May 8, 2020

Q1/20 results strong on higher realized gold price

Author - Ben McGregor

Gold pauses, but gold mining stocks keep heading up

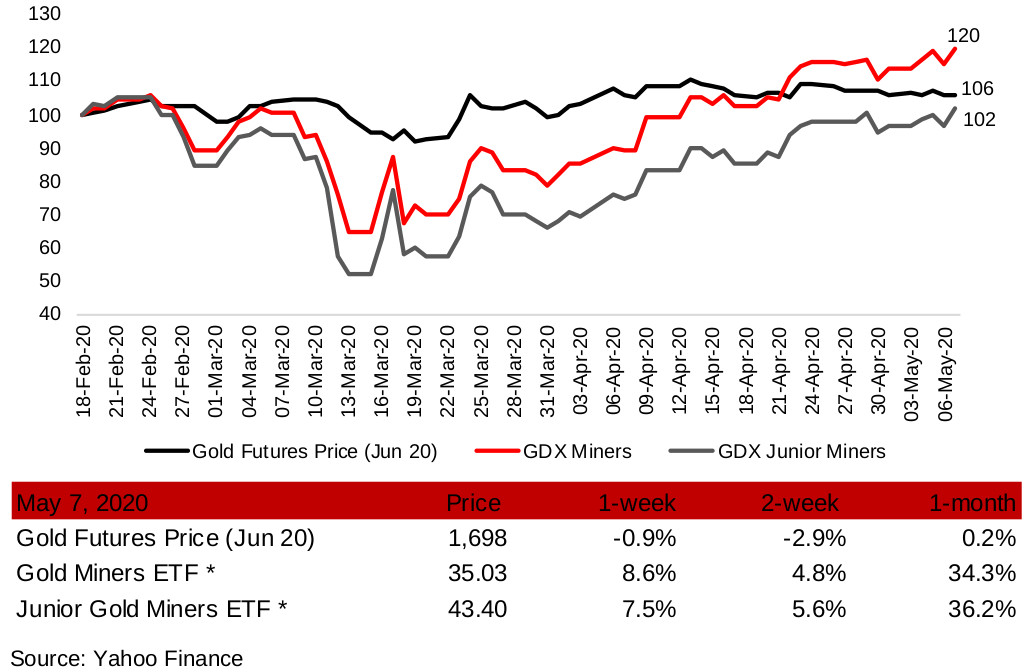

The gold price paused this week, with the futures dipping a marginal -0.9%, but gold mining stocks continued to rise, with the GDX up 8.6%, as decent Q1/20 results came through this week,while the GDXJ rose 7.5%.

Big wave of Q1/20 results for producing miners

Most of the larger producing gold miners reported Q1/20 results this week, bolstered yoy by a spot gold price averaging US$1,582/ounce for the quarter, while production was only marginally impacted by the global health crisis up to end-March 2020.

Figure 1: Gold futures price and gold mining ETFs

Gold pauses, but gold mining stocks continue to rise

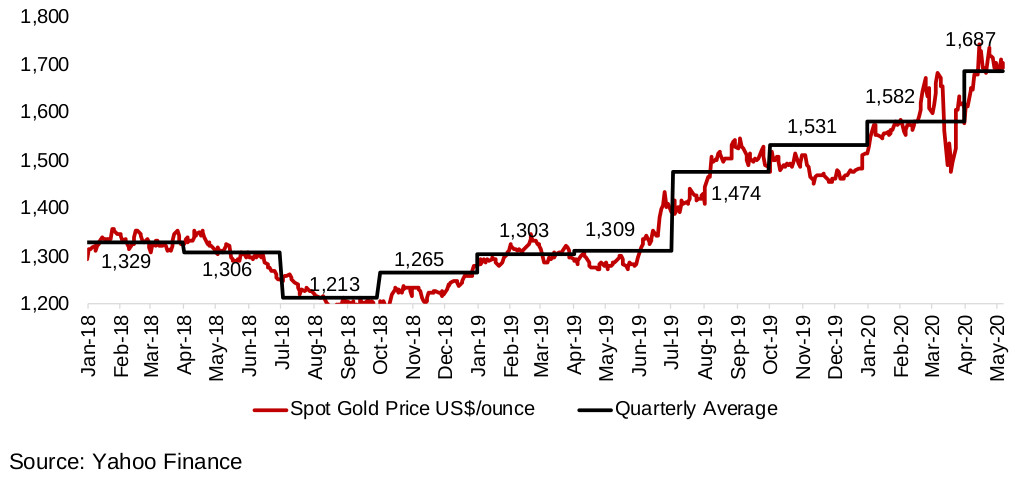

This week the gold price paused, with the nearest contract gold futures down -0.9%, but the both the producing gold miners (up 8.6% based on the GDX) and the junior gold mining stocks (with the GDXJ increasing 7.5%) continuing to rise (Figure 1). The producers had a good week as an overall strong set of Q1/20 results came through, and the companies enjoyed a large move in the realized gold price, with the spot price up 21% yoy to US$1,582/ounce in Q1/20, from US$1,309/ounce in Q1/19 (Figure 2). The average gold price so far this quarter bodes well for Q2/20 results, at US$1,687/ounce.

Figure 2: Gold spot price quarterly average

Producing gold miners Q1/20 results boosted by rising gold

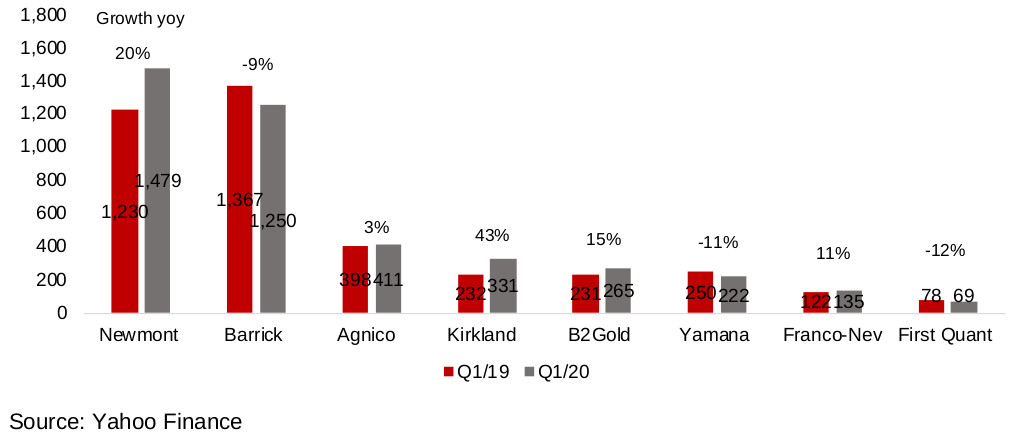

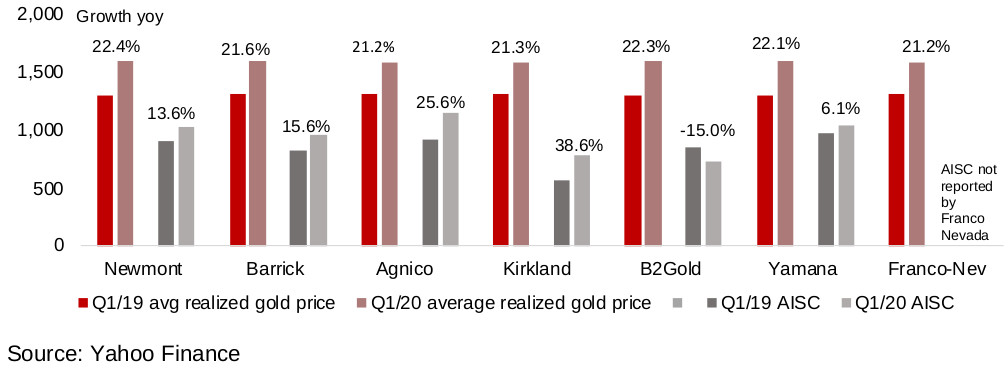

Overall the large cap producing gold miners saw a rise in gold production across the sector, with a 20% rise in ounces of output yoy for Q1/20 at one of the two sector giants, Newmont, offsetting a -9% decline at the other, Barrick (Figure 3). Production at Agnico-Eagle (up 3% yoy), Kirkland (43%), B2Gold (15%), and Franco-Nevada (11%) all increased, while only Yamana (-11%) and First Quantum (-12%), relatively small contributors, saw declines. Production reductions related to the global health crisis were still not a major issue up until well into March, and therefore had only a marginal effect on the results, but will be more of a driver next quarter. The most dramatic factor in the results was the yoy surge in the gold price, with all the companies seeing over 20% yoy increases in realized gold prices, a level which is now substantially above costs (Figure 4).

Figure 3: Major gold miners' Q1/20 gold production and growth yoy

Figure 4: Major gold miners' Q1/20 realized gold price and costs

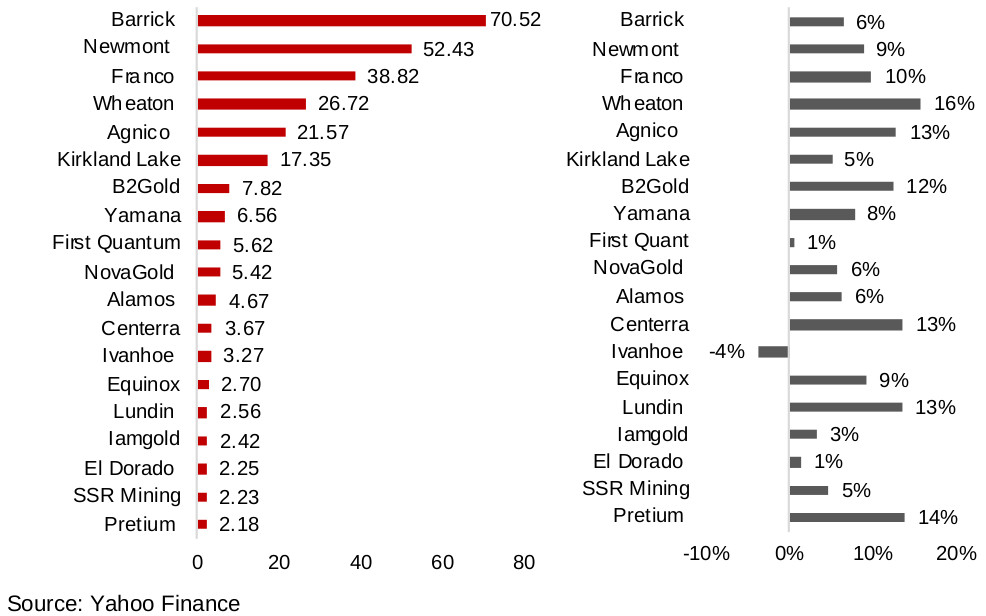

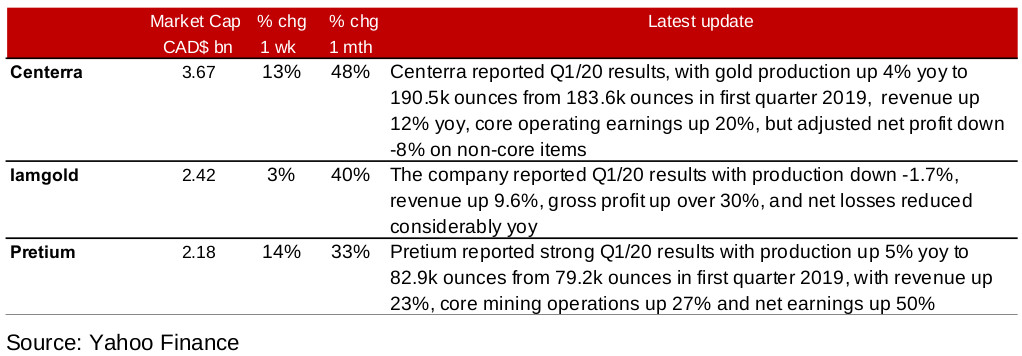

Q1/20 results the main driver this week for producing miners

The Q1/20 results were the main focus of the stock price moves for the producing miners this week (Figures 5, 6), with the top five producing gold miners by market cap seeing gains between 6% to 16%. For the mid-cap producing miners, strong results drove gains for Centerra, up 13% on a rise in gold production of 4% yoy for Q1/20, and Pretium, up 14%, with production up 5% yoy for the period (Figure 7). Iamgold also reported, with a -1.7% decline in production driving only a 3% rise in its share price this week.

Figures 5, 6: Canadian producing gold mining stocks

Figure 7: Producing gold miners updates

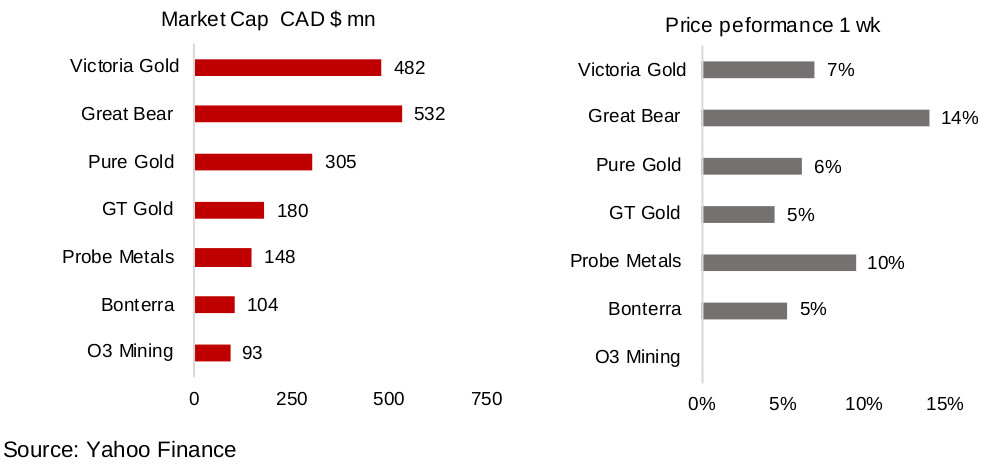

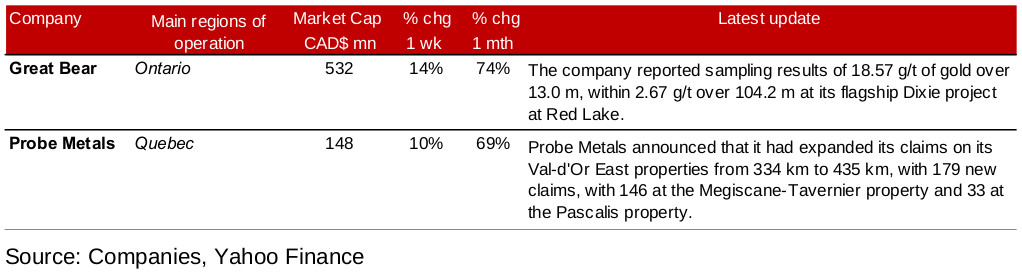

Sampling results and expansion drive Canadian operating juniors

Material gains in Canadian operating junior gold mining stocks were driven by company specific news flow, with gains for much of the group in mid-single digits (Figures 8, 9). Great Bear Resources jumped 14% this week on the release of new sampling results from its Dixie Project in Red Lake (we cover more detail on Great Bear later in this report), and Probe Metals rose 10% on an expansion of its Val-d'Or East Properties (Figure 10).

Figures 8, 9: Canadian junior gold miners with operations in Canada

Figure 10: Canadian junior gold miners operating in Canada updates

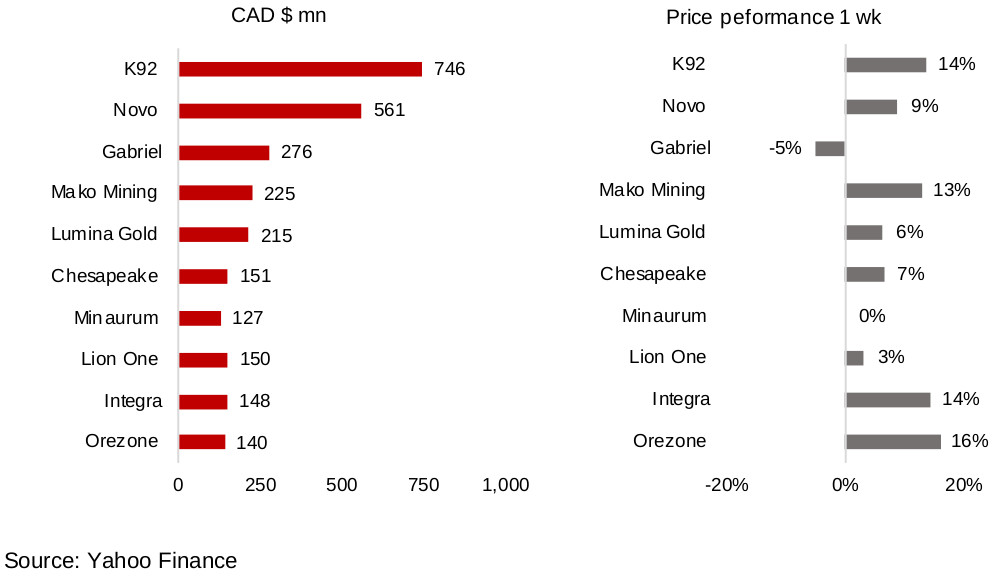

Sampling results, capital raise, drive internationally operating juniors

The internationally operating Canadian junior gold mining stocks saw a strong week overall (Figures 11, 12). There was material news flow from Mako Mining, which released strong sampling results for its San Albino project, which boosted the share price by 13%, while Minaurum was flat after an announcement of a planned CAD$5mn capital raising to fund further exploration of the Alamos silver project (Figure 13).

Figures 11, 12: Canadian junior gold miners operating mainly internationally

Figure 13: Canadian junior gold miners operating mainly internationally updates

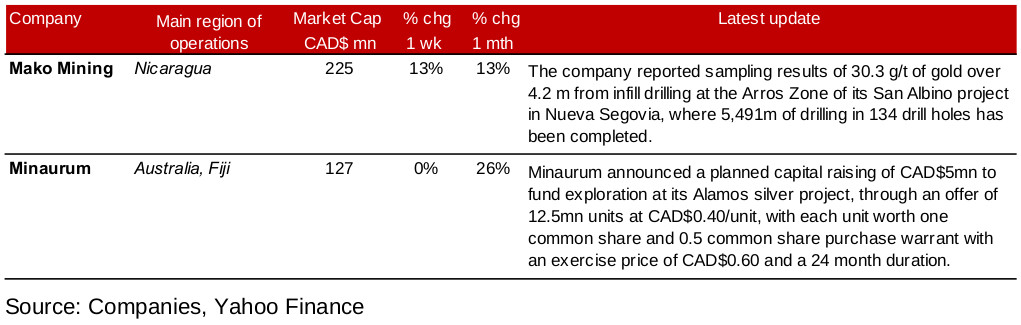

Figure 14: Great Bear Resources

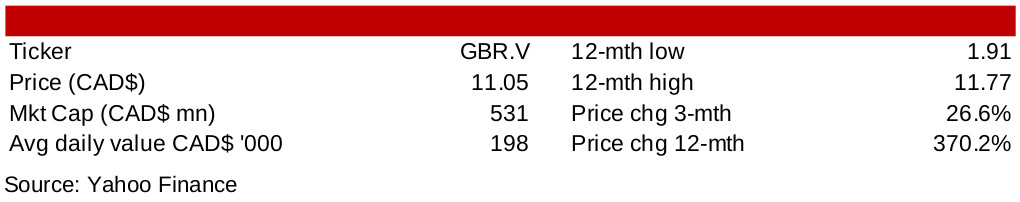

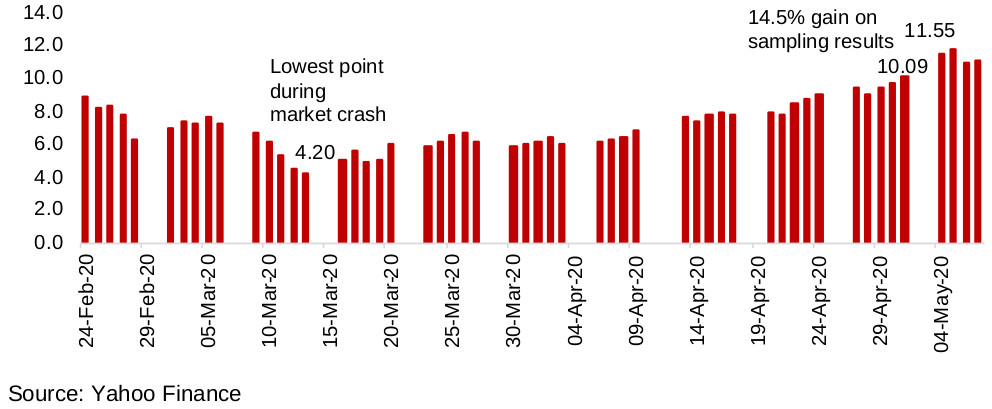

Great Bear reports sampling results, share price up 14.5%

Junior gold miner Great Bear Resources released new sampling results on May 4, 2020, with highlights including 18.57 g/t over 13.0 metres, within 2.67 g/t over 104.15 metres, at its flagship Dixie Project in Red Lake in Ontario, a historically prolific gold district with production starting from the 1930s. While these results were not the highest seen over the past year (Figure 15), they were still very well received by the market, with the share price rising 14.5% on the announcement (Figure 16). A combination of the continued gold price resurgence, and lessening concern that the global health crisis would massively disrupt the junior mining space, in terms of both exploration and activity to capital, also likely helped propel these gains. The company is now above its levels before the market crash, and has more than doubled off its bottom in the market crash.

Figure 15: Great Bear Resources sampling highlights

Great Bear has continued drilling, and is cashed up

Great Bear is well positioned financially, with CAD$21mn in cash, and the company was still able to continue its sizeable drilling program, with 110,000 metres and over 300 holes planned for 2020, even given the ongoing health crisis. While the company has been reporting strong sampling results through 2019 and 2020 from separate areas of the Dixie Project, it has also been reporting better than expected continuity between these areas in recent months, which could mean a much greater resource than was previously expected.

Red Lake continues to gain interest, Pure Gold another play

The Red Lake district continues to be an increasing focus for junior gold mining firms, and is drawing a host of new operators. In addition to Great Bear, another key play on the region is the junior miner Pure Gold Mining, which is at an even more advanced stage than Great Bear, with a preliminary economic assessment already complete, and Pure Gold is expecting its first gold pour by the end of the year. Nonetheless, the market cap of Great Bear is CAD$531mn, compared to just CAD$309mn for Pure Gold, with the market currently expecting more output from Great Bear long-term. See our report 'Overview of Red Lake' for more detail on the region and the junior gold mining companies operating there.

Figure 16: Great Bear share price up 14.5% on new sampling report

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.