April 09, 2025

Protect Your Portfolio Against the COMING CRASH with This Gold Play

Contents

- Consumers and Businesses Are Scared

- Stagflation Around the Corner?

- The Coming Stock Market Crash

- Gold and Other Real Assets Should Be on Your Radar

- But Isn’t Gold Expensive?

- Which Gold Stocks Should Investors Focus On?

- Massive Potential Catalysts Ahead

- A Revolutionary Processing Technology

- Takeaway

Stock markets are panicking.

Investors have realized that the United States could be headed into a recession—and soon.

In fact, a massive economic slowdown could happen as soon as this year.

(It’s already begun. The Federal Reserve Bank of Atlanta’s real-time growth indicator shows that the economy will contract by 2.4% in the current quarter.)

By the end of the year, this showdown could only accelerate…

There’s no time to waste. The UCLA Anderson School of Management has just issued a warning… and it’s stark.

Its experts say that over the next one or two years, the U.S. economy could face a stagflation. (As a reminder, stagflation is a period of low or negative growth AND high inflation.)

In a moment, we will discuss all the reasons why investors should start looking at gold and gold-linked companies to protect their portfolios from the many, many risks they are facing.

You may not have heard about it in the mainstream press… it’s too short-sighted to understand what is really going on in the economy.

That’s why we bring you this URGENT update…

Before we explain in detail what’s going on with the U.S., we suggest that you keep in mind that gold has historically proven to be a hedge against economic calamity.

This gold mining junior, Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB), could be one of the most promising companies in the industry.

Consumers and Businesses Are Scared

The U.S. consumers drive most of the country’s economy.

Yet recently, Americans have become much less willing to spend and support this growth.

The University of Michigan’s recent consumer survey found that Americans’ view of the economy fell by 11% over the previous month.

Right now, it’s the lowest it’s been since November 2022. In other words, American consumers are as afraid now as they were at the end of the pandemic.

That’s telling us something…

At the same time, inflation expectations are running high… much higher than the Fed’s 2% target.

Right now, Americans expect inflation to hit 4.9% over the next 12 months. If that happens, the economy will tank. People won’t be able to spend anymore (and prices are already sky-high after years of out-of-control growth.)

And these surveys point out that it doesn’t really matter what these consumers’ political affiliations are. Both Republicans and Democrats fear that the next 12 months are going to be horrible for their incomes and lifestyles.

We agree… and would like to add that the actual situation could be even worse than everybody expects.

Businesses are feeling the pressure of high inflation and uncertainty, too.

An S&P Global survey showed that businesses are now paying much more for their inputs than they did over the past two years. This “input inflation” has been at its highest level since 2023.

And it’s not only manufacturers who are suffering. Businesses working in the service industry are going through the same problems.

They aren’t too eager to hire new workers, either.

We will not be surprised to see unemployment rise over the next several months.

This will scare consumers and investors even further.

You heard it here—and now you’re prepared for what’s coming.

Stagflation Around the Corner?

Before we tell you how you can protect your portfolio (and how gold mining juniors such as Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB) could potentially help you diversify), let’s talk about stagflation. We are quite sure that most investors focused on the latest CNBC headline neither understand what it is nor are prepared to handle it.

We want you to be ahead of the crowd when it comes to what’s going to happen…

There are three components of stagflation: low or negative growth, high inflation, and high unemployment.

The most likely cause of stagflation is a price shock.

And we see one coming. Global trade wars have already started lifting prices. Higher tariffs imposed on more goods by more countries could produce a global price shock.

This shock will drive inflation higher—and at the same time, economic growth will slow.

All those businesses seeing their input costs going up won’t be able to handle this for long. They can only absorb so much or pass these costs to the already overstretched consumers.

The system will break, and it could happen soon.

When growth is slow and prices are high, businesses don’t hire new staff.

(Remember that we have shown you a moment earlier that businesses aren’t as optimistic about hiring new people as they were in the past? That’s also part of this trend.)

And here’s why stagflations are so dangerous.

You see, governments don’t have that many tools to deal with them. They have the fiscal ones (spending or cutting taxes) and the monetary ones (manipulating interest rates, for example.)

The problem is that pretty much any tool you use to battle stagflation will backfire and make it worse.

For example, if the Fed lowers its interest rate to fight the economic slowdown, it’ll fuel higher inflation.

If it raises rates, the economy will tank further.

And on and on…

This is why stagflations are so dangerous.

And the one we see coming won’t be a piece of cake either.

Governments won’t be able to do much at best, and at worst, they will make the situation even harder to deal with.

Investors are on their own, in other words. They need to start looking for ways to diversify into real assets such as gold and companies exposed to them, such as Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB).

And we want you to be prepared to handle this next crisis.

But first, here’s what not to do…

The Coming Stock Market Crash

The stock market will find it difficult to process what’s going on…

Growth expectations have just been lowered to an annual rate of just 1.7%, while unemployment could rise to 4.4% (or higher, of course.)

When the market finally understands what’s going on, it’ll most likely overreact.

(Some experts call the stock market a “recession amplifier,” which means that its volatility makes things even worse for the real economy.)

But not yet… In fact, even after the recent selloff, stock indexes are deeply in the “bubble territory.”

The widely used Shiller Price-to-Earnings valuation ratio is at levels not seen since the 2000 dotcom bubble.

Stocks are trading at an average ratio of about 36x. Well, back in 1999, before the dotcom crash, the ratio hit 44x. Not too far from where it is right now.

And to understand where things could be headed, consider that after the 2000 crash, this ratio shrunk to just 14x.

Well, if stocks’ valuation shrinks by almost two-thirds, almost every investor is in deep trouble.

And when a crisis of these proportions happens, stocks won’t be the only asset to suffer.

Corporate bonds, for example, are also trading near their all-time highs… which makes them vulnerable to a correction, too.

Investors who try to “diversify” their portfolios into these supposedly safe assets may find themselves in a precarious situation when stocks and bonds fall at the same time.

The real estate, too, is vulnerable. Home prices are at record levels in the United States, and people find it hard to afford to buy new homes.

The number of unsold homes is at levels last seen during the Global Financial Crisis of 2007-2009.

And if the real estate market freezes, the lives of the 8.3 million people employed in construction will change for the worse.

This could drive unemployment figures higher still and worsen the situation.

But investors prefer to ignore these risks…

They are obsessed with more speculative trends, such as obscure artificial intelligence stocks… and outright speculations, such as crypto.

They are euphoric at the time when they need to be extremely cautious.

But you don’t have to be one of them.

Now that you learned about the coming stagflation, you have the tools to position yourself for protection and profit.

How?

Gold and Other Real Assets Should Be on Your Radar

World Gold Council looked at past episodes of stagflation, and here is what its analysts found out:

“Real assets do well during stagflation, with commodities both fuelling and feeding off inflation, while gold has tended to benefit from the elevated risk environment, rising inflation, and a lowering of real interest rates,” analysts said.

When the real economy is going through a painful period of stagflation, investors don’t chase growth. They seek safety.

But, as we showed earlier, equities and bonds will not be likely to provide enough protection.

Gold and other commodities, on the other hand, are the places to be.

Gold doesn’t depend on the global financial system or the Fed. Some investors say that, unlike so many interconnected assets, gold is “nobody’s liability.”

And this is why it works as a hedge against market crises, including stagflation.

Investors know this. Some of the “smart money” has been buying gold in droves.

Both private and institutional investors, such as central banks, have been adding gold to their portfolios and reserves in massive amounts.

In 2024, central banks purchased more than 1,000 t of the metal. They have been adding gold to their portfolios for three years in a row.

They have been net buyers of the metal for the past 15 years.

And there’s a reason why private investors, too, have been buying gold.

In six out of the last eight recessions, gold outperformed the S&P 500 by 37%, according to Forbes.

We expect that the coming stagflation will see gold outperform broad stock and bond markets, just like it did in the past.

But Isn’t Gold Expensive?

As of writing, gold is trading at over $3,000 an ounce.

Its price is in record territory, and some say that it’s vulnerable to a correction.

But is it?

Consider all the fundamental reasons driving the price of gold... Inflation expectations, a slowing housing market, a stock and bond bubble… Economic uncertainty and global trade wars…

In our opinion, gold has much more room to rise from these levels. The trends pushing its price higher aren’t going anywhere. And, in fact, the economic situation could worsen much more than economists expect. And remember, the Atlanta Fed’s real-time growth indicator is already flashing red.

But almost nobody prefers to notice…

Meanwhile, gold has delivered an incredible performance for the investors who paid attention to where the U.S. economy is headed…

Since the beginning of the year alone, it soared by 13%. In the meantime, the S&P 500 index lost 2% (and could potentially fall further as stagflation fears get priced into risky assets.)

Remember that after its peak in August 2008, the S&P 500 fell by 48%.

That same year, gold ROSE by 47%.

We will not be surprised if gold delivers a similar performance during the coming stagflation…

And it could do even better, because there is another and very powerful catalyst.

The U.S. Dollar May Lose Its Global Dominance

Even though the U.S. dollar remains a global leader, its prospects aren’t as bright as a lot of investors think.

First, it has already started to lose value against gold. And its trend could accelerate going into the stagflation we are talking about.

We have mentioned above that gold is up 13% year-to-date, while the S&P 500 is down 2%.

Well, the U.S. dollar has not fared well, either.

The U.S. Dollar Index is down 4% since the beginning of the year.

In other words, a supposedly stable currency has fallen more than the frothy stock market so far this year.

Investors who think that the U.S. dollar will protect their portfolios over the next 12 months should think again…

Stock prices are vulnerable to a massive correction… bonds could fall in tandem with broad markets… and even the “safe haven” USD is in trouble.

You shouldn’t underestimate the impact the dollar’s demise could have on gold.

We may be looking back at $3,000 an ounce a year from now and think: “What a bargain.”

Gold and gold-backed assets, on the other hand, have been flourishing, and we expect this trend to continue.

The metal’s price is gaining momentum… and gold-linked stocks are doing well, too.

An ETF tracking big gold mining companies is up 25% this year.

The one tracking junior gold miners is up 23%.

Both act as expected… they are “leveraged” to the price of gold, which means that they outperform the metal itself during a gold bull market.

As the U.S. economy collapses and the value of the U.S. dollar falls, gold and gold-backed stocks would be our asset of choice to navigate the coming uncertainty.

Which Gold Stocks Should Investors Focus On?

The gold space is quite varied. There are large producers and junior exploration-stage companies.

Profitable miners offer less risk but also potentially lower rewards.

The junior space, on the other hand, is filled with quite a few companies that could be difficult to analyze.

Right now, we want to bring to your attention one of the potentially most exciting opportunities we have seen.

The company’s name is Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB).

Grande Portage is a Vancouver-based junior resource company focused on its New Amalga project in southeast Alaska. The project is located 25 km north of Juneau, AK.

The company has a 100% interest in the project, which means that it is directly exposed to the project’s upside potential.

And this potential has been growing. In fact, since Grande Portage acquired the project, it has grown its mineral resource by more than 1,000%.

It has almost 1.4 million ounces in the NI43-101-compliant Indicated category. And the resource is very high-grade, at 9.47 grams per tonne.

The project also hosts an Inferred resource of 515,700 ounces at an average grade of 8.85 g/t gold.

And note that the body of mineralization this resource estimate is based on is open both to length and depth. This means that in the future the company could increase New Amalga’s ounce count even more.

New Amalga hosts at least six (and potentially more) large and consistent gold veins. This consistency could potentially make it easier and cheaper to produce gold from New Amalga in the future.

The company’s claims lay within an area that in the past produced more than eight million ounces of gold.

(Disclaimer: Please note that any production history at or near a company’s projects isn’t a guarantee of future production or revenue. Investing in junior mining companies involves risk.)

The company has done a lot of work to get New Amalga to this stage.

The project saw a lot of exploration activity, including 240 holes from 55 platforms for a total of 54,000 meters of drilling.

Recent drilling outside of the resource area found new high-grade targets. The company says that three intersections 100 meters or more below the surface delivered high-grade intervals 80 meters east of the current NI43-101 resource.

The company continues drilling at the multiple gold-bearing veins at New Amalga. And here are some of the select high-grade drill results:

• Hole DDH 11E-2 delivered 15.27 meters of 37.07 g/t gold at the Deep Trench vein.

• Hole DDH18S-2 delivered 9.08 m of 30.24 g/t gold at the Goat Creek vein.

• Hole DDH 11I-4 delivered 3.04 m of 1,328 g/t silver and 3.42 gold, including 0.93 m of 4,010 g/t silver and 7.75 g/t gold.

You can see the results from hole DDH 11E-2 for yourself:

Image: Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB)

In other words, the project keeps growing as Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB) continues its exploration activities.

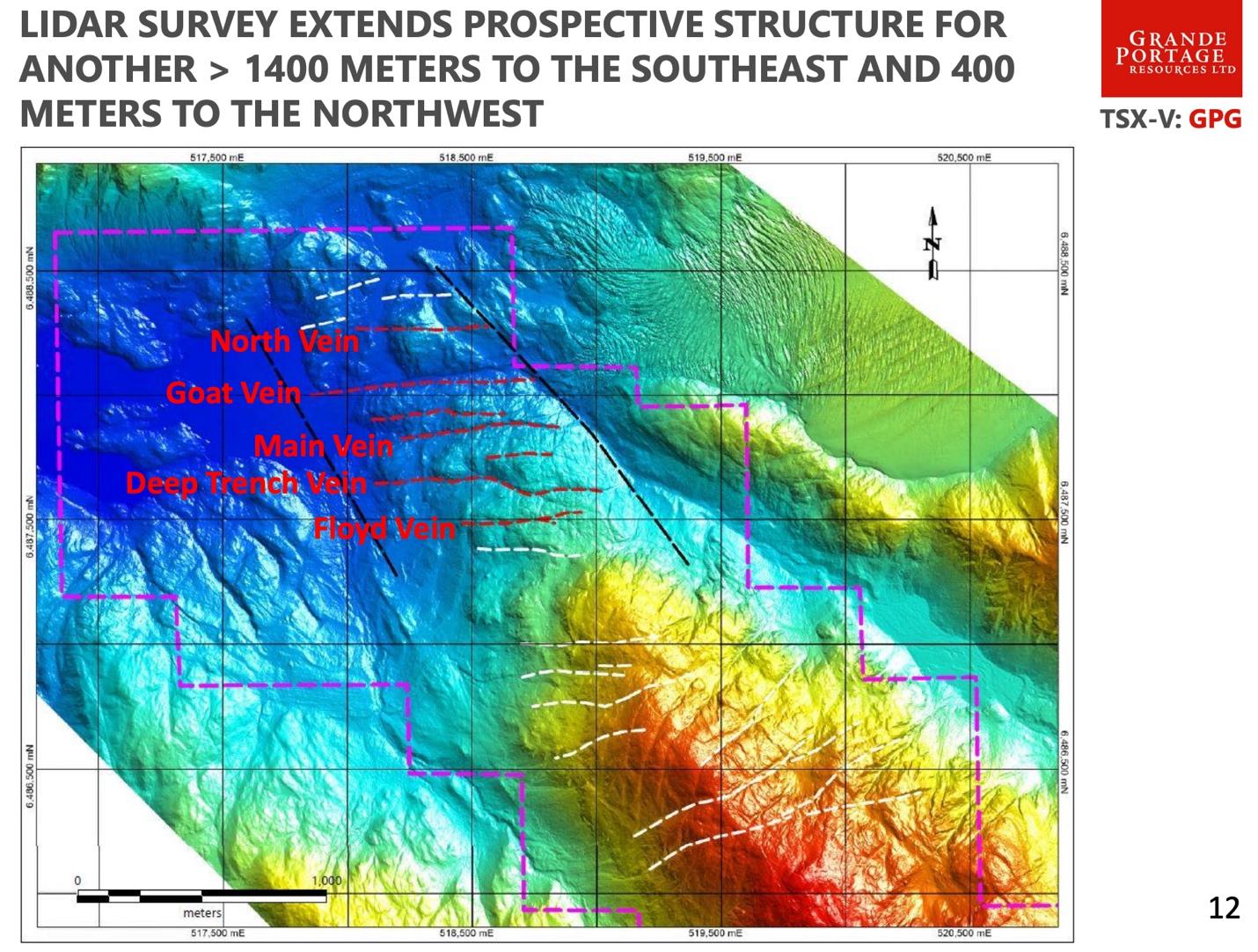

Recent lidar surveys have found potential new exploration targets (white lines in the image below).

Massive Potential Catalysts Ahead

It has already filed its 2025 drill permits, paving the way for more exploration activity.

Specifically, the company plans to drill about 4,000 meters from up to four diamond drilling platforms.

It will also continue working to determine optimal processing methods for the project’s mineralization. (More on this in a moment.)

Importantly, the project is located in a safe mining district with developed infrastructure.

New Amalga’s successful growth is due to the company’s leadership, which has consistently delivered exploration progress, as well as metallurgical and environmental studies.

Its CEO, Mr. Ian Klassen, has more than 20 years of experience in business management, public relations, and entrepreneurship.

He also has experience in running public companies and establishing relationships with government and local communities. This skill set will be critical got advancing New Amalga to its next stage.

Mr. Klassen and his team have added significant value to the company’s assets already. As we said earlier, the company’s team has increased the project’s resource by 1,000%.

The most recent resource upgrade and studies that outlined multiple new potential drill targets tell us that there could be much more value to be unlocked in the future.

A Revolutionary Processing Technology

Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB) has already started testing the best ways to process the ore at the New Amalga project.

An efficient way to separate ore from waste could potentially increase the company’s revenue and reduce costs.

So it started an early collaboration withore-sorting testwork with a third-party company that offers a revolutionary solution…

Consider this video demonstration:

This smart sorting technology uses industry-leading techniques and advanced sensors to scan every single bit of mined material and separate ore from waste.

Grande Portage aims to use this advanced method to potentially improve the mine’s economics.

This method is unique, and, in our opinion, it could give Grande Portage a unique advantage over other gold mining companies.

On April 8, Grande Portage announced that it had received results from its advanced sensor-based ore testing equipment.

The idea here was to see how much waste the machine would reject and how much ore grades would improve as a result.

The results were great and exceedingly consistent. Ore grades in the processed samples went up 120%, while the total volume of ore went down by 57% as the wasted got sorted out. Gold grade of product was 12.94 g/t.

This is an impressive result. The company aims to transport and process ore at a third-party facility. Reducing the volume of shipments will lower costs. Higher grades in the ore could potentially increase the company’s profitability if New Amalga becomes a producing mine.

Takeaway

We believe that Grande Portage Resources (TSXV:GPG, OTC:GPTRF, FSE:GPB) could potentially benefit from several macro- and company-level catalysts.

At the level of the economy, it can benefit from a slowdown and even stagflation. Those risks are real, and gold-linked companies could provide investors with true diversification benefits.

Gold has entered a massive bull market, and all the fundamental drivers that sent its price above $3,000 an ounce are still there.

Moreover, as the U.S. dollar continues losing its value and global reserve status, gold could soar even higher.

As we have shown you, gold-linked companies have outperformed even the metal itself.

And in addition to these catalysts, we have the company’s own progress and outlook.

It successfully identified NI43-101 resources at its New Amalga project, 70% of which remains open to expansion drilling.

And it has identified a unique and advanced ore processing technology that could potentially put it ahead of competition…

On March 18, the company announced that it initiated comprehensive environmental and cultural baseline studies for its New Amalga project. The studies will include wetlands delineation, surface water sampling, meteorological and hydrological studies, and others.

It has a history of successfully adding value to New Amalga, a clear exploration plan for 2025, and about $1.5 million in the treasury.

Its ore sorting testwork delivered consistent results that, in our view, bode extremely well for the project’s economics.

In our view, Grande Portage is one of the best early-stage companies in the red-hot gold space.

We urge you to put it on your watchlist.

Sign up to receive our future articles and updates.

Disclaimer

Thematerial in this article should not under any circumstances beconstrued as an offering, recommendation, or a solicitation of anoffer to buy or sell the securities mentioned or discussed, and is tobe used for informational purposes only. Neither Canadian MiningReport (the "Publisher", "we", "us", or"our"), nor any of its principals, directors, officers,employees, or consultants ("Publisher Personnel"), areregistered investment advisers or broker-dealers with any agencies inany jurisdictions. Canadian Mining Report ("Canadian MiningReport", "Us", "Our" and/or "We")is a Canadian based media company that typically works with publiclytraded companies and provides digital marketing strategies andservices.

Atmost, this communication should serve only as a starting point to doyour own research and consult with a licensed professional regardingthe companies profiled and discussed. Conduct your own research. Wedo not provide personalized or individualized investment advice oradvice that is tailored to the needs of any particular recipient.Read More