May 28, 2020

Miners dip as gold pauses on global health risk declines

Author - Ben McGregor

Gold slides over past two weeks as global health risk falls

Gold was up 0.5% this week, but has declined -1.9% off its most recent peak over the past two weeks, as global health risks have begun to decline; we look at falls in the gold price in the 2009 to 2012 bull market this week to put this retreat in context.

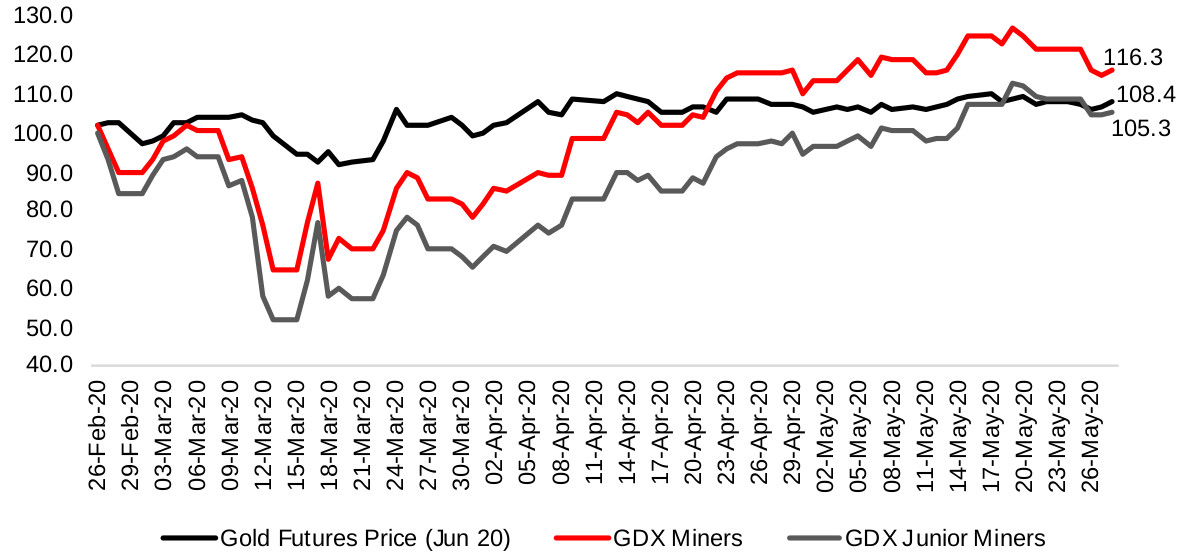

Producing miners down with reduced risk baked into gold

The large producing miners were nearly all down this week, a combination of both the market likely baking in a lower global health risk into the average gold price assumption and a natural pullback after two strong months of gains.

Figure 1: Gold futures price and gold mining ETFs

Gold price down as global health risk falls

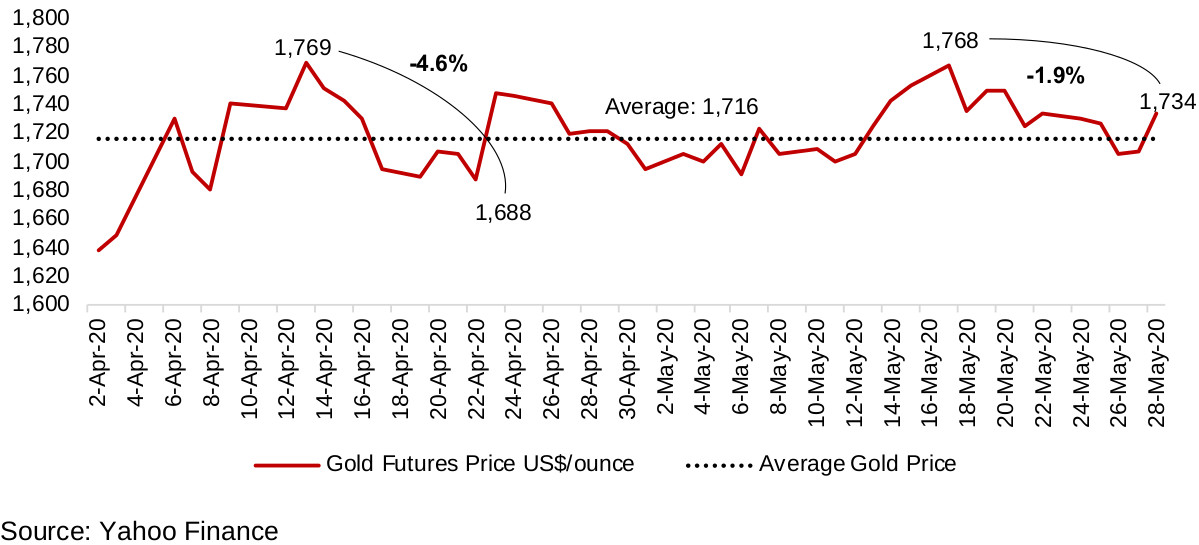

The gold futures price rose 0.5% this week, but is down -1.9% from its recent peak of US$1,768 on May 17, 2020 (Figure 2). This was partly because of a perceived decline in global health crisis risks, including announcements of progress towards to a vaccine. With most countries beginning to relax restrictions, it is clear that the worst-case scenario of wide scale lockdowns for many months is not occurring. However, this major change in outlook has not driven down gold even as much as an earlier post-crash dip of -4.6% from April 13, 2020 to April 22, 2020. With the gold price being maintained above US$1,716/ounce since February 2020, and not seeing sustained moves below US$1,700, or above US$1,760 for the past two months, the global health crisis is clearly not the only major factor driving gold.

Figure 2: Gold futures price over past two months

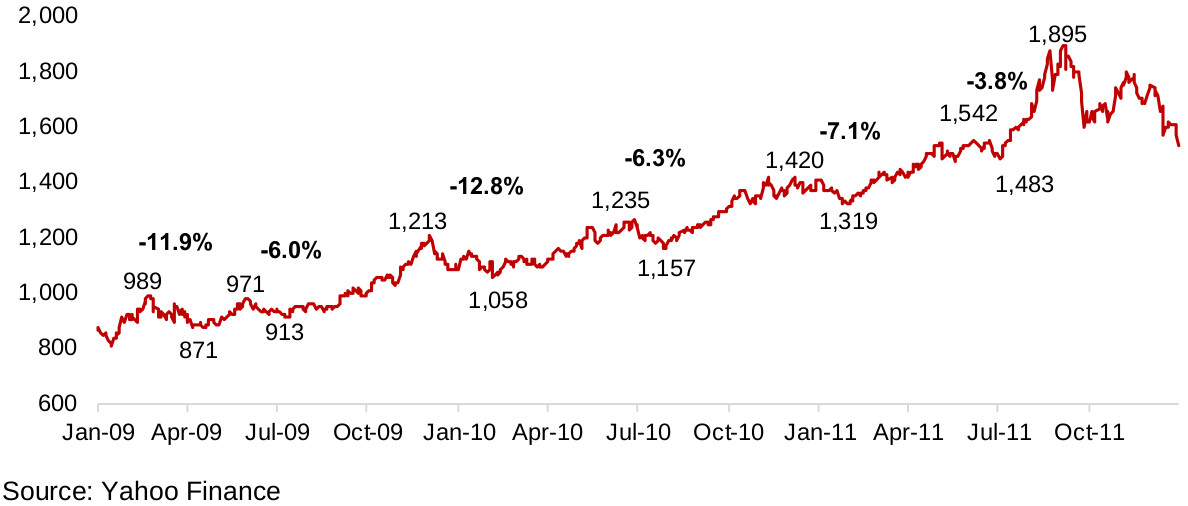

It still remains difficult to untangle the premium baked into gold due to the actual global health crisis itself, and that from the major monetary stimulus in reaction to the market crash, and the feedback effects between the two. However, we expect that the global health crisis risk will subside as early as the next few months, while zero interest rates will likely persist, likely for years. Therefore, while we may see some downward pressure on gold as the former risk subsides, the latter factor is likely to support the gold price for some time. We can put the recent two dips in the gold price in context by examining gold's movements in the previous gold bull market from 2009 to 2012 where we see six major periods of decline, ranging from -3.8% to -11.9% (Figure 3). Based on this, if gold is, in fact, currently in a gold bull market, pullbacks like the two we have seen in the past months are not severe, and can be expected as part of the natural shorter-term ebb and flow within a broader upward trend.

Figure 3: Gold price pullbacks in the 2009 to 2012 uptrend

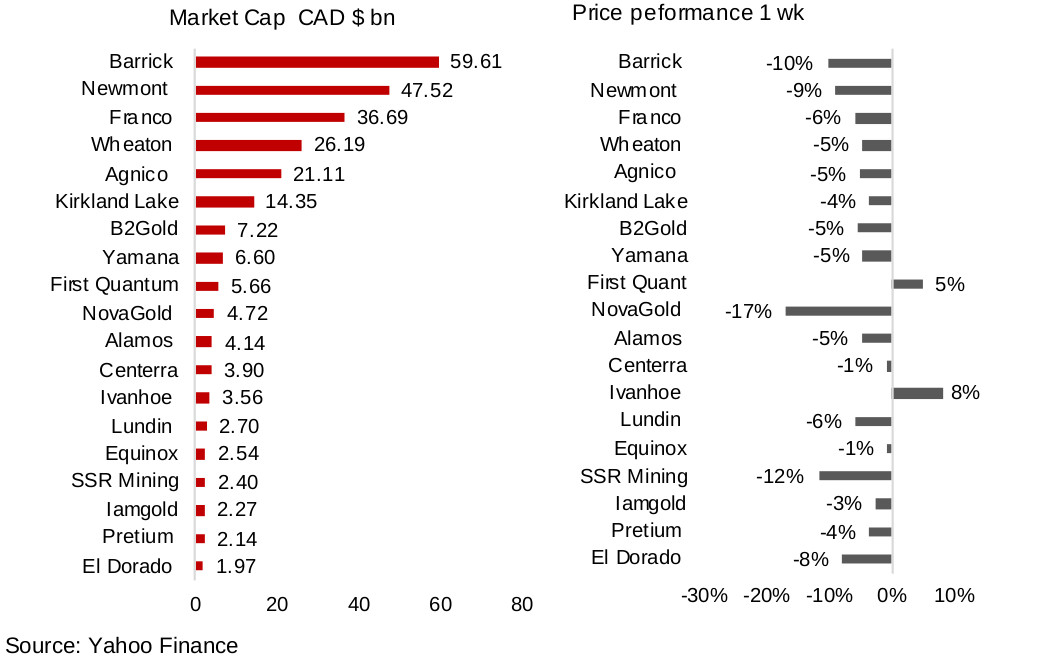

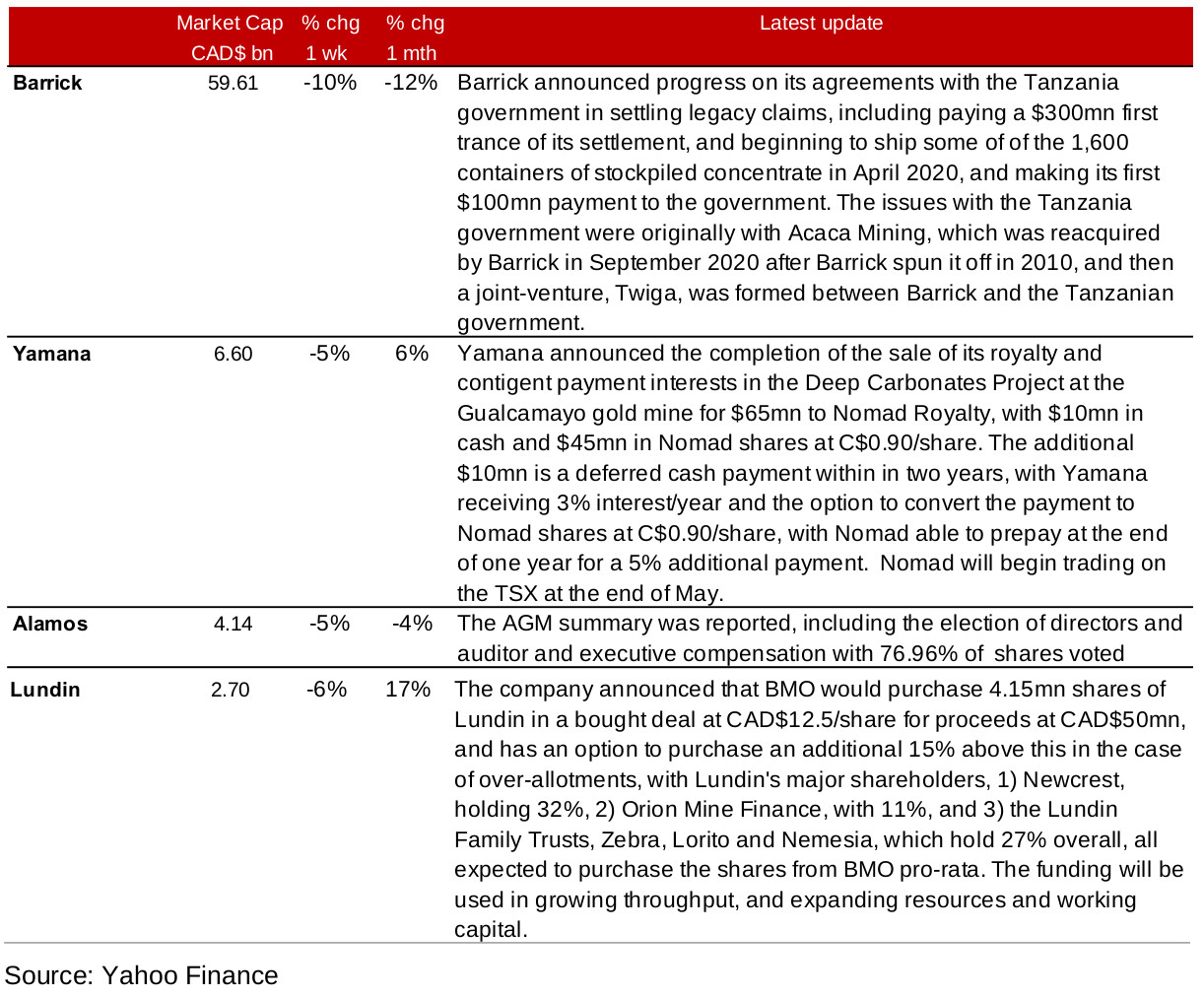

Figures 4, 5: Canadian producing gold mining stocks

Material declines for most producing miners

Most of the larger producing miners declined this week, a combination of; 1) a considerable decline in global health risks, including news flow that there is progress towards a vaccine, which may have reduced expectations for the risk driven premium baked into the gold price, and 2) a natural pullback with the Q1/20 results now all in, and profit taking after the sector's considerable two month run (Figures 4, 5). Major news flow was limited compared to the last two weeks, with Barrick announcing progress on its deal with Tanzania government, Yamana completing the $65mn sale of a project to Nomad Royalty, Alamos declaring the results of its AGM and Lundin entering a CAD$50mn bought deal with BMO which will be sold on to major shareholders, which are expected to buy in on a pro-rata basis (Figure 6).

Figure 6: Producing gold miners updates

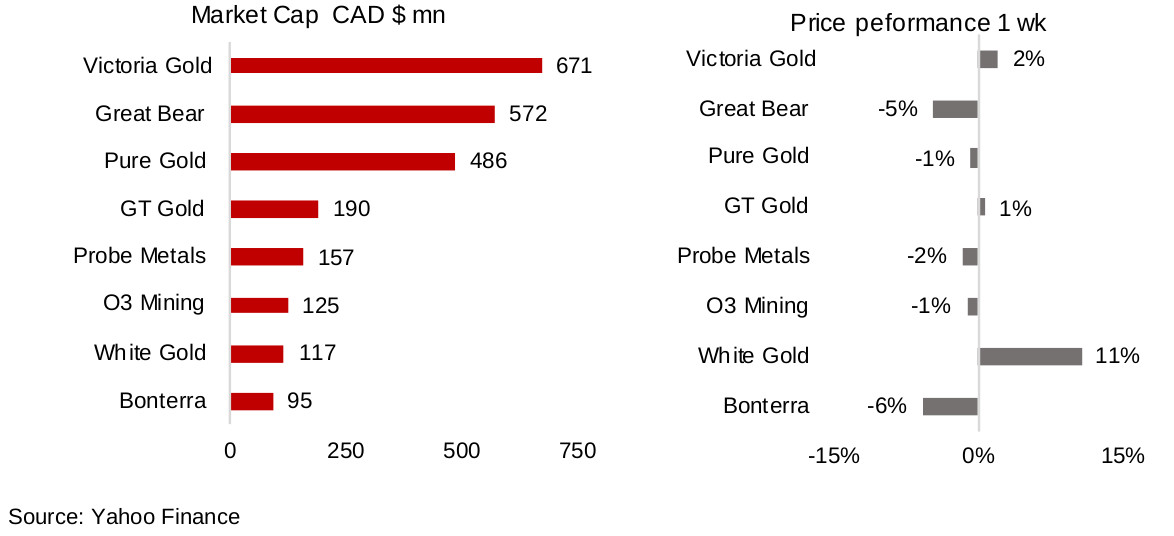

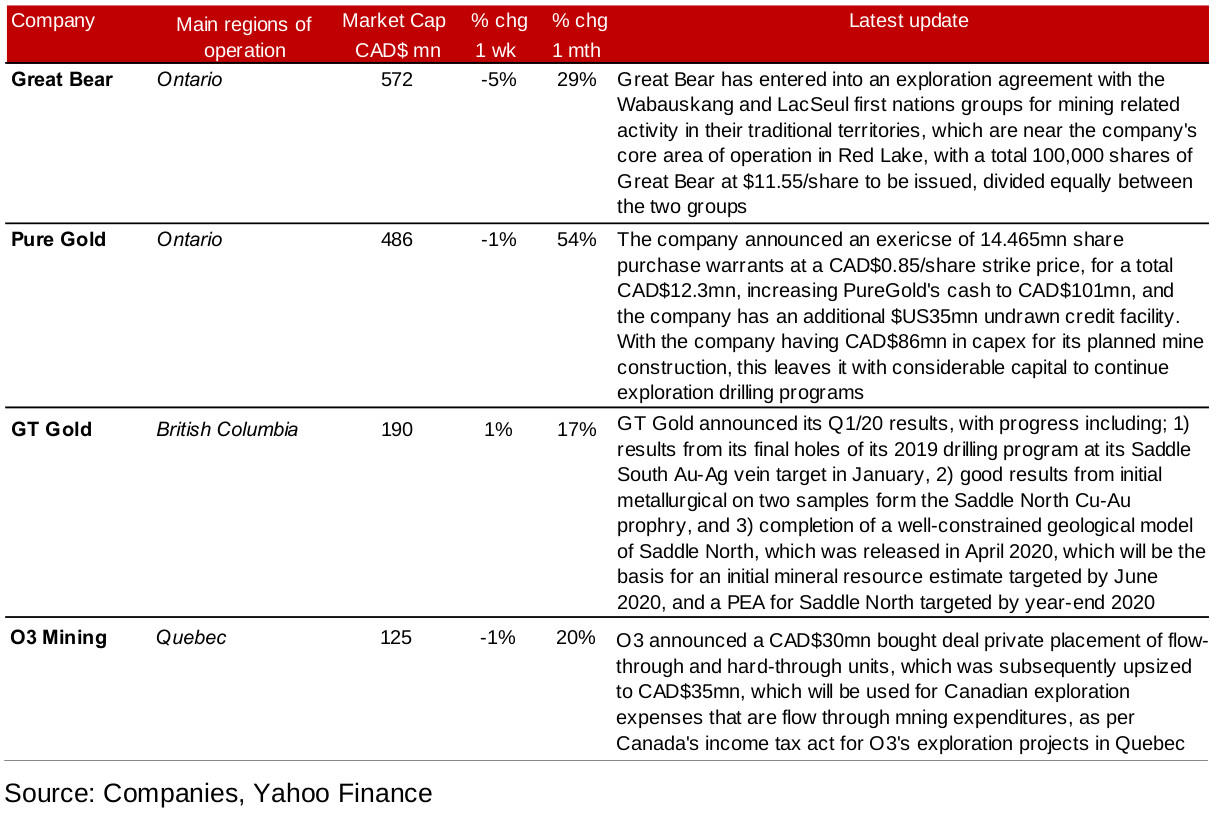

Figures 7, 8: Canadian junior gold miners with operations in Canada

Figure 9: Canadian junior gold miners operating in Canada updates

Canadian operating juniors see mixed performance this week

Most of the larger Canadian operating junior gold mining stocks declined this week, with company specific announcements not enough to hold off the overall downward pressure on the sector (Figures 7, 8). News flow on Great Bear regarding a deal with local communities allowing for the expansion of its exploration activities, and Pure Gold's raising of CAD$12.3mn through the exercise of stock options did little to move their share prices, with both companies already having seen substantial gains this year (Figure 9). GT Gold saw little movement on Q1/20 results which contained mainly a review of news already known to the market, and O3 Mining was little changed after a CAD$30mn bought deal private placement was announced.

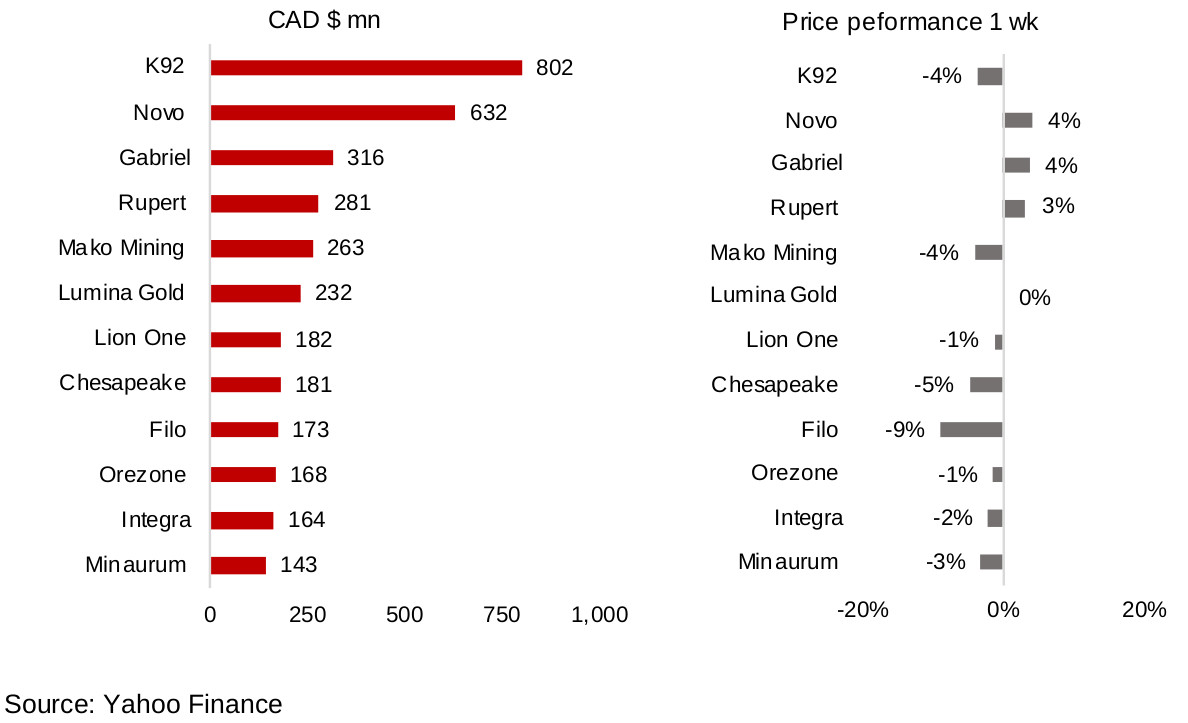

Figures 10, 11: Canadian junior gold miners operating mainly internationally

Foreign operating Canadian junior miners see mixed performance

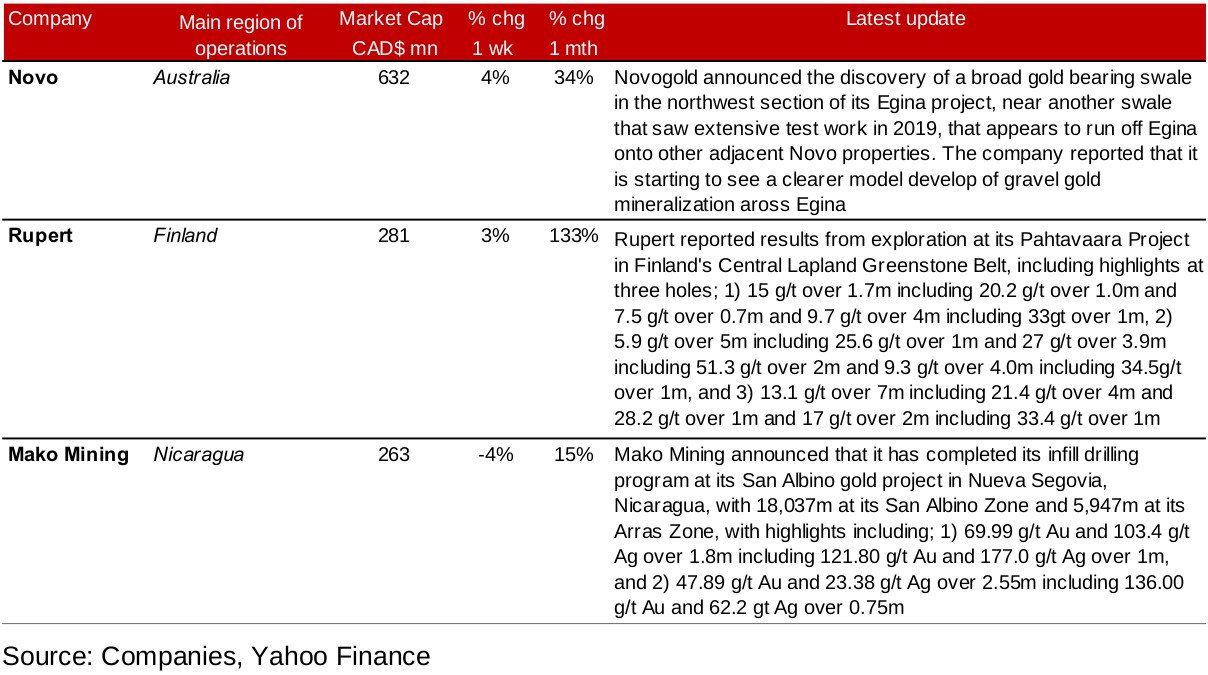

The performance of the larger cap foreign operating Canadian junior mining stocks was mixed this week (Figures 10, 11). Two gainers, Novo Resources and Rupert Resources (see the In Focus section below for more detail on Rupert Resources), were driven by a new exploration discovery, and drilling results, respectively (Figure 12). Mako Mining also reported new drilling results, but still saw a moderate decline in its share price.

Figure 12: Canadian junior gold miners operating mainly internationally updates

Figure 13: Rupert Resources

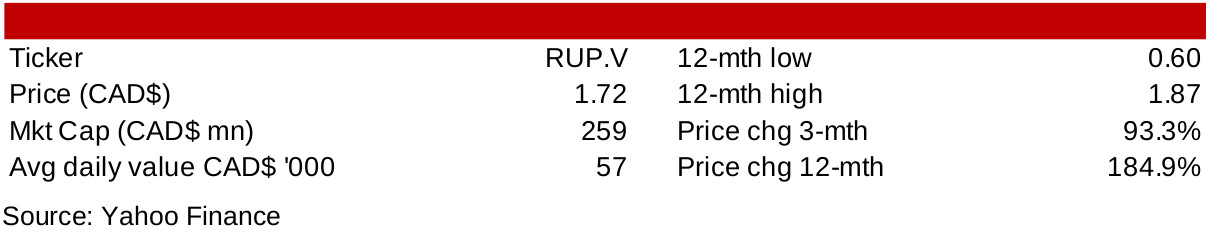

Exploring in Finland and Canada with five projects

Rupert Resources has five projects, its flagship, Pahtavaara in Finland, which is the current main focus, two other projects in Finland, Hirsikangas and Osikonmaki, with inferred resource estimates of 89k ounces and 276k ounces respectively, and two very early stage projects in Canada, at Red Lake in Ontario, and at Surf Inlet in British Columbia.

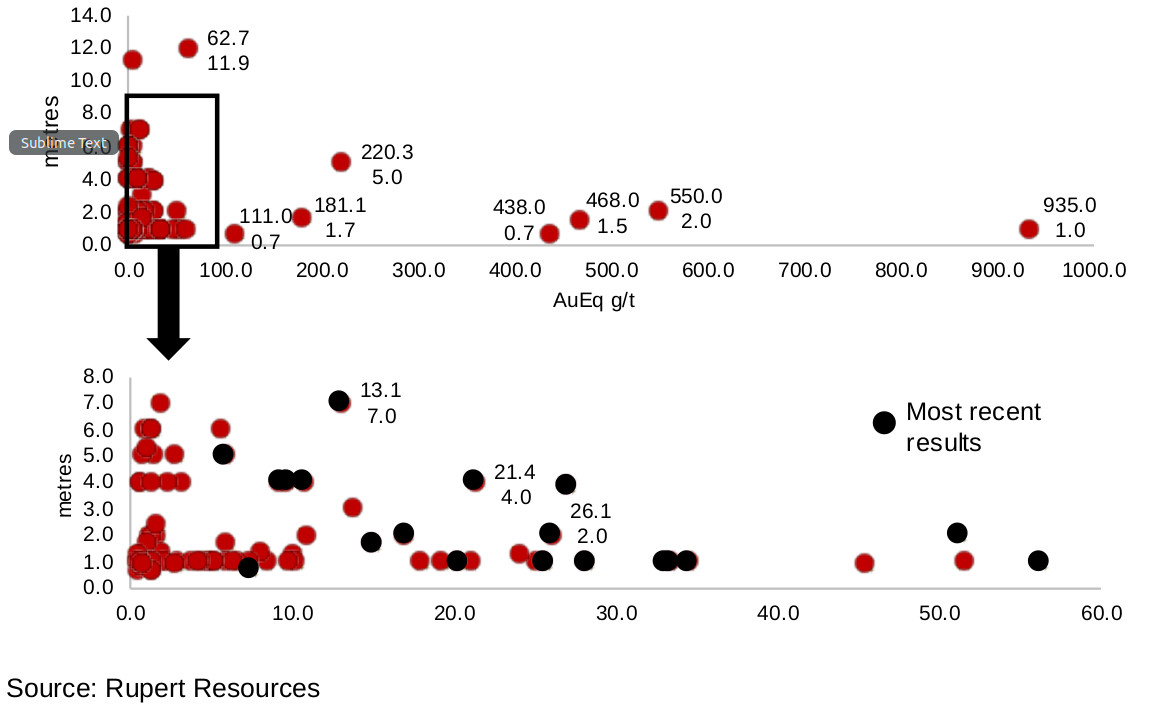

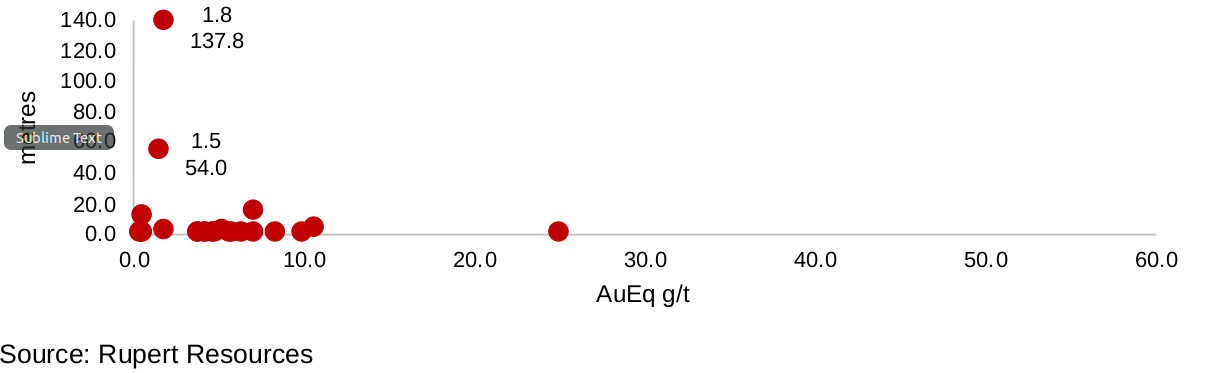

Figure 14: Pahtavaara mine 2019/2020 drilling results

Pahtavaara in Finland is the flagship

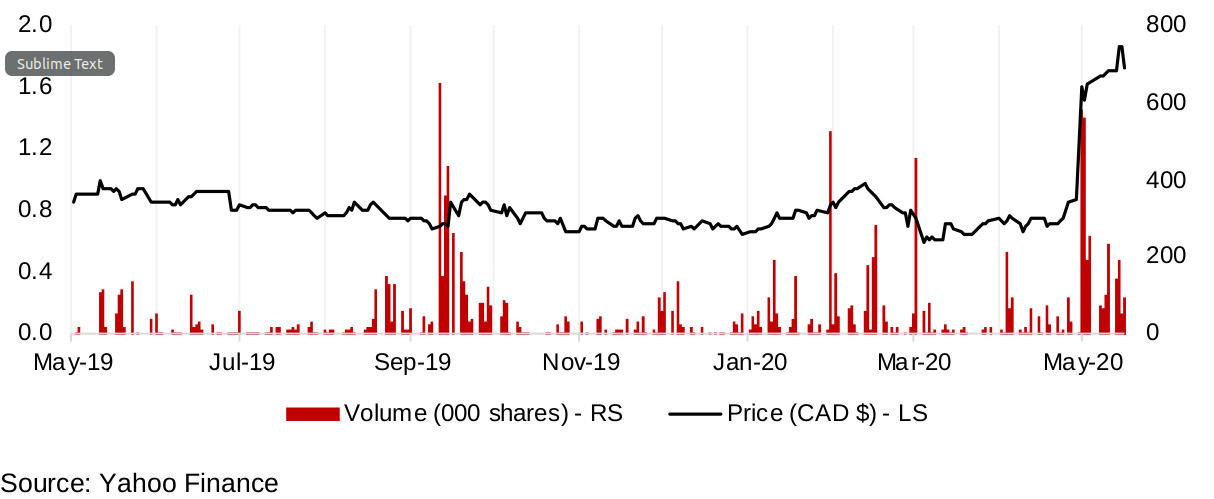

The company has been operating an extensive drill program through 2019 and 2020 at its flagship Pahtavaara project in the Central Lapland Greenstone Belt in Finland, with the results shown in Figure 14, but these had not led to a major rise in the share price in the year to end-April 2020 (Figure 15). However, on May 12, 2020, the company released drilling results from a newly identified target, Ikkari, at the Pahtavaara project (Figure 16), which drove an 85% increase in the share price in the two days following the announcement, and the stock is now 186% up of its CAD$0.60 lows on March 16, 2020.

Figure 15: Rupert Resources share price, volume

Figure 16: Ikkari target at Pahtavaara project

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.