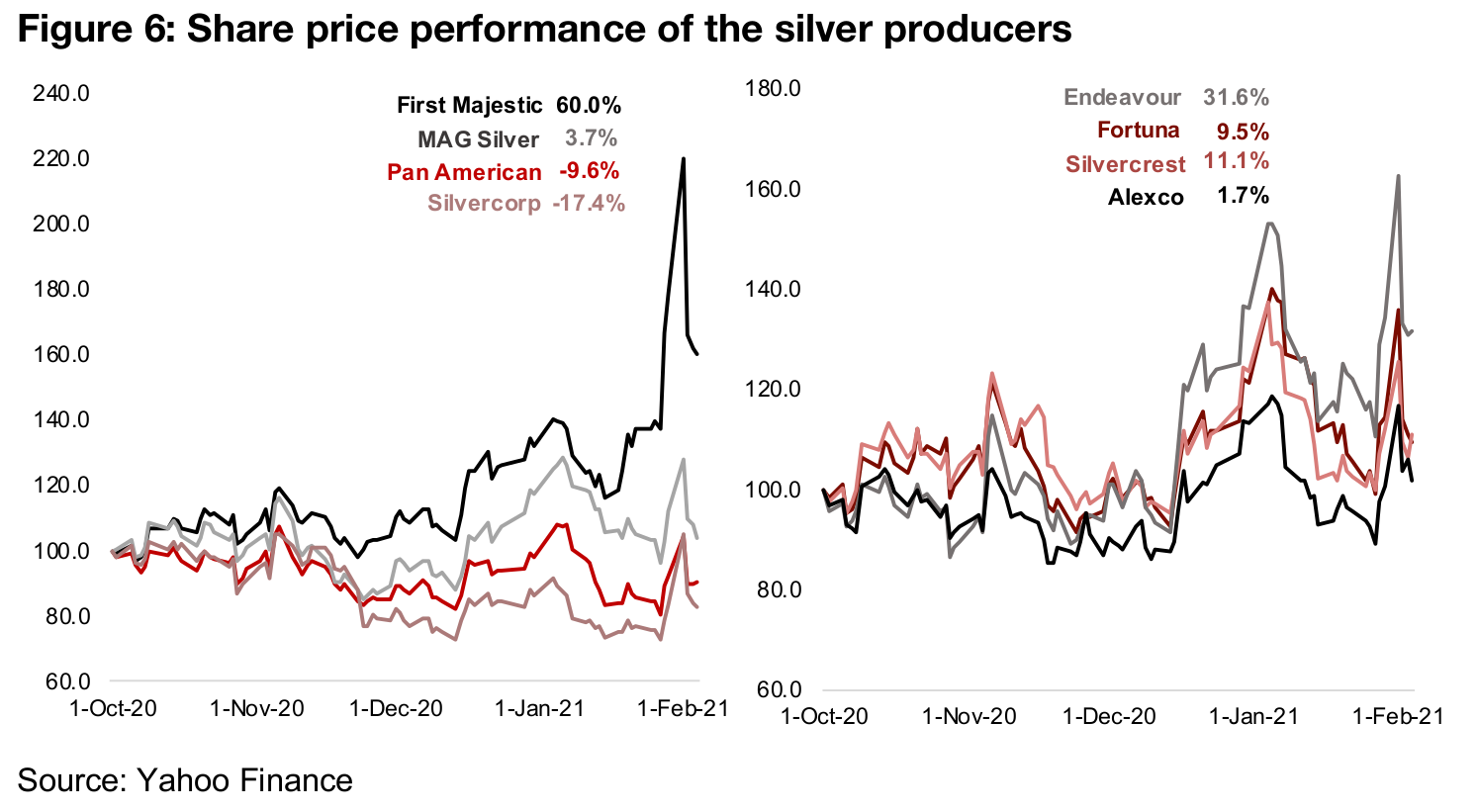

The name most in play this week, First Majestic, was already the strongest performing

silver stock since October 2020, and WSB seems to have just catalyzed an upward

movement that was already happening (Figure 6). Also, whether such moves are a

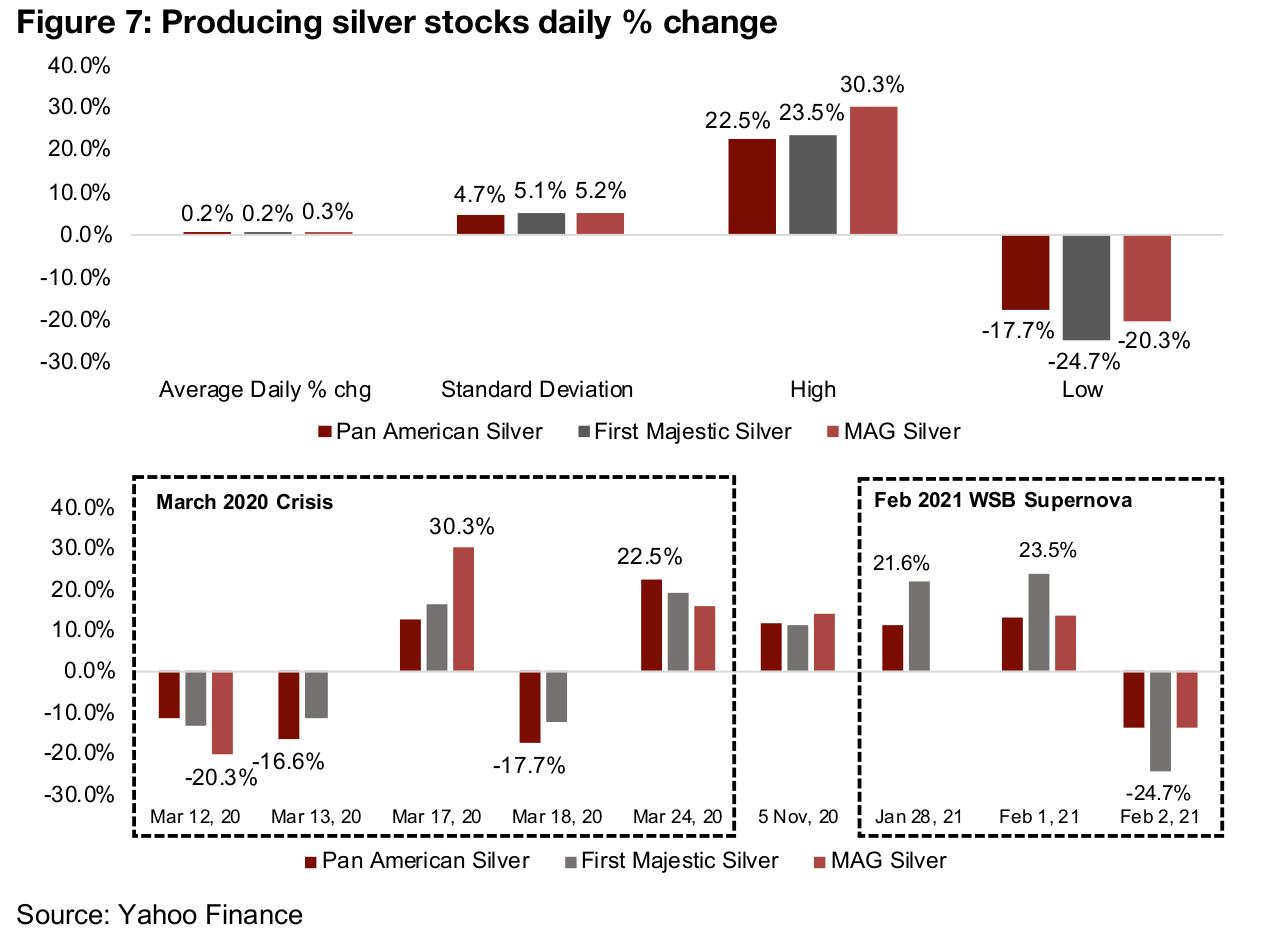

'good' is questionable, as this type of price action is usually reserved for times of

major crisis, as shown by the largest daily moves of the big silver stocks since 2020,

which occurred mainly in the March 2020 crisis and the February 2021 frenzy (Figure

7). The average daily price movement since 2020 is much more subdued, at much

less than a percent, and these slow and steady gains were what the H2/20 silver bull

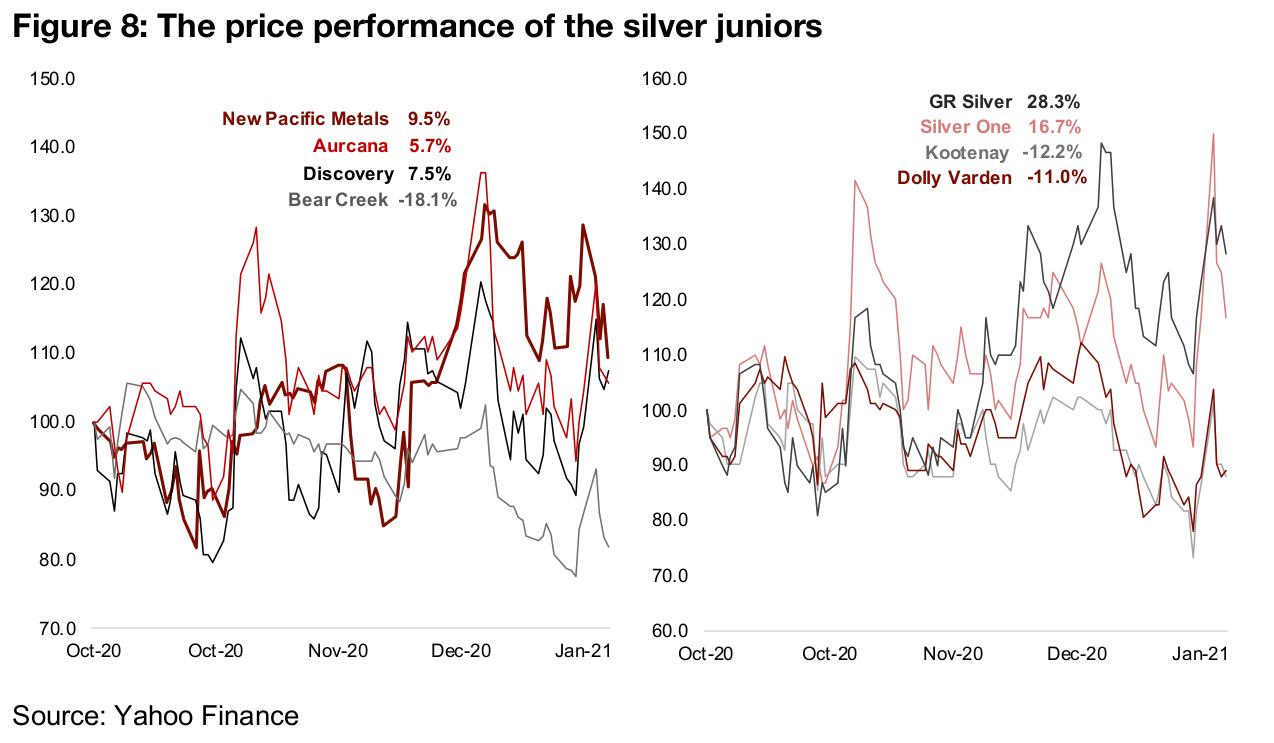

market really consisted of, not huge jumps. The top Canadian junior silver stocks also

rose, but by less than the producers, up 4.1% on average for the week (Figure 8).

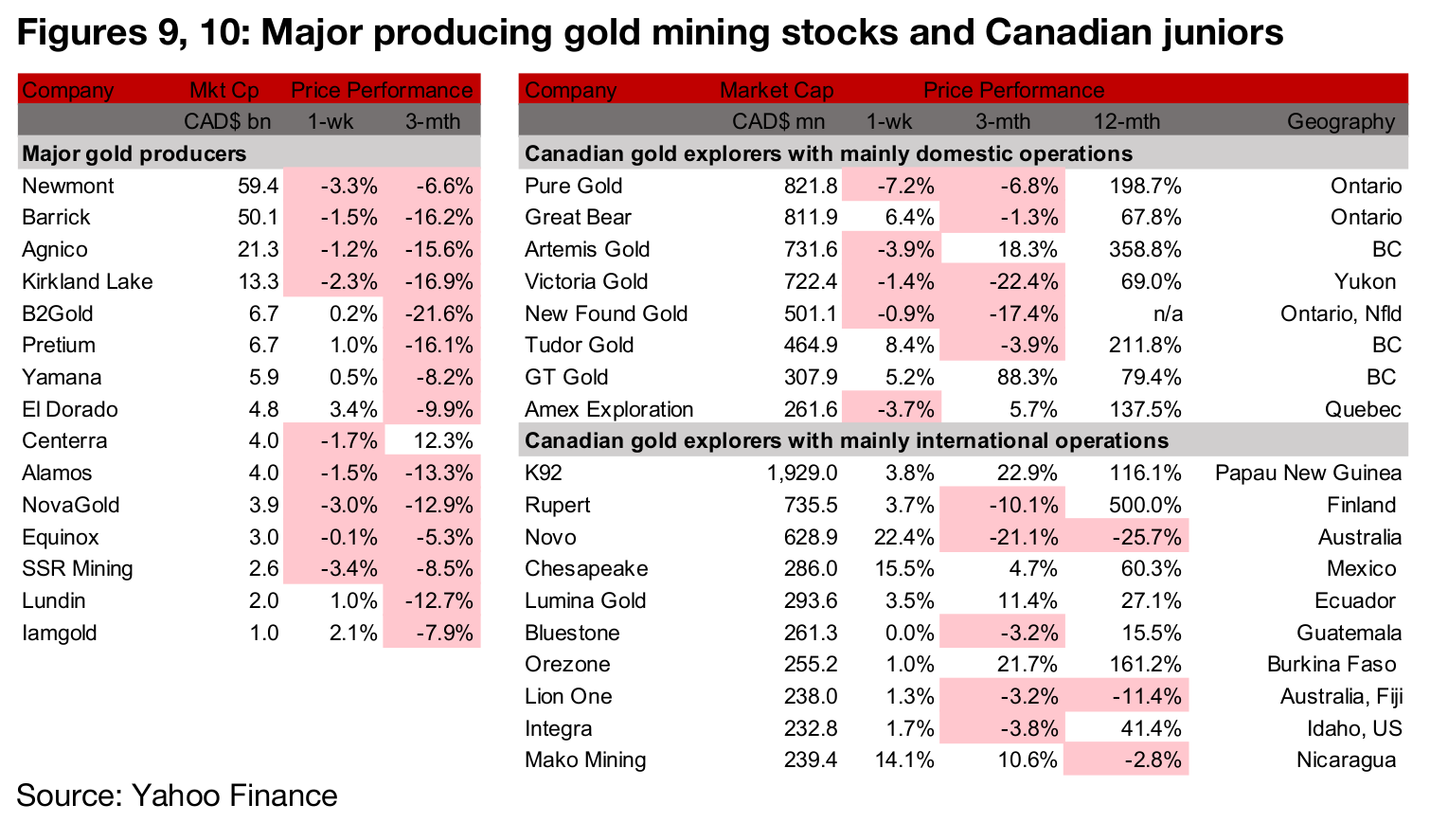

Producers mixed even as gold dips

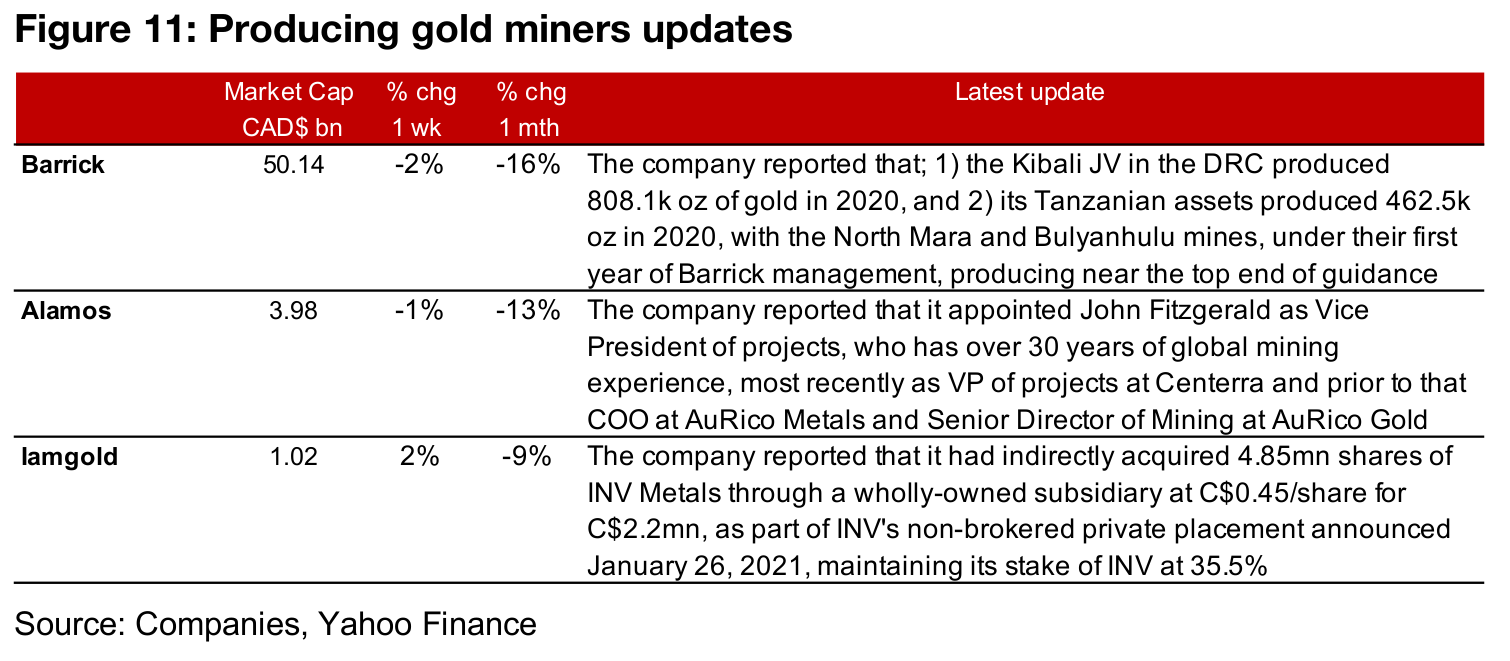

The producing miners were mixed on near flat gold, and news flow was limited as the companies are preparing for the results season beginning in the next two weeks (Figure 9). Barrick gave an update on some of its operations in Africa, including the Kibali JV in the DRC and Tanzania, with some new mines there, under their first full year under Barrick management, producing near the top end of guidance. Alamos announced the appointment of a new Vice President of Projects, and Iamgold reported that it indirectly participated in INV's recent non-brokered private placement through a wholly-owned subsidiary, maintaining its stake at 35.5% (Figure 11).

Canadian juniors mixed

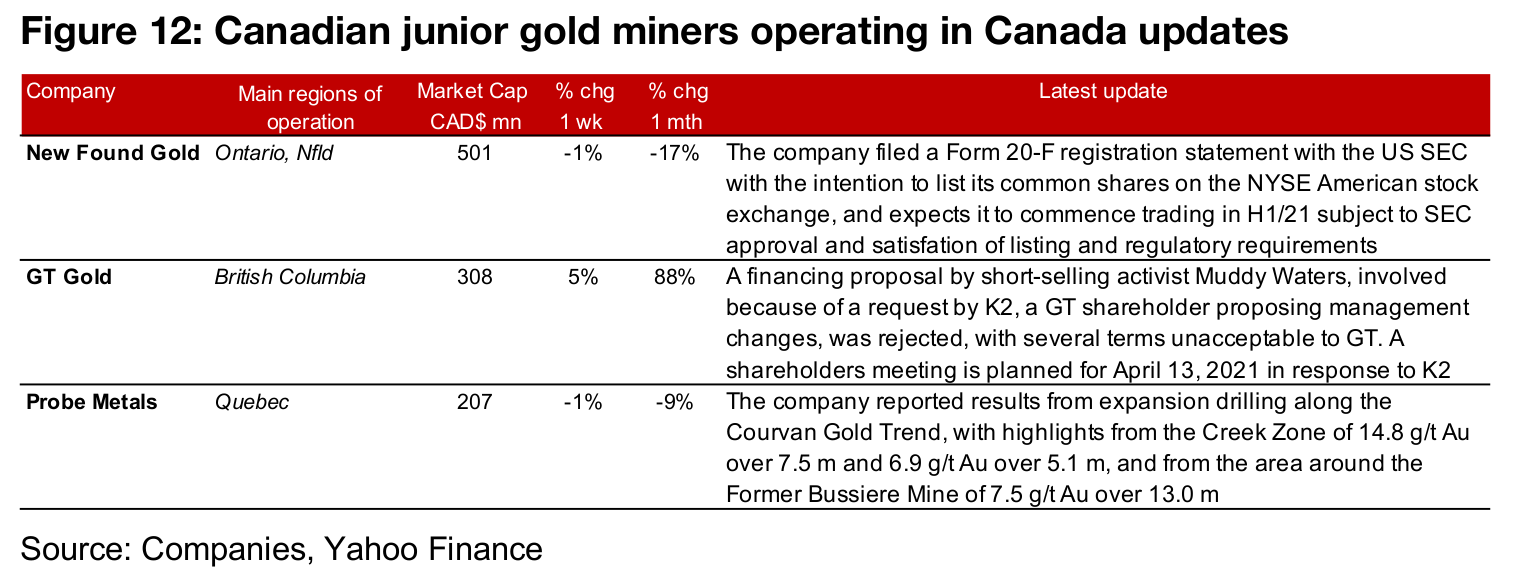

The Canadian juniors were mixed this week even as gold fell (Figure 10). For the

juniors operating mainly domestically, New Found Gold filed with the US SEC with

the intention to list on the NYSE American stock exchange in H1/21. GT Gold rejected

a financing proposal by Muddy Waters, which was brought in by K2, a GT shareholder

looking to make management changes at GT Gold, and Probe Metals reported drilling

results from the Courvan gold trend (Figure 12).

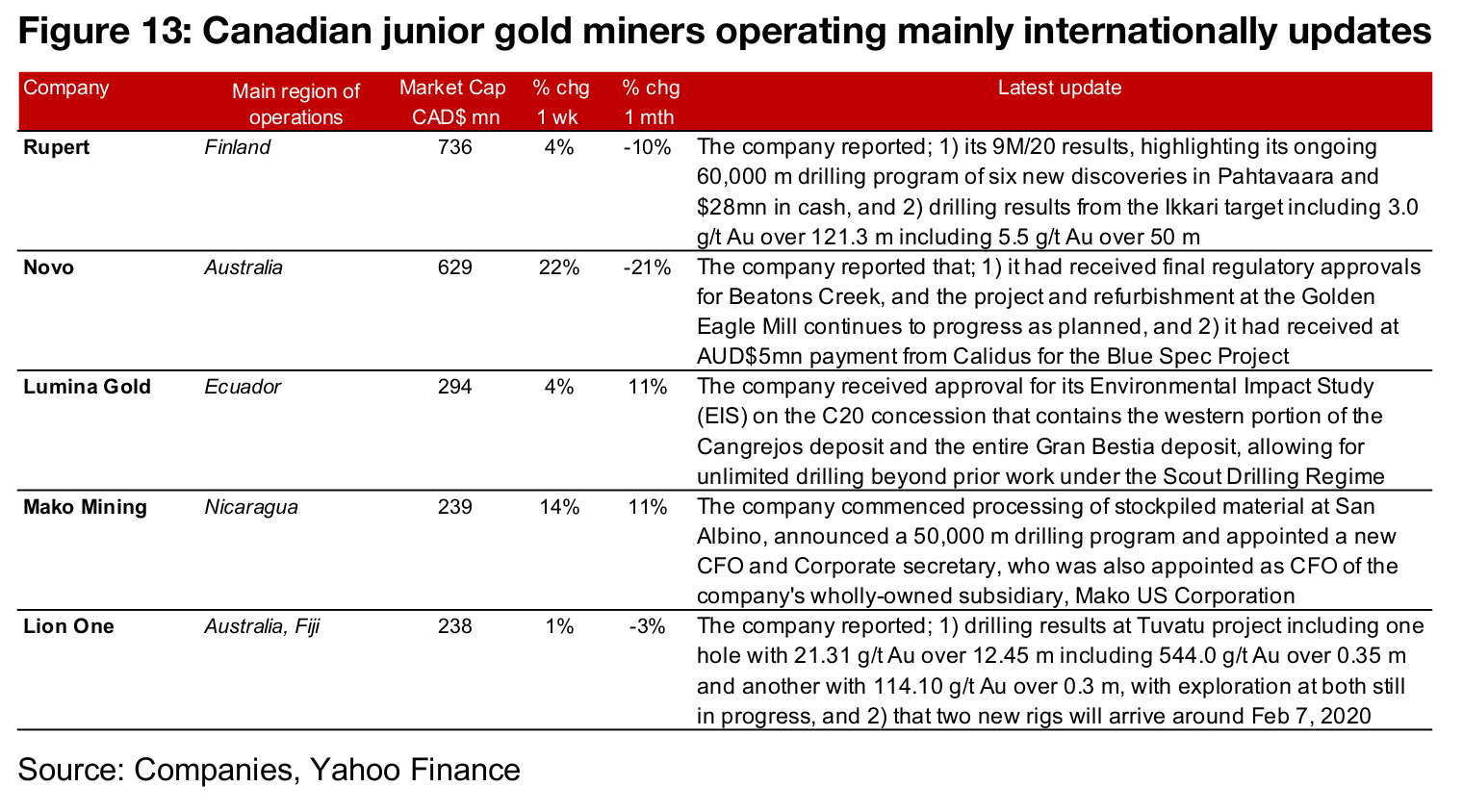

For the juniors operating mainly internationally, Rupert reported its 9M/20 results and

drilling results from the Ikkari target, Novo received final regulatory approval for

Beatons Creek and a $5mn payment from Calidus for the Blue Spec Project, and

Lumina received approvals for its Environmental Impact Study on the C20 concession

of the Cangrejos project. Mako Mining commenced processing of stockpiled material

at San Albino, announced a 50,000 m drilling program and appointed a new CFO and

Corporate Secretary. Lumina reported drilling results from Tuvatu and that two new

rigs will arrive around February 7, 2021 (Figure 13).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.