June 20, 2022

Is the Fed Getting Volckerian?

Author - Ben McGregor

Gold down as Fed surprises with 75 bps rate hike

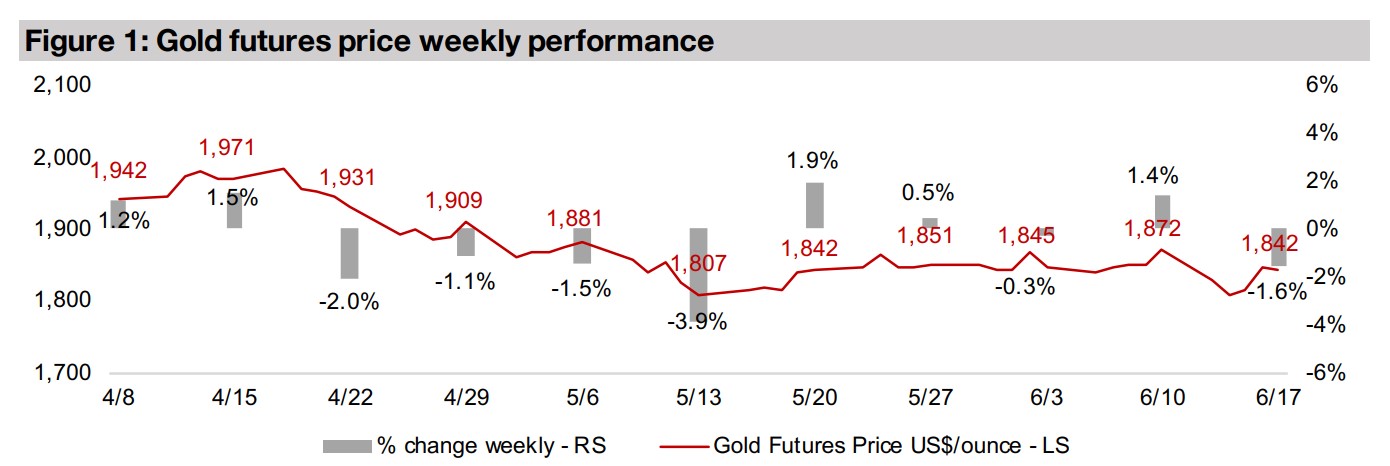

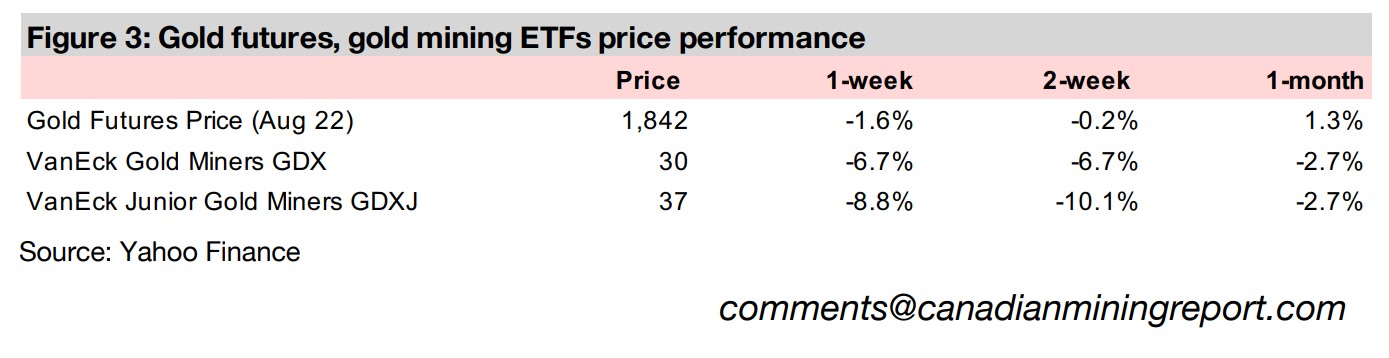

Gold declined -1.6% to US$1,842/oz this week as the Fed came through with a 75 basis point Fed Funds rate hike as it attempts to drive down inflation, and seems to be mimicking Fed Chairman Paul Volcker, who curbed inflation in the early 1980s.

Multi-metal explorer Canadian Northern Resources In Focus

This week the recently TSXV-listed Nunavut focused multi-metal explorer Canadian Northern Resources is In Focus, with the company having recently released an upgraded mineral resource estimate for its Cu-Ni-Co-Pd-Pt Ferguson Lake project.

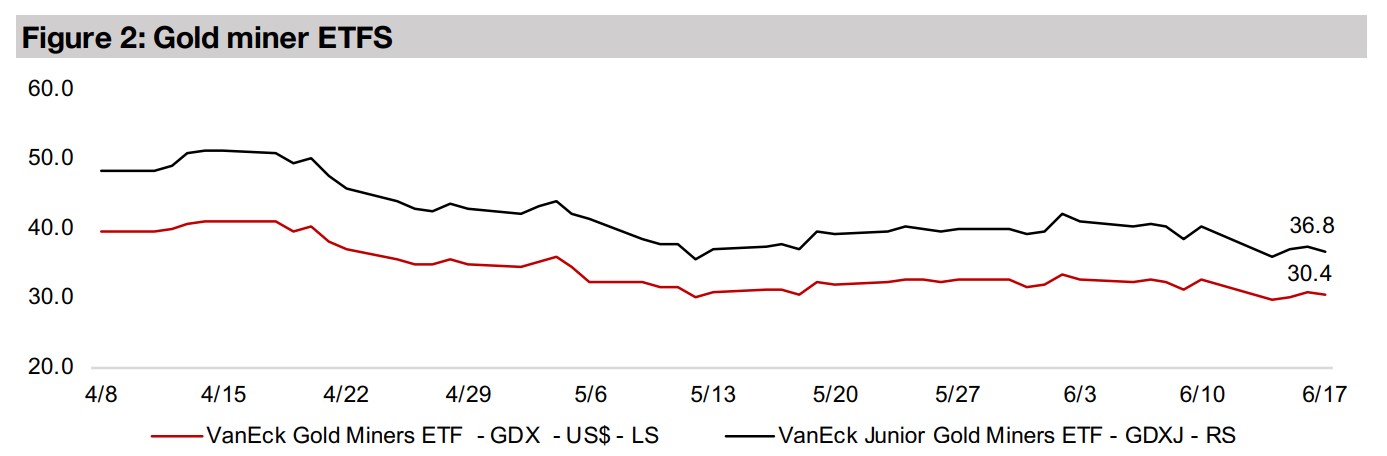

Producers and juniors both down on gold and equity decline

The producers and juniors were both down, with the GDX and GDXJ declining -6.7% and -8.8%, respectively, on the gold dip and continued collapse in equity markets, as it became clear the Fed would continue to aggressively tighten monetary policy.

Is the Fed Getting Volckerian?

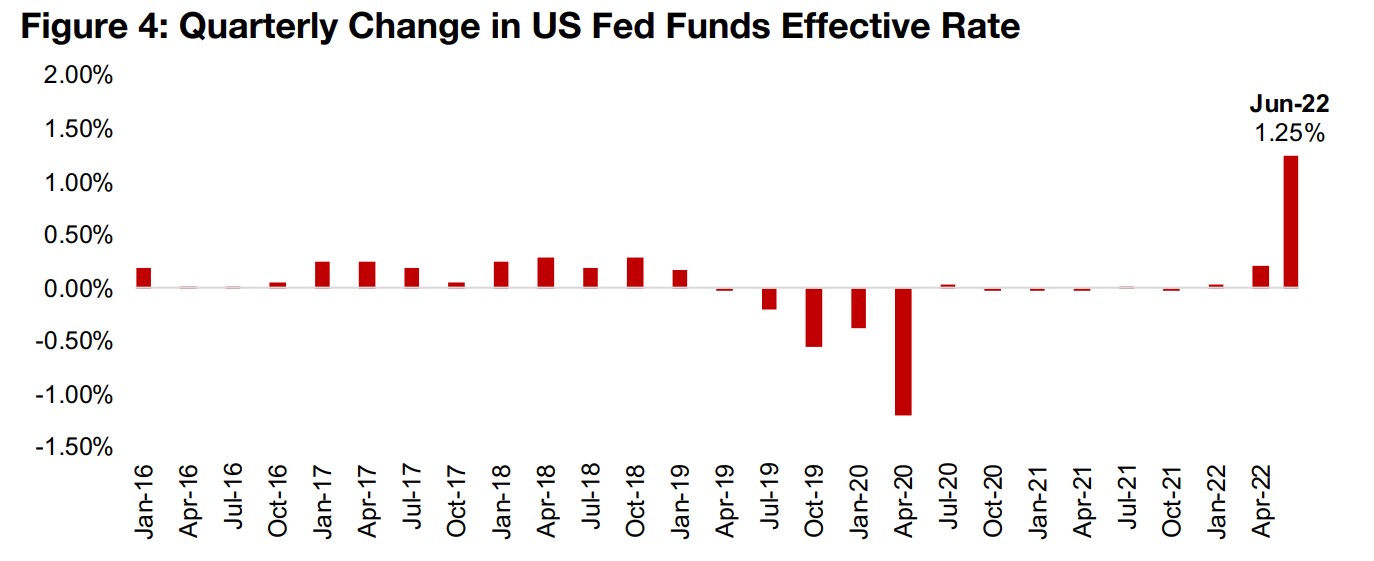

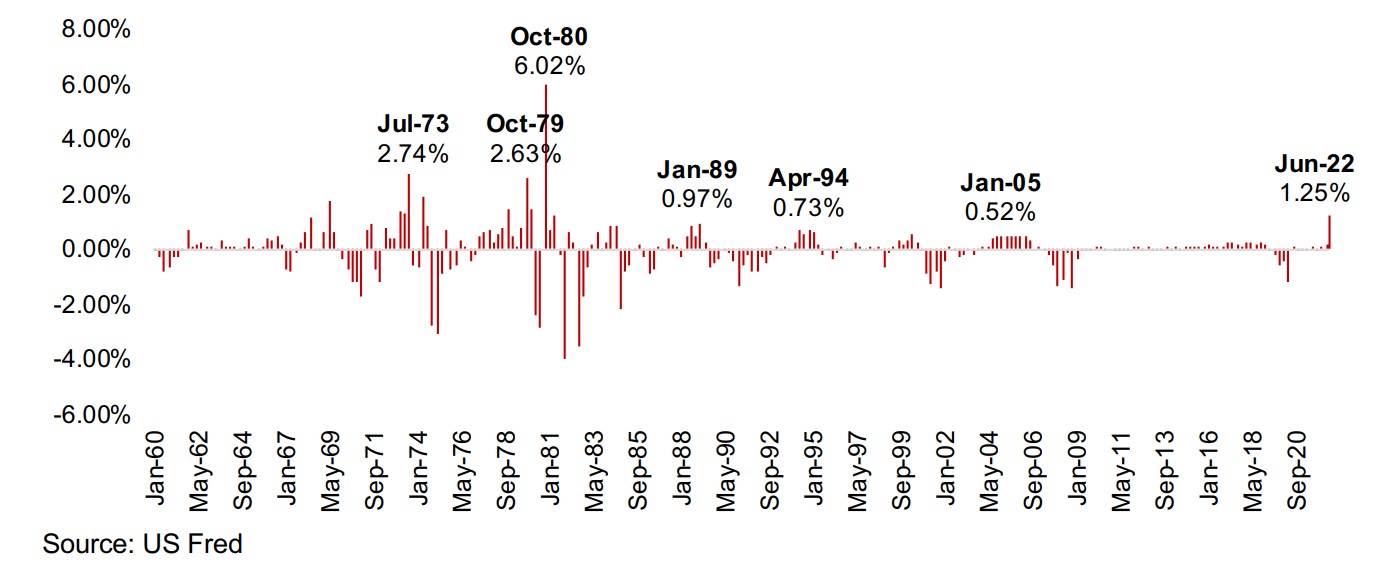

Gold declined -1.6% for the week to US$1,842/oz, as the US Fed surprised the market with an aggressive 75 bps increase in its base rate, with the market seeming to have expected a 50 bps hike. This saw global equity markets continuing a plunge that has persisted throughout 2022 on the news, as it became clear that attacking inflation was the Fed's number one priority, and that the stock market correction and even rising fears of a global economic recession had not led to a softening of its stance. Figure 4 shows just how major the rate hikes have been over the past two months, with the first panel showing the quarterly rise in the Fed Funds effective rate since 2016 using January, April, July and October quarter end dates until April 2022 and then showing the increase in just the past two months of May 2022 and June 2022, a 1.25% rise which dwarfs any rate hikes over the past five years. This would be expected, as the years following the 2008-2009 financial crisis saw extremely easy monetary policy, and only in 2017 and 2018 were there some efforts by the Fed at gradual tightening, before the global health crisis drove a drop in the rate.

It is interesting that when the Fed's tightening in 2017-2018 started to precipitate a downturn in the stock market, it pulled back on rate hikes, as this was a period of very low inflation, allowing it to focus more on the growth side of its two pronged 'maintain stable prices/promote economic growth' mandate. We are certainly not seeing any such concerns by the Fed over the equity market plunge this time, however, and it is shocking to see just how aggressive the hikes of the past two months look in a long-term term perspective going back to the 1960s. A 1.25% hike in less than a quarter has only been surpassed three times, with a 6.02% hike in the quarter to October 1980, 2.74% in the quarter to July 1973 and 2.63% in the quarter to October 1979. Since the early 1980s, prior to the current quarter, the Fed Funds rate was never hiked more than 0.97%. We would also note that we still have one Federal Open Market Committee Meeting to go in July 2022, which could mean that the increase in this quarter could be even more extreme.

How far before Powell can be considered to have gone full Volckerian mode?

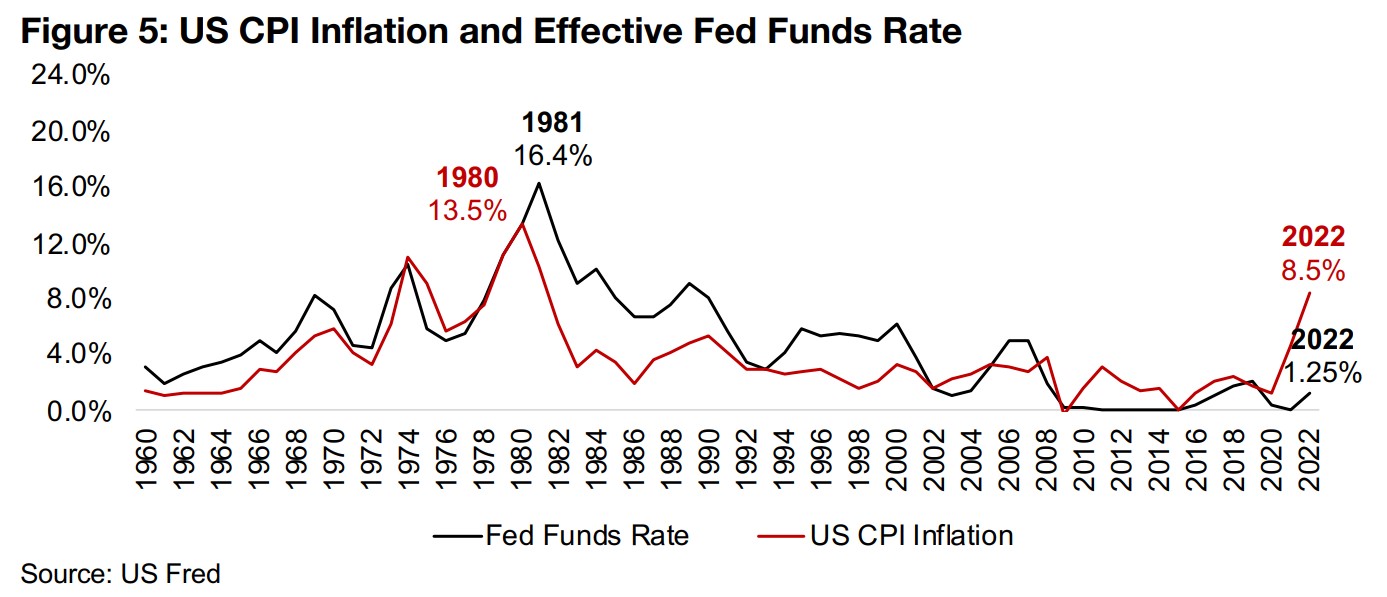

The Fed appears increasingly be taking a stance similar to that of Paul Volcker in the late 1970s and early 1980s, who was responsible for most of the historically highest quarterly rate hikes we see above. He was tasked with smashing the historically high inflation that had persisted from the mid-1970s, and successfully did so, although not without causing a major recession in the US in 1981 and 1982. How far would the current Chairman of the Fed Jerome Powell have to go to become a true Volckerian? We can see in Figure 5, that to curb inflation that had reached 13.5% in 1980, Volcker had to hike the Fed Funds rate to 16.4%, or about 120% of the peak inflation level. If we assume that Powell would have to make similarly extreme hikes, 120% of the current inflation of around 8.5% would suggest a Fed Funds rate of over 10.0%. Given the stock market's reaction so far, if he and the Fed were to attempt such hikes, while this would almost certainly obliterate inflation, both the US economy and equity markets would probably go with it.

Equity investment likely to remain risky with Fed on inflation warpath

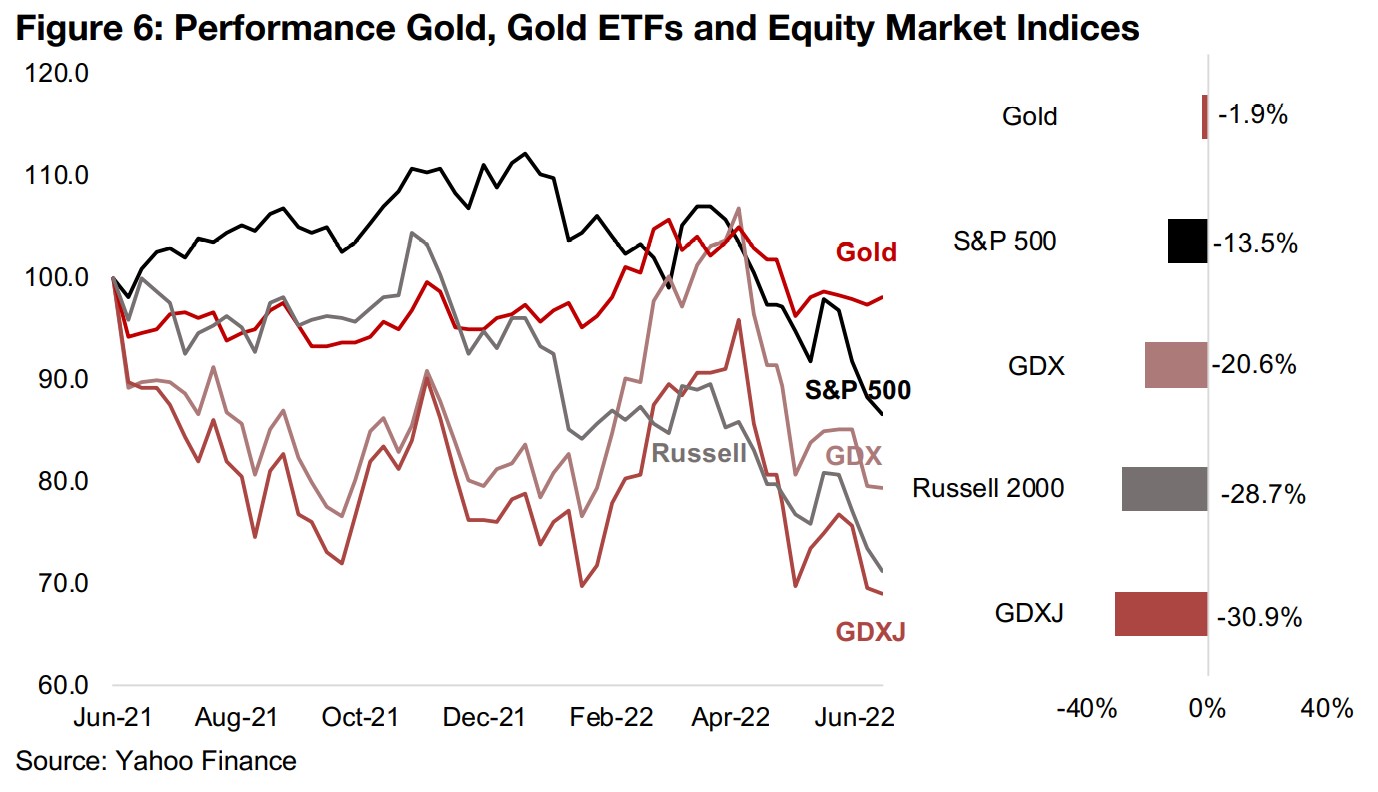

We don't expect that it will be feasible for the Fed to reach full-Volckerian mode, with even an increase in the Fed Funds rate to just 5.0% to mean a 400% increase in rates. We expect that such a path would eventually prove politically unfeasible given the potential fallout for the equity markets and the economy, which could drive a crash that would make what we have seen so far in 2022 seem moderate. However, what the Fed has proved is that for now, and likely at least through 2022, it will aggressively attempt to curb inflation with rate hikes. Therefore we can expect that equity markets will continue to take a major hit, and as we have warned since the start of 2022, this is likely not the time to be piling into gold stocks, especially the riskier junior miners. Even the gold producers, as measured by the GDX ETF, are down -20.6% over the past year, well below the -13.5% drop in the S&P 500 Index, the large cap benchmark, while the juniors are down -30.9%, slightly underperforming the Russell 2000 small cap benchmark, that has dropped -28.7% (Figure 6).

Gold holding up likely on rising overall risk

Gold itself, meanwhile, has continued to hold up well, down just -1.9%. While we might expect that the Fed hikes and pausing inflation would draw funds away from gold, as real yields become less negative, making bonds more attractive, gold has remained relatively flat over the past month. This is likely because investors are pricing in a premium for broader rising economic and geopolitical risks which could be offsetting downward pressure from less negative real bond yields. We believe that a balance between downward pressure from the Fed, and the upward support from a general rise in risk could see gold continue to maintain this level through 2022.

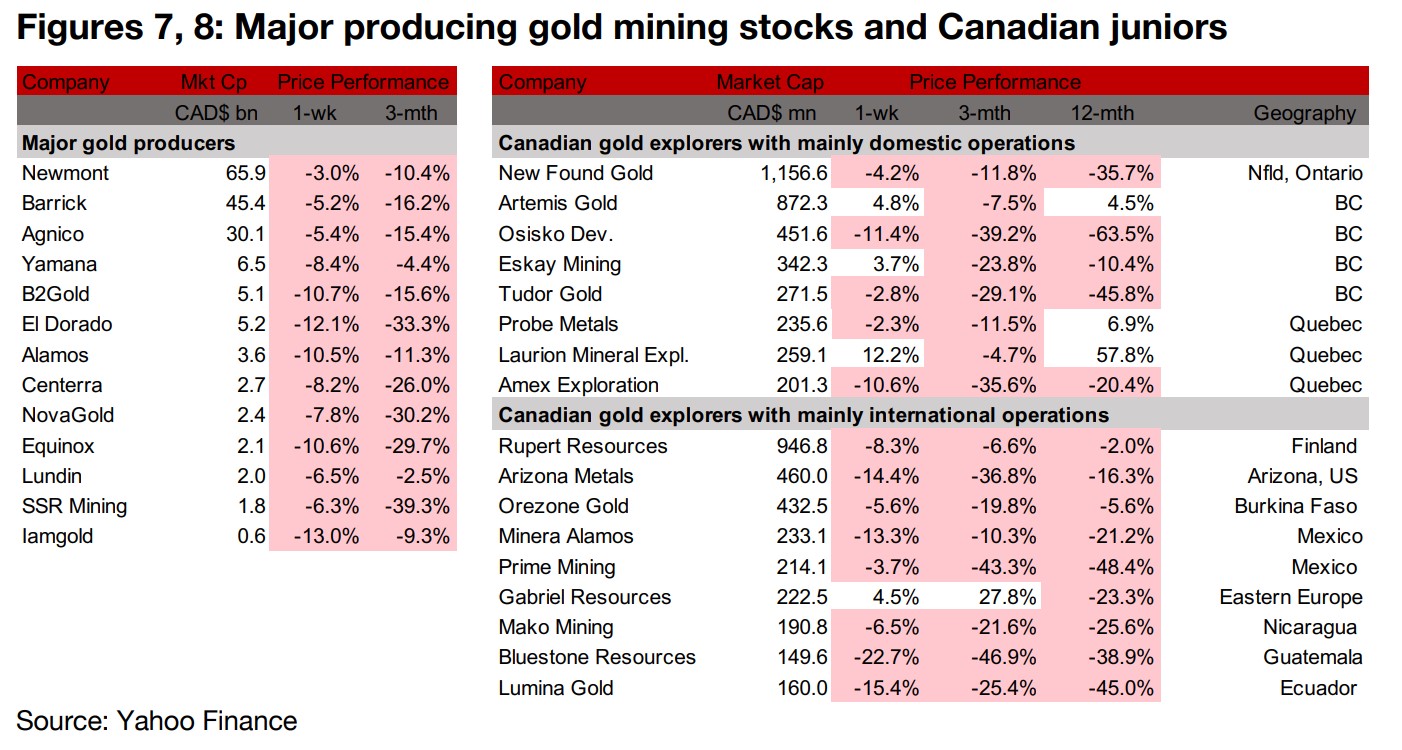

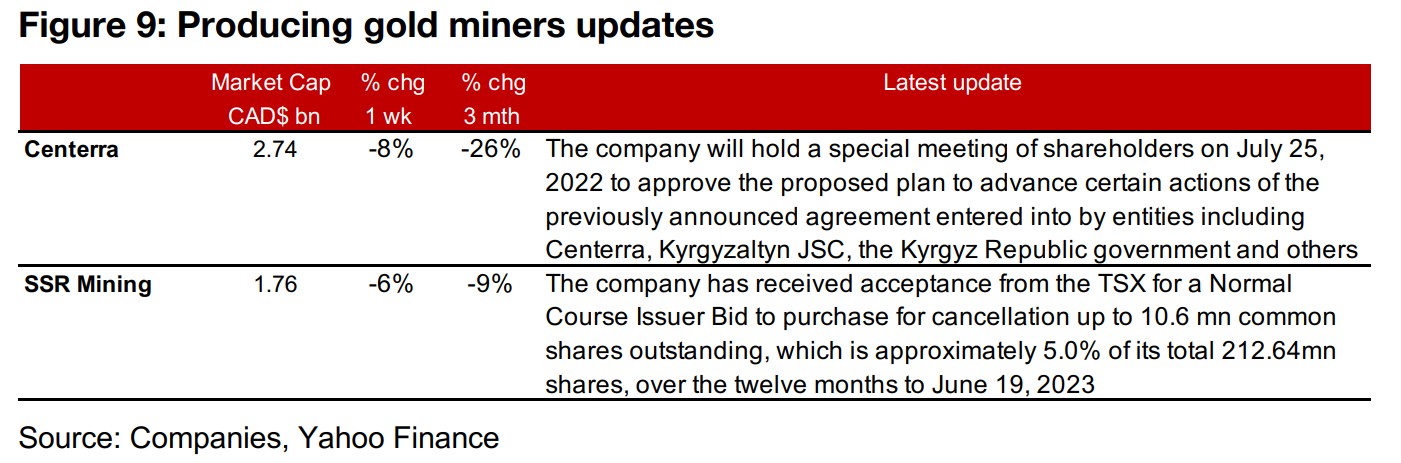

Producing miners all down on gold and equity market declines

The producing gold miners were all down as gold and the equity markets declined (Figure 7). Centerra reported that it would hold a special meeting of shareholders on July 25, 2022 to approve its plan to advance a previously announced plan entered into by Centerra and the Krygyz Republic over its earlier disputed project in the country and SSR received acceptance from the TSX for a Normal Course Issuer Bid for a cancellation up to 10.6 mn shares, which is approximately 5.0% of its total 212.64 mn shares, over the twelve months to June 19, 2023 (Figure 9).

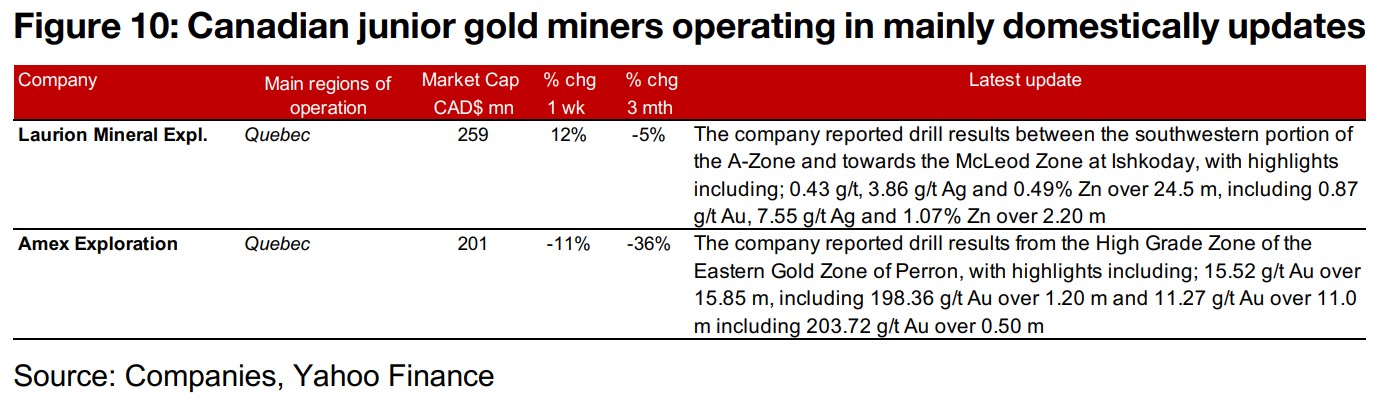

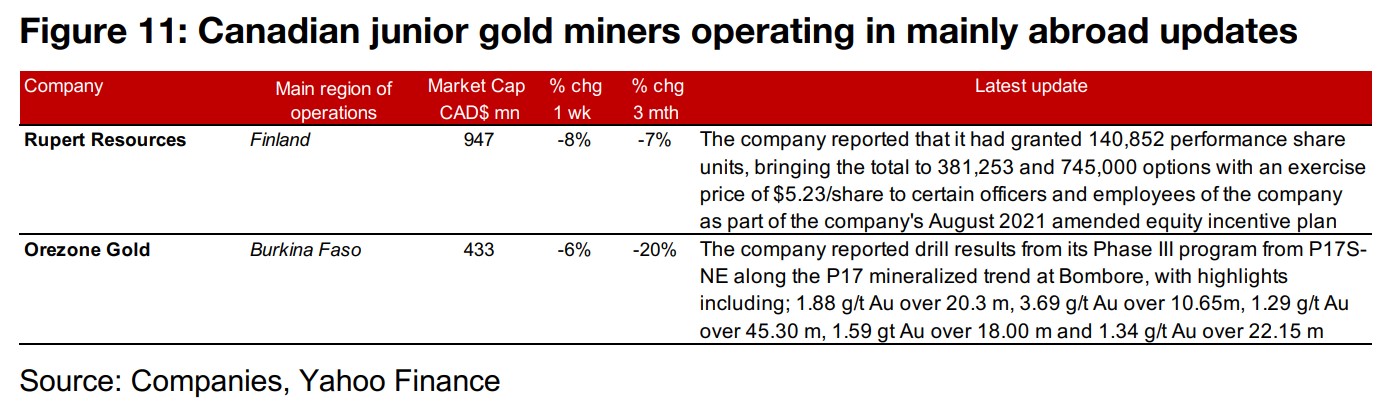

Canadian juniors mostly down as gold and stock markets slide

The Canadian juniors were mostly down as gold and stock market fell (Figure 8). For the Canadian juniors operating mainly domestically, Laurion reported drill results from between the southwestern portion of the A-Zone and toward the McLeod Zone at Ishokoday and Amex reported drill results from the High Grade Zone of the Eastern Gold Zone of Perron (Figure 10). For the Canadian juniors operating mainly internationally, Rupert reported the granting of performance share units and equity options and Orezone reported drill results from its Phase III program from P17S-NE along the P17 mineralized trend at Bombore (Figure 11).

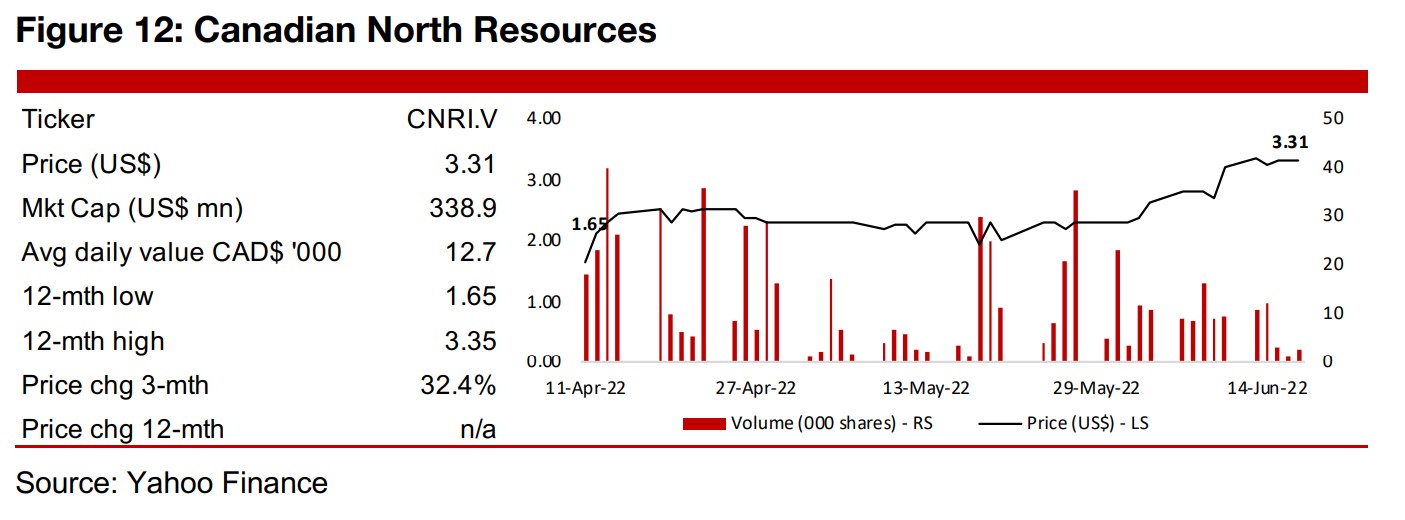

In Focus: Canadian North Resources (CNRI.V)

Exploring the multi-metal Ferguson Lake project in Nunavut

Canadian North Resources is exploring the multi-metal Ferguson Lake project in Nunavut, 150 km south of Baker Lake. While the stock was just recently listed on the TSXV in April 2022, having raised US$19.99mn from strategic investors prior to the listing and an additional $2.19mn from the exercise of special warrants into shares, the company has been exploring Ferguson Lake since 2013. The project is a massive sulfide zone of over 15 km containing five main metals, copper, nickel, cobalt, palladium and platinum and had seen extensive historical exploration by Starfield, which released a resource estimate for the project in 2011.

Share price relatively flat from late April 2022 to early June...

While the share price picked up in its first two weeks of trading from CAD$1.65/share on its listing date of April 11, 2022, to US$2.50/share by April 19, 2022, it remained relatively flat until early June, although this actually marked a significant outperformance of the declining equity markets and the junior mining sector. During this period the company announced the start of a 15,000 meter drill program at Ferguson Lake on April 19, 2022, a targeted $CAD11mn exploration program on April 25 and drill results on May 16. The stock began to rise from early June 2022 in the two weeks leading up the release of its updated mineral resource estimate for Ferguson Lake, even as equity markets continued to decline, and traded at CAD$3.31/share as of its most recent close, doubling from its first day of trading.

...but rose leading up to updated resource for Ferguson Lake

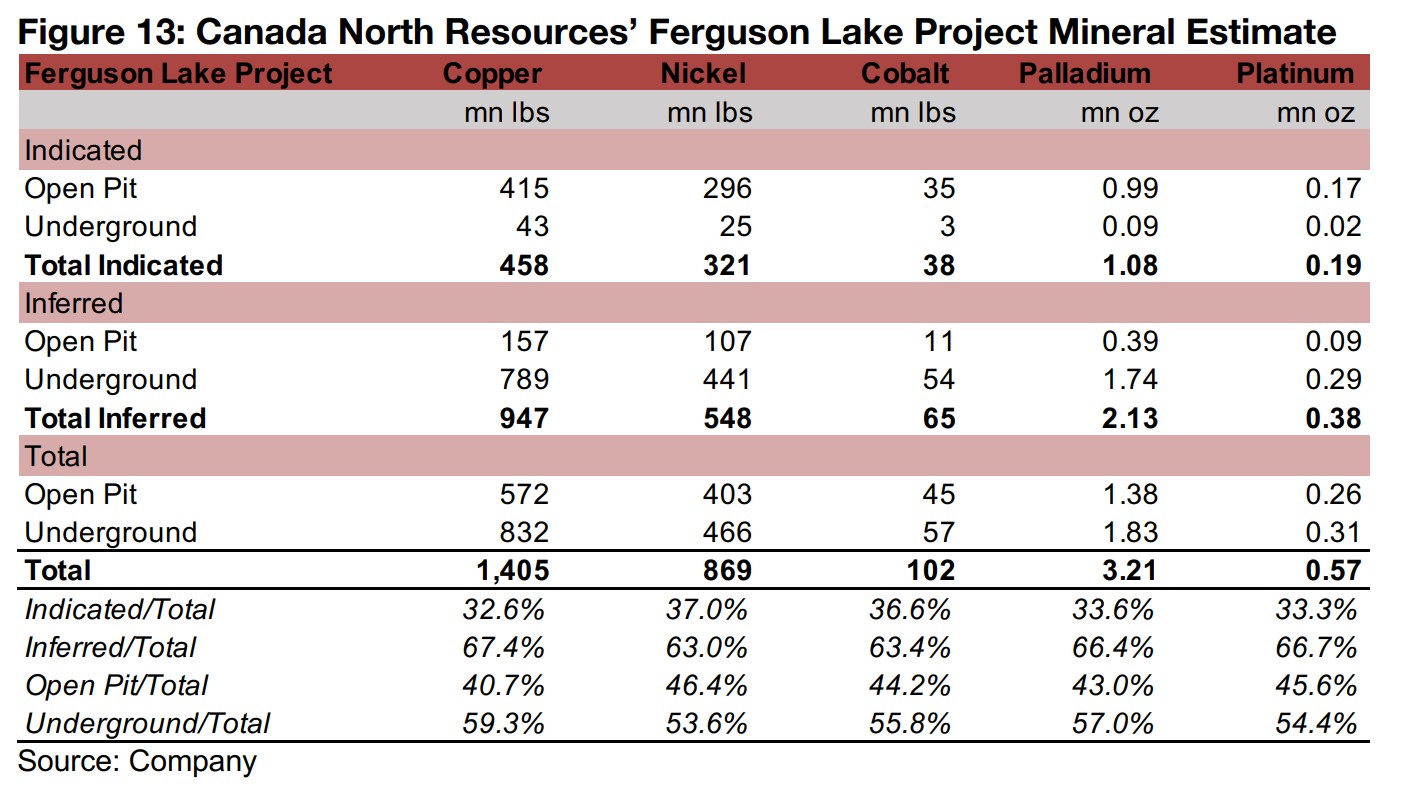

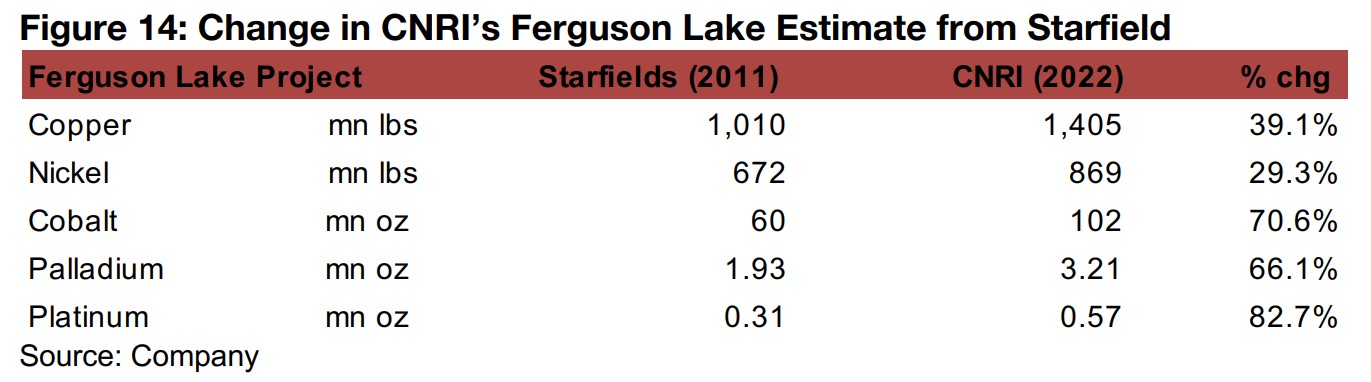

The updated Ferguson Lake mineral resource estimate shows a total Indicated and Inferred resources of 1,405 mn lbs in copper, 869 mn lbs of nickel, 102 mn lbs of cobalt, 3.21mn oz of palladium and 0.57 mn oz of Platinum (Figure 13). Around 35% of the estimated resources are Indicated and 65% Inferred, with the Open Pit resources estimated at 44% of the total with 56% of the resources Underground. The updated resources mark a significant rise from Starfield's 2011 estimate, with copper up 39.1%, nickel rising 29.3%, cobalt increasing 70.6%, palladium up 66.1% and platinum up 82.7% (Figure 14). The company plans to continue exploration of Ferguson Lake including expanding metallurgical tests with current and alternative processing technologies, drilling for high-grade nickel-copper massive sulfides, establishing high-grade resources for PGM in low sulfide zones with definition drilling along the known mineral zones, environmental and engineering studies and engaging with local communities. The company had US$17.5mn in cash and US$15.5mn in available resources as of its March 2022 results, which will fund its exploration activity through 2022.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.