October 24, 2022

Metals Decline Eases

Author - Ben McGregor

Gold rebounds on market hopes of Fed hike slowdown

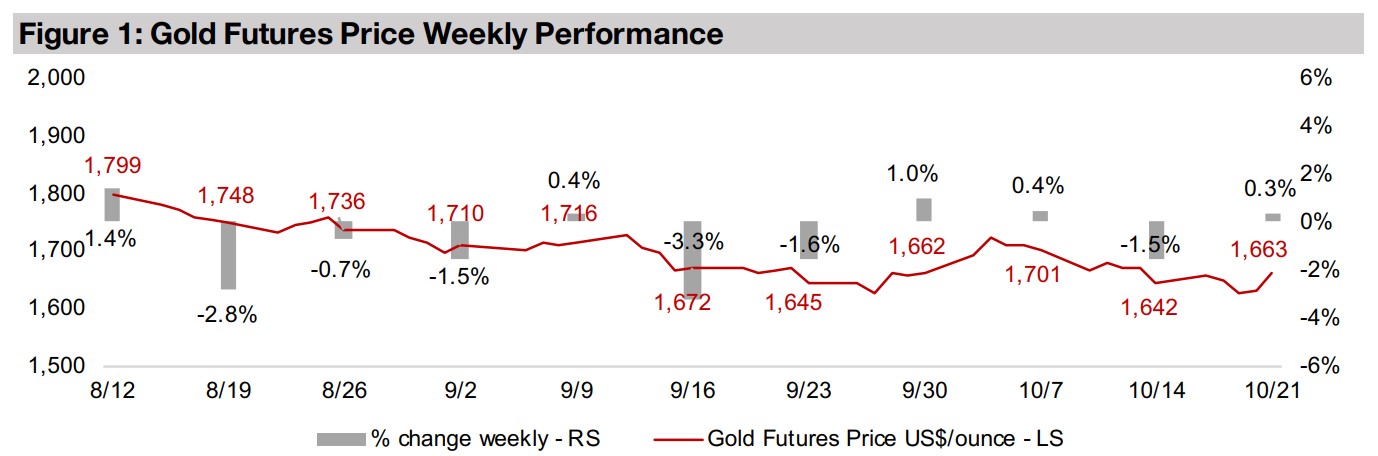

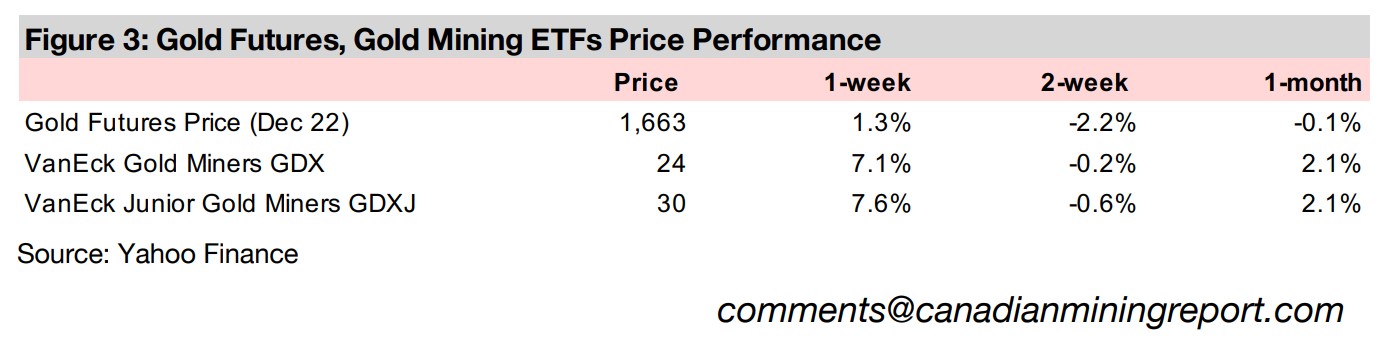

Gold rose 1.3% this week to US$1,663/oz and equity markets jumped on market hopes that the Fed could potentially pullback on the degree and pace of its planned rate hikes, which saw it rebound off two-year lows reached last week.

Metals sector price decline from mid-2022 appears to be easing

This week we look at the price performance of the major metals since 2021, with there being signs over the past three months that the abrupt decline in prices for the sector overall that started around March to May 2022 has started to ease.

Metals Decline Eases

Gold was up 1.3% to US$1,663/oz, rebounding off of two-year lows set last week,

as market hopes that the US Fed would reduce the degree or pace of their rate hikes

buoyed the metal and the equity markets. However, we have seen these type of

swings throughout 2022 only to have the Fed show no signs of backing down from

the inflation fight and coming through with strong rate hikes. With inflation still around

8.0%, but US bond yields at just 4.2%, and historically rates needing to reach or

exceed inflation to really bring it down, we expect the Fed to continue to boost rates

aggressively through 2022 and into early 2023 at least.

The Fed has also been clear that even if it does pause on rates eventually, it will leave

them at a high level for an extended period to ensure that inflation has truly been

squeezed out of the system. In general, we believe that the market hoping for relief

on rate hikes as a key driver of the economy or stock markets is a stretch, especially

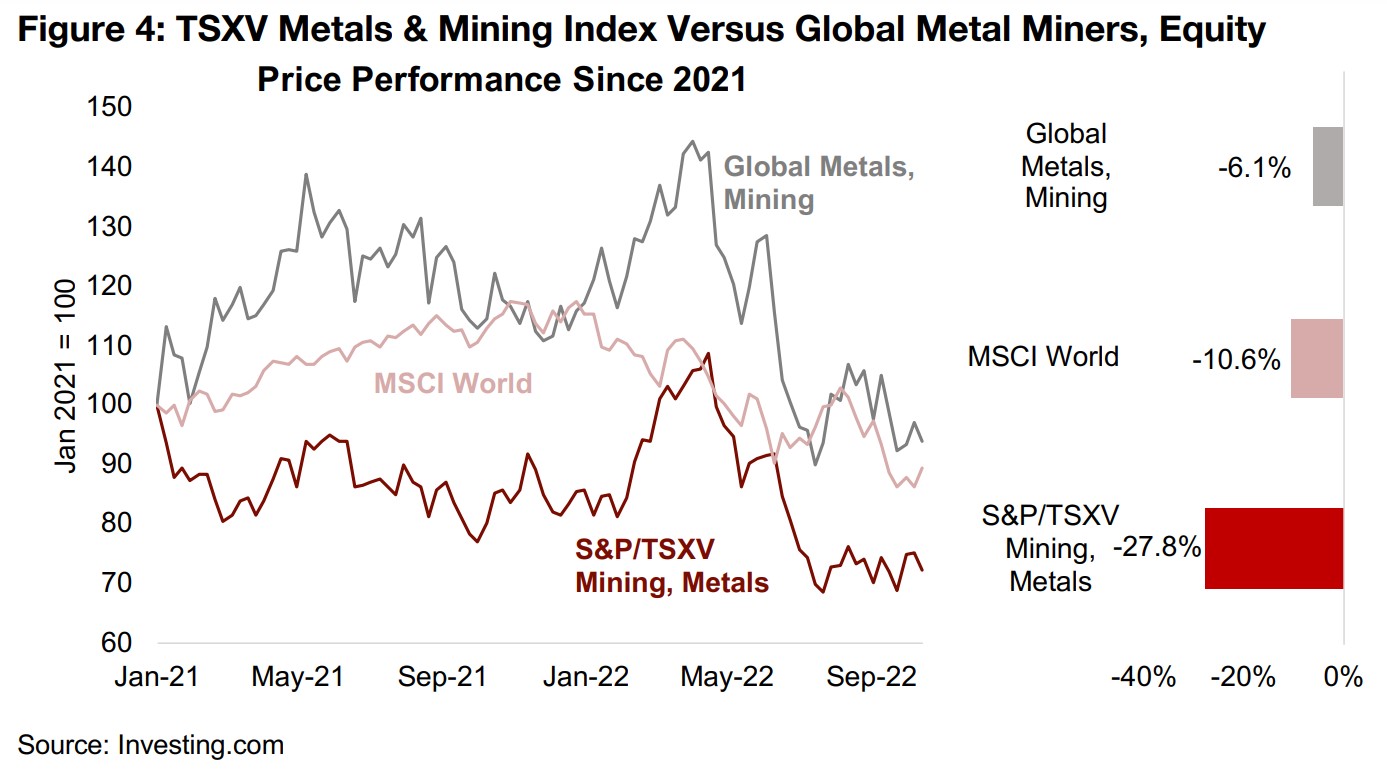

for the rest of 2022. This could mean that pressure on the TSXV Mining and Metals

Index continues, with a -27.8% drop since 2021 (Figure 4).

In the context of a -10.6% decline in the MSCI World, much of this -17.2% underperformance can be justified by the much greater risk of junior miners, which mainly have no revenue and need to raise cash to keep exploring, even as capital markets become more difficult. Interestingly, the Global Metals and Mining Producers ETF has outperformed the MSCI World, suggesting that the decline in the TSXV Metals and Mining index is not part of a market aversion to mining stocks specifically, but rather part of a more global pullback from small cap equity in general.

Slide in major metals appears to be taking a pause

This week we look at the price movement of the major metals, which continue to

trend down overall, after peaking post-global health crisis from roughly March to May

2022. However, the rate of decline seems to have slowed, with the rapid phase of

correction appearing to have ended around late July 2022, and several smaller metals

have actually picked up over the past two months. We highlight the price movement

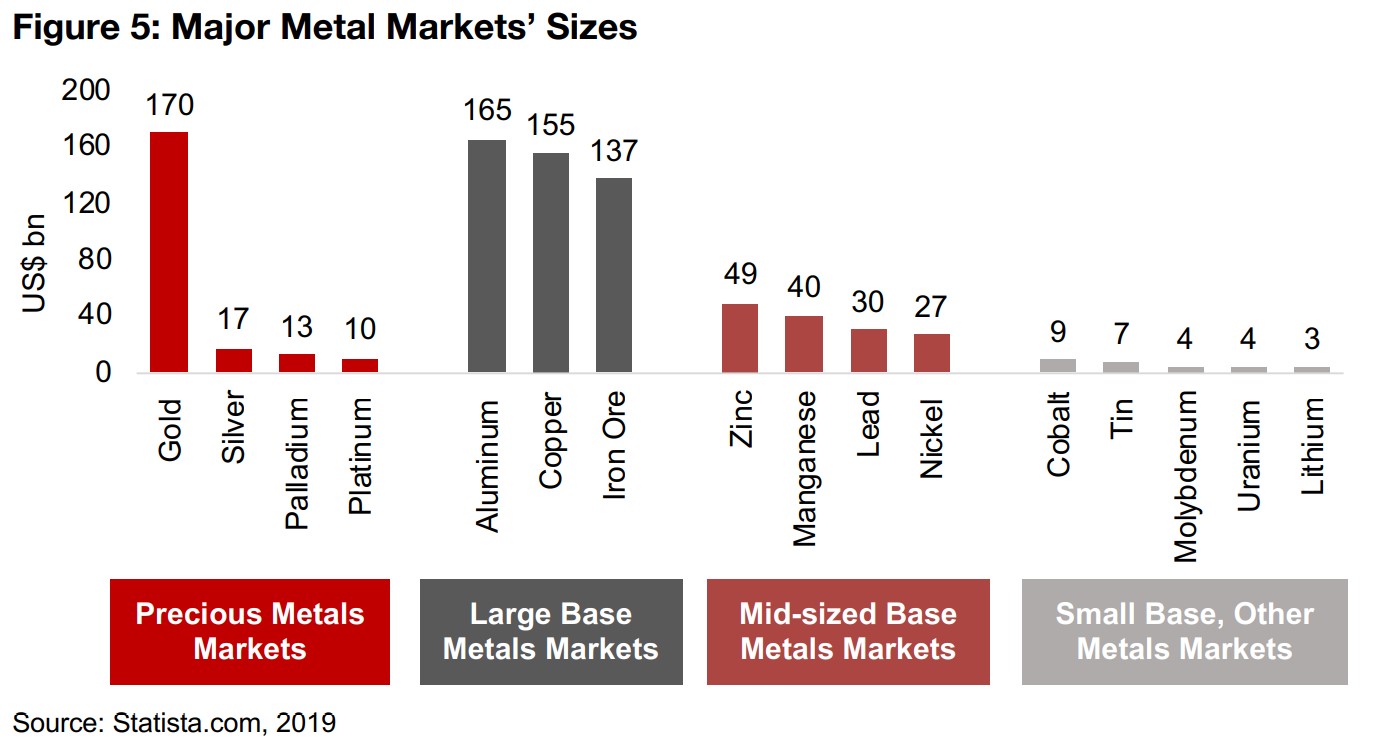

for the metals in four segments since 2021; 1) precious metals, with gold by far the

largest, silver about one tenth of its size, and palladium and platinum even smaller; 2)

the large base metals, aluminum, copper and iron ore, which combined can be

viewed as a barometer for the global economy, 3) the mid-sized base metals zinc,

manganese, lead and nickel, and the small base and other metals markets, cobalt,

tin, molybdenum, uranium and lithium (Figure 5).

With the US Fed set to continue aggressive rate hikes and with global bond yields

picking up, higher rates will likely continue to weigh on the economy, and therefore

metals prices, for the rest of 2022 and into 2023. However, it is possible that any

subsequent decline could be more gradual and orderly, with the market now well

aware both of the high likelihood of high rates and global economic weakness. The

markets have yet to devolve into a panic, and if one was to have developed, we

believe that it probably would have already. Perhaps global investors, only recently

having been through the unprecedented disruptions of the global health crisis, are

finding a slow economy and higher rates undaunting by comparison, resigning

themselves to a slow fade of weak markets, without the need for aggressive selling.

Monetary-driven gold could continue to see pressure

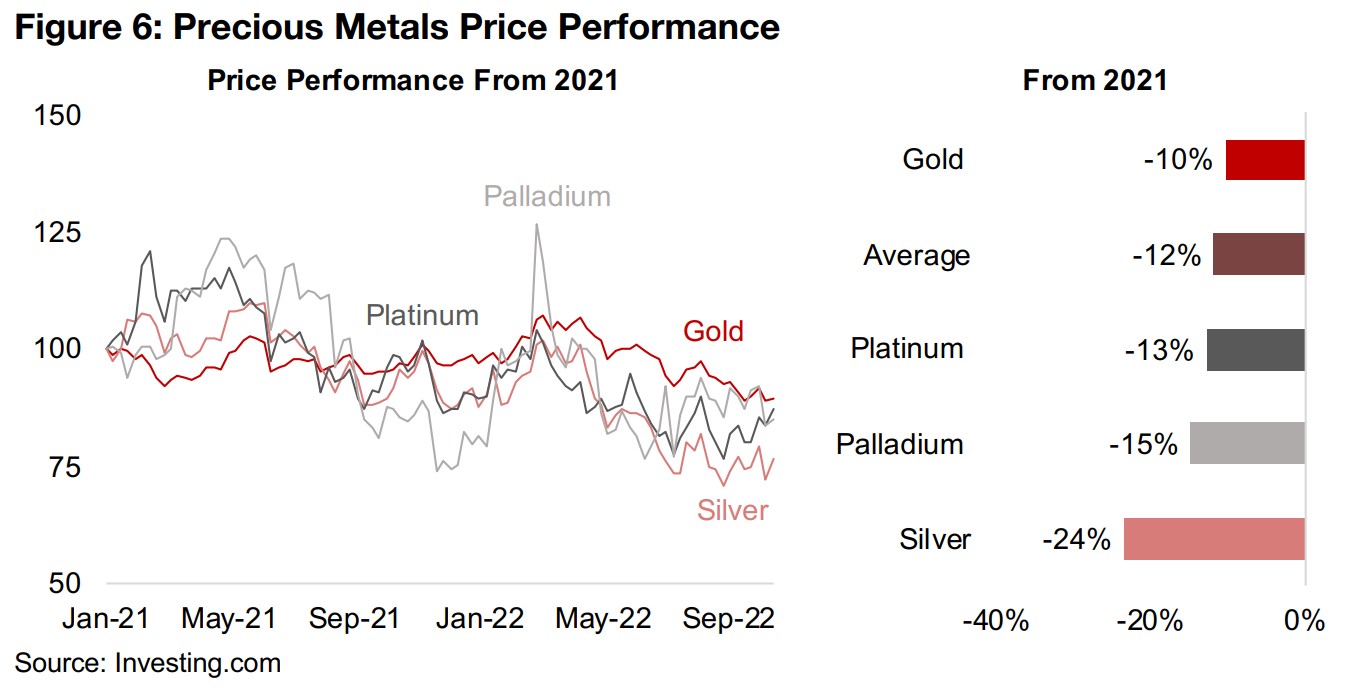

The precious metals are all down since 2021, driven by a combination of both

monetary drivers and industrial drivers, in contrast to the base metals, driven only by

the latter (Figure 6). Gold has held up the best, down just -10% since 2021, having

remained relatively flat for most of 2021 and gaining in early 2022 to April as a risk

hedge after Russia's invasion of Ukraine. However, this was also the time when the

seriousness of the Fed's rate hikes were becoming clear to the market, and this has

seen gold trend down since May 2022. The higher rates have made real yields less

negative, making bonds more attractive, drawing fund flows away from gold, while

the strong US$ also weighs on gold, with the two assets tending to move inversely.

Compared the other precious metals, only a small amount of gold demand comes

from industrial uses, so the Fed's interest rate changes and their effects on the money

supply, real yields and the US$ will continue to be the main factors affecting gold.

With continued rate hikes expected, the outlook for gold still looks weighted to the

downside, although there could be some relief from a weakening US$ as other

countries continue to hike rates, gradually closing the differential with the US and

drawing away some fund flows.

Platinum and palladium volatile since 2021, silver cyclicality more muted

While platinum and palladium have declined moderately more than gold, down -13%

and -15%, respectively, their path has been much more volatile. The main driver of

both of these metals is for their use in catalytic convertors for automobiles, although

they also have a monetary driver as a store of value, similar to gold. Prices for both

rose over in H1/21 on tight supply chains from the global health crisis, and declined

in second half as these issues started to clear up.

Into 2022, as overall economic demand surged in the wake of the crisis, palladium

and platinum picked up, with palladium spiking on the Ukraine invasion as Russia is

by far the largest global supplier of the metal. However, both platinum and palladium

pulled back through to July 2022, as interest rates started to pick up especially from

Q2/21, although the prices for both have flattened somewhat over the past three

months. Platinum and palladium cyclicality will likely continue to follow the

automobile industry, which could face some pressure from a global economic

slowdown, while the monetary driver may not be that supportive in 2022 and into

early 2023, similar to what we expect for gold.

Silver has been the weakest performer of the group, down -24%, and followed a

similar cyclicality to palladium and platinum, although with a more muted amplitude.

Silver was actually near flat versus 2021 as of March 2022, but has been hit quite

hard in the metals slide this year, given that it has a far larger industrial component to

its demand and less of a backup from the monetary driver, especially compared to

gold. Given that a continued economic slowdown seems likely for the rest of 2022,

we believe that the silver price could also continue to trend down.

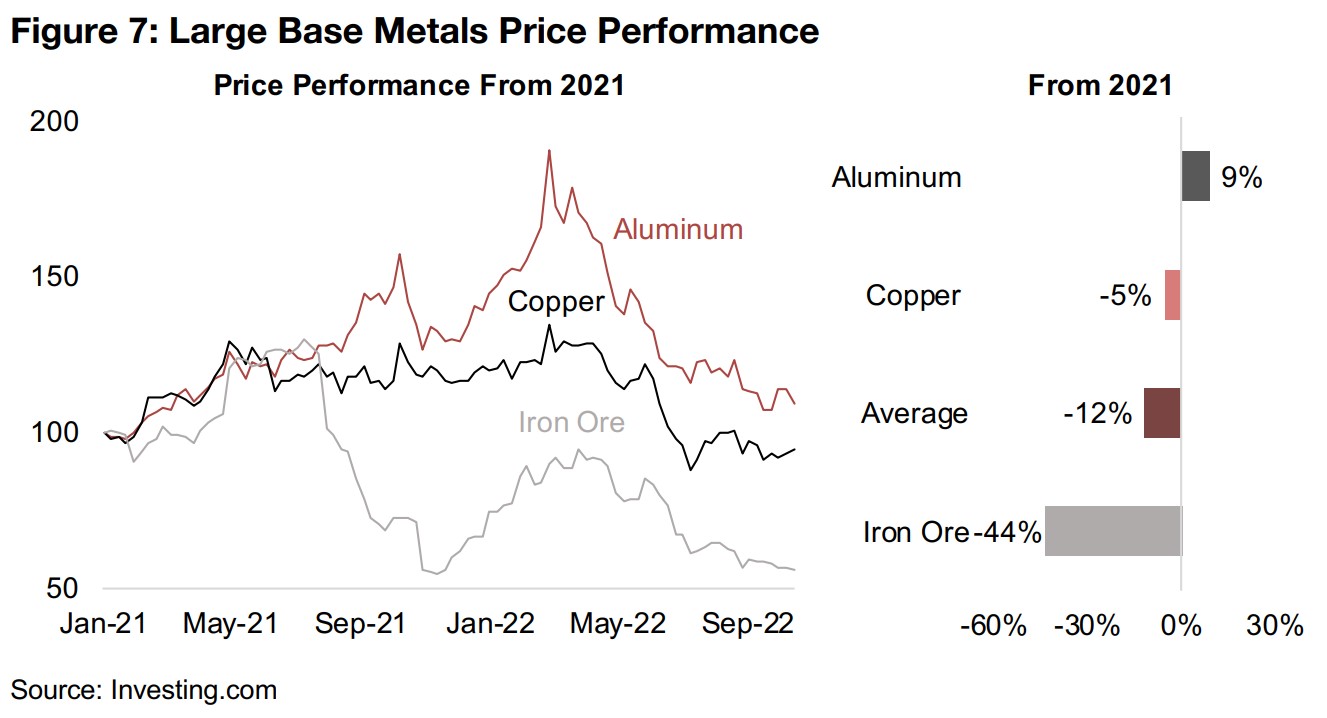

Volatile round trip for aluminum and copper while iron ore is weakest metal

The big three base metals are all viewed as important proxies for the direction of the

world economy, given their wide use across many industries, with aluminum

considered a general global barometer, copper more an indicator of the situation in

developed nations and iron ore especially reflecting the situation in China. Aluminum

saw by far the biggest spike of the three since 2021, up nearly 100% at its peak, but

has taken nearly a round trip back to just a 9.0% gain currently (Figure 7). Copper's

gain has been more muted, peaking up 24% as of early 2022 and now down 5%.

Iron Ore gained early in 2021, but declined considerably since H2/21 on a drop in

demand from China, especially because of a slowing construction and housing sector,

and is now down -44%. While the abrupt slowdown for all three that started around

April 2022 seems to have started to ease as of end-July 2022, they are still declining

since, just at a more moderate rate. If the Fed continues with aggressive rate hikes,

we expect that this will slow global economic activity further, which could lead to

lower prices for these especially macro-driven metals.

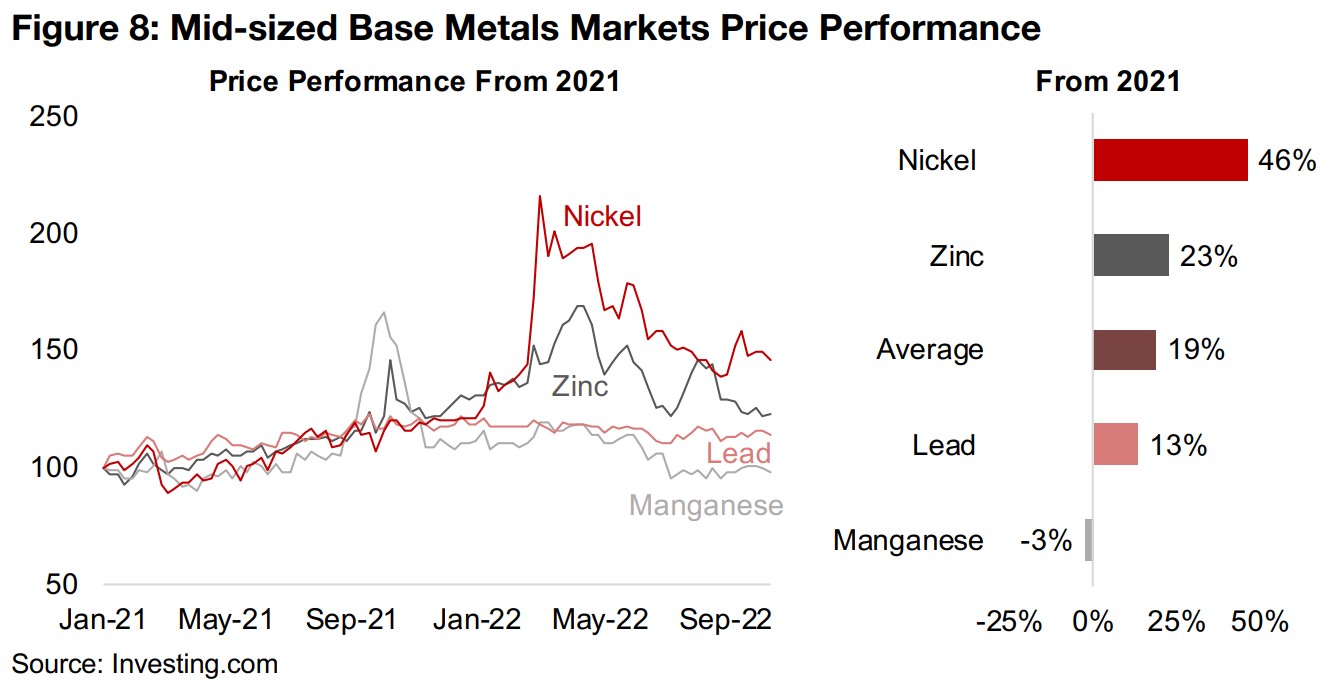

Mid-sized base metals still up since 2021 after retreat from early 2022 spikes

The mid-sized base metals have seen a split in performance between the volatile moves in nickel and zinc and the subdued performance of manganese and lead (Figure 8). Nickel trended up gradually through 2021 on rising global economic demand, but then saw a huge spike as Russia, which is the third largest global nickel producer, invaded Ukraine. Concerns rose that this could cause nickel supply disruptions at a time where output from another major supplier, China, was low and demand for nickel from the steel and battery industries, the metal's two major uses, was spiking. However, nickel supply was not severely curbed, and along with slowing global economic demand, the price corrected, although it is still up 46% in 2021, and has picked up over the past two months.

The zinc price trended up smoothly through 2021 apart from a spike in October 2021

as there was a supply cut from some major European suppliers, and it then gained

more quickly as demand surged in early 2022 through to a peak in May. However,

the price has trended down since, and is up 23% since 2021, with about fifty percent

of zinc demand by sector coming from the steel sector and by country coming from

China, and the steel industry in China has weakened over H2/21.

Price action for lead, up 13% since since 2021, and which sees a majority of its

demand from batteries, has been much less volatile, even as other battery metals like

cobalt, nickel and lithium have spiked, as lead supply has remained relatively strong

in recent years compared to these other metals. Manganese, which sees most of its

demand from the steel industry, is near flat since 2021, down just -3%. Its price action

has also been smooth over the past two years, apart from a spike in Q3/21 on supply

constraints in China, the largest global processor of manganese metal, because of

power issues and shutdowns.

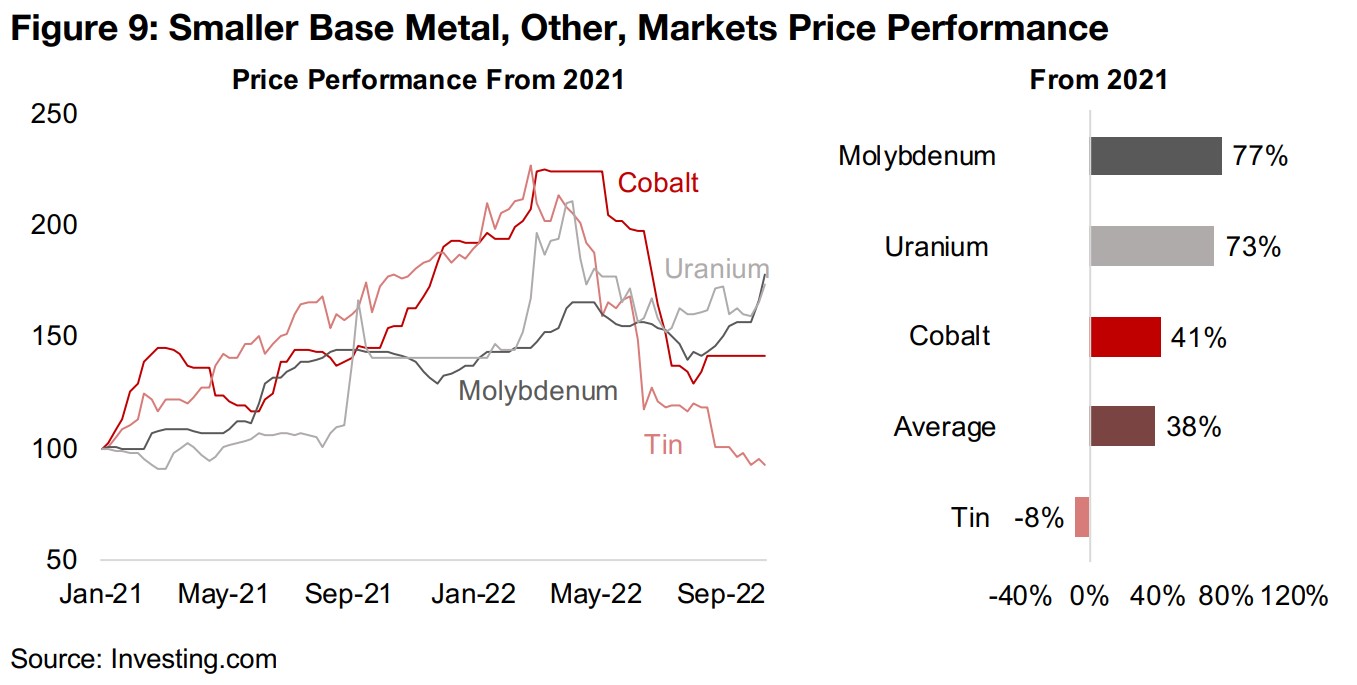

Some smaller metals markets bucking the downtrend

Some of the smaller metals markets have followed the declining trend of the larger metals since around Q2/21 this year, including cobalt and tin. However, molybdenum and uranium have bucked the trend, going on to set new highs, and while uranium had declined off its April peak, it has rebounded strongly over the past month, in contrast to most other metals (Figure 9). There is strong demand for cobalt for batteries for electric vehicles, so it was propelled by surging demand for EVs through 2021, but consequently hit by expectations for weakening demand in the auto sector overall in H2/22, and is still up 41% since 2021.

While tin saw the strongest peak of this group, up over 125% from 2021 as of

February 2022, it also saw the most abrupt fall, and now down -8%, the only one of

the group that has declined. Most of tin's demand is for soldering, used widely across

industry, and supply limitations driven by the global health crisis while demand

surged in 2021 drove the price increase, but the H2/21 decline in demand has

returned the price roughly to where it started in 2021.

Molybdenum is the only major metal that is at a high since 2021, up 77%, with supply

constraints from China, by far the largest producer of the metal, continuing, which

has offset the broader demand decline that has affected many of the other metals.

Uranium has also maintained strong gains, up 73% since 2021, which has been

driven in part by purchases by the new Sprott Physical Uranium Trust through 2021,

which was then exacerbated by political disturbances in Kazakhstan, the largest

global uranium supplier, and Russia, the sixth largest. While the uranium price pulled

back from its April 2022 high as demand expectations cooled, in contrast to most

other metals, it has picked up over the past month, as supply remains tight.

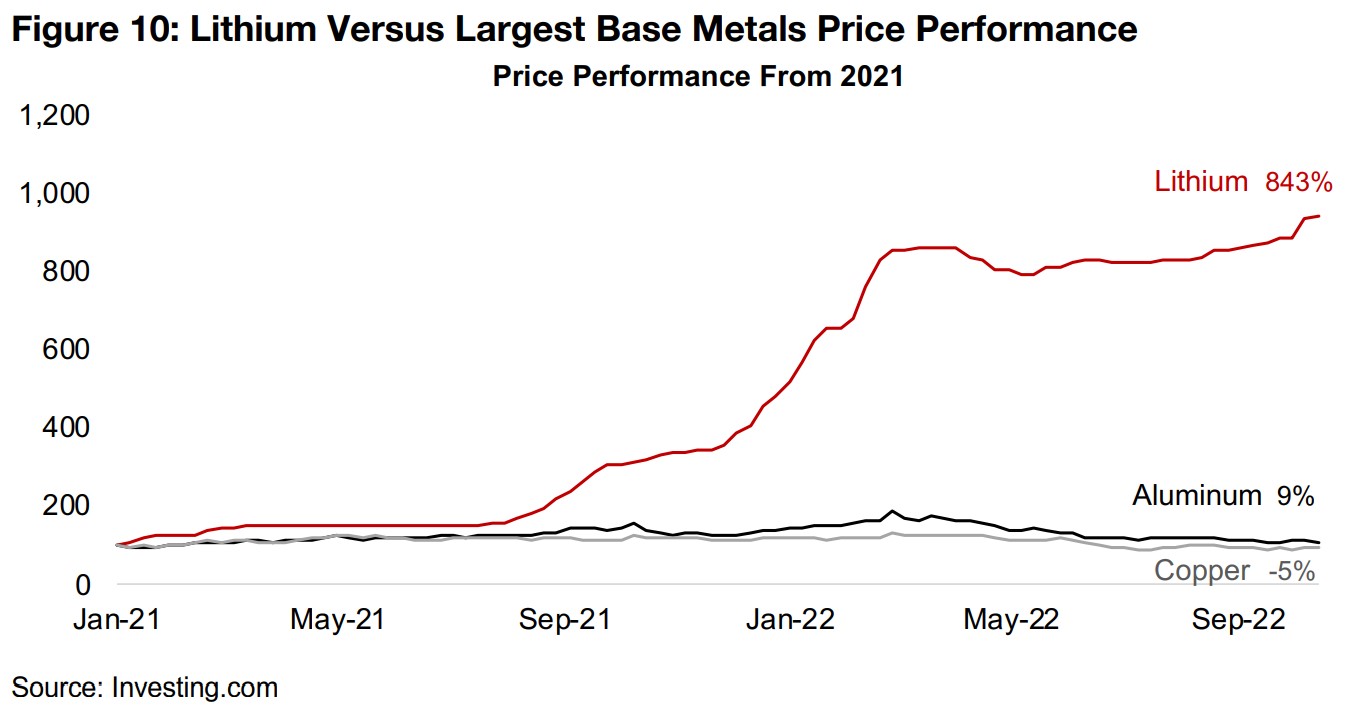

While a few of these smaller metals have performed well in the broader metals

correction, lithium's performance, up 843% since 2021 dwarfs them all, and has

literally gone 'off the chart', requiring the addition of Figure 10, with aluminum and

copper included for comparison. This has been driven in part by the surge in electric

vehicle sales, especially in China, with the majority of lithium demand coming from

batteries to power these cars. However, a large proportion of demand for both cobalt

and nickel also come from batteries from electric vehicles, and yet we have seen the

prices of both of these metals decline. The difference with lithium is that over 30% of

its demand comes from batteries, compared to just 15% for cobalt and 3% for nickel,

and that the supply of processed lithium, mainly coming from China, is still extremely

tight. When making their capacity expansion decisions several years ago, the industry

was not expecting the huge rise in electric vehicle sales of the past year.

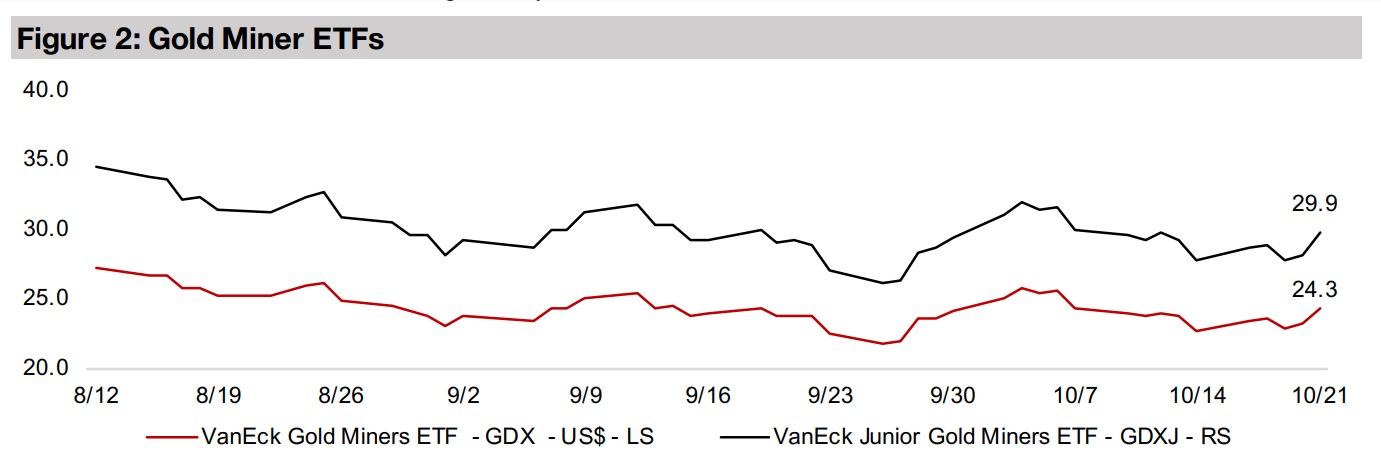

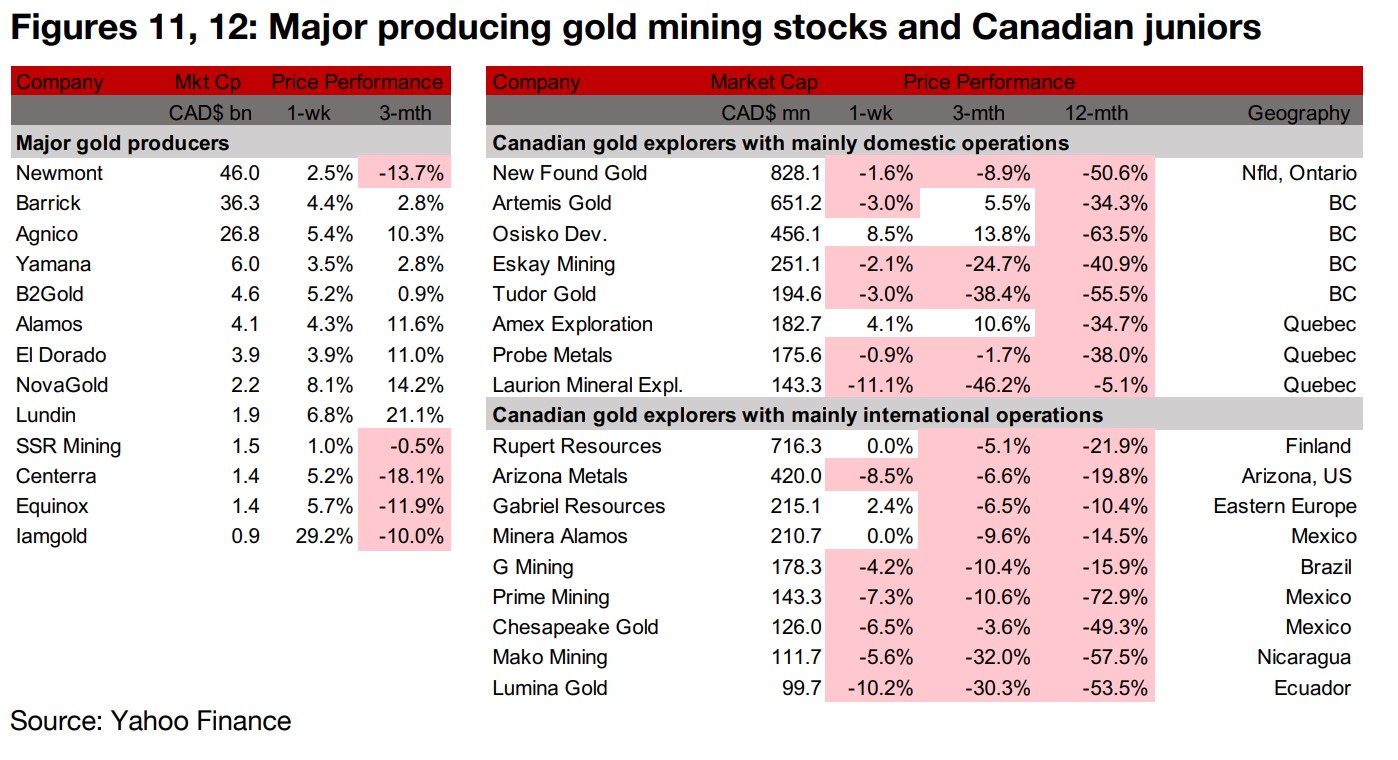

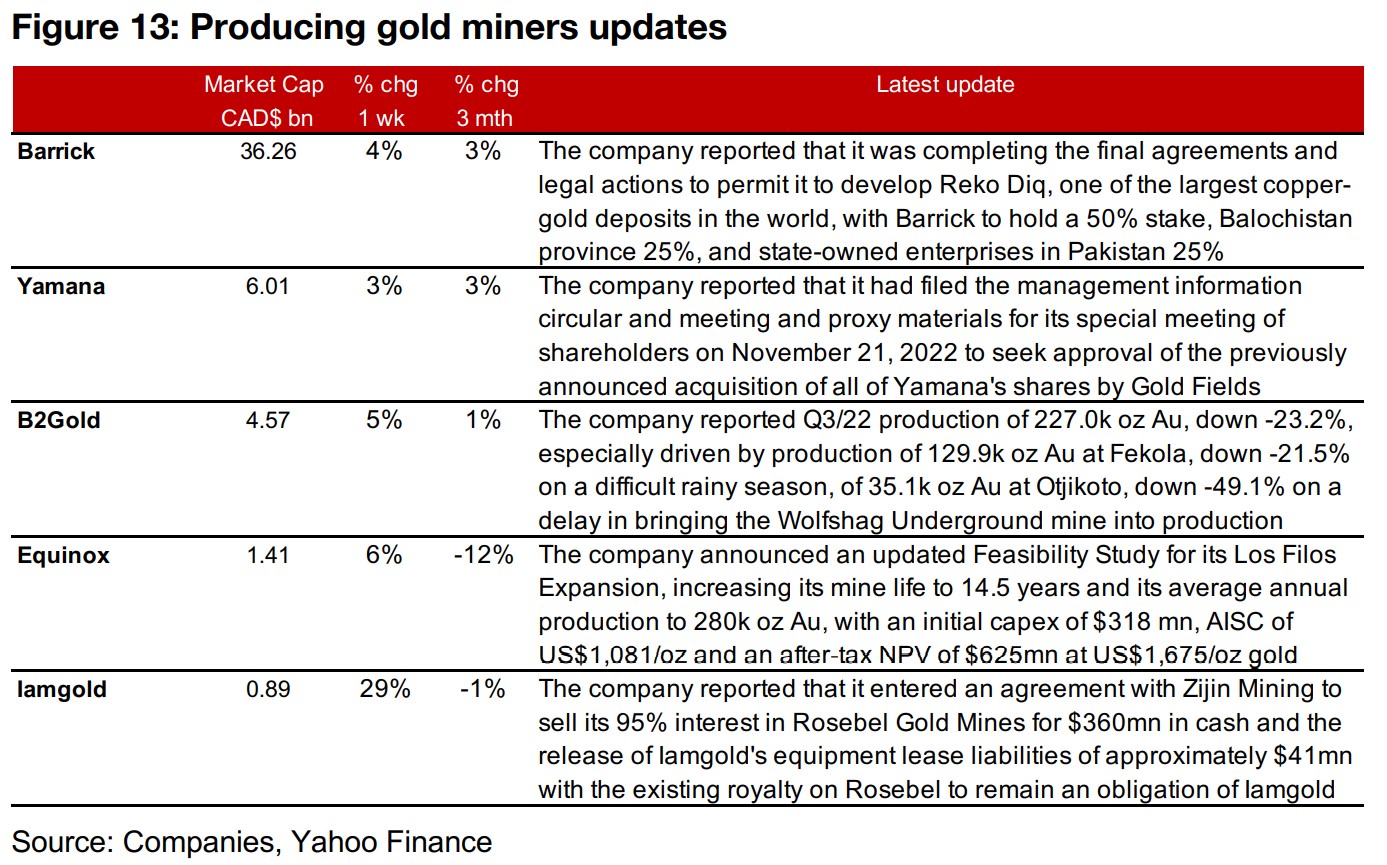

Producing gold miners up on rise in gold and equity markets

The producing gold miners were all up as gold rose and the equity markets jumped (Figure 11). Barrick reported that it was completing final agreements to permit it to develop Reko Diq in Pakistan, one of the largest copper-gold deposits in the world, and Yamana filed the final materials for its special shareholders meeting on November 21, 2022, to seek approval for its previously announced acquisition by Gold Fields. B2Gold reported Q3/22 gold production down -23.2%, Equinox announced an updated Feasibility Study for its Los Filos Expansion and Iamgold agreed to sell its 95% stake in Rosebel Gold Mines to Zijin Mining (Figure 13).

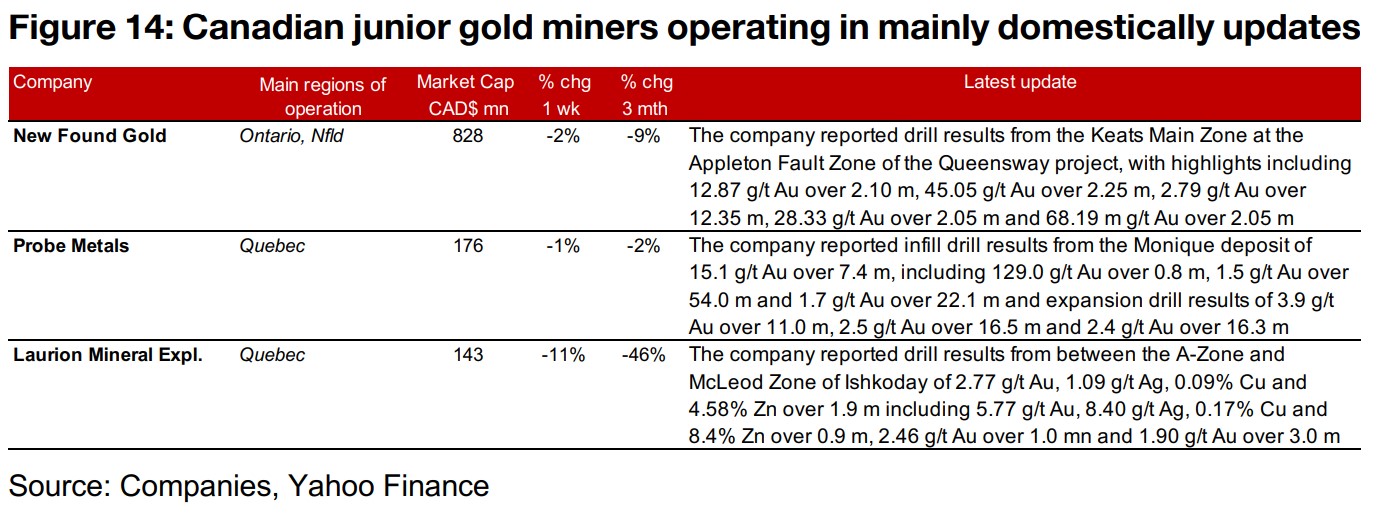

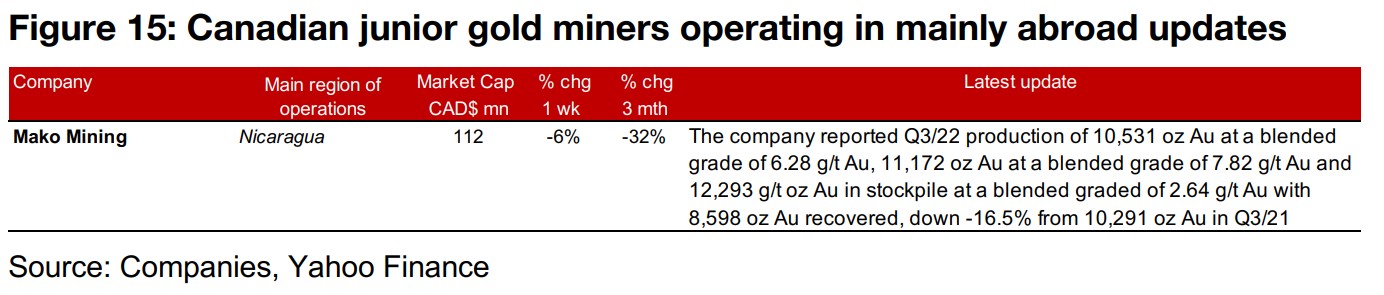

Large TSXV gold juniors mainly down

Most of the larger TSXV gold juniors were down even after the pickup in gold and equity markets (Figure 12). For the Canadian juniors operating mainly domestically, New Found Gold reported drill results from the Keats Main Zone at the Appleton Fault Zone of the Queensway project, Probe Metals reported infill and expansion drill results from the Monique deposit at Val d'Or East and Laurion Mineral Exploration reported drill results from between the A-Zone and Mcleod Zone of Ishkoday (Figure 14). For the Canadian juniors operating mainly internationally, Mako Mining reported Q3/22 production, with recovered gold down -16.5% yoy (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.