November 28, 2022

New Found Gold Still TSXV's Largest Gold Explorer

Author - Ben McGregor

Gold near flat in short US trading week

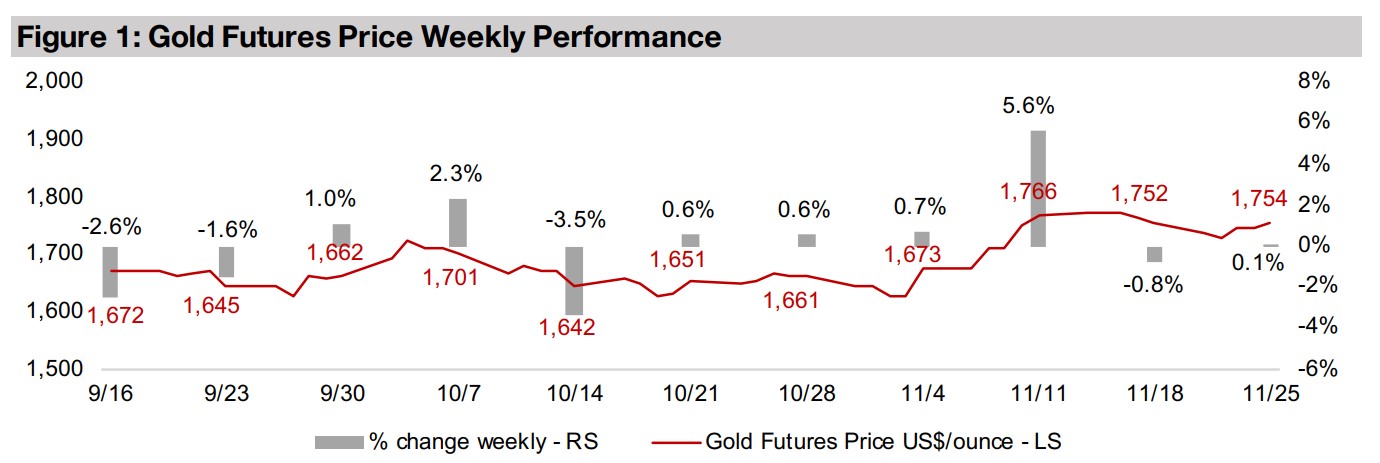

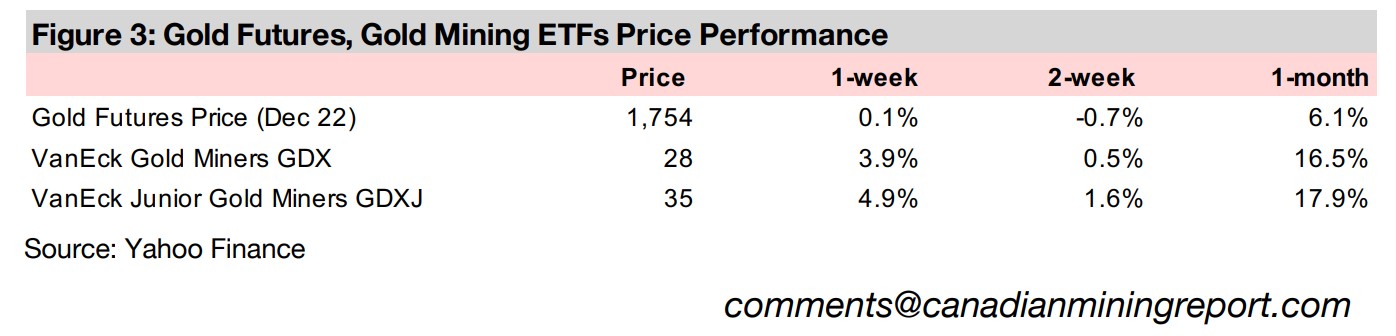

Gold was near flat, rising 0.1% this week to US$1,754/oz as there was a short trading week because of US holidays, with equity markets lifted by US Fed meeting minutes which showed officials agreeing that the pace of rate hikes could be slowed.

New Found Gold valuation holds up in market decline

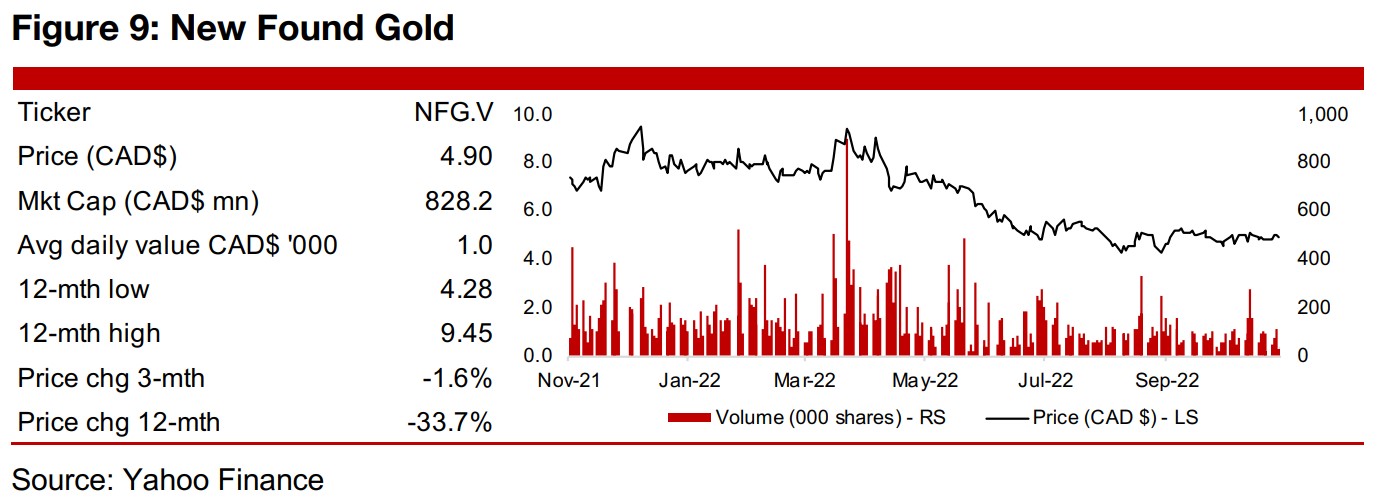

This week New Found Gold is In Focus, the largest gold explorer on the TSXV by market cap, with strong drilling results from its Queensway project supporting its Price/Book valuation over the past year while its peers have faced declines.

NFG Still TSXV's Largest Gold Explorer

Gold was near flat, up 0.1 to US$1,754/oz, even as US Fed meeting minutes showed Fed officials agreeing on the potential for a slower pace of rate hikes, which lifted equity markets but had little effect on gold. However, even a slower pace of rate hikes still means more rate hikes, and we expect this could continue to pressure equity markets and the gold stocks. We view the recent rally as likely a bit overblown, given the potential for lagged economic fallout from the rate hikes already made, let alone those in the pipeline, even if they are more moderate than the market previously expected. For the gold juniors strong company specific fundamentals are becoming increasingly important, with the macro backdrop relatively weak, with support from a relatively resilient gold price broadly offset by rising rates pressuring the economy and driving down equity markets. One such large TSXV gold junior with continued strong company fundamentals is New Found Gold, In Focus this week.

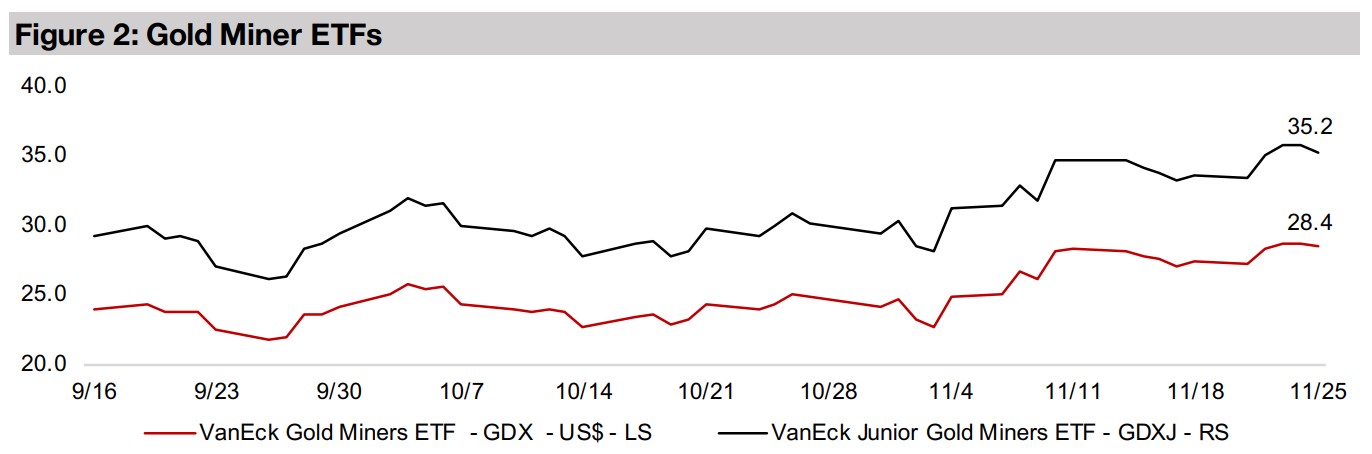

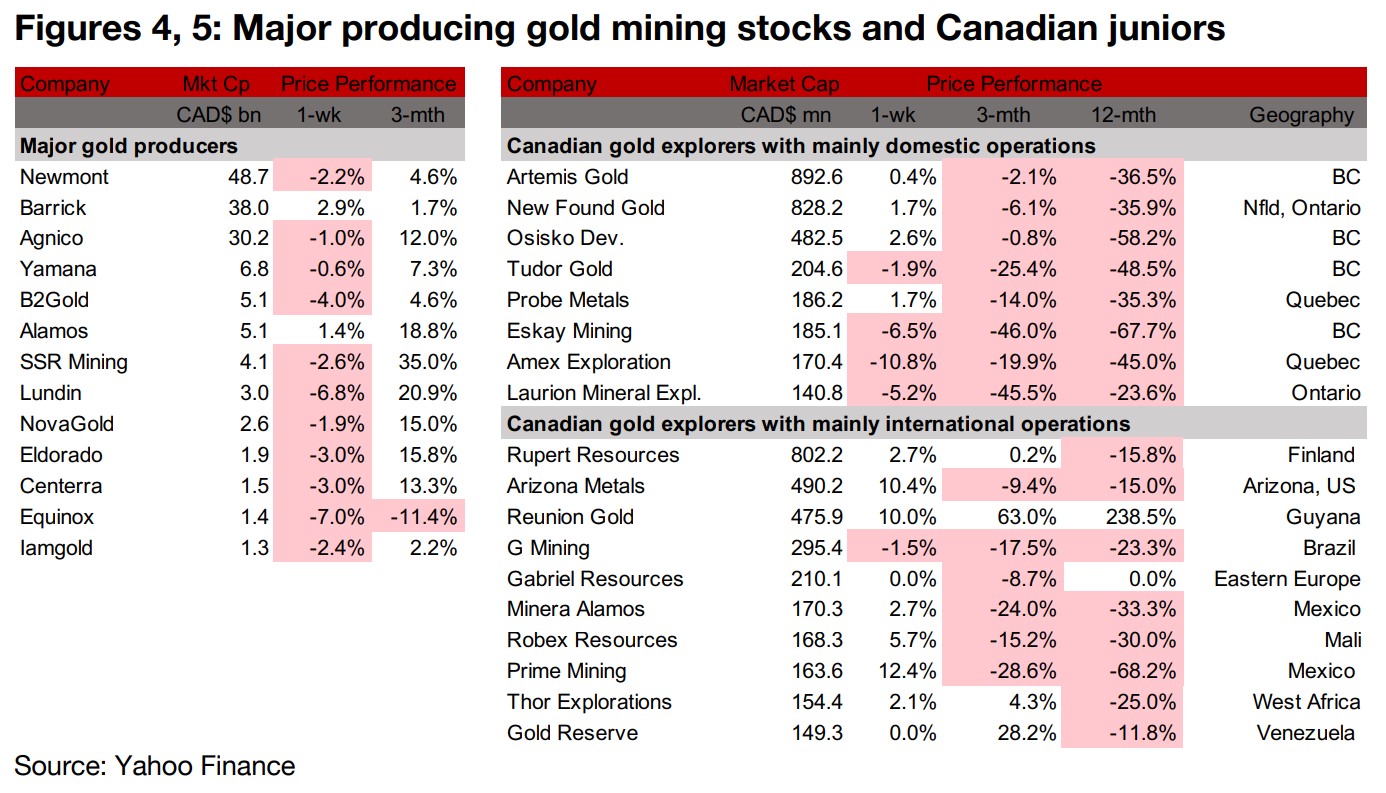

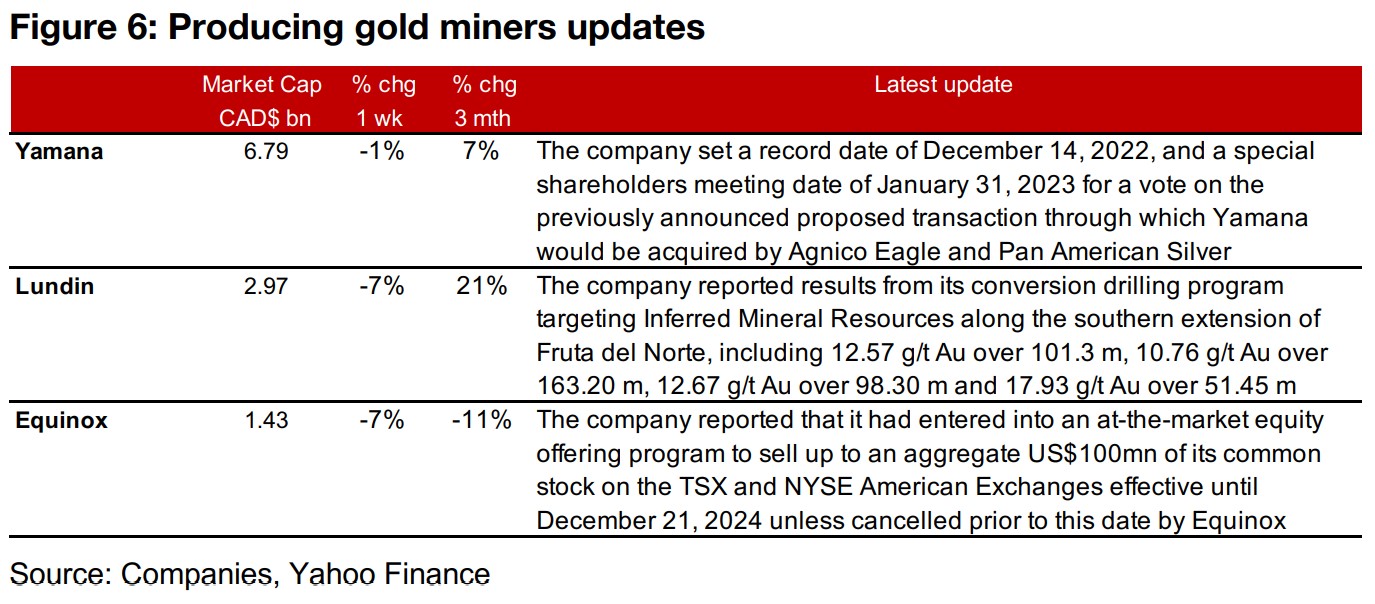

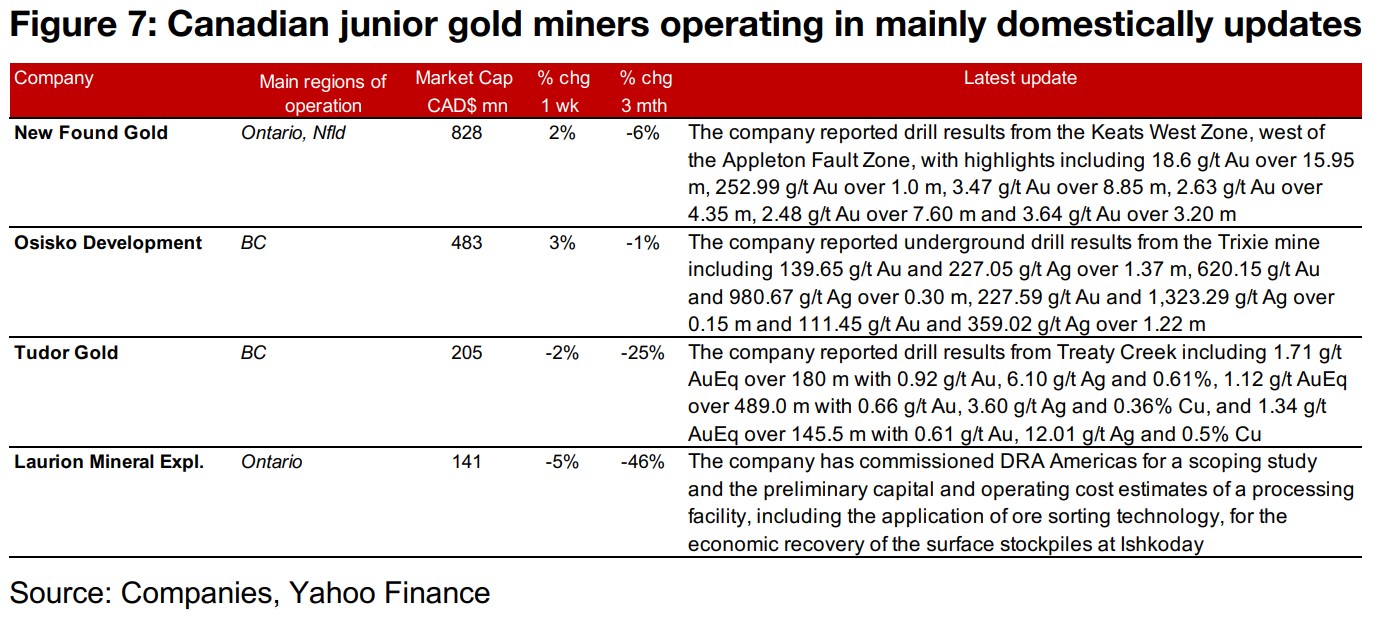

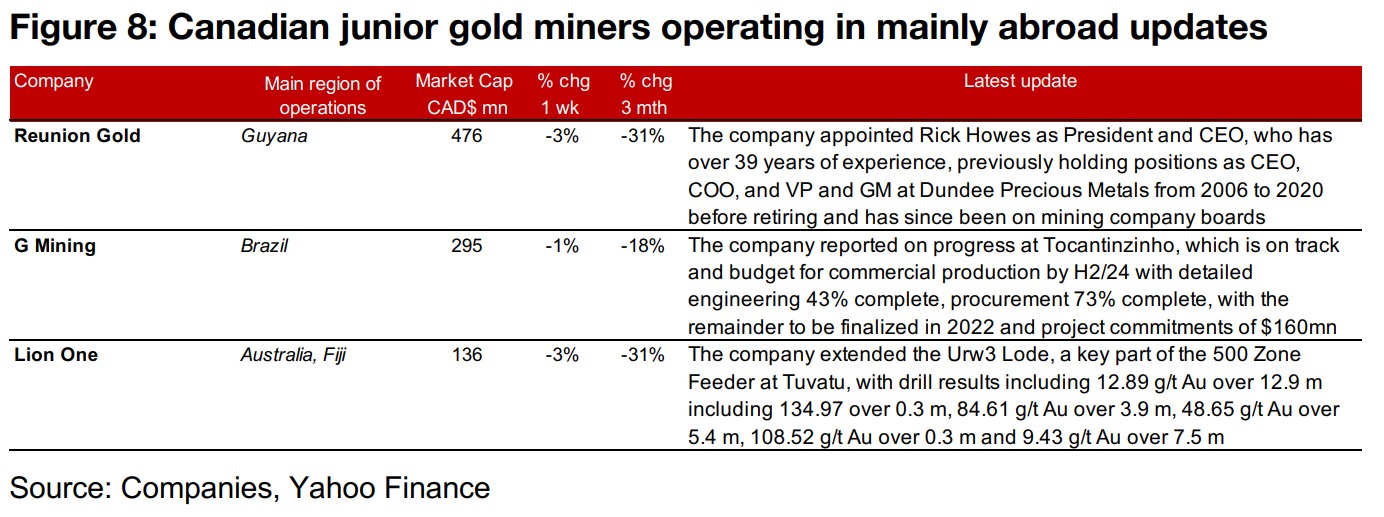

Producers mostly down but TSXV juniors largely gain

The producing gold miners were nearly all down on the flat gold price (Figure 4) but the TSXV juniors mainly rose as equity markets picked up (Figure 5). Yamana set its meeting date for approval of its acquisition, Lundin reported drilling results from Fruta del Norte and Equinox announced a US$100mn at-the-market equity offering program (Figure 6). For the Canadian juniors operating mainly domestically, New Found Gold, Osisko Development and Tudor Gold reported drilling results and Laurion commissioned DRA Americas for a scoping study on stockpiles at Ishkoday (Figure 7). For the Canadian juniors operating mainly internationally, Reunion appointed a new CEO and G Mining and Lion One reported drill results (Figure 8).

In Focus: New Found Gold (NFG.V)

New Found Gold Still the TSXV's Largest Cap Explorer

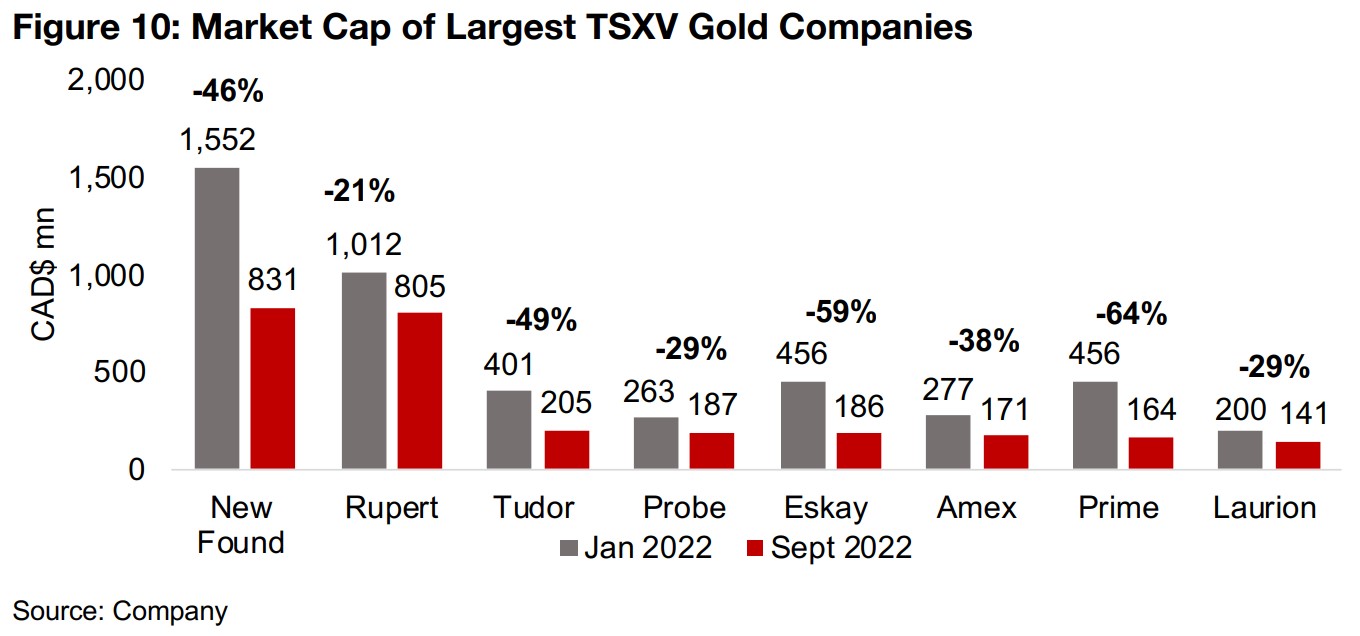

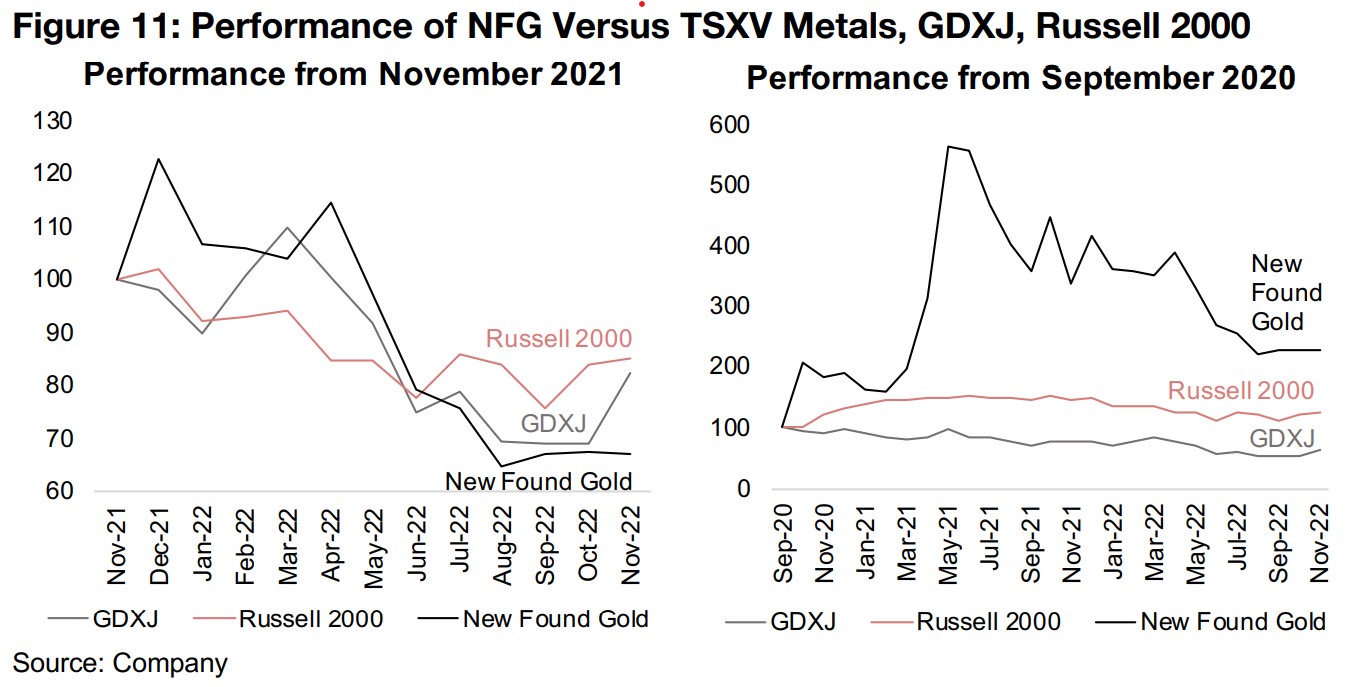

New Found Gold has generally remained the TSXV's largest market cap explorer over the past year, periodically trading off the number one position only with Rupert Resources, currently number two, with the other explorers just a quarter the size of these two (Figure 10). The company has underperformed in the equity market decline that started in November 2021, down -33% versus -15.0% for the Russell 2000 Index of US small caps, and -17.5% for the GDXJ ETF of junior gold miners (Figure 11). These two indices are reasonable benchmarks for NFG, with Russell capturing the pressure on small cap companies over the past year and GDXJ reflecting any issues specific to the junior mining sector. That the performance of the GDXJ is only moderately below the Russell 2000 suggests that most of the issues for the sector have been related to the broader market pressure rather than gold industry-specific problems, with gold is down just -2.2% since the start of the bear market.

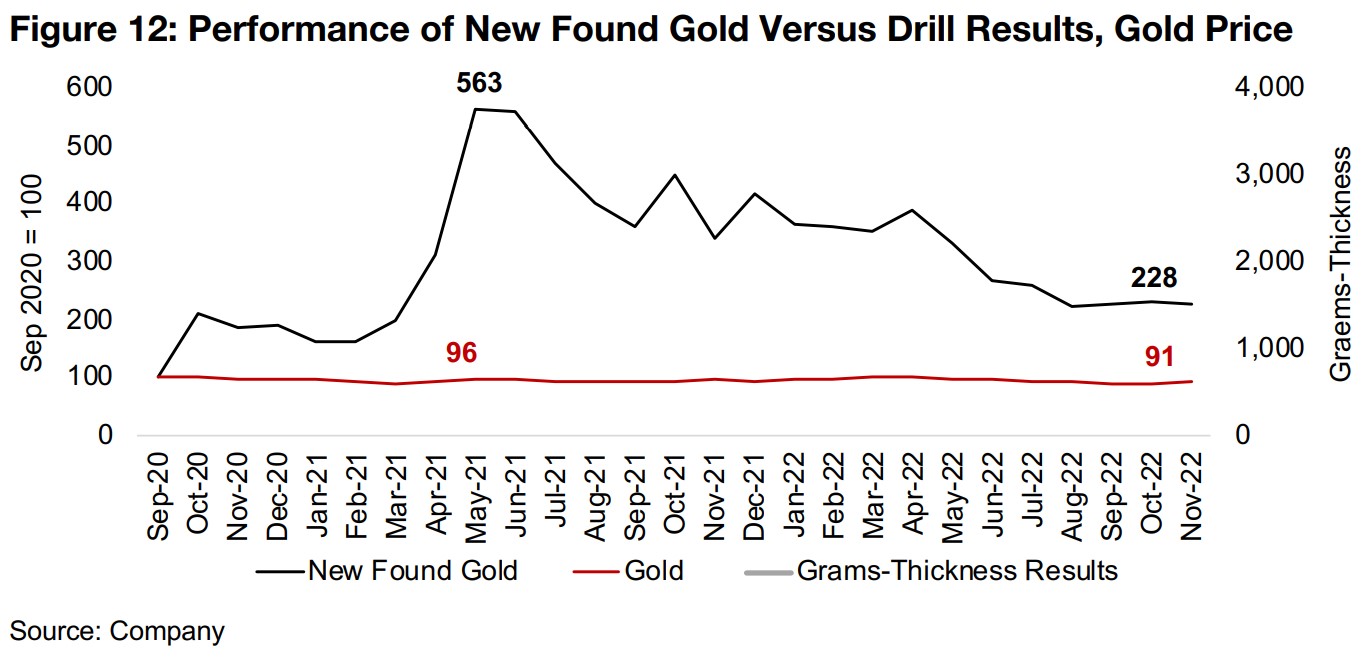

NFG underperformance in 2022 driven by its 2021 outperformance

New Found Gold's underperformance this year to some degree has been due to its own previous success, with the company dramatically outpacing the market and junior gold mining sector since its listing in late August 2020. The company has risen 127% since September 2020, substantially outperforming the 24% gain for the Russell 2000 and -36.4% loss for the GDXJ. At its height in May 2021 it had gained 463% versus September 2020, even while the gold price dipped 4% over the period, driven by some outstanding drill results, which remain outliers among the TSXV larger gold explorers even a year and a half on (Figure 12).

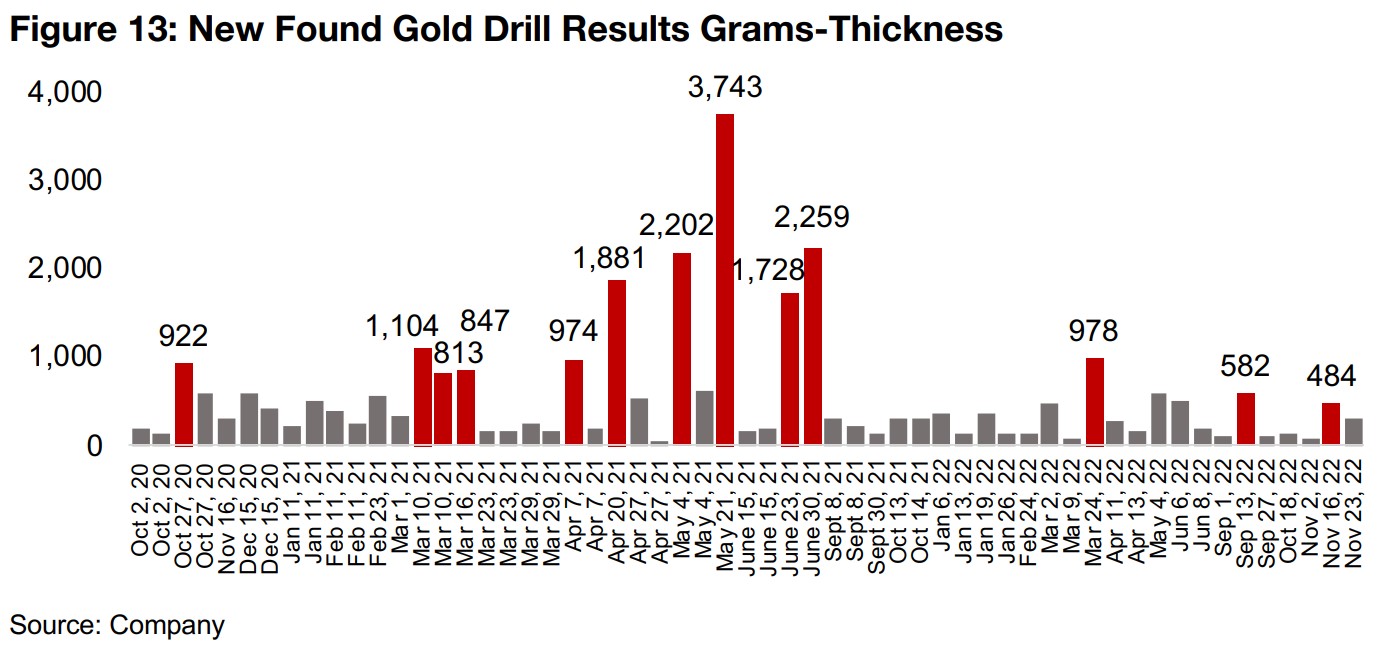

NFG results still strong in absolute sense, but not compared to own high bar

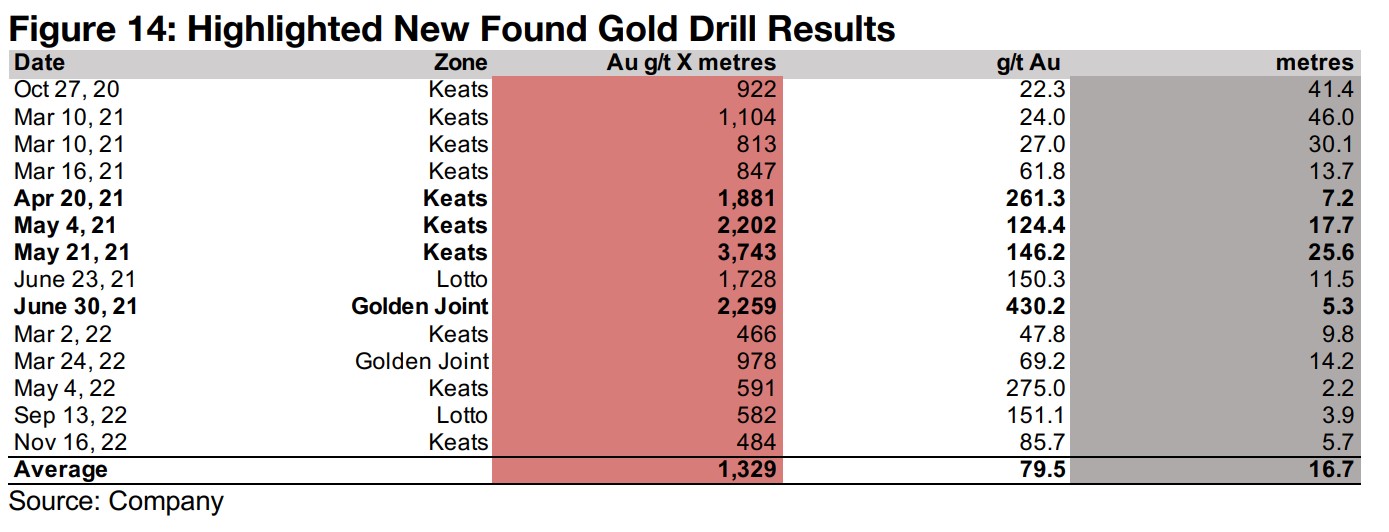

The company's runup was driven by strong drill results from the Queensway project which started to come through from October 2022, with 22.3 g/t Au over 41.4 m for a grams-thickness of 922, followed in March and April 2021 by four results over 800 in grams-thickness (Figures 13, 14). This was followed by particularly outstanding results starting in late April 2021, with an 1,881 grams-thickness, and in May 2021, with a peak of 3,743 grams-thickness, with more strong results in June 2021. While market exuberance on these results send NFG's share price to its peak, its eased as subsequent results were more moderate. Although there have been strong results in an absolute sense in March, September and October 2022, they look less impressive in the context of the bar NFG set for itself 2021. The market seems to have accepted that a repeat of the huge mid-2021 numbers is less likely and combining this with the broader bear market for equities, NFG's share has come down, although holders since the listing have still have substantial gains.

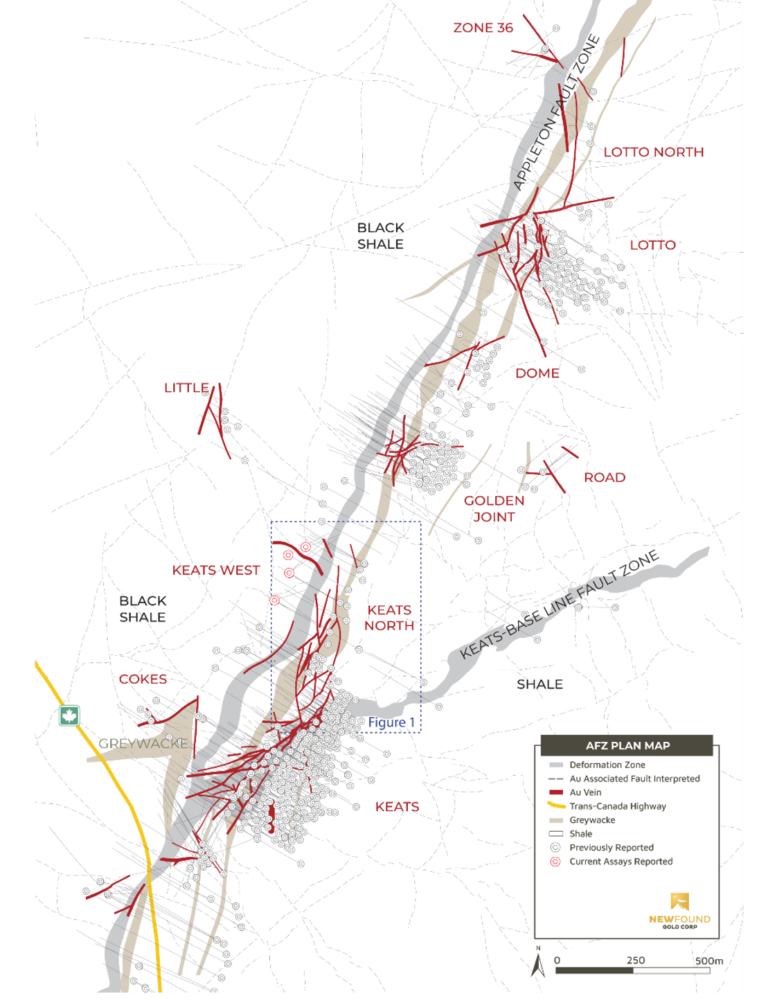

Figure 15: Queensway Project Main Zones

Strong results from three zones, substantial scope for continued exploration

The Queensway project's exceptional results have come three zones, with the Keats Zone, which remains the core part of the project, the focus early on, and producing the highest grams-thickness results in April and May 2021 (Figure 15). However, some of the peak results were also from the Lotto Zone, to the northeast of Keats, and the Golden Joint Zone, in between Keats and Lotto, in June 2021. There have been strong drill results from all three of these zones in 2022, with the potential for continuity between them, and substantial scope for continued exploration. These continued high grade results from multiple zones have seen the company continue to hold off on an initial resource estimate, as to not lock in or anchor its valuation before the true extent of the deposit has been determined. It is now a question of whether New Found Gold could see a repeat of the Great Bear situation, where there is an acquisition of the project before an initial mineral resource estimate is even released.

Aggressive exploration continues, cash pile halved in 2022

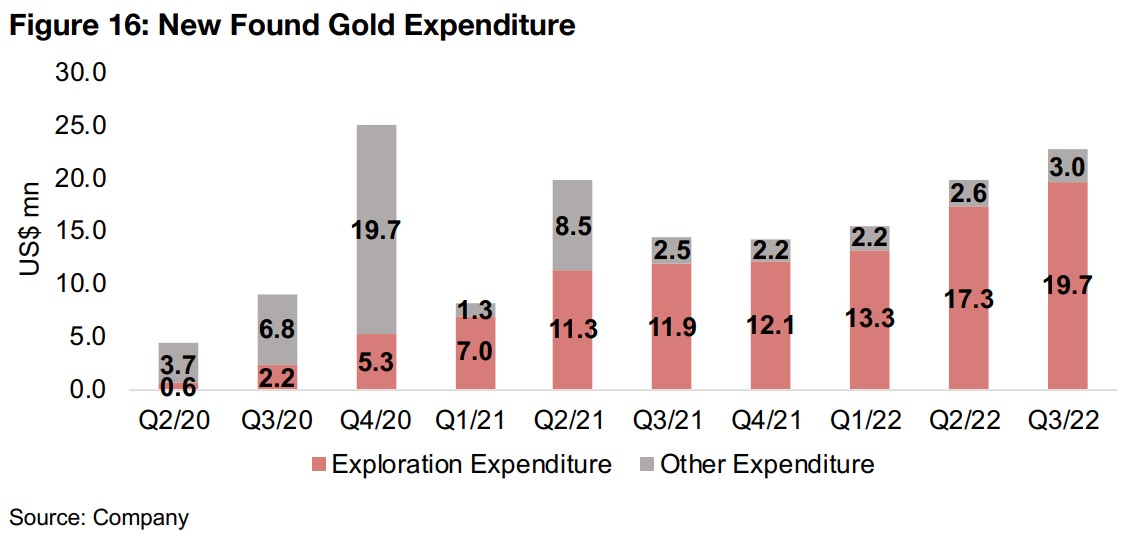

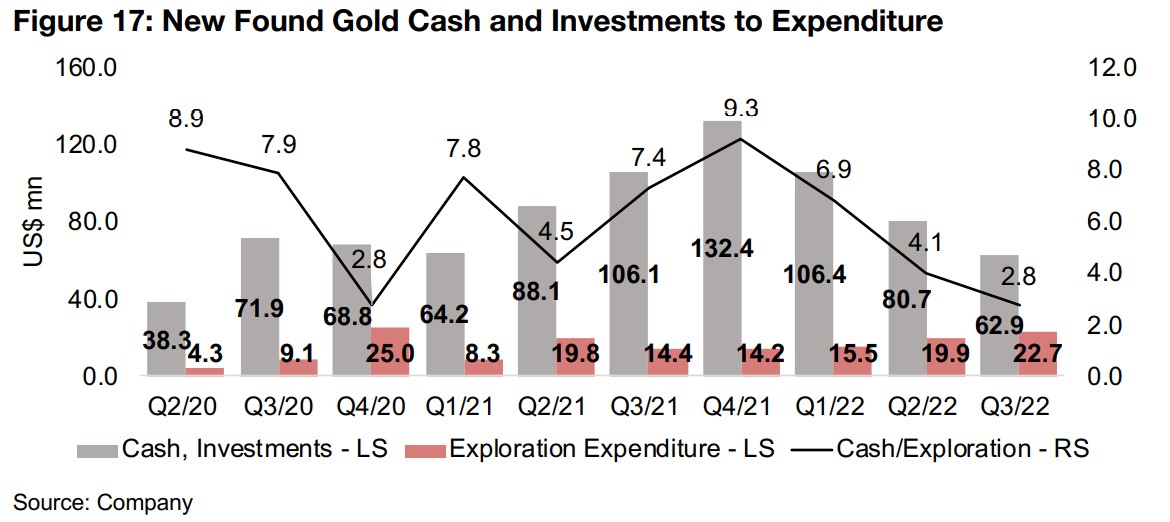

The company has undergone an aggressive exploration campaign this year, with Q3/22 its highest quarter of exploration expenditure so far, at CAD$19.7mn, with only Q3/20 higher in terms of overall expenditure, although most of this was not on exploration (Figure 16). This has reduced the company's cash pile by about half from CAD$132.4mn as of Q4/21 to CAD$62.9mn in Q3/21, which would fund about another three quarters of expenditure at the current rate (Figure 17). This suggests that the company will need to raise capital heading into early 2023, and while capital markets have become more difficult in general, we expect that the company's outstanding grade drill results will likely mean reasonably high interest from investors in continuing to fund the project.

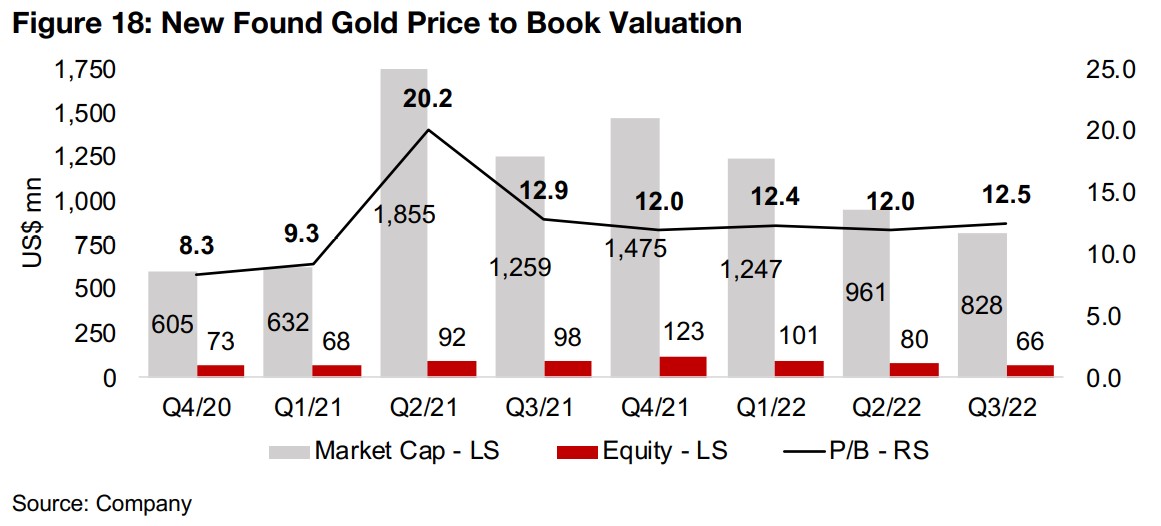

Valuation multiple has remained roughly stable over past year

While NFG's stock price has come down substantially this year, its price to book multiple has actually remained relatively stable, holding between 12.0x-12.5x from Q4/21 to Q3/22. This is because while the company's market cap has declined -41.6% from CAD$1,418mn in Q4/21 to CAD$828mn over Q3/22, its equity has come down moderately more, by -46%, from CAD$123mn to CAD$66mn, as New Found Gold has deployed its cash on exploration expenditure.

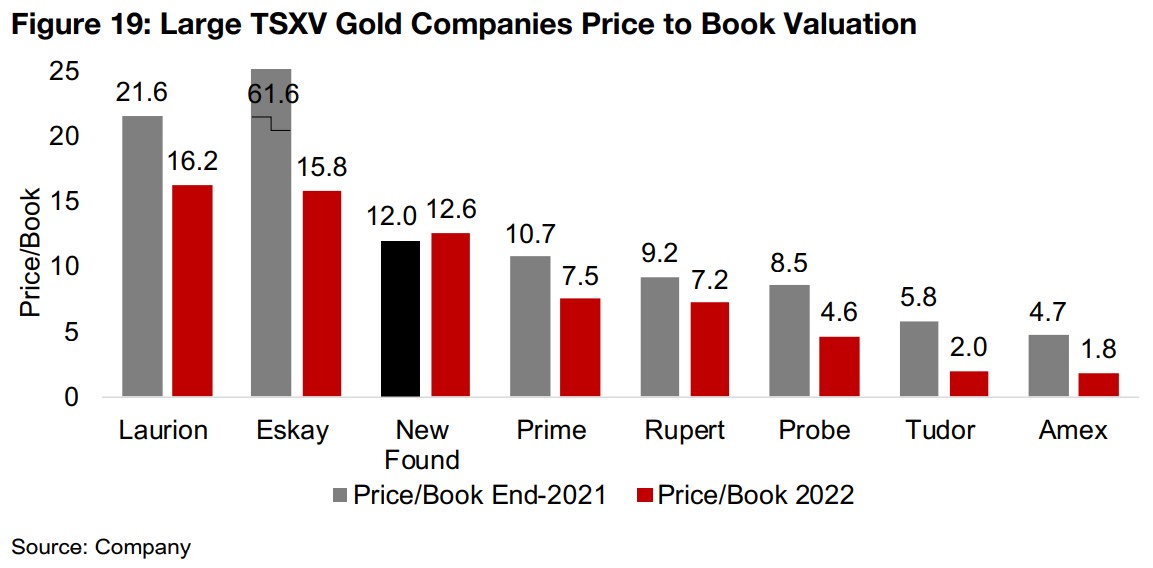

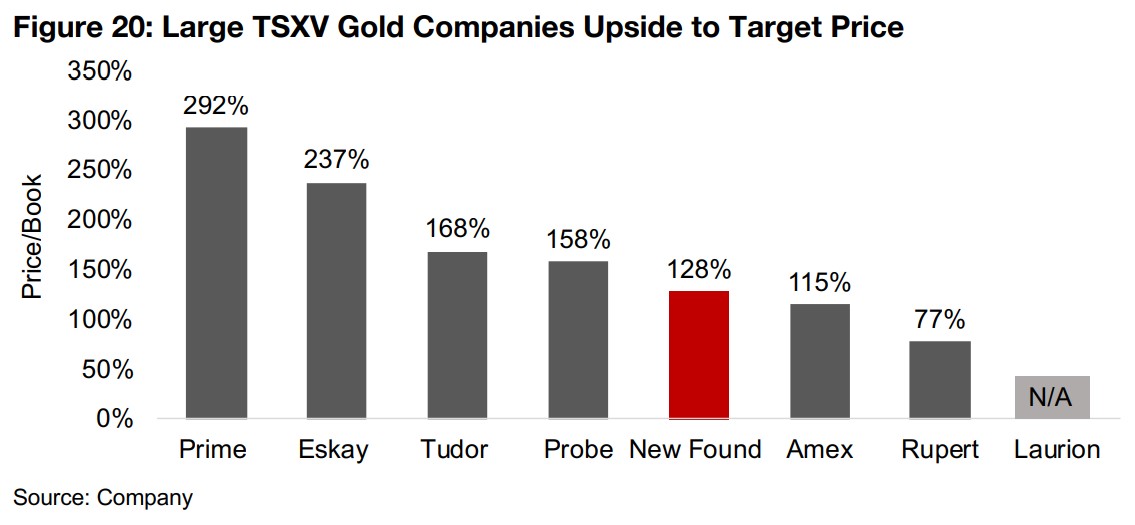

The price to book valuation for New Found Gold is the third highest of the larger TSXV explorers, and it is the only one of the group to see its multiple rise since the start of the year, with a substantial multiple contraction for the other companies, showing relative confidence in New Found Gold from the market (Figure 19). The market is also forecasting a substantial 128% upside to the company's share price, which is actually relatively low versus its larger cap TSXV gold miner peers, with analysts appearing bullish overall on this group (Figure 20).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.