November 11, 2024

Metals Slide After US Election

Author - Ben McGregor

Gold down moderately on US election

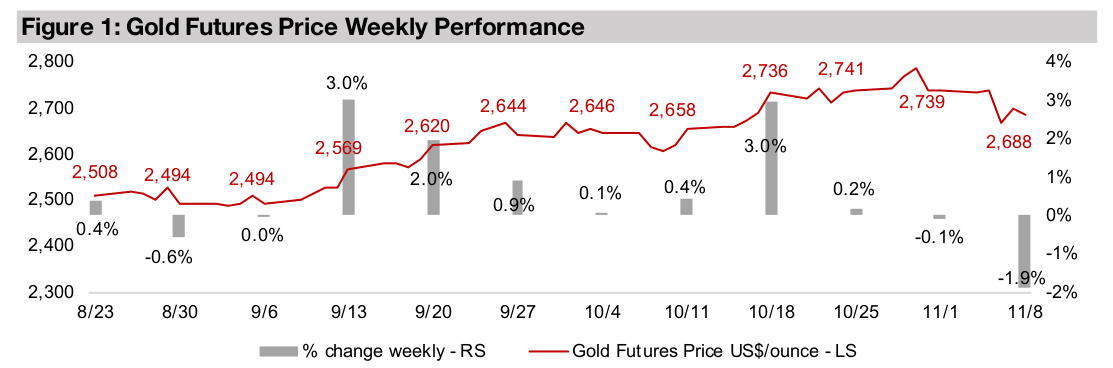

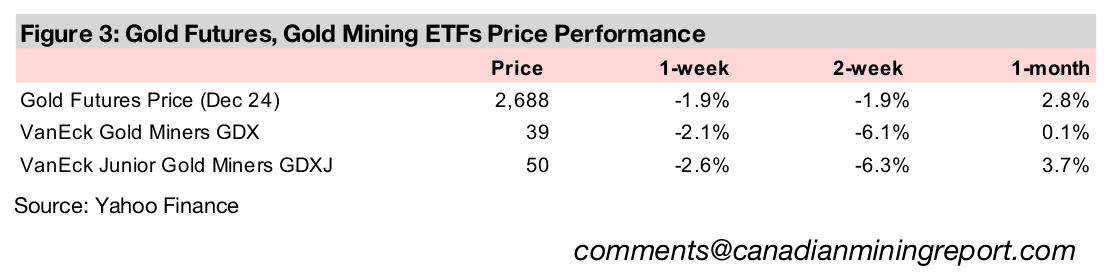

Gold was down -1.9% to US$2,688/oz on Trump’s election win as the metal was pressured by a jump in the US$ and yields while some of the risk premium in the price may have declined with the increased clarity on the global political direction.

Metals down on expected tariff-driven economic dampening

Major metals prices declined after the election mainly on expectations that rising tariffs could slow the global economy, although Canada-US trade, including metals, could remain robust given its huge size and the strong political ties between the two.

Metals Slide After US Election

The gold futures price declined -1.9% to US$2,688/oz, after holding above the

US$2,700/oz level for three weeks. This was not any more severe than the typical

weekly pullback seen for the metal over the past few years and could be viewed as

subdued given the huge shift political shift in the US, with Trump winning the election.

The new government’s policies are expected to include rising tariffs and a focus on

expanding domestic production and manufacturing, including a major expected push

for fossil fuels. The initial reaction so far has been a jump in US equities, yields and

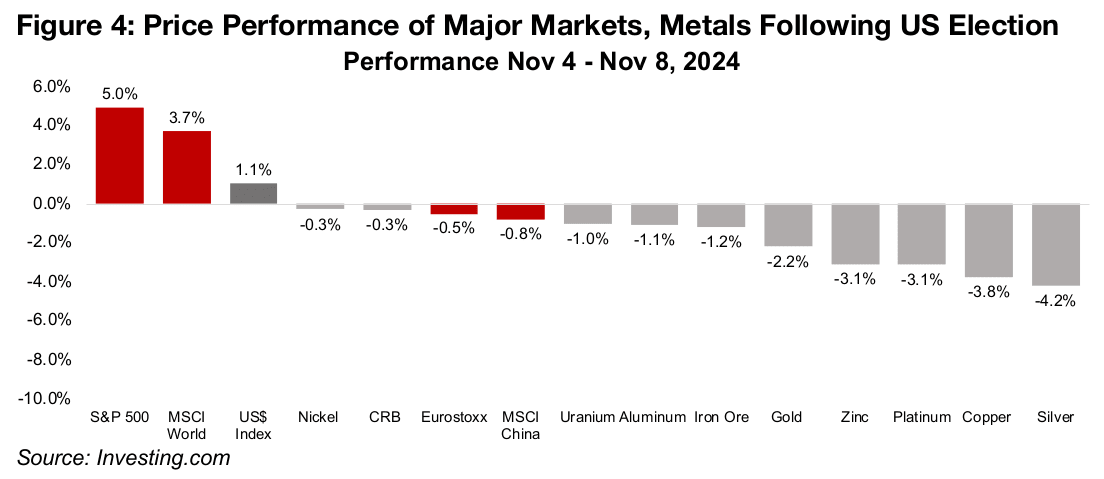

the dollar while international stocks edged down, commodities were near flat, and

most of the major metals declined (Figure 4).

From just before the election to the end of the week, the S&P 500 gained 5.0%, pulling

up the MSCI World 3.7% and outperforming the Eurostoxx 600, down -0.5%, and

MSCI China, off -0.8%. These declines were not severe and indicated that that the

markets did not expect severe downward pressure on international equities from the

new US political direction. The US$ index saw a strong rise of 1.1%, and the CRB

global commodities index was near flat, down -0.3%, with relative strength in some

agricultural commodities offsetting a price decline for most of the major metals.

Potential US tariff hikes expected to hit global demand, metals markets

The Trump government is expected to make heavy use of tariffs and specifically

target countries where it views trade with the US as not fairly balanced. This appeared

to be the main reason for the hit to many major metals, with an effective increase of

prices for exports to such a major economy expected to weigh on global growth

overall. Also, there is the expectation that other countries could also react with

competing tariffs and this could drive up prices of many industrial goods further,

further dampening global economic demand.

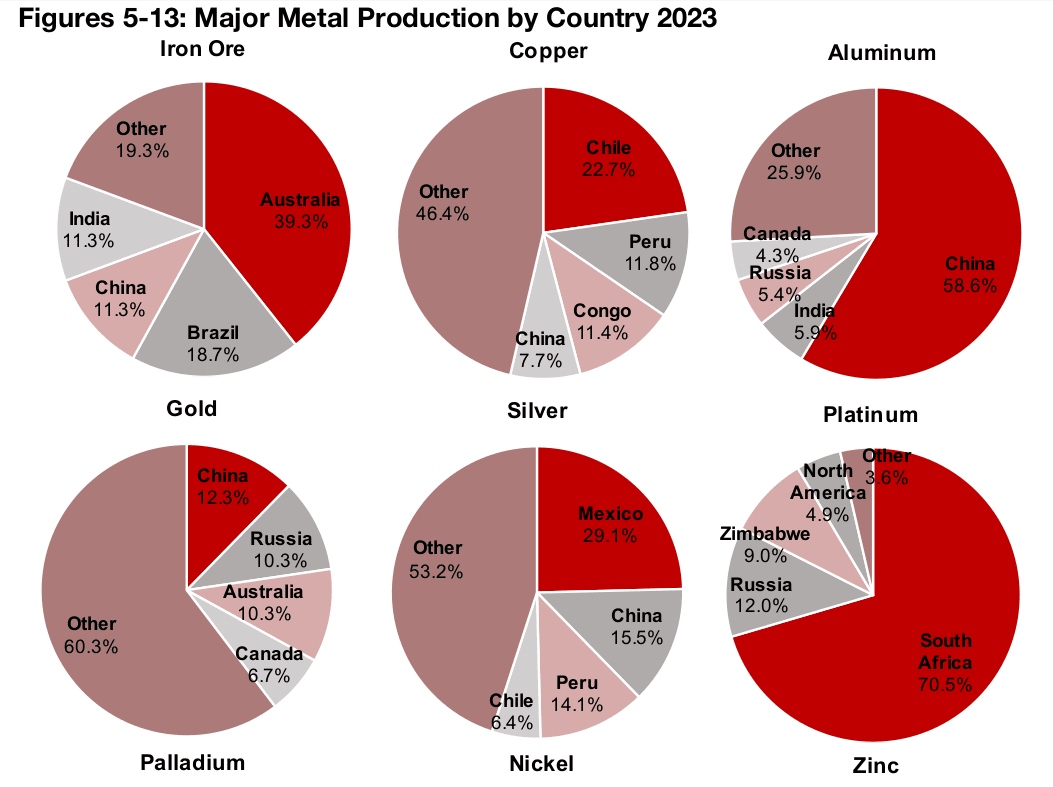

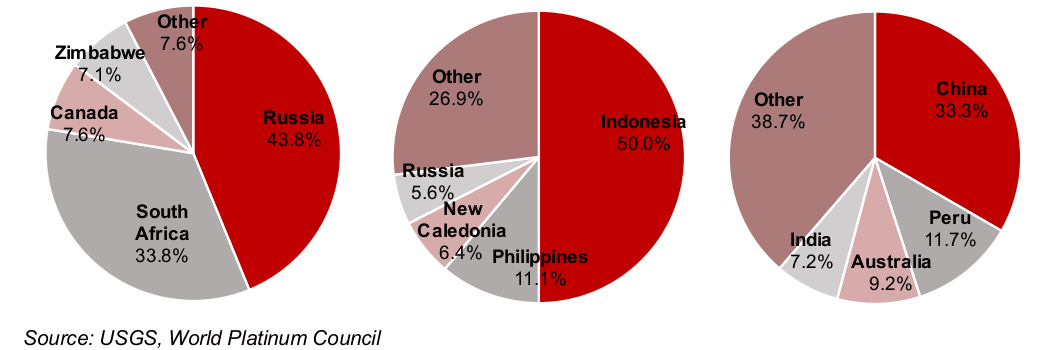

A look at metals production by country shows where tariffs may fall most heavily on

the sector. While countries in the North American trading block, Canada and Mexico,

could receive preferential access to the US market, even they are unlikely to be totally

exempt from tariff increases, and countries outside this region could face more

pressure. This could partly explain the large declines in copper, silver, platinum and

zinc, which have a large proportion of their production from countries that could face

higher tariffs on their exports of these products to the US (Figures 2, 5, 6, 9).

However, this does not seem to be the entire story, as several other metals, including

iron ore, aluminum and nickel (Figures 1, 3, 8), ranged from near flat to down about a

percent, even though they have a large proportion of production from countries

unlikely to receive favourable trade conditions from the US. Of three largest industrial

metals markets, iron ore, aluminum and copper, which are the bellwethers for

economic growth, only the latter faced a significant decline. This suggests that the

markets may not expect the Trump win and potentially heightened trade tensions to

heavily drive down broader global growth, but that they could cause issues that hit

some specific metals markets more heavily.

The gold decline was around the middle of the metals sector performance, with the

spot price down -2.2%, slightly more than the -1.9% drop in the futures price. Partly

this will have been driven by the rise in the US dollar and yields, with gold tending to

move inversely to both. However, there may also have been a decline in the risk

premium priced into gold, especially from rising geopolitical tensions, with

uncertainty greatly reduced given the increased clarity on the political direction of one

the world’s most influential countries. The previous Trump administration also

oversaw a period where there were far fewer major international conflicts than there

are currently, and the markets may expect more of the same starting next year.

US and Canada trade heavily intertwined

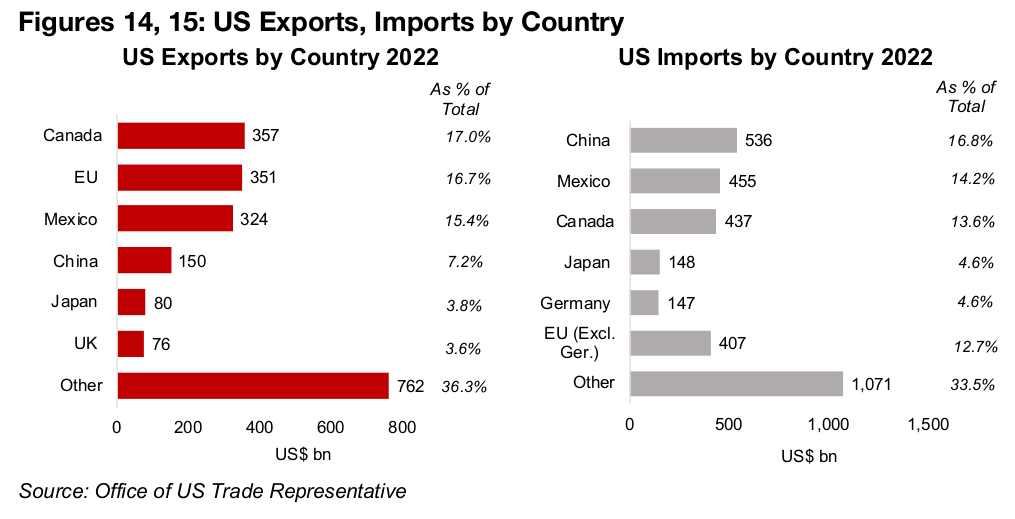

We expect that Canada may be able to gain relatively preferential trade conditions with the US, even given an overall likely tightening of restrictions, with the economies of the two countries heavily intertwined. Even through Canada’s economy is relatively small in the context of global giants like the EU or China, it is still the number one destination for US exports, at 17.0% of the total in 2022, and is the third largest source of US imports, at 13.6% of the total (Figures 14, 15).

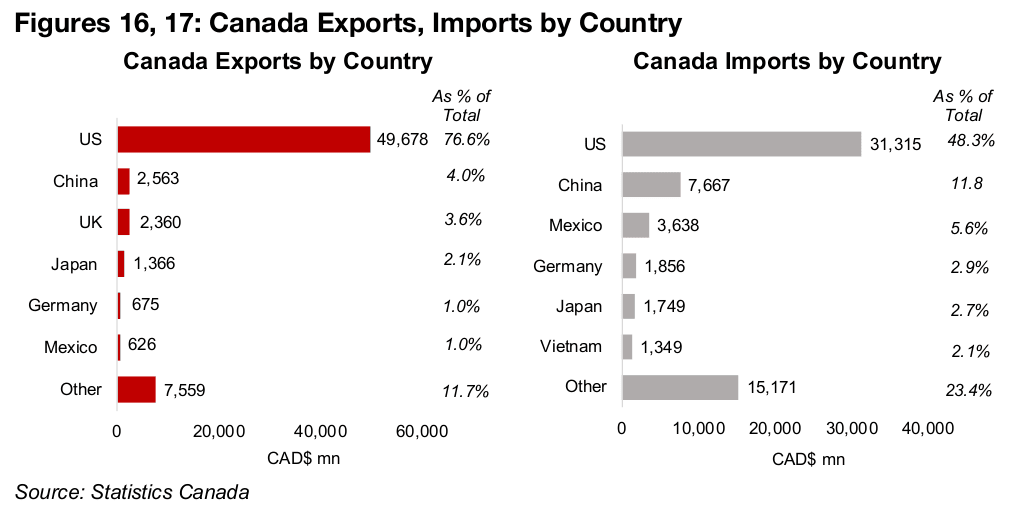

The US is also by far Canada’s largest trading partner, at 76.6% of exports and 48.3% of imports (Figures 16, 17). The countries therefore do have significant incentives from both sides, even though the US economy is far larger, to maintain amicable trade relations. This contrasts with China, for example, which is only the fourth largest destination for US exports, but the largest source of US imports, which could potentially see the US move to see this trade become more balanced.

US a major market for Canadian mineral exports

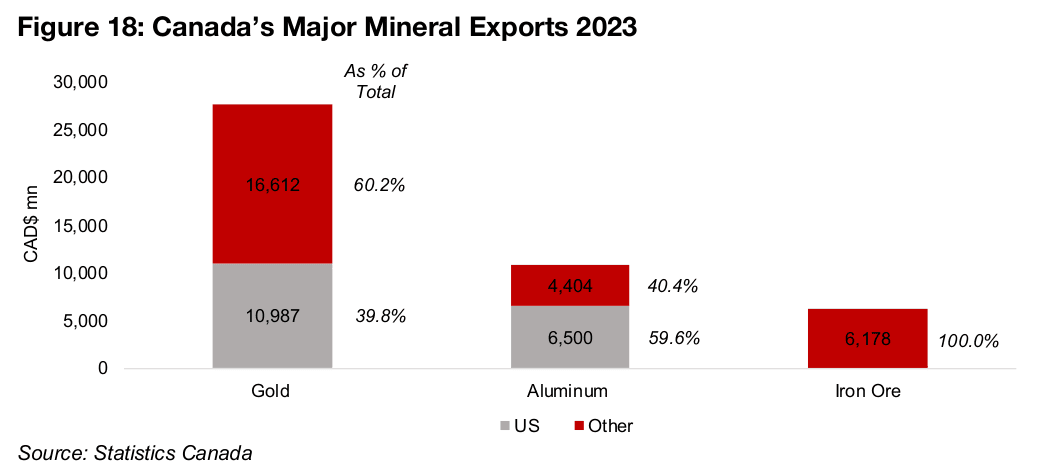

For metals specifically, the US is a major market for Canadian exports. The two largest metal exports from Canada by value are gold and aluminum, of which the US accounted for 39.8% and 59.6% of the total in 2023, respectively (Figure 18). However, the US is not a major destination for all of Canada’s major metals exports, with iron ore exports 100% to other countries.

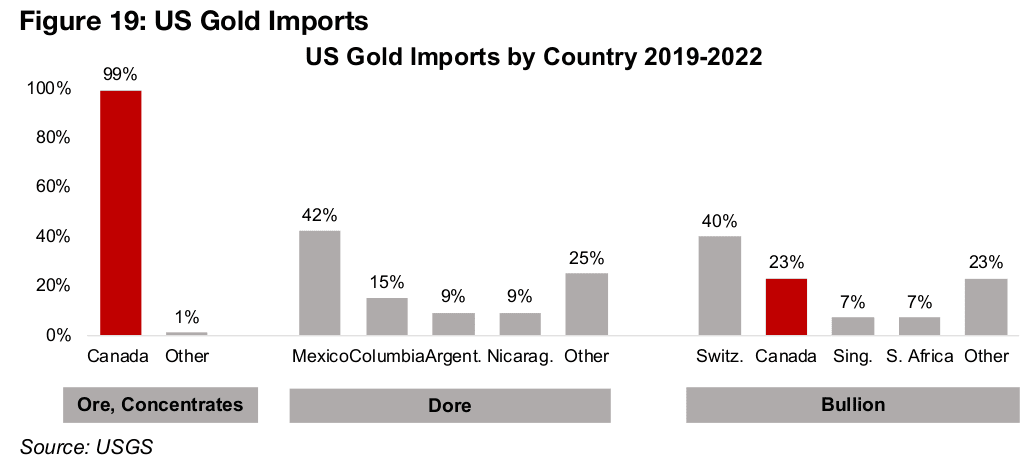

The proportion of US imports by metal shows a major contribution from Canada. For

gold, Canada accounted for nearly all US ore and concentrate imports, at 99%, and

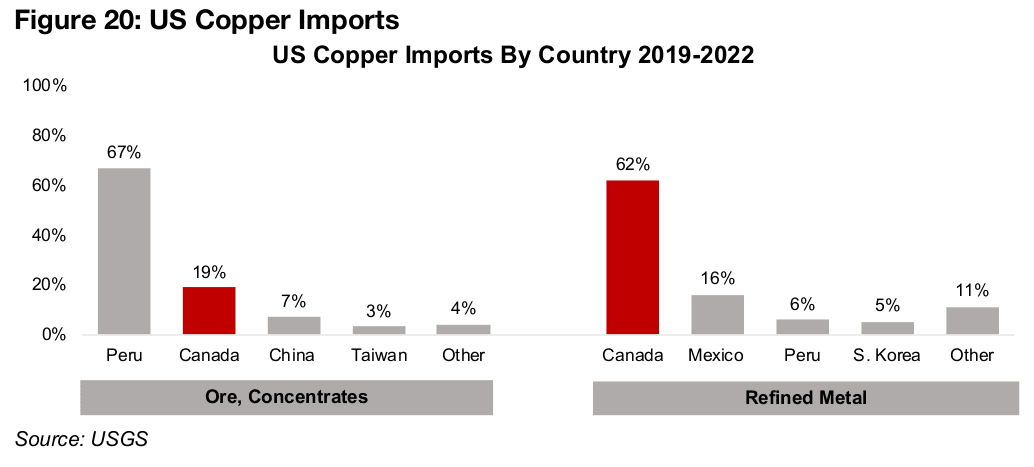

was the second largest source of bullion imports, at 23% (Figure 19). For copper,

Canada was the second largest source of ore and concentrates, at 19%, and number

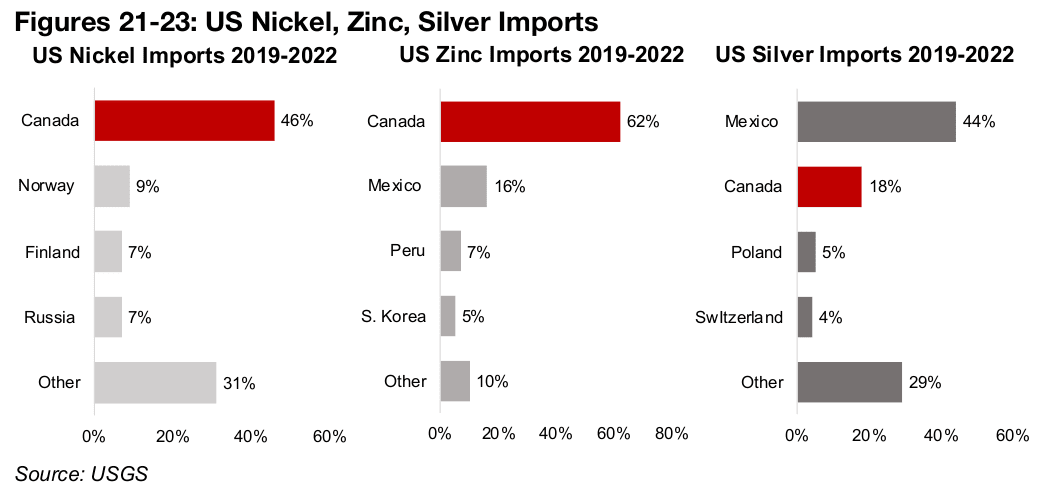

one for refined metal, at 62% (Figure 20). Canada was also by far the largest source

of US nickel and zinc exports, at 46% and 62% of the total and the second largest

source of silver imports, at 18% of the total (Figures 21-23).

The increases in US tariffs are more likely to fall on manufactured goods that compete

heavily with domestic production, with China specifically targeted by the new

administration. Canada’s metals exports to the US may be less affected, as there are

no major tariffs on gold imports and the large copper, nickel, zinc and silver imports

would likely all be considered critical to growth and less likely to fall under scrutiny.

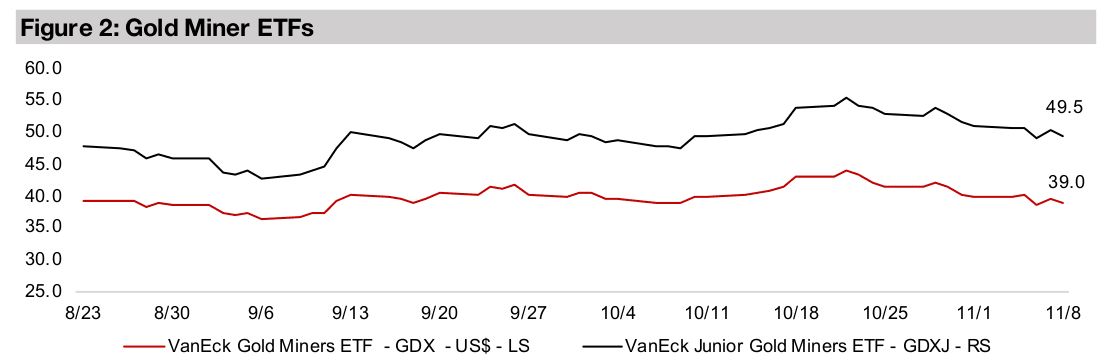

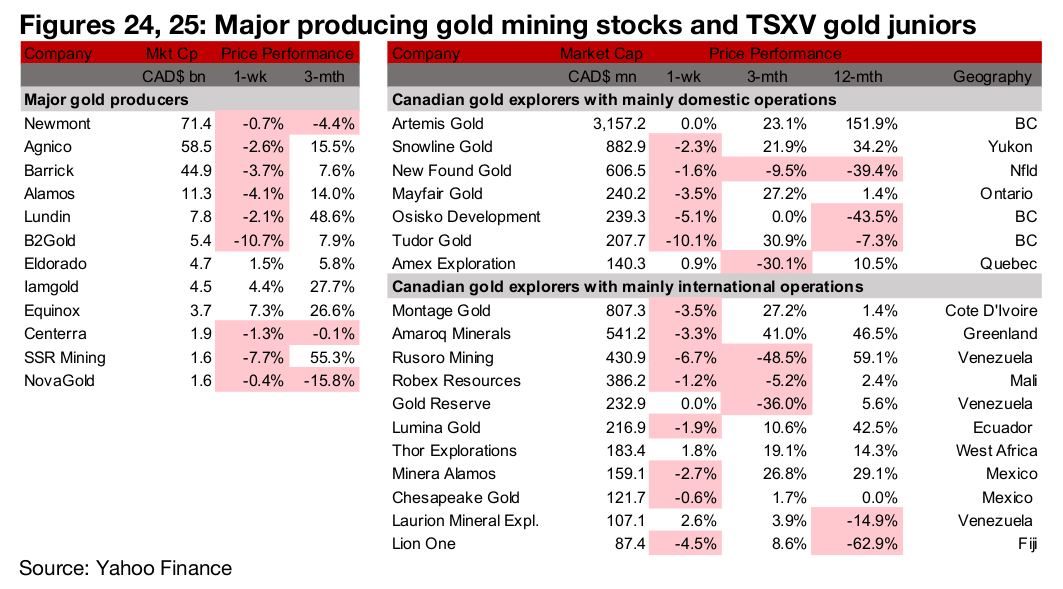

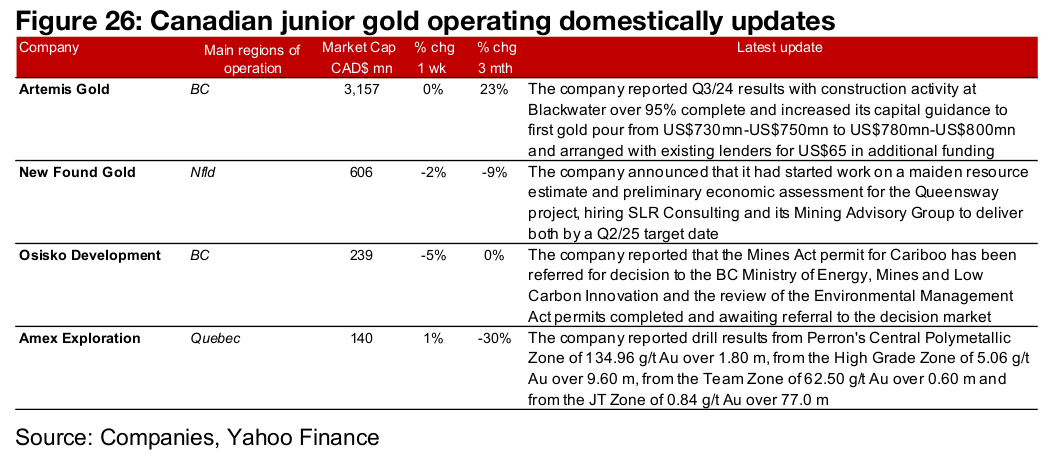

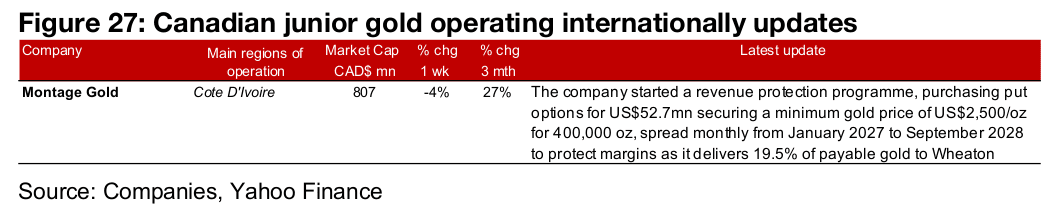

Large producers and TSXV gold mostly down

The large producers and TSXV gold were mostly down on the decline in the gold price (Figures 24, 25). For the TSXV gold companies operating domestically, Artemis reported Q3/24 results, New Found Gold announced the start of work on a maiden resource estimate and PEA for Queensway, Osisko Development reported progress in permitting for Cariboo and Amex Exploration reported drill results from Perron (Figure 26). For the TSXV gold companies operating internationally, Montage Gold started a revenue protection program through the purchase of gold put options (Figure 27).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.