June 02, 2023

Show These Charts to Everyone You Know

It's time to take a victory lap.

Our team at the Canadian Mining Report has been discussing the benefits of gold as an asset that protects investors against inflation for a while now.

We're convinced that it's one of the best investments-alongside shares of select Canadian mining companies-for uncertain times.

And now the data is in.

We URGE you to share this chart with every investor you know.

Because it makes one point loud and clear: despite some volatility, gold protects the value of your money in the long term.

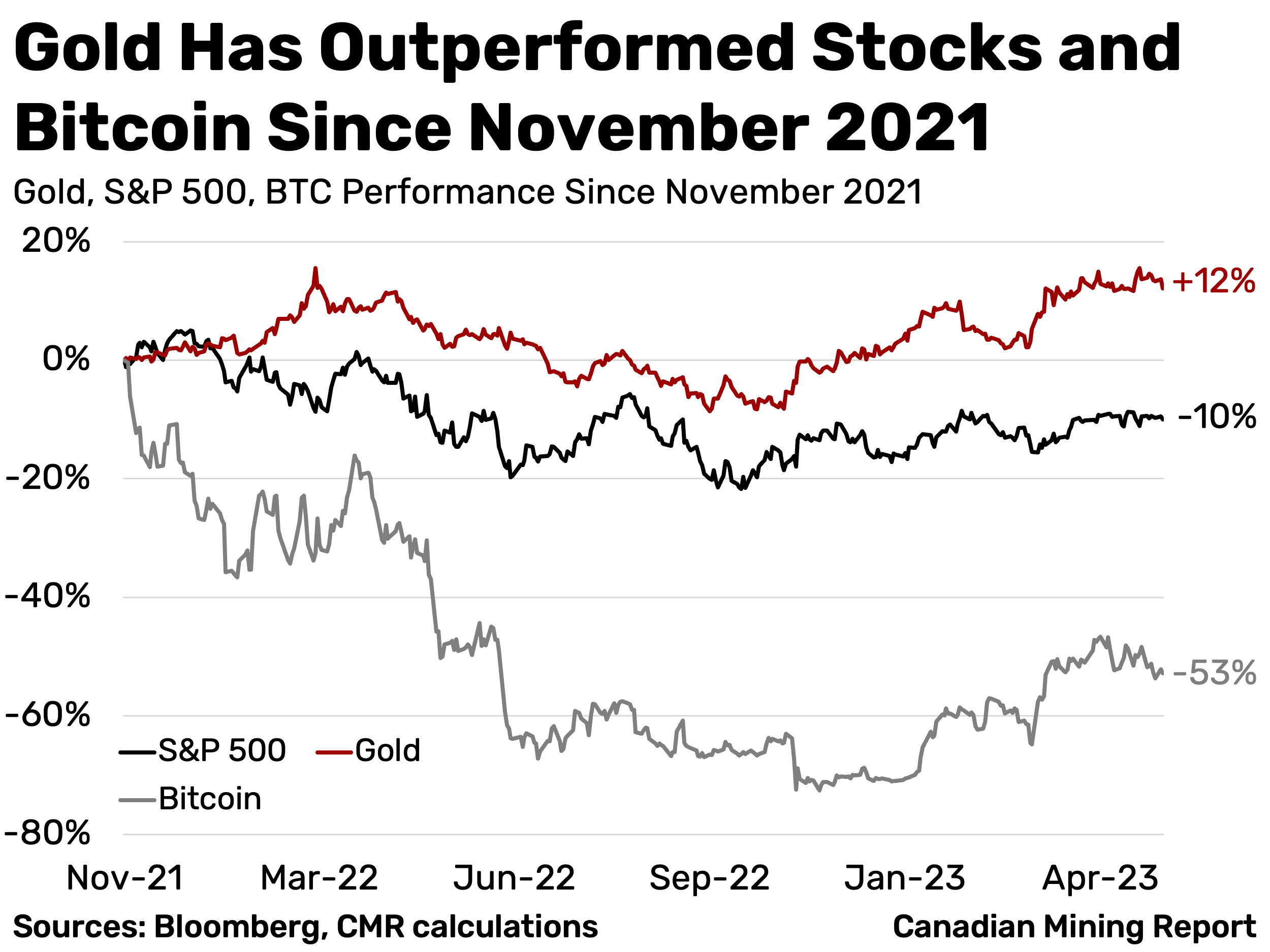

The chart below tracks the value of gold and bitcoin, as well as the level of the S&P 500 index since November 2021.

That's when the period of high inflation that we're still living through began.

Take a look at this chart...

Gold is up 12% while both the S&P 500 and bitcoin are down.

Between November 2021 and April 2023, the cumulative inflation number is 9.1%.

Which means that in real terms gold is up 2.7%.

It has delivered a positive return over the medium term, unlike stocks or crypto.

Bonds, by the way, have also fallen by more than 10% over the same period.

What does it mean?

First, that gold has acted as a safe haven, just as expected. When stocks and bonds were losing value, gold has preserved the value of investors' capital between November 2021 and May 2023.

Second, that gold proved to be a great diversifier for a stocks-and-bonds portfolio.

But there's more to gold and other commodities...

Companies that were leveraged to commodities performed even better.

The 'Commodity Leverage' Delivered Outstanding Results

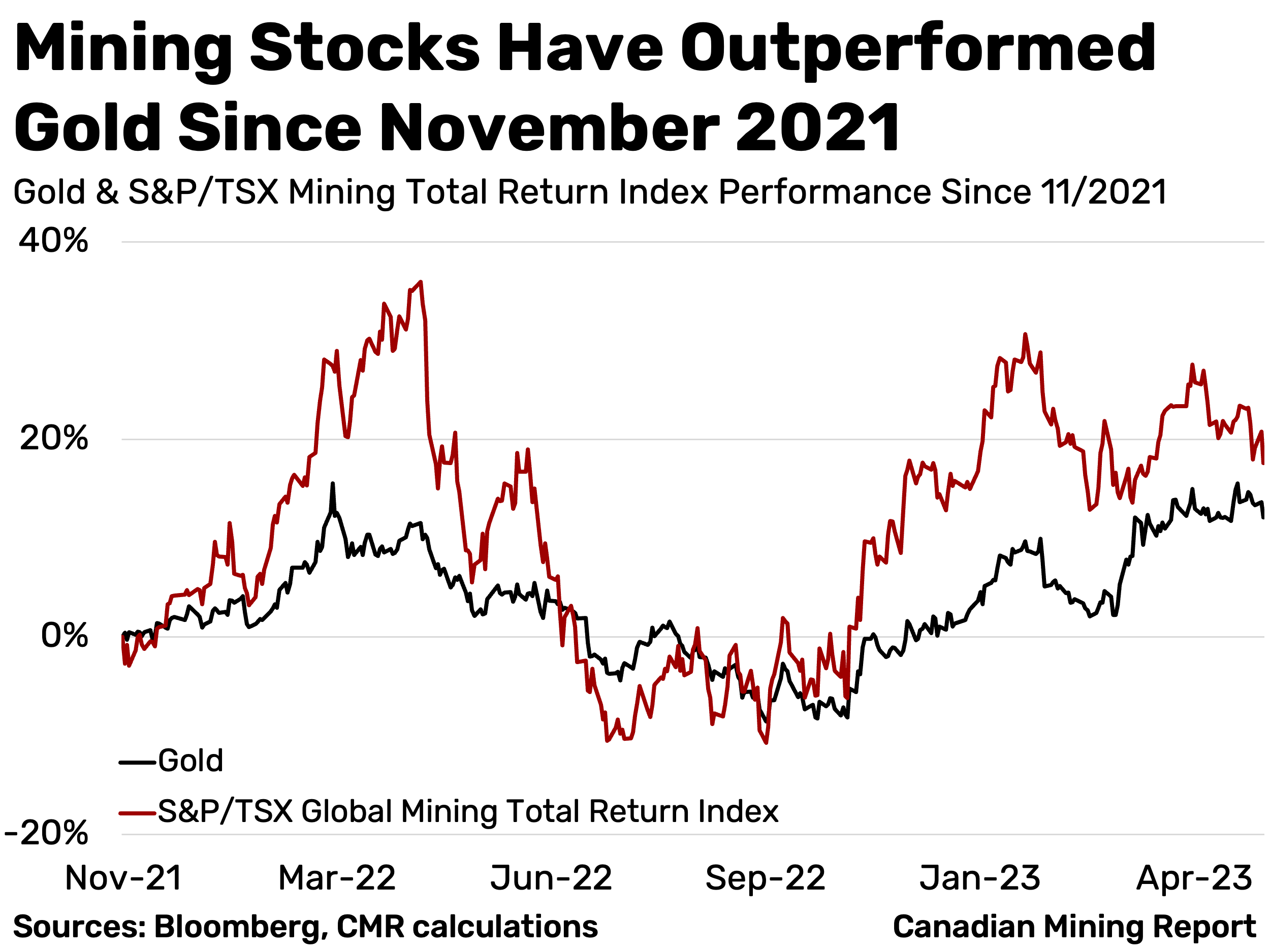

Since November 2021, gold has been up 12%.

But a certain group of companies delivered an even better return.

The S&P/TSX Global Mining Total Return index appreciated by 17% since then.

The index tracks a portfolio of companies, about 39% of which are based in Canada.

If you look at the chart, you'll clearly see the “leverage” that we are talking about.

When gold went up, the index appreciated much more.

Back in April 2022, it was up more than 30% compared to its November 2021 level.

As inflation continued, the index corrected, but growth returned in the beginning of this year. As we mentioned, it is up about 17% compared to the pre-inflation level.

How do you interpret this information?

Canadian Mining Companies May Outperform the Underlying Commodities

This outperformance effect is nothing new to industry insiders.

In fact, it's one of the biggest reasons why investors put their capital at risk in the mining sector.

When an underlying commodity, such as gold, enters a long-term bull market, the companies exposed to it appreciate as well. And often they outperform the commodity itself.

Right now, we see two trends that have been performing well in the commodity space.

The first one if, of course, inflation. We have just shown you that gold acted as a safe haven and delivered positive inflation-adjusted returns since November 2021 when inflation started accelerating.

The second one is clean energy and the “green transition.” Commodities that are exposed to the decarbonization and electrification trends have been market favorites for a while now. Copper, lithium, cobalt, and others have seen investor interest.

This trend hasn't stopped, much like inflation. It is widely expected to continue in the long-term as the world moves away from fossil fuels.

But back to inflation and gold.

The yellow metal has proven to be a reliable inflation play.

We have enough data to prove it.

As a result, if you are looking to diversify into this alternative asset, it could be a good time to consider gold as part of your portfolio.

Some estimates say that allocating 10%-20% to gold could provide you with diversification benefits.

Canadian mining companies are another asset that could amplify gold's returns if you have the capacity to handle some volatility in the near-term.

If you are new to the Canadian mining space, you're in the right place.

The Canadian Mining Report focuses on these companies and provides updates on the space regularly.