April 3, 2020

Junior Gold Miner Weekly

Author - Ben McGregor

A much calmer week compared to recent chaos

Gold dipped 1.9% this week, marking a period of relative calm compared to the chaos of the previous two weeks, and importantly gold has maintained an average price of over US$1,600/ounce during the crash.

Russian central bank to halt gold purchases

While prior to the crisis, this week's announcement that Russia's central bank would halt gold purchases in April would have likely hit gold, this may be offset by the current safety and fear motives of the wider market.

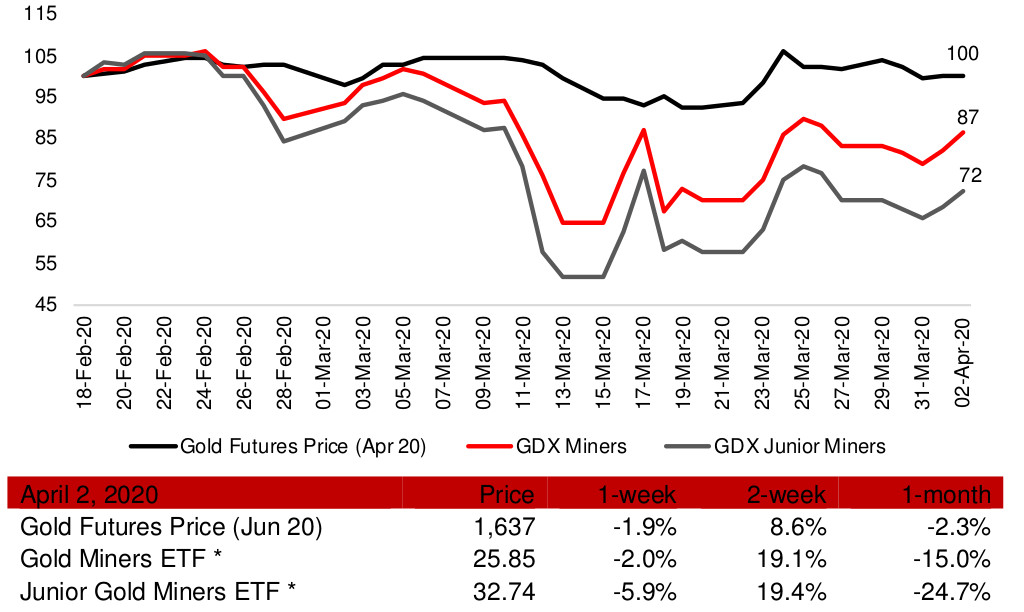

Gold price and gold mining ETFs

Source: Yahoo Finance, *Van Eck

A relatively calm week compared to recent chaos

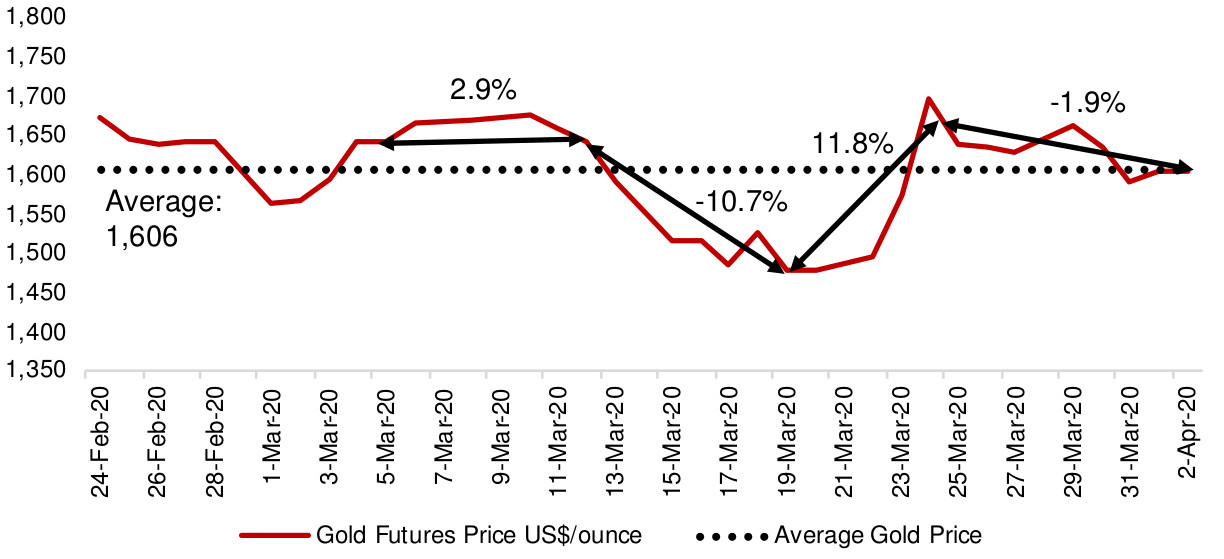

The gold market was relatively calm this week, with the nearest contract gold futures price dipping just -1.9%, compared to the prior chaos, with an 11.8% jump last week, and a -10.7% plunge the week before that (Figure 1). Underlying the turbulence, however, we can see a strong average gold price since February 24, 2020, of US$1,606. This certainly is high enough to provide sufficient margins to the average Canadian producing gold mine, and likely also provides enough of a premium even to offset the risk to investors involved in funding the operations of larger junior miners.

Figure 1: Recent weekly gold price movement

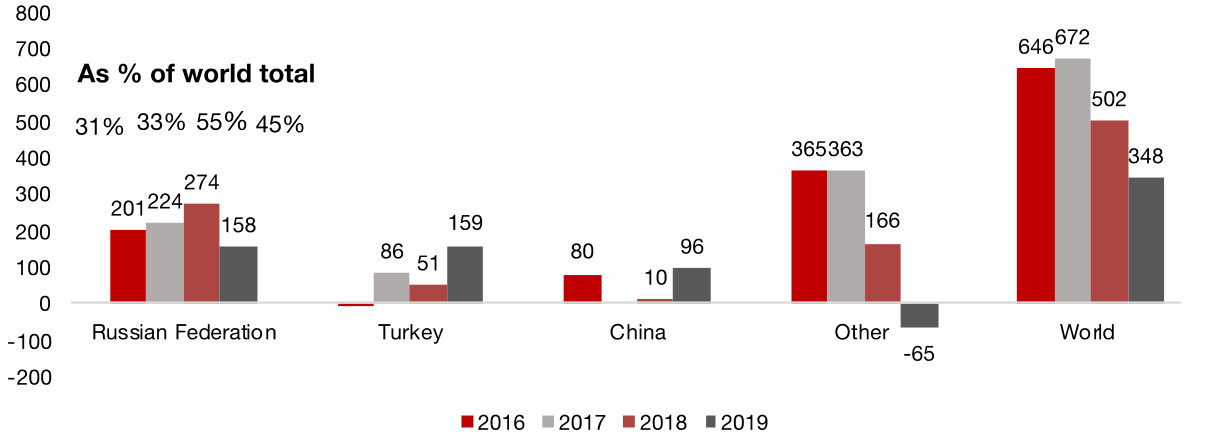

Russia's central bank halts gold purchases

One major piece of macro news for the gold market this week was the announcement that Russia's central bank would halt purchases of gold from April 1, 2020. This is important given that strong demand from global central banks overall for the past few years has been a key driver supporting gold, and of these central banks, Russia has been by far the largest net purchaser. In 2019, of net purchases of 348 tonnes of gold by central banks globally, Russia accounted for 158 tonnes, or 45%, and accounted for 55%, 33% and 31%, in 2018, 2017 and 2016, respectively (Figure 2). Thus, in the pre-crisis environment, we could have expected that such a withdrawal of demand could have put some downward pressure on the gold price. However, in this post-crisis world, this pressure could be more than balanced by a strong mix of; 1) broad based economic fear by the global population looking for safety, and 2) concerns over the fiat currency devaluation effects of the massive monetary expansion being made in response to the crisis.

Figure 2: Change in central bank gold holdings (tonnes)

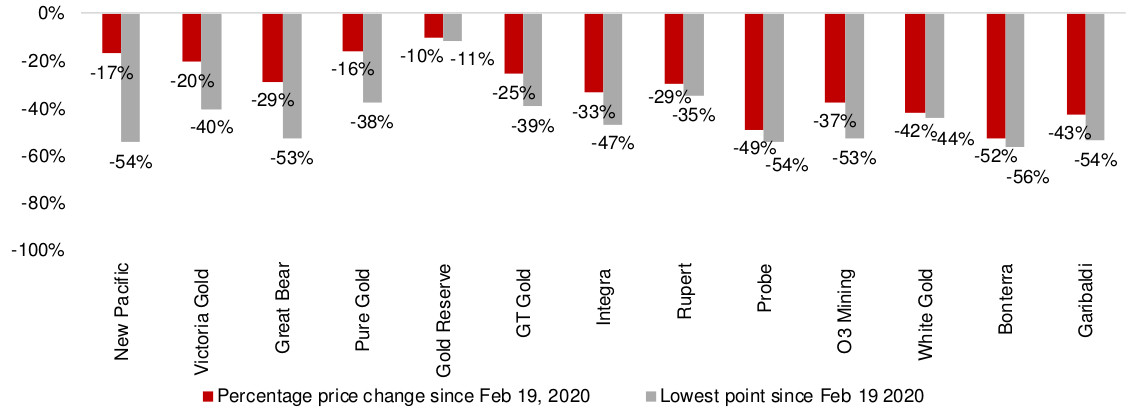

Canadian juniors off the lows

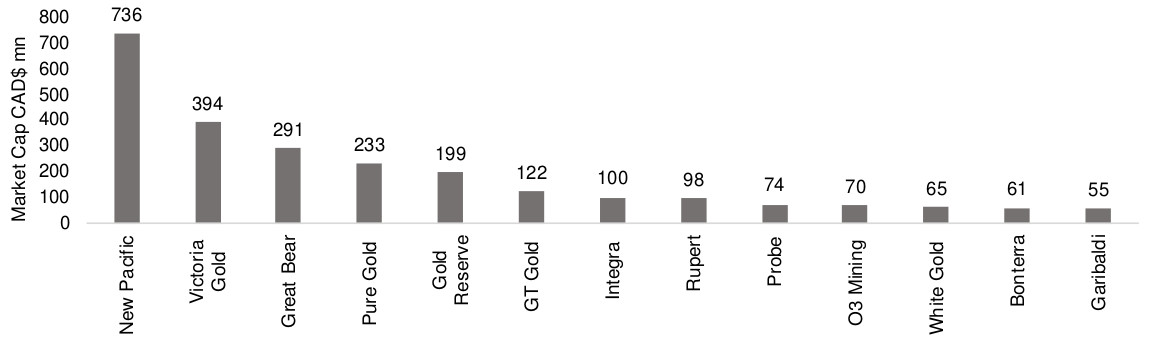

The group of Canadian juniors gold miners shown in Figures 3 and 4 (ranked by market cap), have seen a 25% decline in aggregate market cap since February 19, 2020, or just prior to the onset of the current crisis. However, the entire group is now off its lows, and many names substantially so. Although not an exact rule, the general trend has been that larger market cap stocks have bounced back much more strongly, and the smaller market cap companies less so.

This is likely due to the balance of the two core factors driving the juniors currently, one of which is the strong gold price, and the other which will be concern over rising difficulty in accessing capital since the crisis. For the larger cap juniors, the market may be weighting the rise in the gold price higher, and expecting that these companies will have sufficient access to capital. As we move down in market cap, the rise in gold may be given less of a premium, and the concern that these smaller firms may have difficulty securing sufficient funding, weighed more heavily.

Figure 3: Price performance of Canadian junior gold miners

Figure 4: Market cap of Canadian junior gold miners

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.