August 22, 2022

Industrial Metals Stocks Lag Market Rebound

Author - Ben McGregor

Gold declines as US$ continues to surge

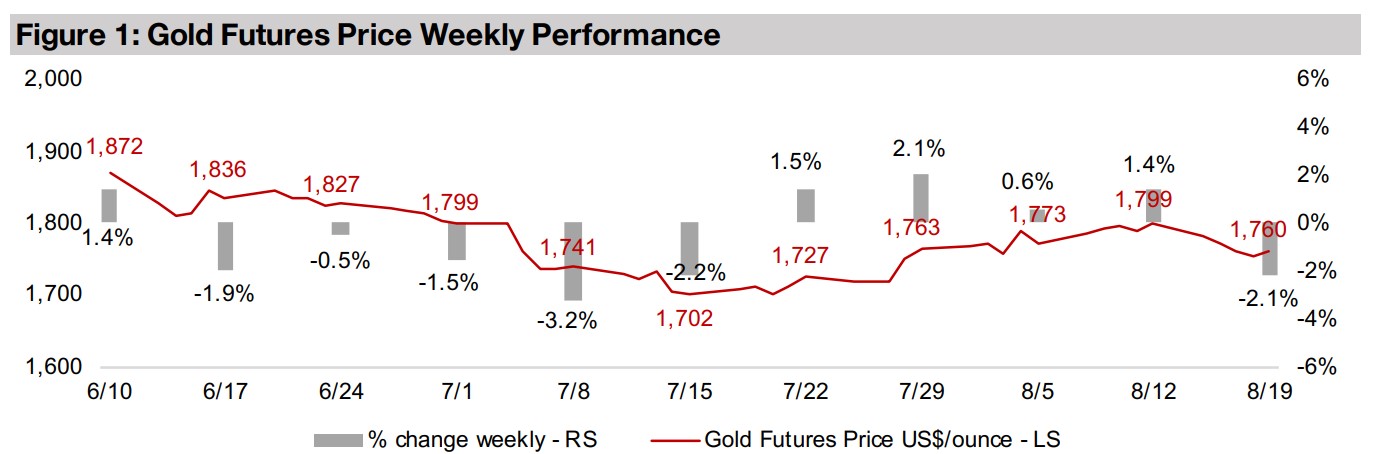

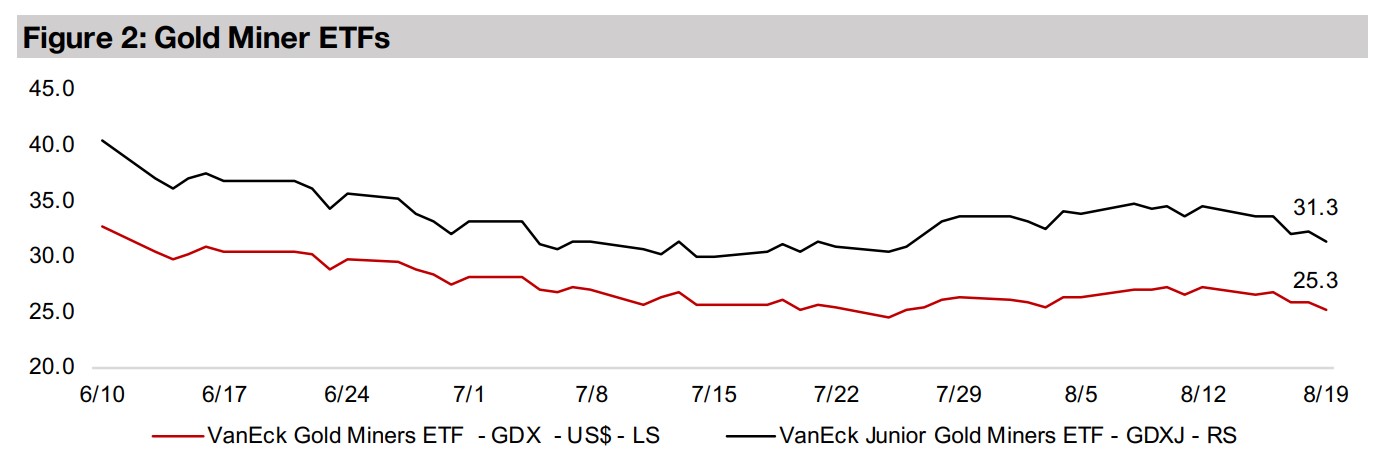

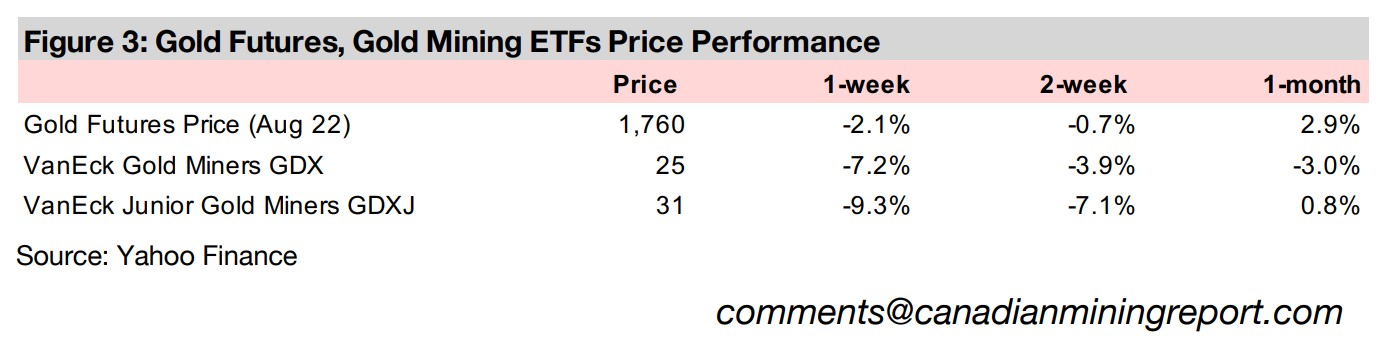

Gold was down -2.1% to US$1,760/oz this week, easing off a multi-week high, mainly as the US$ continues to surge, with gold and the US$ tending to move inversely, and the trade weighted US dollar index hitting a twenty year high.

Large TSXV industrial metals stocks lagging market rebound

This week we look at the performance of the large TSXV industrial metals stocks and see that they are generally underperforming the market rally that began in mid-June 2022, although the lithium stocks are an exception, with some seeing strong gains.

Industrial Metals Stocks Lag Market Rebound

Gold was down -2.1% to US$1,760/oz, easing off a several week uptrend, especially on gains in the US$, which tends historically to move inversely to the gold price. The US$ trade weighted index hit a twenty year high this week at 108.2, a level not seen since first half 2002. The next benchmarks would be the thirty-year high set in April 2001 at 119.4 and the all-time peak in early 1985 at over 160.0. How far the dollar can keep going will especially depend on the monetary policy of other major regions and countries, especially Europe and Japan. Both are still keeping rates low, and the growing differential between them and the US rates is driving the strong flows into the US$, given its much higher yields since the Fed spiked rates to fight inflation. We expect that Europe and Japan will need to boost rates soon as both are also facing very high inflation, and this could lower the interest rate gap with the US and generate rising demand for the Euro and Yen. However, until rates in these other regions start to catch up, we can expect a continued strong US$ to be a downward driver for gold.

Industrial metals stocks not participating in the equity market rally

Last week we showed that overall the large TSXV gold stocks were not participating in the market equity market rally that started in mid-June 2022, with the S&P 500 now up 15.1% since June 17, 2022. This week we turn to the TSXV industrial metals stocks, including copper and other base metals, silver, lithium and uranium and see a similar trend, with the group generally underperforming the overall equity markets substantially. The major exception has been the lithium stocks, some of which have participated in the rally and seen a strong rebound, and while the uranium stocks have eked out small gains, they have still significantly underperformed the market.

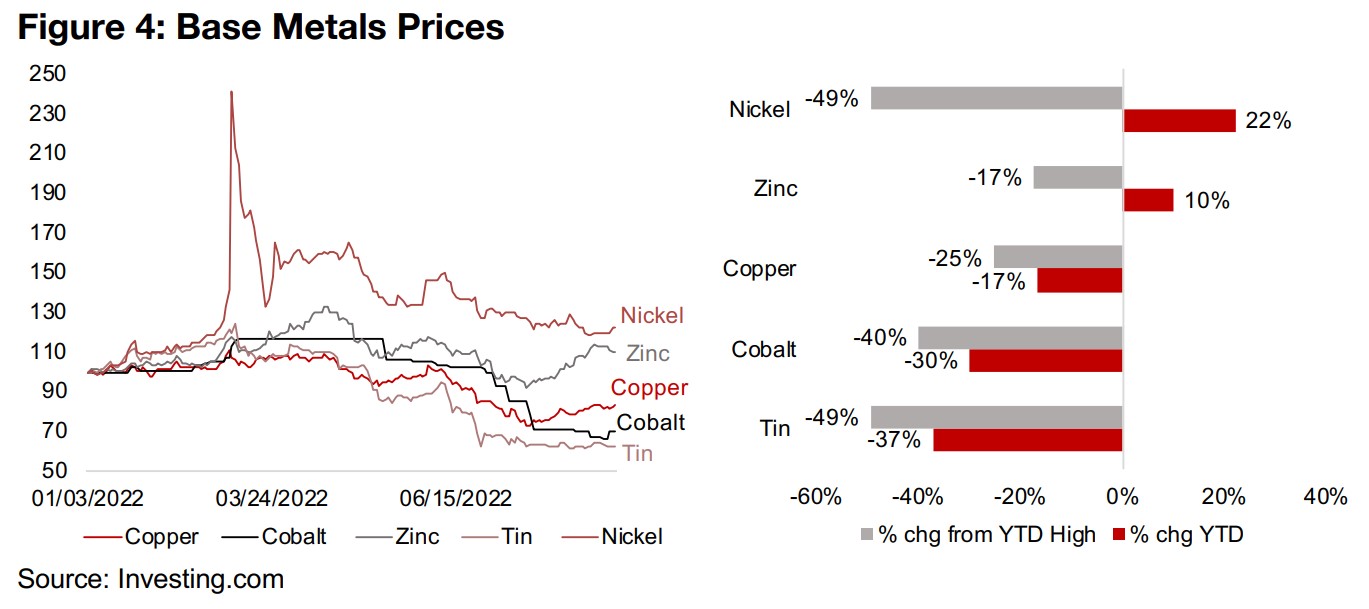

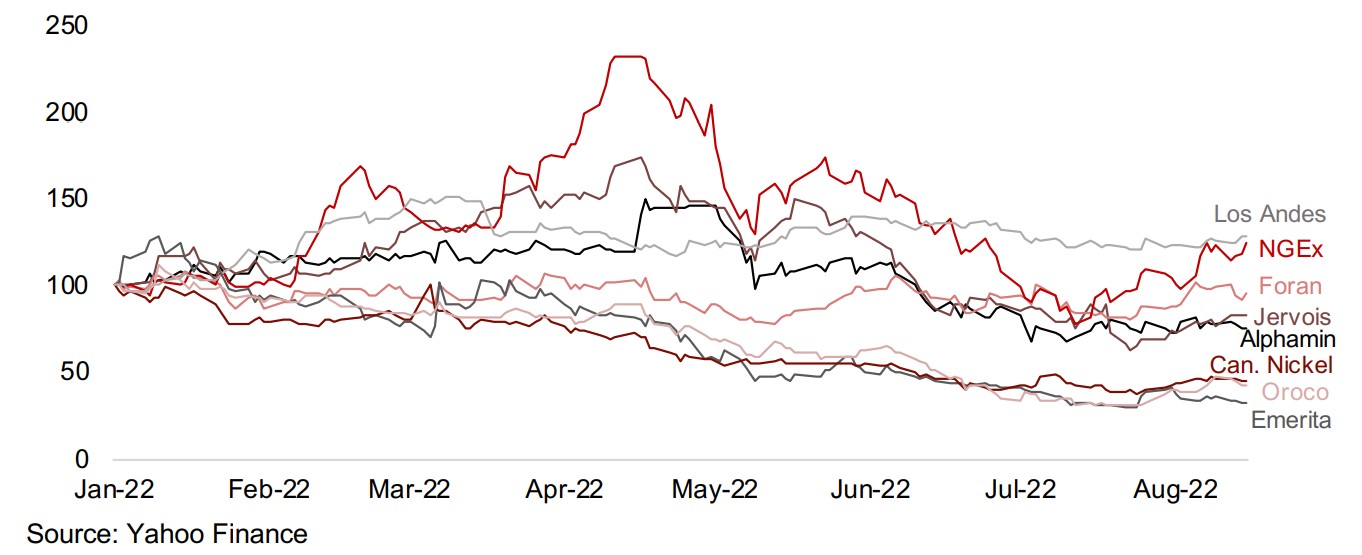

Base metals wave crested and broke between March and May 2022

While the large TSXV base metals mining stocks had already been under pressure

early this year from the broader equity market decline, about half of the group was

still trending up as of the end of Q1/22. These gains in early 2022 had been driven by

a continued wave of base metals price rises off the global-health crisis lows in early

2020. However, this wave started to crest by March 2022 and had entirely broken by

May 2022, and all of the major metals related to the larger TSXV stocks in the group

are now down substantially off their highs. Even the best performers zinc and copper

are down -17% and 25%, respectively, off their YTD highs, with cobalt down -40%,

and tin and nickel down -49% (Figure 4).

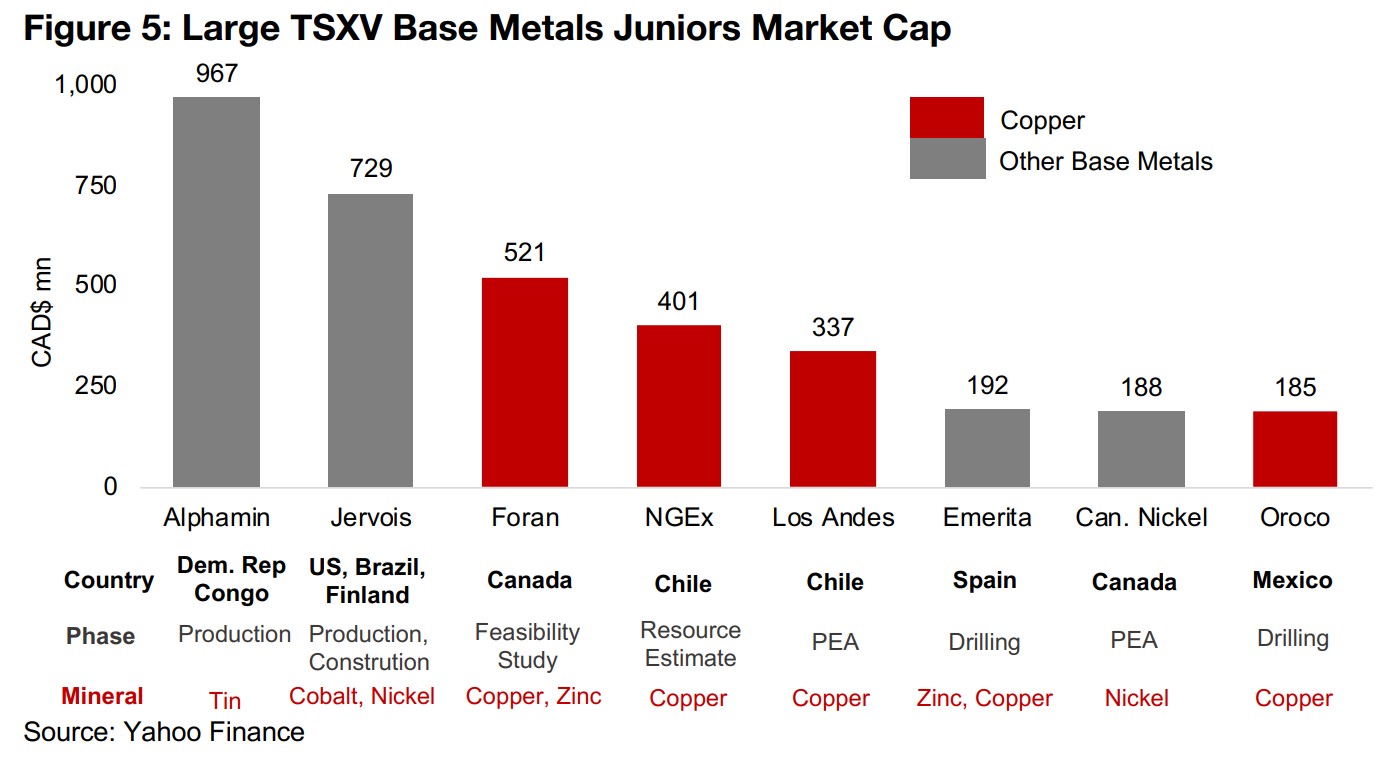

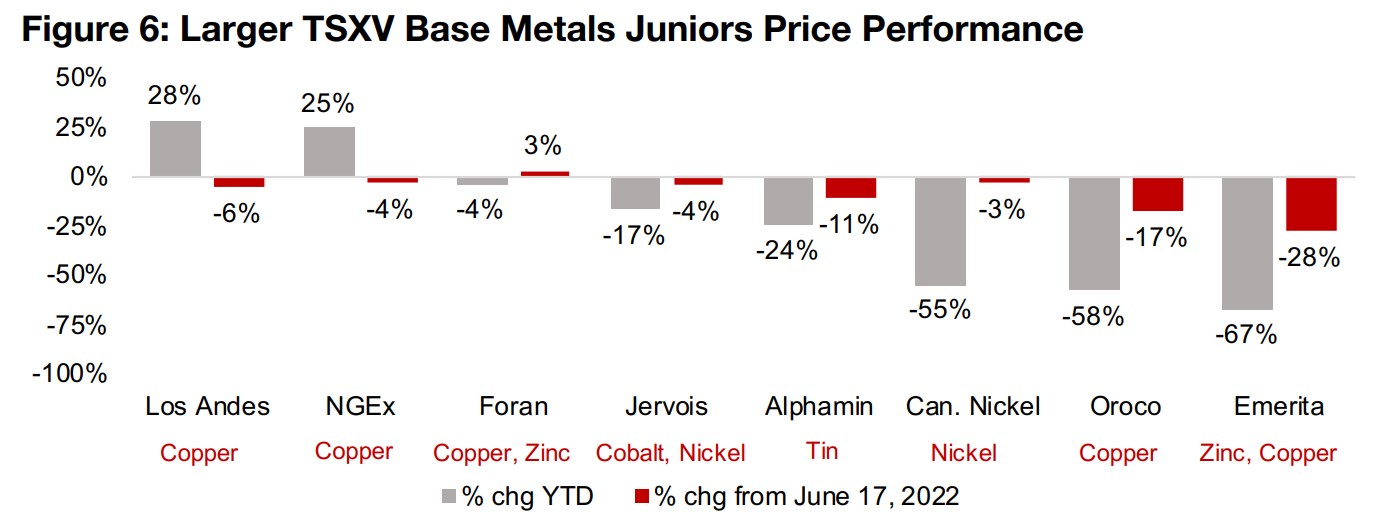

This has driven down the share prices of cobalt-focussed producer and developer

Jervois, tin producer Alphamin and nickel developer Canada Nickel (Figure 5)

substantially YTD, while all three have seen moderate declines since mid-June 2022,

which marks a substantial underperformance of the overall market. The rest of group

is focused on copper or both zinc and copper, with Emerita and Oroco facing major

losses both YTD and since mid-June 2022 and Foran near flat for both. Only Los

Andes and NGEx have gained YTD, with both having very strong drill results so far

supporting their share prices, but even these have edged down and underperformed

since mid-June 2022.

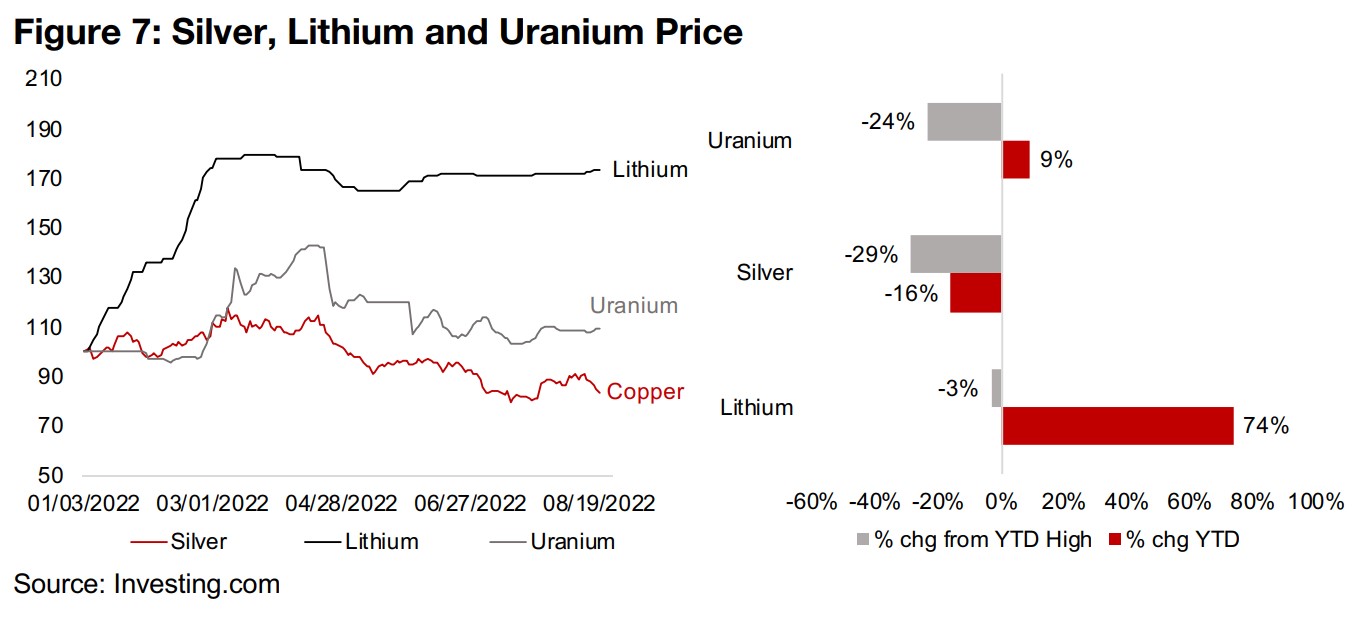

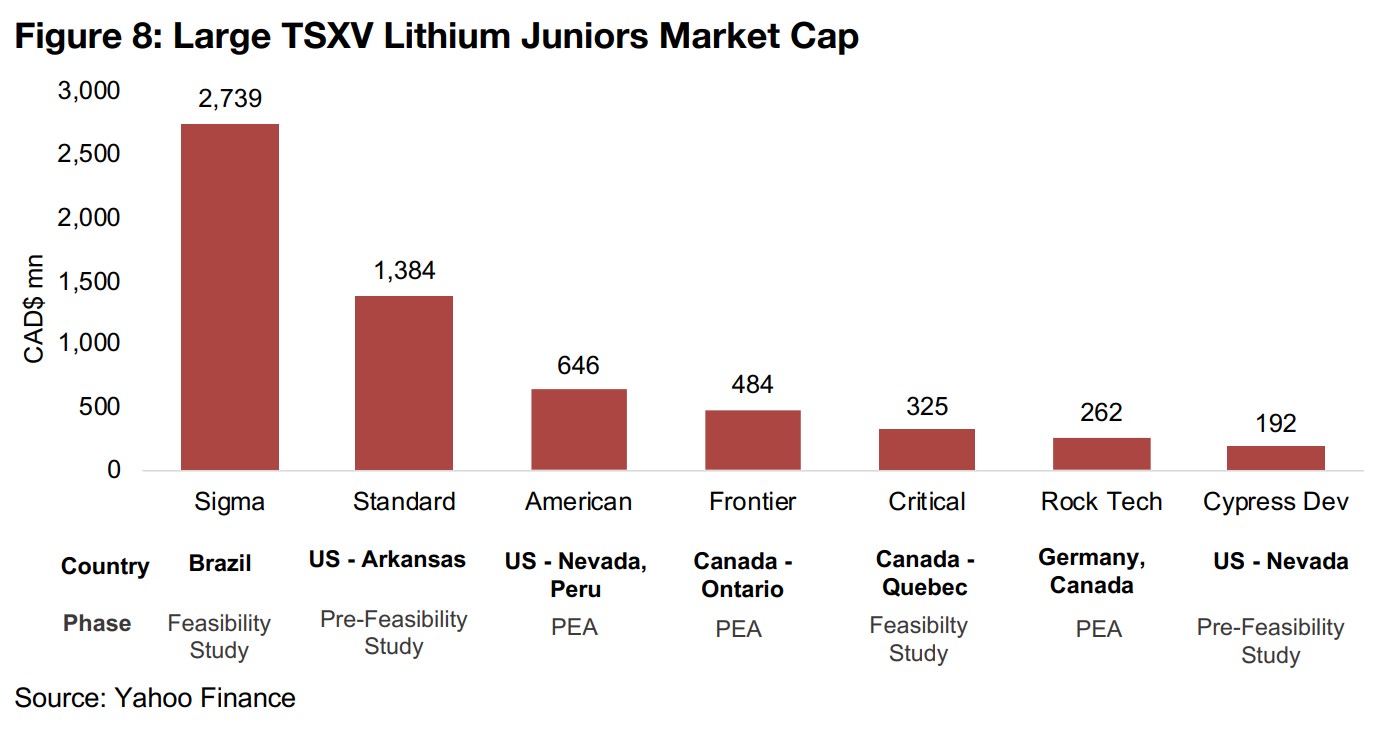

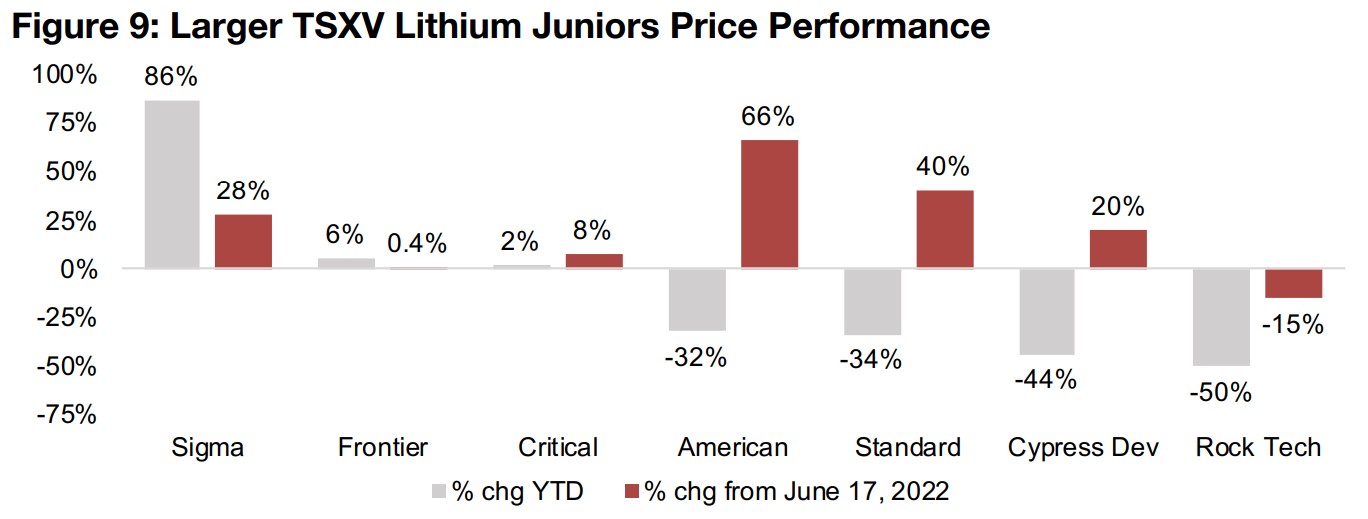

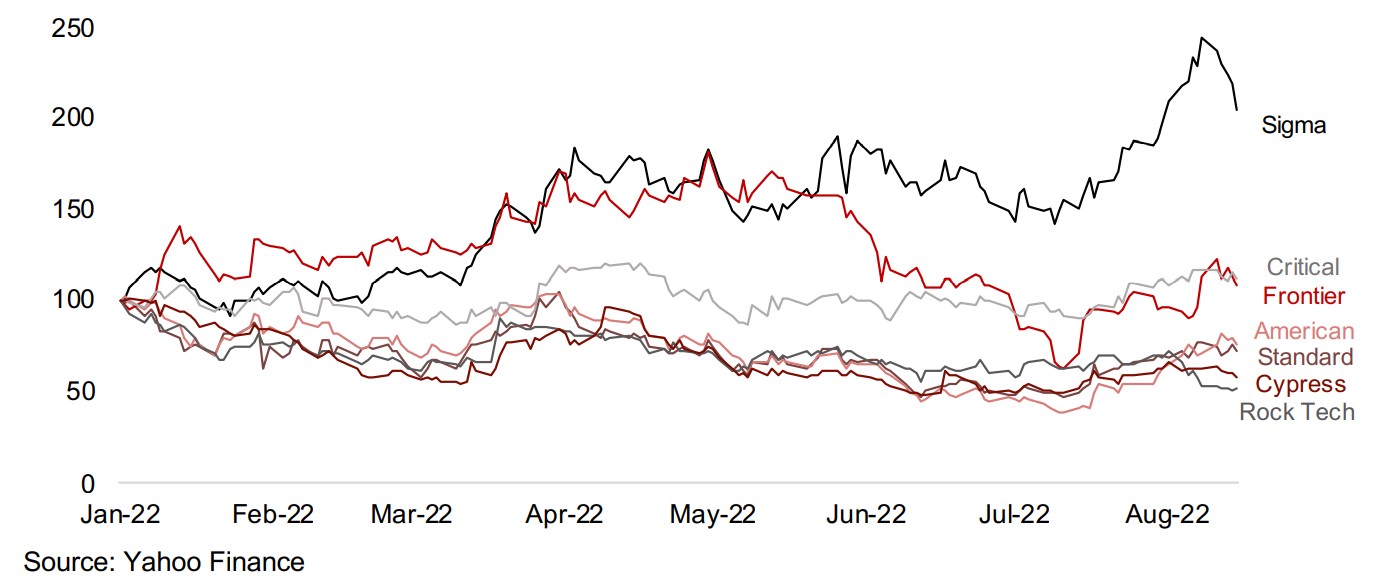

Most large TSXV lithium stocks seeing a rebound along with the market

Lithium has been one of the only major industrial metals that has resisted the

downtrend since Q2/22, and is down only -3% off its highs, and still up 74% YTD,

over three times the 22% gains for nickel, which is the second-best performer this

year (Figure 7). In contrast to the other base metals, which are facing pressure from

the overall expected downtrend in global economic growth, lithium has a very strong

sector specific driver in its use for batteries in the surging electric vehicle industry,

while raw supplies from Australia and refining capacity in China remains tight. This

lithium price resilience has been the main driver making lithium stocks the exception

for the TSXV industrial metals, with nearly the entire group (Figure 8) gaining over the

past two months, except for Rock Tech, which is down -15% (Figure 9).

However, the lithium strength has not been enough to support the share prices of the

entire group YTD, with the broader downtrend in equity markets seeing four stocks,

American, Standard, Cypress Dec and Rock Tech all down over 30% this year. For

the rest of the group, Critical is near flat and Frontier only up mid-single digits, and

only Sigma has seen major gains, up 86% YTD, as it could start generating revenue

by this year and has recently upgraded its expected production with a third phase.

So while risk-on sentiment has lifted the lithium stocks over the past two months, it

still has not been enough to offset the much stronger risk-off sentiment, especially

hitting riskier small cap stocks, that prevailed earlier in the year.

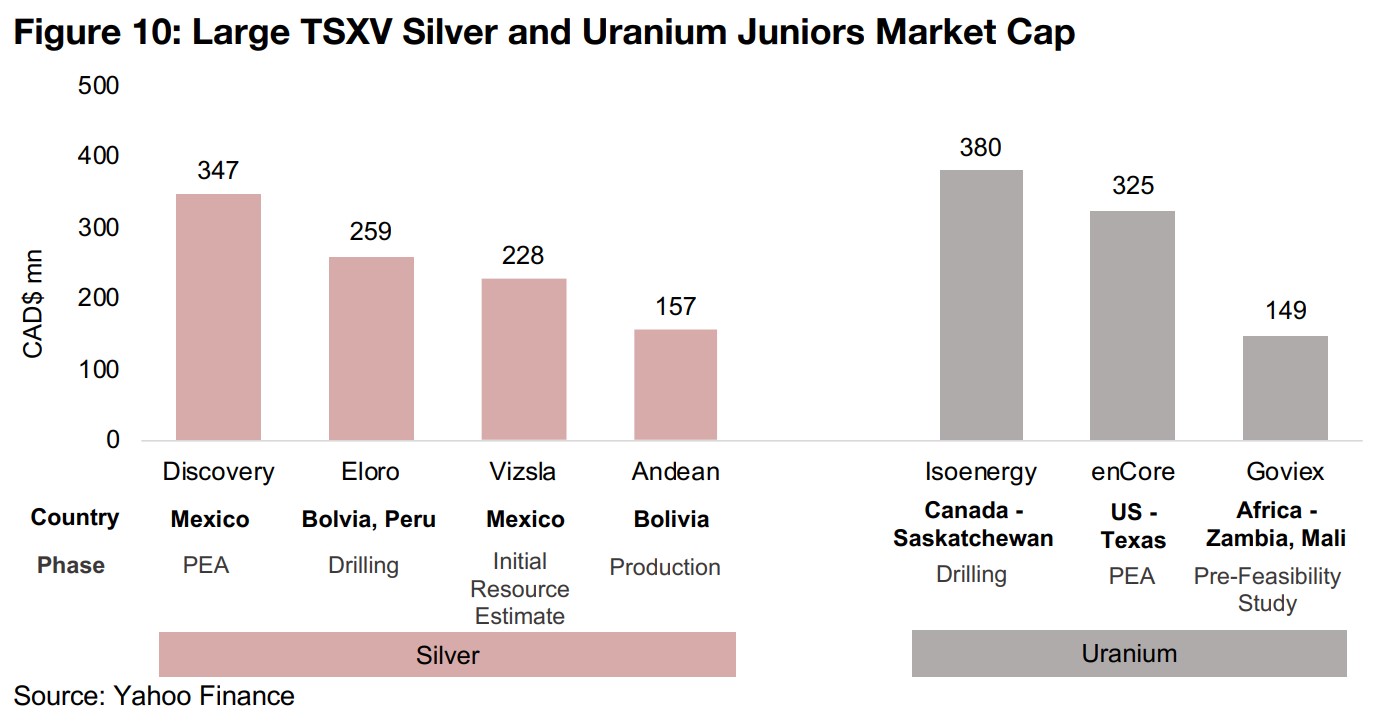

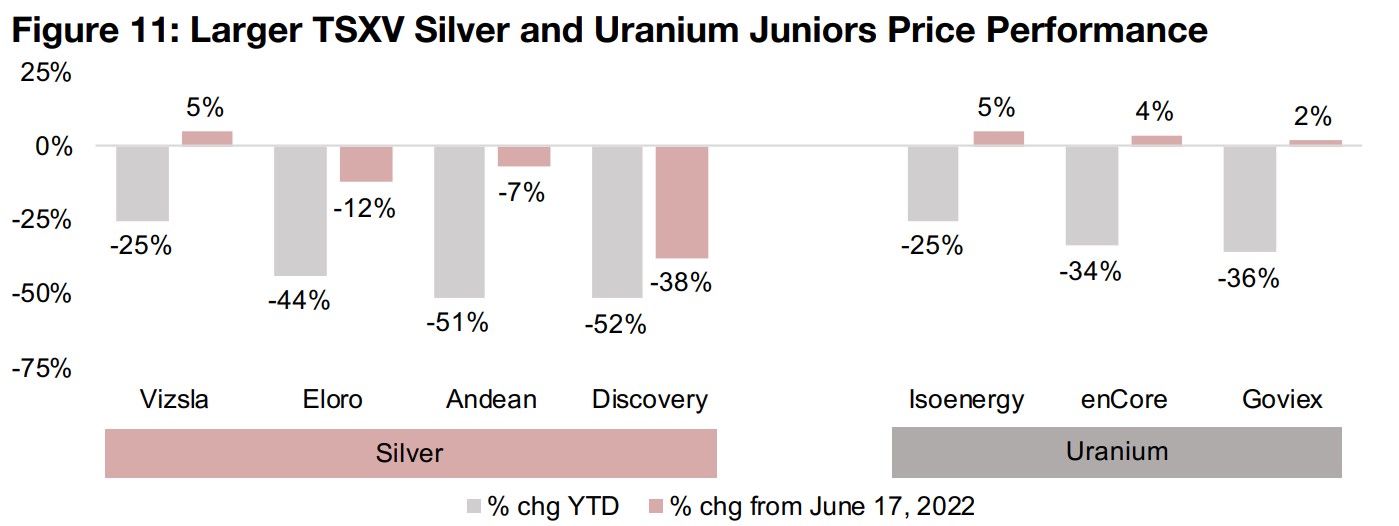

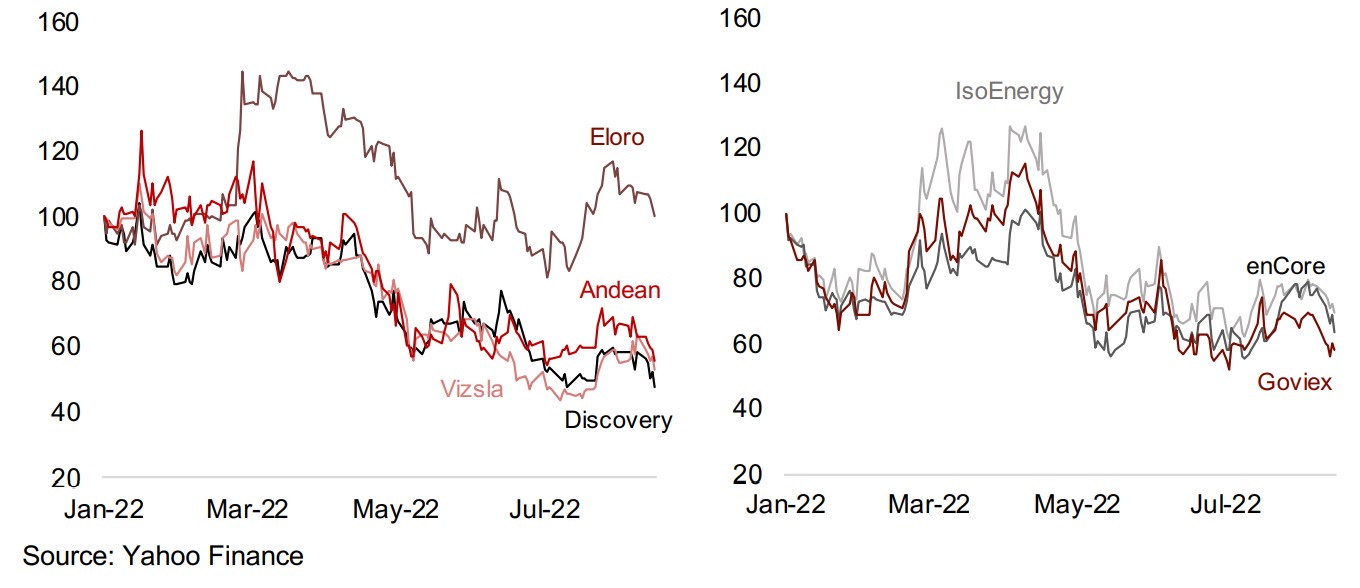

Large TSXV silver stocks lagging in rally, uranium stocks edge up

The TSXV silver and uranium stocks do not have near US$1bn or larger market cap

companies like the base metals or lithium groups, with the largest silver stock,

Discovery, at CAD$347mn and largest uranium stock, IsoEnergy, at CAD$380mn

(Figure 10). The silver stocks are all down 25% or more YTD, mainly because silver's

decline by -29% off its 2022 highs and -16% YTD, with only Discovery seeing slight

gains in the rally, up 5% (Figure 7). While the uranium stocks have also seen major

declines YTD, also of 25% or more, as the uranium price has slid 29% off its 2022

highs, all the stocks have made mid-single digit gains in the rally since June.

It is interesting that both the lithium and uranium stocks have seen more support over

the past two months versus the base metals, gold and silver. We note that both of

these sectors have seen support from markets especially in the past year as they are

both key parts of the shift to low emissions 'green' energy. Lithium is critical for use

in low emissions electric vehicles, while uranium is key for its use in nuclear electricity

generation, which is the lowest emission power source by far, even compared to wind

and solar.

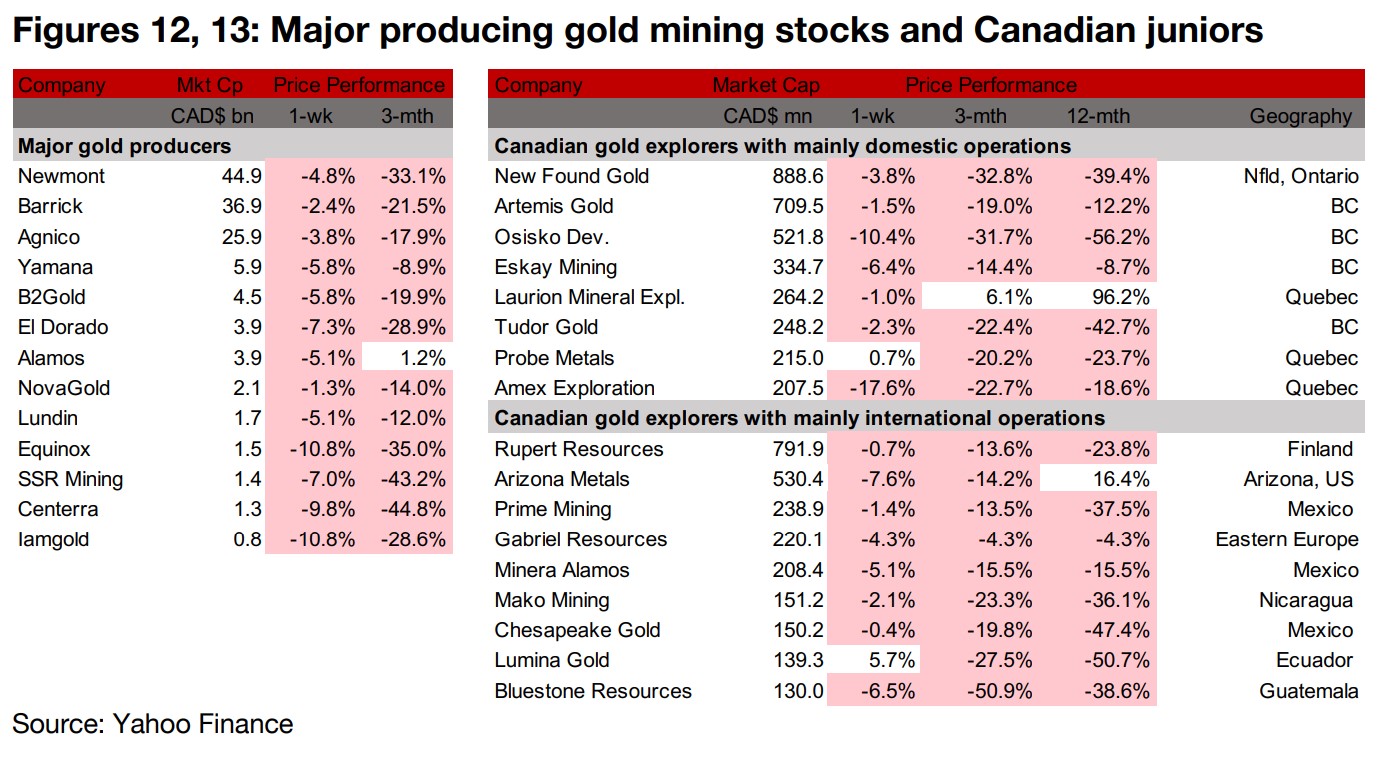

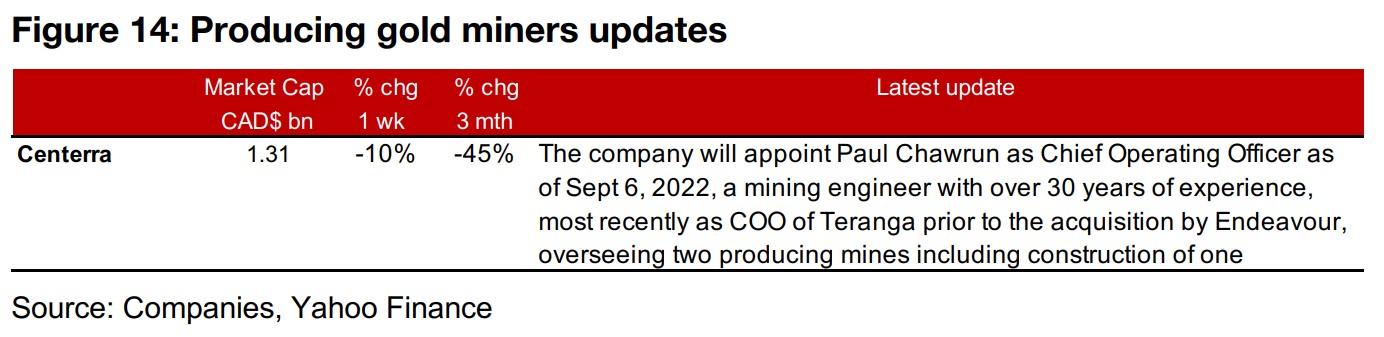

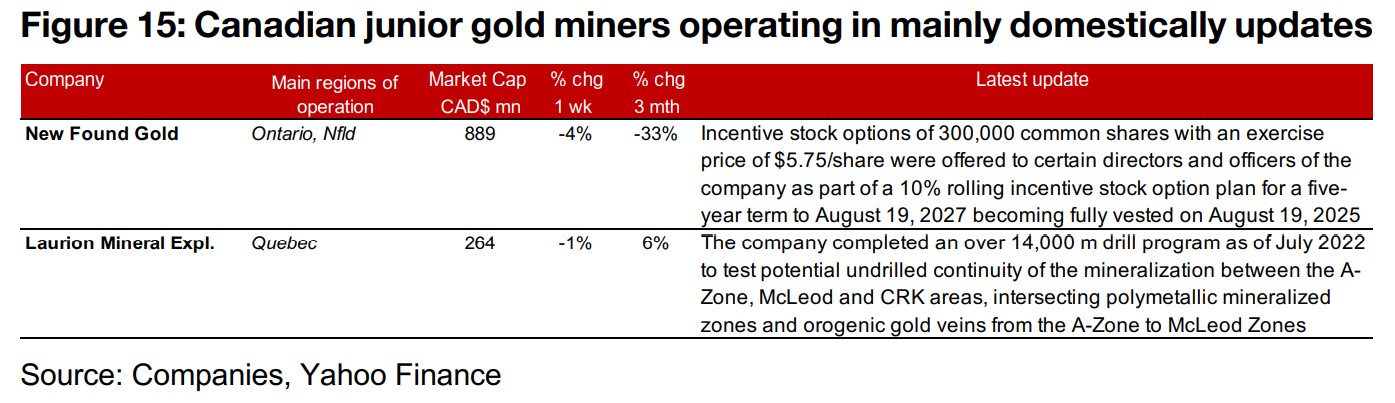

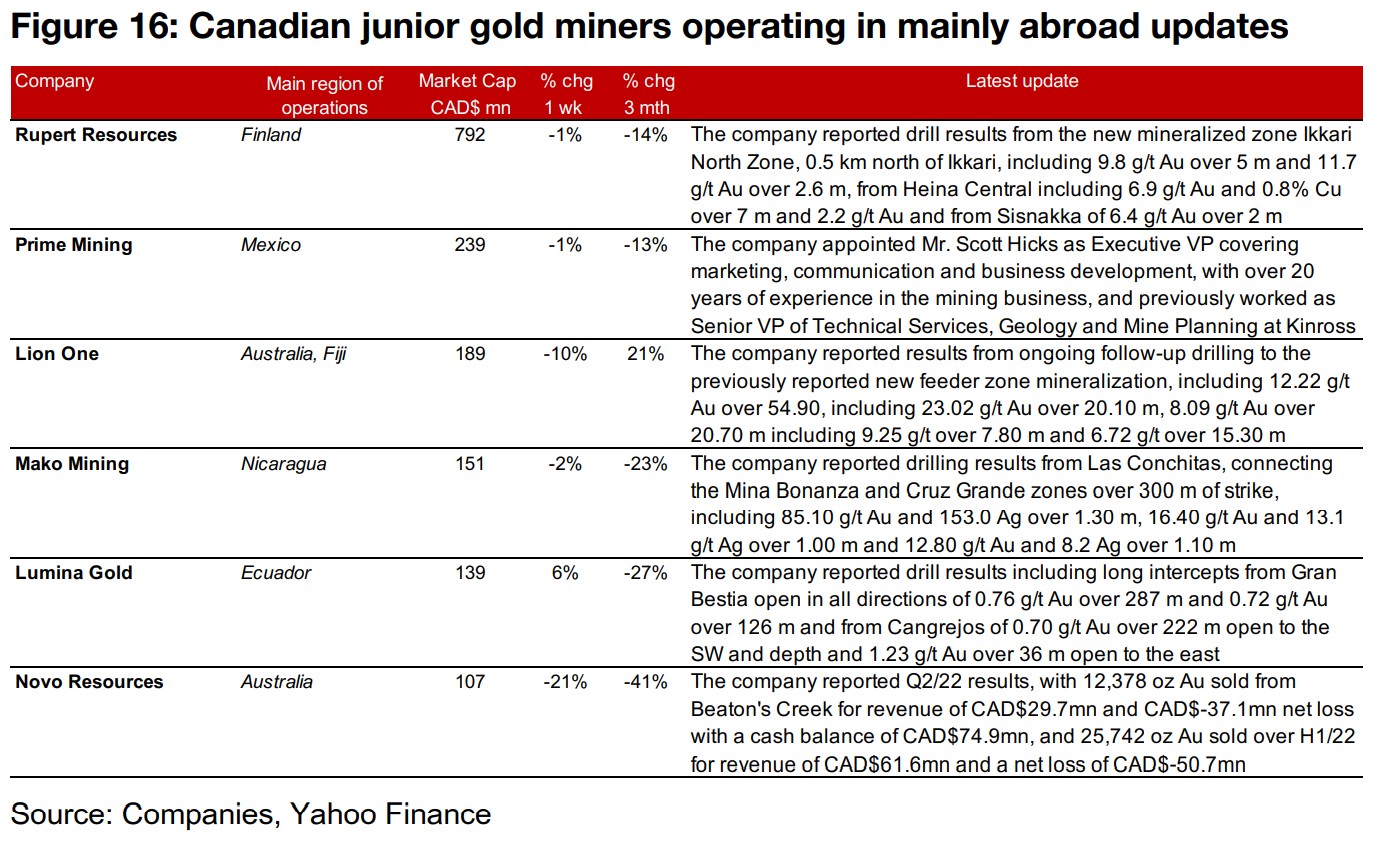

Producing and Canadian junior miners down on gold and equity drop

The producing gold miners were all down (Figure 12) and the large TSXV gold miners nearly all dropped (Figure 13) on the decline in both gold and equity markets. For the producers news was limited with a lull after the end of the Q2/22 reporting season last week, with a press release only from Centerra, which appointed Paul Chawrun as its Chief Operating Officer (Figure 14). For the Canadian miners operating mainly domestically, New Found Gold offered incentive stock options to directors and officers of the company with an exercise price of $5.75/share and Laurion announced that it had completed an over 14,000 m drill program as of July 2022, intersecting polymetallic mineralized zones and orogenic gold veins from the A-Zone to McLeod Zones (Figure 15). For the Canadian juniors operating mainly internationally, Rupert reported drill results from the new mineralized zone Ikkari North, Prime Mining appointed Mr. Scott Hicks as Executive VP covering marketing, communication and business development and Lion One reported results from the follow-up drilling at its new feeder zone. Mako Mining reported drilling results from Las Conchitas, connecting the Mina Bonanza and Cruz Grande zones, Lumina reported drill results from Gran Bestia and Cangrejos and Novo Resources reported Q2/22 results, with revenue of CAD$29.7mn and a net loss of CAD$-31.7mn (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.