October 29, 2021

Mixed economic data continues

Author - Ben McGregor

Gold rises as mixed economic data continues

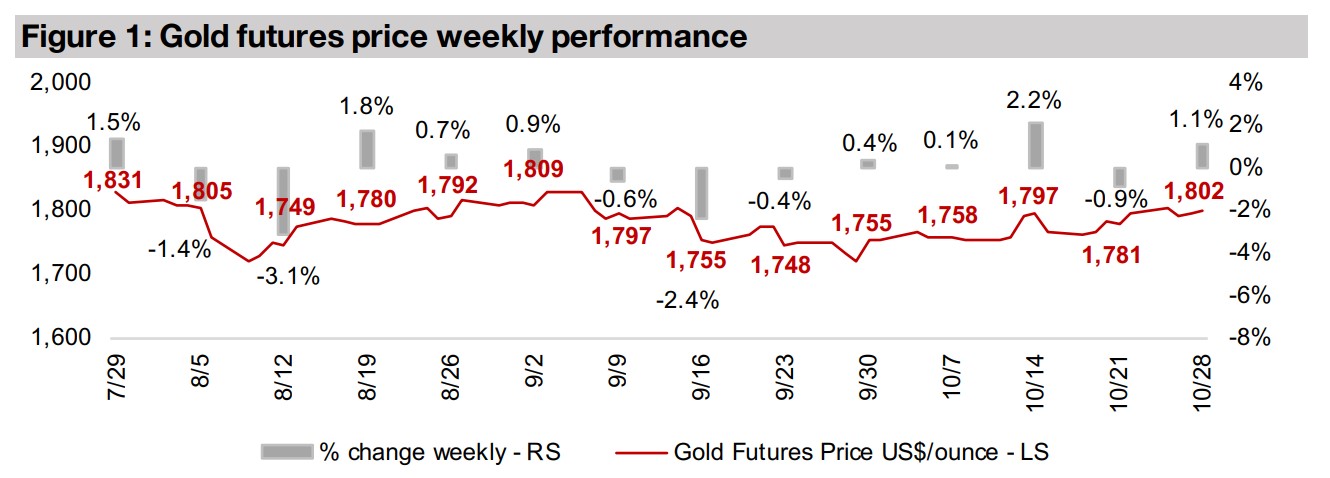

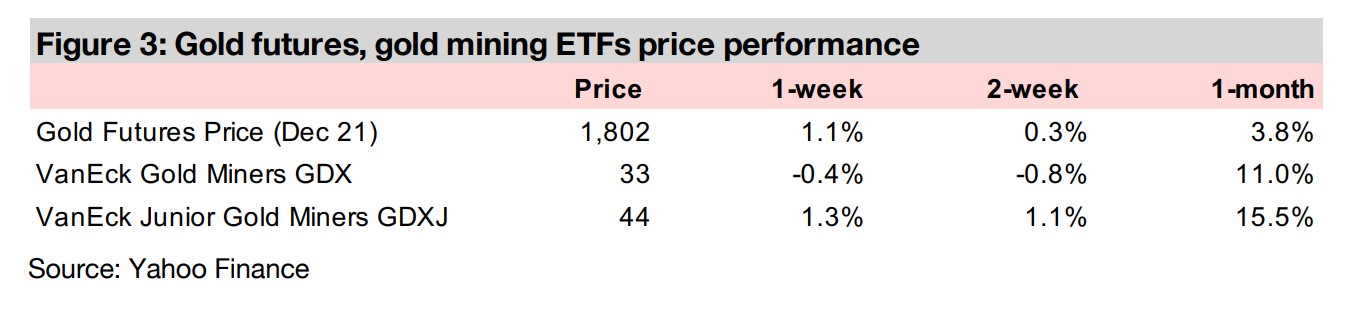

The gold price rose 1.1% to US$1,802/oz this week, as economic data remained mixed, but the market seemed to be seeing rising risks, especially of inflation, and shifted more into gold, as a hedge against rising prices and as an instrument of safety.

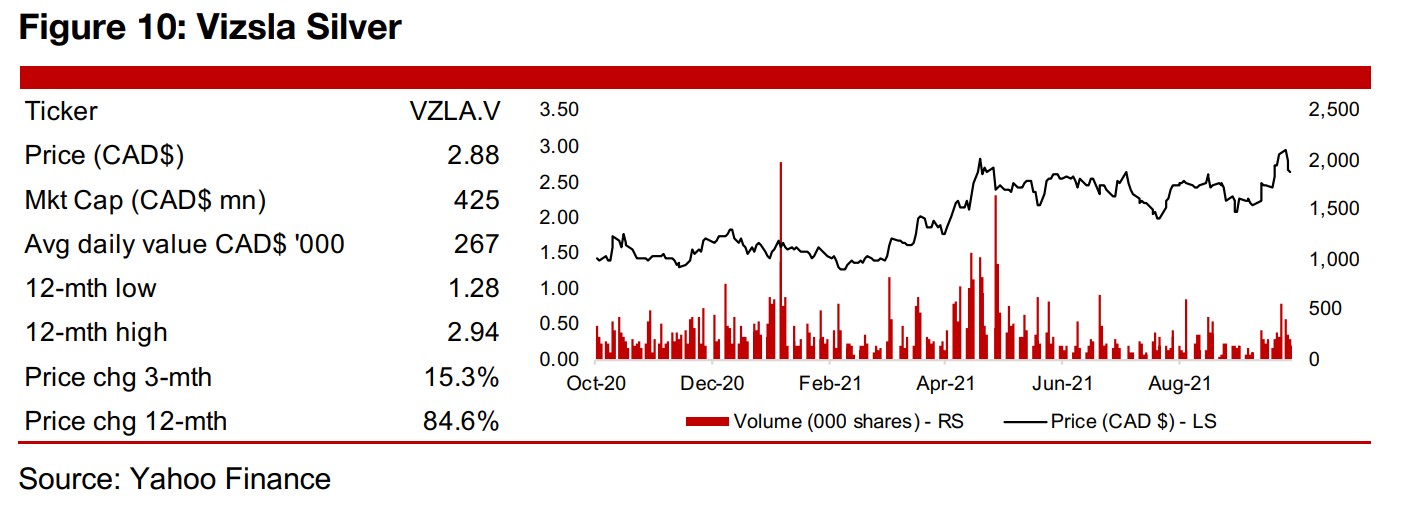

Vizsla Silver and Thor Explorations In Focus

In Focus this week are junior explorers seeing strong gains this year, Vizsla Silver, which has seen strong drilling results from its Panuco silver project in Mexico, and Thor Explorations, which has poured first gold at its Segilola mine in Nigeria.

Mixed economic data continues

Gold rose 1.1% this week to US$1,802/oz, with economic data continuing to remain

mixed, but the market seeming to see it as balanced toward rising risks, especially

with regards to inflation, and moved towards gold as a hedge against rising inflation

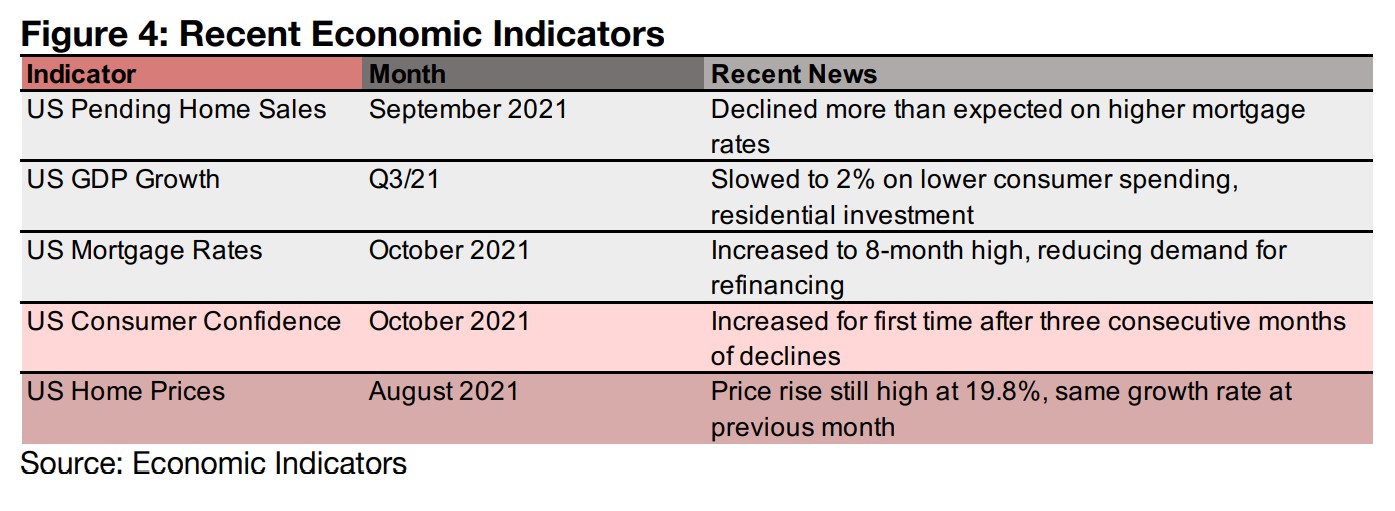

and as a general instrument of safety. Figure 4 summarizes recent economic news,

with the highlights in grey indicating generally 'negative' economic news, the light

pink indicating 'positive news' and the purple more 'neutral news'. Overall, we are

seeing recent data that skews negative. Pending homes sales in the US declined

more than expected in September 2021, likely because of higher mortgage rates,

which rose to an eight-month high. US GDP growth was also its weakest since the

crisis, slowing to just 2.0% on lower consumer spending and residential investment.

To the upside, US consumer confidence in October increased, but this was after three

months of straight decline, so even this indicator could still be considered quite

bearish in terms of trend. While US home prices remained strong in August, growing

at 19.8% yoy, the growth rate was flat m-o-m, suggesting that the rate of increase

could be about to slow. So even the 'upbeat' indicators are not entirely encouraging.

Topping all this off, is a claim by Twitter founder Jack Dorsey that was widely shared

in social media that he believed that hyperinflation had already arrived. Economists,

including the widely renowned David Rosenberg, came out to counter this claim as

totally ridiculous, and with hyperinflation usually defined as over a 50% y-o-y rise in

prices for an extended period, US inflation is hardly there yet, at just over 5.0%.

Jack Dorsey is obviously no economist and not a reliable analyst on these matters at

all, but what he, and Twitter, do represent, are the current fears of the general

population. That inflation has become a general fear is important, because it does

drive behaviour that has effects in the real world. It could cause consumers to

demand higher in wages, driving up inflation, and at the limit, causing a wage-price

spiral. With the potential for this to occur even as economic growth seems to be

slowing could lead to a combination of low growth and high inflation – stagflation.

Such a scenario would likely be very supportive of the gold price.

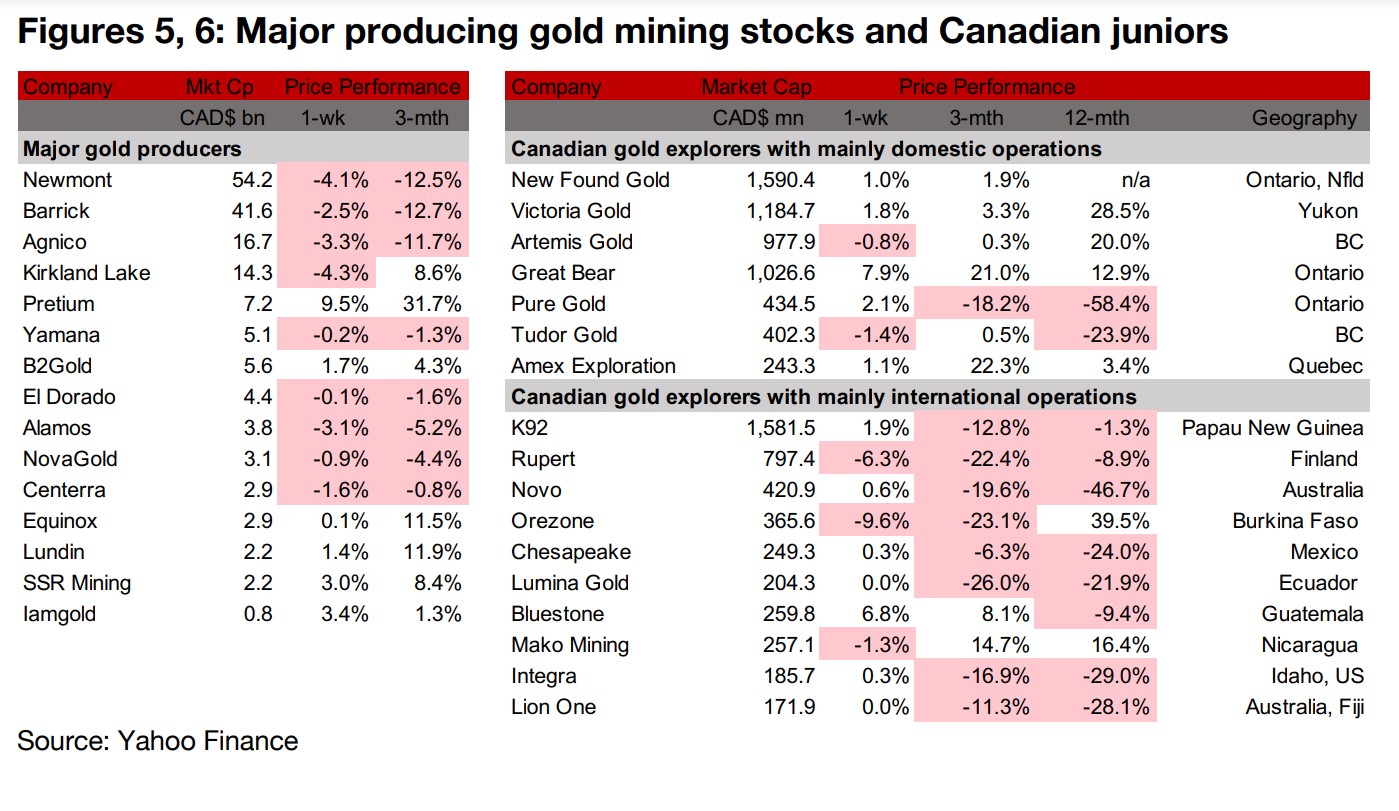

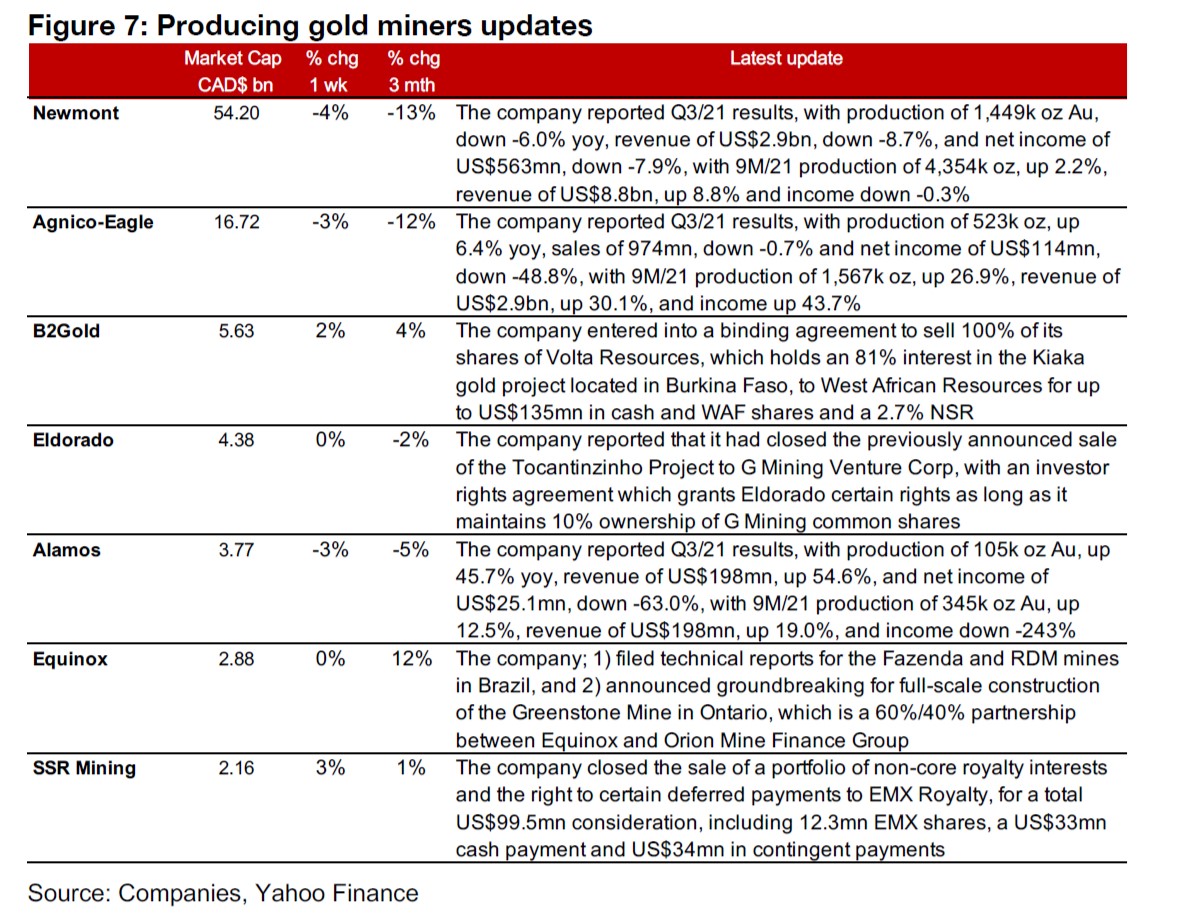

Producers mixed as Q3/21 results start

The producing gold miners were mixed even as gold rose, as Q3/21 results started to come in, and were relatively weak (Figure 5). Newmont's Q3/21 saw production, revenue and net income down moderately, Agnico-Eagle saw a mid-single digit rise in production, slight dip in revenue and a near -50% decline in net income. Alamos saw a stronger topline for Q3/21, with production and revenue up nearly 50%, but net income declined -63.1%. B2Gold reported that it will sell its share in Volta Resources, which holds 81% of the Kiaka gold project in Burkina Faso, to West African Resources. Eldorado closed its sale of the Tocantinzinho Project to G Mining Venture Corp, Equinox filed technical reports for the Fazenda and RDM mines in Brazil and announced groundbreaking for construction of the Greenstone Mine in Ontario, and SSR Mining closed the sale of a portfolio of non-core royalty interests and deferred payments to EMX Royalty (Figure 7).

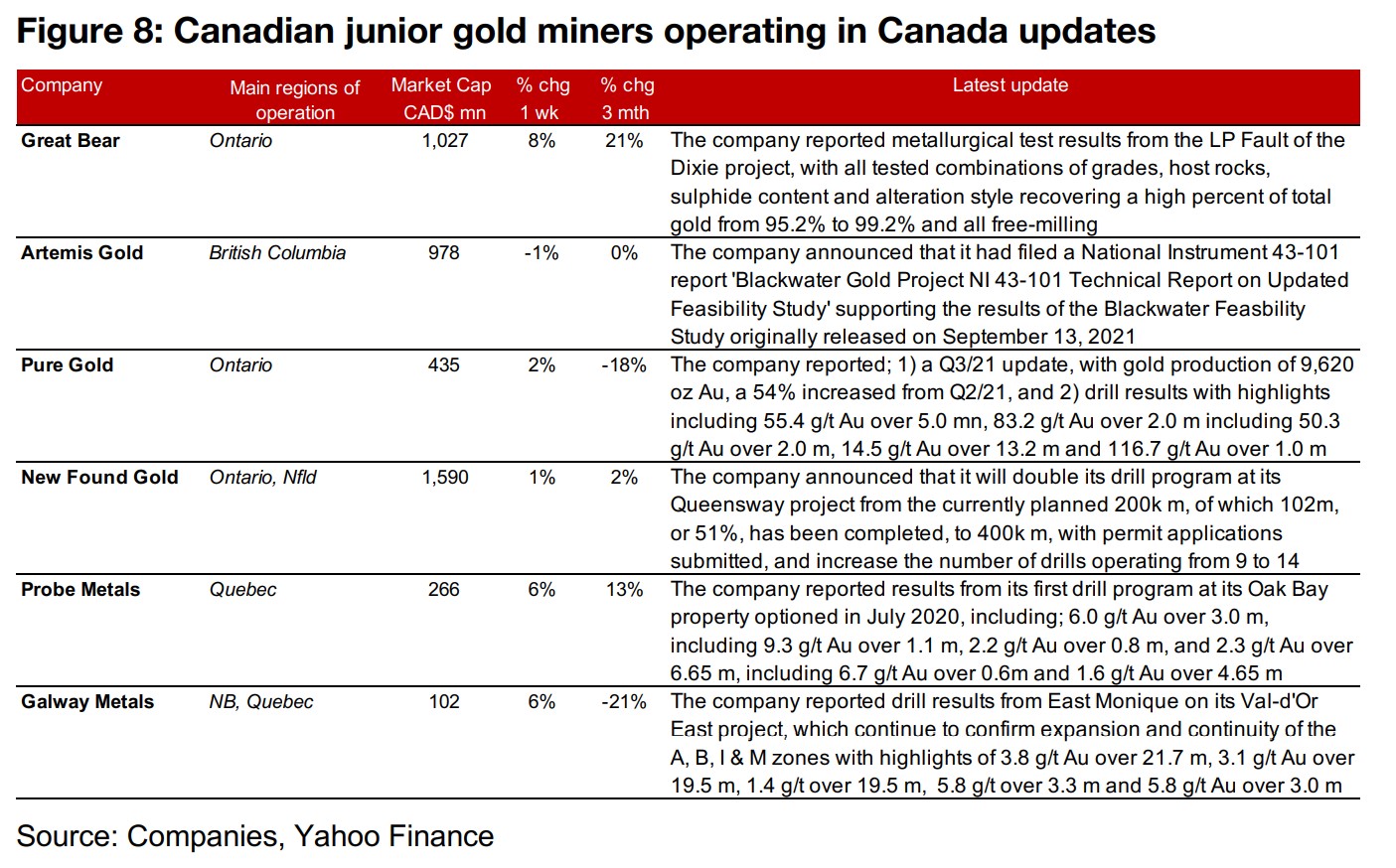

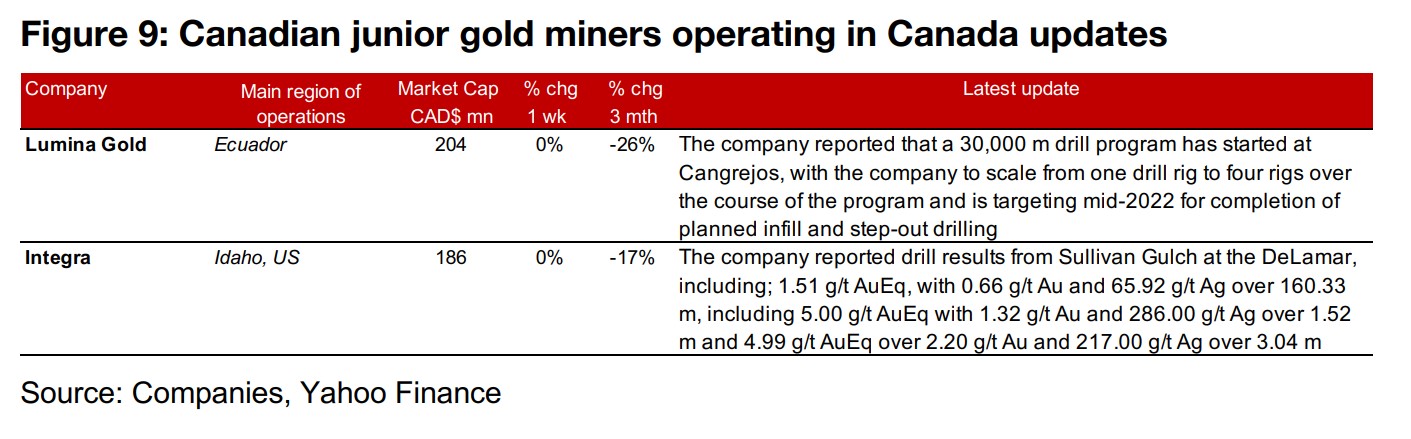

Canadian juniors mainly up on gold's rise

The Canadian juniors were mostly up on the rise in gold (Figure 6). For the Canadian juniors operating mainly domestically, Great Bear reported metallurgical test results from the LP Fault, Artemis filed an updated technical report for Blackwater, Pure Gold reported a Q3/21 update and drill results, and New Found Gold announced that it would double its drill program to 400k m from 200k m. Probe reported results from its first drill program at its Oak Bay target, and Galway reported drill results from East Monique on its Val-d'Or East project (Figure 8). For the Canadian juniors operating mainly internationally, Lumina initiated a 30,000 m drill program at Cangrejos, and Integra Resources reported drill results from Sullivan Gulch at Delamar (Figure 9).

In Focus: Vizsla Silver (VZLA.V)

Drilling at the Panuco silver project in Western Mexico

Vizsla Silver's main asset is its 100%-owned Panuco silver project in Western Mexico, where the company is focusing on two discoveries, Napoleon and Tajitos, with ten drill rigs operating, six for definition and four for exploration, with 85,000 m of drilling completed. The project is on 9,500 h.a. package which lies along the same silver trend as First Majestic’s San Dimas mine, which is 80 k away, and has never been systemically explored. As Panuco’s area had past producing mines, infrastructure is already established, including power, water, road access and 500 tpd permitted mill.

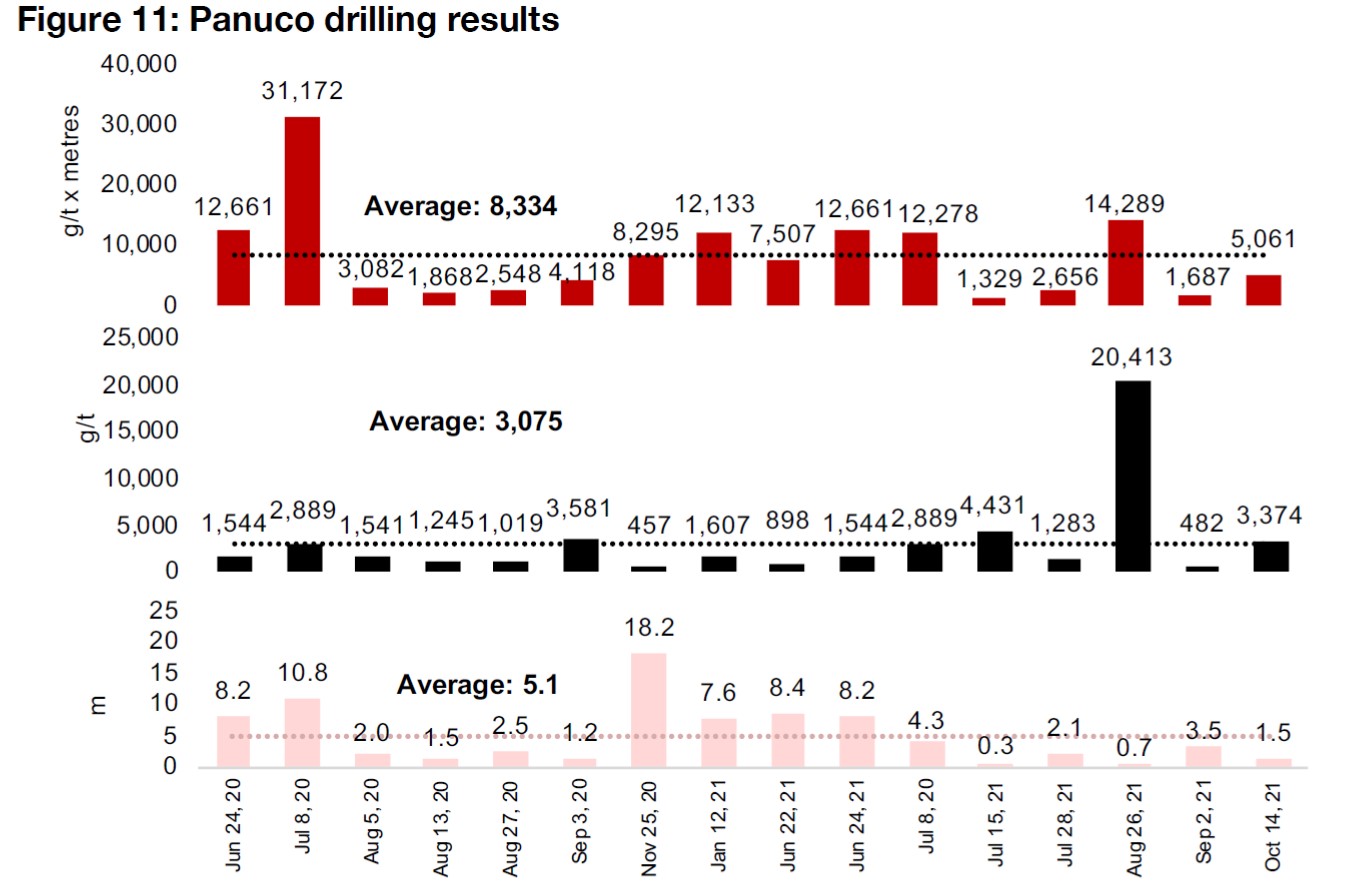

Strong drilling results over the past year, strong cash balance

The company's strong performance of the past year, the second highest of the major TSXV-listed silver juniors, up 53%, has been driven by a series of strong drilling results from Panuco (Figures 11, 12). The best results so far were released in August 2021, with 20,413 g/t Ag over 0.70 m, with strong results also released in July 2021, with 4,431 g/t over 0.3m, and in October 2021, with 3,374 g/t Ag over 1.50 m. With cash of US$76mn as of its fiscal quarter ended July 31, 2021, the company has sufficient cash to continue its exploration program for a very extended period.

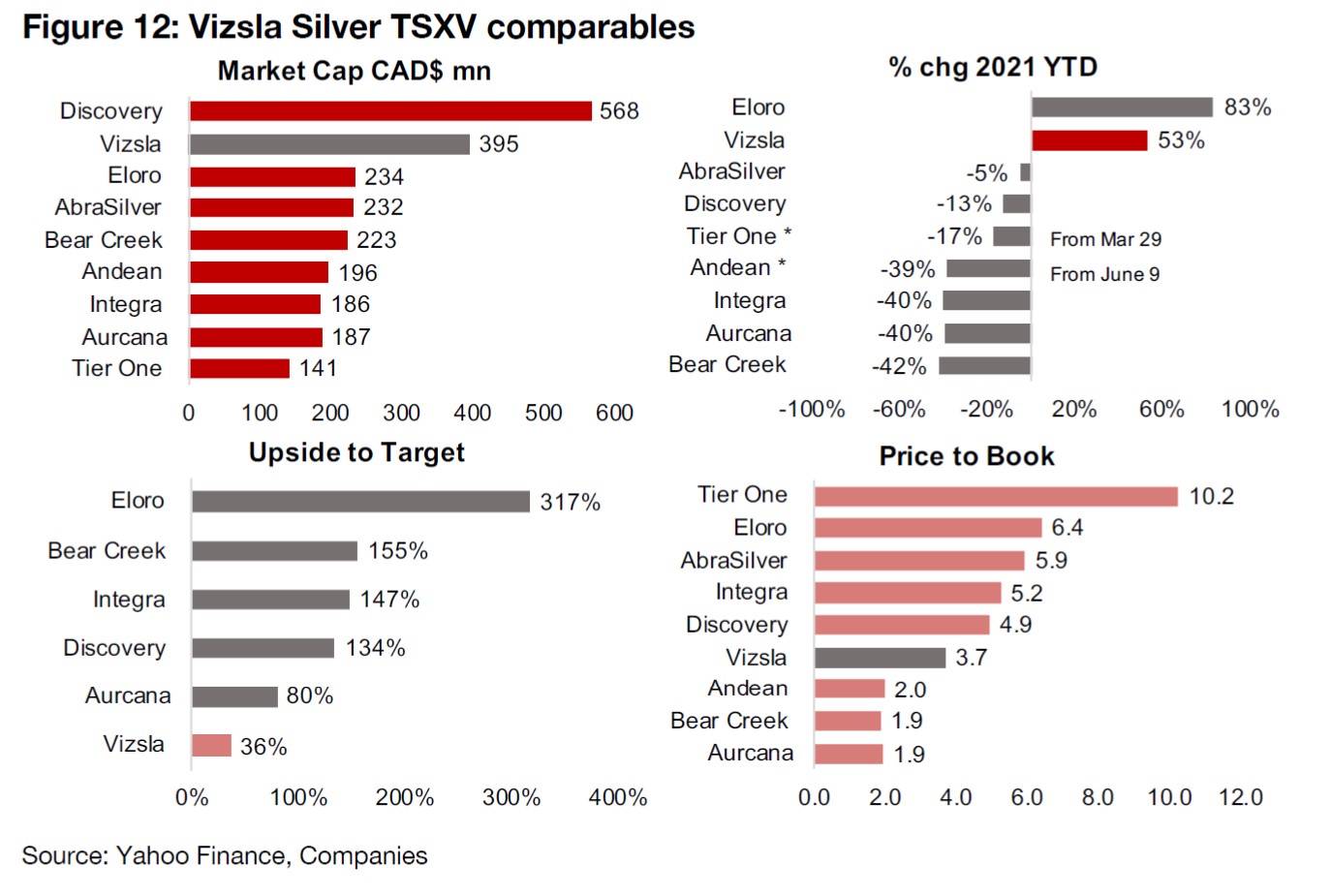

Vizsla nearing market target, but valuations moderate versus peers

Vizsla's large gains on its strong drilling results have seen it significantly outperform most of the other TSXV-listed silver juniors, with only Eloro, up 83% YTD, surpassing it, and all the other top silver juniors declining. It is the second largest silver junior on the TSXV, with a market cap of US$385mn, second only to Discovery Silver. This has brought Vizsla quite close to its market target price compared to the rest of the group, with just 36% upside expected. This is in contrast to the rest of the group, most of which have over 100% upside to their consensus target prices, with the market appearing to be factoring in a pickup in the silver price. The company's Price/Book valuation, however, still remains relatively moderate versus the group, at just 3.7x, suggesting that it is not particularly overvalued versus its peer group.

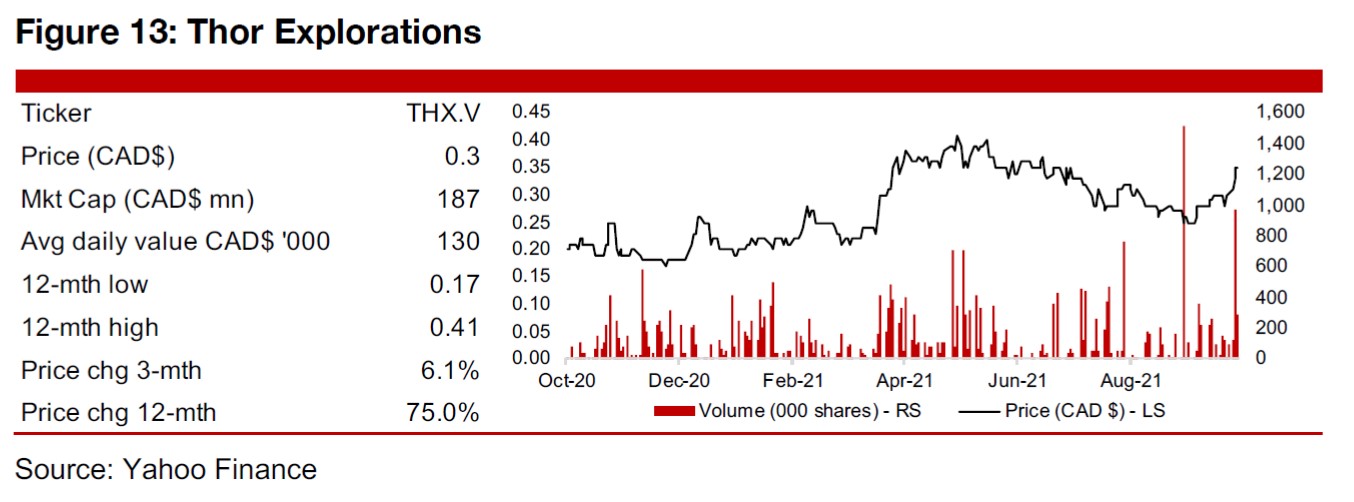

In Focus: Thor Explorations (THX.V)

Exploring for gold in three countries in Africa

Thor Explorations is exploring for gold in Africa, with three projects; 1) its flagship Segilola project in Nigeria, which the company targets as the country's first ever large scale commercial gold mine, 2) the Douta project in Senegal with Thor holding 70% of the license with a local partner, close to both Senegal's only operational gold mine, Sabodala, and the country's largest undeveloped gold resource, the 4.4mn oz Massaawa deposit, with the option to increase this to 100%, and 3) the Central Hounde Project in Burkina Faso, of which it holds 100% after acquiring Barrick's 51% interest for 1% NSR.

Flagship Segilola Project has reached first gold pour

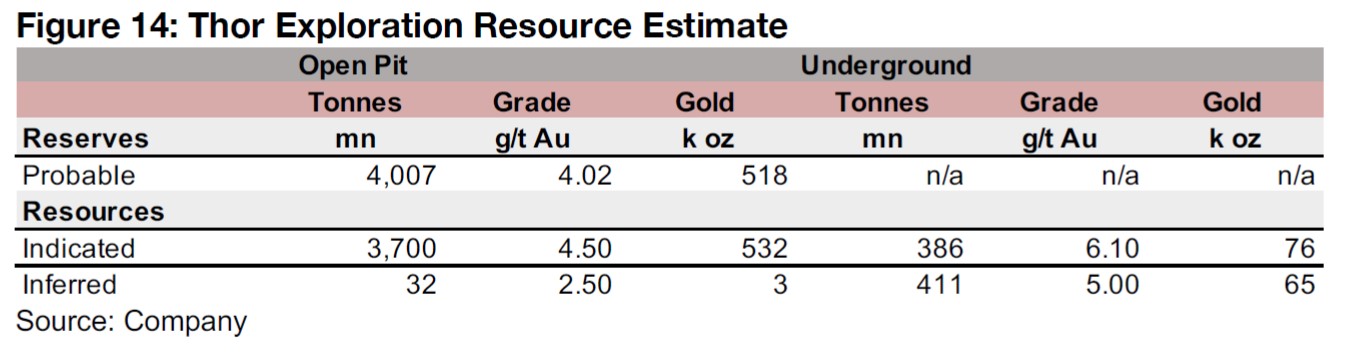

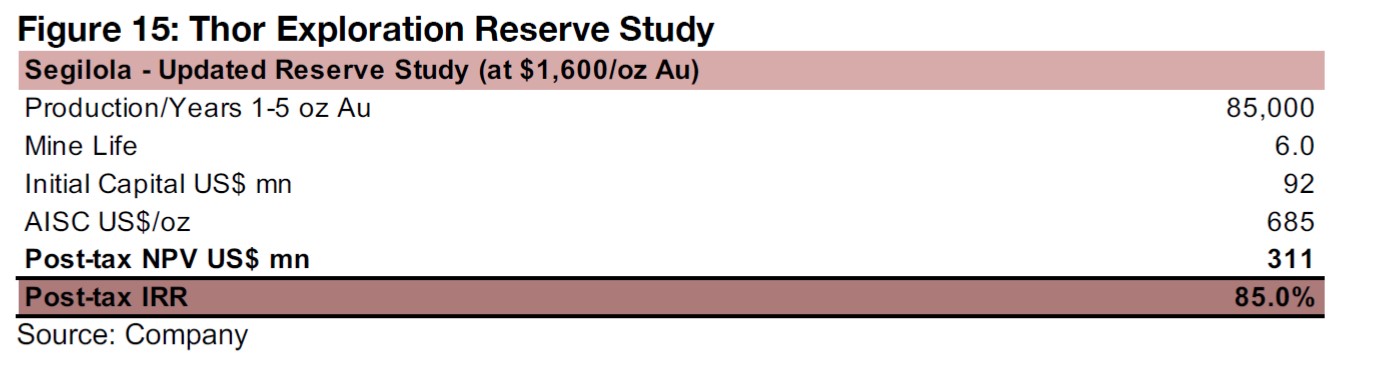

Thor's flagship Segilola Project reached first gold pour in July 2021, and the ramp up of its mine continues, with construction 95% complete. The project is estimated to have 518k oz Au of Probable open pit Reserves, and 532k oz Au in Indicated and 3k oz Au in Inferred open pit resources, and 76k oz Au Indicated and and 65k oz Au in potential underground resources (Figure 14). A Reserve Study for the mine estimates 85k oz Au in production over years 1-5 of a six year mine life, and a very low-cost mine, with initial capex of US$92mn and an AISC of US$685/oz, for a post-tax NPV of US$311mn, for an IRR of 85% (Figure 15). The company will also continue exploration near the mine, with seven targets identified this year.

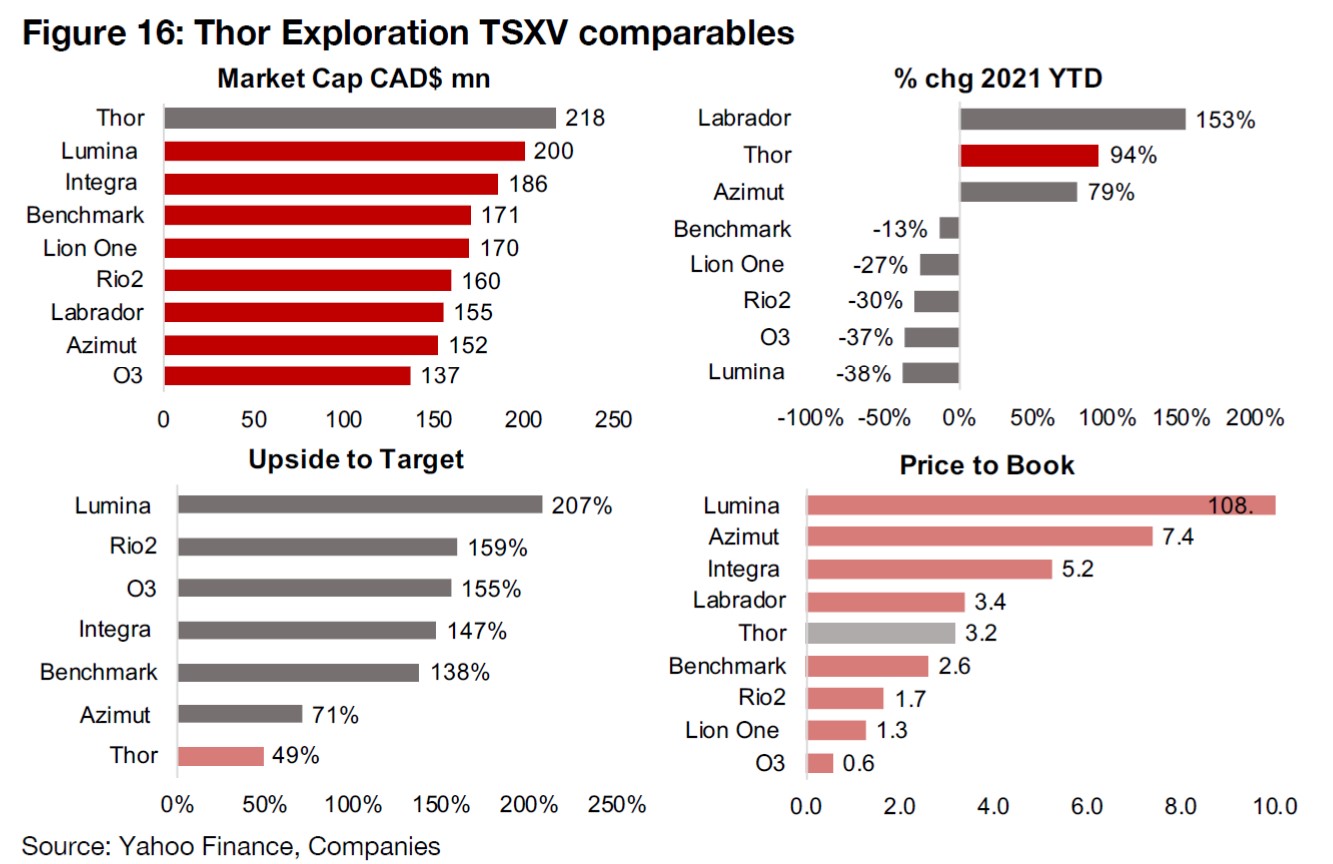

The largest of the mid-tier TSXV-gold juniors

The progress on the Segilola mine has led to a 94% increase in Thor's share price, and among the mid-tier TSXV-listed gold juniors, is second only to Labrador Gold, up 153% (Figure 16). It now has the largest market cap of these comparables, at US$218mn, with most of the group seeing significant share price declines this year. The gains have meant that it now has the lowest upside to its target price of the group, although this is still reasonably high, at 49%, and its Price/Book ratio is near the median of the group, at 3.2x.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.