June 24, 2024

Metals Diverge After Correlated Decline

Author - Ben McGregor

Snowline Gold reports Initial Resource Estimate

Snowline Gold reported its Initial Resource Estimate for the Valley Deposit of its Rogue Project in the Yukon with 7.2 mn oz of gold at 1.48 g/t Au putting it near the middle of the larger TSXV gold developers in terms of resource size and grade.

Metals Diverge After Correlated Decline

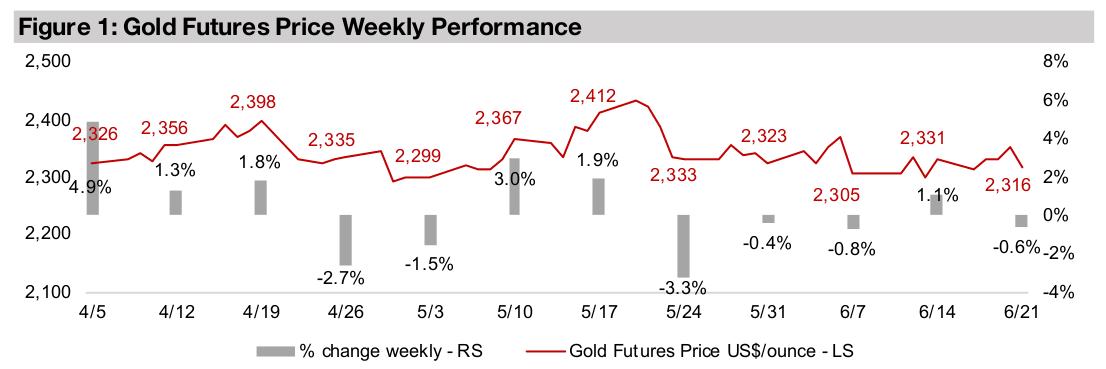

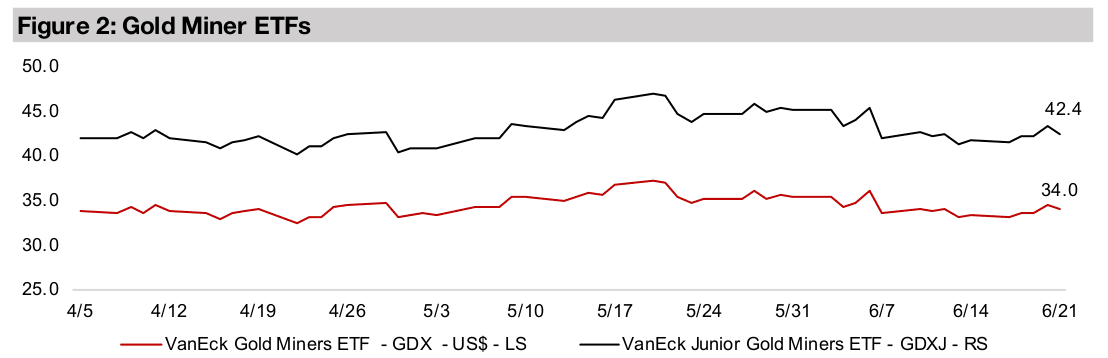

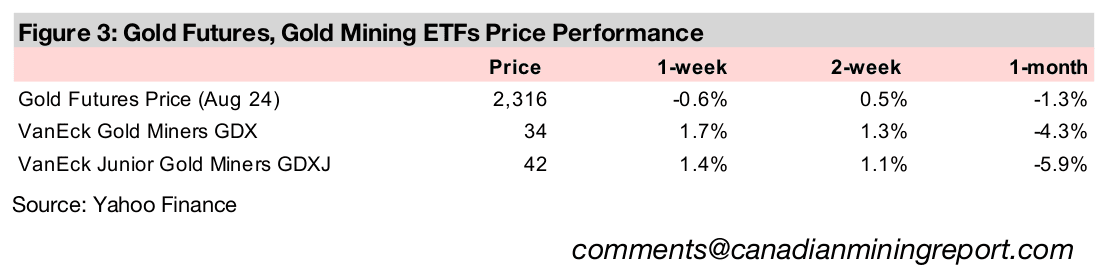

Gold edged down -0.6% to US$2,316/oz, staying within a range around US$2,300/oz-US$2,350/oz which has persisted for most of the past three months. The key US economic data this week was May 2024 retail sales, which were slightly below expectations, increasing 0.1% month on month and 2.3% year on year. Large cap US equity continued to rise, although tech was not as strong as in recent weeks with the Nasdaq up just 0.39%, outpaced by 0.75% gain in the S&P 500. Small caps continued to struggle, edging up 0.09%, and have lost -1.29% over the past month. Gold stocks still gained even without major support from equity markets or the metal price, with the GDX up 1.7% and GDXJ gaining 1.3%.

Inflation subsiding and rate cuts starting internationally

Other key economic news was a decline in UK inflation to the Bank of England’s

target rate of 2.0% in May 2024. While the UK central bank kept rates flat at its June

meeting, expectations rose for a rate cut in August 2024 with dovish sounding

commentary after the meeting. The Swiss National Bank reduced rates this week for

the second time this year by 0.25% to 1.25%, as inflation in the country fell to just

1.4% in April and May 2024, after a first cut of 0.25% in March 2024.

This follows a 0.25% rate cut by the European Central Bank to 3.75% in early June

2024, and seems to indicate that a rate cutting cycle by the major global central banks

has finally begun in earnest. While the US continues to hold back on rate cuts given

still moderately high inflation at 3.1% in May 2024, above the Fed’s 2.0% target, it is

still widely expected to also start rate cuts in the next few months, which should be

supportive of gold.

Markets pile back into tech over past month

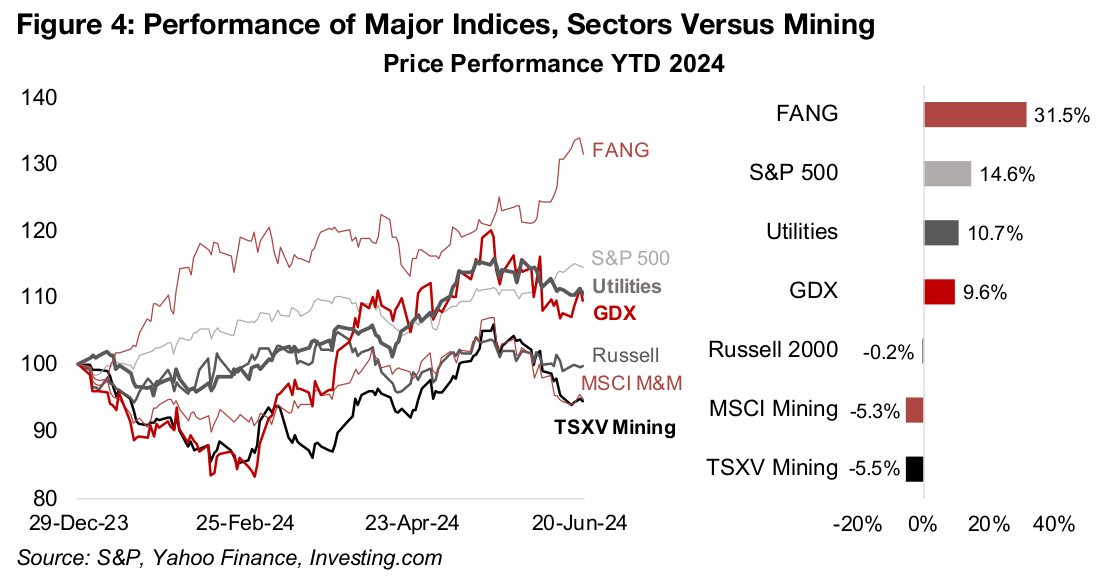

While at this time last month some defensive sectors like gold stocks and utilities had

nearly caught up with large cap tech for 2024, since mid-May 2024 the latter have

gone on another run, and former pulled back. The FANG ETF of large cap US tech

still leads the market this year, up 31.5%, doubling the 14.6% rise for the S&P 500

(Figure 4). However, the market is still hedging its bets, with the pull back in the GDX

ETF of gold producers and US utilities ETF over the past month still moderate, and

the funds gaining 9.6% and 10.7%, respectively, this year. The near flat performance

of the Russell 2000 small cap index also shows broader risk aversion. While by mid-

May mining stocks recovered above even for 2024, they have also pulled back, with

the MSCI Miners ETF off -5.3% and S&P/TSXV Metals and Mining Index losing -5.5%.

Only a few large tech stocks have been driving up the major US indices, masking

what appears to be an increasingly risk averse market overall. The farther the tech

run continues and the higher the valuations get, the greater the chance the sector will

eventually fail to meet soaring expectations. This contrasts with the moderate

valuations of many other US sectors and global markets, implying that more risk has

been priced in, providing a greater margin of safety, including for the mining sector.

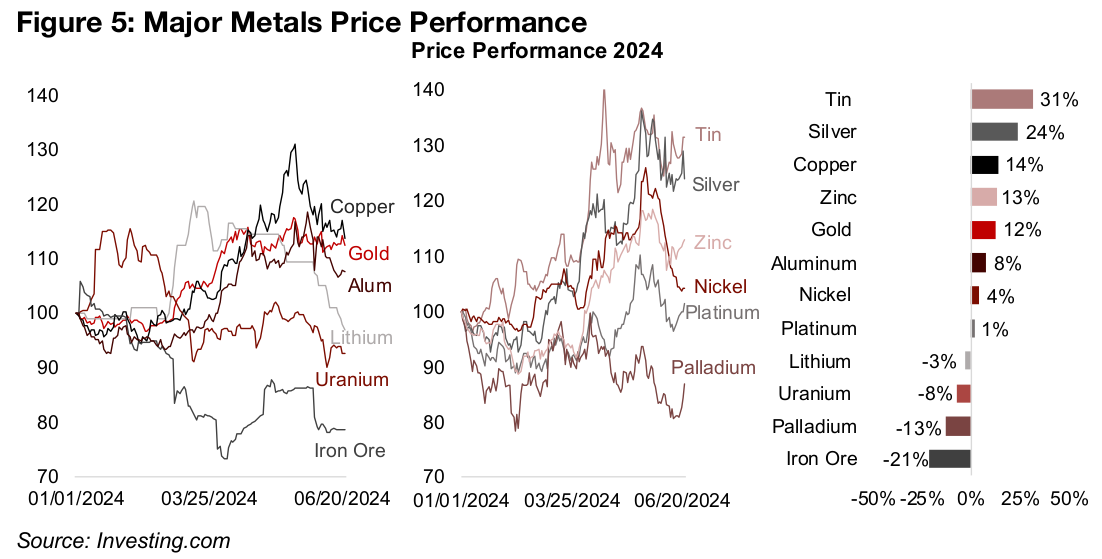

Metals prices diverge after correlated drop

After a three-week decline that was largely correlated across many of the major

metals from mid-May 2024, there was some divergence in their performance this

week. Of the three major industrial metals, copper and aluminum steadied while iron

ore was flat for a second week. Copper has maintained the largest gains of the three

year to date, up 14%, while aluminum has risen 8% and iron ore has been the

weakest of the major metals, down -21% (Figure 5).

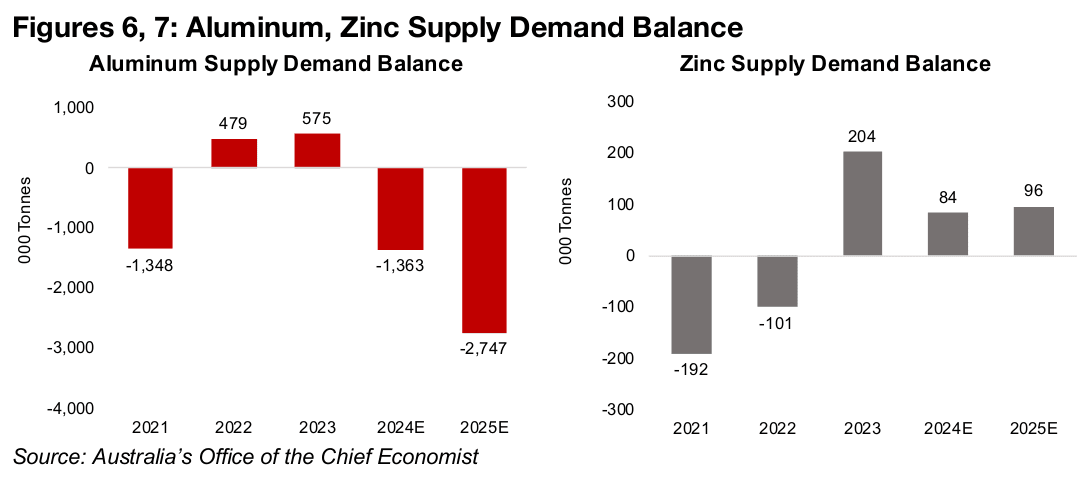

The prices of copper and aluminum have returned to their levels of April 2024, before

what in retrospect appears to have been a quite speculative month-long surge.

However, there are still strong fundamentals driving the gains in copper in aluminum

overall this year, especially rising global demand from an increasingly electrified

economy. The outlook for the supply demand balance for the copper market is mixed

for 2024, with the International Copper Study Group forecasting a surplus and

Australia’s Office of the Chief Economist (AOCE) a deficit. For aluminum, the AOCE

expects a shift to a major deficit for 2024 and 2025 (Figure 6). The iron ore price is

mainly a function of Chinese steel demand, and the drop reflects the weaker

construction outlook there, with a softer property market and infrastructure demand.

Tin, silver and zinc picked up for the week, and remain three of the top four strongest

performers of the major metals year to date, up 31%, 24%, and 13%, respectively.

The silver and tin markets are widely expected to continue having large deficits in

2024, while the AOCE forecasts the zinc market surplus to decline by more than half

this year (Figure 7). For the other precious metals, gold edged down while platinum

and palladium surged after extended slumps. The latter two were driven by news that

US Securities and Exchange Commission was nearer to approving the first platinum

and palladium ETFs to be traded in the US after a change in a key rule.

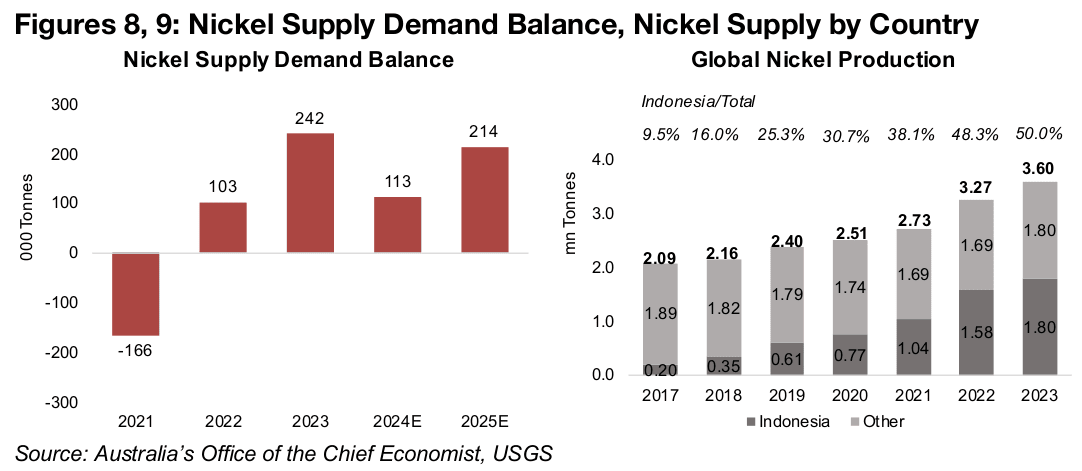

Only lithium and nickel saw major declines for the week, although they are still trading

close to flat for the year, with lithium down -3.0% and nickel up 4.0%. Lithium

continues to face pressure from a slowdown in the growth EV sales and increase in

lithium chemical capacity in China, which accounts for the majority of global

production. The nickel price has been hit especially by large surpluses which started

in 2022 and are expected by the AOCE to continue out to at least 2025 (Figure 8).

This has been driven by surging supply from Indonesia, where production rose from

just 0.2 mn tonnes in 2017 to 1.8 mn tonnes in 2023, increasing its share of global

output from 9.5% to 50.0% over the period (Figure 9).

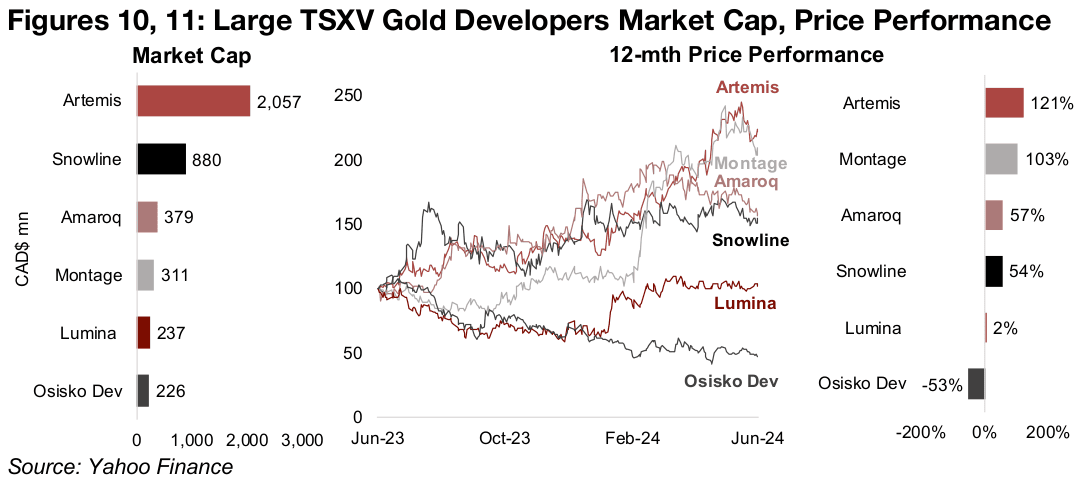

Snowline reports Resource Estimate for Rogue’s Valley Deposit

One major developments for the TSXV gold sector this week was Snowline Gold’s release of its Initial Resource Estimate for the Valley Deposit of its Rogue Project in the Yukon. This makes Snowline the second largest TSXV gold developer by market cap, at CAD$880mn, and it soon could be the largest, with the CAD$2,057mn market cap Artemis Gold to start producing at its Blackwater project by the second half of 2024 (Figure 10). The performance of the larger TSXV gold developers has been strong overall for the past year, with Artemis and Montage up over 100% and Amaroq and Snowline rising over 50% (Figure 11). Lumina Gold has been near flat, while Osisko Development has been the only significant laggard, down -53%.

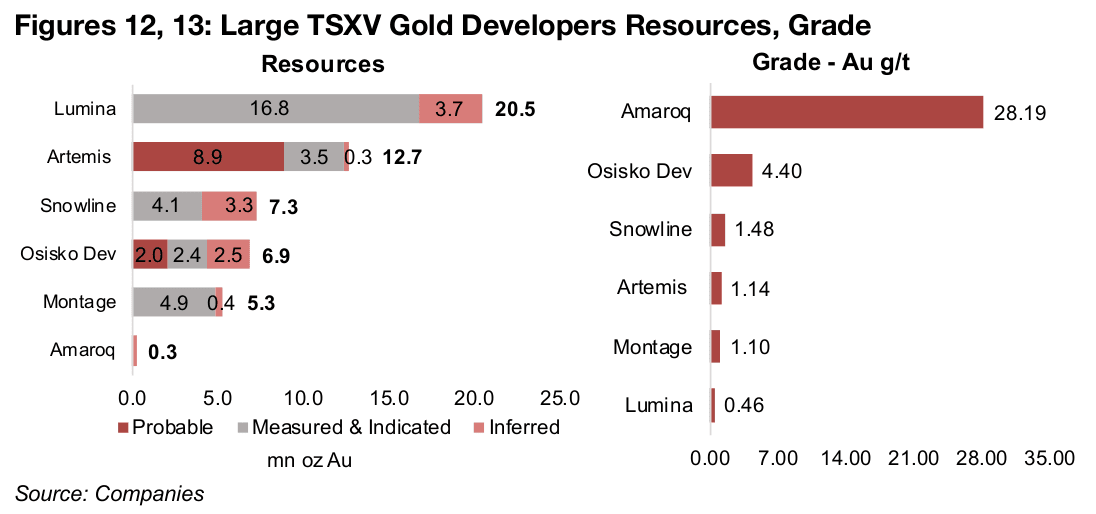

Snowline’s Resource Estimate of 7.3mn oz Au places it towards the middle of the

TSXV gold sector in terms of size, between Osisko Development, at 6.9 mn oz, and

Artemis, at 12.7 mn oz (Figure 12). The grade of the project at an average 1.48 g/t Au

is moderate in the context of the larger TSXV gold developers. It is ahead of Artemis

and Montage, with grades of 1.14 g/t Au and 1.10 g/t Au respectively, and about three

times the 0.46 g/t Au grade of Lumina (Figure 13).

However, it is well below the average 4.40 g/t Au grade for Osisko Development

across its three projects. This grade is boosted by the high 23.2 g/t Au grade of Trixie,

but this is just 7% of the total resources, while its main project, Cariboo, which is 79%

of total resources, has a grade of 3.5 g/t Au. Amaroq has by the far the highest grade,

at 28.19 g/t Au for Nalunaq, but the project is tiny at just 0.3 mn oz Au.

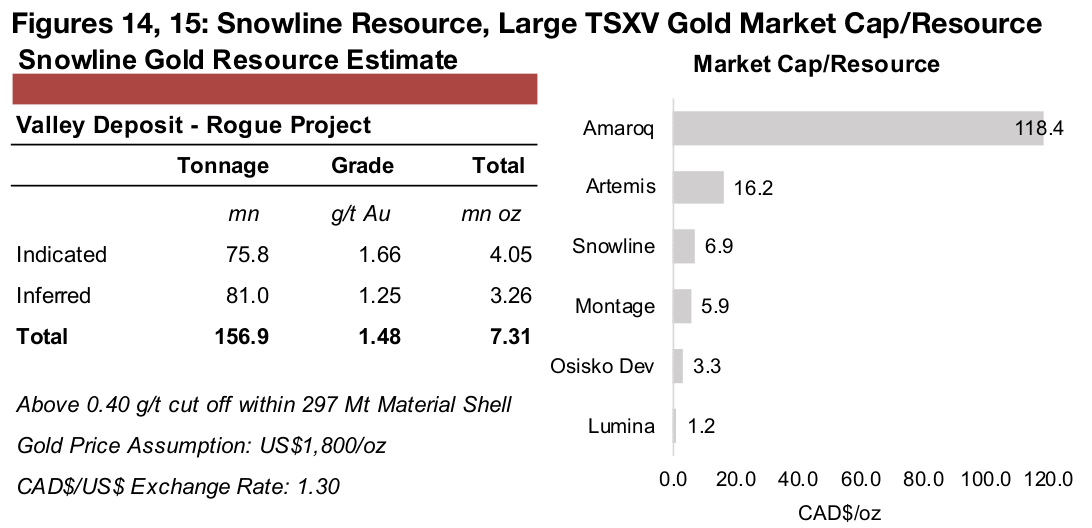

Over half of the Snowline’s estimate for the Valley Deposit is Indicated Resources, at

4.05 mn oz Au, with a grade of 1.66 g/t Au, with 3.26 mn oz of Inferred Resources, at

a grade of 1.25 g/t Au (Figure 14). The estimate applies a 0.40 g/t cut-off grade, a

gold price assumption of US$1,800/oz and CAD$/US$ Exchange Rate of 1.30.

Snowline trades near the middle of the TSXV large gold developers on a Market Cap/

Resource valuation, at CAD$6.9/oz (Figure 15). Amaroq has by far the highest

valuation, at CAD$118.3/oz, supported by its extremely high grade. Artemis has a

valuation over two times that of Snowline, at CAD$16.2/oz, even though it has a

significantly lower grade, justified partly by its very advanced stage, with production

expected to start this year. Montage’s valuation of CAD$5.8/oz is the closest to

Snowline, coming in slightly below likely to some degree because of its lower grade.

Osisko Development’s Market Cap/Resource of just CAD$3.3/oz is quite low versus

the group given its relatively high grade. Lumina trades at just CAD$1.2/oz, having by

far the lowest grade of the group.

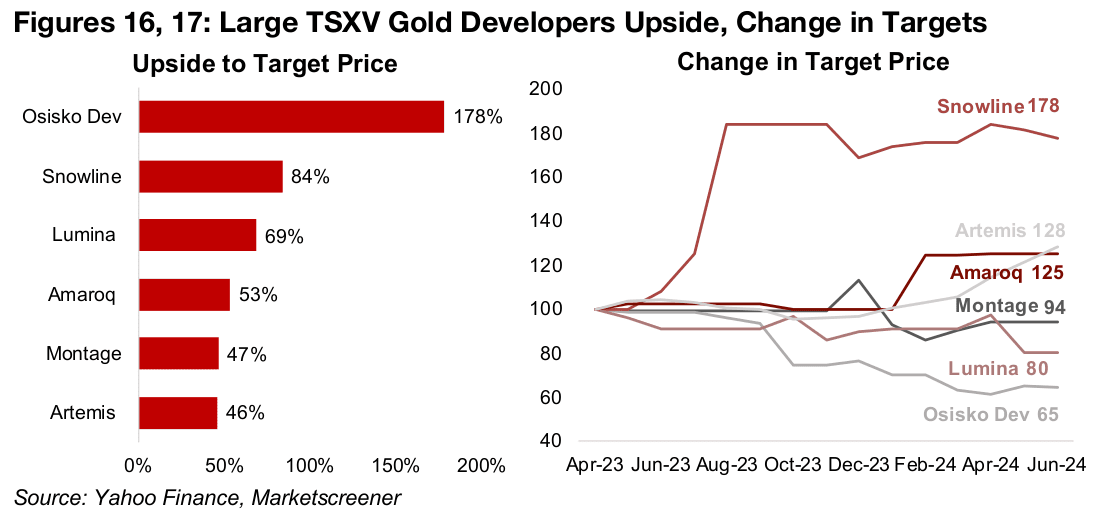

The market expects further gains for Snowline Gold, with 84% upside to its target price, second only to the 178% upside for Osisko Development, for which the market expects an eventual rerating for its high grade. Decent upside is also expected for the rest of large TSXV gold developers, ranging from 46% to 69% (Figure 16). Over the past year Snowline has seen by far the most substantial upgrades to its target price, with a near doubling, although this was mainly from May to July 2023, and its target has been relatively flat since (Figure 17). Amaroq and Artemis have seen similar levels of upgrades of 25% and 28%, concentrated in 2024, with the targets mainly flat last year. The targets of the rest of the group have declined, with Montage dipping -6%, Lumina down -20% and Osisko Development dropping -35%.

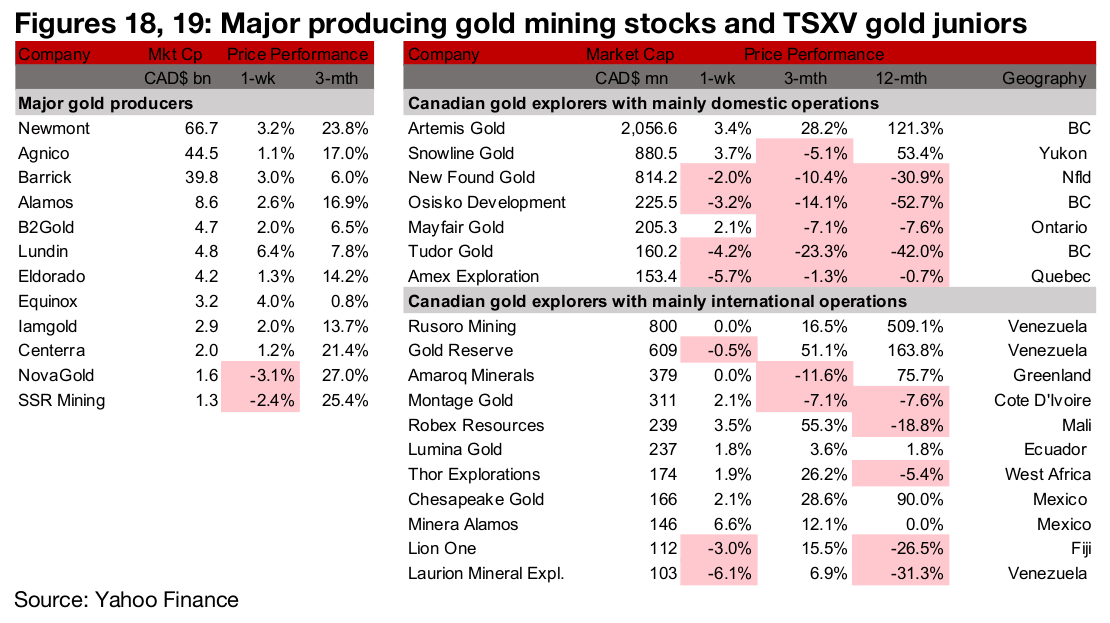

Most major gold producers rise and TSXV gold mixed

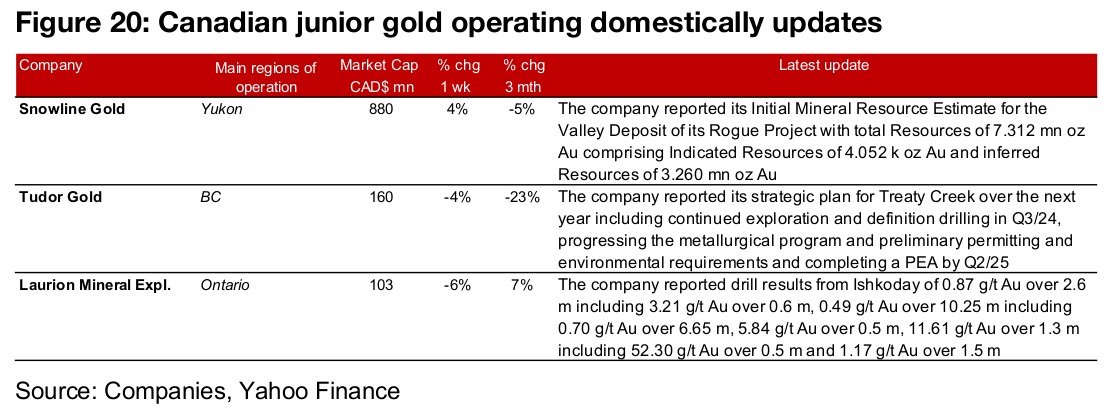

Most of the major gold producers rose and TSXV larger cap gold was mixed even as the metal declined and equity markets excluding tech gained moderately (Figures 18, 19). For the TSXV gold companies operating domestically, Snowline Gold reported its Initial Mineral Resource Estimate for the Valley Deposit of the Rogue Project, Tudor Gold announced its strategic plan for Treaty Creek over the next year and Laurion Mineral Exploration reported drill results from the Ishkoday project (Figure 20). For the TSXV gold companies operating internationally, there was limited major news flow.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.