April 10, 2020

Junior Gold Miner Weekly

Author - Ben McGregor

Gold's impressive strength continues

Gold continued to be one of the strongest global assets this week, with the futures up 6% to multi-year highs of US$1,741, and gold is still up 10% over two months, when the S&P 500, Eurostoxx, silver, copper and crude all saw double digit declines.

Major miners announcing shutdowns and Q1/20 production

News from the major miners this week was mainly comprised of; 1) news earlier in the week of measures in relation to the global health crisis, and 2) reports of Q1/20 production starting to be released for some companies later in the week.

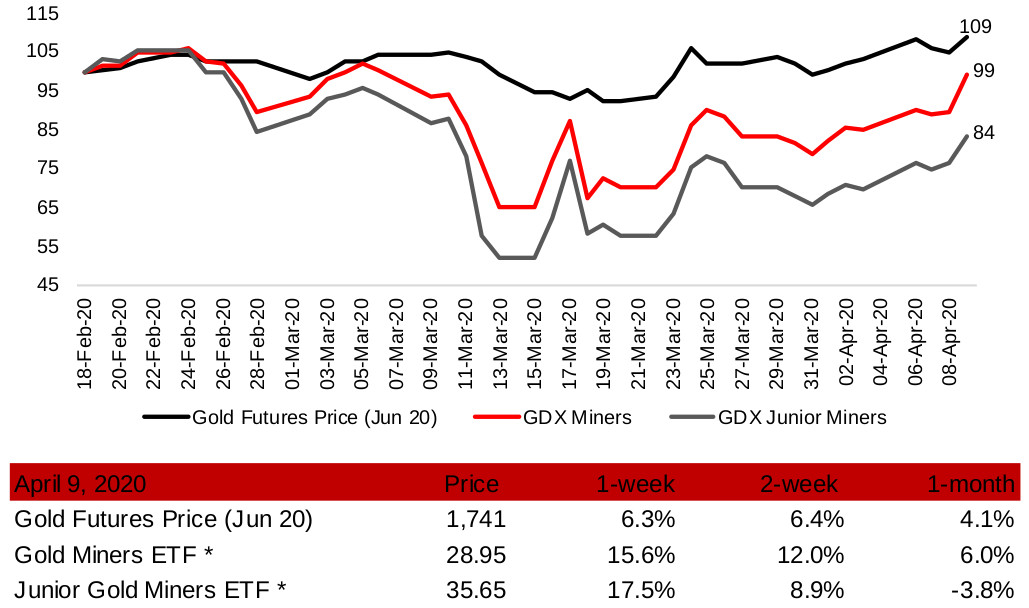

Gold price and gold mining ETFs

Source: Yahoo Finance

Impressive gold strength continues

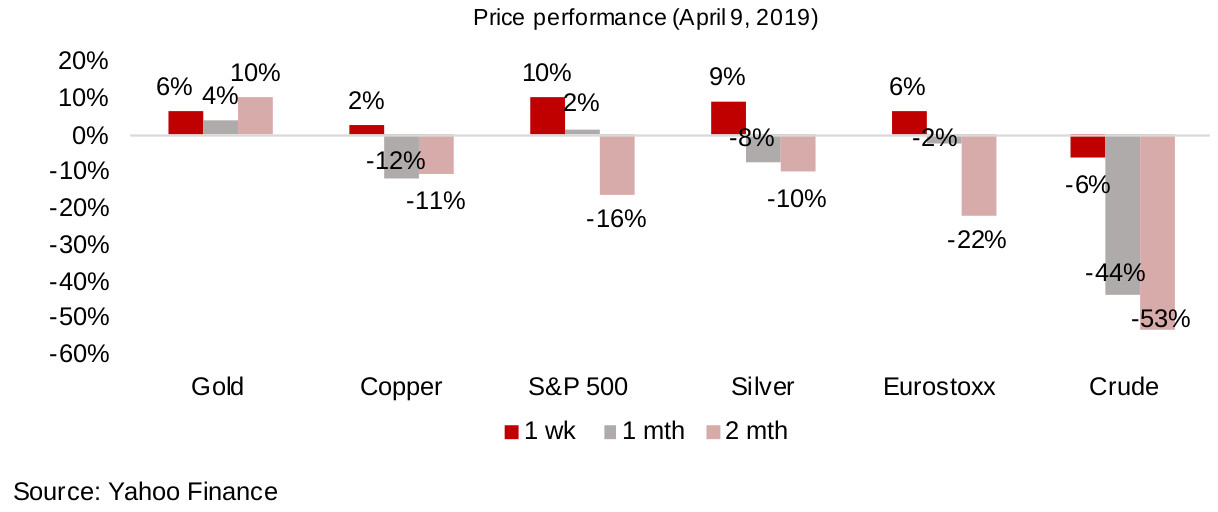

Gold's impressive recent strength continued this week, with the futures jumping 6% to US$1,741 as of April 9, 2020. There was a strong bounce on Thursday, with the Fed's announcement of an additional US$2.3trn from the Fed to support markets, in addition to its already extreme monetary stimulus measures, including reducing interest rates to zero. Other asset classes saw strong rebounds, with the S&P 500 and Eurostoxx 600 up 9% and 6%, respectively, as well as other commodities, with silver up 9% and copper up 2% (Figure 1). However, looking beyond the past week to the past two months, it is only gold that has really held up during this crisis, rising 10% over the past two months, versus double digit declines for the S&P 500, Eurostoxx 600, silver, copper and crude.

Figure 1: Price changes in gold, markets, commodities

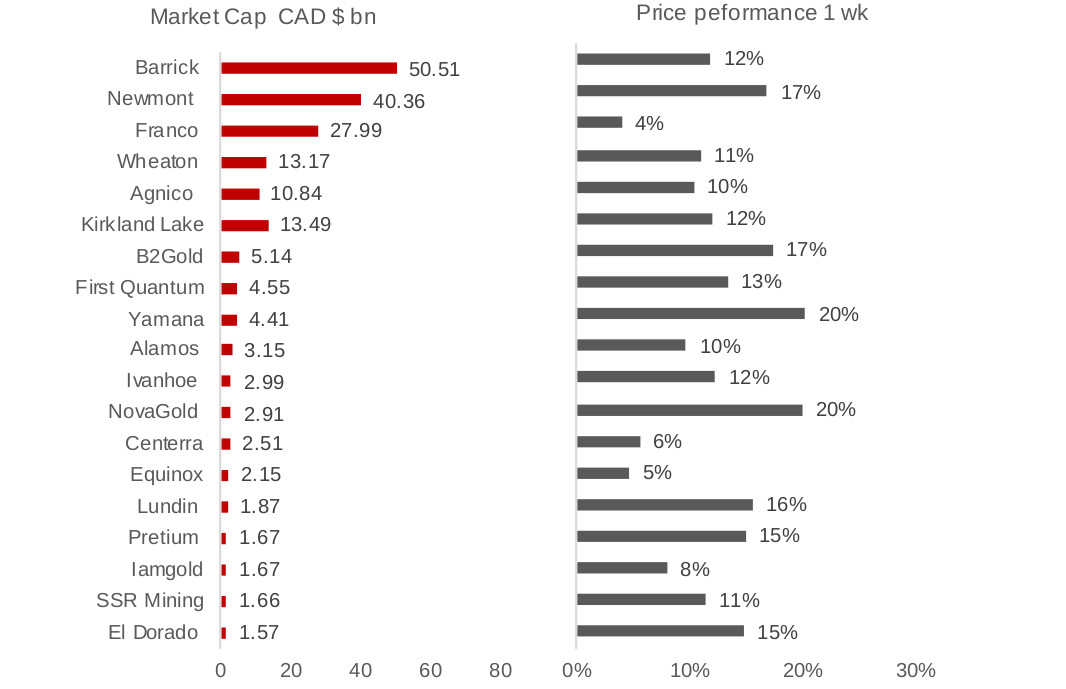

Producing Canadian gold mines having strong week

The major producing Canadian gold mines, shown in Figures 2 and 3, all saw gains this week, with the majority in double digits, a combination of; 1) major monetary stimulus measures leading to a rebound across most asset classes, and a pull-back in margin call driven sell offs, 2) the strong probability that these monetary measures will devalue fiat currencies, thus supporting gold 2) continued investor uneasiness, even with the recent short-term relief, also leading to gold for safety.

Figures 2, 3: Canadian larger gold mines market cap, price performance

Source: Yahoo Finance

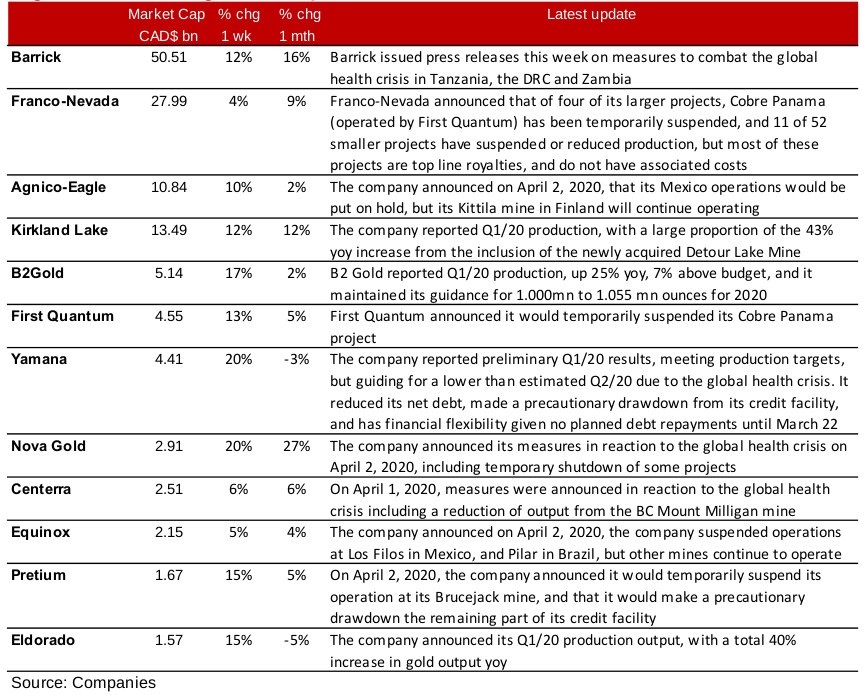

Producers announcing shutdowns and Q1/20 production

The announcements this week from producing mines were mainly of two types; 1) reports earlier in the week of measures in response to the global health crisis, with some shut- downs, but also some producers able to continue operations, depending on location, and 2) later in the week the first wave of reports of Q1/20 production (Figure 4). The Q1/20 production reports so far overall were not seeing any downside shocks, as shutdowns related to the global health crisis were mainly only implemented in late March and early April, and had only a marginal effect on Q1/20 at most. In general Q1/20 production either met or moderately surpassed expectations, and share prices reacted in kind, from remaining flat to single digit increases. The rest of the large jump this week in can mainly be attributed to the gain in the gold price.

Figure 4: Producing miners updates

Canadian juniors rebound strongly

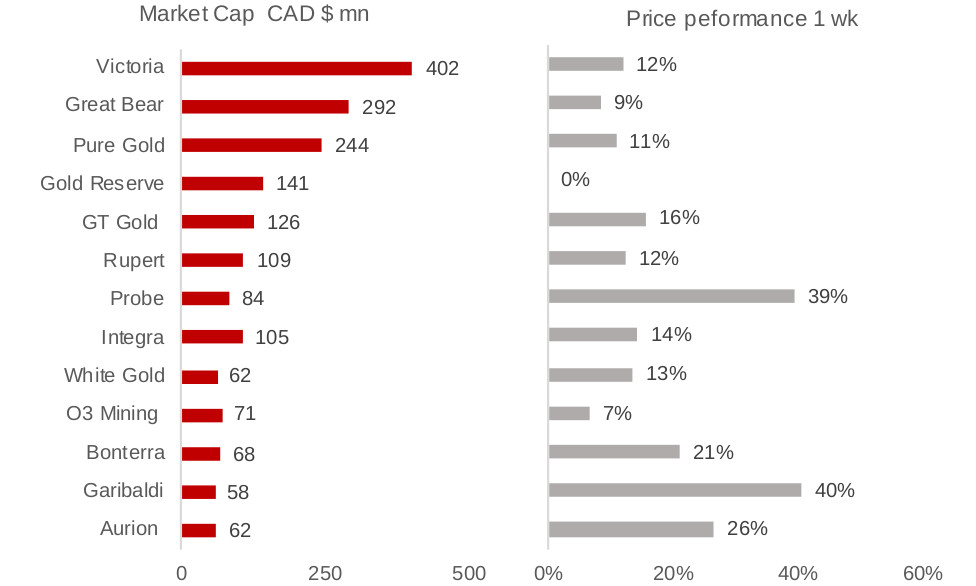

The Canadian junior gold miners shown in Figures 5 and 6 rebounded strongly in the past week on the whole, a combination of; 1) the jump in the gold price to multi-year highs, and 2) the extreme stimulus measures boosting markets and easing some concerns that the juniors could see their access to capital curbed by a continued market decline. Interestingly, while earlier in the crisis we had seen smaller market cap juniors face bigger declines, with risk subsiding this week, we have seen a reversal of this to a degree, with smaller names like Bonterra and Aurion seeing some of the strongest gains, without material company- specific news flow.

Figures 5, 6: Canadian junior mines market cap, price performance

Source: Yahoo Finance

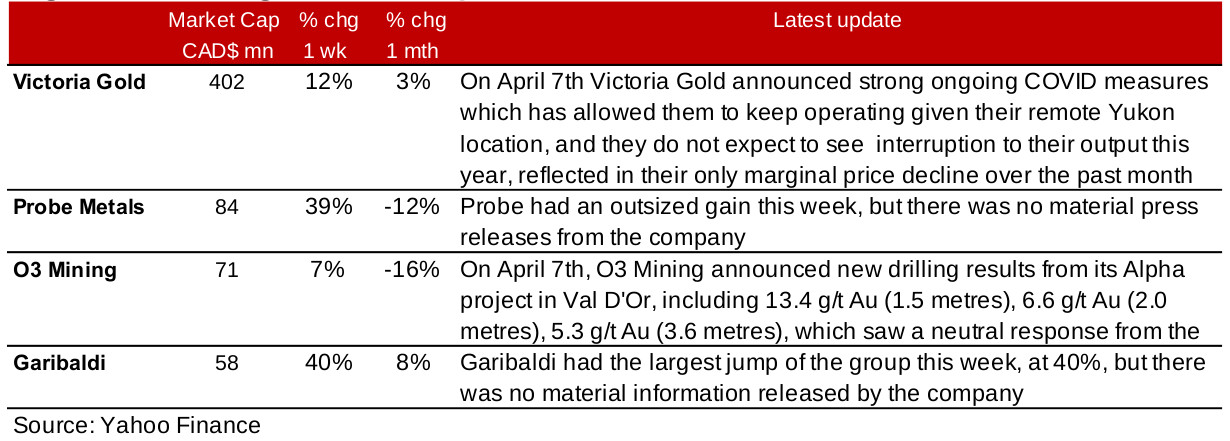

Major gains for Probe and Garibaldi with no material news

Beyond the broader drivers of rising gold and falling risk, both Probe Metals, up 39%, and Garibaldi Resources up 40%, saw outsized gains. However, neither had any official material press releases that would have explained the moves. Other notable news from the junior miners included sampling results from O3 Mining, but this had a limited effect on the share price, and a global health crisis measures update from Victoria Gold, which is able to continue its Yukon operations because of its remote location (Figure 7).

Figure 7: Junior gold miners updates

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.