October 23, 2020

Silver outpacing even gold year-to-date

Author - Ben McGregor

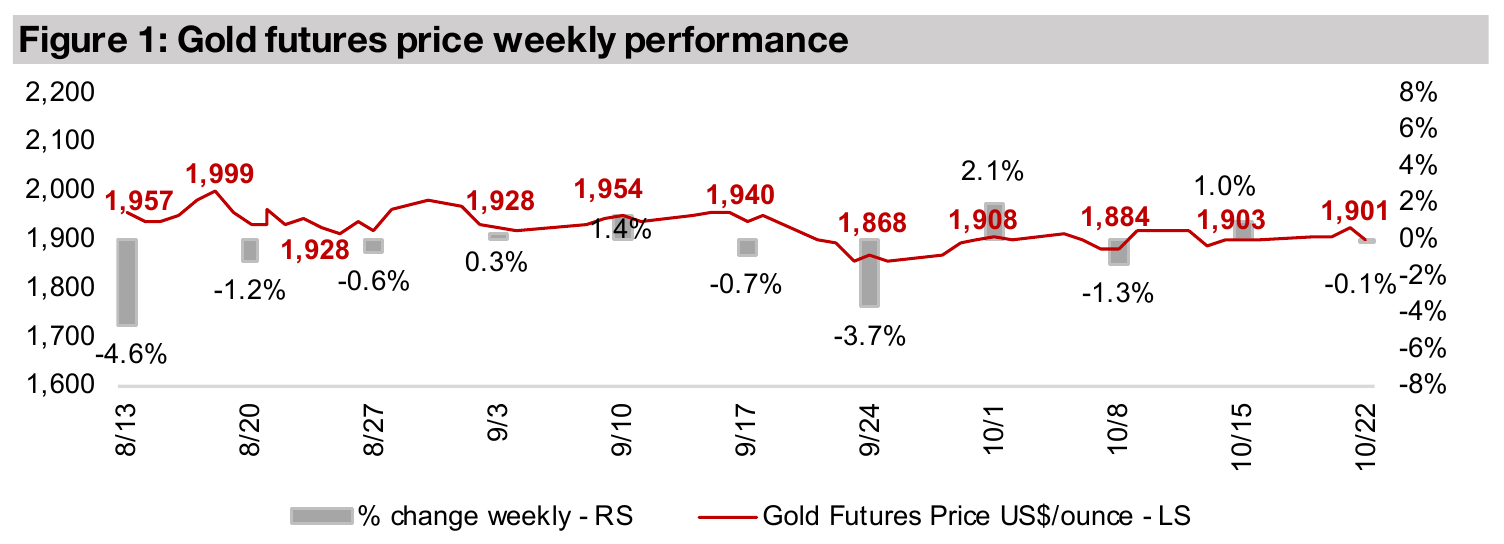

Gold flat as market awaits outcome of US election

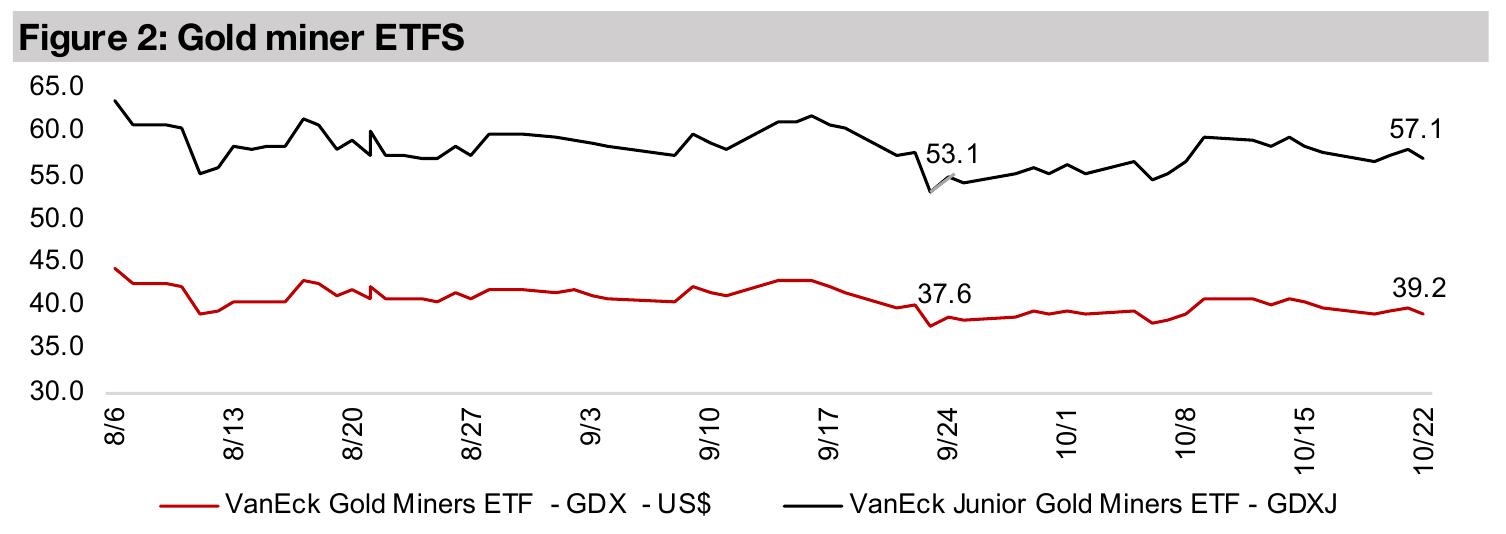

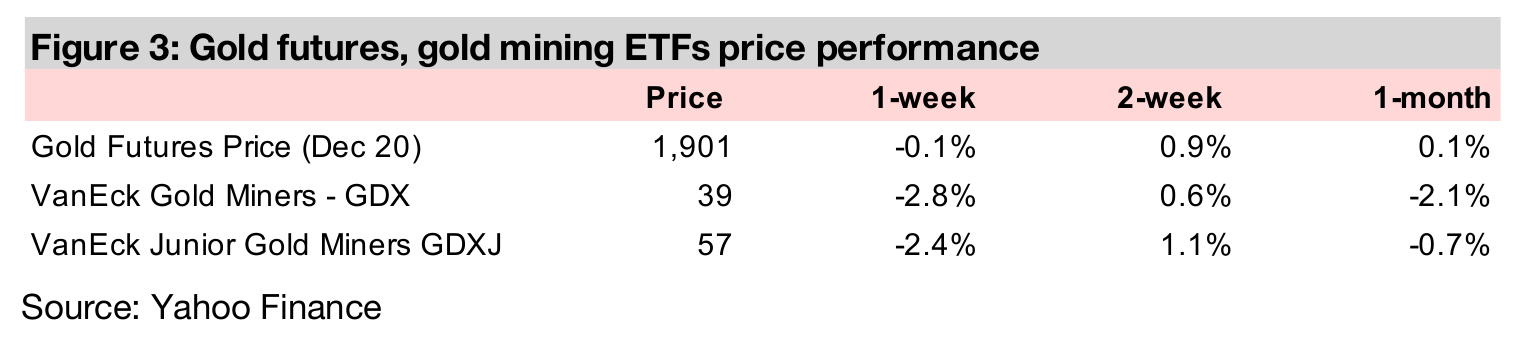

The gold price was near flat this week, down just -0.1% to US$1,901/oz, although producing gold miners fell, with the GDX down -2.8%, as the market may be taking some profit in advance of the US election in two weeks, a major swing

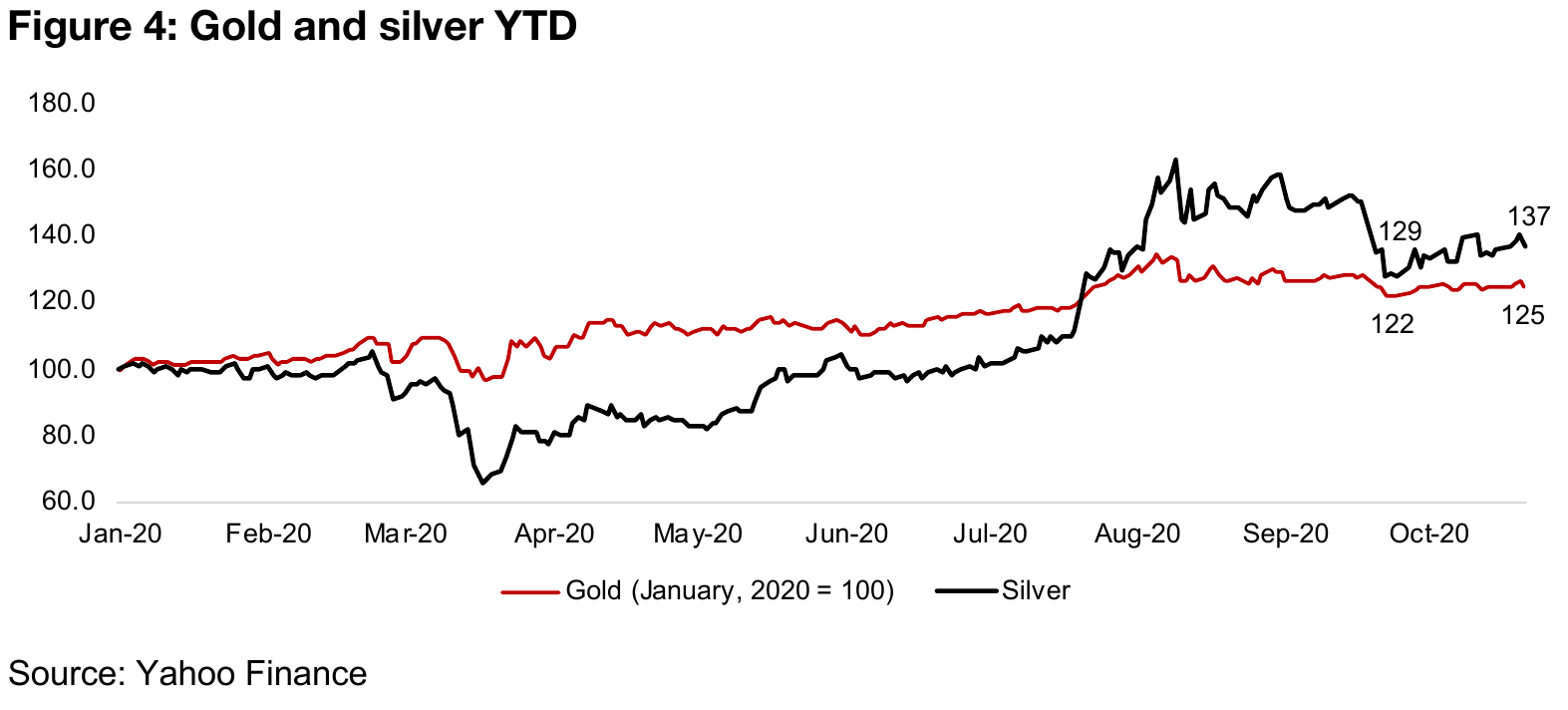

Silver has performed even better than gold this year

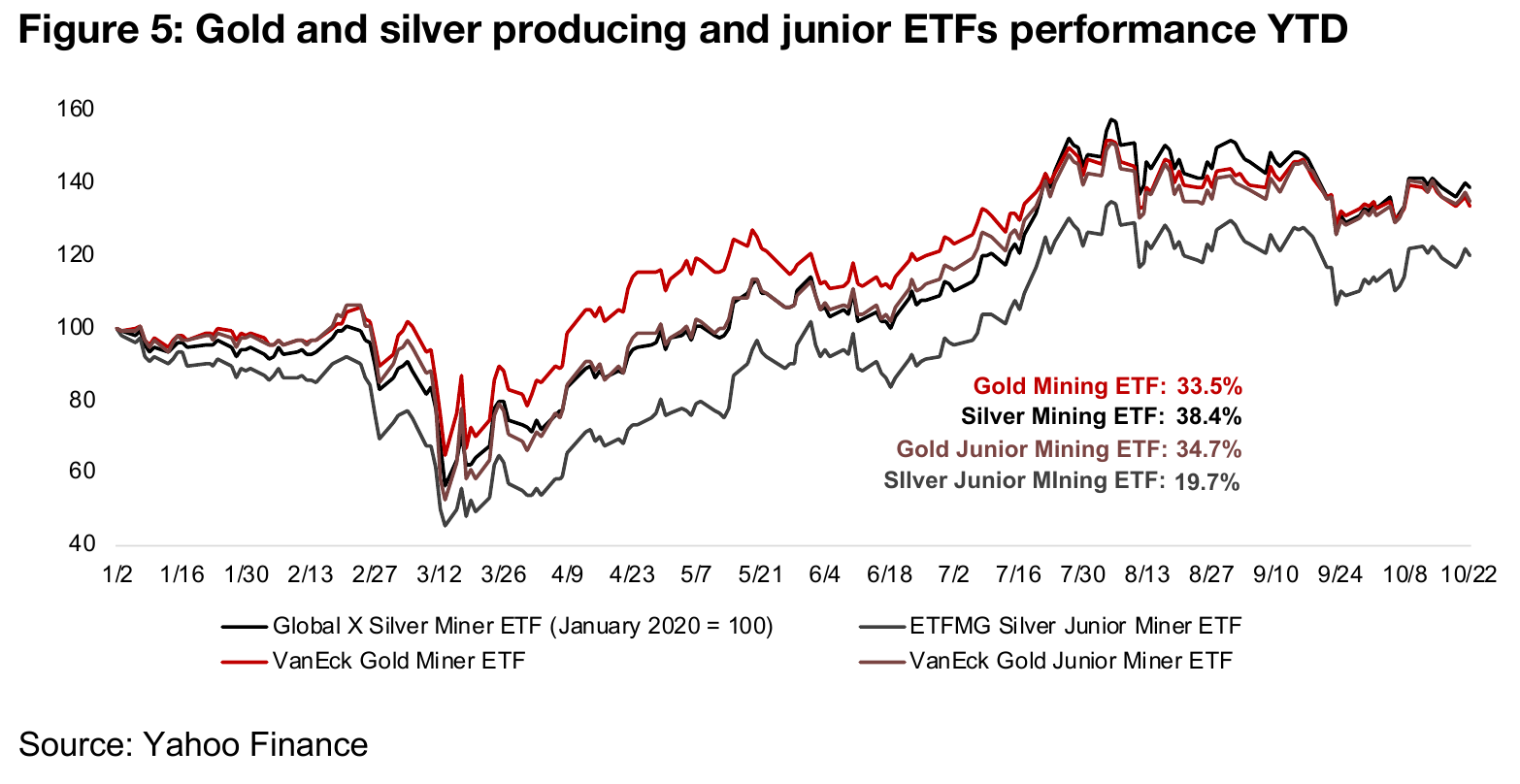

Even with given gold's strong performance YTD, up 25%, silver has done better, up 37%, with the silver ETF, SIL, up 38%, outpacing the GDX, up 35%, and the GDXJ, up 35%, although the silver mining ETF SILJ has lagged, up 20% this year.

Canadian junior gold stocks edge up, silver juniors In Focus

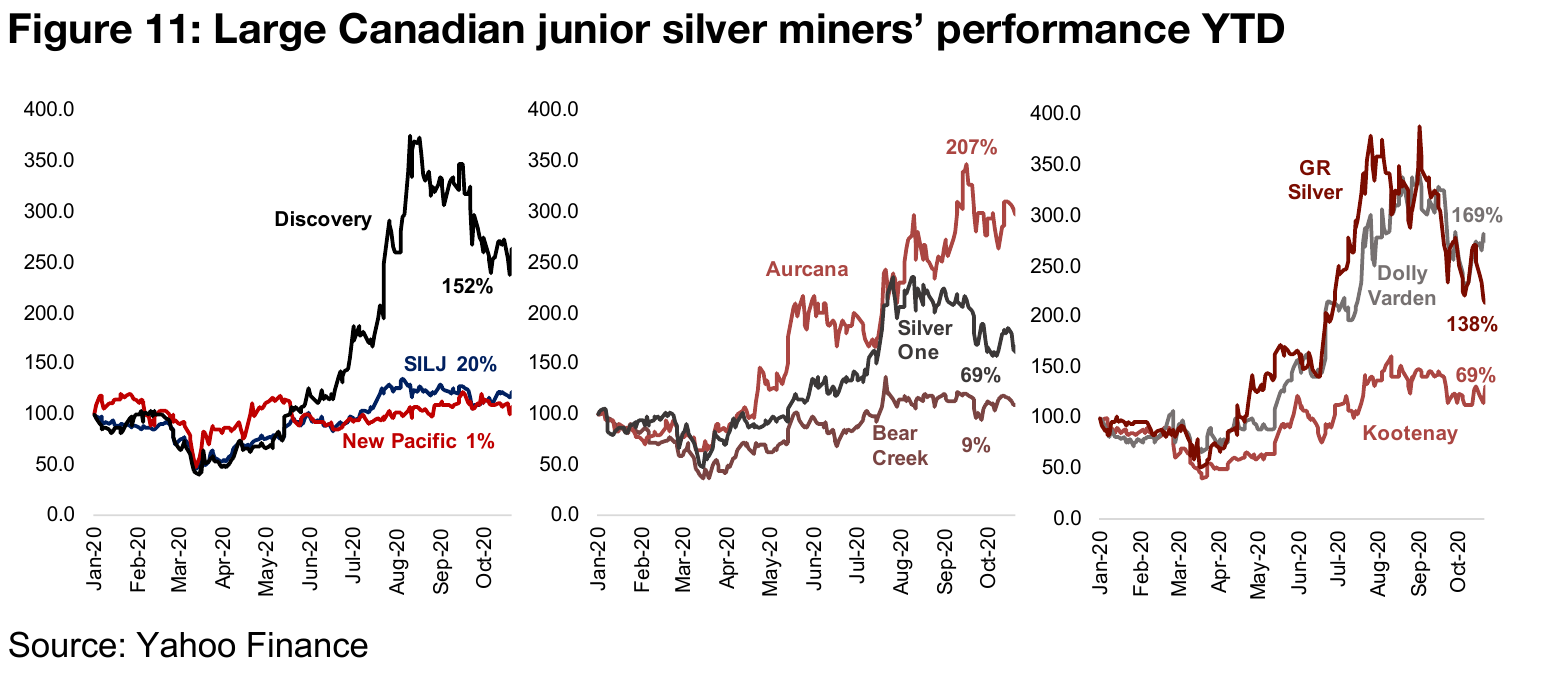

The GDXJ declined -2.4% this week and the Canadian juniors mostly fell. In Focus this week are the larger Canadian junior silver miners, many of which are dramatically outpacing the SILJ, a proxy for global silver junior miners, so far this year.

Silver having even better year than strong gold

While gold continues to have a very strong year, up 25% yoy, silver has done even better, jumping 37% yoy. Although silver had a flat start to the year, and saw a major decline in the March 2020, it recovered gradually from the crisis from March 2020 to June 2020, before surging from the end of July 2020 to well into September 2020. While silver retraced some of its gains down to a recent trough of US$23.0/oz, when it was up just 29%, compared to 22% for gold, it is has started to pick up again in October (Figure 4). This has pushed the major silver miner ETF SIL to a 38.4% gain this, year, above the producing gold mining ETF, GDX, which is up 33.5% (Figure 5).

For the junior mining ETFs, the gold mining junior GDXJ had lagged the GDX considerably, and its performance was nearly inline the silver producing miner ETF, SILJ, from March to June, 2020. In June the GDXJ started to outpace silver briefly, before the silver price surged in late July and into August, but in September and October, the performance of all three ETFs have converged to a very low spread. The big divergence has been the silver mining ETF, SILJ, which has a performance that has averaged 17.6% below the performance of the other three ETFs since the start of the year. The only real convergence between SILJ and the other three was at the trough of the March crisis, where SILJ, already quite weak for the year, saw the other ETFs fall towards it. If we were to suggest any relative movements of these four ETFs, a catch up by the silver ETF SIJL with the other three ETFs seems a possibility.

Producing gold miners down as election nears

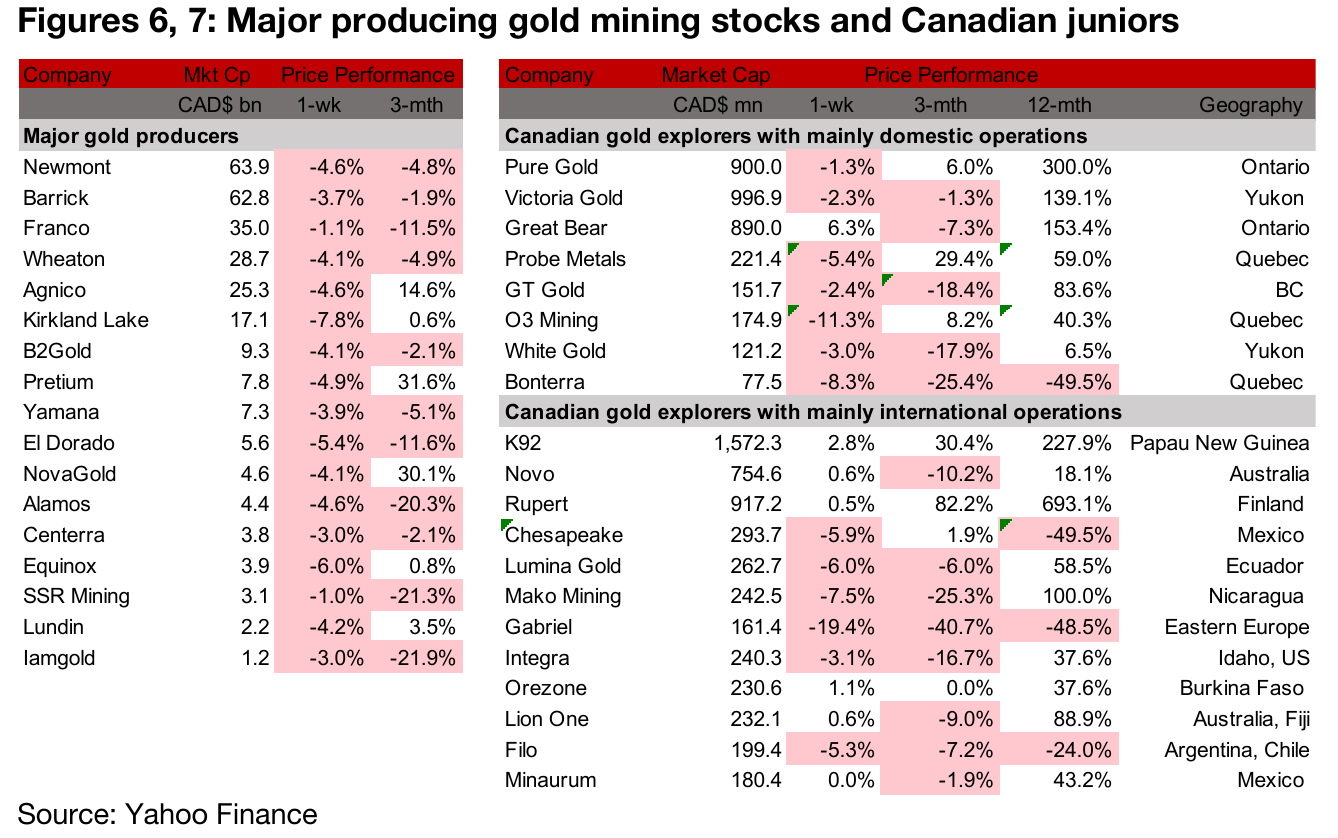

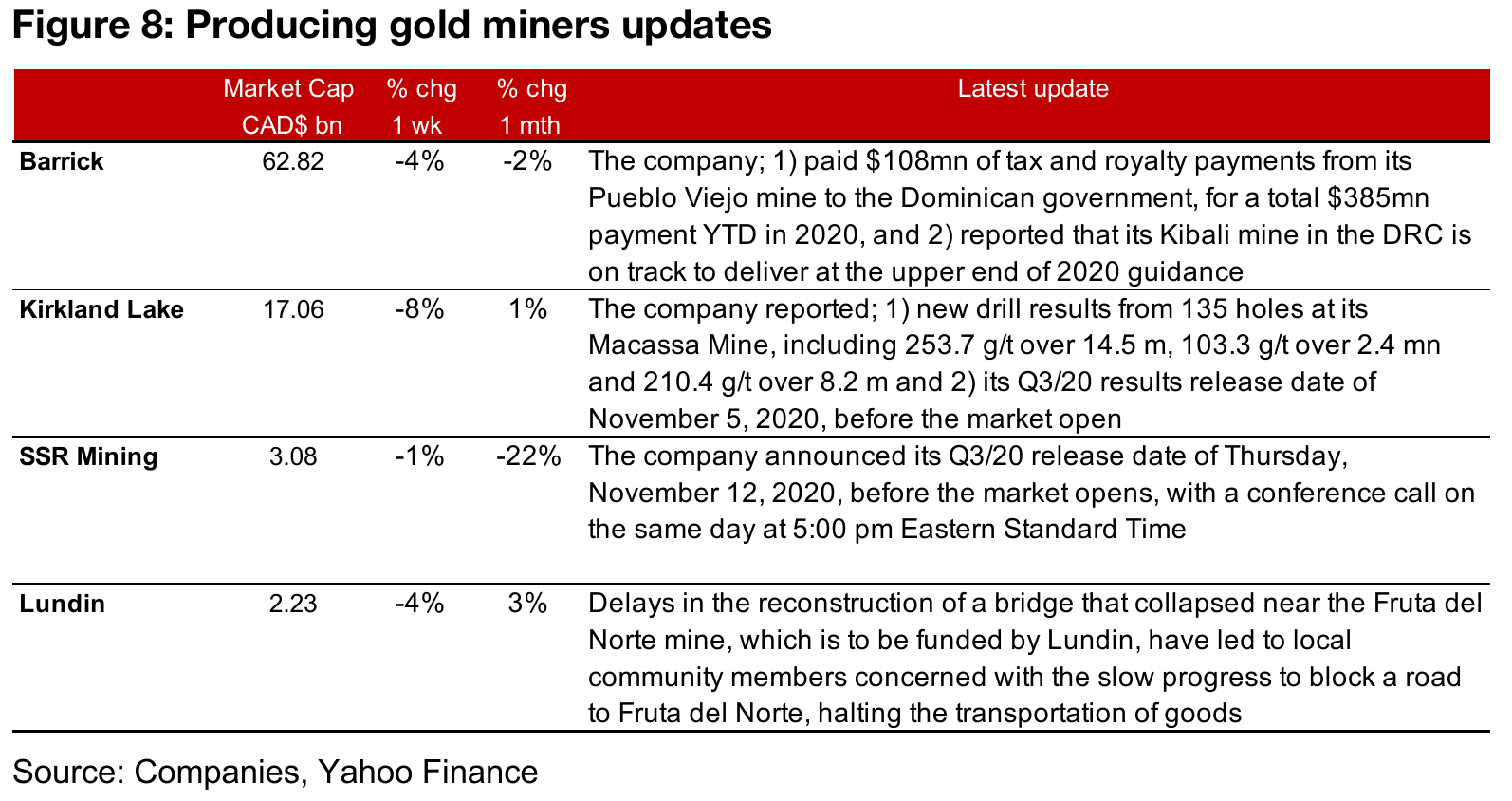

The producing miners all declined this week even though gold was flat as investors may be taking some profits in advance of the wild card of the US election, with the upcoming Q3/20 results seasons likely to be more of an upbeat, than a negative, driver (Figure 6). News flows included updates from Barrick on mines in the Dominican Republic and the Democratic Republic of Congo, new drilling results from Kirkland's Massaca mine, SSR's Q3/20 results release details and Lundin seeing disturbance to its operations from a local community blocking a road (Figure 8).

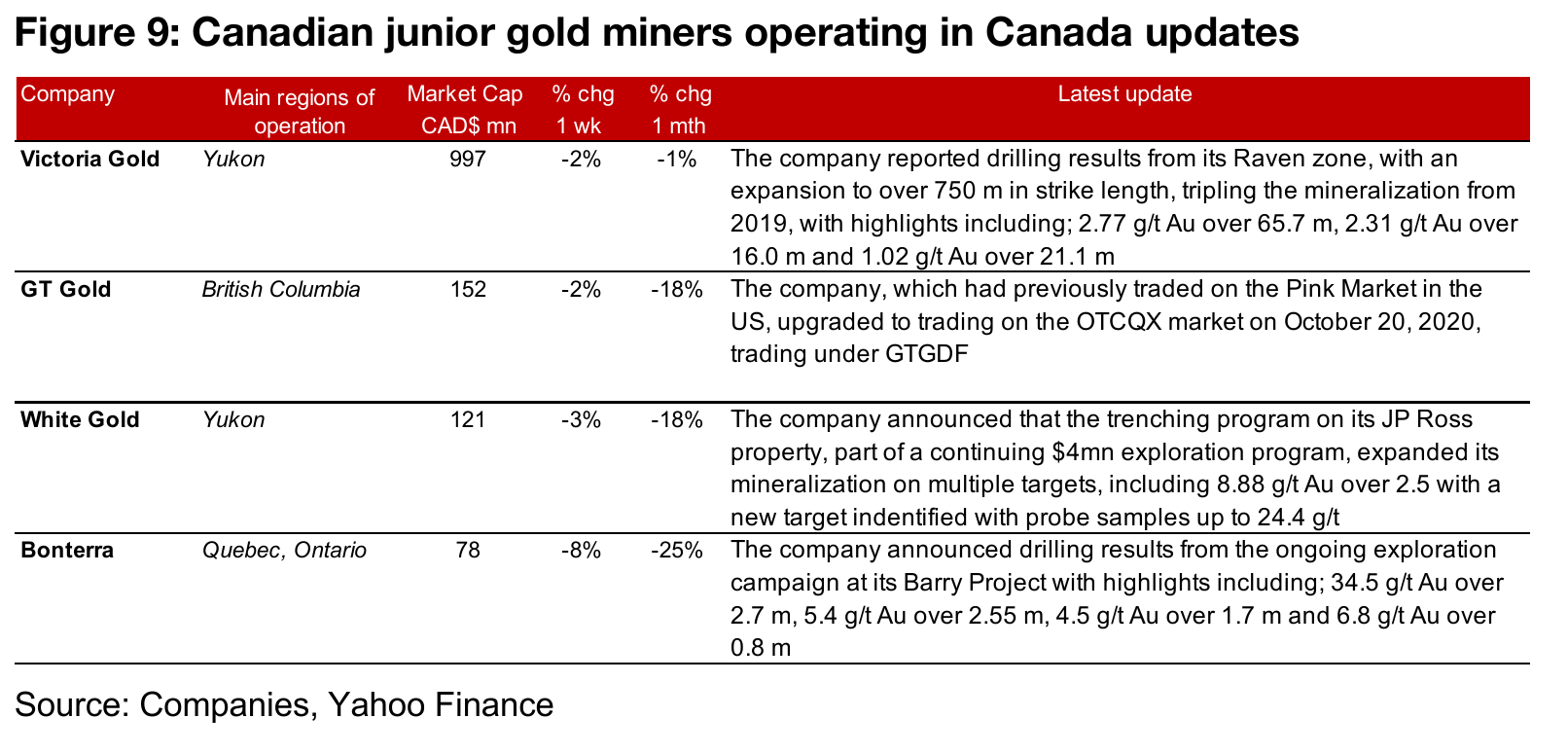

Canadian gold juniors operating domestically mainly down

The Canadian juniors operating domestically mainly declined this week, as the entire sector maybe be seeing profit taking in advance of the US election (Figure 7). Victoria Gold reported drilling results from the Raven zone, tripling mineralization from the earlier 2019 estimate, GT Gold announced that it has upgraded from trading on the Pink Market to the OTCQX in the US. White Gold announced results from the trenching program at its JP Ross property, and Bonterra announced drilling results from its Barry Project (Figure 9).

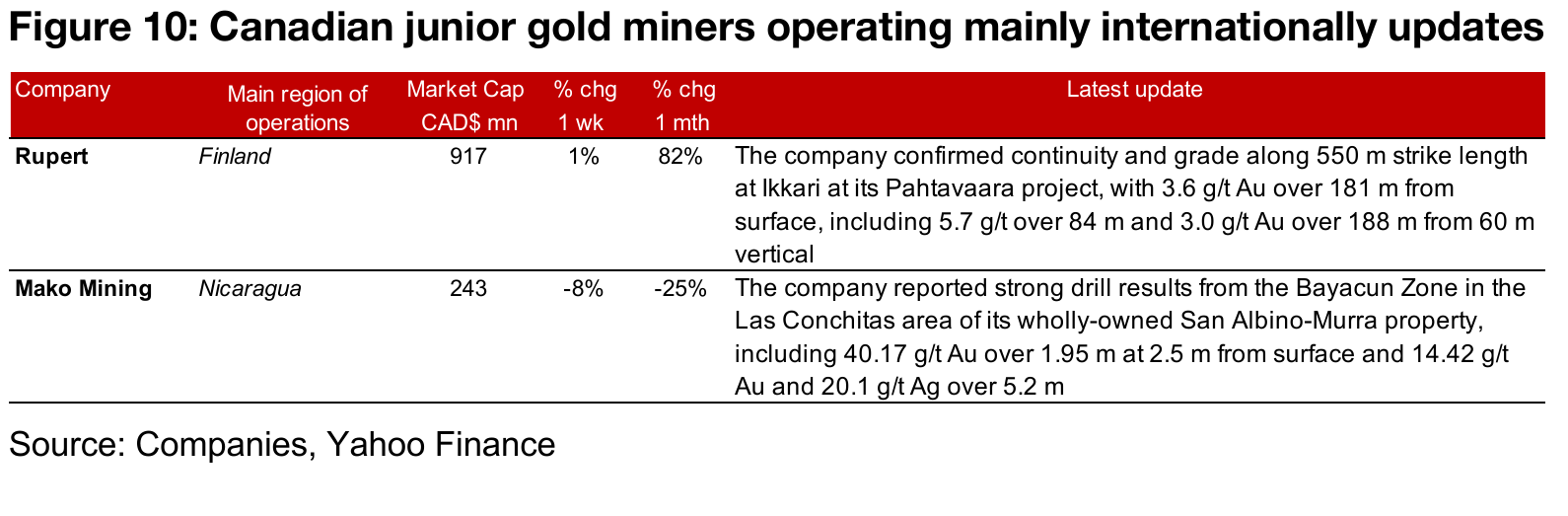

Canadian gold juniors operating internationally mixed

The Canadian juniors operating internationally were mixed this week, and news flow was limited (Figure 7). Rupert further confirmed continuity at the Ikkari zone of Pahtavarra, and Mako reported results from the Bayacuan zone in the Las Conchitas area of its San-Albino Murra property (Figure 10).

In Focus: Large Canadian junior silver stocks

Several larger cap Canadian juniors outperforming the SILJ

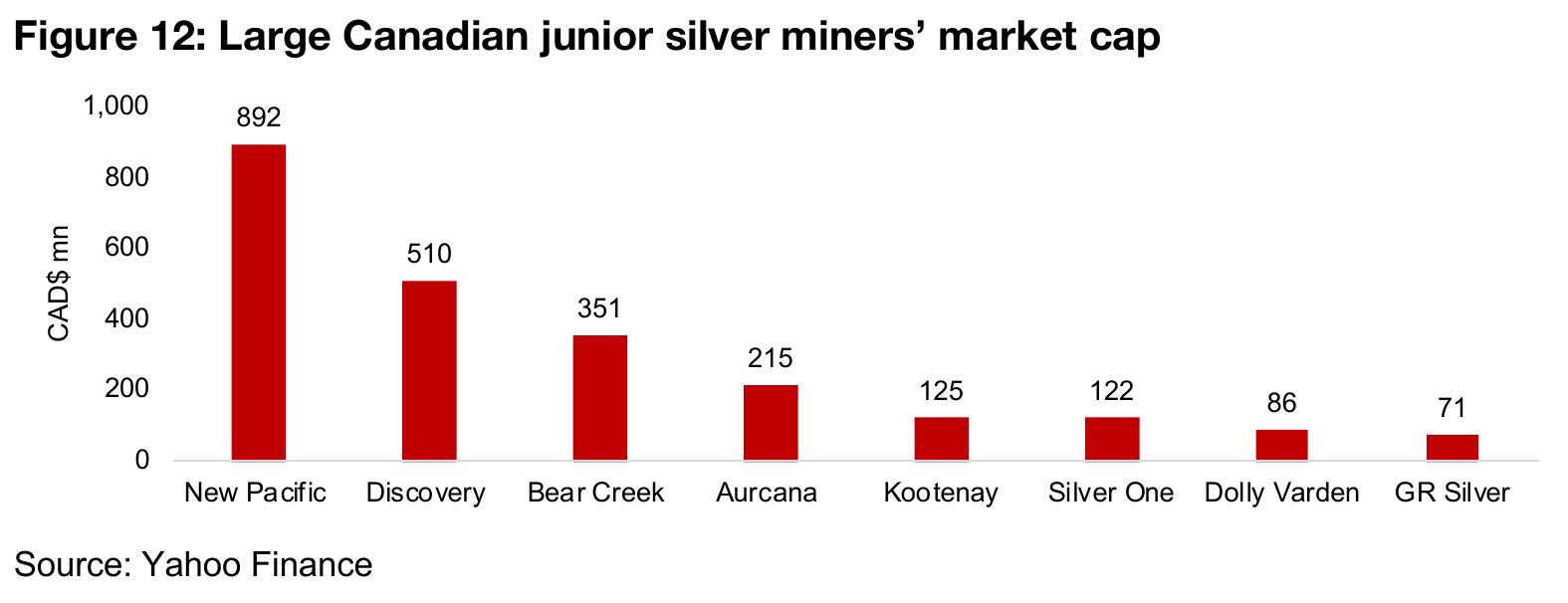

Given silve's continued strong performance this year, In Focus this week are the major Canadian junior silver miners. While as we have noted above, the SILJ junior silver miner ETF has lagged the producing gold and silver ETFs, and the junior gold ETF, it has still done well in absolute terms, up 20% YTD (Figure 11). Many of the major Canadian junior silver miners are significantly outpacing this benchmark of the SILJ, with only two of this group of eight silver miners gaining less than the SILJ, and the other six rising over 100% (Figure 12). The major stand outs of the group have been Aurcana, and Dolly Varden, up 207% and 169%, respectively, while Discovery and GR Silver have also done extremely well, up 152% and 138%. While Silver One and Kootenay's performance of 69% looks moderate in the context of these four, it is still over three times the performance of the SILJ. Even the laggards of the group have not actually declined this year, with New Pacific up just 1%, and Bear Creek up 9%.

New Pacific Metals: Resource estimate for Silver Sand in April 2020

The largest of the group, New Pacific Metals, operates two projects in Bolivia, the more advanced Silver Sand, which it acquired in 2017, and Silverstrike, which has seen limited prior exploration. The company announced in July 2020 that a third project, the 100%-owned Tagish Lake Gold Project in the Yukon, was spun out to a new subsidiary, Whitehorse Gold Corp. The company has had a relatively flat performance in 2020, up just 1%, even after releasing its first Resource Estimate in April 2020 for its Silver Sand project, with 43.05mn oz Ag, 112.81mn oz Ag, and 35.55 mn oz in Measured, Indicated, and Inferred Resources. The company has major shareholders including Silvercorp Metals with 28.8% and Pan American Silver 9.7%.

Discovery Metals: Four projects in Mexico, with Cordero the focus

The second largest, Discovery Metals, operates four projects in Mexico, Cordero, its flagship, and the earlier stage Puerto Rico, Minerva and Monclova. A PEA for Cordero from 2018 estimates a LOM production of 231mn oz silver, 2,864 mn lbs zinc, 1,992 mn lbs lead and 0.35 mn oz gold, and a 29-year mine life. The PEA targets initial and expansion costs of $570mn and $271mn, average operating and plant costs of $2.34/tonne and $5.08/tonnes of mill feed, and $193mn average annual cash operating costs. The post-tax NPV is estimated at $438mn for an IRR of 16.5%. Cordero drilling success and two investments by Eric Sprott have been the focus of news flow in 2020, driving up the share price 152% this year.

Bear Creek Mining: Operates silver-lead-zinc Corani project in Peru

The company operates the silver-lead-zinc Corani project in Peru, with Proven and Probable Reserves 225 mn oz Ag, 2,746mn lbs lead and 1,809mn lbs zinc and Measured Indicated and Inferred Reserves of 135mn oz silver, 1,323mn lbs lead and 902 mn lbs zinc. A PEA from 2019 highlights an average Ag production of 9.6mn oz and 16.3mn over years 1-3, and a mine life of 15 years, initial capital of $579mn, and AISC/oz for the LOM $4.55, and $1.36 over years 1-3. The NPV is targeted at $531mn, with an IRR of 22.9%, versus the company's market cap of $352mn. The company is up just 9% YTD on limited news flow, with only two material announcements this year, both related to a $16.6mn bought deal financing which closed in February.

Aurcana Silver: Flagship project with feasibility study completed

Aurcana Silver operates the Revenue-Virginius project in Colorado, with a Feasibility Study released in June 2018, making it the most advanced project of this group of eight silver juniors. This, combined with a series of major financing announcements this year and the surging silver price, has driven the share price up 207%, the highest of the group. The Feasibility Study outlines Proved and Probable Reserves of 21.2 mn oz AgEq, Measured, Indicated and Inferred Resources of 43.1 mn oz of AgEq, and 3.1 mn oz AgEq production and US$7.38/oz Ag for the first five full years, a LOM AISC of US$8.00/oz, and a NPV of US$74.9mn.

Silver One Resources: Early stage projects in Nevada and Arizona

Silver One operates three projects, Candeleria, in Nevada, a past producing project for which it has a 100% option, Cherokee in Nevada, and a 100% option on Phoenix Silver in Arizona, and in September announced that its three projects in Mexico are to be sold off. The company has been drilling at Candelaria this year, which has a most historic estimate of 46.6 mn oz AgEq M&I Resources and 36.6 mn oz AgEq Inferred Resources, while sampling and mapping has been ongoing at Cherokee, and Phoenix is in early stages. This exploration progress, combined with two rounds of funding, in January and July 2020, and backing by major shareholders including SSR Mining, First Mining and Eric Sprott, have driven the share price up 69% this year.

Kootenay Silver: Exploration across multiple projects

Kootenay Silver has four major projects in Mexico, 1) Columba, 2) Copalito, 3) La Cigarra and Promontorio. The company is exploring multiple projects this year, with a series of drilling results reported this year from Columba and Copalito, with the most recent press releases from these two projects in August 2020 and July 2020, respectively. Cigarra is at an earlier stage of exploration, and Promontorio has an estimated historical resource from 2013 of 118mn oz AqEq. The combined drilling results and exploration from the projects have driven up the share price 69% YTD.

Dolly Varden Silver: Exploring historic mining district in Canada

Dolly Varden is exploring in the Golden Triangle, in Northwest British Columbia, a mining district with an extended and prolific history, with its flagship project the Dolly Varden Silver mine, for which the most recent Resource estimate was released in May 2019, with 32.9 mn oz Ag in Indicated and 11.5 mn oz Ag Inferred Resources. Continued strong drilling results and completed financings this year have driven up the share price 169% YTD.

GR Silver: Three projects in Mexico, Plomosas the current focus

GR Silver operates three projects; 1) San Marcial, acquired in 2018, with a Resource Estimate released in 2019, with 36.0mn oz in AgEq, 2) Plomosas, a past-producer acquired from First Majestic in 2020, which has been the main focus of the 2020 drilling program and 3) the Rosario Silver-Gold Project, near the historically producing Rosario mine. Financing was completed in June 2020, and major shareholders include First Majestic, JDS Mining and SSR. The share price has been driven up 138% YTD on the Plomosas results and rising silver price.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.