June 17, 2024

Metals Pullback Continues

Author - Ben McGregor

Gold gains on lower than expected US inflation

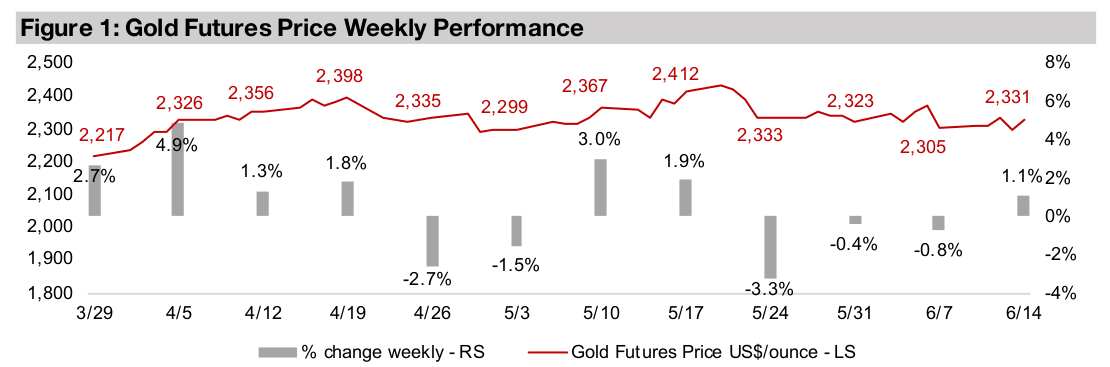

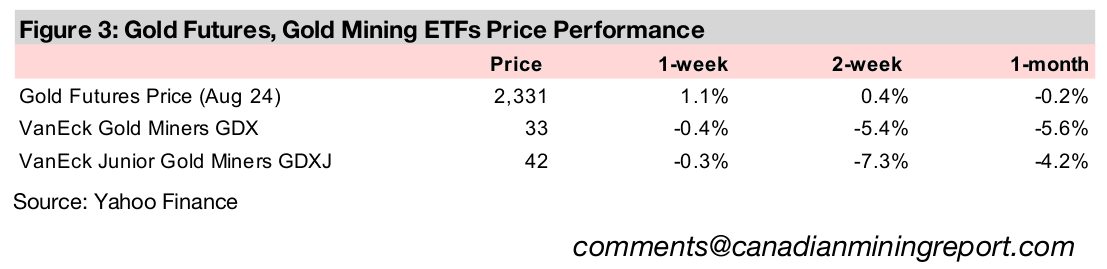

Gold rose 1.1% to US$2,331/oz, even as many other metals continued to pull back, as US inflation came in lower than expected and the Fed maintained interest rates at its policy meeting, with the probability dropping to just 10% for July 2024 rate cuts.

Metals Pullback Continues

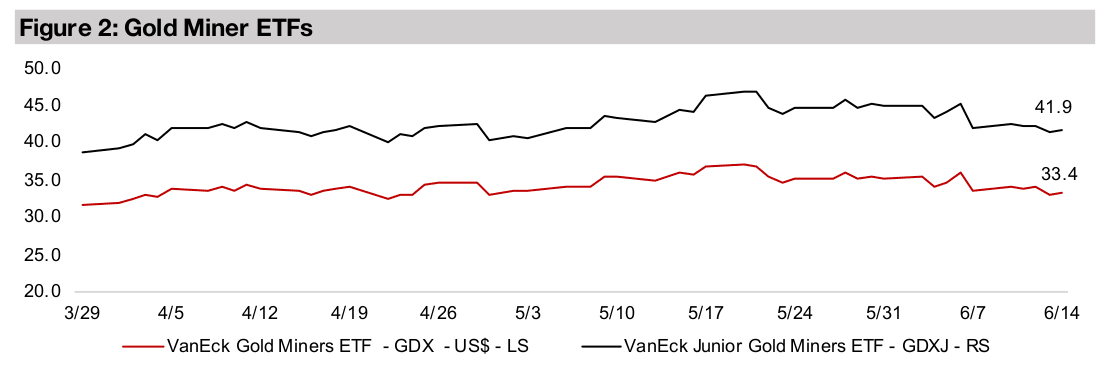

The gold price rose 1.1% to US$2,331/oz, outperforming a continued decline in many other major metals, as the Fed kept rates on hold at its policy meeting but US inflation came in lower than expected. This drove back up market expectations for rate hikes after they dropped last week on a strong US jobs report. While large cap US equity gained, this was concentrated in tech, with a 3.5% surge in the Nasdaq the main driver of the 1.7% rise in the S&P 500, while many other major sectors declined. Small caps struggled for a second week, with the Russell 2000 dipping 0.30%. Overall the equity weakness outside of tech offset the gain in gold and pulled down gold stocks, with the GDX off -0.4% and GDXJ losing -0.30%.

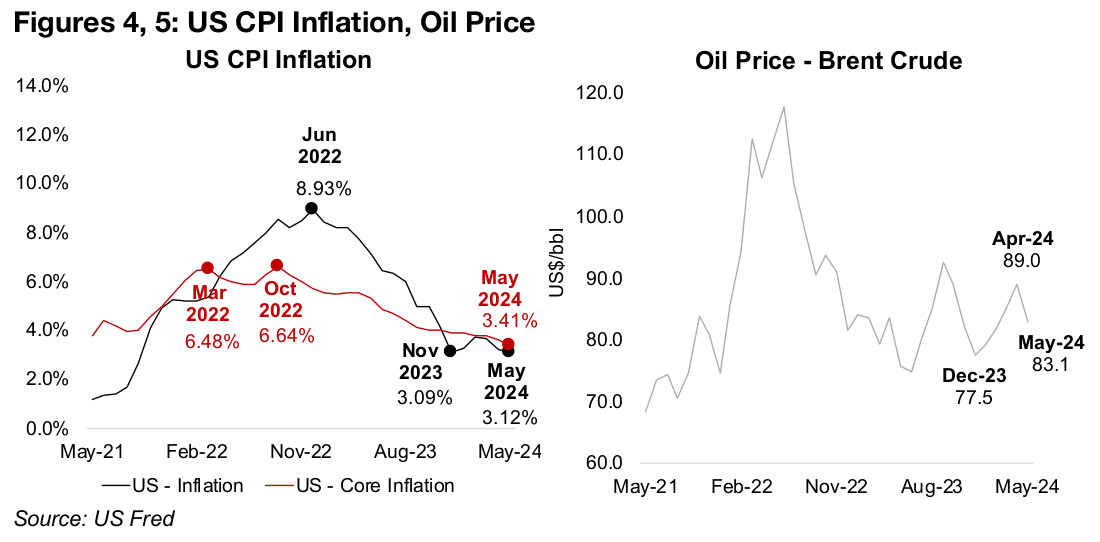

Inflation rebound continues to reverse

US headline CPI inflation was just 3.12% in May 2024, back near three-year lows of

3.09% from November 2023 (Figure 4). The last two months have reversed a pickup

in the measure from December 2023 to a 3.80% March 2024 peak which caused

concerns of an inflation resurgence. The gain had been driven by a rise in oil over the

first four months of 2024 and its price pulled back significantly in May 2024 (Figure 5)

There was no similar rise in core inflation, which has steadily declined off a 6.64%

October 2022 peak, reaching 3.41% in May 2024, levels not seen since April 2021.

However, the Fed remains on cautious on cuts with inflation still above it 2.0% target.

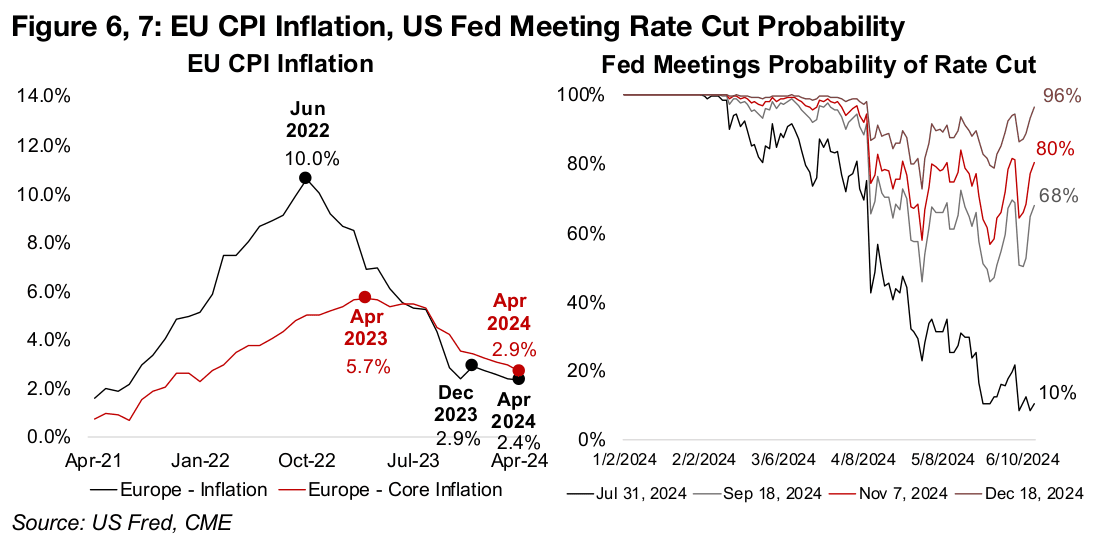

European headline inflation has also declined, after a jump to 2.9% December 2023,

to 2.4% in April 2024, levels not seen since July 2021 (Figure 6). EU Core inflation has

trended down from a peak of 5.7% in April 2023 to 2.9% in April 2024, but is still

above the ECB’s target rate, which, like the Fed, is 2.0%.

The market’s expectations for at least one 25 basis point rate cut by the Fed at the September, November and December 2023 meetings jumped on the inflation news. They returned to levels near those prior to a slump last week on the strong US jobs report, at 68%, 80% and 96%, respectively for the three meeting (Figure 7). The market does not expect a July 2024 meeting cut, with the probability at just 10%.

Relatively flat gold contrasts with slump for many other metals

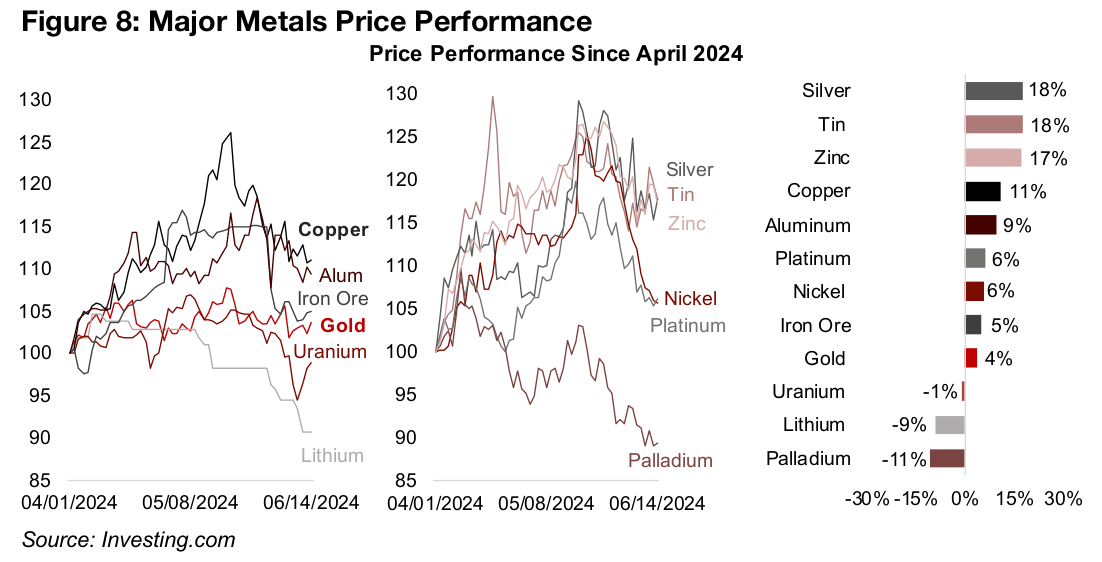

The gold price outperformed many of the major metals this week, especially those driven mainly by the industrial cycle, which declined for a third week in a continued pull back from a speculative ramp up that started in April 2024. While most of these metals are still up strongly for the year, copper, aluminum, nickel and zinc are down -12%, -6%, 16%, and -6%, respectively, off their May 2024 highs (Figure 8).

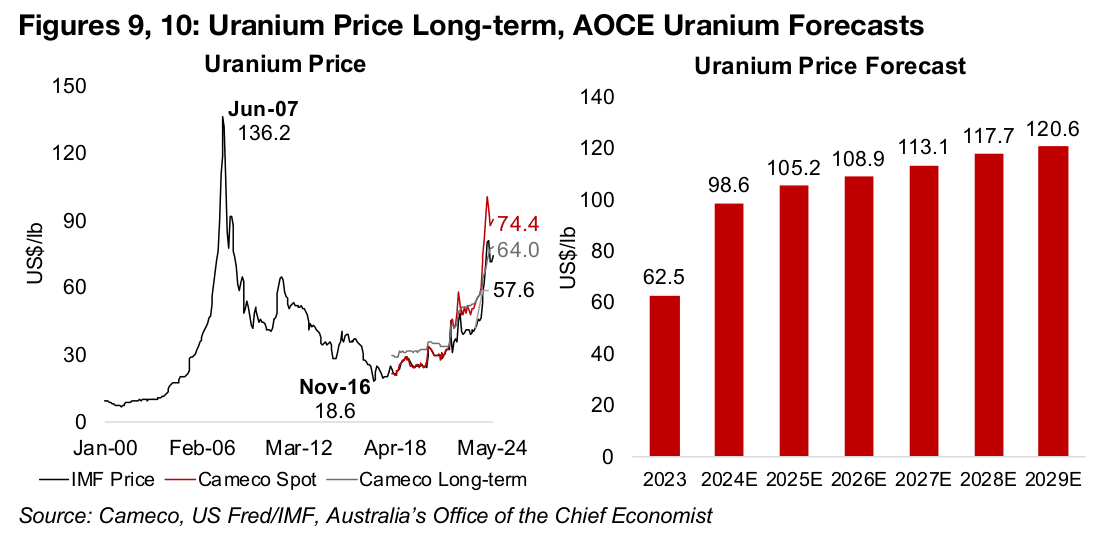

In Focus: Atha Energy

While the slump in the industrial metals has also pulled down the uranium price, it has fallen less than this group over the past two weeks as it did not participate in the speculative jump since April 2024, having roughly tracked the performance of gold. The uranium price also saw a rebound over the past week in contrast to most of other major metals, and is now near flat for the year, down just -1.0%. Longer-term the price has been in a strong uptrend, having more than quadrupled off lows of US$18.6/lb in late 2016 (Figure 9). This has been driven by a broader secular trend of increased support for nuclear power, especially as part of the green energy transition.

Australia’s Office of the Chief Economist forecasts that uranium will have another

strong year in 2024, rising 58%, and then continue a more gradual rise through to

2029 (Figure 10). While this in keeping with a continued strong secular strong upswing

for the industry, we still see some risk of a shorter-term cyclical downturn, which

could potentially hit the uranium price if an economic slowdown reduces demand

from all energy sources, including nuclear.

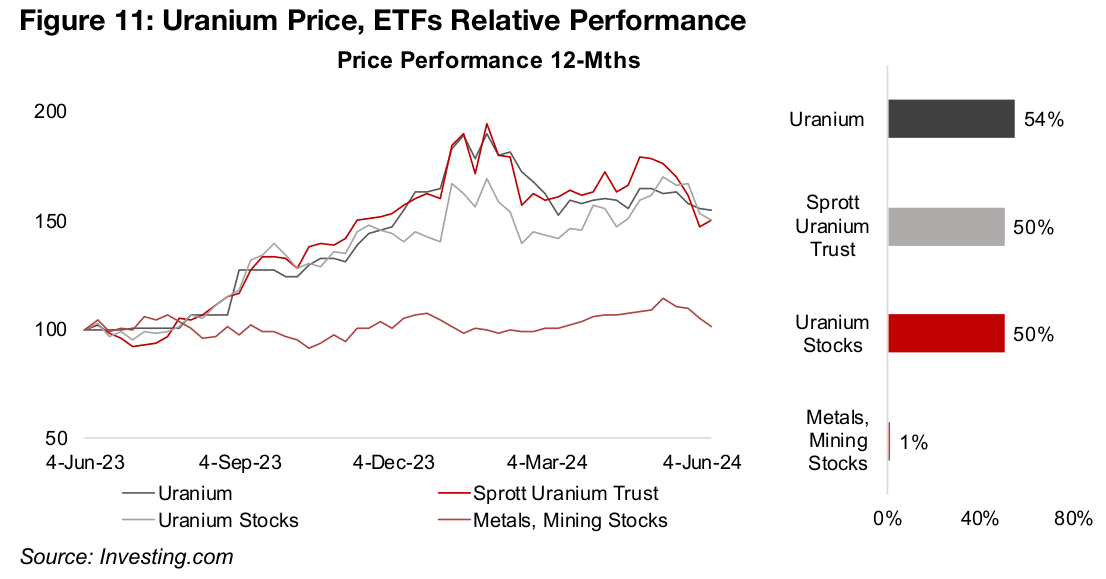

Over the past twelve months key investment vehicles for the uranium industry have

performed well. The 54% gain in the uranium price has been reflected in a 50% gain

in the Sprott Physical Uranium Trust, which is backed by physical holdings of uranium

(Figure 11). The rise in the metal price has also supported the large cap uranium

stocks, with the Sprott Uranium Miners ETF also gaining 50%. The uranium stocks

have substantially outperformed mining equities overall, with the MSCI Metals and

Mining ETF near flat. While the gains in these assets were mostly concentrated in the

second half of 2023, and their performance has flattened so far in 2024, some

consolidation could be expected given a huge seven year run in the uranium price.

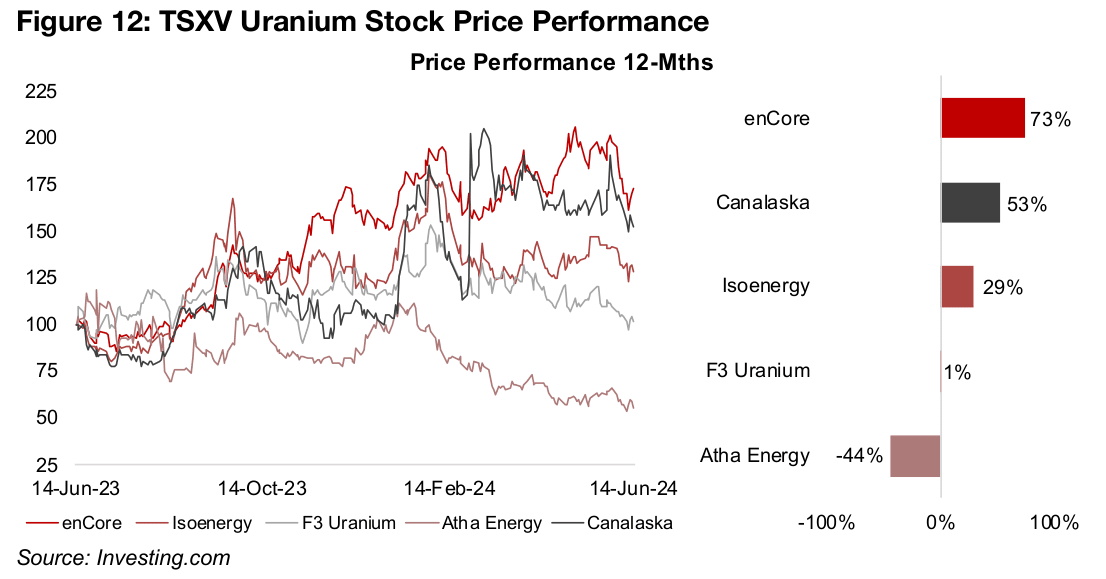

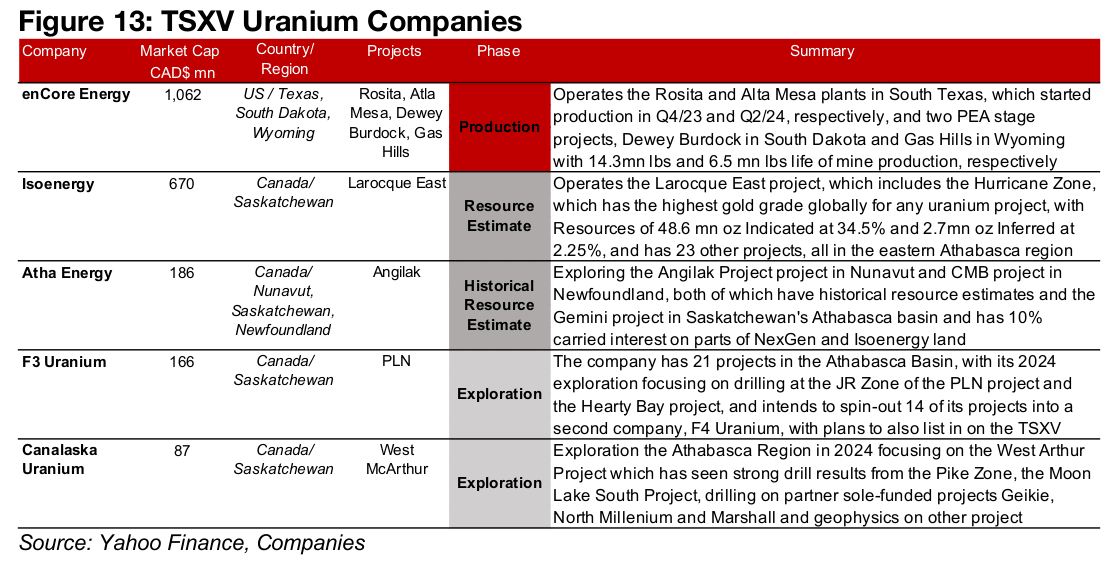

While the rise in uranium has propelled three of the five largest market cap TSXV uranium stocks over the past year, with enCore Energy, Canalaska Uranium and Isoenergy up 73%, 53% and 29%, respectively, two have still lagged, with F3 Uranium near flat, and Atha Energy down -44% (Figure 12). EnCore stands out for a large market cap and its US-based projects already in production. The rest of the companies are focused mostly on the Athabasca region of Saskatchewan with two having resource estimates for projects, Isoenergy and Atha Energy, and two in earlier stage exploration, F3 Uranium and Canalaska Uranium (Figure 13).

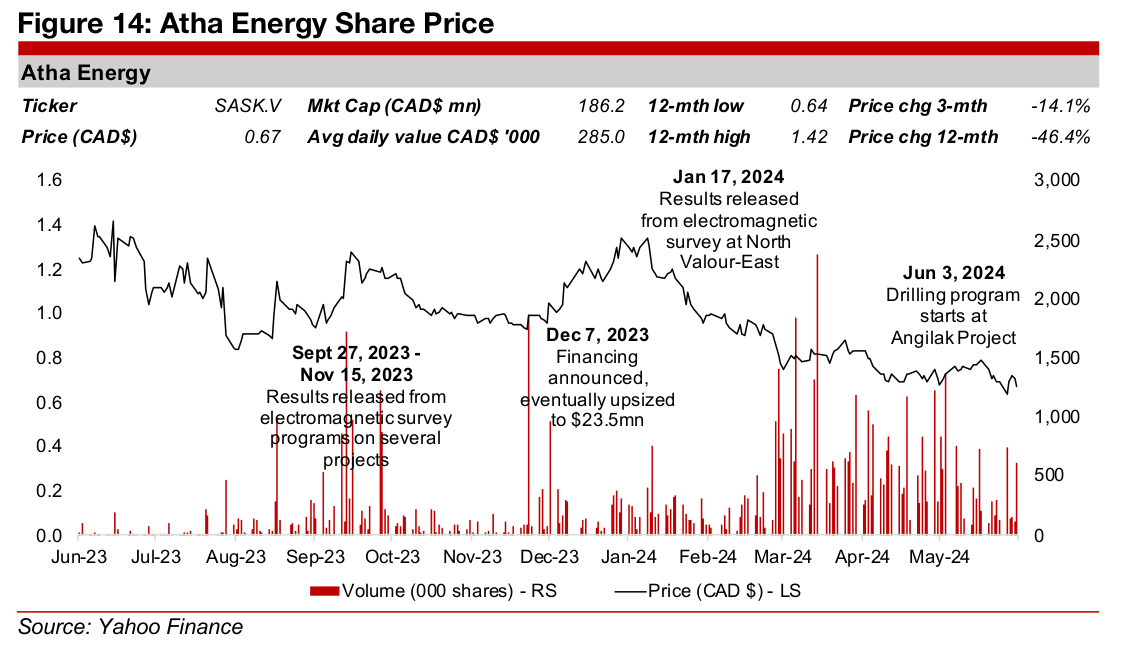

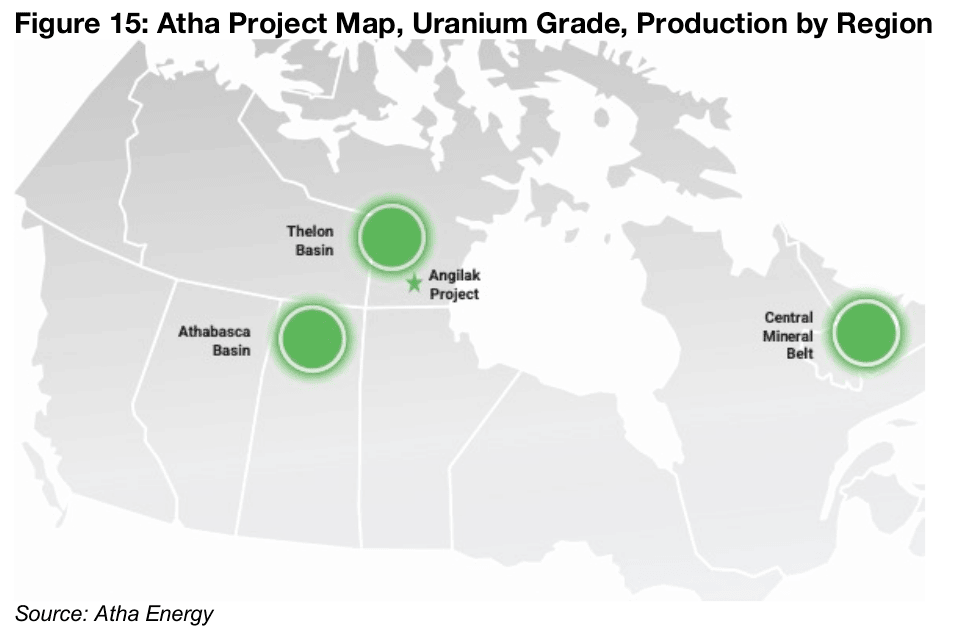

Atha Energy is a relatively new stock, having only listed on April 11, 2023, and its price has struggled over the past year as news flow has been limited mainly to the results of electromagnetic surveys from several projects and a financing in December 2023 (Figure 14). However, the company could see share price drivers in the form of results from a drill program started in recent weeks at the Angilak Project, which has a historical resource estimate 43.3 mn lbs U3O8. The project is based in Nunavut, where Atha sees further potential in the uranium rich Thelon Basin (Figure 15).

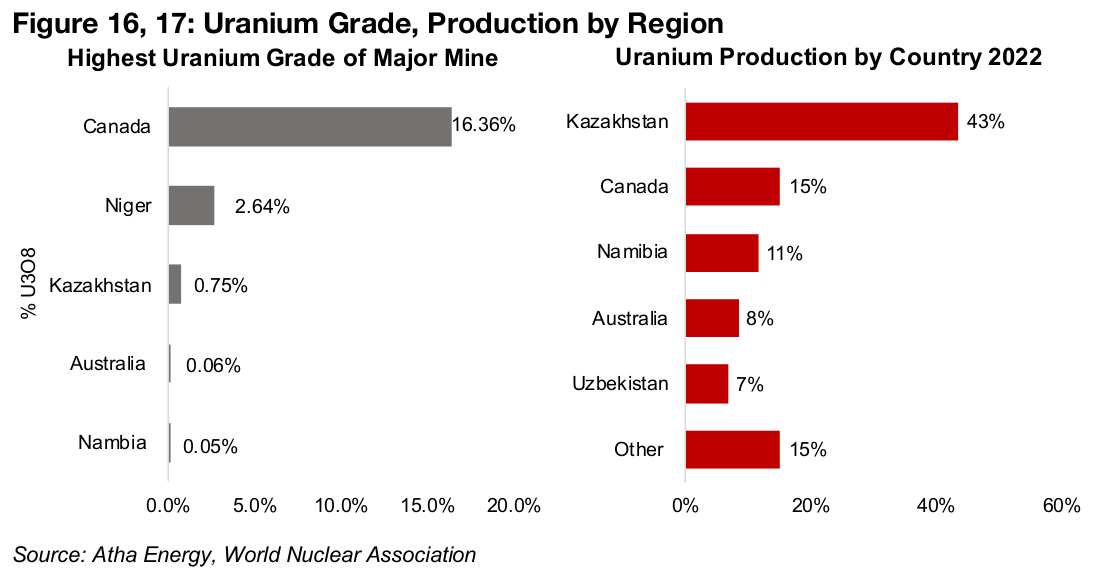

The company also plans to explore in two other areas with strong potential for uranium discoveries, at the Central Mineral Belt project in Newfoundland, which has a historical resource estimate of 14.5 mn lbs U3O8 and at its Gemini project in the Athabasca region. Canada has the highest uranium grade globally for a major mine from the Athabasca, at 16.36%, far ahead of the next highest Niger, at 2.64% (Figure 16). Demand for, and investment into, new uranium discoveries looks set to be high for Canada, which was the second largest global producer after Kazakhstan in 2022, with it the most politically secure source of supply for the US (Figure 17).

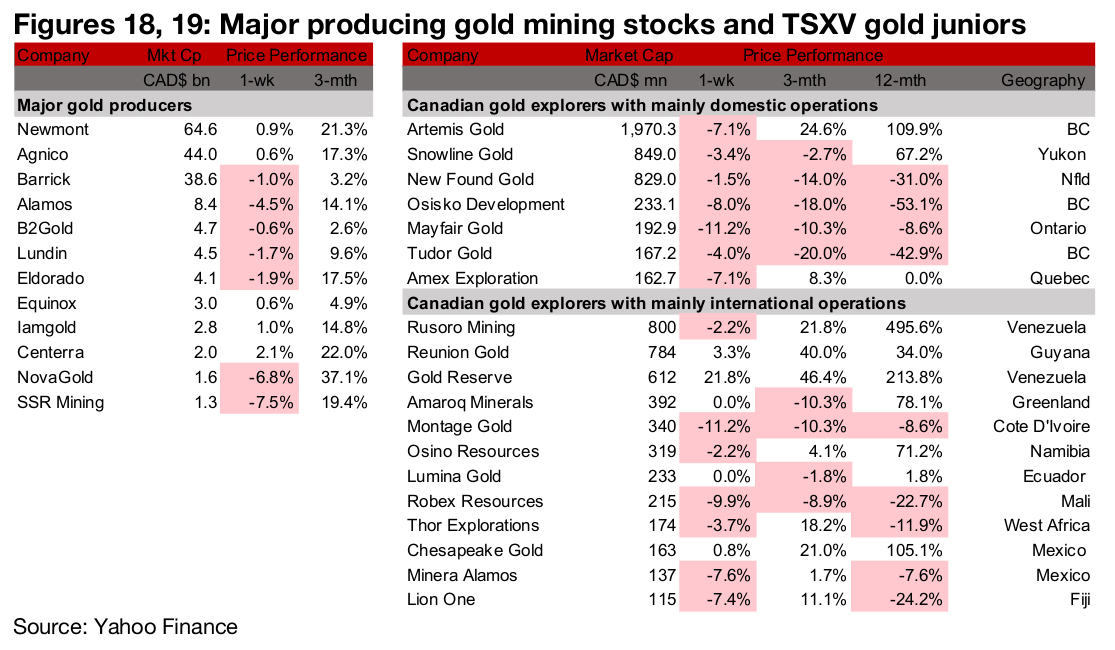

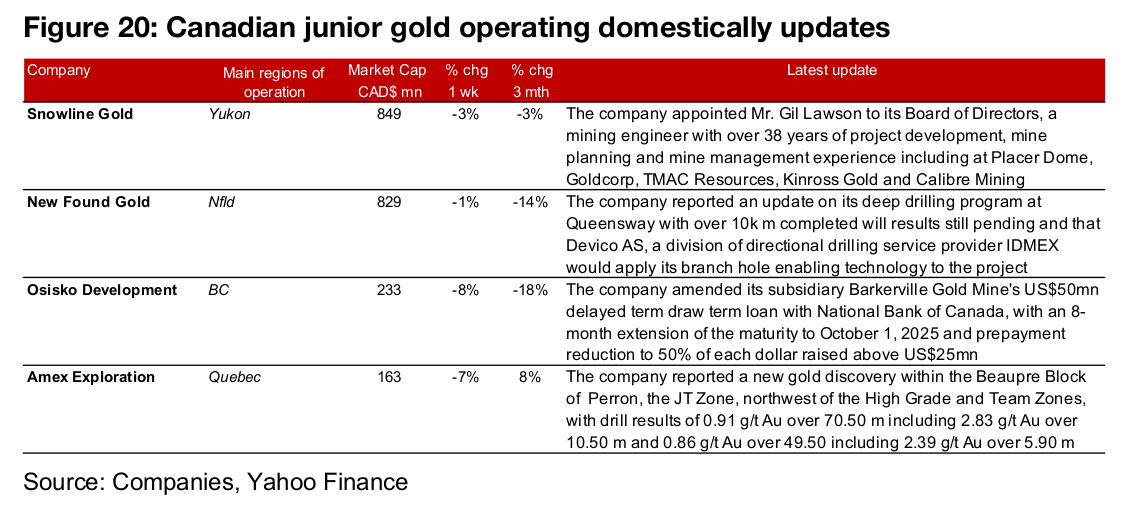

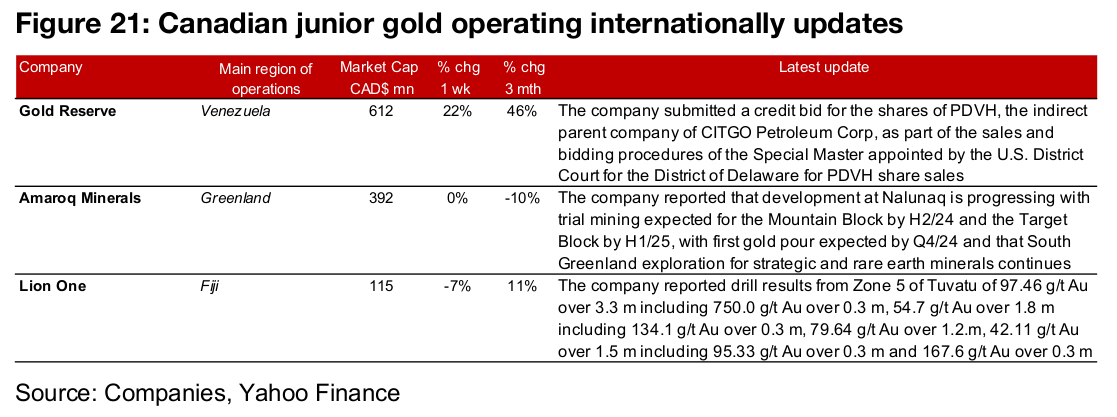

Major gold producers mixed and most TSXV large gold gain

The major gold producers were mixed and the majority of the TSXV gold stocks gained (Figures 18, 19). For the TSXV gold companies operating domestically, Snowline Gold appointed Mr Gil Lawon to its Board of Directors, New Found reported an update at its deep drilling program at Queensway and that Devico AS will provide directional drilling services for the project. Osisko Development subsidiary Barkerville Gold amended its loan with National Bank of Canada and Amex Exploration reported a new gold discovery at the JT Zone within the Beaupre Block of Perron (Figure 20). For the TSXV gold companies operating internationally, Gold Reserve submitted a credit bid for the shares of PDVH, Amaroq Minerals reported development progress at Nalunaq and continued exploration in South Greenland for strategic and rare earth minerals and Lion One reported drill results from Zone 5 of Tuvatu (Figure 21).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.