March 27, 2020

Junior Gold Miner Weekly

Author - Ben McGregor

Margin call driven plunge in gold reversed...

This week saw the reverse of a margin call driven plunge in the gold price that occurred through mid-March 2020, as even more severe monetary stimulus measures were introduced this week, sending the gold price up 10.6%.

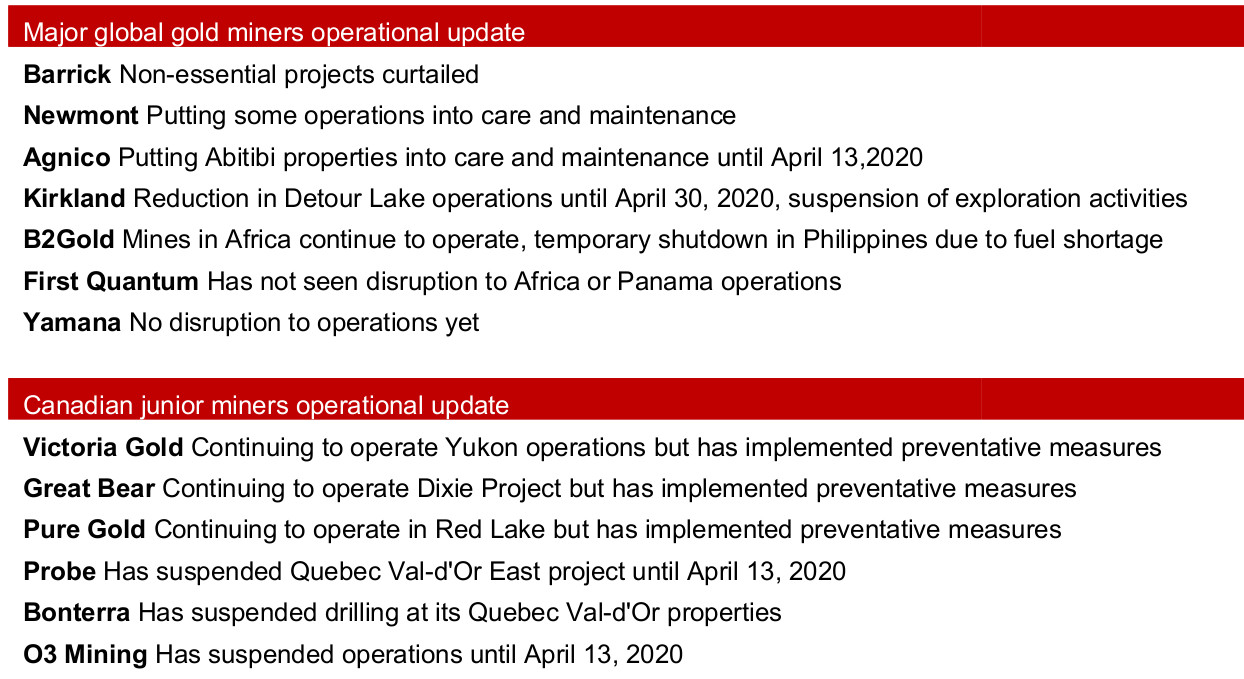

...but a wave of production shutdowns announced

However, offsetting this somewhat has been a wave of production shutdowns across the gold mining space, which, while temporary, could mean months of reduced output from the producers and limited exploration news from juniors.

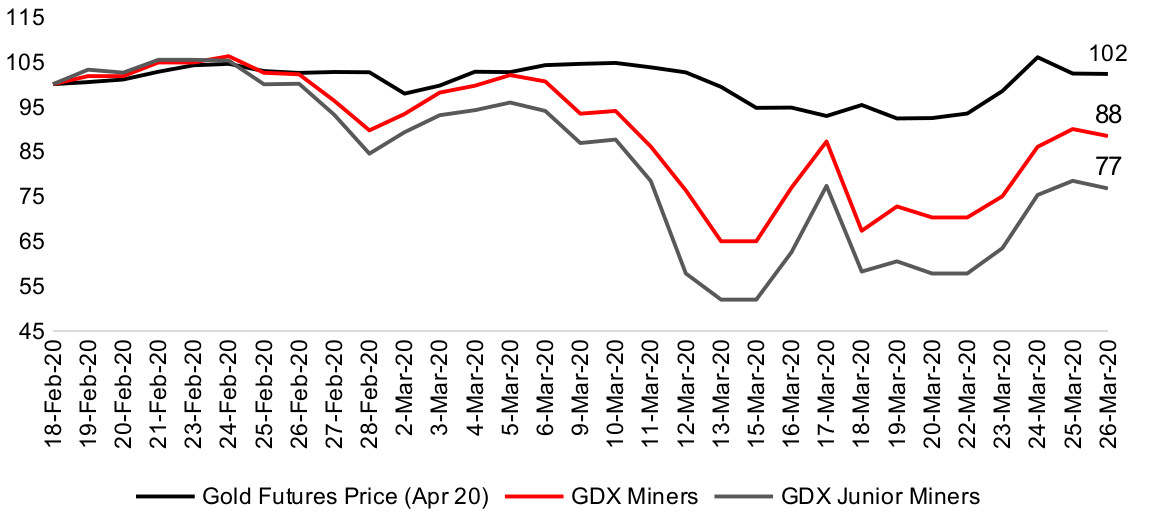

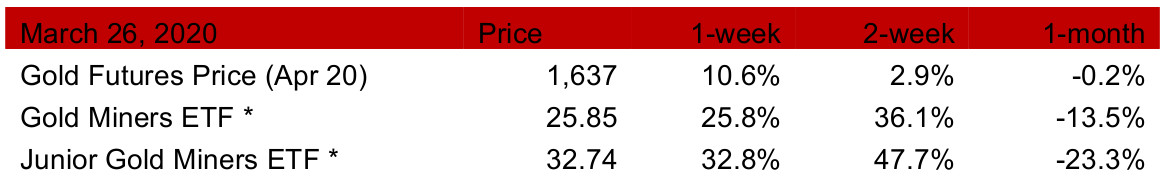

Gold price and gold mining ETFs

Fears of margin call collapse of gold price allayed

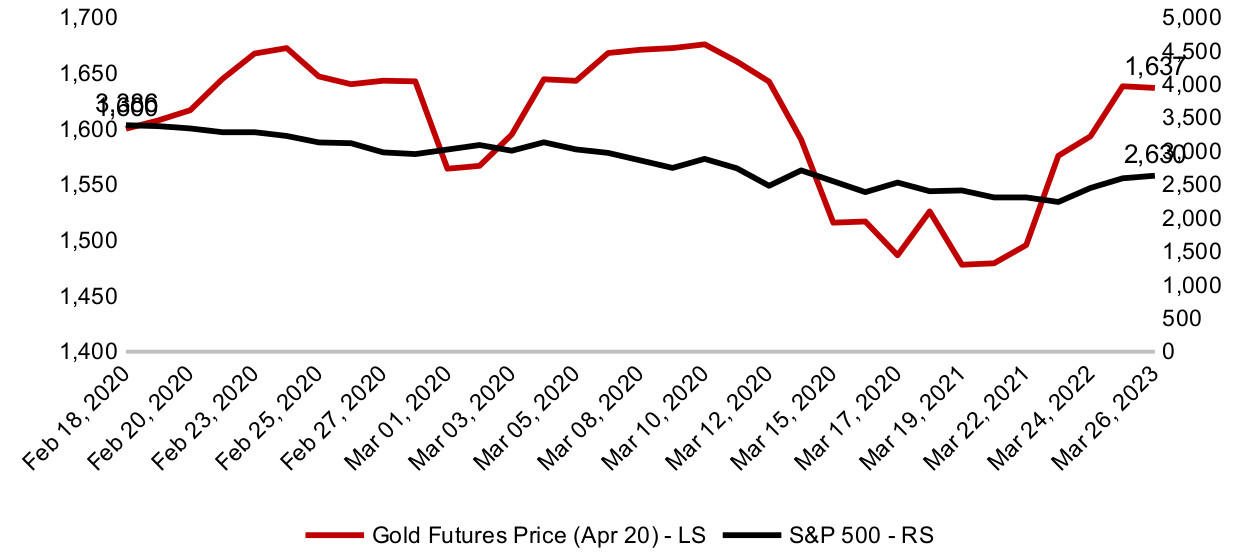

This week was crucial for gold, as even just a week ago there were still concerns that margin call driven selling could continue to drag down the metal, after an 11.8% fall from March 10 to March 19, 2020. However, following a wave of monetary stimulus measures by global central banks, including the Fed's unleashing of QE Eternity (unlimited money printing), gold rebounded 10.7% in the week to March 26, 2020, and is now up 2.3% since February 18, 2020, just prior to the onset of the crash. Interestingly, the wave of stimulus measures has not been so bullish for equity markets, with the S&P 500 still down -22.3% since February 18 (Figure 1). This suggests that investors are seeing gold as a currency of last resort as the planned money printing will devalue fiat currency versus real goods, and as a general backstop to continued real sector risks from the ongoing health crisis.

Figure 1: Gold price versus S&P 500 performance

Source: Yahoo Finance

Wave of announcements of production shutdowns

While gold price resilience this week was good for the gold miners, this was offset somewhat by signs that the global health crisis is starting to have real effects across the space, with a wave of announcements of temporary operational shutdowns. Most of the major global gold miners are seeing some operations halted, and while some Canadian juniors have not been heavily affected yet, like Victoria Gold, Great Bear and Pure Gold, others have stopped operating temporarily, including Probe, Bonterra and O3 Mining (Figure 2).

Operational bad news baked in but gold price strength not?

The question now is which effect, strong gold, or operational issues, will dominate? For now, it is clearly the latter, with the Van Eck Junior Gold Miners ETF still down 23% since the market crash began. Of course, this decline is baking in more than temporary shutdowns, and includes the issue of increasingly risk averse investors being more wary of supplying the capital so crucial for the juniors, many of which have only a short runaway of funding. Nonetheless, all of this is well known to the market, and is likely well discounted in prices. A potential continued resurgence in gold however, might not be.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.