May 1, 2020

Global junior gold mining sector hits pre-crisis levels

Author - Ben McGregor

GDXJ briefly back to pre-crisis levels

The GDXJ this week briefly returned to its levels prior to the financial crisis, before sliding about 5% below pre-crisis levels, as gold has remained strong and concerns that juniors would have severe difficulty sourcing capital have begun to subside.

Producing miners begin to report Q1/20 results

After a very strong couple of weeks, the producing Canadian gold miners saw a less robust performance this week, with several names seeing moderate declines, and the first sets of Q1/20 results for the global gold mining stocks started to come through.

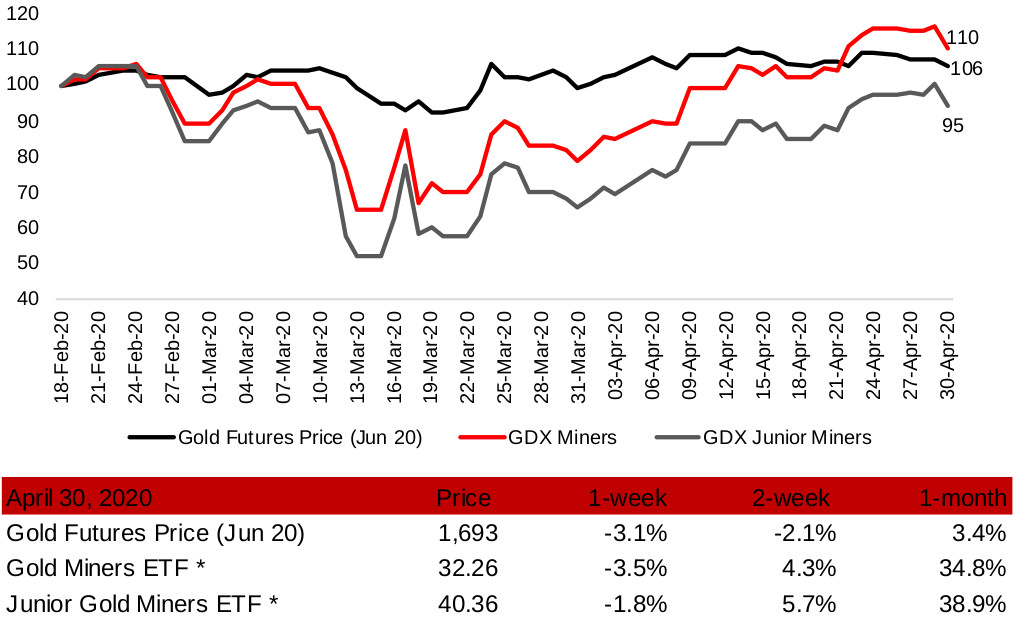

Figure 1: Gold futures price and gold mining ETFs

Source: Yahoo Finance

Global junior gold mining sector briefly regains pre-crisis level

This week marked an important milestone for global junior gold mining stocks, as they finally briefly touched the pre-crisis levels of late February 2020, using VanEck's GDXJ as the proxy for the sector, although they ended the week 5% below pre-crisis levels (Figure 1). The global producing gold mining sector is even farther ahead, with VanEck's GDX gold miner ETF having already regained its crisis period losses two weeks ago, and reaching a 10% gain since the crisis as of this week. Although the gold futures price ticked down 3.1% this week, this alone did not seem to be a major driver for the Canadian gold miners, and movements seemed to be driven more by stock specific issues than in recent weeks.

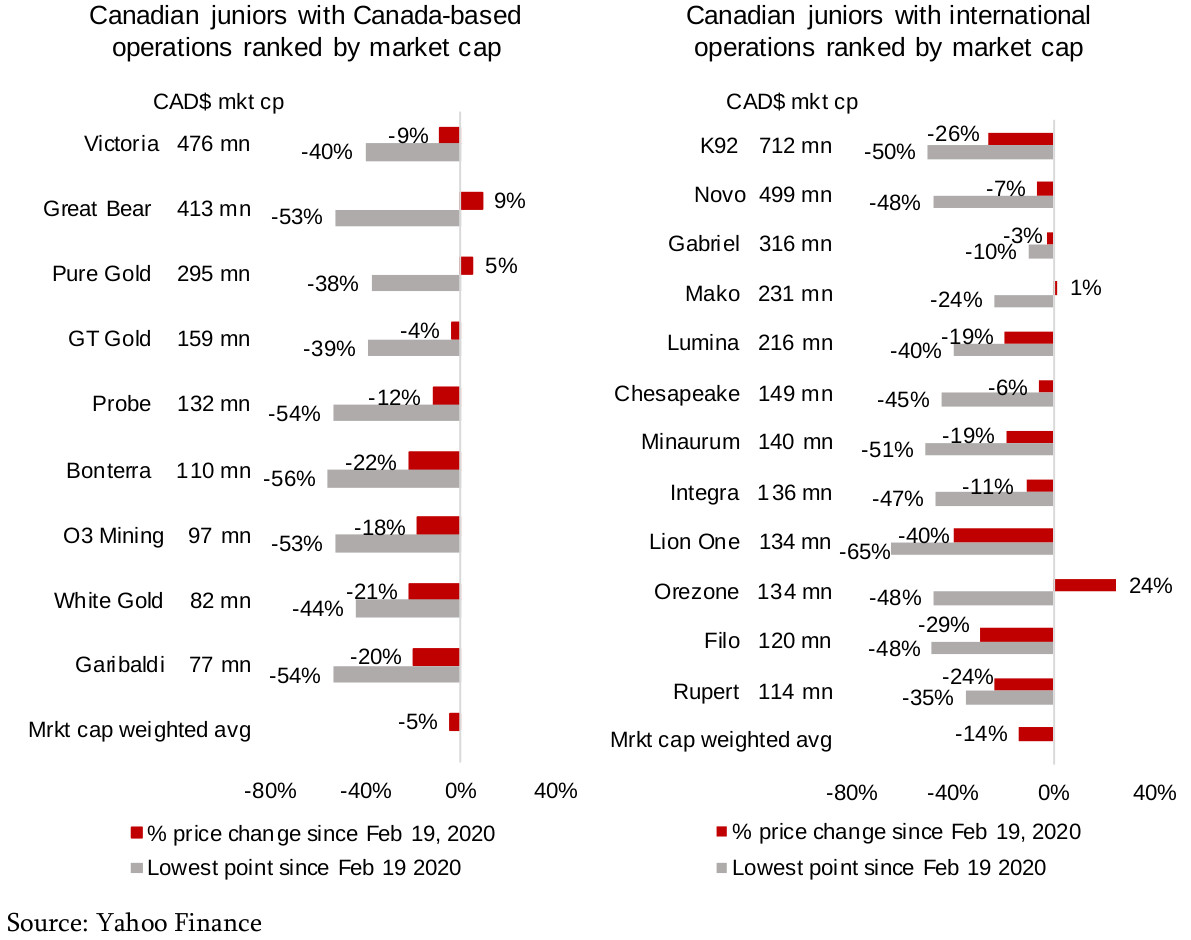

Figures 2, 3: Canadian junior gold mining stocks performance since the crisis

Canadian junior gold miners still haven't regained pre-crisis levels

The larger Canadian junior gold mining stocks are lagging a bit compared to the recovery in the GDXJ, with many still down substantially since the crisis (Figures 2, 3). The Canadian junior mining stocks with mainly domestic operations are heading towards break even as a group, down just 4.5%, weighted by market cap (Figure 2), but those with international operations are still down 13.8% (Figure 3). However, there is wide divergence across the group, with larger losses tending to be correlated with smaller market caps. Nonetheless, this still marks a significant improvement over crushing earlier losses for many of these juniors, and all are now well off of their March 2020 trough levels. Stand outs for large turn arounds to gains since the crisis include the two main Red Lake, Ontario, junior gold mining stocks, Great Bear, up 9% since the crisis, and Pure Gold, up 5%, and Burkina Faso focused Orezone, up 24%.

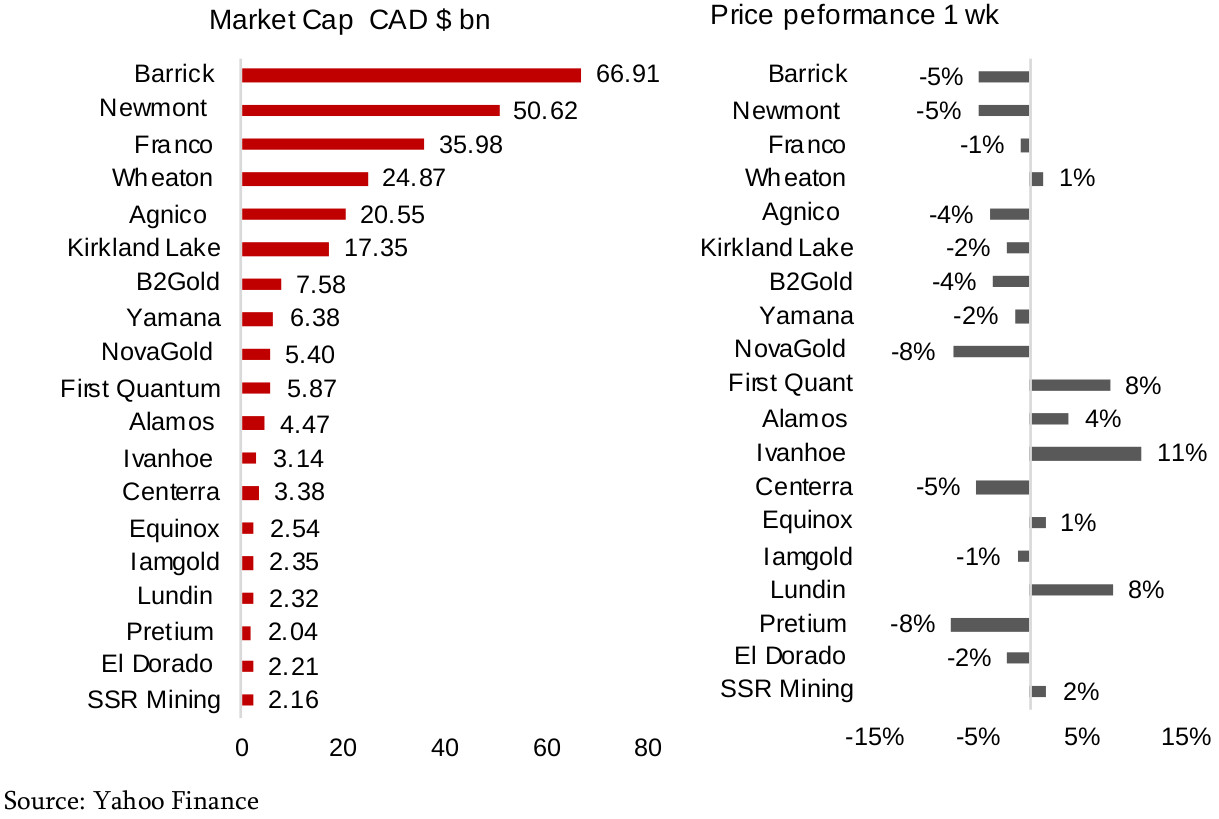

Figures 4, 5: Canadian producing gold mining stocks

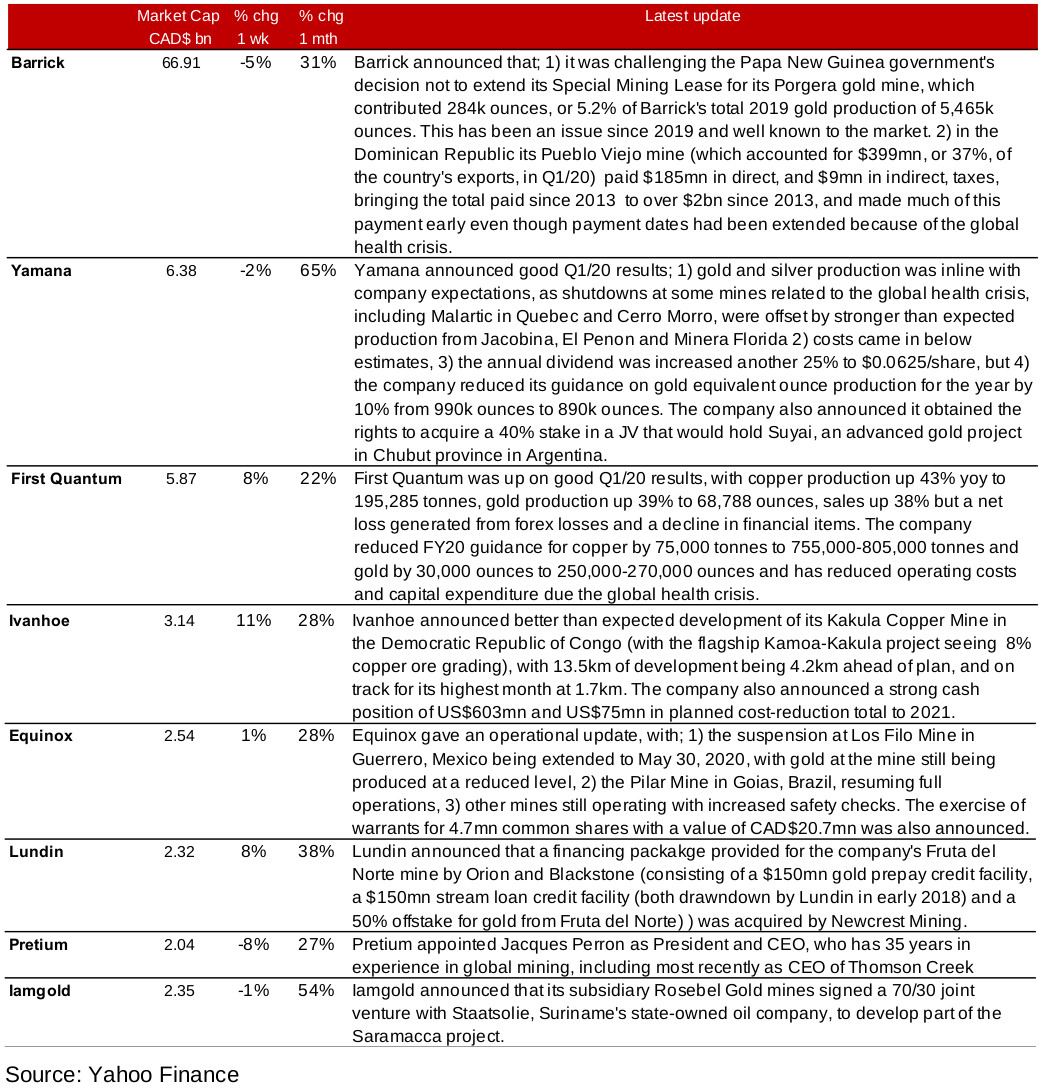

Figure 6: Producing gold miners updates

Producing miners gains slow, Q1/20 results starting coming in

After the two previous particularly strong weeks, there was a slowdown in the gains for the producing Canadian gold miners this week, with several names seeing small declines (Figures 4, 5). The core trend in news flow was the start of Q1/20 results season. Both Yamana and First Quantum reported decent results this week, but Yamana was nearly flat, while First Quantum was up 8%, suggesting it surpassed market expectations somewhat (Figure 6). There was a range of other operational news this week, with Barrick continuing to have issues extending a mining lease in Papua New Guinea, Ivanhoe announcing better than expected progress on its Kakula Copper Mine in the Democratic Republic of Congo, and Equinox providing an update on mine suspensions related to the global health crisis. Lundin announced a transfer in ownership of a financing package, Pretium a change in its CEO, and Iamgold a JV arrangement with a state-owned oil company in Suriname.

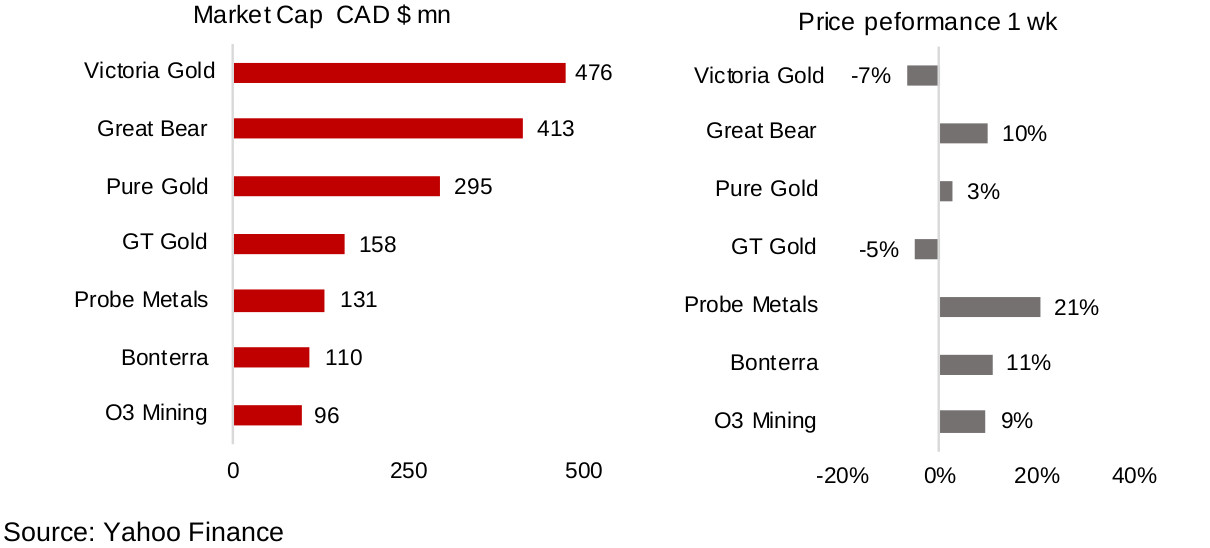

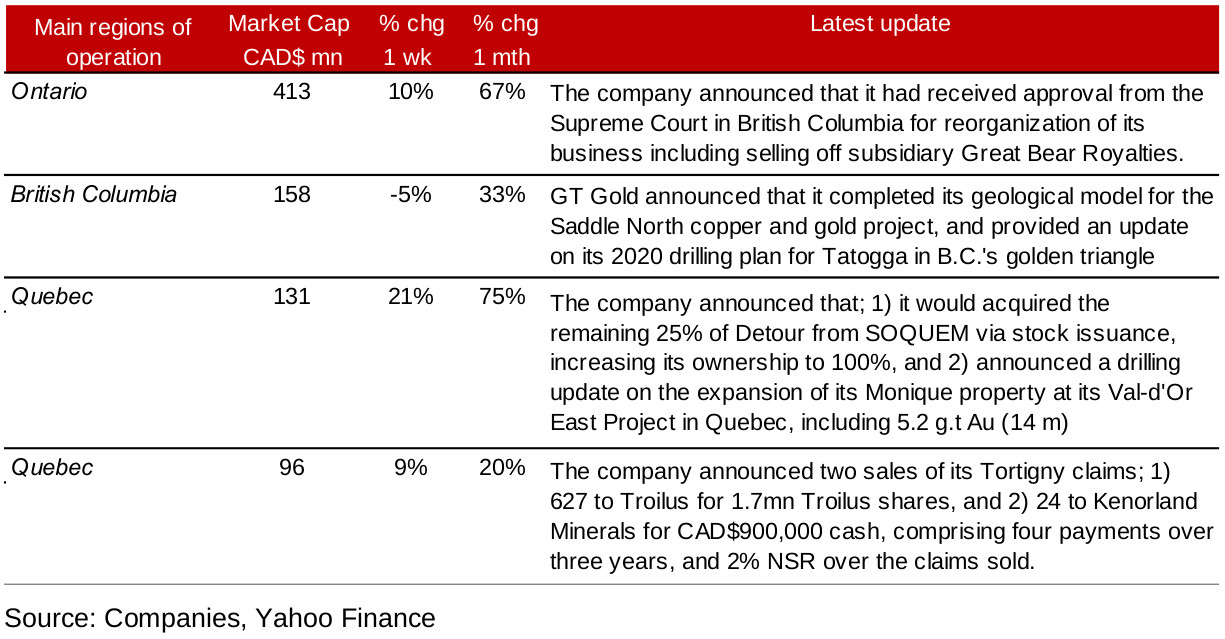

Figures 7, 8: Canadian junior gold miners with operations in Canada

Canadian junior gold miners move on company specific news

While in the previous two weeks, we had seen the Canadian junior gold miners buoyed overall by the rising gold trend, moves this week seemed to be more stock specific. For the Canadian junior miners with mainly domestic operations, Probe Metals saw the largest gain of the group, announcing that it would take an additional stake in Detour, increasing its holding to 100% (Figures 7, 8). Great Bear rose 10%, partly driven by an announcement that its business reorganization had been approved, including the sale of Great Bear Royalties. O3 was up 9%, having announced the sale of some of its Tortigny claims, and GT Gold was down 5%, after announcing the completion of a geological model and its 2020 drill plan (Figure 9).

Figure 9: Canadian junior gold miners operating in Canada updates

Canadian juniors with international operations mostly decline

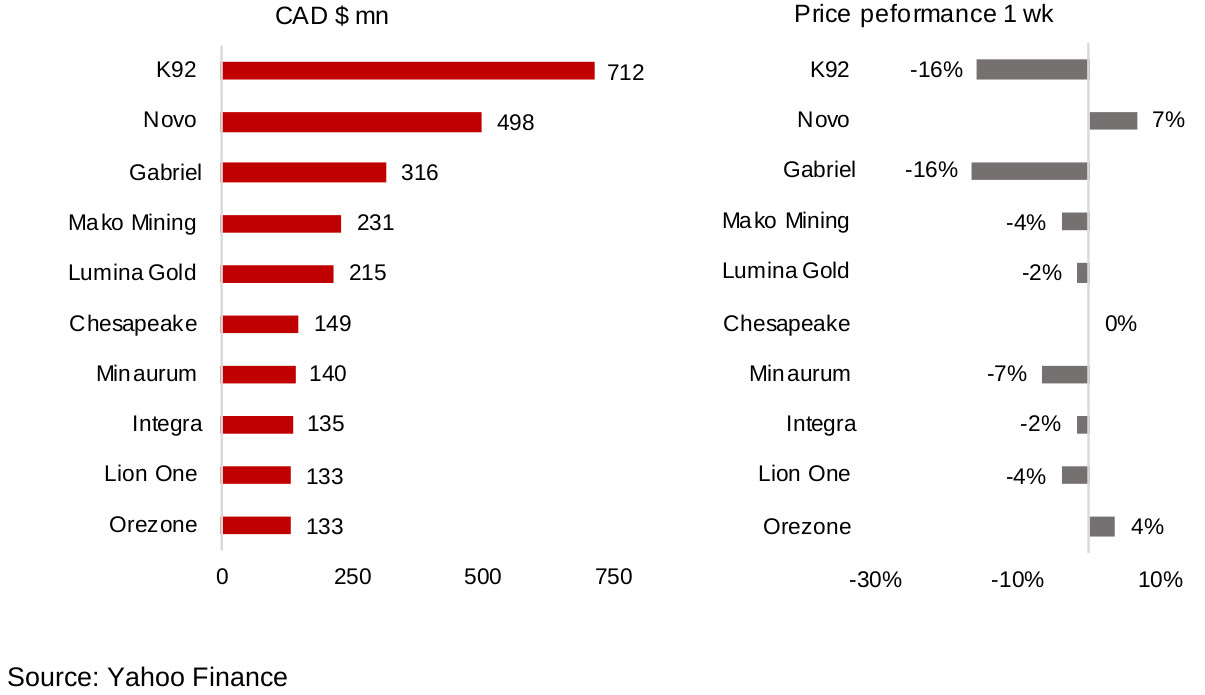

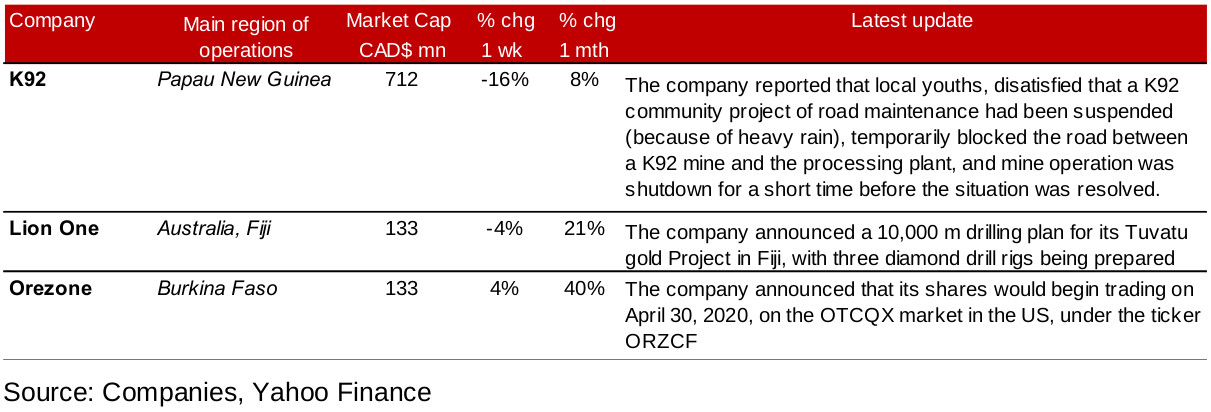

The Canadian juniors with mainly international operations mostly declined this week (Figures 10, 11). K92 was down on a temporary halt to its operations in Papa New Guinea, as a relatively minor incident with local youths near, but not directly involving, its mine led to a short shutdown for safety, but the issue was quickly resolved (Figure 12). Orezone saw a moderate 4% gain as it announced its shares would begin trading on the US's OTCQX market, and Lion One saw a 4% decline, even as it announced details of its new drilling program at Tuvatu.

Figures 10, 11: Canadian junior gold miners operating mainly internationally

Figure 12: Canadian junior gold miners operating mainly internationally updates

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.