The core of US gold mining

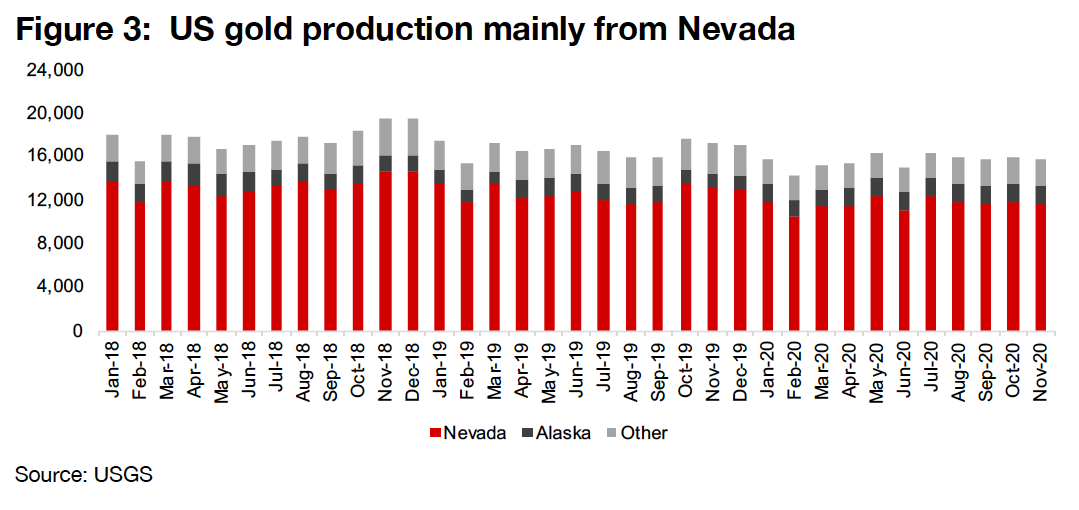

Nevada accounts for 76% of U.S. gold production and 49% of U.S. reserves

Drives US output, making it one of the largest producing regions globally

Nevada produces majority of U.S. gold output

Nevada is the core of the U.S. gold output, accounting for by far the majority, at 75.4% on average for the past year. The state looks set to remain a dominant player in U.S. gold, as it accounts for 49% of total U.S. reserves, with Alaska slightly ahead with 51% of reserves, but just 8.6% of current production. The U.S. accounts for 6.1% of global gold output, making Nevada one of the largest gold producers in the world, with ore of high grades.

U.S. gold output growth has remained quite flat following 2013-18 bear market

Nevada is highest ranking global mining district

Flat growth in a high-ranking district

Nevada (and therefore U.S.) gold output growth has been moderately declined in recent years, as lower cost deposits have largely been mined, and gold prices had been low from 2013-2018, curbing investment in the sector. Output could rise, however, as the operating environment in Nevada is extremely supportive, with the state the highest ranked district globally for investment attractiveness in the Fraser Institute's 2020 survey.

Barrick/Newmont by far the major players in Nevada gold, with 77.2% of production in 2020

Other major players include Kinross, with 11.5% of production and SSR Mining with 6.0% in 2020

Barrick/Newmont dominates low-cost district

Barrick and Newmont dominate Nevada gold production, through its 61.5%/38.5% held Nevada Gold Mines joint venture, with the combined output of five mines, Goldstrike, Cortez, Turquoise Ridge, Phoenix and Long Canyon accounting for 77.2% of the state total. The other major players are Kinross, with its Bald and Round Mountain mines accounting for 11.5% of production, and SSR Mining, with its Margiold mine accounting for 6.0% of production. Nevada stands out for its low production cost/ounce for these main mines, averaging well below competing North American districts Quebec, Ontario and British Columbia.

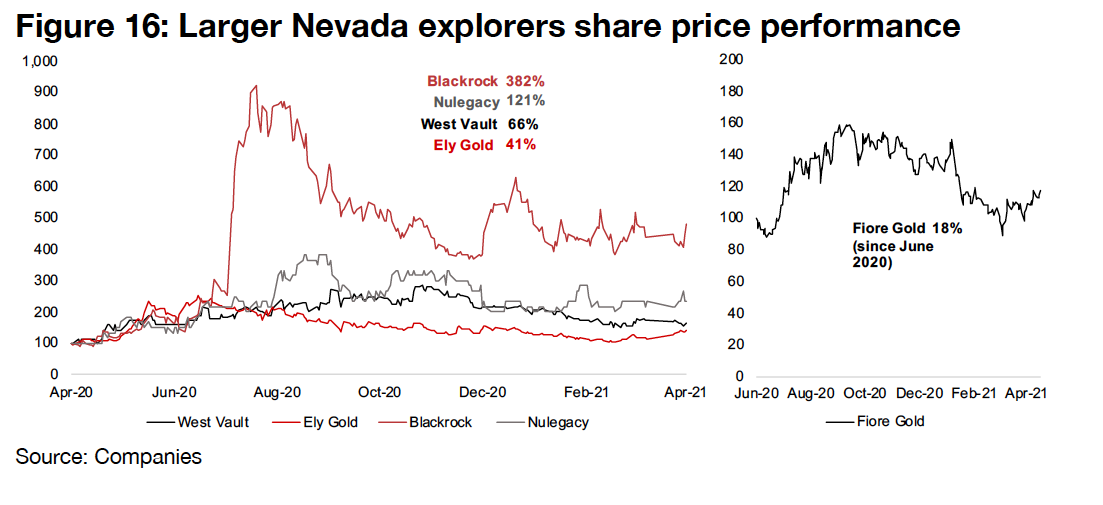

H1/20 had seen the gold price drive up majority of juniors

Company specific factors in focus from H2/20 especially drilling results

Company specific factors become more key

H1/20 especially was a period where the rising gold price drove up the prices of the majority of junior gold stocks. However, since H2/20, as the gold price has declined, company specific factors differentiating the operating performance of these companies have come more in focus. Most of the companies covered in this report have ongoing drilling campaigns at their projects, and results from these have tended to be the big driver, with permitting for drilling also supporting share prices, and other more advanced stage drivers not so crucial for these firms in general.

Range of TSXVlisted juniors exploring in Nevada

Includes royalty company and firms at PEA, FS, mineral resource, and drilling stage

A range of Canadian juniors exploring in Nevada

There are a range of Canadian-listed juniors exploring in Nevada, including the gold royalty company Ely and companies at an advanced stage, in production like Fiore or with a Feasibility Study like West Vault. Other firms are at the mineral resource stage, including Allegiant or New Placer Dome. The rest have recently completed, or have current drilling campaigns, including Blackrock, Nulegacy Gold, Newrange Gold, Nevada Exploration, Contact Gold, Walker River, VR Resources and NV Gold.

Gold price has again been picking up

Canadian juniors in Nevada have operationally advanced over past year

Substantial medium to long-term opportunity

There is a substantial medium to long-term opportunity for Canadian juniors operating in Nevada, with the gold price again picking up, to further support the operational progress that has been made especially over the past year. All the stocks outlined here at least having advanced to the drilling stage, and many much further, and they have projects in the best mining district in the world, and a region that will remain the leading center of US gold production for a considerable time to come.

1) Nevada mining overview

US a key global gold producer, with most from Nevada

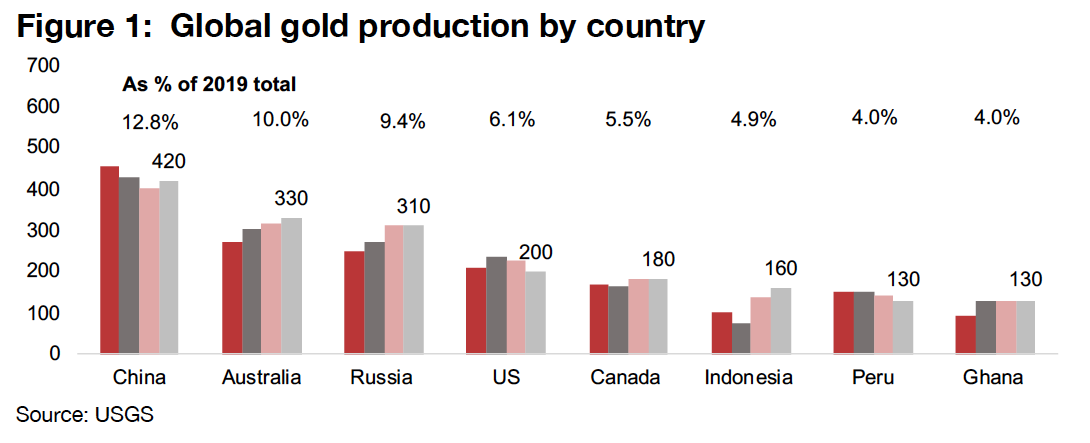

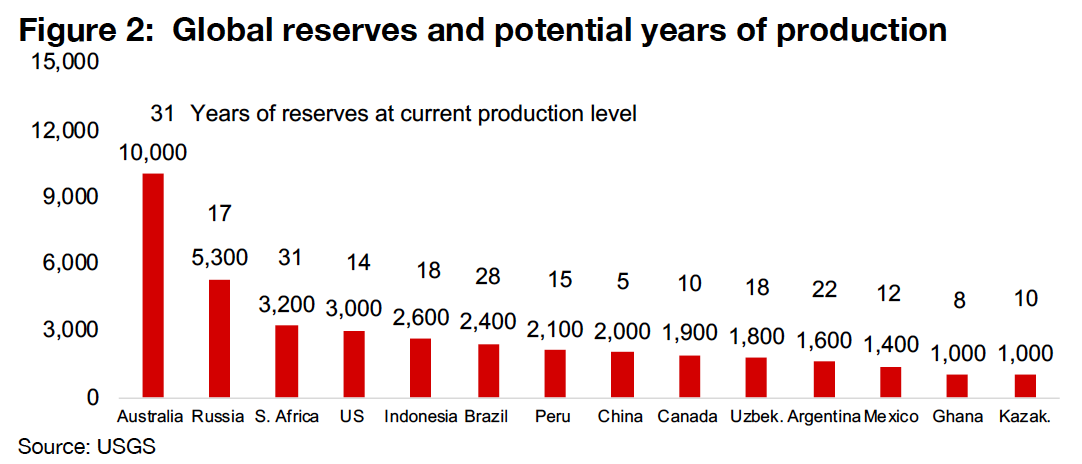

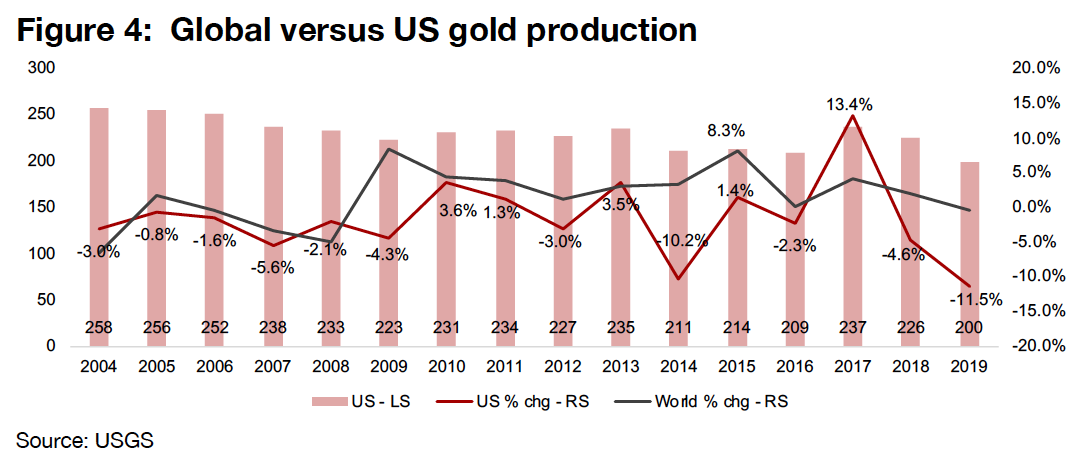

The United States is a key global gold producer, the fourth largest in 2019, at 200 tonnes, or 6.1% of the total (Figure 1), and holds the fourth largest global reserves, at 3,000 tonnes, or 14 years at the current production level, using average 2018-2019 production (Figure 2). US production is mainly from Nevada, which comprised an average 75.4% of the total over the 12 months to April 2020, with the second largest contributor Alaska, accounting for just 8.6%, with 16.0% from other States (Figure 3). US production growth lagged global growth from 2009 to 2019, with the exception of 2017, averaging zero percent from 2010-2019 compared to 3.0% for global production growth over the period (Figure 4).

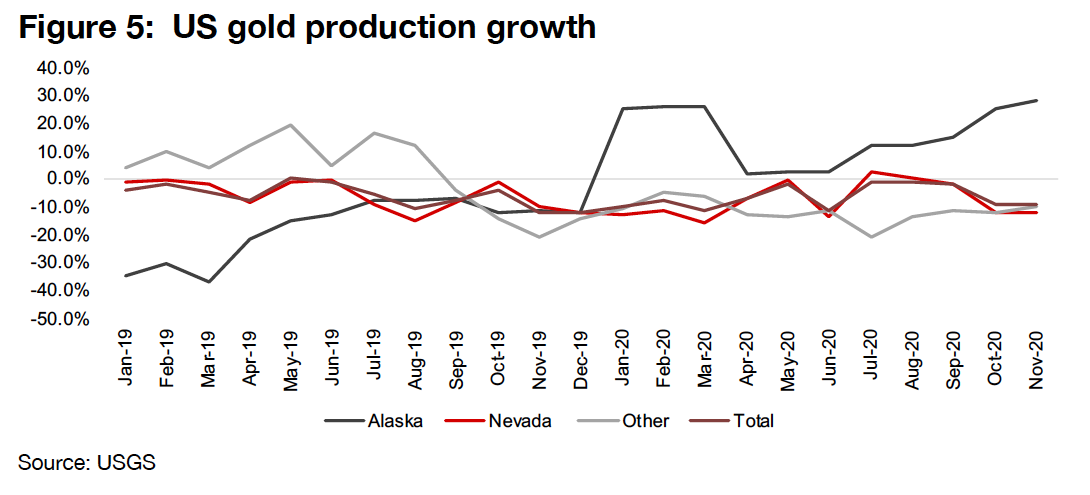

However, growth has been weak in recent periods, with a dip in US production in 2019 and 2020, as a weak expansion of investment in the gold bear market of 2013-2018 continues to transfer through to low output, including the longerterm trend of most lower cost, easy to mine deposits having been largely exploited, given nearly two hundred years of gold mining in the state. As the main contributor to US production Nevada has driven most of the decline, with production growth from 2019 to November 2020 averaging -6.37% yoy, with Alaska declining -1.30% on average over the period Other states down -4.10% (Figure 5). We could potentially see some pickup in gold production if the gold price remains high, with more peripheral projects seeing improved economics with more potential to move to production over in the medium-term.

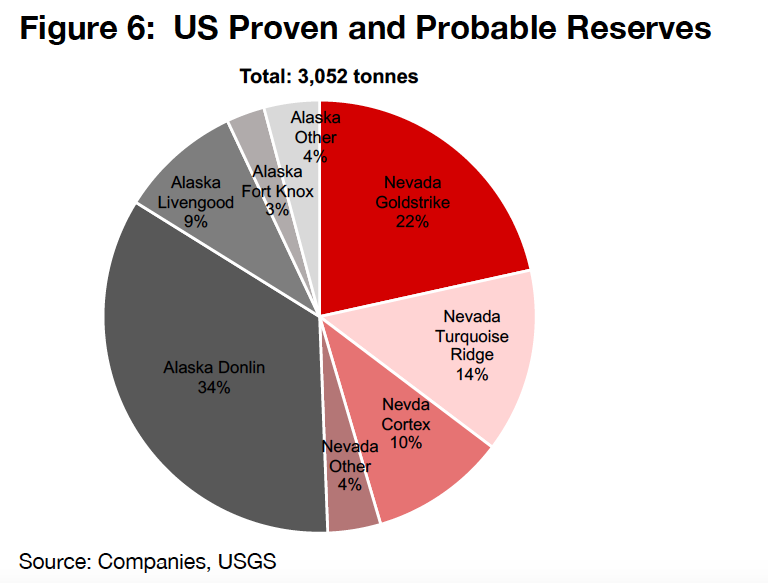

Long-term Alaska could match Nevada in importance

While Nevada will continue to be the main driver of US gold production in the short to medium-term, we can expect to see Alaska have an increasingly important role as it accounts for about half the country's current 3,052 tonnes in reserves. While in Nevada, the Goldstrike, Turquoise Ridge, Cortex and other sources account for 22%, 14%, 10% and 4% of total US reserves, Alaska's Donlin deposit is far larger than any of these, at 34% of the total, with Livengood, Fort Knox and Other Alaska sources comprising an additional 9%, 3% and 4%.

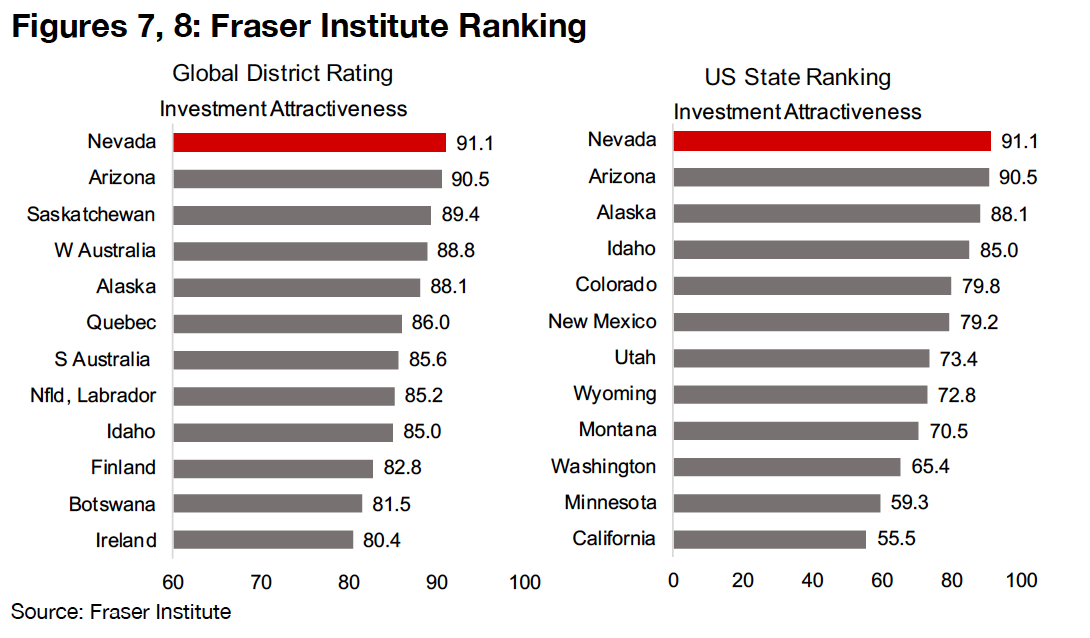

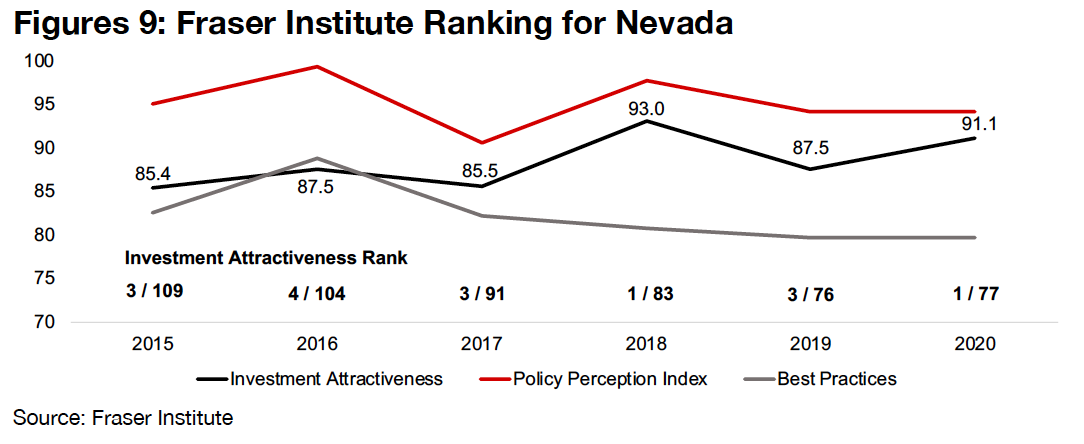

Nevada is the highest-ranked global mining district

Nevada is the highest ranked mining district in the world in the Fraser Institute's Investment Attractiveness survey for 2020, with US state Arizona coming in second, Saskatchewan third, Western Australia fourth and Alaska fifth (Figure 7). Nevada is also the highest ranked state in the US, with Arizona second and Alaska third (Figure 8), and has consistently ranked in the top five for several years (Figure 9). With these states so critical to mining in the US overall, local governments have strong incentives to offer supportive regulatory regimes.

2) Nevada producers and Canadian explorers

Newmont and Barrick produce most of Nevada gold

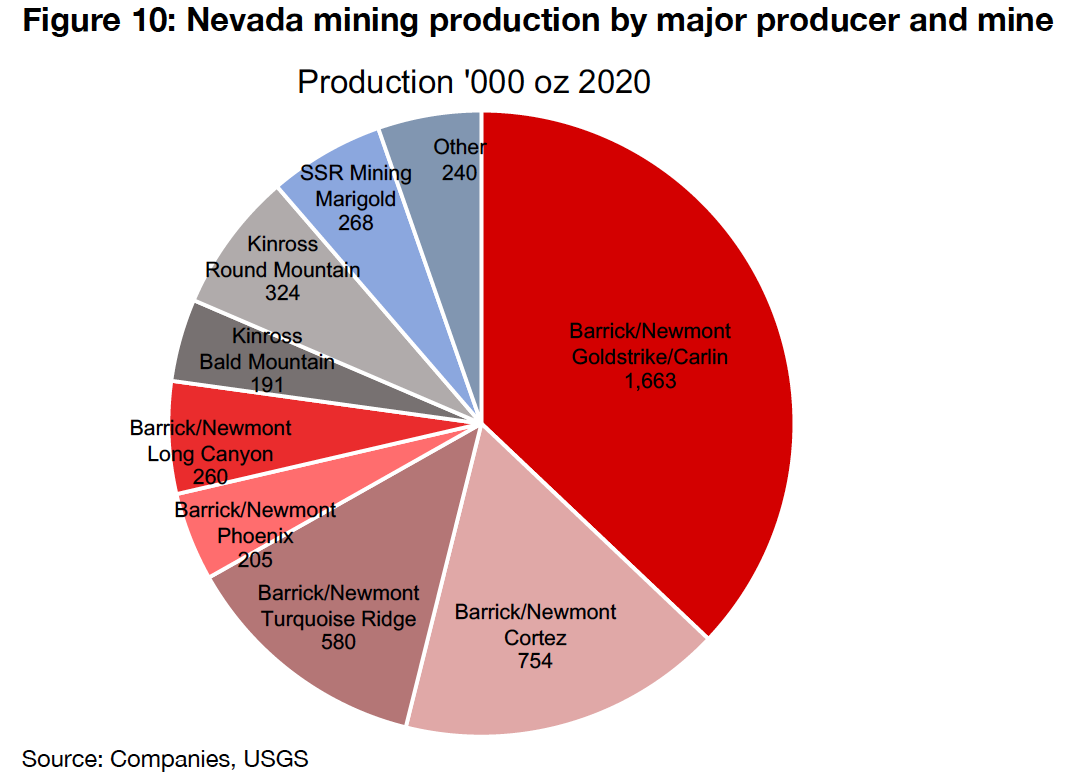

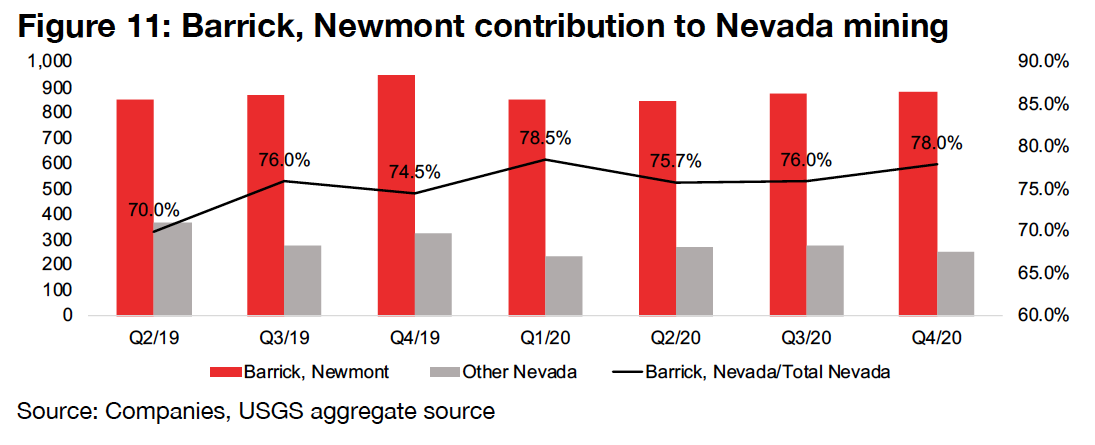

Barrick and Newmont, two of the largest gold producers in the world, are the largest producers of gold in Nevada, with their joint venture Nevada Gold Mines, of which Barrick holds 61.5% and Newmont 38.5%, the major producer, accounting for a total 77.2% in 2020. Goldstrike/Carlin accounted for 1,663k oz, or 37.1% of the total, Turquoise Ridge 754k, or 16.8%, Turquoise Ridge, 580k oz or 12.9%, and Phoenix and Long Canyon 465k oz, or 10.4% combined (Figures 10, 11). The other major producer is Kinross, with Bald Mountain and Round Mountain contributing 516k oz or 11.5%, and SSR's Marigold 268k oz, or 6.0% and other contributors 240k oz or 5.3%. Barrick and Newmont have most of Nevada's reserves, and about half of US gold reserves, and will therefore likely continue to be the leading producer in Nevada and US producer for an extended period.

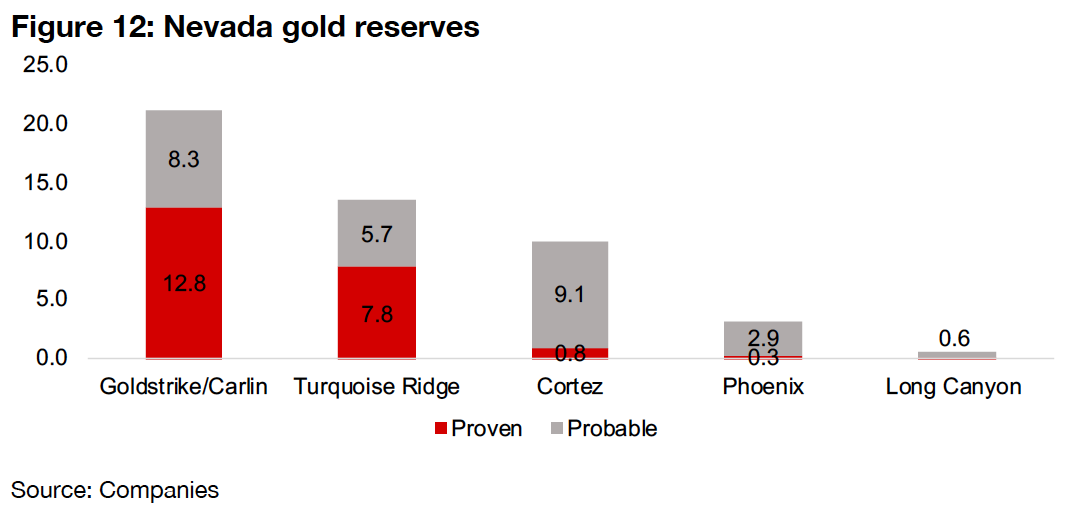

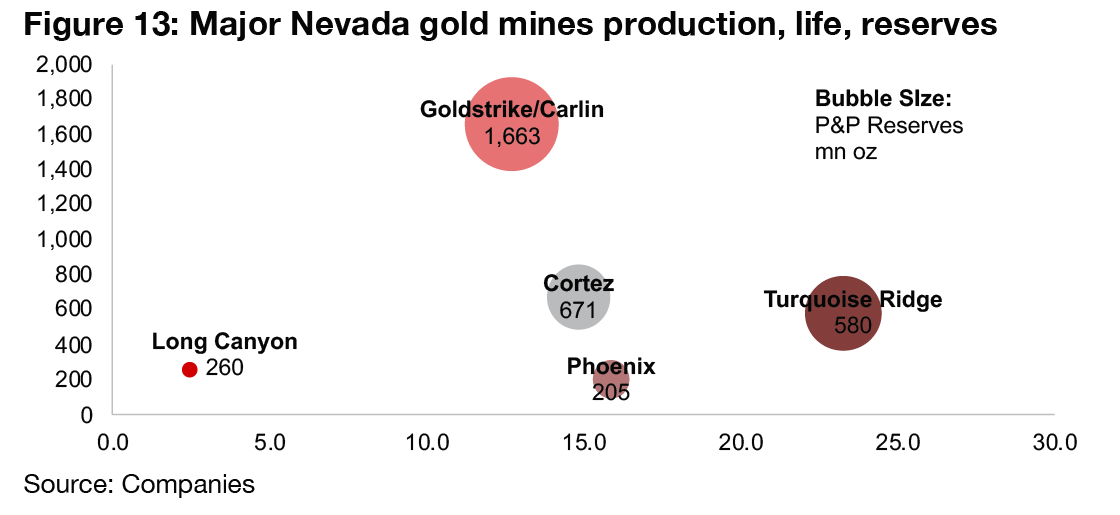

While Turquoise Ridge has the second highest level of P&P reserves oz of the large Nevada producing mines at 13mn oz (Figure 12), it has the highest expected mine life, based on annual production of 0.58mn oz (Figure 13). Goldstrike/Carlin has by far the highest level of reserves, at 21mn oz P&P, but has a higher level of production than Turquoise, at 1.66mn, for a mine life of 12.7 years. Cortez has a moderately higher mine life than Goldstrike, at 14.8 years, but is a much smaller deposit, with P&P reserves of 10mn oz, and production of 0.67mn. Phoenix is a smaller deposit, with reserves of just 3.0mn oz, but also lower production of 0.20mn oz, with a mine life of 15.9 years. Long Canyon has the smallest remaining reserves, at 1.0mn oz, of the Barrick/Newmont Nevada Gold mines, and with production of 0.26mn oz, the lowest mine life of just 2.4 years.

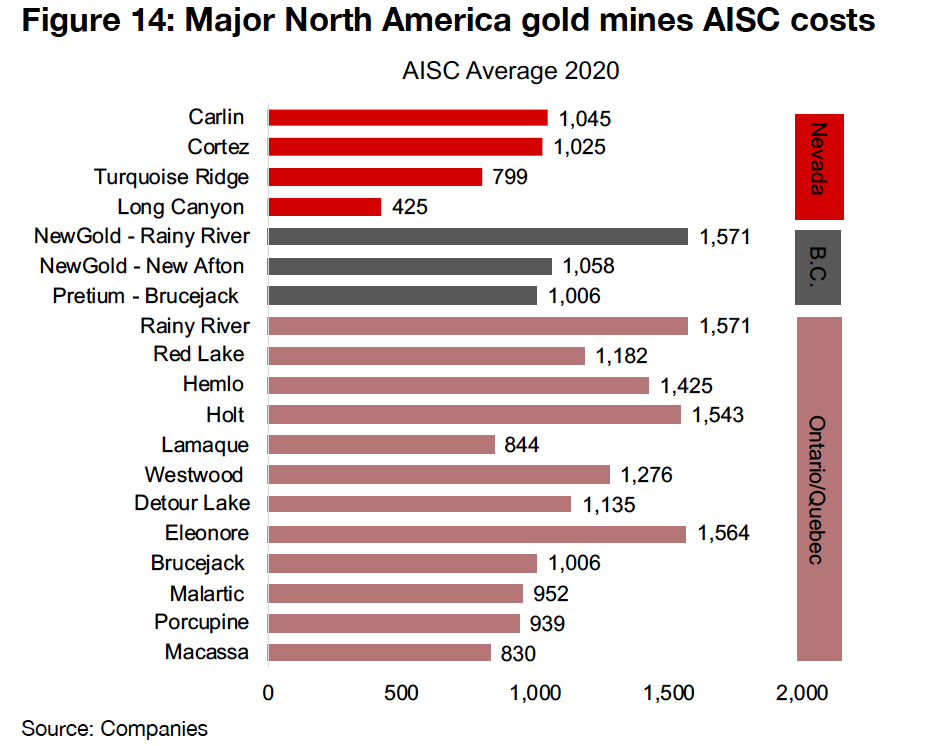

Nevada gold mining costs low in North America context

Nevada has some of the lowest cost gold mining operations in North America,

compared to the other main sources of production in the region, from three

provinces in Canada, Ontario, Quebec and British Columbia (Figure 14). The

average costs of the of the Carln, Cortez Turquoise Ridge and Long Canyon is

$823/oz, compared to an average of $1,212/oz for three mines in British

Columbia, and average of $1,430/oz from four mines in Ontario, and an

average of $1,068/oz from eights mines in Quebec.

The low mining costs in Nevada are driven by in part because of a particularly

low tax rate, and a very mining-friendly regime, as shown in the Fraser Institute

survey outlined above, with a well-defined permitting process, longestablished

infrastructure and an experienced workforce and favorable

weather conditions for mining year-round. While there has been a push from

residents in Nevada to raise the tax rate, it would still remain low in a global

context, and there is much more supporting the industry in Nevada than just

the low tax rate.

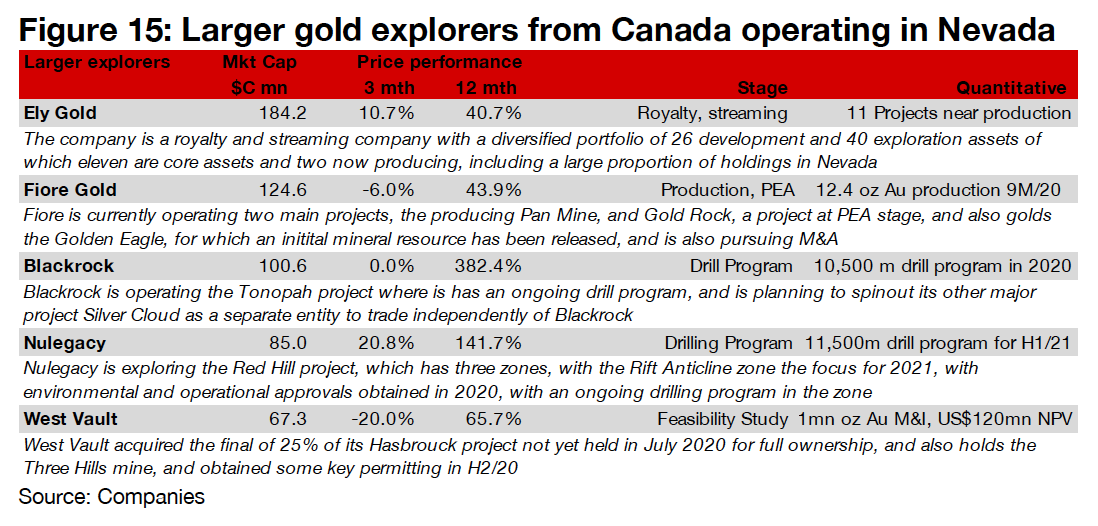

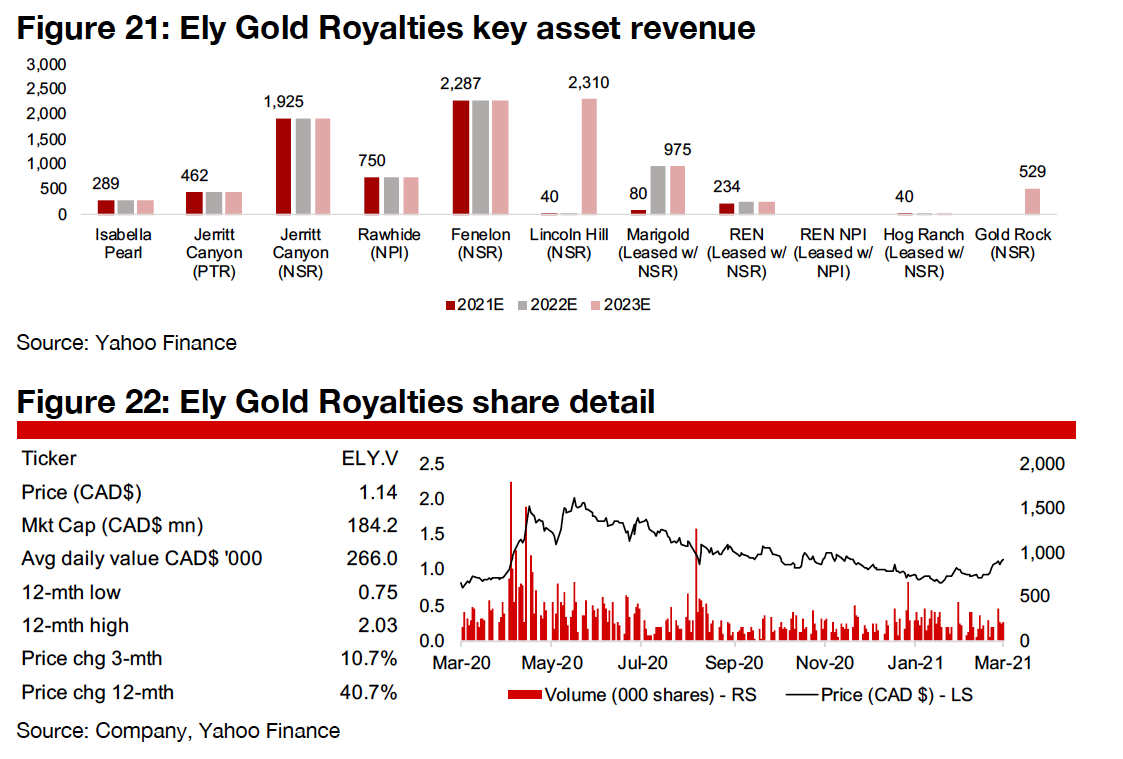

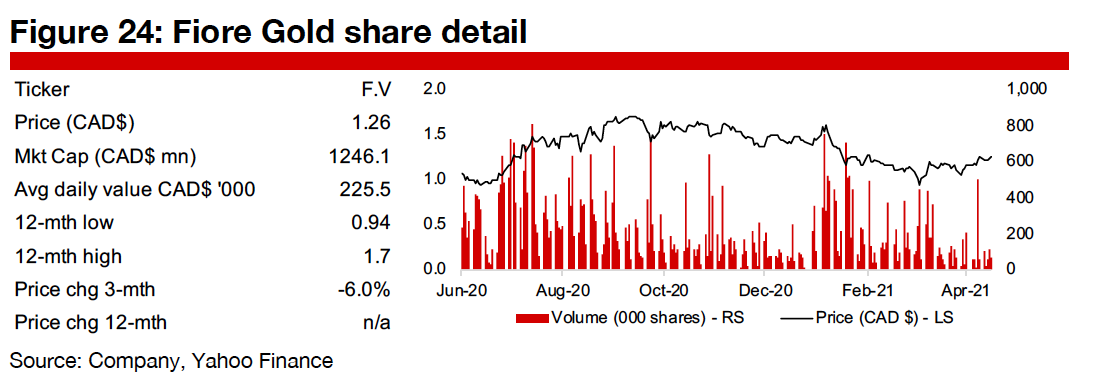

Blackrock leading the larger cap group of juniors

There are five larger cap Canadian junior gold companies focused on Nevada

(Figure 15). The largest is not an explorer, but a royalty company, Ely Gold,

offering access to a portfolio of production, development and exploration

assets. It is up moderately in the context some surging juniors this year, with a

gain of just 40.7% as royalty companies tend to not have the downside risk

common to juniors, but also don't have the strong leverage to the upside when

gold is rising (Figure 16). Fiore Gold has one project each in production, with a

PEA, and with an initial mineral resource, and is also looking for further M&A,

and has had a relatively flat performance over H2/20, up 18%. Blackrock has

two projects at the drilling phase, with Tonopah the current focus, and a

second, Silver Cloud targeted for a spin off. It has had by far the strongest

performance, up 382%, and had gains as high as 800% at the peak for the

gold price in mid-2020, as the progress at Tonopah continues to impress the

market.

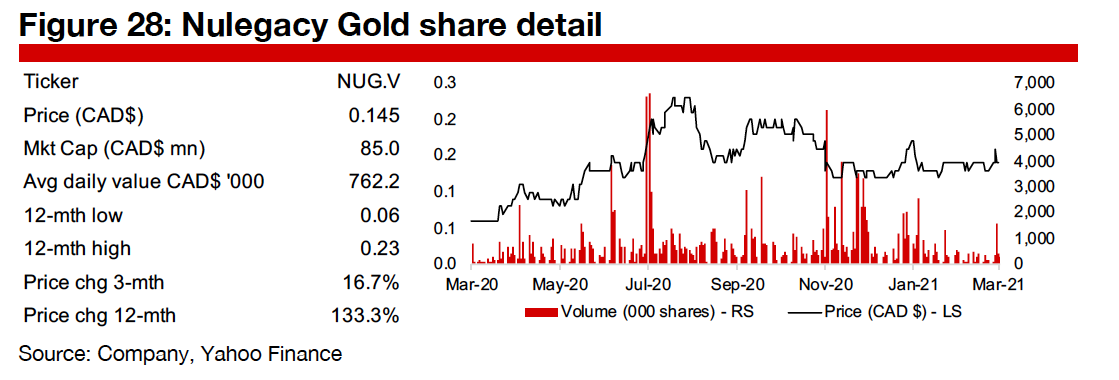

Nulegacy is exploring the Red Hill project where a drilling program is ongoing,

with the company concentrating on the Rift Anticline zone which is showing

continued progress, propelling share price gains of 142% over the past year,

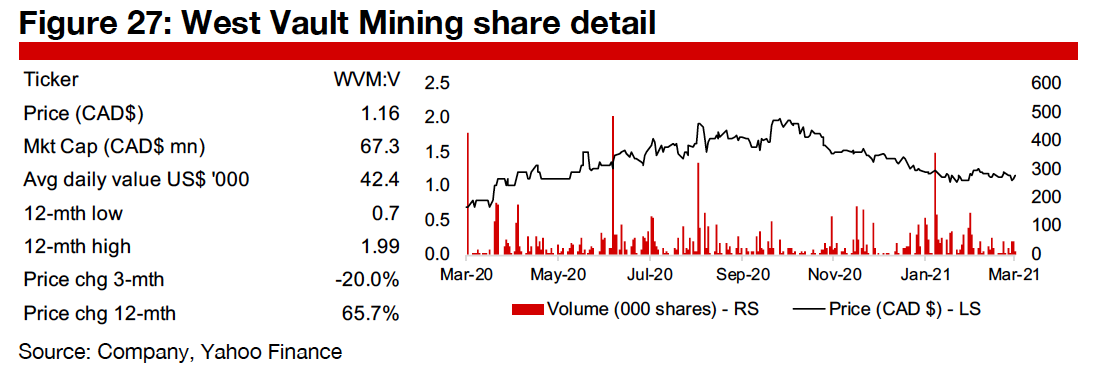

the second highest of the group. West Vault has its main project Hasbrouck at

the Feasibility Study stage, and holds the Three Hills mine, and has obtained

some key permitting over the past year, and has made reasonable gains over

the past year, with the stock up 65.9%.

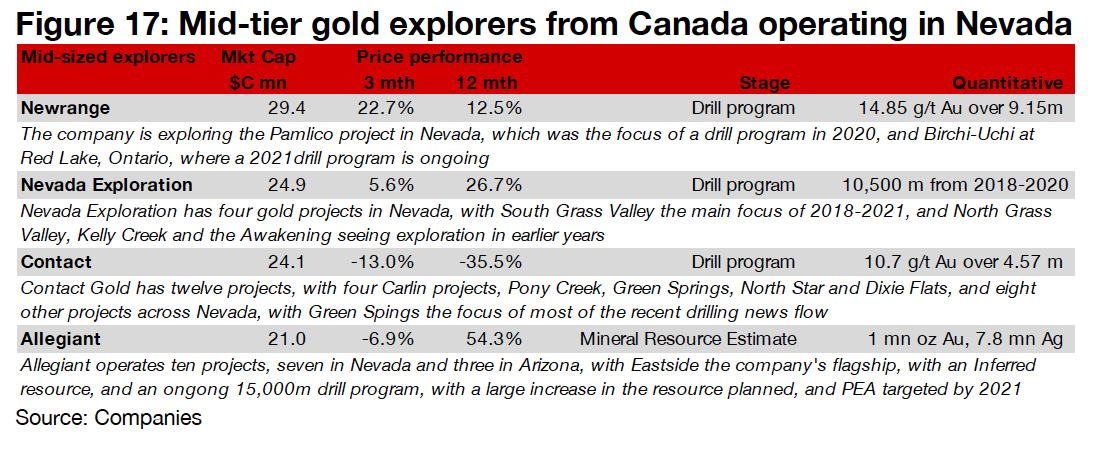

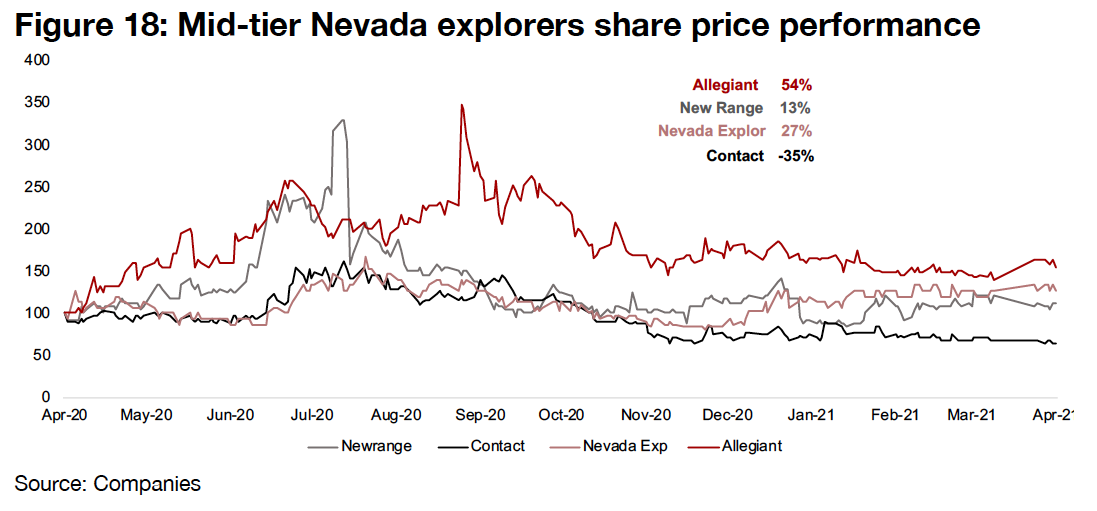

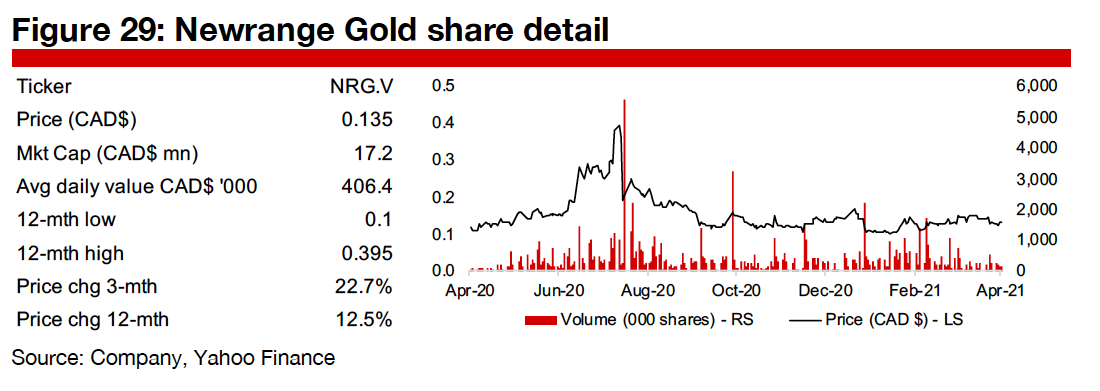

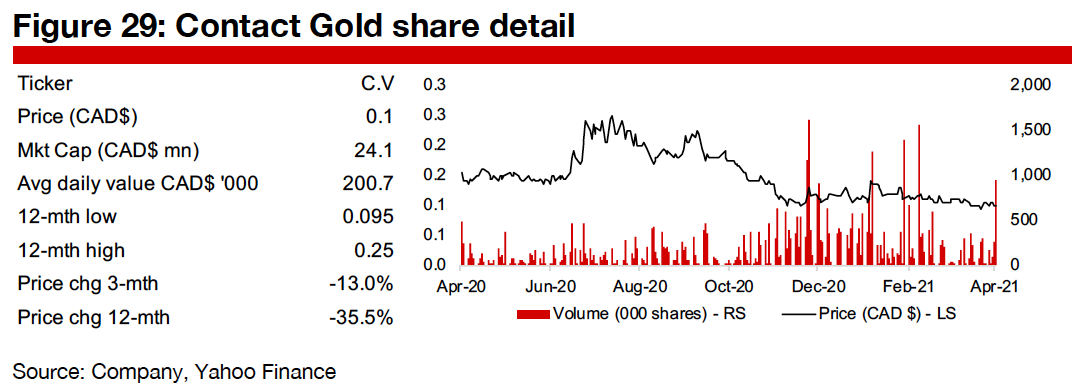

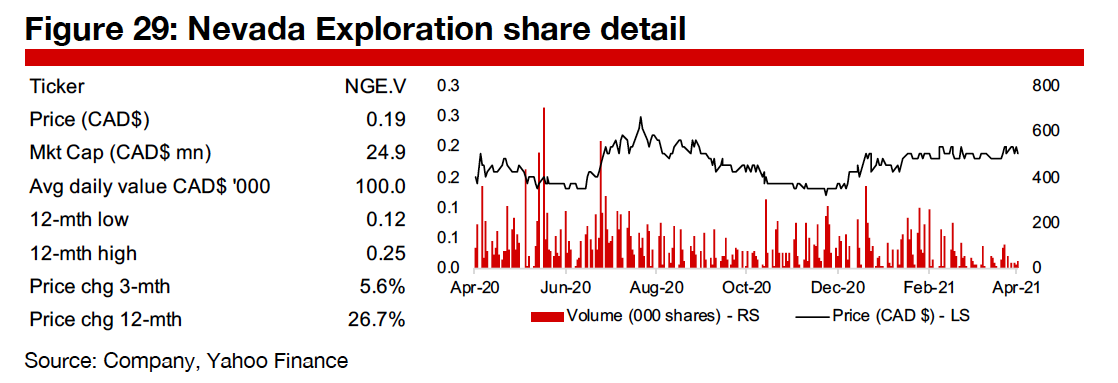

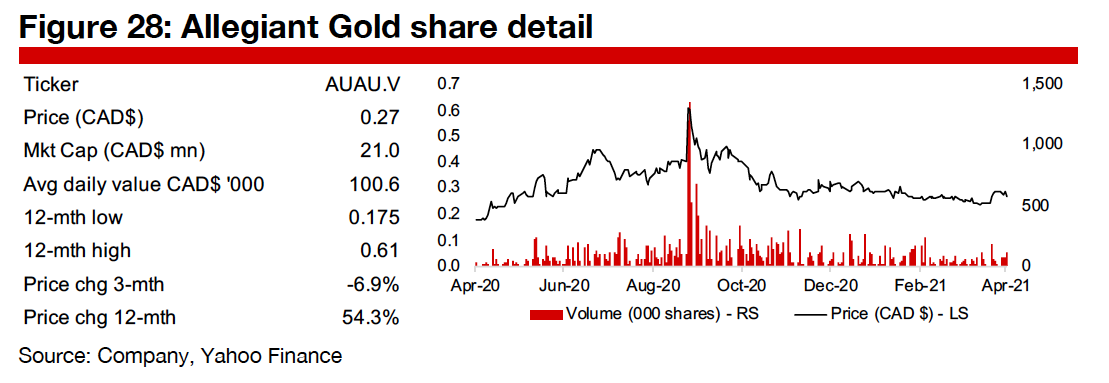

Mid-tier explorers' performance moderate

The performance of the mid-tier juniors has been moderate versus the larger cap names. Newrange is exploring Pamlico, but steady news flow from the project has not buoyed the stock (Figure 17), which is up just 12.5% over the past year (Figure 18). Nevada Exploration, focused on South Grass Valley, has seen better gains, up 26.7%, but still low versus the Nevada juniors overall. Contact Gold has twelve projects across Nevada, with Green Springs in focus, but has had the weakest performance, down -36%. Allegiant also has many projects, seven in Nevada and three in Arizona, including Eastside, with an Inferred resource estimate, a 15k m ongoing drill program and a PEA targeted by 2021.

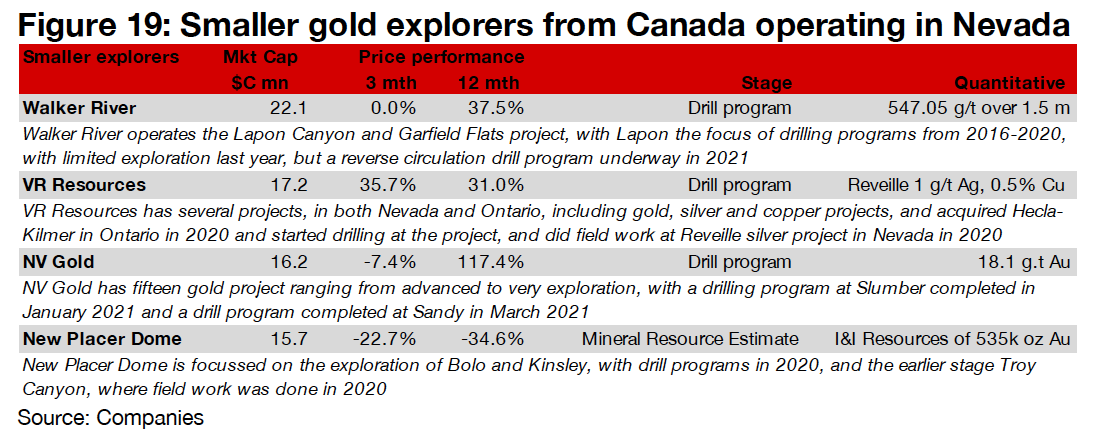

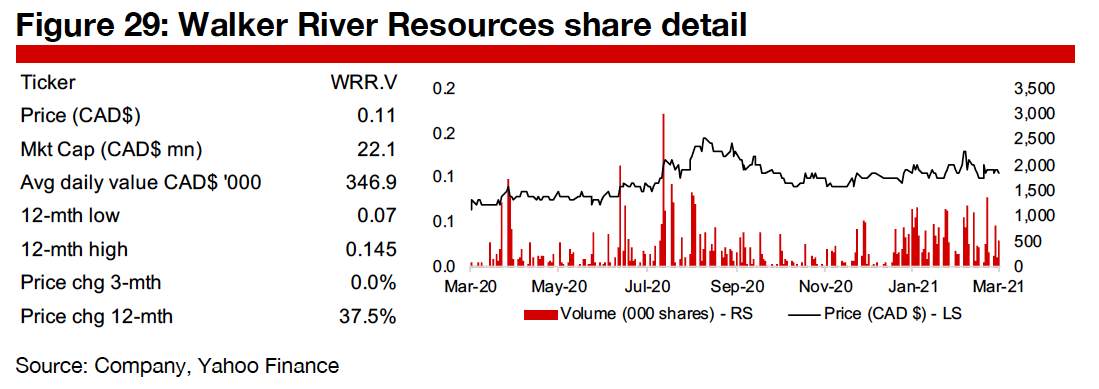

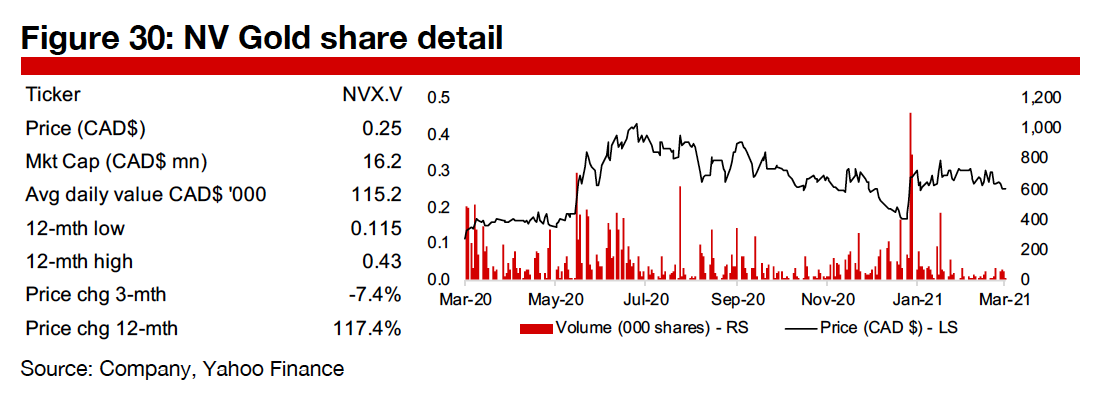

Smaller-sized explorers have mixed performance

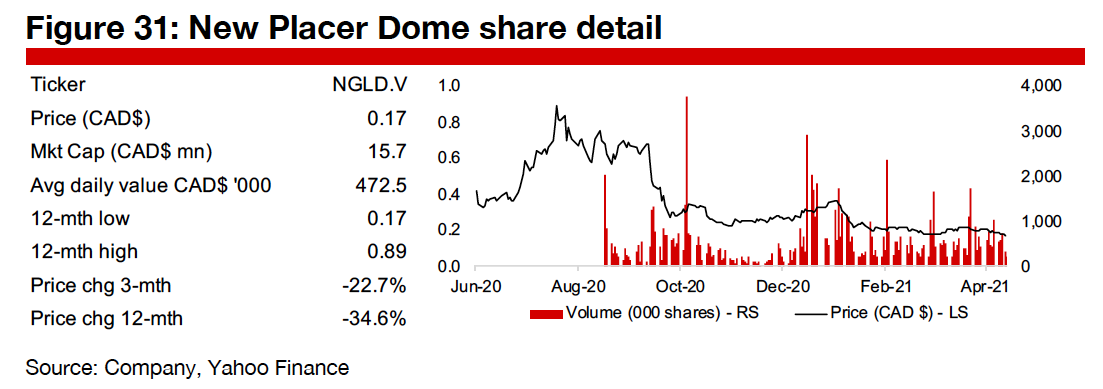

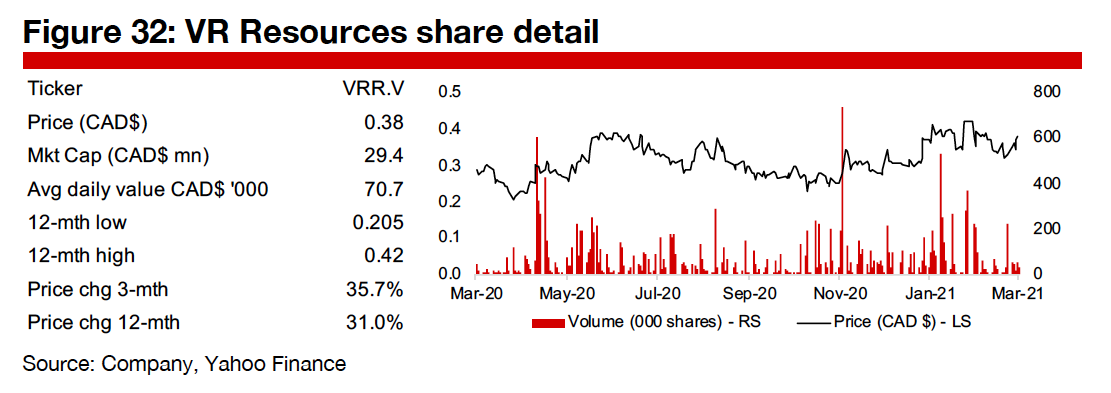

The smaller-sized explorers have had a mixed performance over the past year. Walker River, focused on the Lapon project, where there is a reverse circulation program ongoing (Figure 19), is up 38% (Figure 20). VR Resources, which has several projects in Nevada and Ontario and is doing relatively early-stage exploration in both regions, is up 31%. NV Gold has several projects, with drilling programs completed at Slumber and Sandy in January and March 2021, respectively, and is up 117.4%, the best gain of this smaller-cap group. New Placer Dome has drilled at Bolo and Kinsley and done field work at Troy Canyon, but the results have not propelled the stock, with the second-weakest share price outcome of the total group, down -34.6% over the past year.

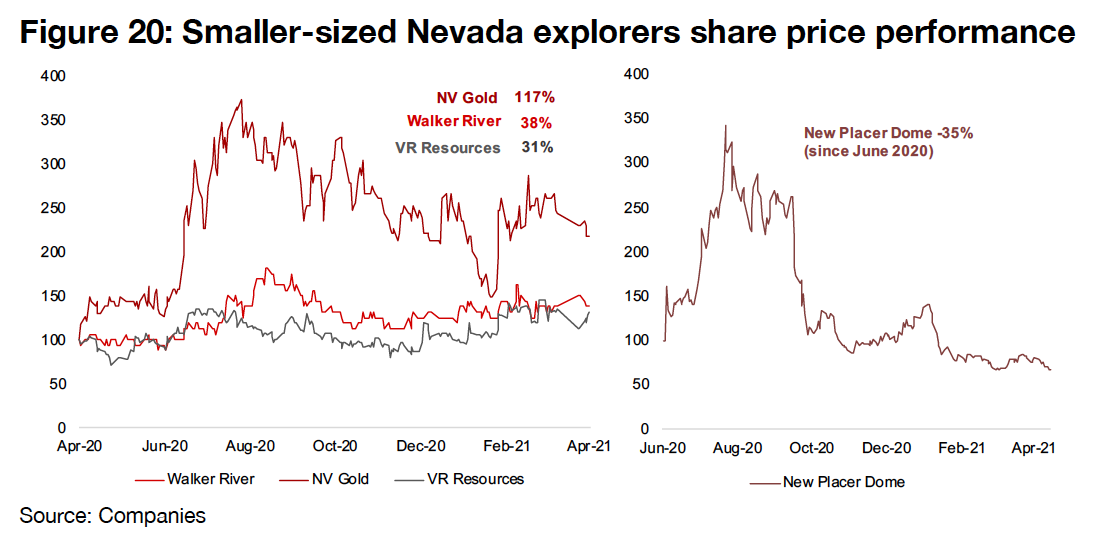

Ely Gold Royalties

Nevada-focused gold royalty company

Has eleven core assets, with nine in production The company operates a gold

royalty model with a very wide portfolio of 26 development assets, and 40 exploration

assets. Of this, it considers eleven as core assets, of which two are already producing

and most of the rest expected to start contributing revenue by 2021 (Figure 21).

Company forecasting strong sales growth The company forecasts very strong

revenue growth for the next three years, from $5mn in revenue for 2020, doubling to

over $10mn in 2021, then growing to about $11mn by 2022, and another large

increase to around $17mn in 2023.

Shares boosted by May cash injection The company raised CAD$17.25mn in May

2020 as has continued to expand its portfolio, with over fifteen acquisitions. While

the share price was buoyed by the cash injection in May 2020, it peaked in June 2020,

and while it has cooled since, it is still up 40.7% over the past twelve months.

Fiore Gold

Producing mine and advanced exploration projects

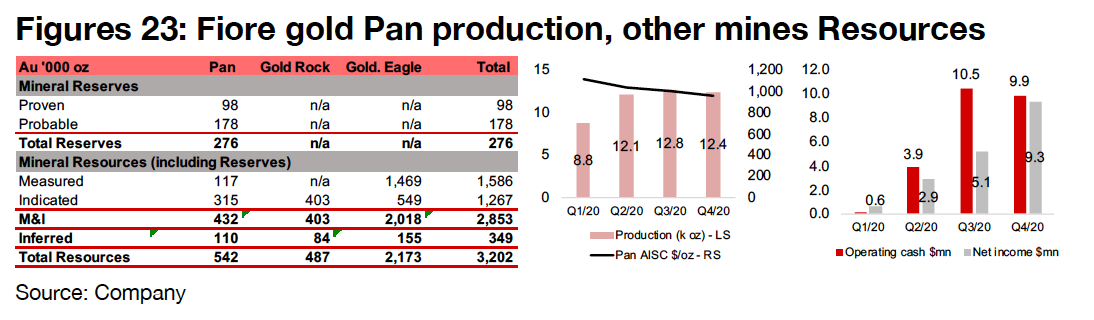

Operating three advanced projects in Nevada Two projects are the focus of 2021;

the producing Pan Mine, and Gold Rock, a satellite of the Pan, fully permitted, and

with 403k oz Au Indicated and 84.3k Inferred Resources, with a PEA estimating an

after-tax NPV of $99.4mn (at a $1,700/oz gold). The company also holds Golden

Eagle, with 2.2 mn oz Au in Resources, and is pursuing M&A.

Pan Mine producing cash flow to fund exploration The Pan Mine produced 12.4k

oz over the past three quarters, while AISC trended down over 2020, and generated

operating cash of $10.5mn in Q3/20 and $9.9mn over Q4/20, providing more than

sufficient funding to continue expanding the Pan resource and exploring Gold Rock.

Strong news across all projects drives share price A PEA was announced for Gold

Rock in April 2020, and a resource estimate for Golden Eagle in May. While Pan

production and Pan and Gold Rock drilling results, combined with rising gold, drove

the shares to peak in October 2020, they have trended down since on the gold decline.

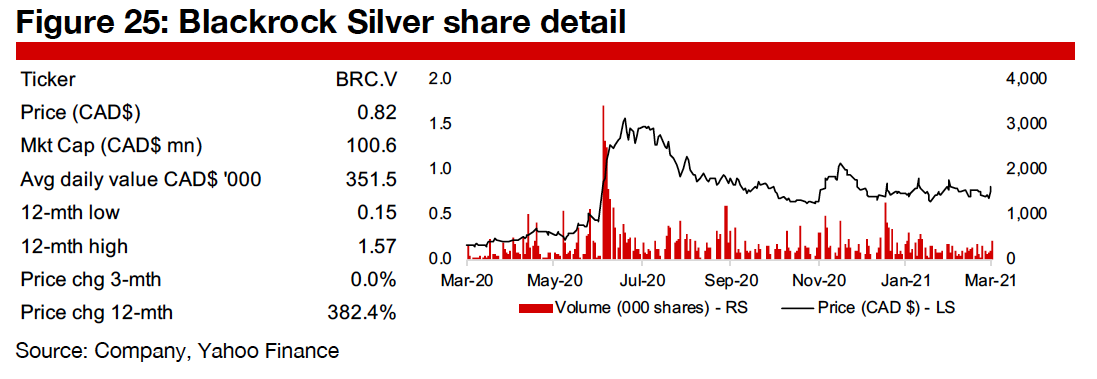

Blackrock Silver

Targeting one of two key projects for spin out

Developing two main silver projects, Tonopah and Silver Cloud The company is

a gold and silver explorer, with two main projects. Tonopah is a silver project, in the

western extension of the historically producing Tonopah silver district, for which a

lease option agreement was completed in Q2/20 and a series of drilling results

released over H2/20. Silver Cloud is a gold project with a large 12,000 acre land

package with 572 mining claims, which the company has been exploring since 2017.

Silver Cloud spinout currently being evaluated However, Blackrock may eventually

be just the Tonopah project, as the company is considering a spinout of Silver Cloud,

by transferring the project to another company, funding it, and spinning out shares of

the new company to Blackrock's shareholders. This will mean that Blackrock will still

hold stakes in both projects, but the company believes that if the two projects were

on the market as separate entities they would be valued more highly that the current

sum of the parts valuation implied by Blackrock's share price.

Silver Cloud and Tonopah results reported over 2020 The lease option on Tonopah

was completed in April 2020, and a 7,000 m drill program started in June 2020. Drill

results were reported in July 2020, and a second rig added and the program

expanded to 20,000 m in August, and drilling results released nearly monthly since

September 2020. For Silver Cloud, drilling results from 2019 were reported in January

and March, 2020, results from a new 2020 drill program reported in April, and an

additional 3,500 m started in November 2020 and results reported in March 2021.

The company has seen increased financing rounds over the past year, closing

$1.24mn in February 2020, $4.5mn in June, $7.5mn in July and $10.4mn in February

2021, and it upgraded to an OTCQB venture market listing in August 2020.

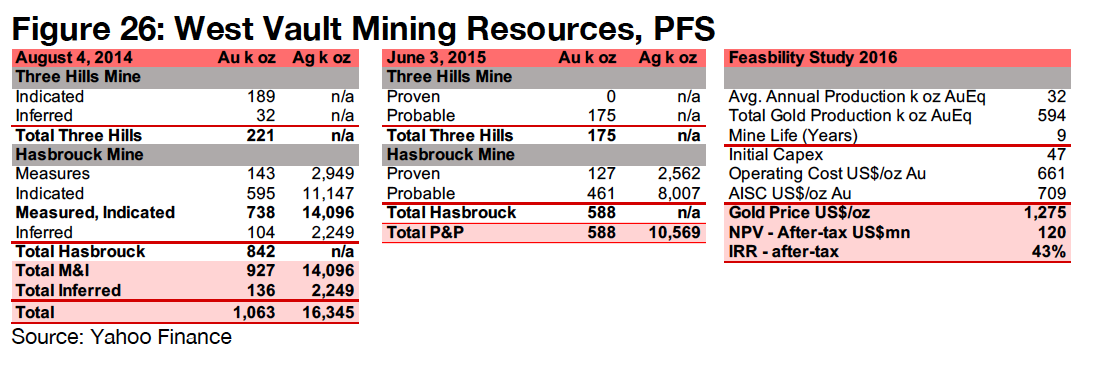

West Vault Mining

Full ownership of flagship project since July

West Vault acquired 25% of Hasbrouck from Waverton The company acquired the outstanding 25% of its flagship project Hasbrouck from Waverton in July for US$11mn, including shares, with the pre-consolidation after-tax valuation of WVM's stake, assuming US$1,800/oz gold, at US$221mn and Waverton's stake at US$74mn. Nearly 1mn oz resource, with $295mn NPV The combined Resources of the Three Hills and Hasbrouck Mines are 1.06mn oz Au and 16,345k oz Ag, based on M&I and Inferred Resources, and 0.59mn oz Au and 10,569k oz Ag using Proved and Probable Reserves, with the 2016 Feasibility Study outlining an after-tax NPV of US$120mn. Financing, permitting progress drive share price Key permitting was obtained in August and November 2020, the Hasbrouck holding increased to 100% and a $10.2mn financing completed in August, and a US$7.3mn gold and silver stream agreement with Sprott was completed in March 2021.

Nulegacy Gold

Early-stage exploration of single project

Focussing on the Rift Anticline of the Red Hill Project The company is exploring

the Red Hill Project, which has three zones, with the Rift Anticline zone the focus for

2020-2021. Red Hill is in a zone of Nevada which has seen three major mines with

over 50mn oz combined since 1989, including most recently Barrick's Goldrush mine,

discovered in 2010, with Nulegacy viewing the Rift Anticline as a 'Goldrush analogue'.

Rift Anticline drilling program ongoing Results were reported from the 2019-2020

Rift Anticline winter drilling program in February 2020, with 9.6 g/t Au. Environmental

and operational permitting approvals followed in June 2020 and September 2020,

respectively, and the winter 2020-2021 drilling program started in October 2020, with

four holes completed by December 2020 confirming a gold-bearing system, and a

total 16 holes over 11,500 m are targeted by H1/21, with drilling starting in April 2021.

Cashed up to continue exploration Nulegacy is cashed up to continue exploration,

having closed a $5.625mn private placement in June 2020, reporting an $8.1mn cash

balance in September 2020 and raising another $12.5mn via a private placement

closed in January 2021. Given expenses of around US$2.0-3.0mn from 2019 to 2020,

it could continue exploration for several years even if expenses rise considerably.

Broad based institutional shareholding, royalty owned by IDC/Metalla The

company has broad institutional shareholding including 10.2% by OceanaGold, 6.6%

Barrick, 7.8% by Sprott Gold Equity Fund and 6.3% by Mackenzie Investment Funds.

The company also has a gross overriding royalty of 3% which is 50% owned by each

of Idaho Resources and Metalla. The progress on exploration and permitting, and

rising gold price, has led to a 133.3% jump in the share price over the past year.

Newrange Gold

Focussed on Pamlico project in Nevada

Exploring Pamlico in Nevada and North Birch in Ontario The company is exploring

two projects, with Pamlico in Nevada the main focus currently, a more advanced

property, which saw early stage exploration in 2019, and has been the main focus of

the drilling program throughout 2020. The second property is Birch-Uchi in Red Lake,

Ontario, which was optioned in December 2019, and the holding expanded in January

2020, and for which a winter exploration program was announced in December 2020.

The company also divested of its Columbian assets over 2019-2020, with the final

sale in May 2020.

Pamlico the focus of exploration in 2020 The company completed an IP survey of

Pamlico in January 2020, and in February 2020 announced that it had staked

additional ground to increase the property size by 50%. A drill program was initiated

at Pamlico in May 2020, with the first results reported in July, with highlights of 9.51

g/t gold and 20 g/t silver over 1.5 m, with subsequent updates in September, October

(with highlights of 14.85 g/t Au over 9.15 m, including 34.11 g/t Au over 3.05 m),

November and December 2020.

Brief bout of market excitement over initial drill results While New Range's share

price has remained near flat over the past twelve months, with a rise of just 12.5%, it

saw a strong spike in the middle of the year, and was at one point up over 200%, as

a combination of the surging gold price and the first drilling results from Pamlico send

the share price up substantially. However, subsequent drilling results and the H2/20

slide in gold proved uninspiring for the market, and the share price had lost nearly all

of its gains by September, and remained relatively stagnant since that time.

Contact Gold

Extensive project portfolio in Nevada

A total twelve projects in Nevada Contact operates twelve projects, with two Carlin

projects, the 8,177 h.a. at Pony Creek and 1,800 h.a. Green Springs the current focus.

The company also has two South Carlin projects, the 468 h.a. North Star and 2,625

h.a. Dixie Flats, and an additional eight projects across Nevada at early stages that

have been intermittently explored or dormant for the past decade, offering a large

land package for potential exploration.

Recent permitting at Pony Creek, Green Springs is focus of 2020 Pony Creek was

the focus of the much of the exploration from 2017 to 2019, but there was limited

news on this project in 2020 until June, when the company received permitting

allowing for the Pony Creek targets developed over the past few years. The main

focus of the news flow over 2020 was from Green Springs, with a series of drilling

results over Q1/20, permitting for the Zulu target there received, bottle roll tests

reported in June 2020, and further drilling results reported monthly from November

2020 through to April 2021.

Strong institutional backing, share price down for year The company completed

a private placement of CAD$1.25 mn in May 2020, and CAD$14.77 mn public offering

concurrent with retirement of its preferred shares in September 2020. The company

has strong institutional shareholding support, with resources-focussed private equity

firm Waterton holding 42%, Newmont, 3%, other institutions, 27%, management, 4%,

and other shareholders, 24%. The share price is down 35.5% over the past twelve

months, and seemed to be tracking overall moves in the gold price this year, but

declined especially over the past few months, as continued announcements mainly

on Green Springs or the Pony Creek permitting were not enough to drive major gains.

Nevada Exploration

Geochemistry-based exploration program

Four gold projects in Nevada The company has four gold projects in Nevada, South

Grass Valley, the main focus of 2018-2020, North Grass Valley (in focus from 2013-

2015), Kelly Creek (2016-2017), and Awakening, adjacent to the past producing

Sleeper Gold Mine (1986-1996), were NGE has explored since 2008. The company

claims one of the largest recent geochemistry-based explorations programs in the

region, with over 6,000 ground water samples and over 30 known gold mines tested.

South Grass Valley drilling in focus South Grass Valley has been the company's

main target over the past three years. Reverse-circulation drilling results were

released in early 2020, with the company reporting significantly improved resolution

to its geologic model, and a 12,500m drilling program was announced in July 2020,

but drilling did not start until March Q1/21, as the company sought financing, while

the permitting process was completed for additional drill sites in February 2021.

Earn-in agreement for Kelly Creek, Awakening expanded Other major moves from

the company in 2020 was an Earn-In agreement with Austin Gold for the Kelly Creek

project completed in July 2020, and the company expanding its land holdings at the

Awakening project by staking an additional 25 sq. km of mining claims.

New financing secured in December, shares holding up against gold decline The

company announced a $3.3mn private placement in November 2020, which closed

in December, allowing for the restarting of drilling at South Grass Valley. The company

is up 26.7% over the past year, and is up 5.6% over the past three months, given the

secured finance and drilling progress, even as the gold price has declined.

Allegiant Gold

Projects in Nevada, Arizona and New Mexico

Ten projects, seven in Nevada and three in Arizona The company has a total ten

project, with seven in Nevada, including Eastside and Bolo, which were the main

focus in 2020, and will continue to be in 2020, two in Arizona, and one in New Mexico,

with optioning out some of the projects a key part of the company's strategy.

Eastside remains the main focus The Eastside project is the company's flagship,

with an Inferred Resource of 1mn oz Au and 7.8 mn oz Ag as of the most recent

December 2019 update, which saw a 52% increase in the resource. The company

started an additional 15,000 m drill program at Eastside in September 2020, and

announced drilling at the Original Pit Zone at Eastside in February 2021, and looks to

expand Eastside to 2mn oz, and release a PEA, by 2021.

Progress on Bolo and optioning of projects The company undertook 3,000 m of

reverse circulation drilling at Bolo from July 2020, and targets an additional 10,000 m

of drilling there by 2022, and eventually an initial resource estimate. The company

also continues to option out other projects, including 70% of the Clanton Hills Silver

in Arizona to Volt Energy and up to 100% of Mogollon Silver-Gold in New Mexico to

Summa Silver, in August 2020, and targets optioning out two more in 2021.

Likely mostly funded for 2021 program The company completed a financing of

$3.0mn in June 2020 and given its recent expenses, should have around $2.5mn of

this or more left as of end-2020, leaving it mostly funded for a planned US$2.7mn

exploration budget for 2021, with the remainder potentially funded by optioning out

projects. The share price has risen 54.3% over the past year, as the market seems

satisfied with the company's progress on exploration and optioning out projects.

Walker River Resources

Early-stage exploration at two projects

Operates the Lapon and Garfield Flats projects The company operates two

projects; 1) Lapon Gold, comprising 147 claims over 2,940 acres, including the main

Lapon Canyon zone, and Pikes Peaks 4 km to the north, and Rattlesnake Range Front

3 km to the west, and 600 m lower than the Lapon Canyon zone, and 2) Garfield Flats

consisting of 156 unpatented mining claims over 3,120 acres covering several past

producing small scale, high grade gold and copper mines, and relatively unexplored.

Lapon Canyon has been recent focus The Lapon Canyon has been the company's

main focus, with drilling programs from 2016-2019 returning significant new gold

mineralization. The company released only a single announcement in 2020 regarding

direct exploration, which was at the Lapon Gold project in February 2020, with

highlights including 96.03 g/t Au over 13.7 m, including 547.05 g/t Au over 1.5 m,

115.38 g/t Au over 1.5 m and 199.06 g/t Aug over 1.5, and 94.81 m g/t Au over 6.1

m, 305.25 g/t Au over 1.5 m and 73.86 g/t Au over 1.5 m. The company announced

in February 2021 that it was restarting its reverse circulation drilling program.

Raised capital in H2/20, share price quite flat on limited news The company raised

$3.5mn in 2020, through a private placement that closed in September 2020, and

with expenses of around $1.0mn per year, the company will had enough cash to

continue operating through 2021. The share price stagnated over most of Q2/20,

given the lack of exploration news flow, picked up on the surge in the gold price, and

maintained some of those gains even as the share declined, but has been flat again

over the past three months. However, given that the decline in the gold price has

driven down many of the junior gold share prices over the past several months, a flat

performance for the past quarter could still be considered relatively decent.

NV Gold

Extensive project portfolio

Holds fifteen projects in Nevada The company is exploring a large number of

projects compared to its competitors around a similar market cap, with fifteen gold

projects in Nevada ranging from advanced to very early exploration, with the Slumber

and Sandy projects the focus of exploration in 2020 and into 2021. The company's

strategy is to quickly evaluate and advance mineral opportunities to drill ready stage

and permit and commence drilling on two to three projects a year.

Slumber and Sandy drilling programs now completed The company made

significant progress on two of its main projects, on roughly the same timeline, with

both Slumber and Sandy completing geophysical modelling in October 2020, moving

to permitting and mobilization through November (and into early December for Sandy),

and drilling for slumber from December 2020-January 2021, and drilling at Sandy

starting in January, upsized to 3,100m in February, and completed by March 2021.

Well-financed, strong shareholder backing with strong share price gains The

company is well-financed to continue its exploration activities, having raised a total

$4.19mn in 2020, with $1.19mn closed in May 2020 and another $3.0 in August 2020.

With annual expenses averaging just under $1.0mn, the company will be positioned

to continue its exploration activities for a considerable period. The company has 60%

backing by major shareholders, with 9.2% held by the Chairman, 8.0% by Eric Sprott,

2.3% by the CEO, 15.4% by institutions, 12.7% by corporates and 10.8% by high

net worth individuals and private wealth. The project progress and continued support

of strong shareholders have driven the price up strongly compared to similarly sized

peers, up 117% over the past 12 months.

New Placer Dome

Formed after Barrian's Kingsley acquisition

New Placer Dome formed in July 2020 after Barrian acquired Kinsley New Placer

Dome was formed in July 2020, when Barrian Gold, which already held Bolo and an

option on the Troy Canyon, both earlier stage projects, completed an acquisition of

Liberty Gold's 79.1% interest in Kinsley Gold (the holder of the Kinsley Mountain

Project, with and Indicated and Inferred Resource of 418k and 117k oz Au,

respectively), which was originally announced on in December, 2019.

H2/20 focussed on Bolo and Kinsley exploration While most H1/20 press releases

related to the acquisition and its financing, from H2/20 news flow has focused on

exploration activities. In June 2020 the company started a one drill rig, 3,500m

planned program at Bolo, and two rig 10,000m reverse circulation program at

Kingsley, commencing in July 2020. Field work on Troy Canyon was announced in

August, as well as a third rig added to Kingsley. Drilling results have followed, with

1.08 g/t Au over 38mn, 0.74 g/t Au over 61 m and 0.92 g/t over 25.9 m from Bolo in

September and October 2020 and February 2021, and 42.7 g/t Au, 10.2 g/t Au over

6.1 m, 24.1 g/t Au over 4.6 m and 9.8 g/t Au over 7.6 m from Kingsley in October

2020 and January, March and April, 2020.

Liberty the largest holder, shares relatively flat over H2/20 The company's largest

shareholder is Liberty, with 9.9%, with other institutions holding 15%, accredited

investors, 35%, management, insiders and close associates 10%, and retail, 20.1%.

While New Placer Dome shares jumped over 100% in Q3/20 on the rise in the gold

price, it has declined since, as the market has not been encouraged by the recent

series of drill results, with the stock down -34.6% over the past year, and down -22.7%

over the past three months.

VR Resources

Two 100% owned exploration projects

Four main projects in Nevada and Ontario The company is currently focussed on

four projects, two in Nevada, its most advanced the Big Ten gold project, and also

the Reveille silver copper project. In Ontario, the Ranoke copper gold project and

Hecla-Kilmer are at earlier exploration phases. Other projects include the Bonita (gold)

Junction (copper-silver) and New Boston (copper-gold).

Both Reveille and Hecla-Kilmer acquired last year The company began the year

with exploration at both Big Ten and Ranoke, and in June 2020 after capital raising

the company completed two acquisitions, which were extensions to these two

projects. First was Hecla-Kilmer in Ontario, as a planned extension to the Ranoke

project, and then Reveille, intended to be an expansion of the Big Ten project.

H2/20 focussed on Hecla-Kilmer and Reveille exploration The company started

drilling at Hecla-Kilmer in September, and announced the intersection of a 600 m

hydrothermal breccia and alteration confirming the presence of copper and gold in

December and reported a lithium discovery at the project in March 2021. For Reveille,

the company confirmed its core target in November, and completed the 2020 field

season in December, received a drill permit in February 2021, began and completed

Phase 1 drilling in March 2021, and is targeting Phase 2 for June 2021.

Company raises $3.5mn in 2020 The company raised a total $3.8mn since 2020,

including $2.2mn closing in June 2020, $1.5mn in January 2021, and $0.15 in

February 2021. The share price rose from March 2020 on rising gold and its

acquisition news, and has continued to rise over the past six months, as progress on

exploration has more than offset the decline in the gold price.

Active exploration in world's best district

Nevada is the number one mining district globally, with Alaska the only big US competitor

Strong interest from Canadian juniors in Nevada will continue

The top mining district will obviously see strong activity

As the number one mining district globally, Nevada will continue to see strong interest from junior explorers, with Canadian miners at an advantage given the country’s strong cultural and geographic ties with the US. With only burgeoning Alaska directly competing with it in terms of reserves and production, Nevada will remain the core center U.S. mining, and this looks set to be the case for many years. We expect that Canadian juniors will thus continue to consider major investment in the state, especially with the advanced gold price.

Rising gold had propelled most gold stocks over H1/20

From H2/20 to the present, companies’ specific strengths more in focus

Specific company strengths coming to the fore

The main difference since the second half of 2020 to the present compared to H1/20 is that the gold price has been consolidating, and it is no longer a case of a rising tide lifting all boats. The tide has ebbed a bit, and we are now starting to see which ships are particularly seaworthy versus others. The main Canadian juniors that have either continued to maintain strong price gains even as the gold price has slipped, including Blackrock, Nulegacy and NV Gold, with most of the rest holding up with decent gains, and only Contact and New Placer Dome seeing substantial declines.

A range of Canadian junior explorers in Nevada from drilling to production

Rise in gold price since 2019 could drive wave of exploration, and opportunities for juniors

Variety of Nevada choices for Canadian junior investors

There are a range of Canadian juniors to choose from, whether investors prefer momentum plays and look to the outperformers, or are seeing some value plays in the underperformers. The group has a decent range of market caps from US$184.2mn to US$15.7mn, ranges from new producers and companies with reasonably large resource estimates to those with the initial major drill programs having been run, offering a wide variety of choices of various risk preferences and potential holding periods. While if the gold rebound of the past few weeks continues it could lead to the entire group again being boosted, during the current period of gold consolidation, it is probably time to focus more on company specific strengths than during the H2/19-H1/20 gold boom.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.