November 08, 2024

How to Maximize Returns from this Secular Silver Boom

While most investors are focused on following the latest fleeting trend, something important has been going on in this overlooked corner of the market.

Silver has skyrocketed over the past 12 months.

Since October 2023, the silver price has soared by 38%. Meanwhile, the tech-heavy and “unbeatable” S&P 500 index has delivered 33.6%.

In other words, silver has managed to trounce the index that includes “the Magnificent Seven” stocks (Alphabet, Apple, and others).

And not only that…

Silver has also outperformed the broad commodity space.

Over the past 12 months, the Bloomberg Commodity Index has fallen by about 6.3%.

It means that silver has outperformed the index by more than 44 percentage points.

Here at the Canadian Mining Report, we follow commodity trends and report on the latest developments in the exciting Canadian mining space.

Today, we’re looking at silver. And specifically, silver mining companies.

Silver Stocks Have Delivered Excellent Performance

As we have just said, silver has delivered stellar performance over the past 12 months.

But our mantra here at the Canadian Mining Report is “play it with stocks.”

Yes, you can get exposure to the underlying metal by holding one of the commodity-focused ETFs… but you may miss out on the upside that mining companies could offer.

Case in point…

Silver has soared by 38% over the past year. That’s excellent.

An exchange-traded fund that tracks silver miners, Amplify Junior Silver Miners ETF (SILJ), has returned 50.5%.

We hope you start to see the pattern… Stocks tend to do better than the underlying metal in a bull market.

However…

Some individual mining companies have doubled that performance.

Silvercorp Metals Inc. (NYSE American:SVM, TSX:SVM) has soared by 102.5% over the same time period.

In other words, Silvercorp has delivered twice the performance of a silver mining ETF and almost three times the performance of silver itself.

(We need to make the necessary disclaimer here that past performance may not indicate future results. Investment involves risk. Talk to your financial advisor before making investment decisions.)

How did Silvercorp manage to pull this off?

And can investors expect this company to outperform in the future?

Let’s take a closer look…

The Silver Bull Market Continues

Before we get to the company, let’s talk about silver itself. The share price of a miner such as Silvercorp is tied to the performance of the underlying metal.

As for silver, there are these powerful forces that, we believe, will continue driving its price higher.

First, demand for the metal is surging. This year, it’s projected to reach the second-highest level in history, at about 1.2 billion ounces. Both industrial and investment demand are responsible for the surge.

On the industrial side, silver demand is supported by photovoltaics (which are part of the solar energy revolution), 5G, and electric vehicle integrations.

A new research paper says by 2050, solar energy production could require 85%-98% of the current global silver reserves.

This could potentially add an enormous and long-lasting catalyst to the price of silver.

The newest wave of demand comes from AI. Silver is being used in semiconductor fabrication, sensors, connectors, and other applications.

Second, the silver market is in a state of deficit and has been in that state since 2021. Demand grows faster than supply, which is bullish for the price of silver. This year, analysts forecast that the demand-supply imbalance will persist. This, again, will continue supporting the long-term bull market in silver.

Finally, there is gold. Gold and silver are strongly correlated. Investors use both these metals as hedges against future uncertainty and potential crises.

Gold has been performing very well lately. Its price has risen by about 30% this year.

And it’s our belief that gold will continue rising due to the uncertainty about the global economy. Silver will potentially enjoy a boost from its close relationship with the yellow metal.

How to Take Part in This Bull Market

As we mentioned, getting exposure to silver is quite easy.

A low-cost ETF of silver miners might be a good start. However, investors should be aware that ETF portfolios might not hold the best mix of silver stocks. There will be “bad apples” dragging the performance of the fund down.

Another way of leveraging the price of silver is directly owning silver mining companies.

We mentioned Silvercorp Metals Inc. (NYSE American:SVM, TSX:SVM) at the beginning of this piece.

The company delivered excellent performance compared to that of the metal itself. Its share price doubled over the past 12 months.

But, in our view, the company has plenty of upside potential owing to its strong underlying business model.

First off, Silvercorp has a diversified portfolio of producing mines and development-stage projects in China and Ecuador.

Silvercorp so far has produced over 100 million ounces of silver and has consistently generated profits from its mines, enabling the company to return over $200 million to shareholders through dividends and share buybacks.

It has over $200 million in cash and no debt, making it one of the strongest balance sheets in the industry.

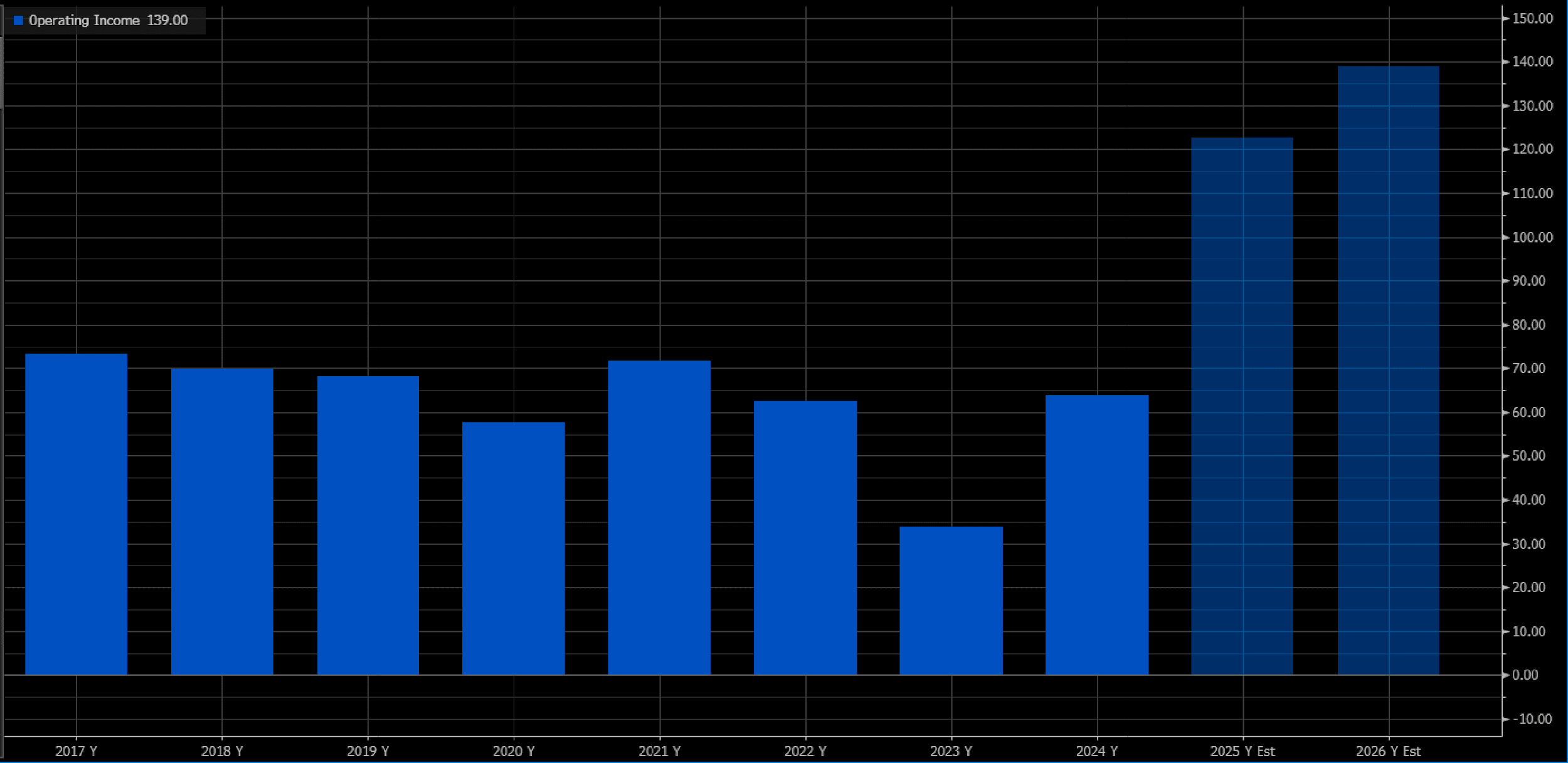

Better yet, analysts predict that the company’s operating income will continue growing in the years ahead.

Between 2024 and 2026, it could potentially grow by 117%.

Image: Bloomberg

(Note that analyst forecasts could be incorrect and that future operating results are inherently difficult to predict. Consult your financial advisor before taking any investment action.)

In other words, Silvercorp is firing on all cylinders.

And it is more profitable than its industry peers. The company’s trailing twelve months EBITDA margin is 45%, while its peers’ is just ~20%.

Silvercorp’s trailing twelve months return on equity (a popular profitability metric) is 9.4%. Its peers’ is negative 0.3%.

In other words, Silvercorp has been outperforming its peers by multiple metrics.

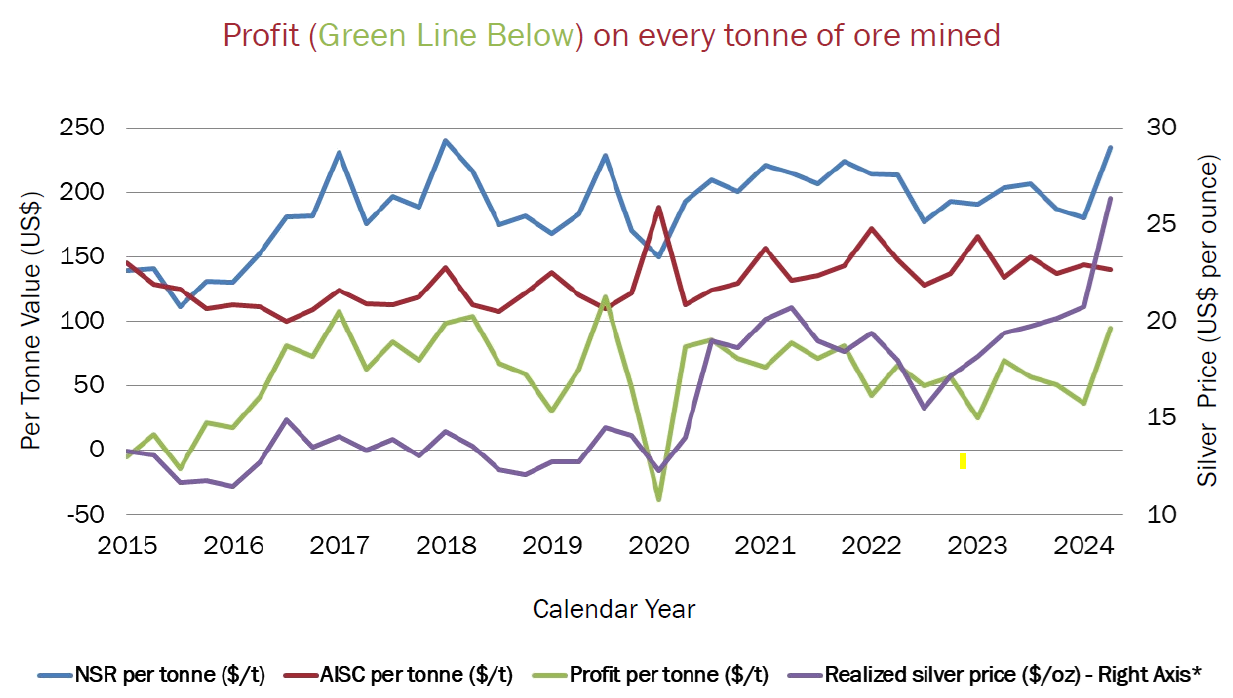

Across industries, a defining attribute of a successful business is its ability to generate free cash flow—a principle to which Silvercorp is firmly committed.

This is clearly illustrated in a chart from the company’s corporate presentation. Despite inflationary cost pressures creeping into the global mining sector, Silvercorp has managed to maintain a stable cost profile (represented by the red line). Consequently, as silver prices increase (the purple line), the company achieves profit margin increases (the green line)—a feat not achieved by many other miners.

Image: Silvercorp

And it continues to invest in the expansion of its existing mines, as well as building and exploring its Ecuador projects. Silvercorp plans to start production at its fully permitted El Domo copper-gold project in 2026.

Silvercorp also has a meaningful investment in a silver developer New Pacific Metals Corp. This investment will provide Silvercorp with exposure to two open-pittable world-class silver deposits in permitting stages.

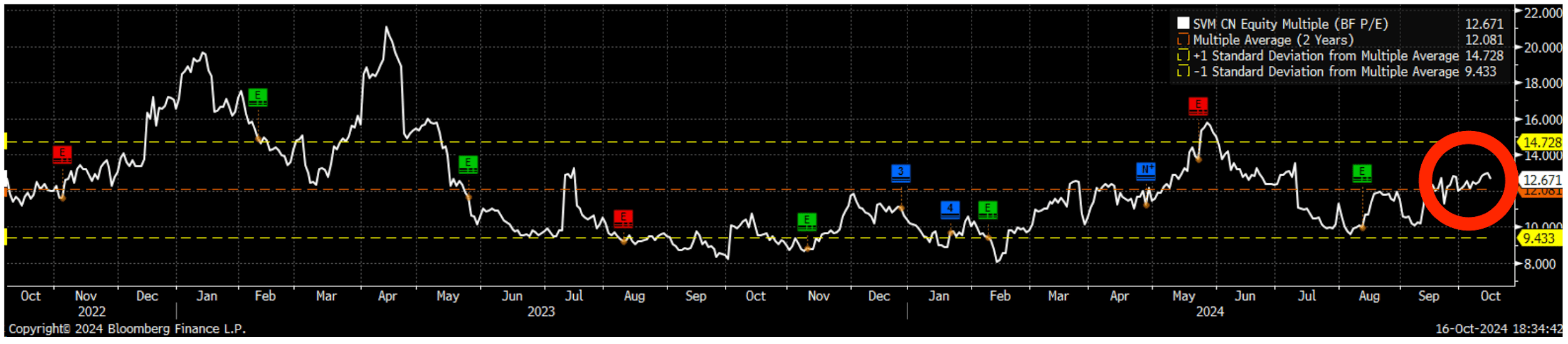

Finally, Silvercorp’s shares represent good value right now, in our view.

The company’s price-to-earnings ratio (or P/E) looks cheap at 12.7x.

The chart below shows that the company’s shares are trading close to their two-year average based on this metric. However, back in 2023, they reached their two-year high of 21.1x. And Silvercorp’s operating performance has remained remarkable.

As a result, we wouldn’t be surprised if the market re-values the company’s shares higher based on its operating track record and the excellent outlook for its earnings.

In our opinion, Silvercorp Metals Inc. (NYSE American:SVM, TSX:SVM) shares have plenty of upside potential.

This company is one of our favorite investment ideas for the ongoing silver bull market.

We invite investors to learn more about Silvercorp .

Sign up to receive our future articles and updates.

Disclosure

The Canadian Mining Report has been retained by Silvercorp Metals Inc. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Silvercorp Metals Inc.. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Silvercorp Metals Inc. and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient.

Read More