Nov 06, 2020

Q3/20 results strong for gold producers

Gold jumps even as US election results still up in the air

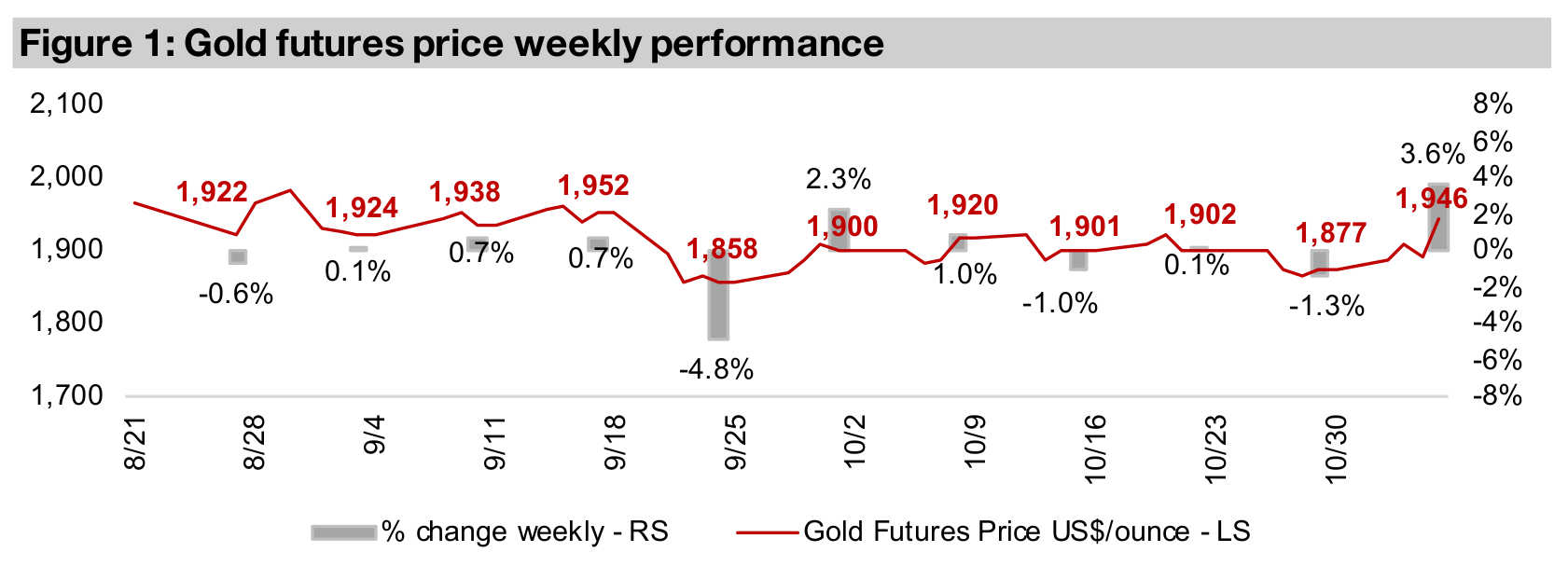

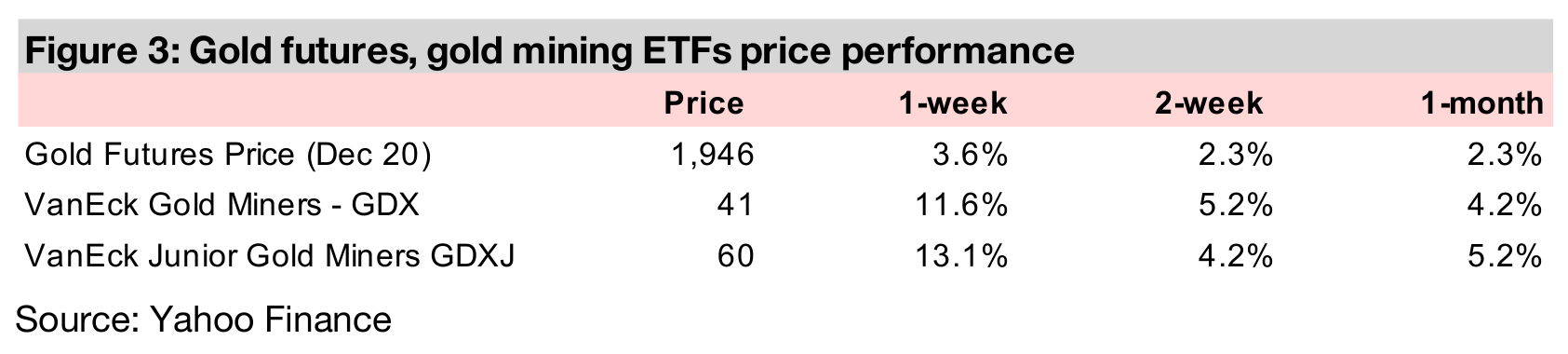

The gold price rose 3.6% this week to US$1,946/oz, its highest weekly gain in three months, driven by the US election, even though the results still remain up in the air, and the final decision will still take days, if not weeks, with ongoing lawsuits probable.

Q3/20 results for gold producers looking strong

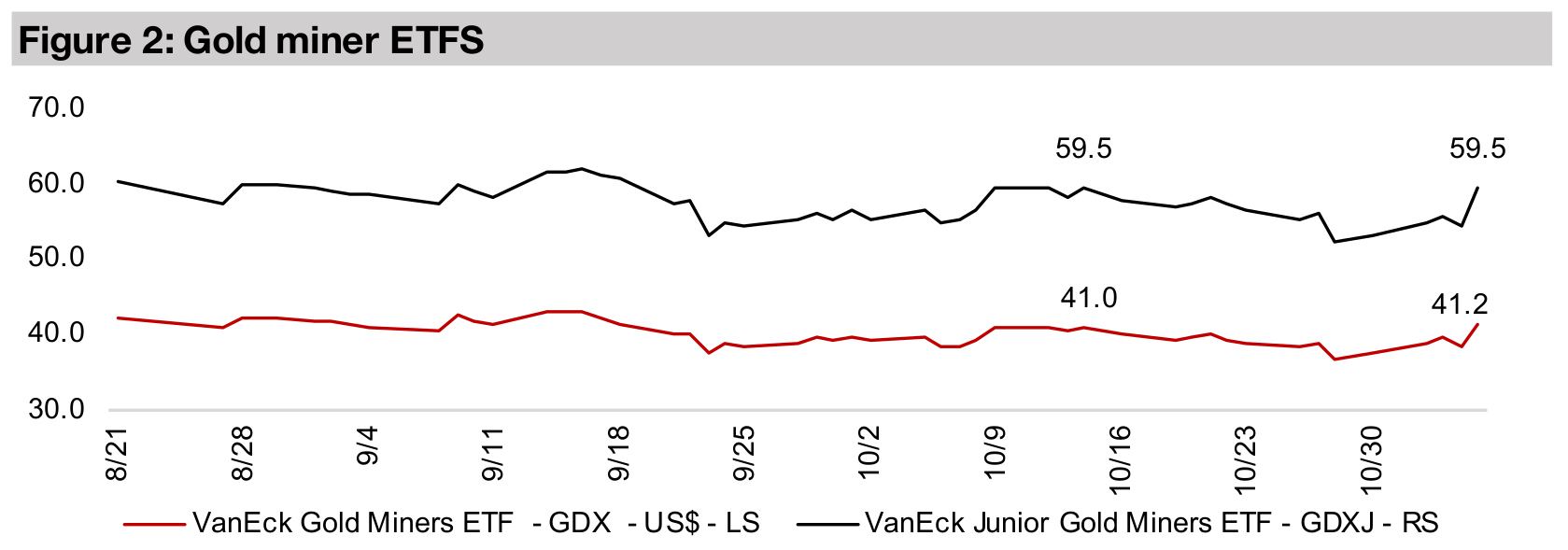

Gold producers had a strong week, with the GDX up 11.6%, driven the by election and strong Q3/20 results, with most major companies already reporting, with strong revenue growth across the board, and robust net income growth for the majority.

Gold up even as election results still up in the air

Gold rose 3.6% this week to US$1,946/oz, mainly driven by US election, although the actual winner has still not been announced, and vote counting continues. We may not see a clear decision for an extended period of time, as lawsuits are being pursued related to the voting process which could put the final outcome on hold for weeks, or even months. However, the vote was enough to push gold out of the stagnation that had lasted for about a month, allowing it to break through resistance to the upside.

Strong Q3/20 for producers with most majors already reporting

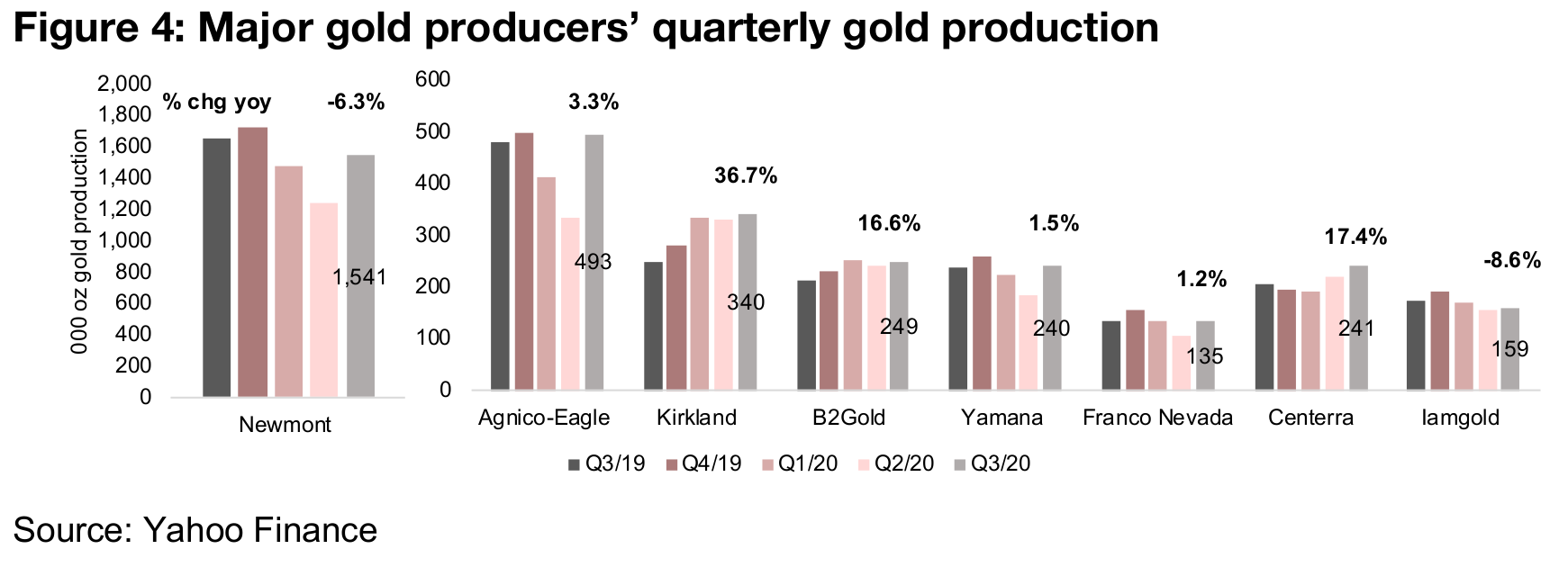

With the US election the big driver this week, the strong underlying fundamental developments in Q3/20 results seemed to be overshadowed a bit, with the sector's leverage to the gold price taking full effect. Gold averaged US$1,911/oz over the quarter, well above costs for most mines, compared to US$1,722/oz in Q2/20 and under US$1,600/oz in Q1/20. Meanwhile, production rebounded for most mines qoq as shutdowns related to the global health crisis were lifted for most operators in Q3/20 (Figure 4). Production did decline -6.3% year on year for industry leader Newmont (the other giant, Barrick, reports next week), but mid-sized players Agnico- Eagle, Kirkland, B2Gold and Centerra all saw significant production gains, and Yamana's and Franco-Nevada's output edged up, and Iamgold's production fell.

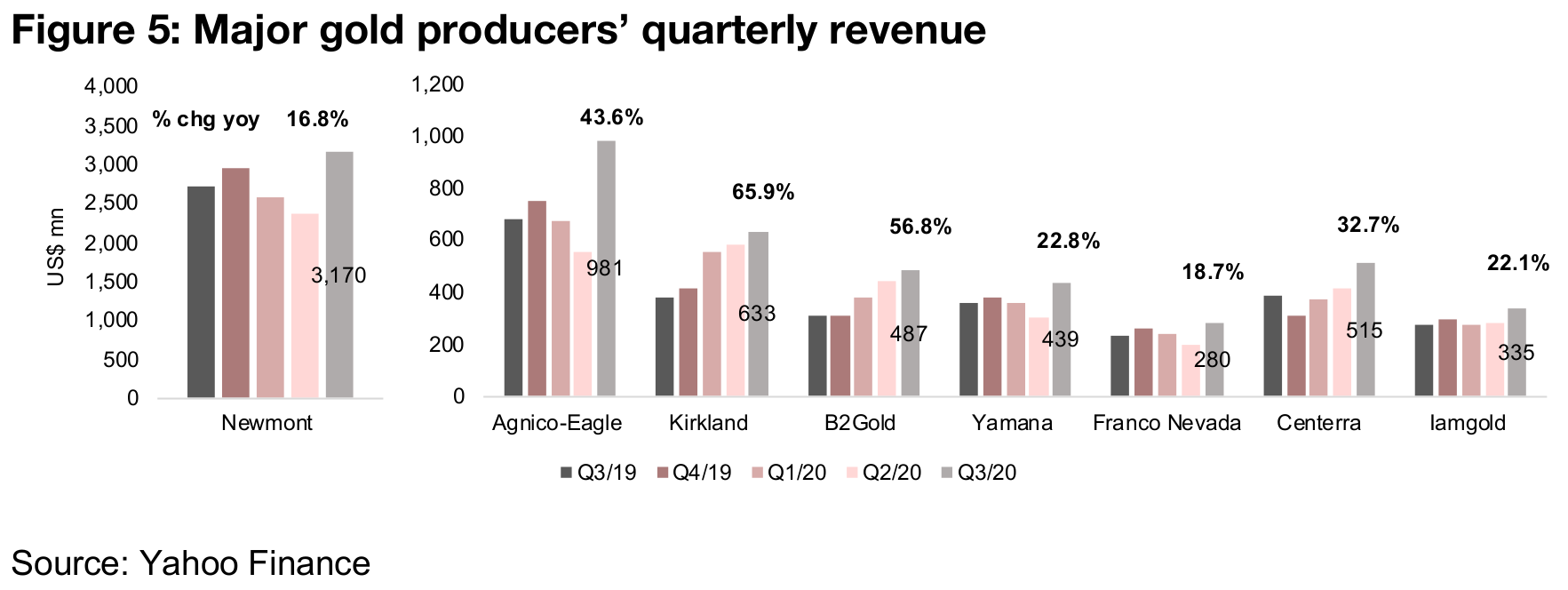

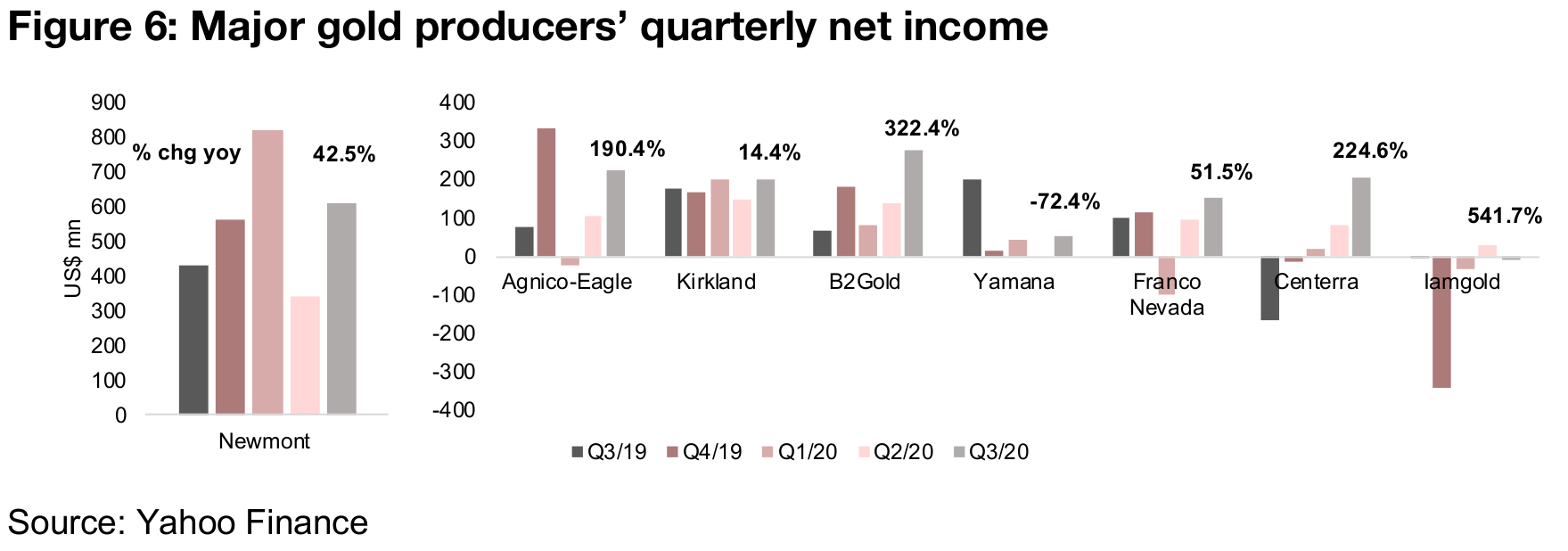

However, revenue growth was up across the board yoy, with all producers seeing double digits revenue gains, as the high gold price drove a big rise in revenue even for those producers with only moderate growth, or contractions in production (Figure 5). The strong revenue growth drove some very strong gains in net income for many of the producers yoy, with Newmont's net income up 42.5%, Agnico-Eagle up 190.4%, Kirkland up 14.4%, B2Gold up 322.4%, Franco-Nevada up 51.5%, Centerra up 224.6%, and Iamgold up 541.7%, with only Yamana seeing a decline, down -72.4% (Figure 6). All in all, it was one of the large cap gold producing sector's strongest quarters in years, and with the gold price remaining high in Q4/20, and with production shutdowns mostly lifted across the industry, the final quarter of 2020 will likely continue to see a strong performance.

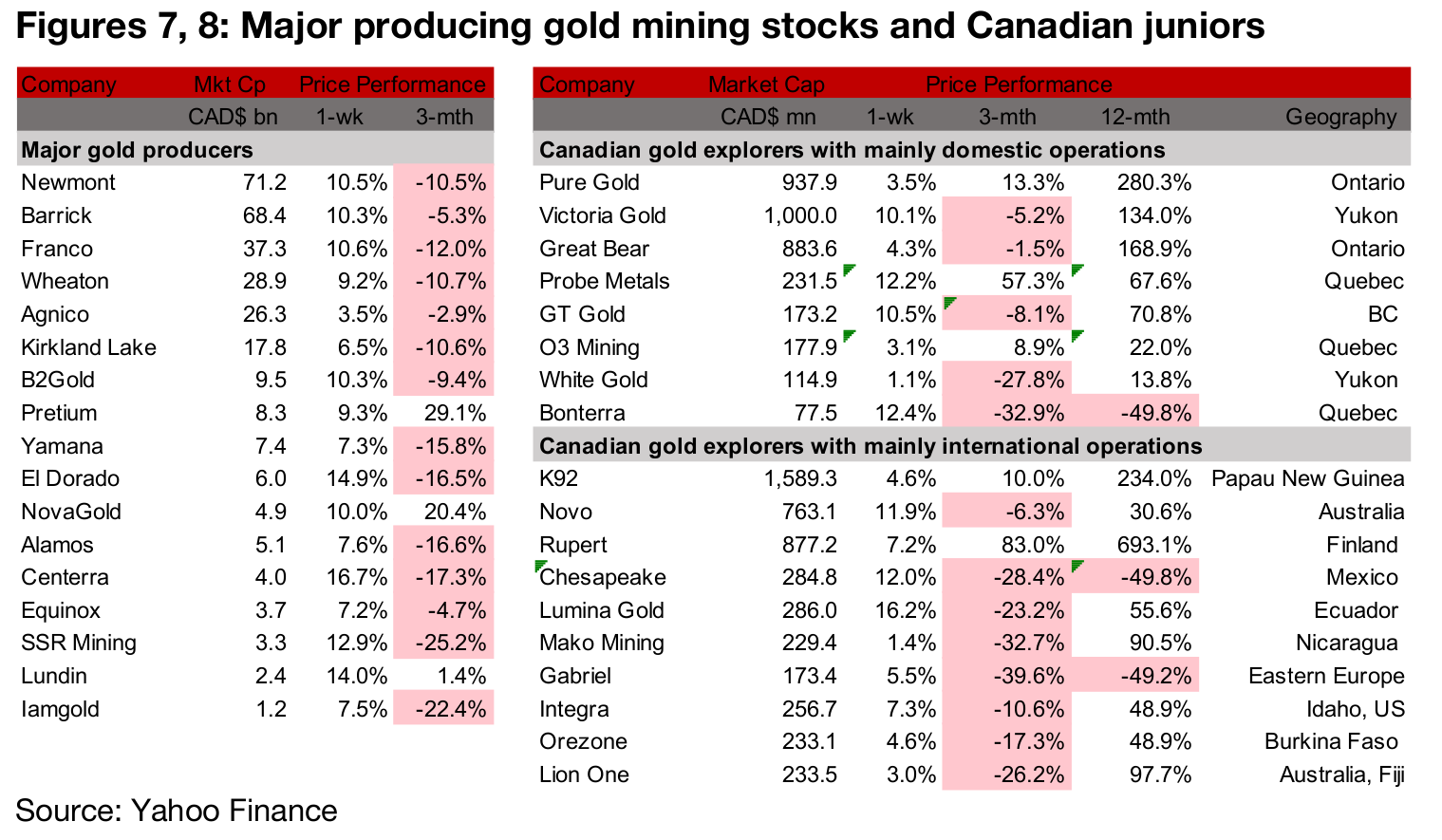

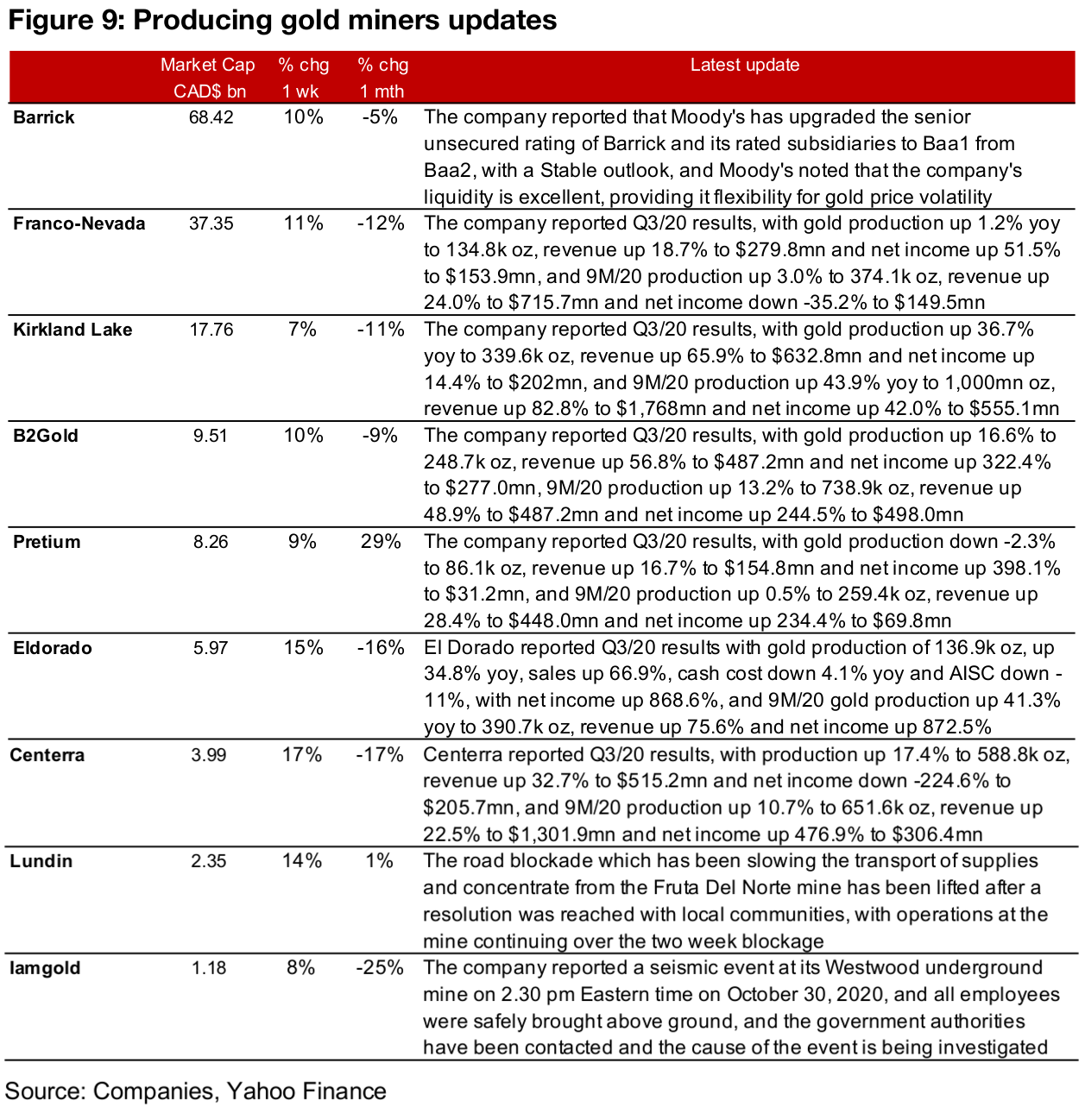

Producing miners up on elections and strong Q3/20 results

The producing miners all rose this week, on the election results and the strong Q3/20 results (Figure 7). News flow was dominated by Q3/20 results releases, with Franco- Nevada, Kirkland Lake, B2Gold, Pretium, Eldorado, and Centerra all reporting (Figure 8). Other news flow included Barrick announcing an upgrade to its senior unsecured debt rating by Moody's, the end of a road blockade at Lundin's Fruta del Norte mine, and a seismic event at Iamgold's Westwood mine which is now being investigated.

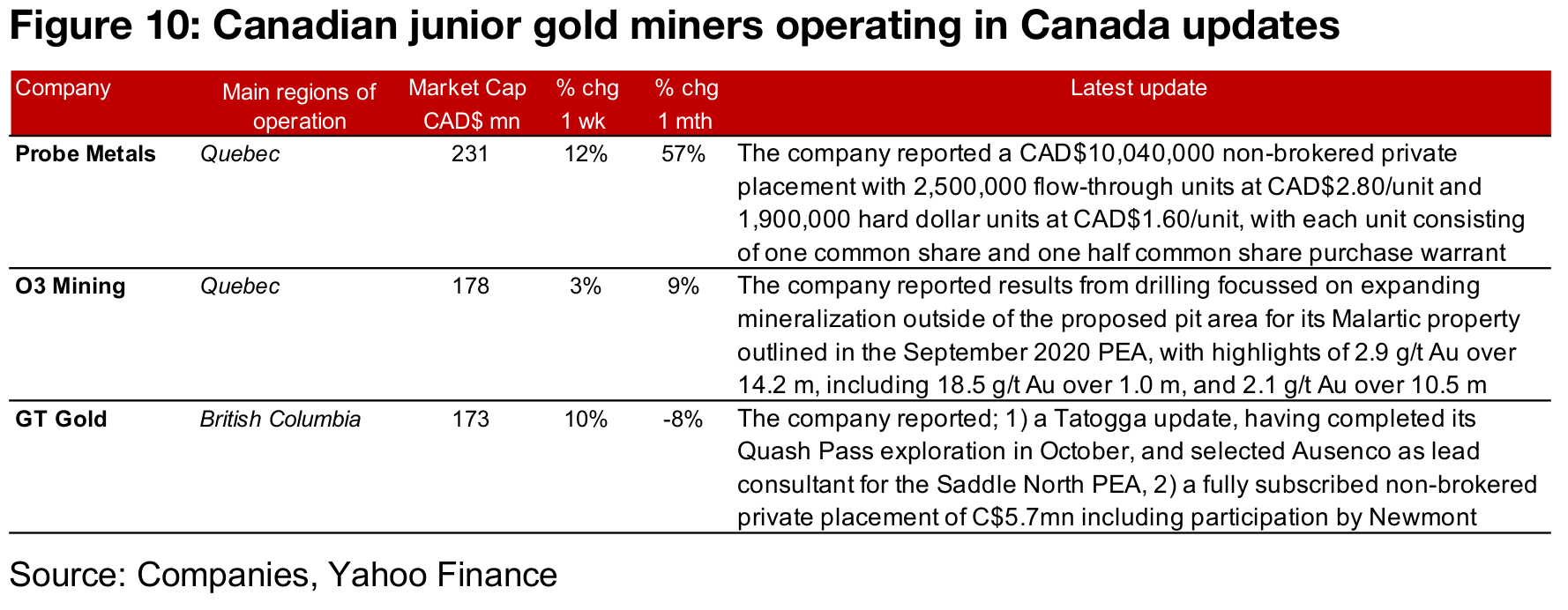

Canadian gold juniors operating domestically all rise

The Canadian juniors operating domestically were all up on the jump in the gold price and the strong Q3/20 results (Figure 8). Probe Metals announced a CAD$10.0mn non-brokered private placement, O3 Mining reporting drilling results focussed on expanding mineralization at its Malartic property and GT Gold reported updates on the Tatogga project and a CAD$5.7mn non-brokered private placement, including industry leader Newmont (Figure 10).

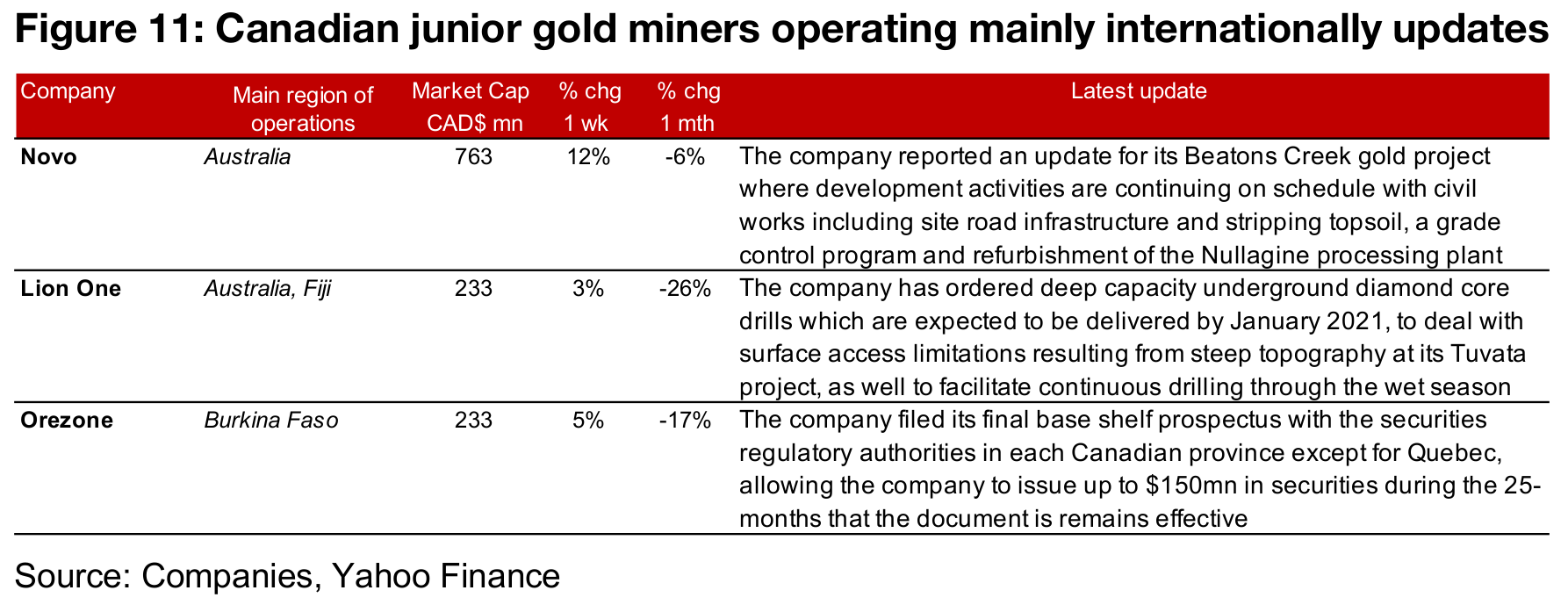

Canadian gold juniors operating internationally all up

The Canadian juniors operating internationally were also all up this week, with gold rising and producers' strong Q3/20 further propelling the upbeat outlook for the sector (Figure 8). Novo reported an update for its Beaton Creek project, Lion One has ordered two new drills to be delivered by January 2021 to deal with limitations to exploration at Tuvata, and Orezone released its final base shelf prospectus, allowing it to issue up to $150mn in securities (Figure 11).

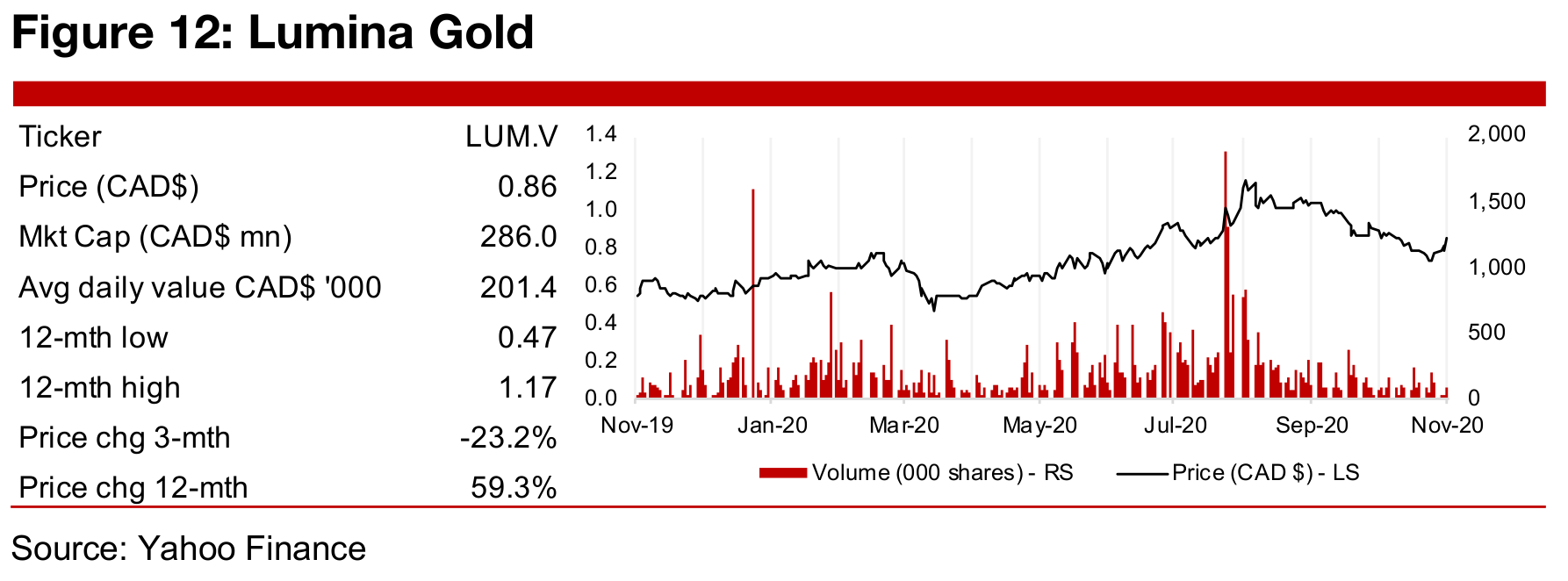

In Focus: Lumina Gold (LUM.V)

Lumina Group has strong history of project development

Lumina Gold's current main project is the Cangrejos project in Ecudaor, where the mining industry has been becoming more active, with a Ministry of Mines only established as recently as 2015. This was followed by a reopening of the concession system in 2016, with Lumina being awarded 32 prospective concessions. The industry structure was further improved for mining exploration companies when the government eliminated the windfall tax and reduced the NSR range from 5%-8% to 3%-8%. The first large-scale mines are now in production, with an open pit copper- gold mine, Mirador, and an underground gold mine, Fruta del Norte. Prior to the current project, Lumina Group has a 15-year history of developing strong projects, mainly in South America, with seven of its projects and one portfolio of royalties having been acquired since 2006, for a total $1,619bn, compared to a total $275mn capital raised for these projects (Figure 13).

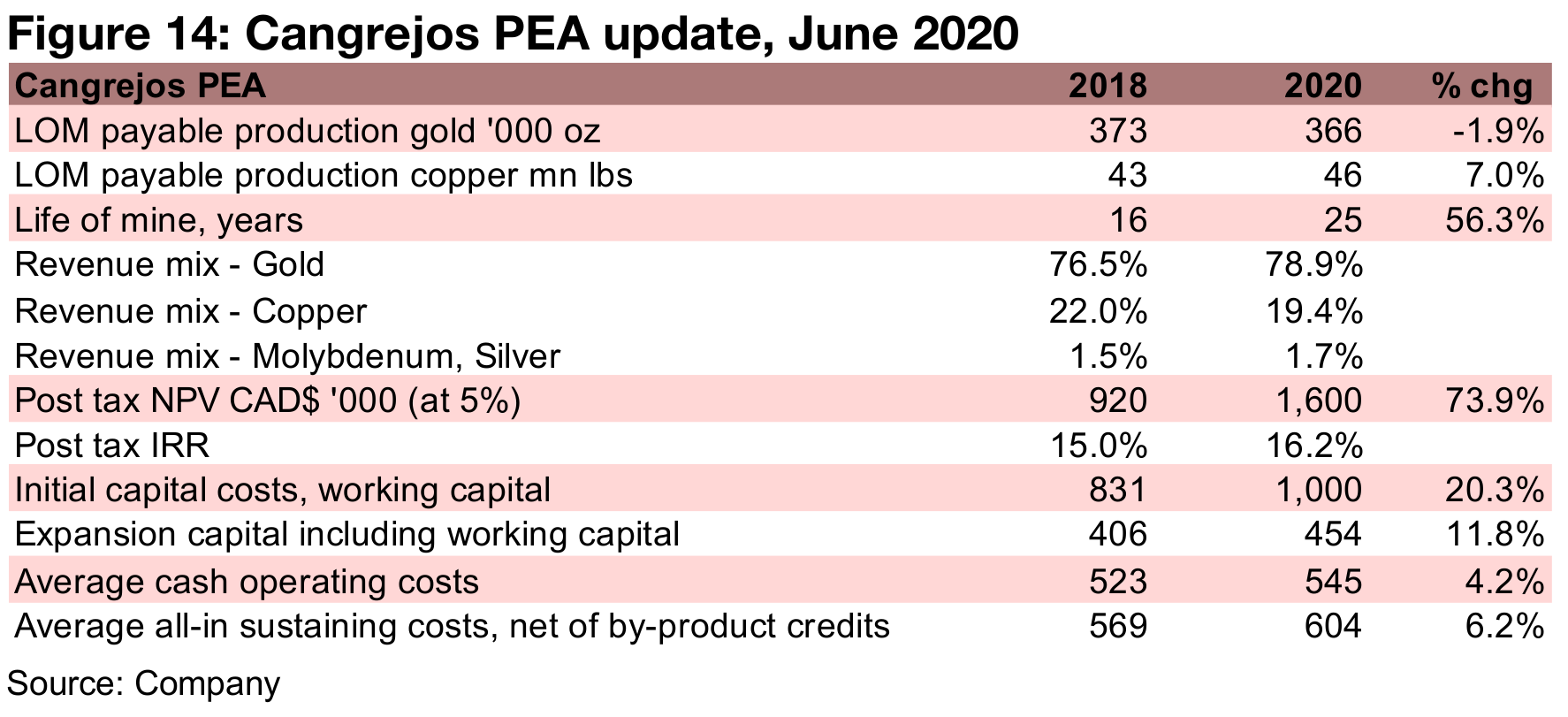

A pullback in June after updated Cangrejos PEA

The company's saw a pull-back in its share price after it released a June 2020 update to the 2018 PEA for the Cangrejos project (Figure 14). While the project's NPV increased by a substantial 73.9% to $1.6bn from the previous PEA, this was mainly because of the rise in gold price estimates. The expected production actually edged down, and costs increased in the new PEA, which was met with some disappointment from the market, with the stock price declining 11.3% to CAD0.80/share in the three trading days following the updated PEA announcement. However, the shares then rebounded, rising to a peak on August 6, 2020 at $1.17/share.

New credit facility announced from major shareholder Ross J. Beatty

However, the share price has trended down since August, with news flow following the PEA update in June 2020 limited, with a filing of an NI 43-101 related to the PEA in July 2020, with no major differences reported, and then the results of its annual shareholders meeting in September 2020, with all resolutions passed. Last week saw the most material announcement since mid-2020, with the company's major shareholder Ross J. Beatty, who holds 19.8% of Lumina, providing a CAD$5.0mn credit facility to the company. The company's current assets as of Q2/20 totaled $2.0mn, including cash at $1.9mn, and expenses over H1/20 were $4.3mn. Assuming expenses continued at around the rate of H1/20, cash would have been likely getting very low in recent months, but with the new credit line, operations could be sustained for another six months, assuming no major increases in operating expenses versus H2/20. The share price has picked up in the past week following the announcement.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.