December 26,2022

Metals Price Forecasts for 2023

Author - Ben McGregor

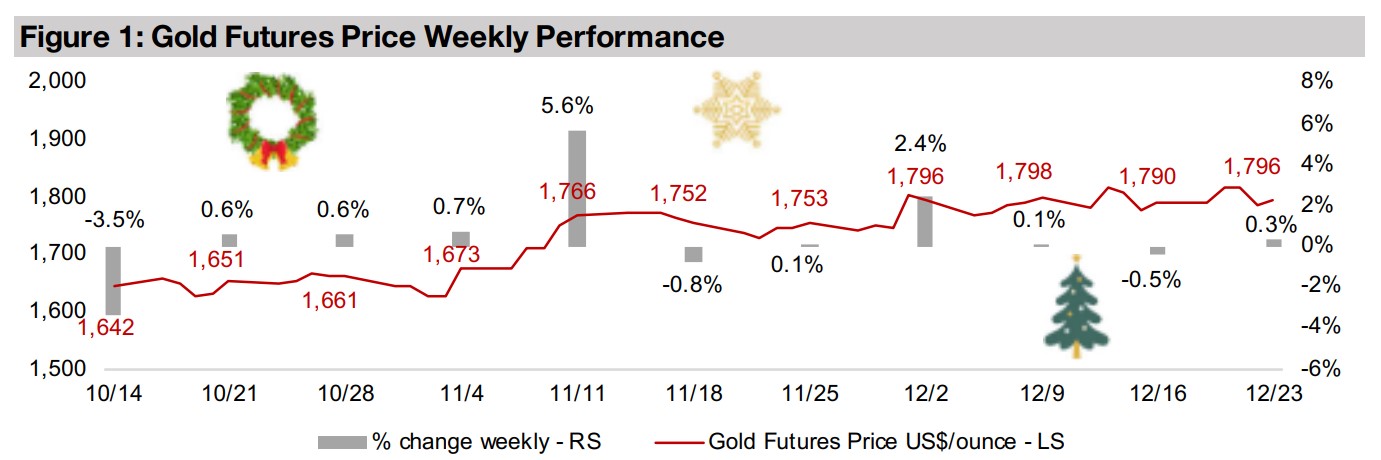

Gold near flat on limited major economic news flow

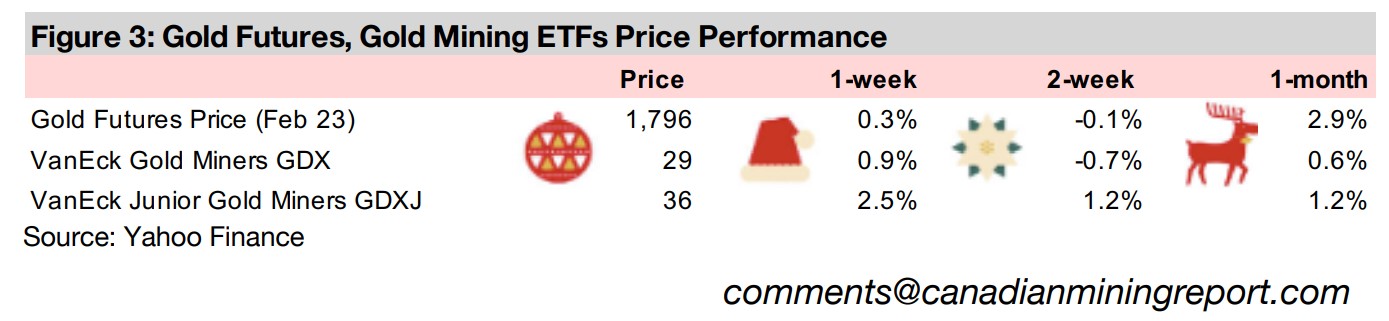

Gold was near flat this week, up just 0.3% to US$1,796/oz as there was limited major economic news flow especially in contrast to a series of material announcements that had been made over the past several weeks, driving equity market volatility.

Metals price forecasts and TSXV Top 10 Gold shifts

This week we look at metals price forecasts for 2023, with expectations for a broad decline, with precious metals outperforming base metals, and the shifts in the TSXV Top 10 Gold stocks by market cap from January 2022 to December 2022.

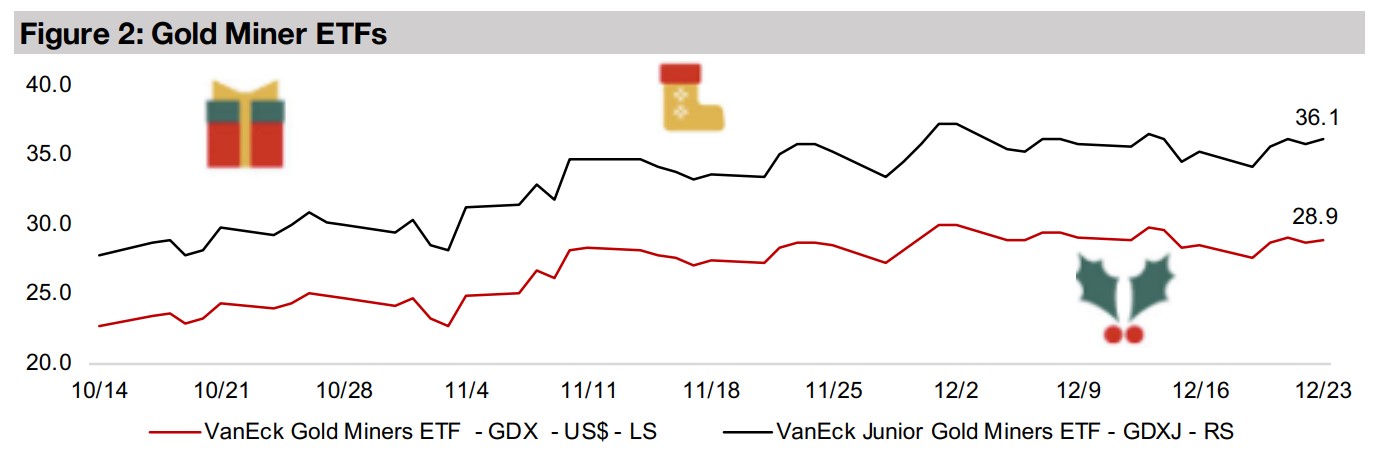

Producers and junior gold up even on flat gold and equity markets

The producing and junior gold miners rose, with the GDX up 0.9% and GDXJ gaining 2.5% and the larger cap TSXV gold stocks were mixed even as gold only edged up and the equity markets were near flat on limited major economic news flow.

Metals Price Forecasts for 2023

Gold was near flat, up just 0.3% to US$1,796/oz, and equity markets were near flat

as there was limited major economic news flow especially in contrast to the series of

major announcements over the past two months that drove considerable stock

market volatility. The markets will likely remain relatively subdued heading into the

holiday period, although there may be an upwards lilt to the market because of

'window dressing'. This occurs when funds will make some moderate purchases of

the stocks they hold to bump up their prices slightly giving their returns for the year

a small lift and improving their overall performance

It appears that gold will just break US$1,800/oz this year, having averaged

US$1,801/oz, and even a dip in these last few trading days will not drag it down below

this benchmark level, which it has held for a second year, with 2021 averaging exactly

US$1,800/oz. While we didn't make an explicit forecast for gold in 2022, we expected

it to 'hold up' this year, and it has certainly done that. We had also been cautious on

any potential upside for gold, and beyond one brief spike towards US$2,100/oz on

geopolitical risk in March 2022, sustained upside for gold was limited this year.

Metals price performance mixed in 2022 as market distortions continue...

With 2022 now nearly behind us, we can see that the performance of metals prices this year has been quite mixed, especially in contrast to the surge in 2021. Last year almost every major metal was up over 20% or more with gold the only laggard, and even it was up 2%. In 2022, based on averages to November, six of these ten metals declined, with only aluminum, nickel and zinc seeing major gains. These price movements in 2022 are still reflecting market distortions caused by the global health crisis, with certain metals having faced lingering shortages driven by shutdowns even as demand rebounded through 2021 and 2022, causing substantial price spikes.

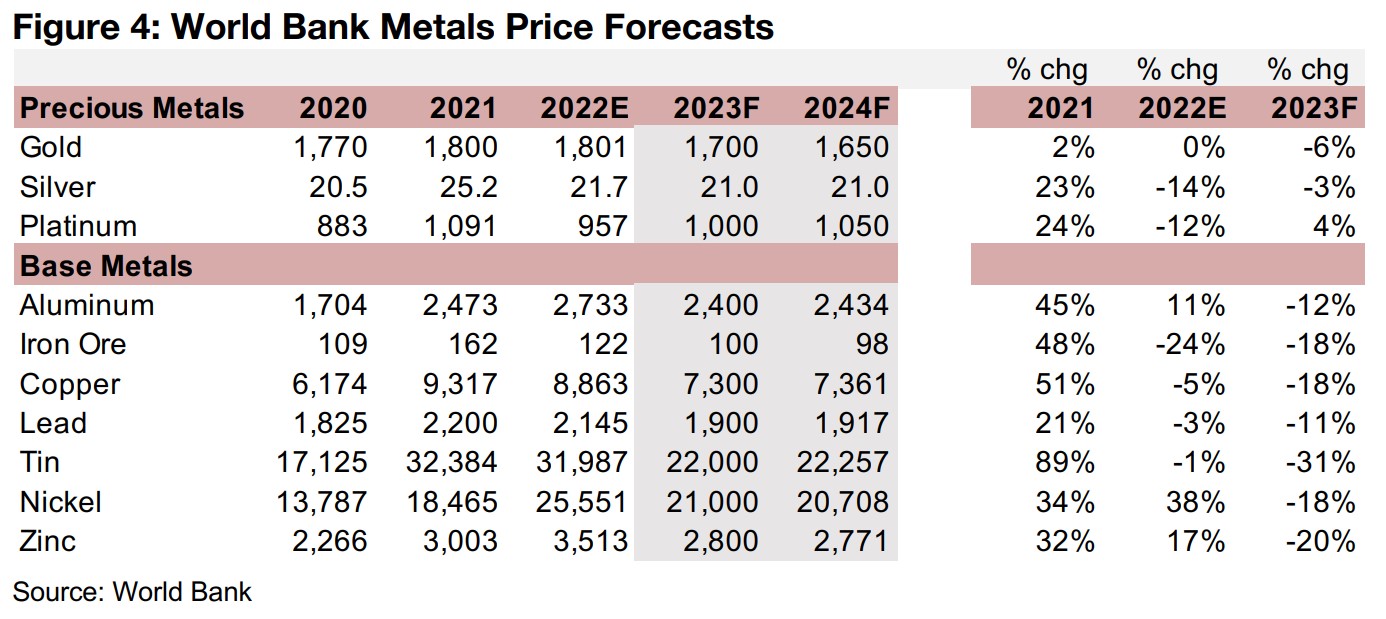

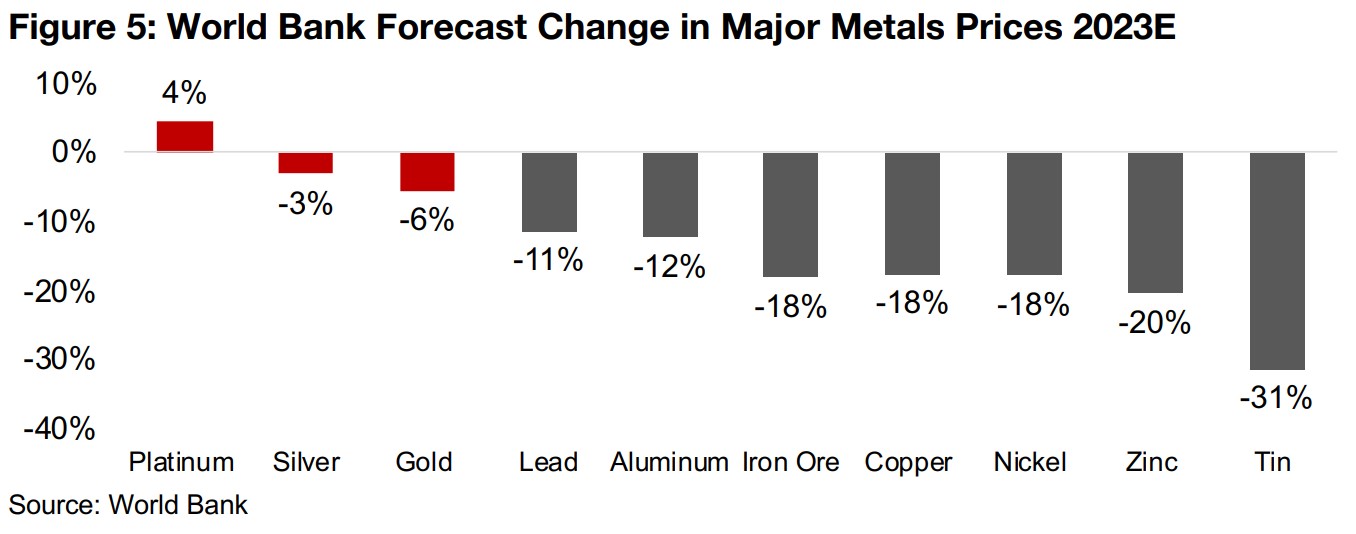

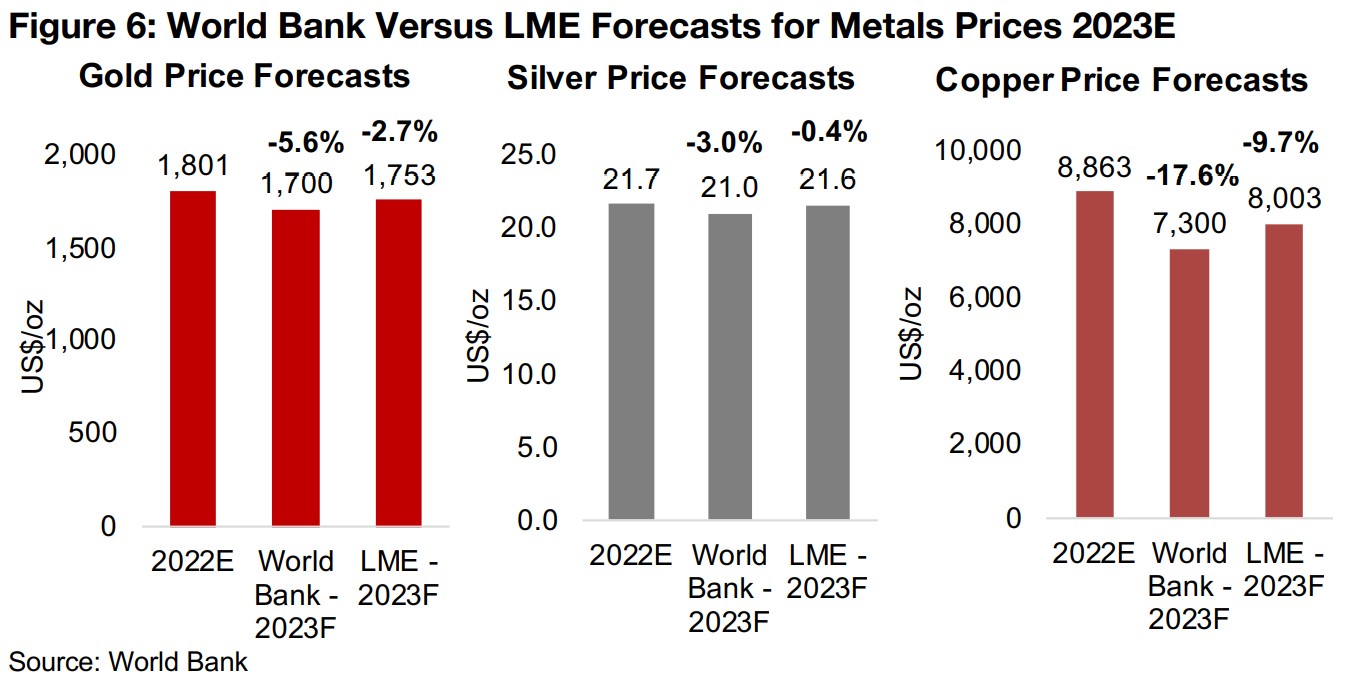

...but metals prices are forecast to decline in 2023

By 2023 it is expected that most of these supply chain distortions will have been largely worked out, and that these metals markets will return to being driven by the 'normal' forces of supply and demand. However, just as the supply side recovers, a major decline in demand is expected in 2023 from a global recession, which is being driven by surging interest rates. The World Bank forecasts that almost all of the major metals' prices will decline, with five base metals down -18% or more and the tin price expected to see the worst performance, dropping -31%. The precious metals are expected to fare slightly better, with gold down -6%, silver down -3% and platinum the only gainer, but only by 4%. These three precious metals have a monetary and risk hedge element to their demand which will support them, and while they are partly driven broader industrial demand, it is not to the high degree of the base metals.

For comparison, we also look at the metals' price forecasts of the London Metal Exchange which also targets a decline for gold, silver and copper, but to a lesser degree than the World Bank. WB has gold, silver and copper down -5.6%, -3.0%, and -17.6% in 2023F, versus -2.7%, -0.4% and -9.7%, respectively, for the LME. Nonetheless, we see a similar general theme, which is an outperformance of the precious metals like gold and silver versus base metals like copper. Overall, it seems to imply that overall risk will be rising and monetary stability still in question with high inflation and rising rates, driving a move towards the inflation and risk hedges of precious metals, while base metals are potentially hit by a global economic slowdown.

Precious versus base metals price spread could widen more than forecast

While we agree with the broad themes of these forecasts for 2023, with precious metals holding up versus the base metals, we believe that there is potential for an even wider spread in the price movement between the two groups. We see a chance that precious metals, especially gold, actually rise next year, as inflation could remain relatively high while the Fed could be forced to pull back on its aggressive monetary stance sooner than expected if both rising unemployment and geopolitical risks continue. At the same time, forces which have already been put in motion this year by the huge rise in interest rates could drive the economy down more than expected, hitting the base metals prices even harder than these current forecasts.

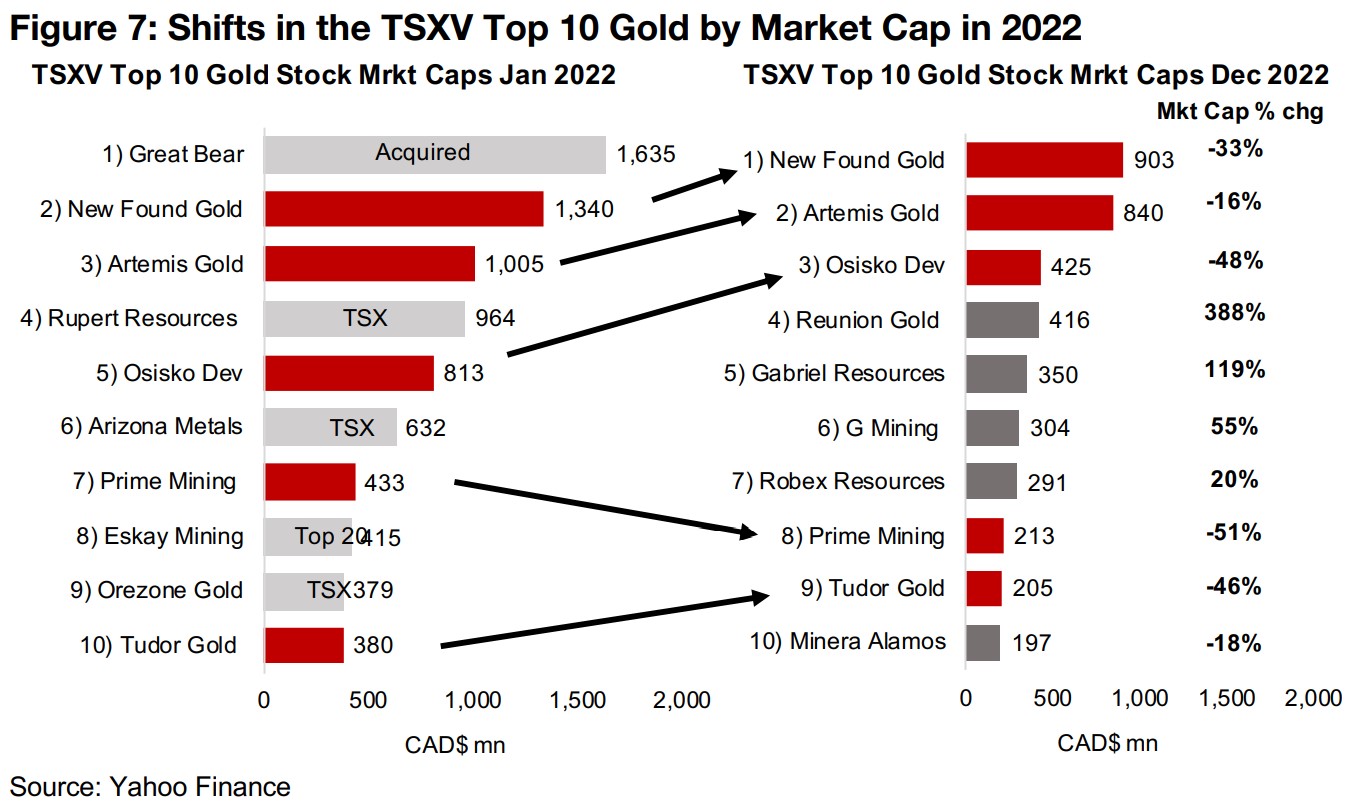

From Jan 2022 Top 10 one acquired, three move to TSX, one drops to Top 20

With the year coming to a close, this week we look at the shifts in the Top 10 TSXV

Gold by market cap over the year, with significant changes in the sector leaders, with

only five of January 2022's Top 10 in the December 2022 Top 10. The number one at

the start of the year, Great Bear Resources, was off the list by February 2022, after

being acquired by Kinross, with the company pre-Initial Resource Estimate but with

strong drill results and continuity across a large project in Ontario (Figure 7).

Three of the Top 10 from January 2022 graduated from the TSXV to the TSX, as their

operations became more established and there were able to meet the stricter listing

requirements of the main exchange. One was Rupert Resources, at number four in

January 2022, operating the Rupert Lapland project in Finland, for which a PEA was

released in November 2022, and it was one of the largest of the TSXV gold stocks,

before moving to TSX in December 2022. Arizona Metals, number six at the start of

2022, also graduated to the TSX this year in October, after continued strong drill

results from the exploration stage Kay Mine gold-copper-zinc project in Arizona.

While we include Orezone Gold in January 2022, it actually moved to the TSX at the

very end of December 2021, driven by an advanced development project at the time,

Bombore in Burkina Faso, which continued to progress over the past year and

entered commercial production in December 2022. While Eskay Mining, at the

exploration stage in BC, dropped out of the Top 10, it is still in the Top 20.

Five companies remain in the Top 10 since January, with four moving up

Five of the companies from January 2022 remain in the Top 10 as of December 2022,

and four of these have moved up in position. The January 2022 number two, New

Found Gold has moved to number one in the absence of Great Bear. The company

is developing the Queensway project, which has the highest consistent grades of the

large TSXV gold stocks and increasing evidence of continuity. As with Great Bear,

the company has held off on an Initial Resource Estimate so far as the project

continues to expand to more zones, and it looks like a potential takeover target.

However, the company's market cap it still down -33% this year as investors have

become increasingly risk averse, and earlier stage exploration companies, even those

with particularly impressive drill results like New Found Gold, are getting hit as the

market is looking for increasingly more concrete evidence to support valuations, at

least an Initial Resource Estimate, if not a PEA or Feasibility Study.

Number two Artemis has risen from number three in January, with its Blackwater

project in British Columbia, one of the largest of the TSXV gold stocks, at a very

advanced stage, having secured financing and already started the early stages of

construction. The advanced stage of Blackwater helped support Artemis' share price,

which is down just -17%, considerably ahead of several companies in the Top 10 still

at the exploration stage. The third largest market cap stock, Osisko Development, is

down -48 even though it had three projects in production this year. However, this was

only test mining at Bonanza Ledge in BC, part of the PEA-Stage Cariboo project,

which was completed, and at Tintic in Utah, which the company acquired this year.

There was also processing of a stockpile from San Antonio, which is at the Initial

Resource Estimate stage. Prime Mining, at the exploration stage for its Los Reyes

project in Mexico, has dropped from seventh to eight place, and is down -51% even

as it delivered strong drill results throughout the year. Tudor Gold declined -46% but

rose from tenth to ninth place and is at the Initial Resource Estimate stage for its

Treaty Creek project in BC and reported moderate grade drill results in 2022.

Five newcomers to the TSXV Top 10 Gold companies

Five new stocks entered the Top 10 since January 2022, with the biggest gainer

Reunion Gold, up 388% to fourth place, the only one of the Top 10 starting the year

around the C$100mn market cap level. The company operates Oko West in a

historically prolific gold belt in Guyana, which is at the exploration stage and surged

over 2022 on very high-grade gold results. Gabriel Resources, the second largest

newcomer, at number five, is up 119%, mainly from progress on its arbitration case

with the UN over its Rosia Montana project in Romania. The project is at a newly

designated World Heritage Site which prevented development, and Gabriel

Resources is expected to receive some compensation for this from the arbitration

tribunal. G Mining Ventures, in sixth place, has seen the second largest gain in market

cap, up 55%, with a Feasibility Study released early in 2022 for its advanced

Tocantinzinho project in Brazil, with the mine in the early phases of construction.

Robex Resources, one of only two companies in the Top 10 in full production, has

reached seventh place with steady output at its Nampala mine in Mali and exploration

at its Kinero project driving up its market cap 20%. The other producer, Minera

Alamos, operating in Mexico, is in tenth place, with its Santana mine in its first full

year of production, limiting its market cap decline to -18%, and the Initial Resource

Estimate-stage Cerro De Oro and PEA-stage La Fortuna projects in development.

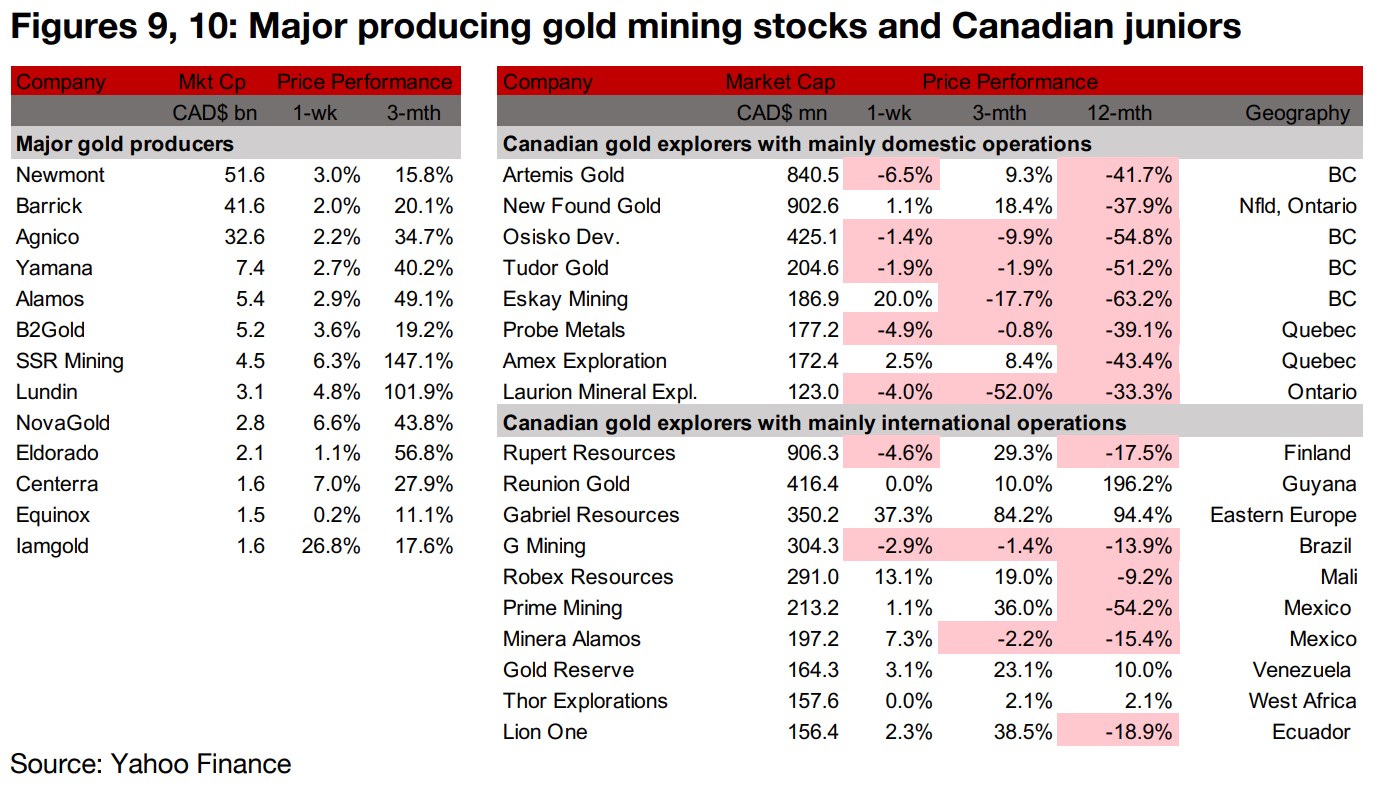

Producers up and TSXV gold mixed as equity markets near flat

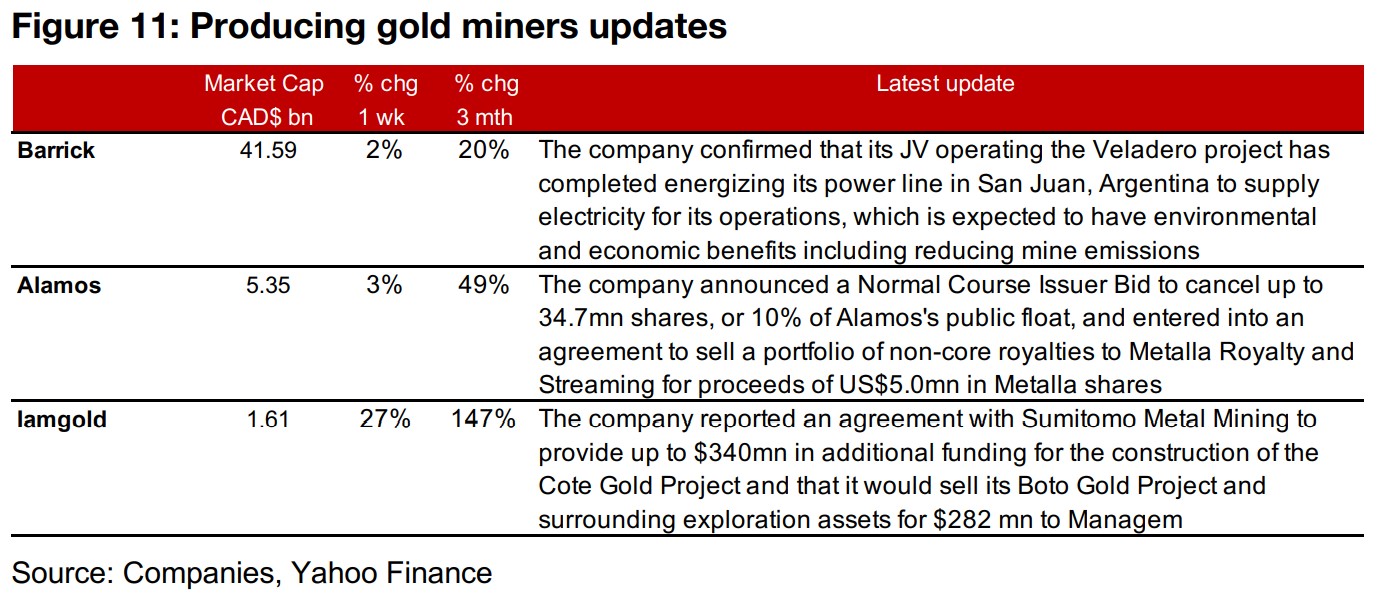

The producing gold miners all rose and the TSXV junior gold miners were mixed as

gold edged up and the equity markets were nearly flat (Figures 9, 10). For the

producing miners, Barrick's JV operating the Veladero project in San Juan, Argentina

completed energizing its new power line. Iamgold reported that Sumitomo Metal

Mining would provide up to $340mn in funding for the Cote Gold project and the sale

of the Boto Gold Project and surrounding exploration assets for $282mn to Managem.

Alamos announced a Normal Course Issuer Bid to cancel up to 10% of its public float

and entered into an agreement to sell a portfolio of non-core royalties to Metalla

Royalty and Streaming for US$5.0 in Metalla shares (Figure 11).

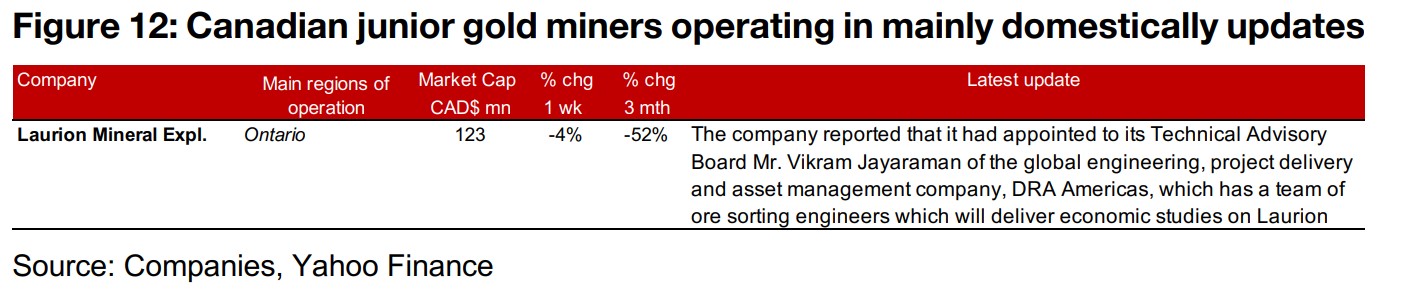

For the Canadian juniors operating mainly domestically, Laurion Mineral Exploration

appointed Mr. Vikram Jayaraman, of global engineering, project delivery and asset

management company DRA Americas, to its Technical Advisory Board (Figure 12).

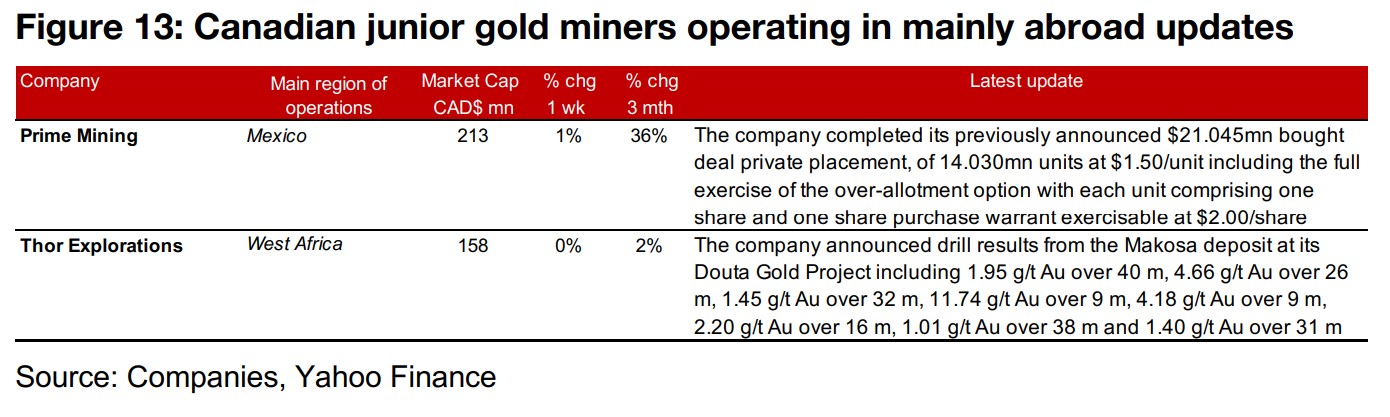

For the Canadian juniors operating mainly internationally, Prime Mining completed its

$21.045mn bought deal private placement of 14.030 mn units at $1.50/unit including

the full exercise of the over-allotment option and Thor Explorations announced drill

results from the Makosa deposit at its Douta Gold project (Figure 13).