November 13, 2020

Risk-on hits gold, but Q3/20 results strong

Author - Ben McGregor

Gold down as investors shift to risk-on

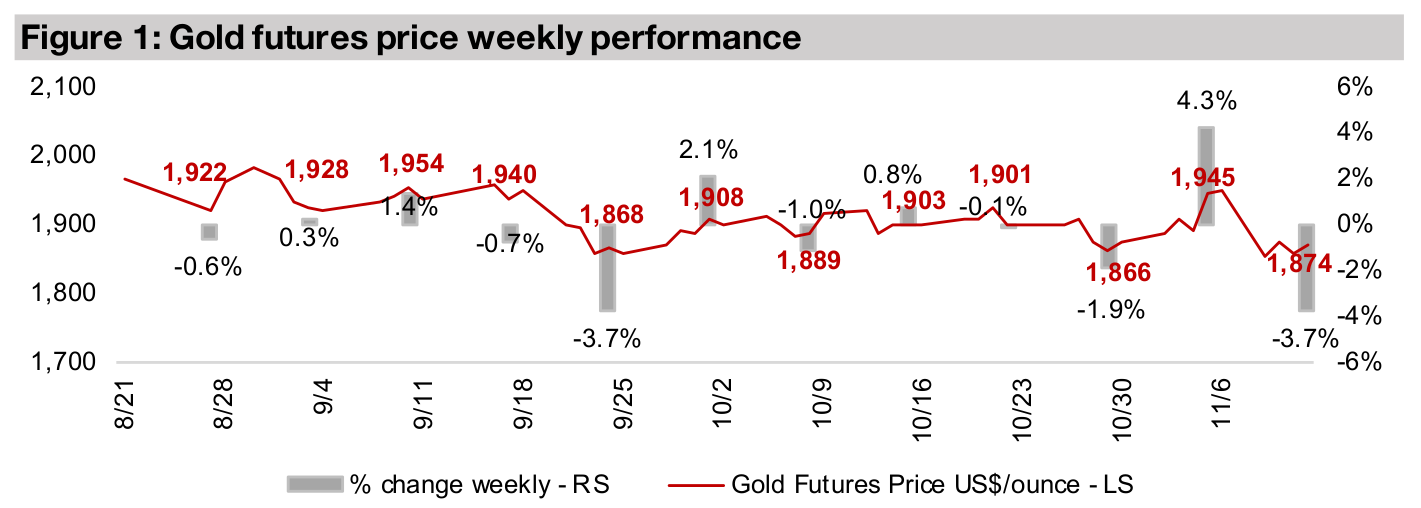

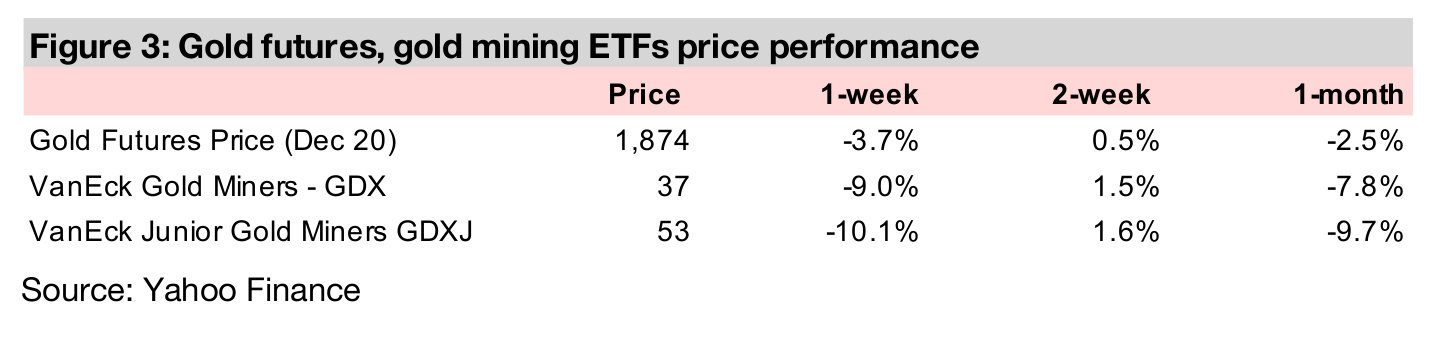

Gold declined -3.7% this week to US$1,874/oz, mainly on news of progress on a vaccine, which lead to a more risk-on stance by investors, with safer assets, including gold and US treasuries, falling, and the global stock market rising.

Producers' Q3/20 shows strong revenue and surging income

All major gold producers have now reported, showing a very strong Q3/20, with the top ten producers seeing production growth down just -1.1% even with shutdowns, revenue growth rising 30.2% and net income up 116% to its highest level in years.

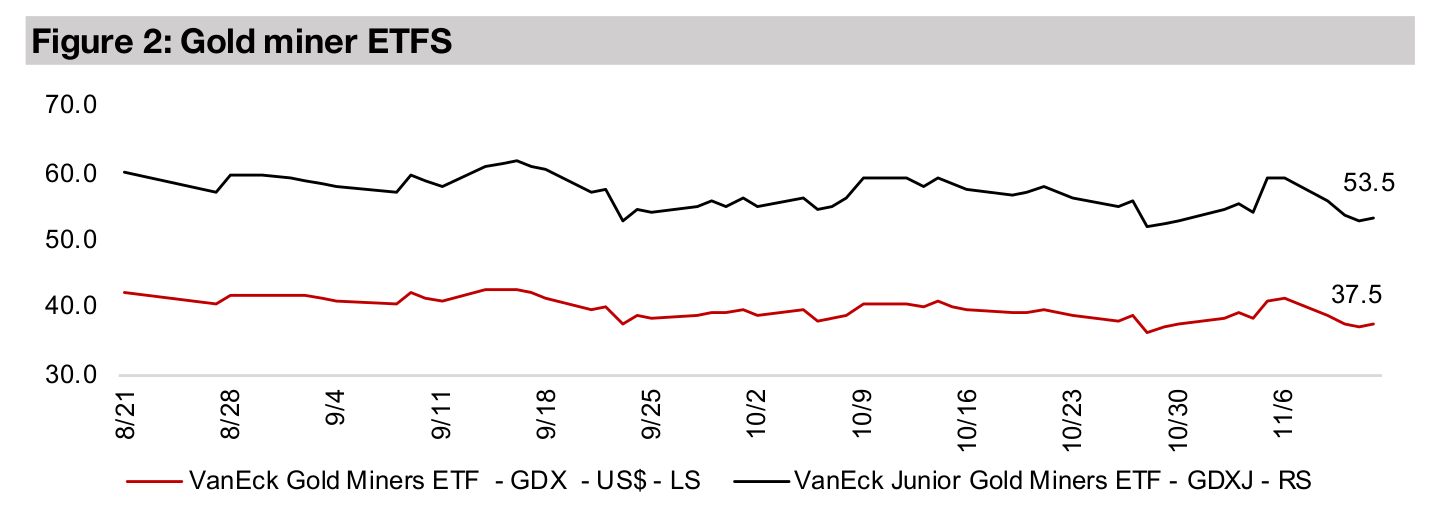

Junior gold miners drop, Rupert Resources in (RUP.V) In Focus

Gold juniors slid, with the GDXJ down -10.1%, and most of the Canadian junior gold miners down for the week, although Rupert Resources, by far the strongest performer of the Canadian juniors YTD, bucked this trend, and is In Focus this week.

Gold takes a short-term hit as investors go risk-on...

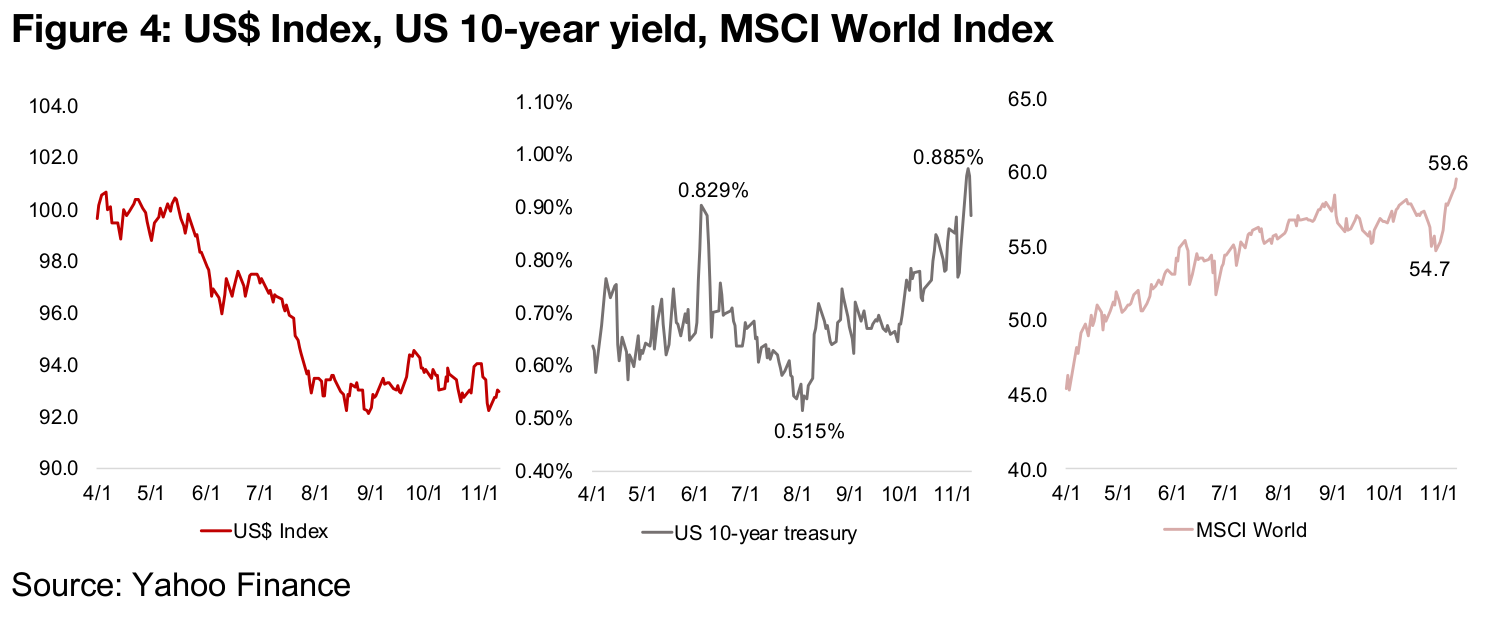

Gold dropped -3.7% this week to US$1,874/oz, mainly on news of major progress on a potential vaccine to help curb the global health crisis. This led investors to adopt a more risk-on stance, and safe haven US treasuries were also sold off, leading to a surge in yields to 0.885% for the US ten-year, off of August 2020 lows of 0.515% (Figure 4). Global stock markets have also jumped over the past week, with the vaccine news building on a rebound that had already started since the US election. However, as ever, we wouldn't count on an extended drop in gold.

...but underlying fundamentals do not support an extended fall

First, there is a large chasm between early progress on the vaccine, and actually getting it distributed to the public to an extent where the global economy can fully get back to normal. Second, while the holding of the US election has provided short- term relief, vote recounts are occurring, and it remains to be seen whether the policies of a new administration will drive a sustainable boost to the economy and stock market. Third, longer-term, no matter what party won, aggressive monetary and fiscal stimulus in reaction to the ongoing global economic crisis were going to be a part of their plan. The resulting monetary and debt expansion required to fund this will inevitably put pressure on the dollar, and inversely boost gold given its pricing in US$.

Big Q3/20 for gold producers

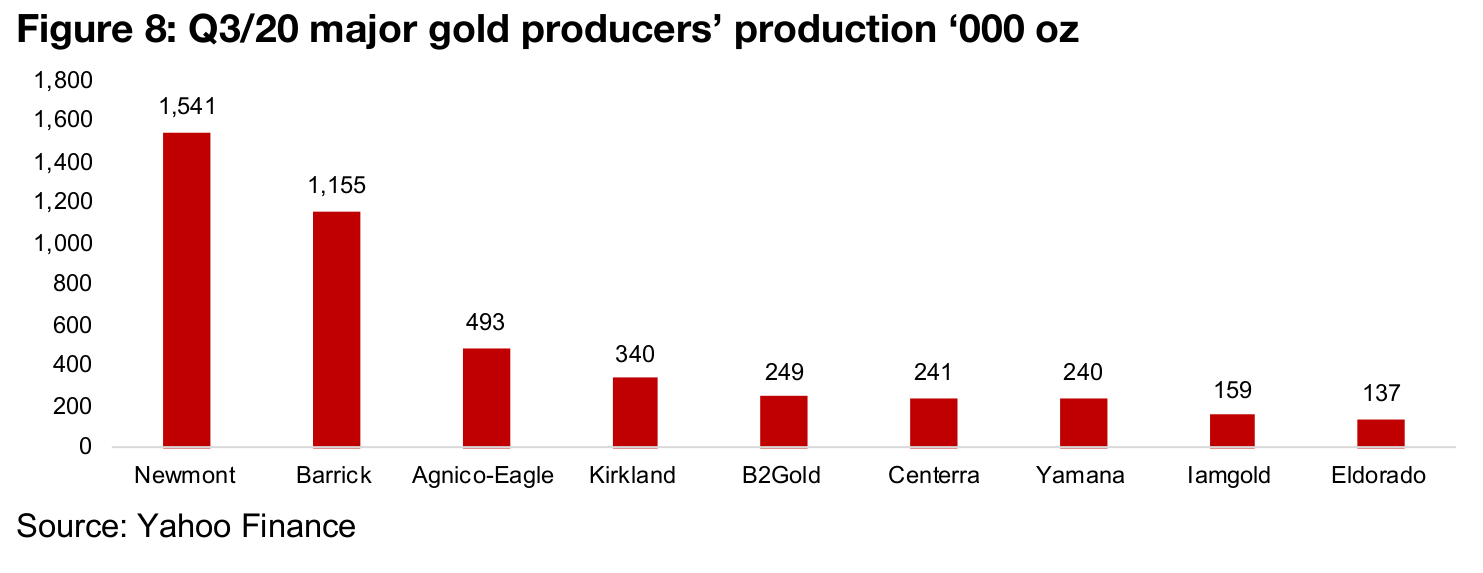

While gold has pulled back a bit short-term, it is still averaging over US$1,750/oz this year, and remains in very bullish territory compared to even just a year ago. And this range has been more than enough to propel the major gold producers, which in aggregate have seen a very strong Q3/20. With all the major producers having now reported their Q3/20 results, we look at the aggregate gold production, revenue and net income of the top ten combined (comprising Newmont, Barrick, Agnico-Eagle, Kirkland, B2Gold, Yamana, Franco-Nevada, Centerra, Iamgold and Eldorado), and also a ranking of the best performers for these three metrics.

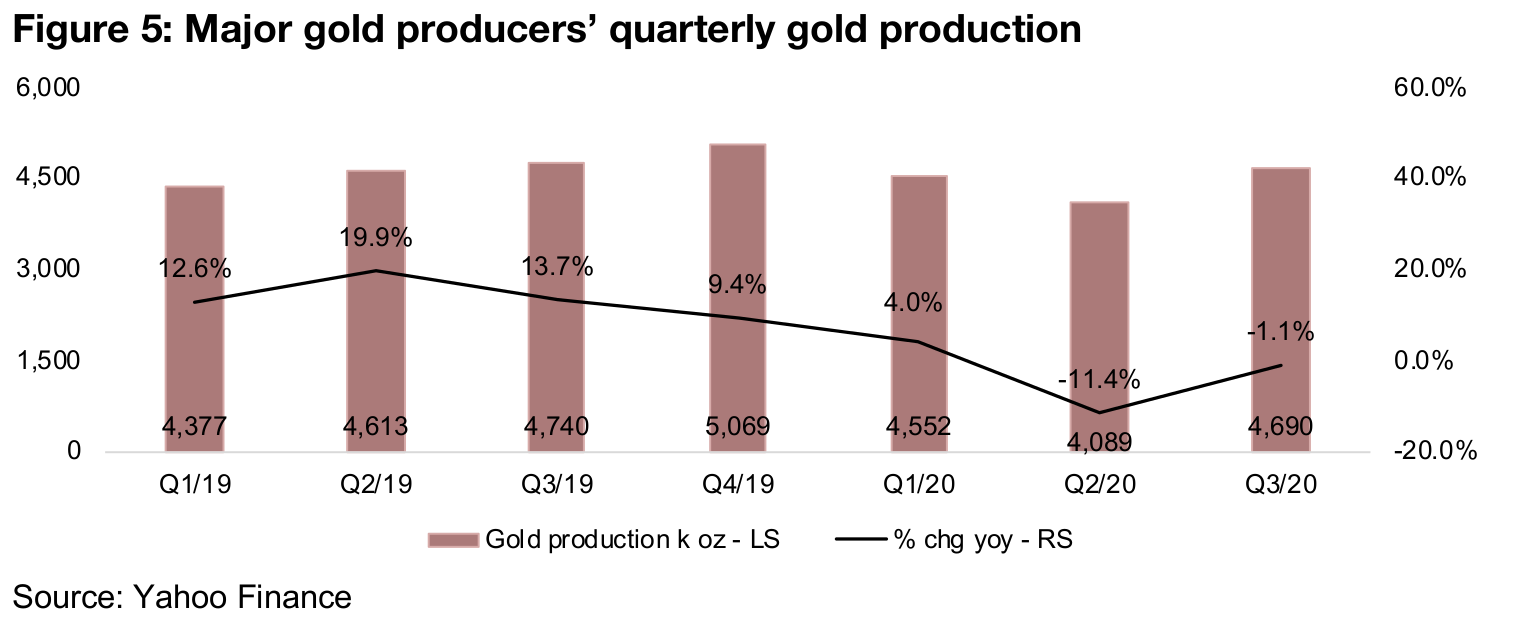

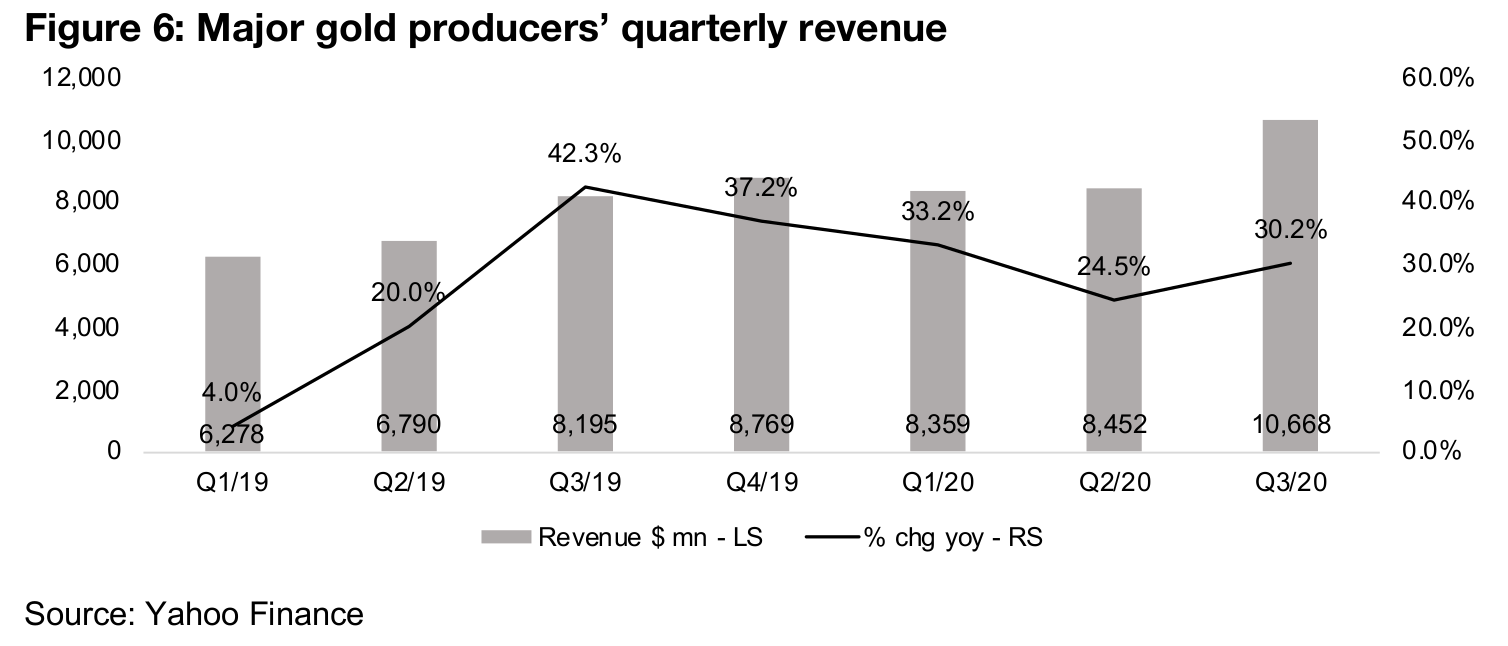

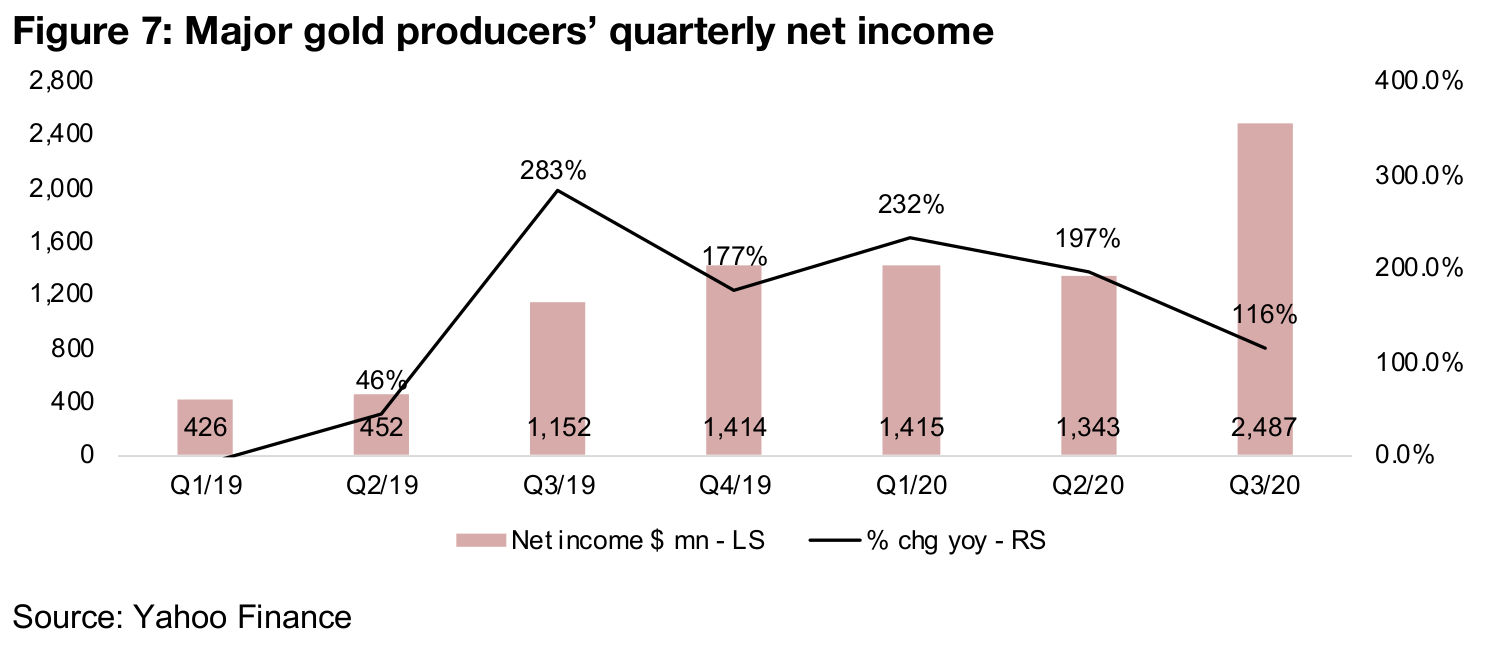

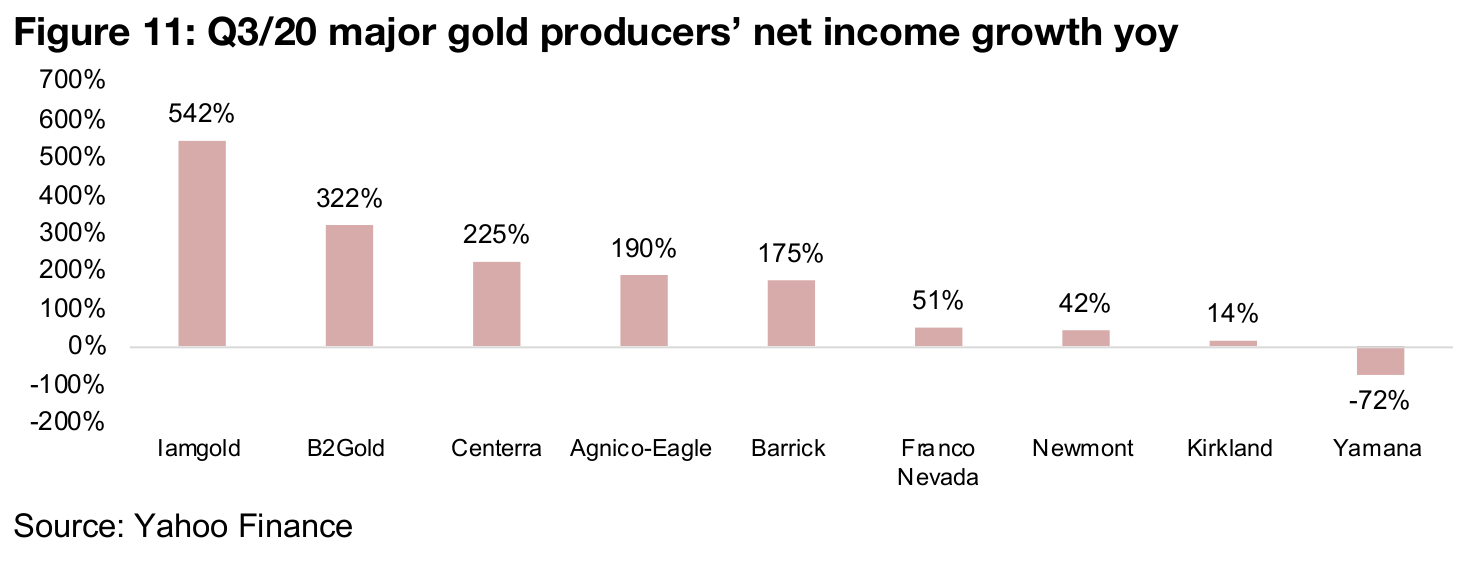

Net income in Q3/20 at nearly six times the level of H1/19

While production for the major gold producers continued to contract, by -1.1% yoy in Q3/20, this was up from a -11.4% decline in Q2/20, and with most temporary shutdowns in production now over, production growth is likely to return in Q4/20 (Figure 5). The surging gold price offset the production slowdown, with revenue up 30.2% yoy for Q3/20, and even at the Q2/20 trough, revenue growth was still strong at 24.5% yoy (Figure 6). But the most impressive number was net income, which rose 116% yoy, and is now nearly six times as high as quarterly net income over H1/19, demonstrating the sector's very strong leverage to the gold price (Figure 7).

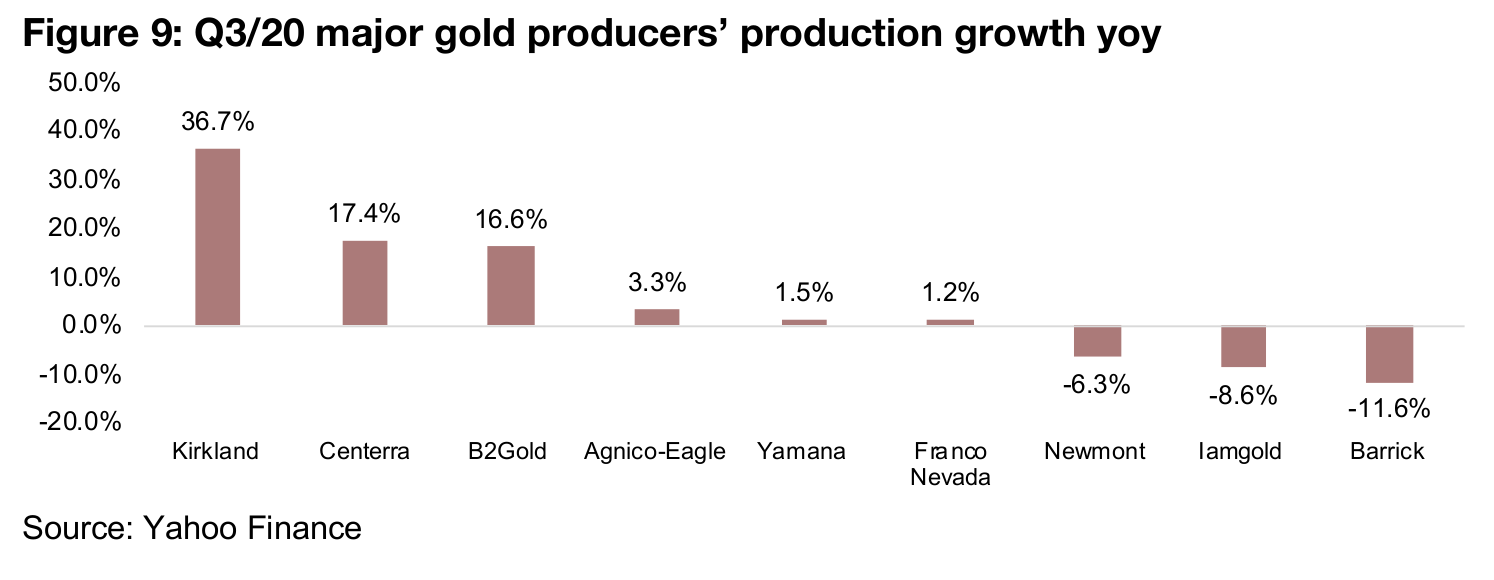

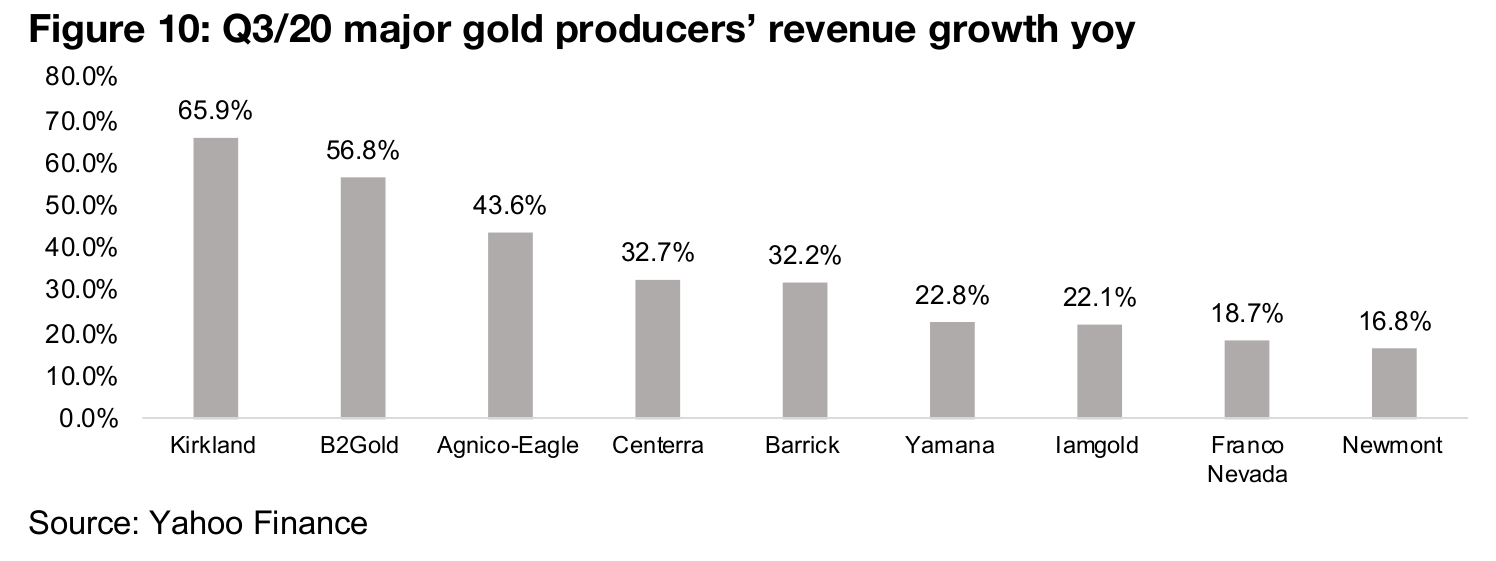

Big winners in Q3/20 operating off a lower base

While nearly all of the major producers had a strong Q3/20, the big winners have tended to be the smaller players of the group, mainly because it is difficult for the massive producers, especially Newmont and Goldcorp, to generate a high percentage production growth off such a high base (Figure 8). Therefore it tends to be the mid and smaller-sized producers in general that are seeing stronger production (Figure 9), revenue (Figure 10) and net income growth (Figure 11), and of the two market giants, Barrick's growth has outpaced Newmont's this quarter.

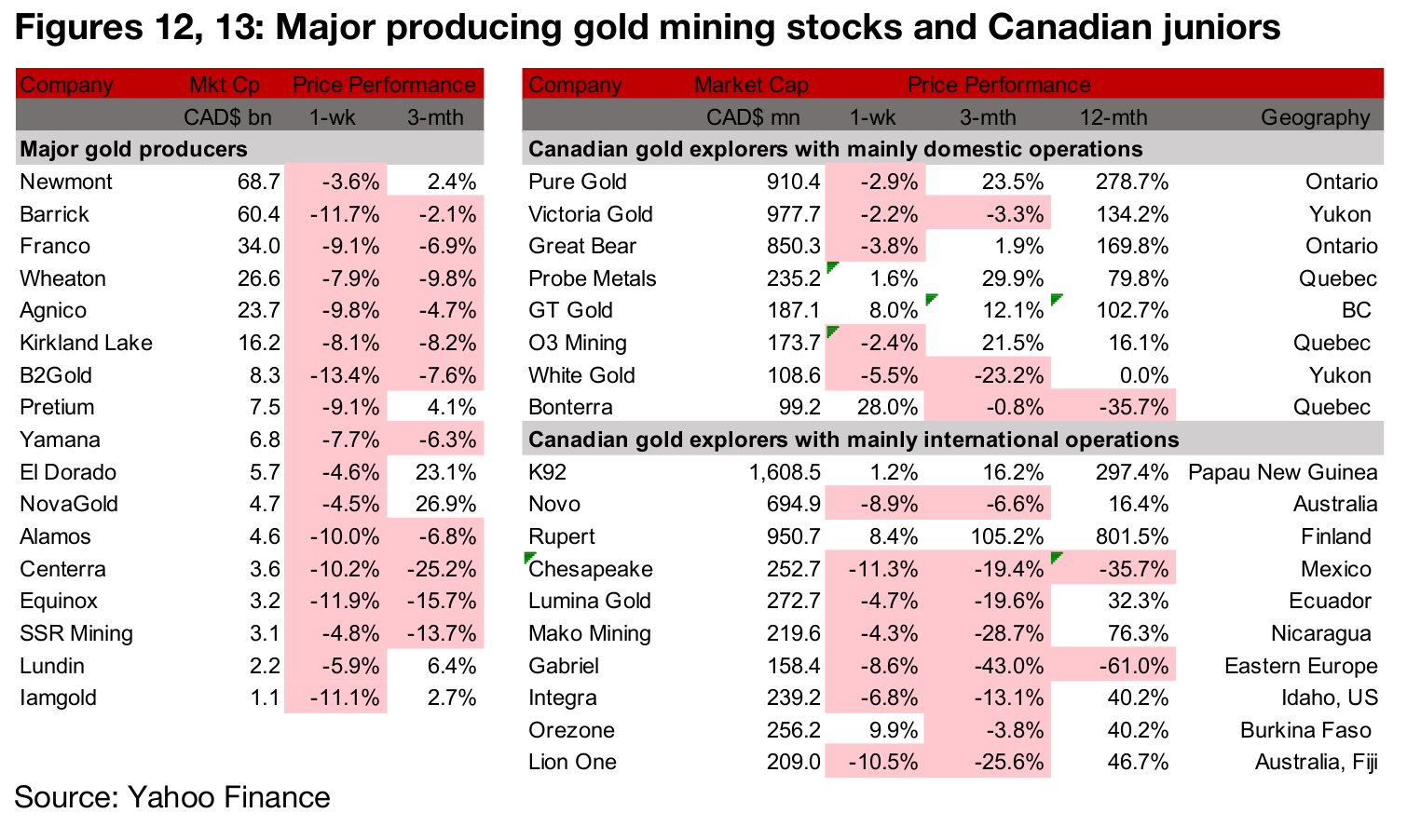

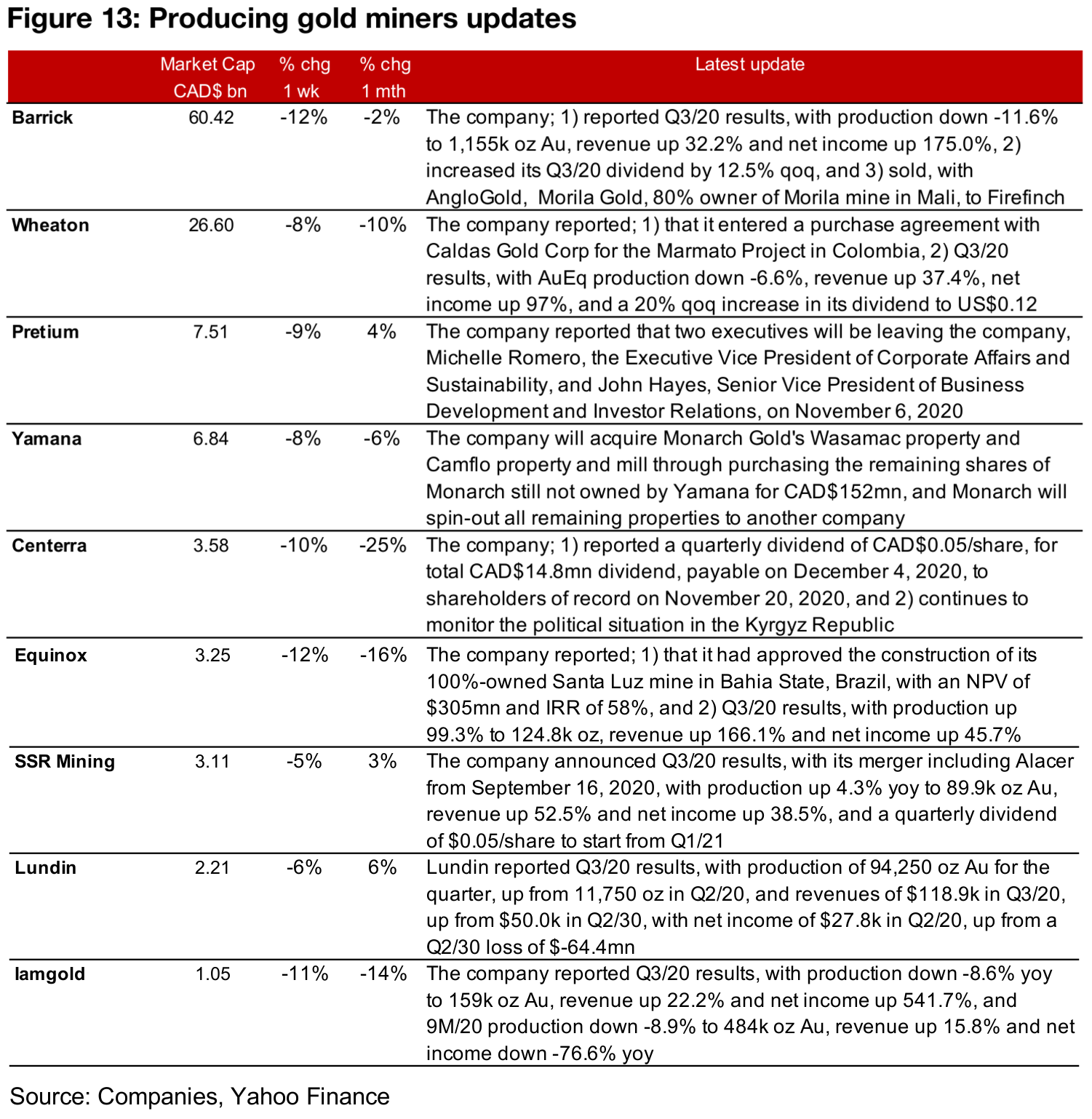

Producers down on gold decline, Q3/20 results season wraps

The producing miners were all down this week on the retracement in the gold price (Figure 12), even as strong Q3/20 results continued to come through this week, with the results season wrapping up and Barrick, Wheaton, Equinox, SSR, Lundin and Iamgold all reporting (Figure 13). Barrick also announced the sale, with AngloGold, of its holding of Morila Gold, 80% owner of the Morila mine in Mali, to Firefinch. Pretium reported the departure of two key executives, Yamana announced an acquisition of Monarch Gold's Wasamac and Camflo properties, Centerra reported its quarterly dividend, and Equinox approved the construction of its 100%-owned Santa Luz mine in Brazil.

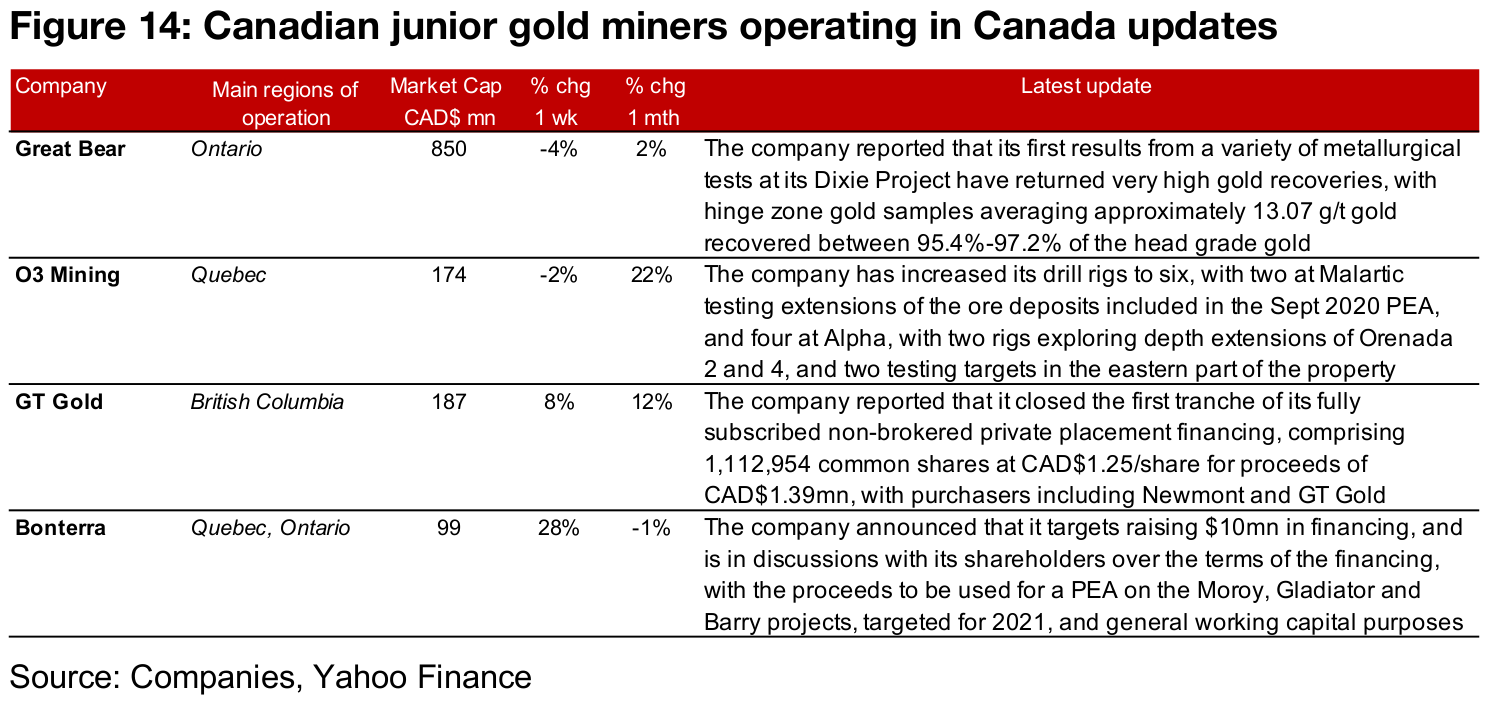

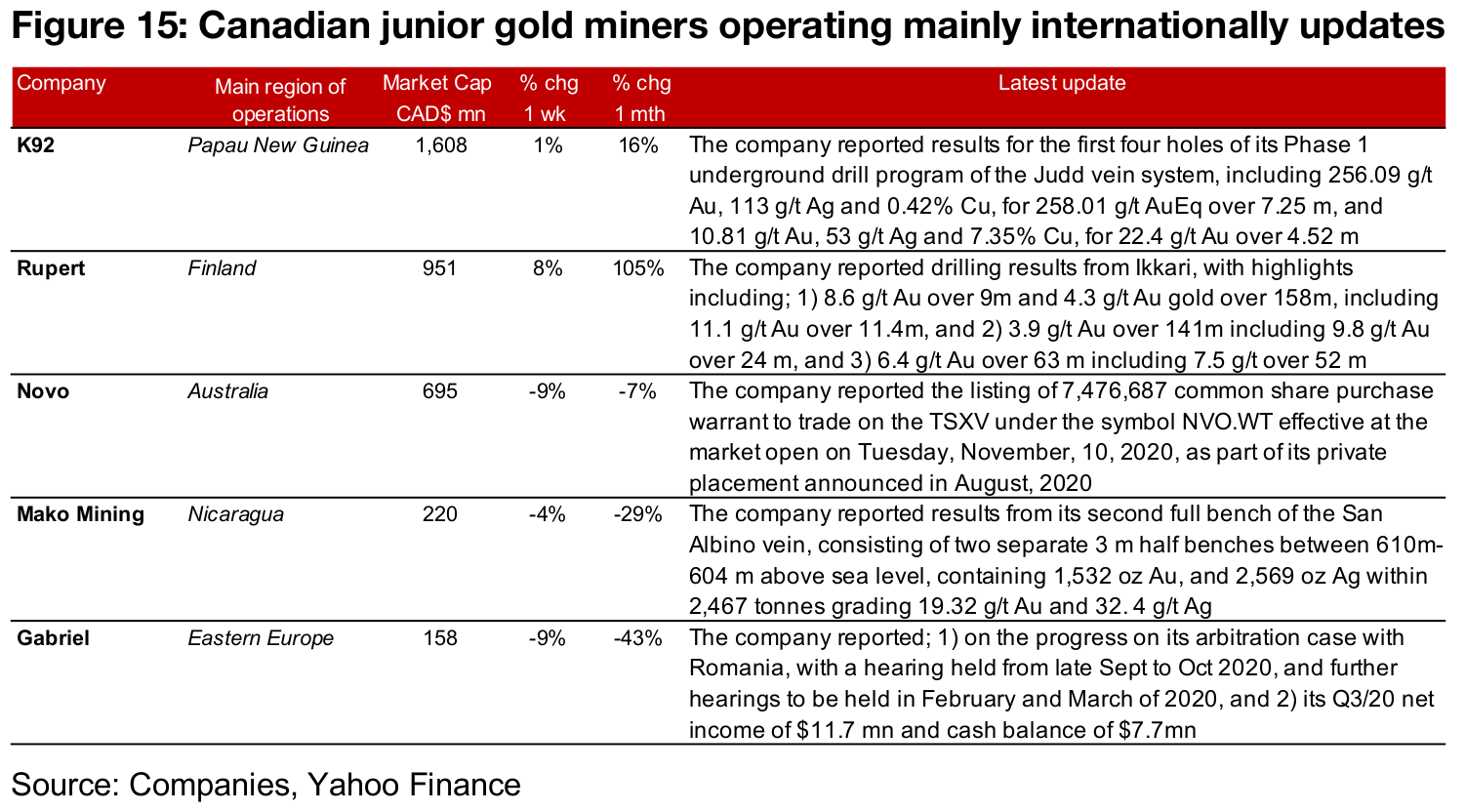

Canadian gold juniors mostly down

The Canadian juniors were mainly down this week on the decline in gold (Figure 13). For the Canadian junior gold miners operating domestically, Great Bear reported results from a series of recent metallurgical tests, O3 Mining expanded to six drills at Malartic, GT Gold closed the first tranche of its private placement, and Bonterra announced a planned CAD$10mn in financing to fund a PEA. (Figure 14). For the internationally operating juniors, K92, Rupert and Mako all provided exploration results, Novo announced the listing of warrants on the TSX and Gabriel provided an update on its ongoing arbitration in Romania (Figure 15).

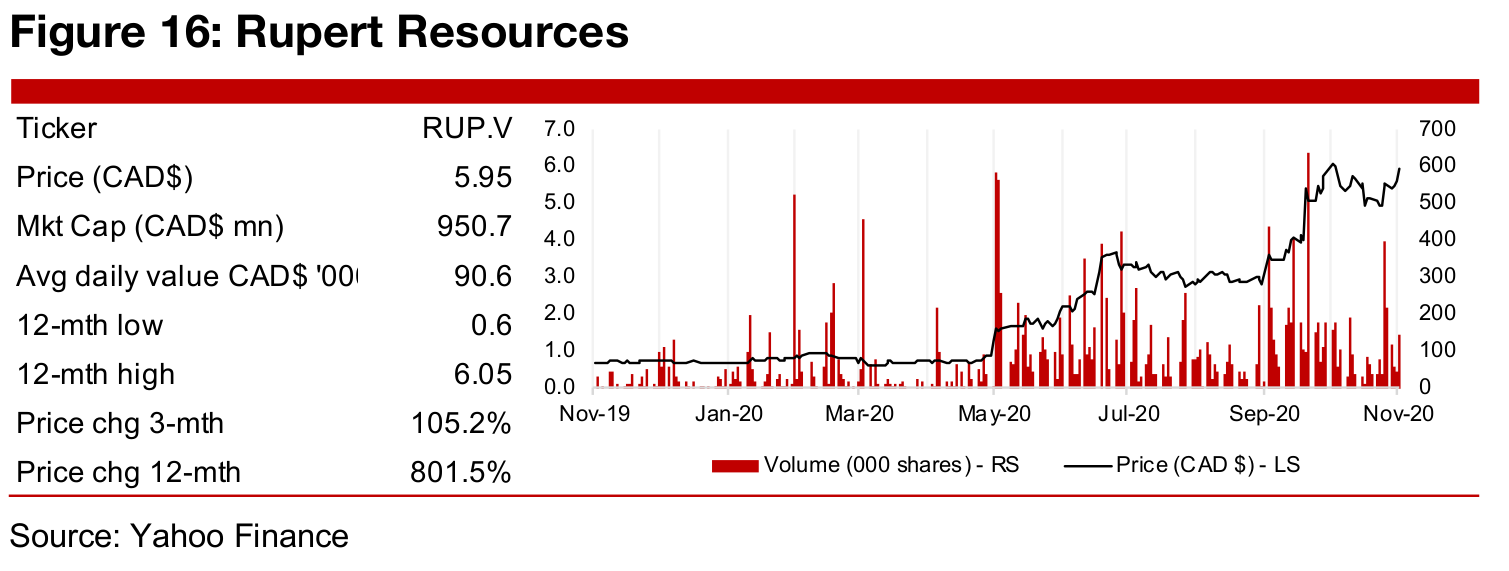

In Focus: Rupert Resources (RUP.V)

Ikkari target at Pahtavaara drives share price surge

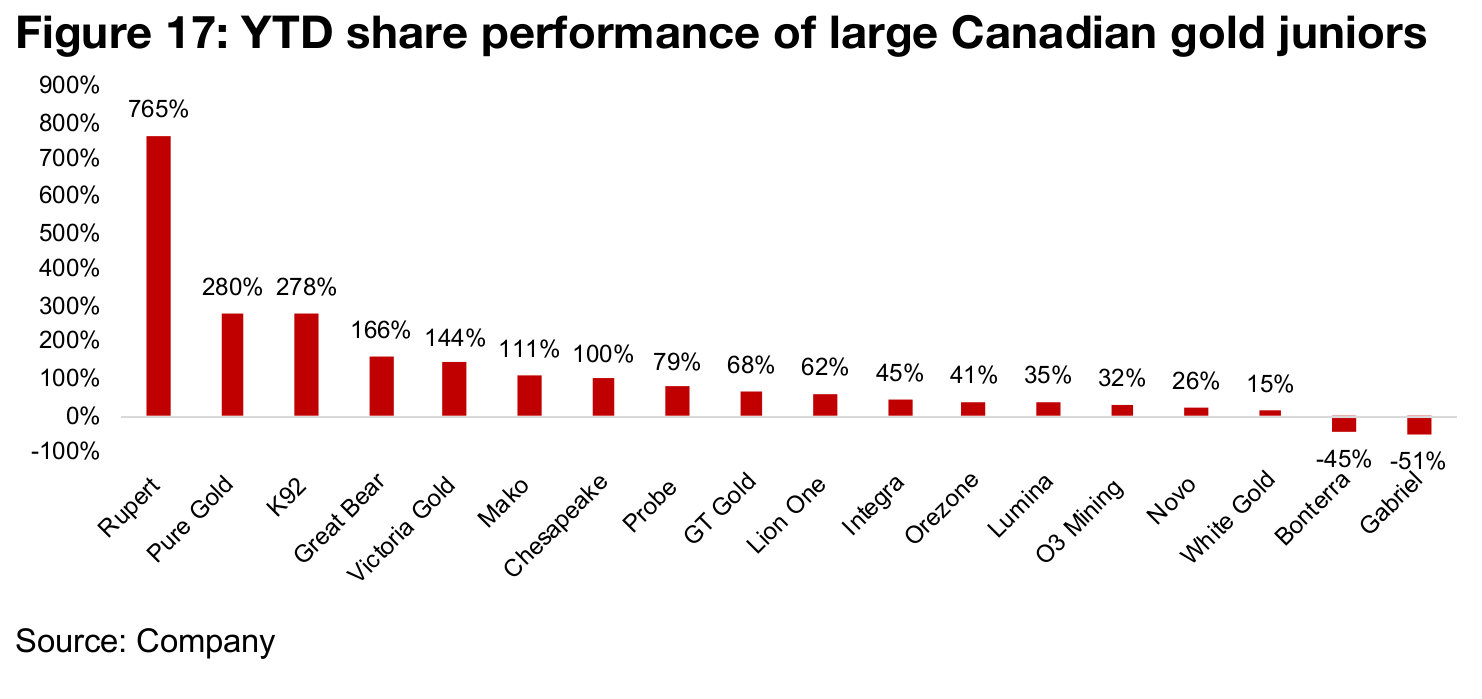

While most Canadian junior gold mining companies declined this week on the pull back in the gold price, and global junior gold miner proxy ETF GDX dropped -10.1%, Rupert Resources solidly bucked the trend, rising 8.4% for the week. The stock continues to be by far the strongest performer over the past 12 months of the larger Canadian junior gold miners, surging 802%. Rupert has beat out even the strong performance of the Red Lake plays Pure Gold Mining, expecting its first gold pour soon, and Great Bear Resources, which produced very strong drilling results this year, with increasing signs of continuity (Figure 17). It has also outpaced K92 Mining, which started production this year. Rupert Resources' share price really started to take off this year at the discovery of the Ikkari target at its Pahtavaara project in Finland, with the announcement of the first outstanding result there on May 12, 2020.

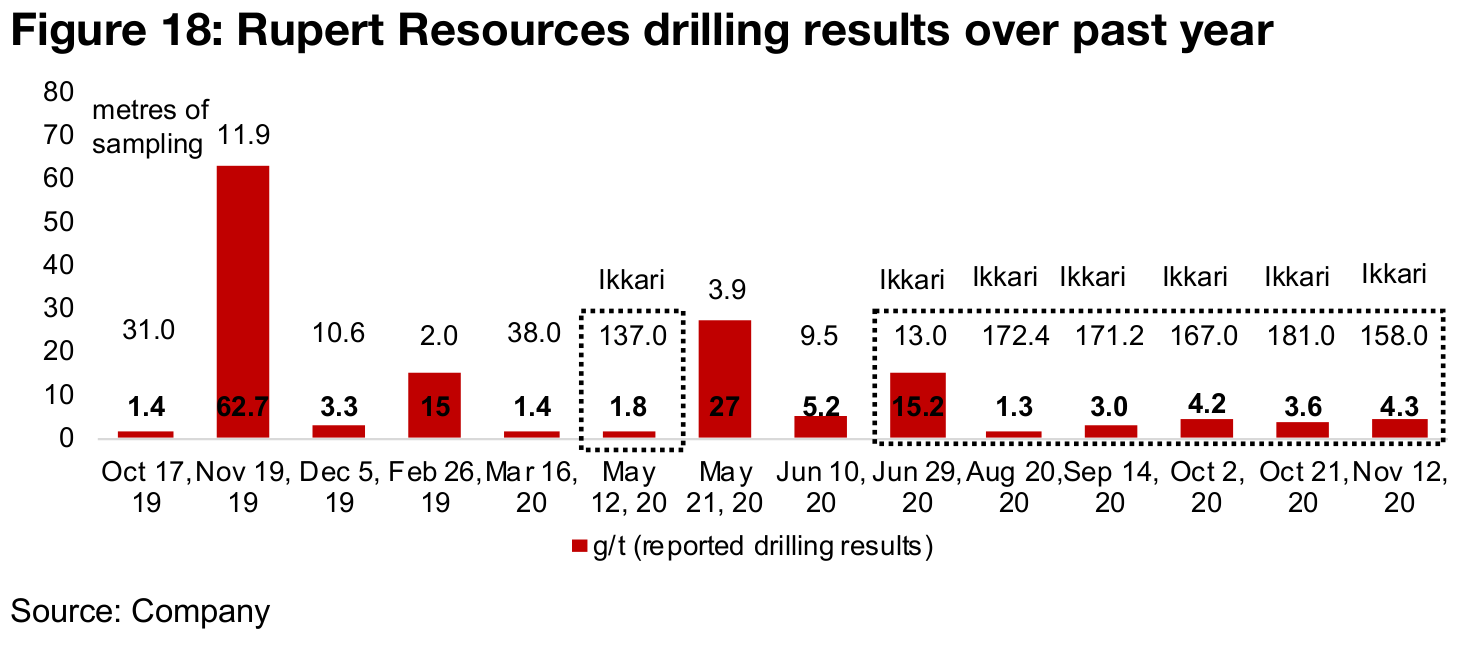

While the company had been operating an extensive drill program through 2019 and

2020 at its flagship Pahtavaara project in the Central Lapland Greenstone Belt in

Finland, these had not led to a major rise in the share price in the year to end-April

2020. However, the first Ikkari drilling results on May 12, 2020, drove an 85% increase

in the share price in the two days following the announcement, as the find, although

not of a particularly high grade, at 1.8 g/t, had a very large width of 137m (Figure 18).

The share price has continued to see major gains related to the Ikkari find, as five

similarly wide intervals have been reported since August, 2020, and the grades of the

last three announcements have been especially high, with 4.2 g/t over 167.0 m

reported on October 2, 2020, 3.6 g/t over 181.0 m on October 21, 2020, and 4.3 g/t

over 158m reported this week, on November 12, 2020.

While the company has yet to release either an initial resource estimate for

Pahtavaara or a PEA, these very strong results in the context of the current major bull

gold market could see it become an interesting potential acquisition target for major

gold producers which are accumulating an increasingly substantial base of capital,

as indicated by the strong Q3/20 results outlined above. The company does have

resource estimates, though, for its other two projects in Finland, Hirsikangas and

Osikonmaki, with Inferred resource estimates of 89k ounces and 276k ounces

respectively, and its other projects are two very early stage operations in Canada, at

Red Lake in Ontario, and at Surf Inlet in British Columbia.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.