April 17, 2020

Global gold juniors continue to recover losses

Author - Ben McGregor

Gold flat, but global juniors continue to recover losses

While the gold price rise paused this week, with the nearest futures contract near flat at - 0.6%, this is still a 17% recovery off the lows, and a 9% gain from pre-crisis levels, and the global junior gold mining sector continued to curb its losses since the crash.

Major mines in Quebec come back online

The stand out news for the Canadian producing mines this week was the announcement that as of April 15, 2020, the province of Quebec, which is home to some of Canada's largest mines, would allow mining production to resume.

Several larger cap Canadian juniors recoup the bulk of losses

Global junior miners continue to head back towards their pre-crash levels, with the GDXJ now just 10% below pre-crash levels. For the Canadian junior miners, the larger the market cap, the larger the average recovery off the mid-March lows has been.

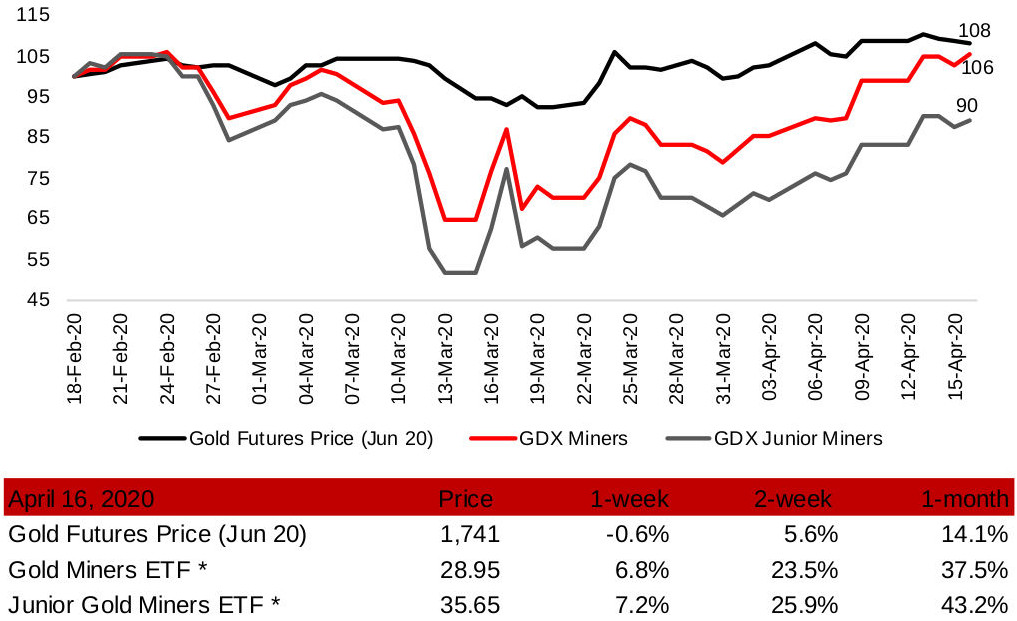

Gold futures price and gold mining ETFs

Source: Yahoo Finance

Juniors continue to recover towards pre-crisis levels

The junior gold miners continued to recover towards pre-crisis levels this week. While gold paused, with the nearest futures contract down -0.6% to US$1,741, it has still recovered 17% off crisis lows and is now 9% above its pre-crisis level on February 18, 2020. Senior gold miners moved above their pre-crisis levels this week, based on the VanEck gold miners ETF, which rose 6.8% this week and is up 6.0% since the crisis. The junior miners also made gains, with the VanEck junior gold miners ETF up 7.2%, leaving the sector now just 10% below pre-crisis levels, well off the near 50% decline at the trough just a month ago.

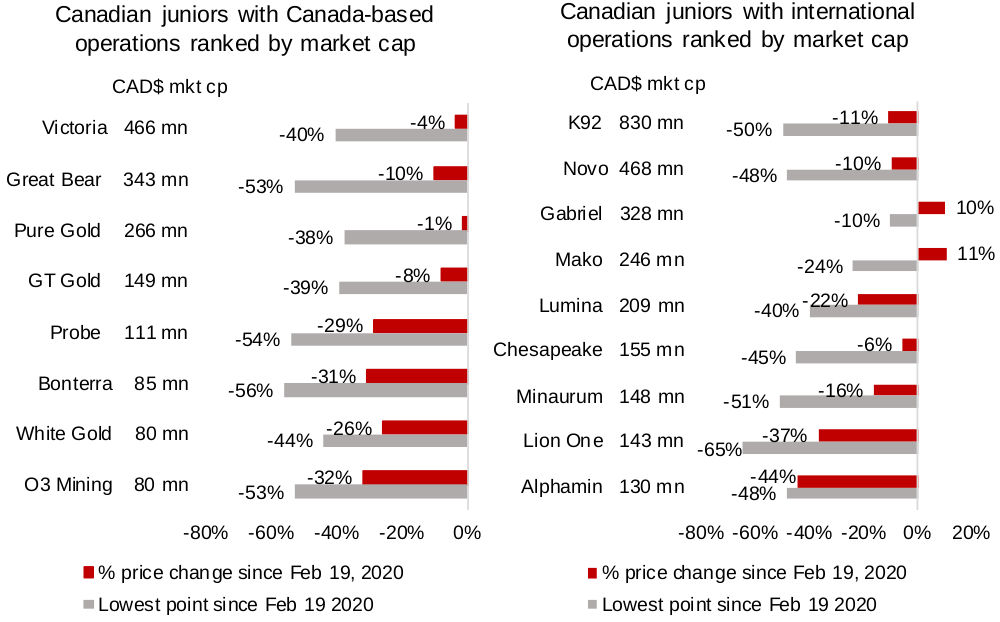

Figures 1, 2: Price performance of Canadian juniors since the crisis

Canadian juniors market cap and recovery generally correlated

For the Canadian junior miners, the degree of recovery and company size (based on market cap) has been generally correlated, with several larger cap names recouping much of the their gains, but many of the smaller cap stocks still facing considerable losses since the crisis began. The standout recoveries for the companies with operations in Canada have been and Victoria and Pure Gold (Figure 1), and for companies with mainly international operations, Gabriel and Mako have performed the best, with both now above their pre-crisis levels. (Figure 2)

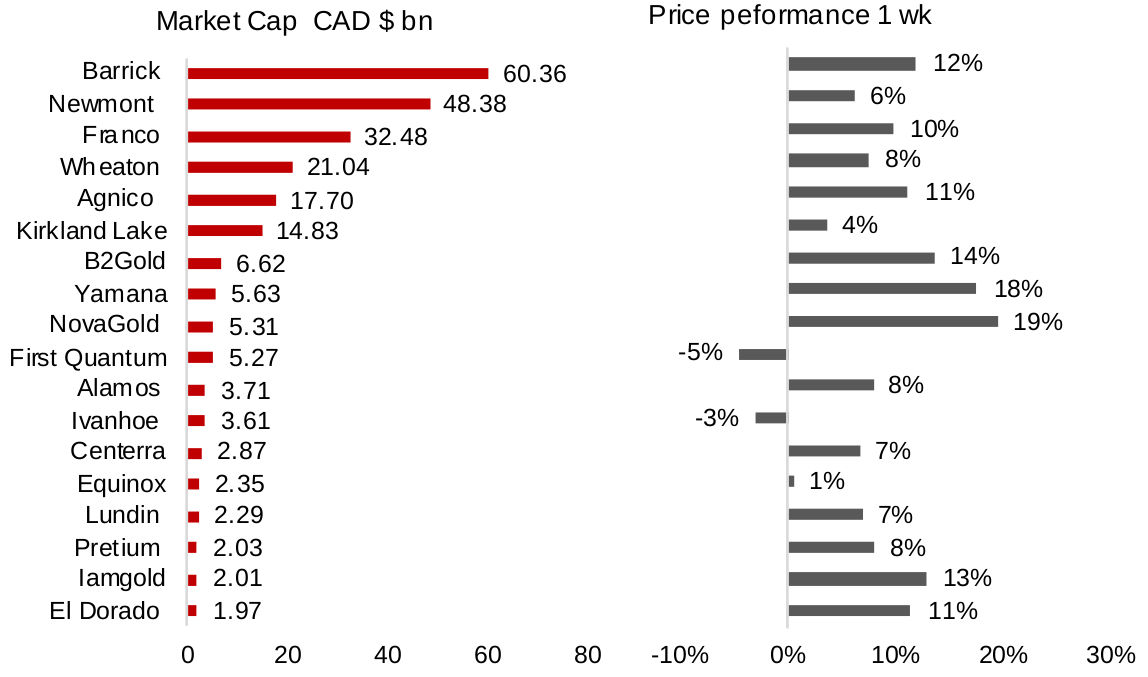

Major Canadian producing mines continue rebound

The major Canadian producing miners overall had another strong week (Figures 3,4), although it was more muted than last week's across the board surge in prices. The outstanding news for the Canadian producing mines this week was the Quebec government's announcement that the mining sector was official considered a critical sector of the economy, and therefore would resume operating, even given the global health issues (Figure 5).

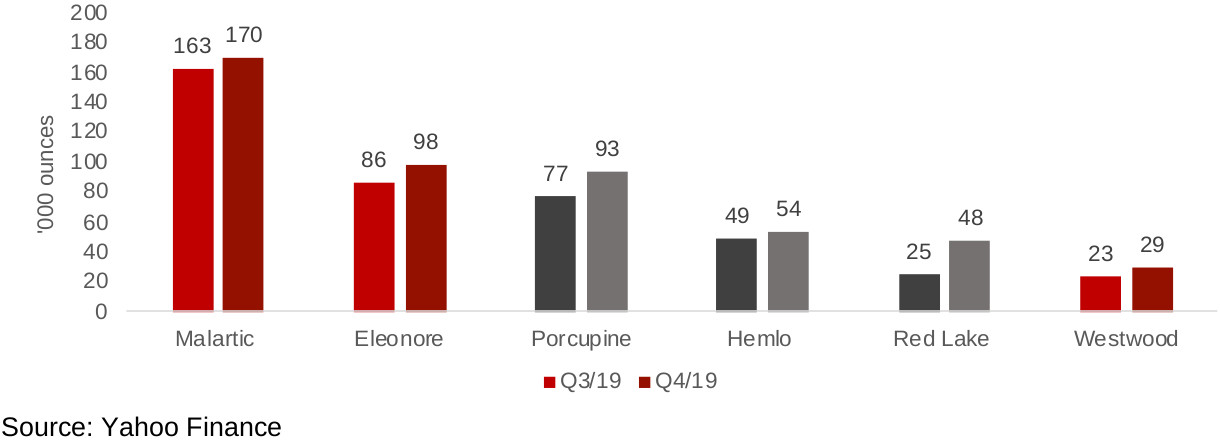

Figures 3, 4: Canadian producing miners

Major Quebec mines back to work on April 15, 2020

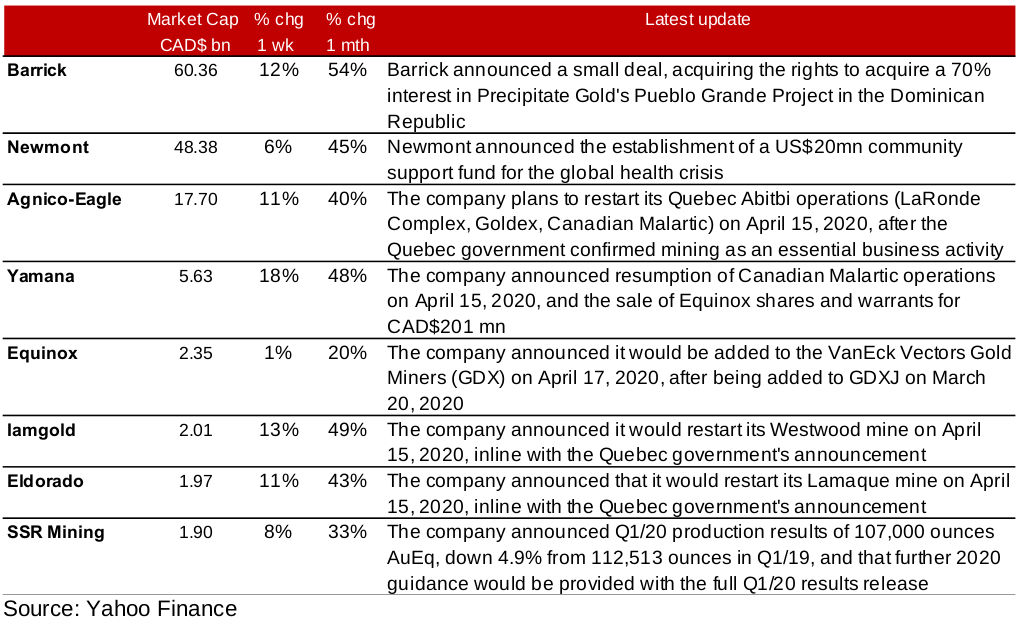

Specifically this meant that Quebec's major mines would restart operations as of April 15, 2020, having only closed for a few weeks, which could mean a relatively small reduction in 2020 production. Agnico-Eagle and Yamana, the joint 50% operators of the Canadian Malartic mine in Quebec, Iamgold, operator of Westwood, and Eldorado, operator of the Lamaque, all announced that production would resume from April 15, 2020. This is critical to total Canadian production for 2020, with Malartic and Westwood being two of the largest mines in the country (Figure 6). Other key news from the producing miners was that Equinox would be added to the GDX ETF in April 17, 2020, after having been added to the GDXJ ETF on March 20, 2020.

Figure 5: Producing miners updates

Figure 6: Largest producing Canadian mines

Canadian juniors operating in Canada see more muted rebound

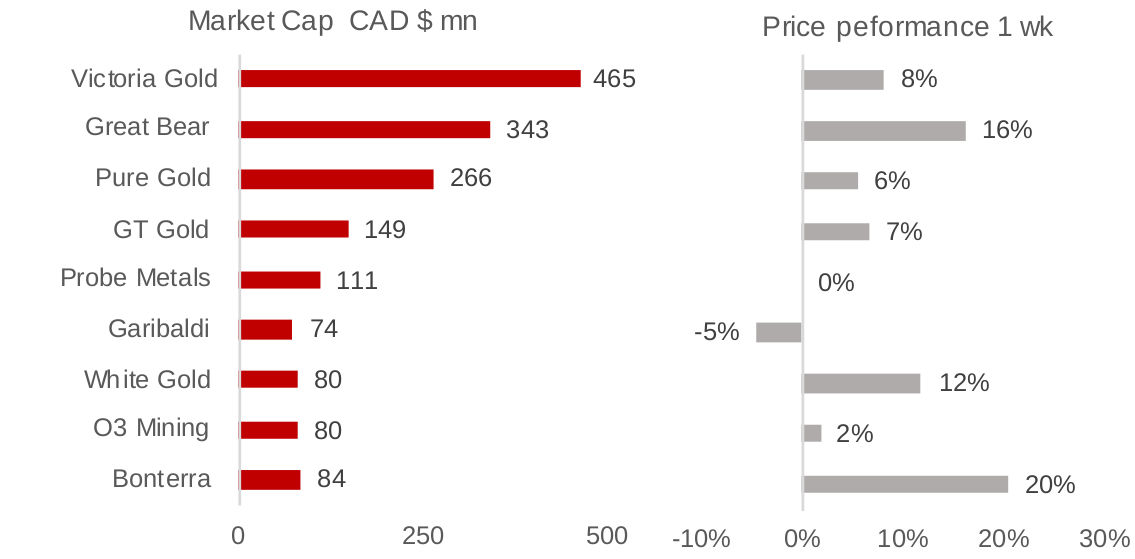

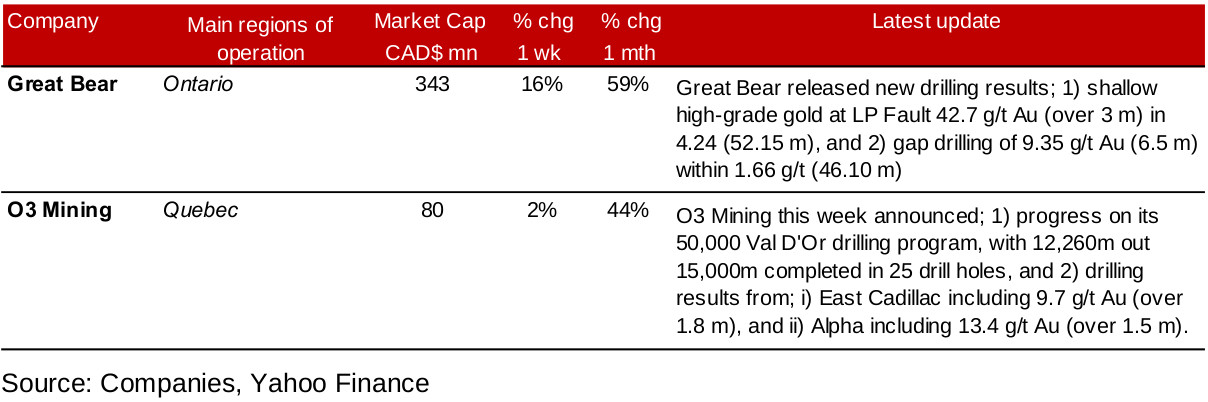

The larger Canadian junior gold miners with operations in Canada (Figures 7, 8), continued to make gains this week, but as with the producing mines, this was more muted than last week. The most material announcement was Great Bear's most recent sampling results (Figure 9), which drove its stock price up 16%. O3 Mining's announcement of drilling program and sampling results did not drive a material move from the market, with the stock up 2% for the week.

Figures 7, 8: Canadian juniors with operations in Canada

Source: Yahoo Finance

Figure 9: Canadian juniors operating in Canada updates

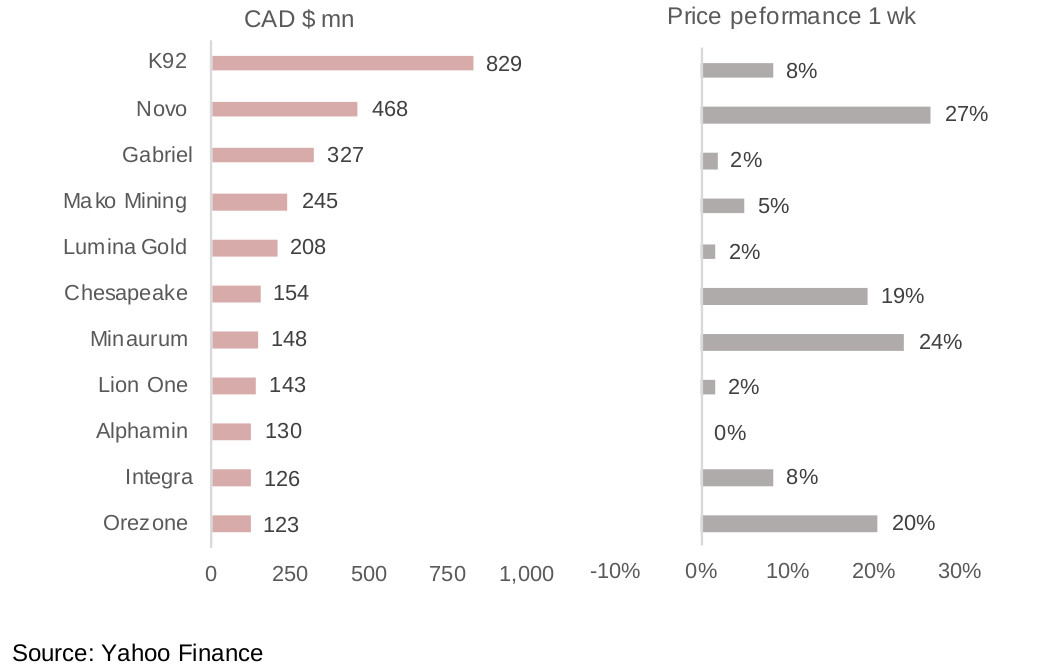

Gains for most internationally operating juniors

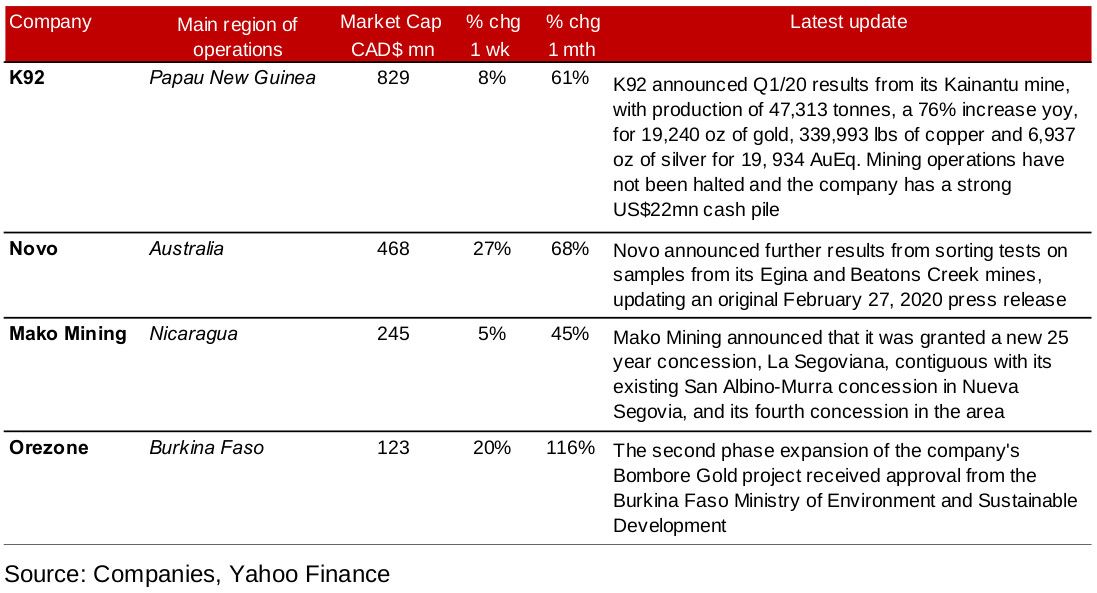

Most of the larger Canadian juniors with mainly international operations saw gains this week (Figures 10, 11). Major press releases included K92's Q1/20 production results from its Kainantu mine in Papua New Guinea, which lead to an 8% rise in the stock for the week (Figure 12). Novo's reporting of sorting tests from its Egina and Beaton Creek mines sent its stock up nearly 27%. Mako's announcement of a new concession had a marginal effect on its stock price, but Orezone's announcement of a government environmental agency approval lead to a 20% gain. Chesapeake and Minaurum both had significant gains this week, but issued no material press releases over the period.

Figures 10, 11: Canadian juniors with operating mainly internationally

Figure 12: Canadian juniors with operating mainly internationally updates

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.