October 31, 2022

Producers' Q3/22 Results Season Underway

Author - Ben McGregor

Gold near flat as market awaits upcoming Fed rate decision

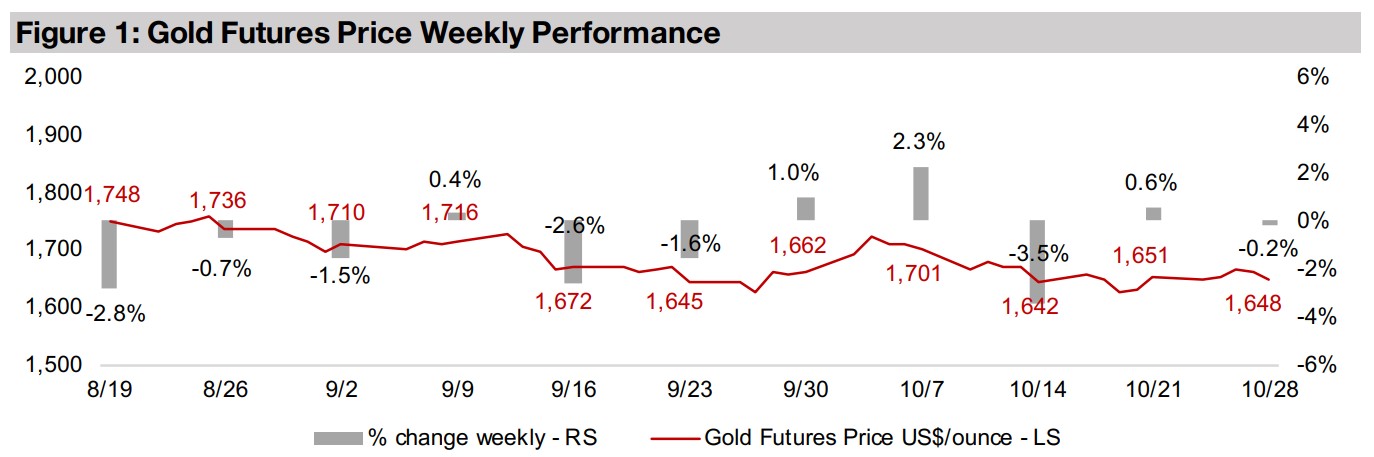

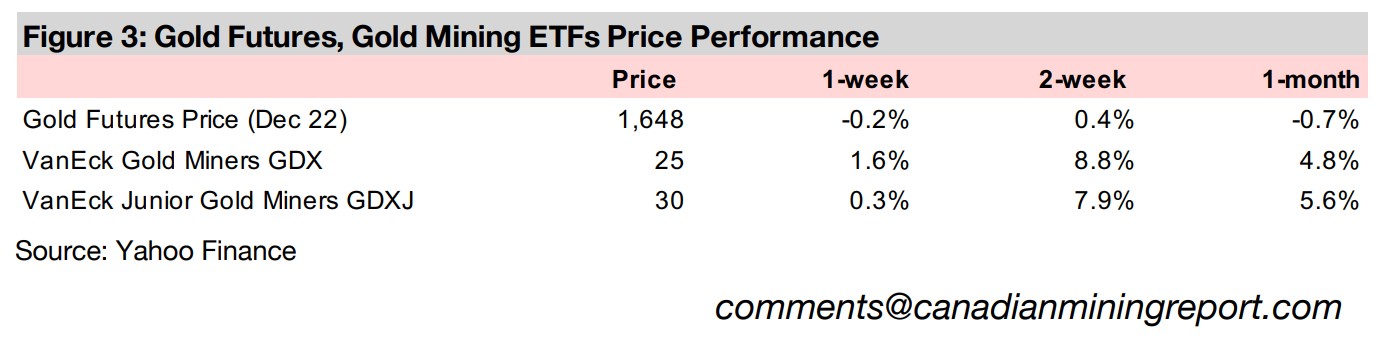

Gold was near flat this week, down just -0.2% this week to US$1,648/oz, and has remained relatively flat for the past two weeks likely because the market is awaiting the US Federal Reserve interest rate decision that will be announced this week.

Mid-tier gold producers report Q3/22 results

The Q3/22 results season has started with the mid-tier gold producers Agnico Eagle, Yamana, Alamos and Eldorado reporting, with the group showing mixed production growth, declining average realized gold prices and rising all-in-sustaining costs.

Producers' Q3/22 Results Season Underway

Gold was near flat this week, down -0.2% to US$1,648/oz, and has remained flat for

nearly two weeks, and seems to have settled into a new range from about US$1,650-

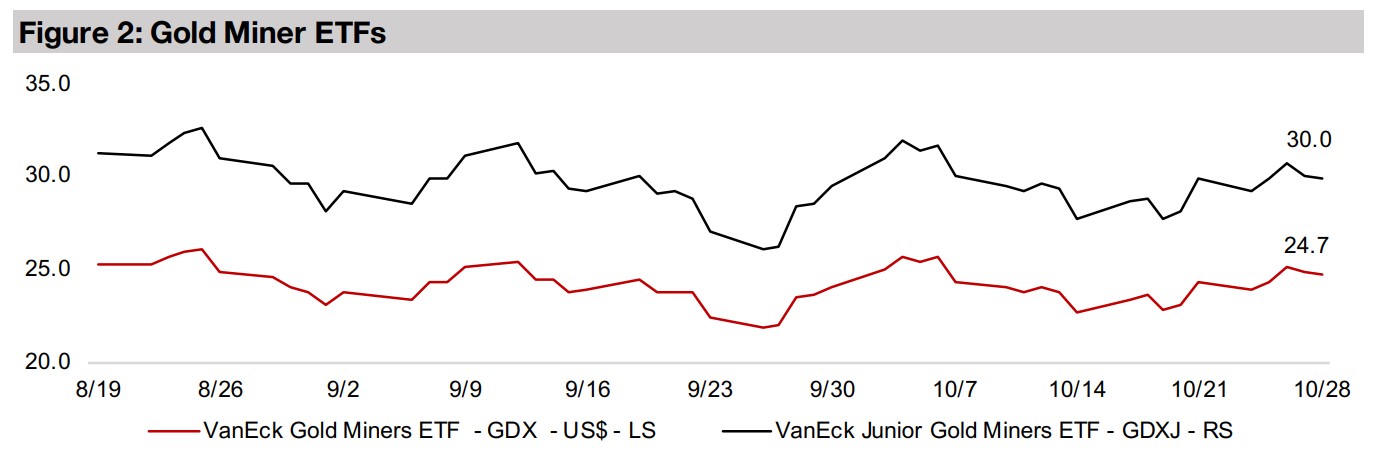

US$1,700/oz over the past two months. Gold stocks edged up overall this week even

with the flat gold price, as the equity markets picked up significantly on apparent

hopes for some signs of dovishness in the Fed's statement accompanying its interest

rate decision this week. We suspect that the Fed may disappoint the market and not

indicate a softening of its stance, as inflation, although easing off its recent peak, is

still at forty-year highs while unemployment is at multi-decade lows.

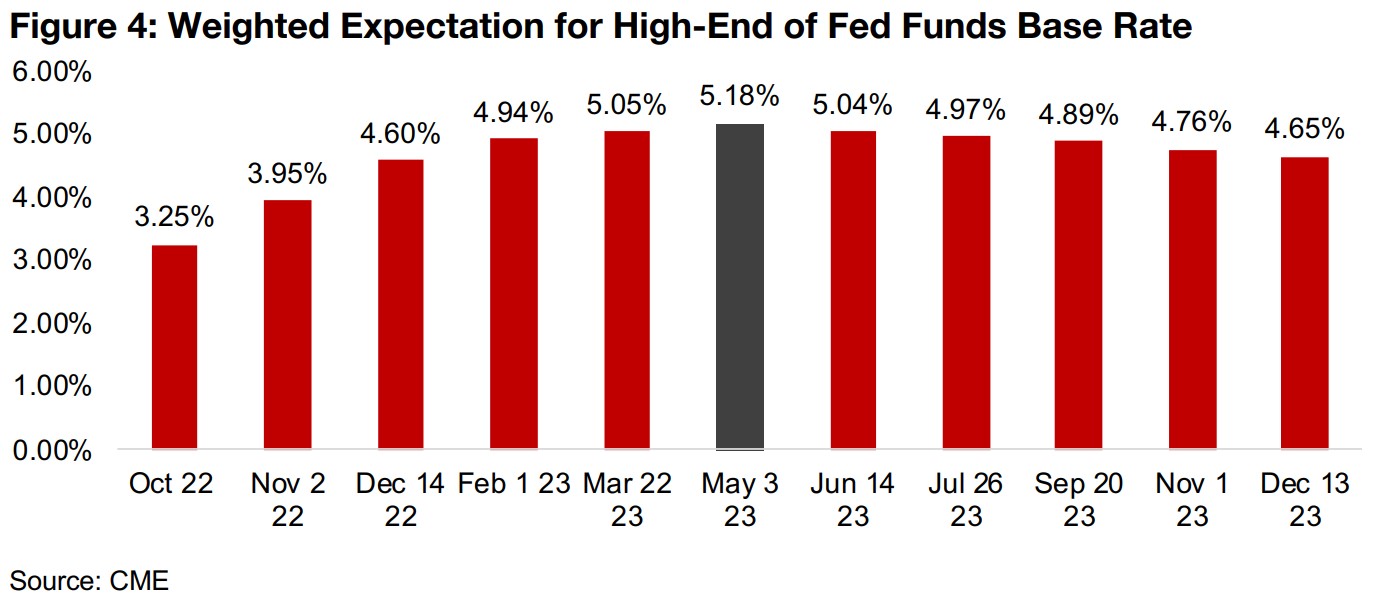

The market is expecting a continued rise in interest rates until May 2023 before they

start to trend down, based on market expectations for the Fed Funds Base Rate

reported by the CME Group (Figure 4). For the decision this week, the market

forecasts around a 75 bps rise in the base rate to 4.00% from 3.25% currently. We

note that while the estimate in Figure 4 for the November 2, 2022 meeting shows

3.95%, the Fed tends to increase rates in 25 bps increments. The 3.95% is calculated

using the upper end of the 350-375 range reported by the CME, or 375, multiplied by

its 19% weighting and adding the upper limited of the 375-400 range multiplied by

its 81% weighting. We use a similar calculation for the rest of expected rates shown.

The expectations reported by the CME implies that we have another two percent in hikes of the US Federal Reserve base rate to 5.25% by May 2023, which does not bode well for equity markets. As rates rise, valuations tend to come down, unless companies can generate higher earnings to offset this, but a weakening economy, coupled with inflation driving up costs, will make boosting income difficult for many companies currently. For the rest of 2022, therefore, we believe that the probabilities will remain weighed to the downside for equity markets in general, including gold stocks, if these expected rate hikes continue to come through.

Producers' Q3/22 results seasons begins with mid-tier players

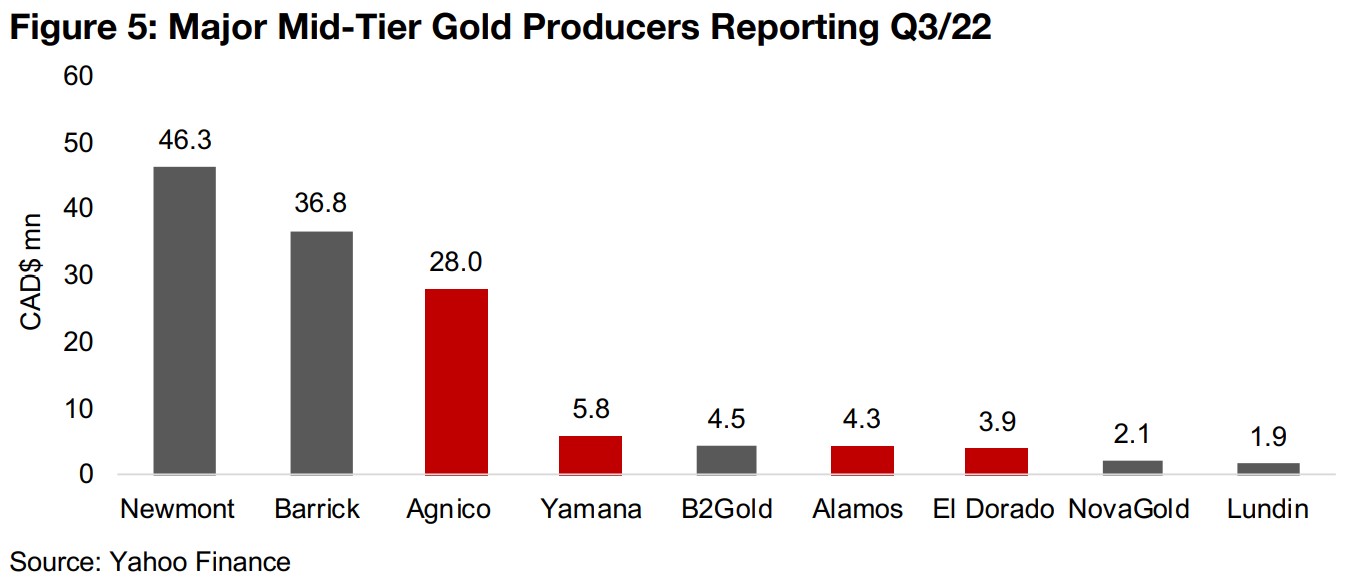

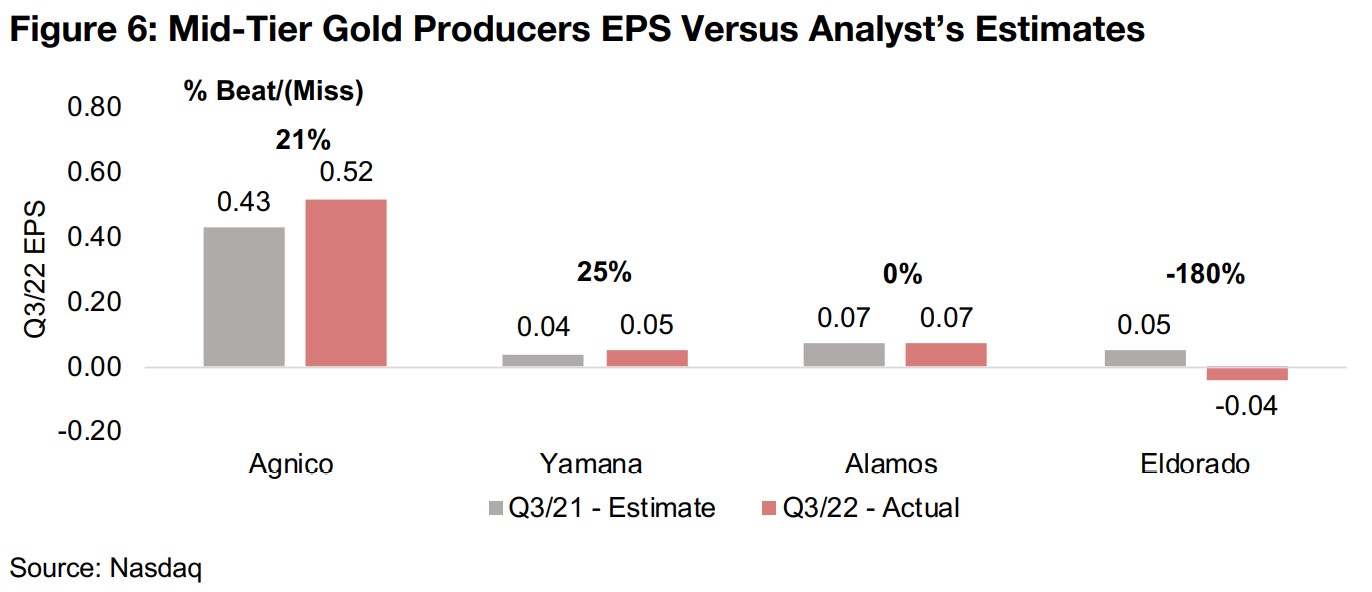

The producer's Q3/22 results season began over the past week with several mid-tier majors reporting, including Agnico-Eagle, Yamana, Alamos and Eldorado, with industry giants Newmont and Barrick to report this week (Figure 5). Overall the group did reasonably well versus analysts estimates, with Agnico and Yamana beating consensus forecasts by 21% and 25%, respectively, Alamos coming exactly inline, and only Eldorado missing estimates substantially (Figure 6).

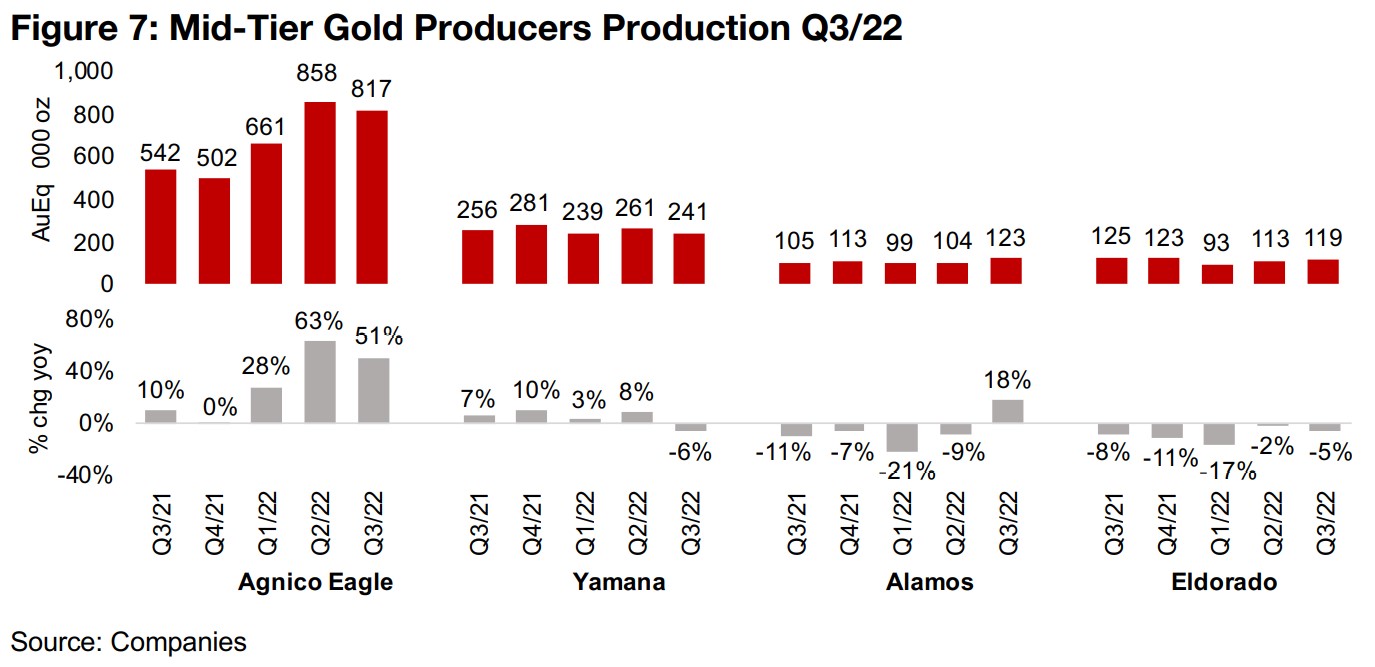

Agnico Eagle led the group in terms of absolute levels of the production and

production growth, up 51%, yoy, but down 5% qoq (Figure 7). The big gains versus

last year were driven by its acquisition of Kirkland Lake in February 2022, with the

first full quarter of consolidation in Q2/22, so there should be another two quarters of

this outsized yoy growth to come. Alamos also stands out for strong production

growth yoy, up 18%, driven by the first full quarter of production from the La Yaqui

Grande Mine.

Yamana's output fell -6% yoy on a -13% decline from its largest producer, Canadian

Malartic, and a -15% drop from its second largest producer, El Penon. Eldorado's

production fell -5% yoy, driven by a -26% decline in output by its second largest

producing mine Kisdalag, as material on the heap leach pad declined as

debottlenecking of the belt agglomeration circuit continued, reducing stacking

capacity. This offset a 14% rise in output yoy from its largest producer, Lamaque.

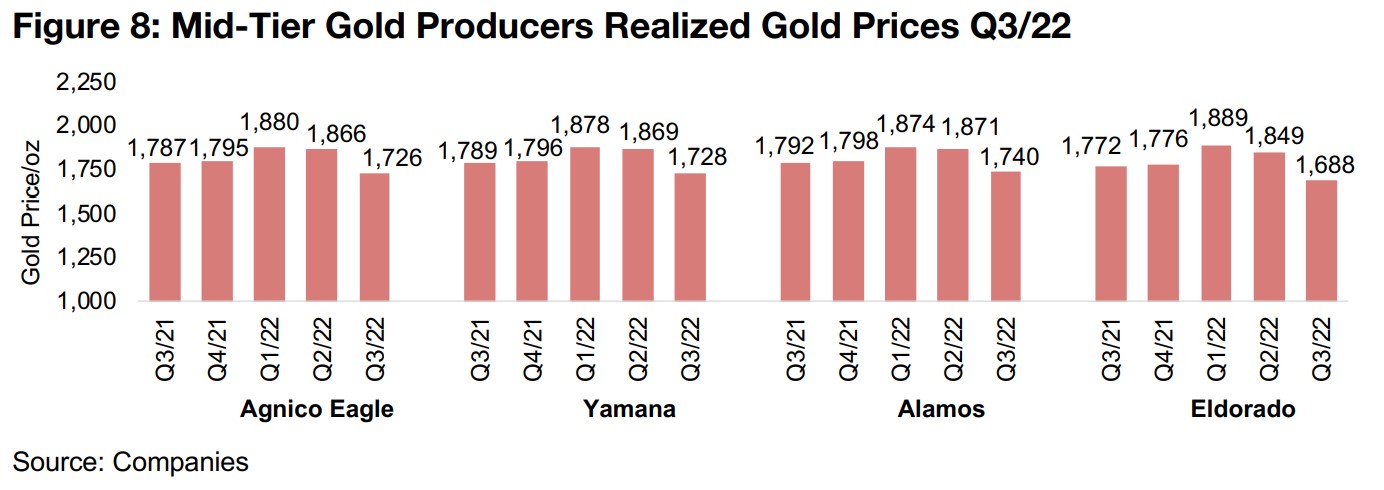

Realized gold prices down for second consecutive quarter, and drop yoy

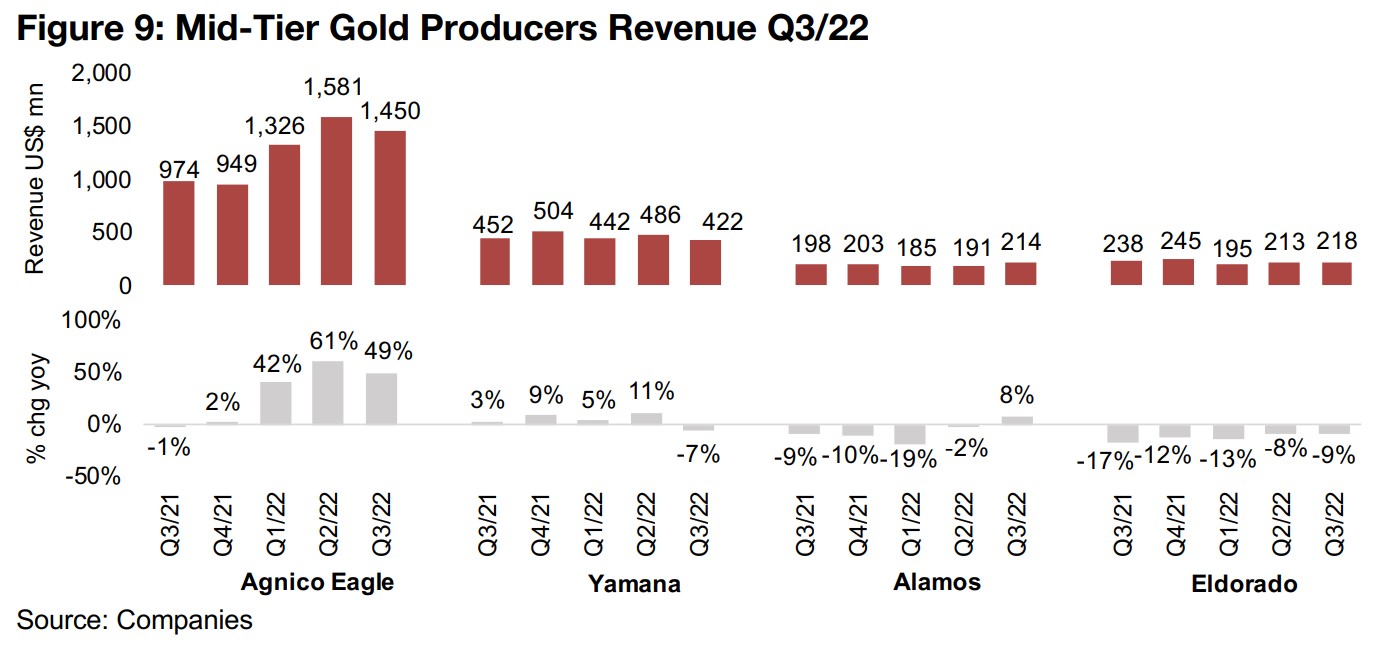

Realized gold prices for the group continued to weaken from their most recent peak in Q1/22, with all of the group seeing the second consecutive quarter of decline and considerably lower gold prices yoy (Figure 8). Revenue growth remained strong for Agnico Eagle, up 49%, on the gain in production from the Kirkland acquisition, and was moderate for Alamos, up 8%, marking the first revenue increase for several quarters (Figure 9). In contrast, Yamana saw the first decline in revenue, down -7% yoy, after several quarters of gains, and Eldorado's revenue was down -9%, continuing multiple quarters of contraction.

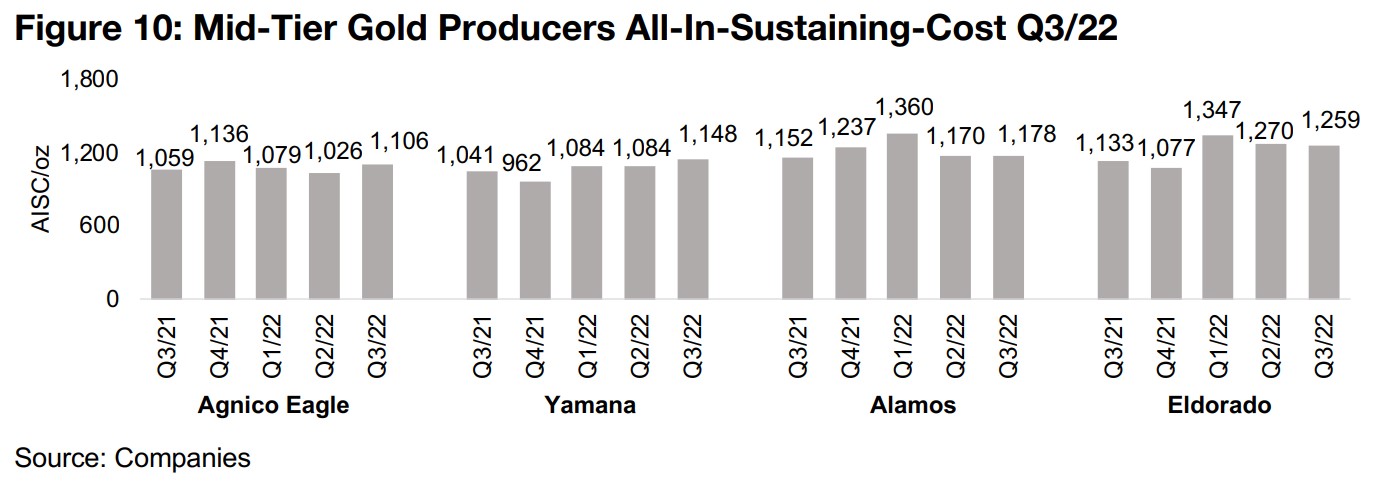

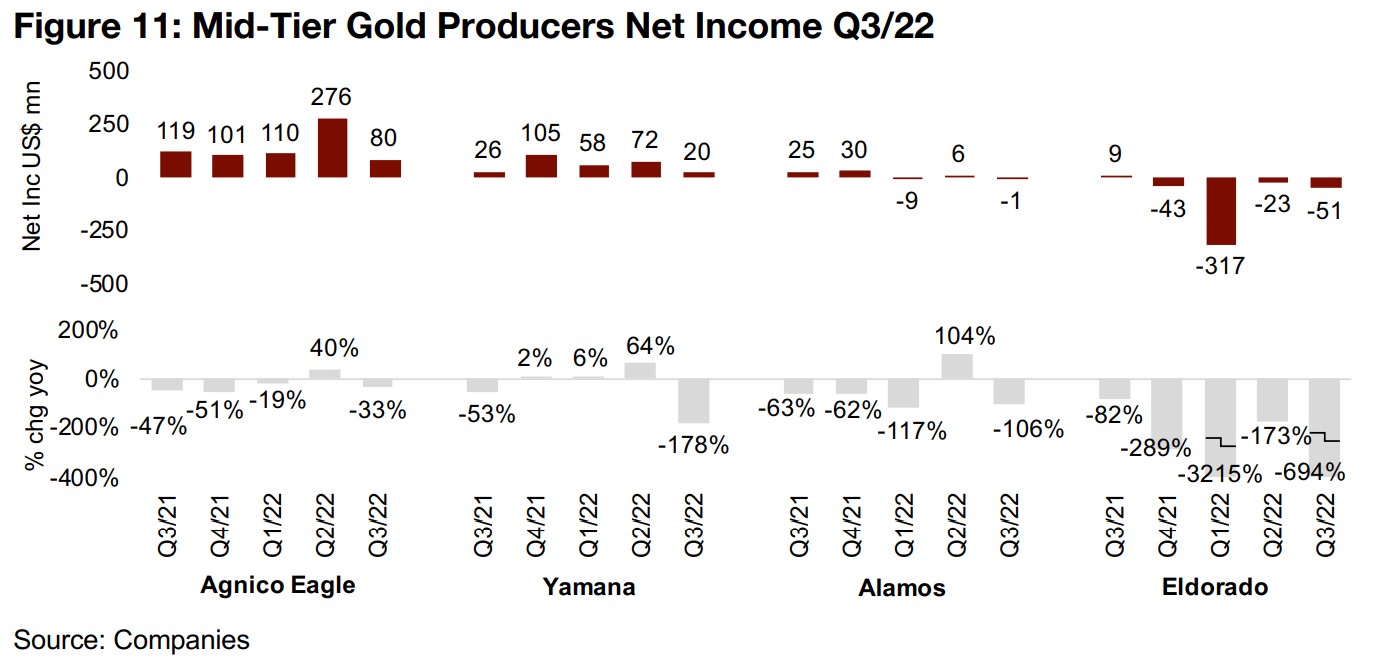

AISC continues to trend up, net income growth reflects non-core items

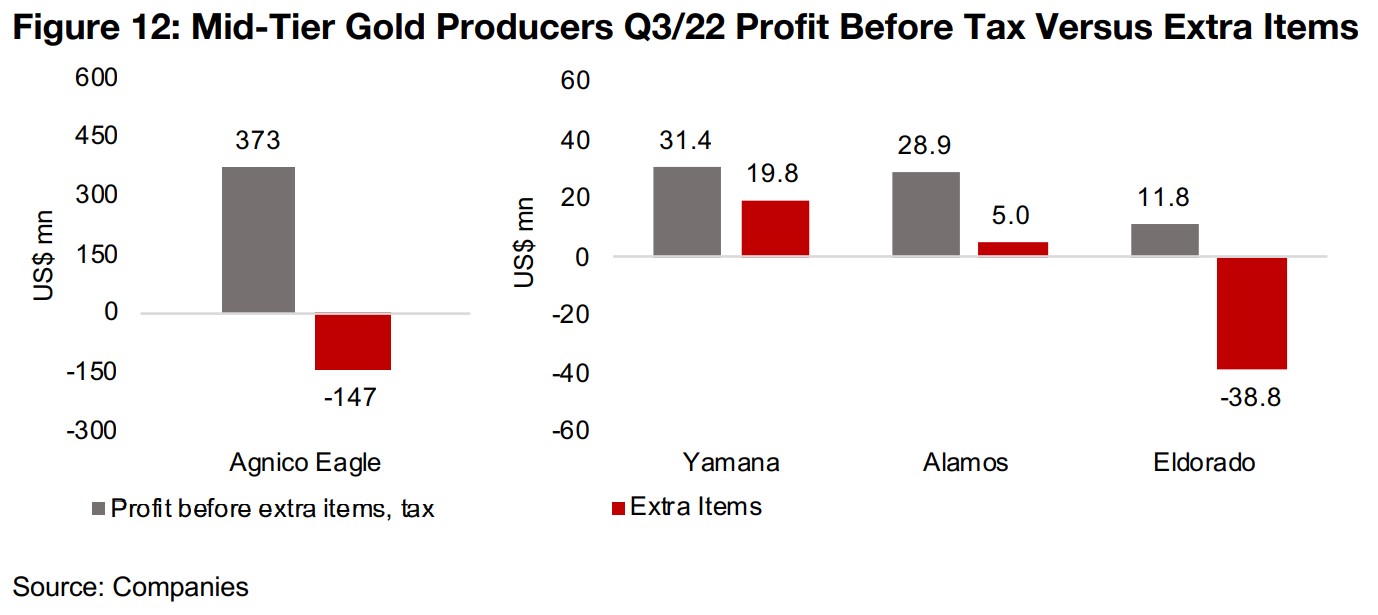

Rising inflation can be seen in the all-in-sustaining costs for the group, which have generally been trending up for all the companies over the past year (Figure 10). While the rising costs will have had a negative effect on net income, the largest declines in net income were more from exceptional items than from operating issues (Figure 11). Foreign exchange was a key extra item, with Agnico Eagle's net income lowered by forex losses, but Yamana and Alamos boosted by forex gains, and Alamos also had gains on derivatives and other items. Extra items had the largest negative effect on Eldorado's earnings, including major impairment expenses and mine standby costs (Figure 12).

Producers' Q3/22 results read across for junior miners

There is some read across for the junior miners from the results so far, although we

will still need to see Q3/22 results from Newmont and Barrick to confirm overall

industry trends, given their very large weighting. The first is that production growth

for these majors remains relatively low overall, and the only exception, Agnico Eagle,

needed a major acquisition to drive its substantial production gains. With only a

handful of such large-scale potential deals left in the market, it indicates that the

majors will continue to need juniors to develop new riskier properties that they can

acquire just to maintain, let alone grow, their production.

The second is the downtrend in the gold price, which while not severe, is concerning

given that fundamentals continue to move against gold. These include rising US real

yields, which make assets that pay out cash, like bonds, relatively more attractive

versus yield-less gold, and the strength of the dollar. There are some signs that

US$ strength may be peaking, with global rates rising and starting to close the gap

with US rates, thus drawing in fund flows to these other currencies. However, US real

bond yields look set to continue to move against gold with US inflation starting to

flatten and nominal rates rising. For juniors the gold price is obviously a major factor

in their valuations and if it continues to decline, their stocks prices could see pressure.

The other major read across is the rise in costs that we are seeing across all these

companies, which is the other major driver of the junior miner valuations along with

the gold price. Even if inflation is peaking currently, if it continued to remain at its

levels around 8% for just two and a half years, it could drive a 20% increase in costs

for projects across the industry, lowering their valuations. Overall, the need of the

majors for additional production from the juniors remains the core long-term driver,

and remains bullish, while the two negative drivers, the declining gold price and rising

costs are likely more cyclical, and both could subside with a year or two.

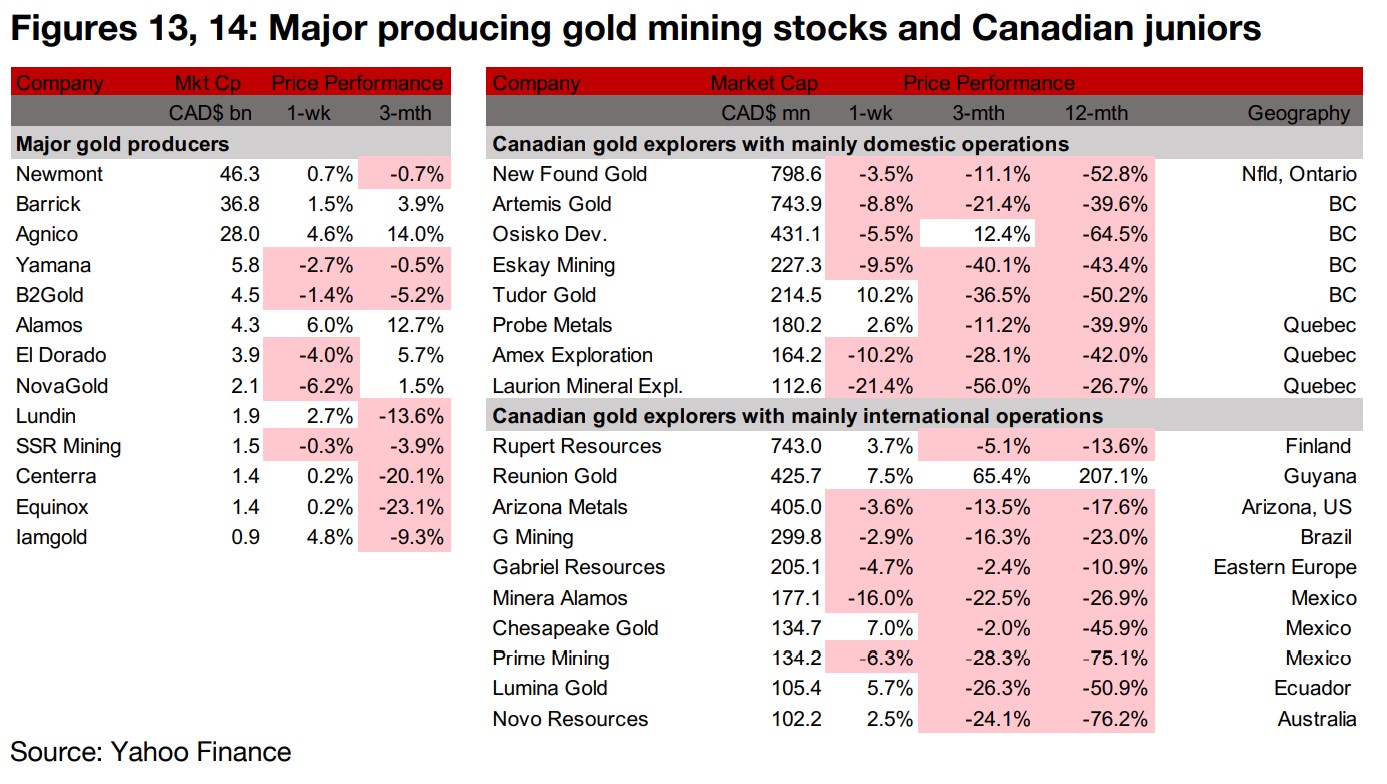

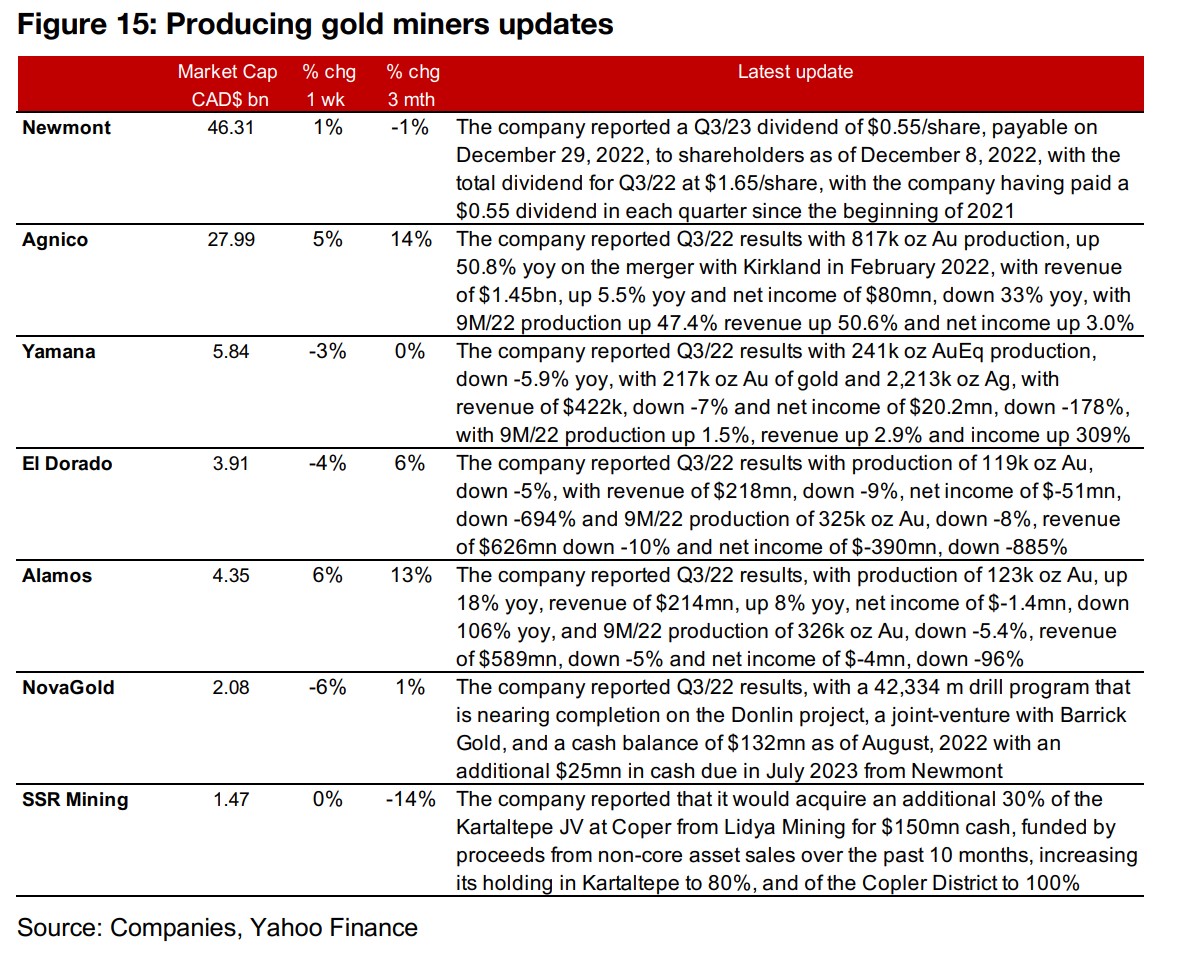

Producing gold miners up on rise in gold and equity markets

The producing gold miners were mixed as gold was near flat but the equity markets rose (Figure 13). The Q3/22 results season started, with Agnico Eagle, Yamana, Alamos and Eldorado all reporting. Newmont reported its Q3/23 dividend, Novagold, which is developing Donlin, reported its Q3/22 results and SSR Mining reported that it would acquire 30% more of Kartaltepe, increasing its stake to 80% (Figure 15).

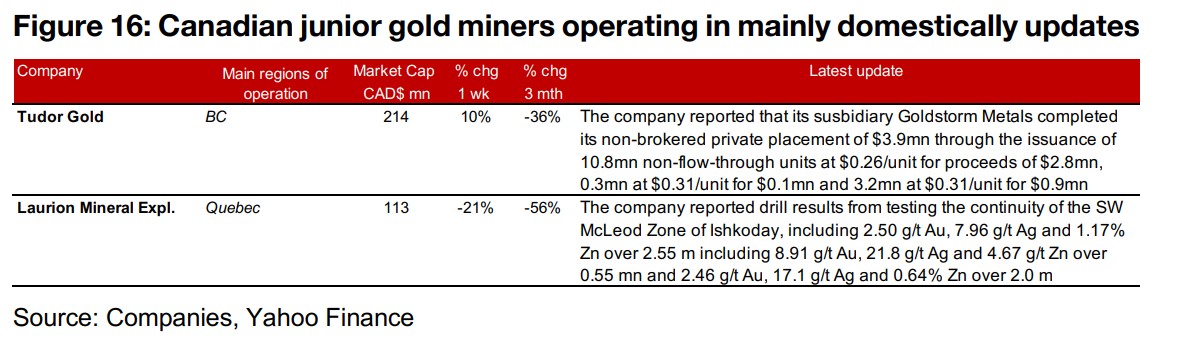

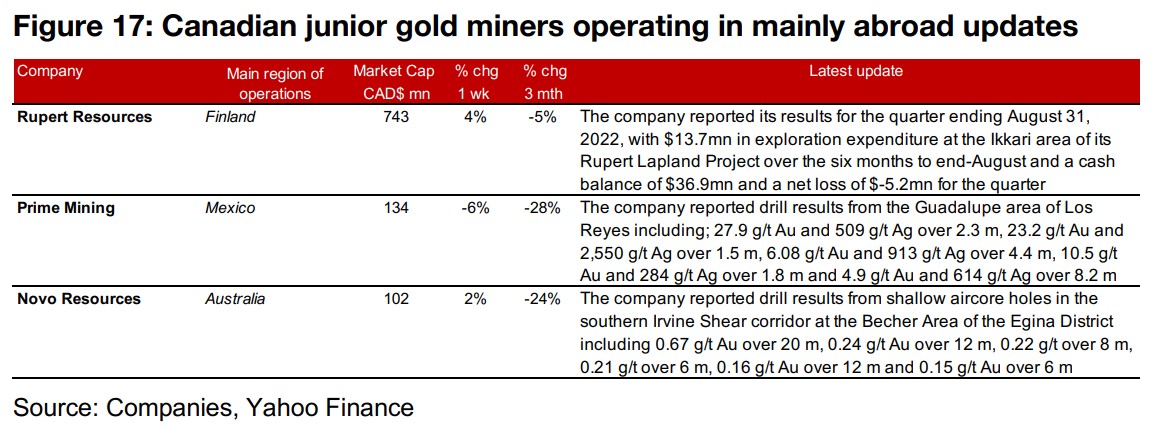

Large TSXV gold juniors mixed

The larger TSXV gold juniors were mixed as stocks market gained and gold stagnated (Figure 14). For the Canadian juniors operating mainly domestically, Tudor Gold's subsidiary Goldstorm Metals completed a private placement and Laurion Mineral Exploration reported drill results from the SW Mcleod Zone of Ishkoday (Figure 16). For the Canadian juniors operating mainly domestically, Rupert Resources reported Q3/22 results, Prime released drill results from the Guadalupe East area of Los Reyes and Novo Resources reported drill results from the Becher Area of Egina (Figure 17).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.