December 23, 2024

Hawkish Fed Hits Markets

Author - Ben McGregor

Canada and US import tariffs remain low

Trump trade threats continued to cause fallout, this time in the Canadian government with the Finance Minister resigning, while both countries actually have very low import tariffs compared to many other large nations, apart from the dairy sector.

Hawkish Fed Hits Markets

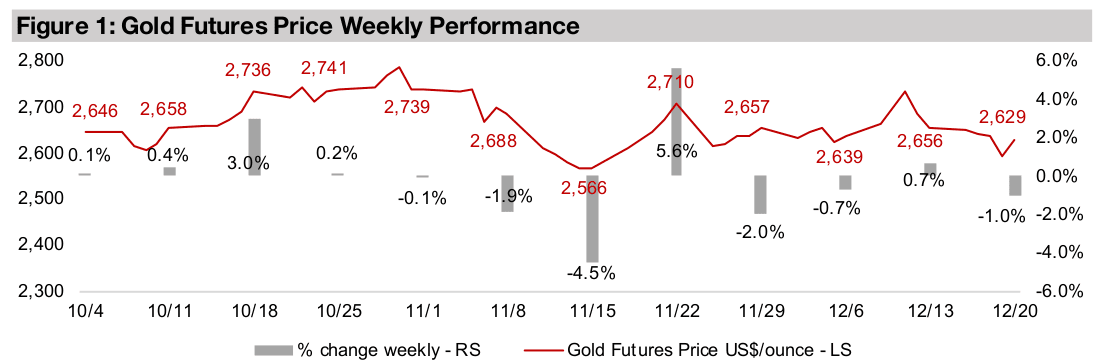

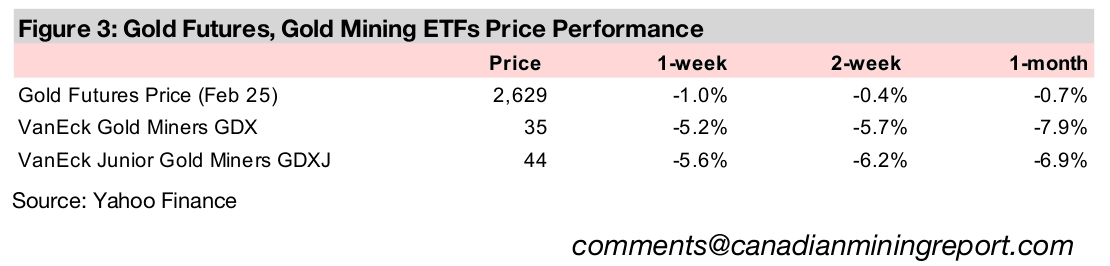

Gold was down -1.0% to US$2,629/oz, leaving it near flat over the past two weeks,

as the Fed came through with its expected 0.25% rate hike. However, commentary

from Chairman Powell indicating that the rate of interest rate cuts would slow was

taken as very bearish by the markets. The Fed lowered its unemployment forecast to

4.2% from 4.4%, however, indicating it was seeing improvement in the jobs situation.

Overall this led to a spike in the US$ and bond yields and slump in equity markets,

with the S&P and Nasdaq both down -2.2% and the Russell 2000 losing -4.3%.

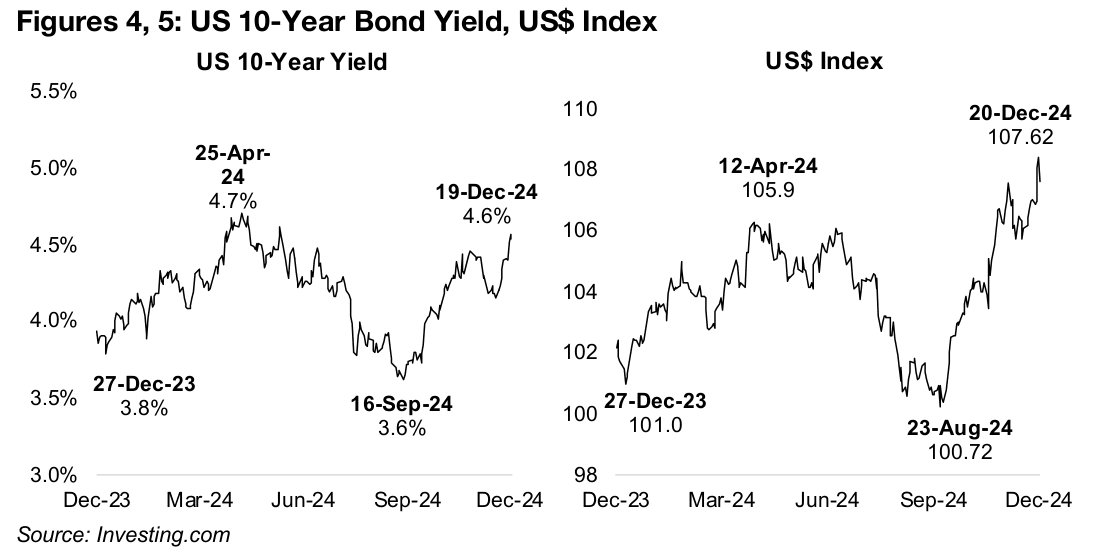

The rising US$ and bond yields were likely the main driver of the decline in gold,

offsetting the upward driver coming from a spike in risk indicated by a surge in the

VIX volatility index. The US 10-year bond yield at 4.6% is now near its highs of the

past year, with a peak at 4.7% in April 2024, and the US$ Index is at by far its highest

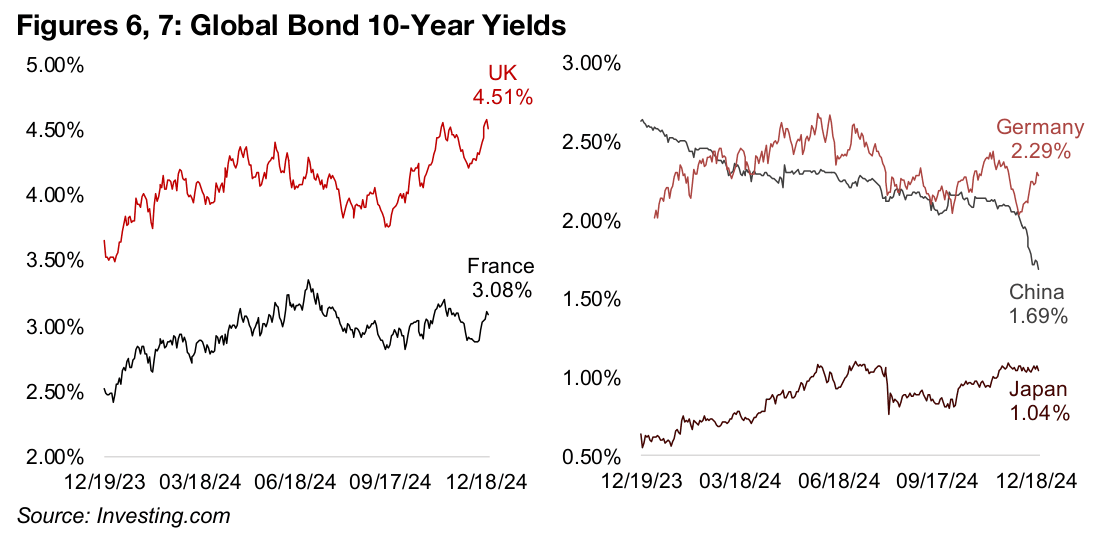

level for 2024 at 107.62 (Figures 4, 5). European yields have also risen over the past

month, with the 10-year for the UK, Germany and France all up, and the UK at its

highs for the year (Figures 6, 7). Japan yields have been flat, and of the largest

economies, only China has seen a major decline in bond yields over the past month.

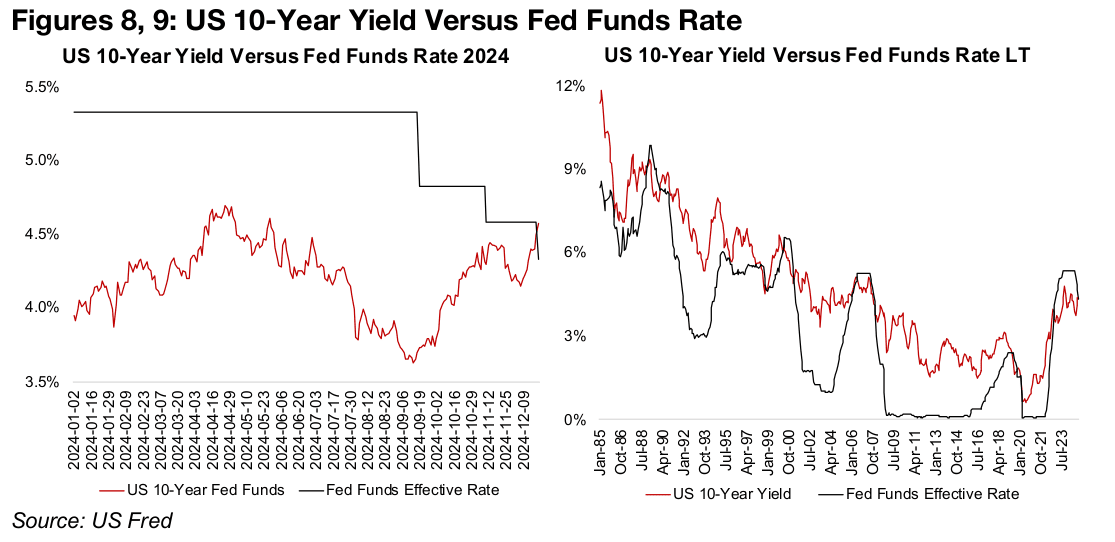

There has been a trend over the past few months where bond yields are rising even as central banks cut rates, with the US 10-year yield rising consistently from September 2024 even as the effective Fed funds rate, a key short-term rate, has come down to 4.26% from 5.33% (Figure 8). The US 10-year has also been below the Fed Funds rate for most of the past year, which is rare, as long-term rates are generally higher than short-term rates to account for the higher risk over time. This inversion where the Fed rate rises above the US 10-year yield has occurred only a few times since 1985, in 1989, 2000, 2007, which all preceded major recessions (Figure 9).

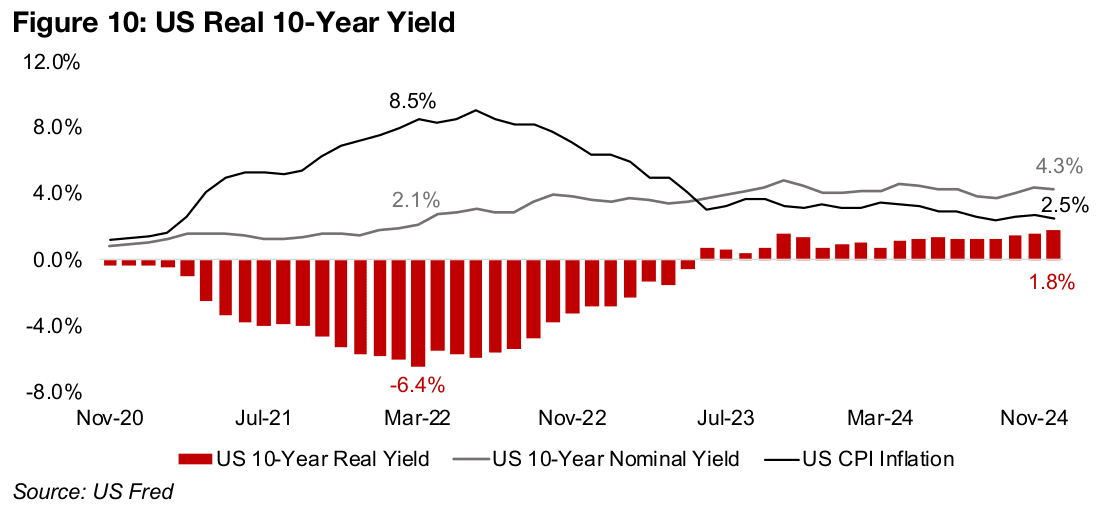

Gold continues to gain even as real yields rise

Rising real yields tend to be negative for the gold price, as they imply a higher opportunity cost of holding yieldless gold instead of bonds with increasing returns. However, while real yields have risen consistently from their lows at negative -6.4% in March 2022, rising above zero in mid-2023 and hitting multi-year highs of 1.8% in November 2024, gold has risen through this entire period (Figure 10). Part of gold’s outperformance during this period will have been because of a rising premium for political risk, as well as broader economic risk. However, recently there have also been strong monetary undercurrents at play, with the global money supply, which is a key long-term driver for gold, having increased for the past several months.

While this week the Fed’s shift to a more hawkish stance was in focus, it is important

to note that they indicated only a slowdown in cuts, not that they would stop, or that

rates would increase soon. Recent cuts by other major central banks also seem to

indicate that rates will continue to come down in 2025, and even the most hawkish

scenario would likely only be flat rates. This would mean a continued expansion of

the money supply and even a potential resurgence of inflation, which the market may

already be pricing in, and driving up bond yields to compensate for this scenario.

This could explain some of the resilience of gold, even as real yields rise, with the

market effectively subtracting higher levels of inflation to get to their expected real

yield than what we are actually seeing in the current CPI. Both an expansion of the

money supply and the way it effects CPI inflation will be key drivers to watch for gold

heading into next year, as will be any major shifts in the geopolitical risk premium.

Canadian political turmoil with Trump trade policy the catalyst

Political turmoil continued this week, this time domestically, with the resignation of

the Finance Minister in Canada a major hit to the current government. The departure

came after talks between the Prime Minister and Finance Minister over the budget

with the former planning to increase expenditure while the latter was looking to

conserve funds to brace for potential fallout from Trump’s expected tariff increases.

The resignation has led to a cabinet reshuffle, raised calls by the opposition

Conservative party for a confidence vote could even drive the Prime Minister to resign

and trigger an election. The outgoing Finance Minister had negotiated trade

agreements with the first Trump administration and relations had reportedly not been

amicable. It remains unclear whether a different Liberal representative or even a new

Conservative government would improve the tone of the trade talks.

Canada has already agreed to some of Trump’s requests related to border security,

and could also increase military spending, which is another issue raised by the new

President. While these moves could help ease trade relations, it seems that tariffs are

very likely to rise, but it is still not clear on which products, and by how much.

Certainly having strong representatives in a period of expected aggressive moves by

the US will be key for Canada as it is the country’s largest trading partner.

That the 25% tariff across the board tariffs that Trump has claimed will actually be

applied seems unlikely. Such a move would not be straight forward to implement

given wide variations in trade across different sectors, and seems to be more of an

opening salvo indicating tough negotiations. We expect that Canada may be able to

negotiate more favourable trade terms for the metals sector especially, as it such a

major source for US imports of all four major metals markets, gold, copper, iron ore

and aluminum, and a major supplier for some smaller markets, including uranium.

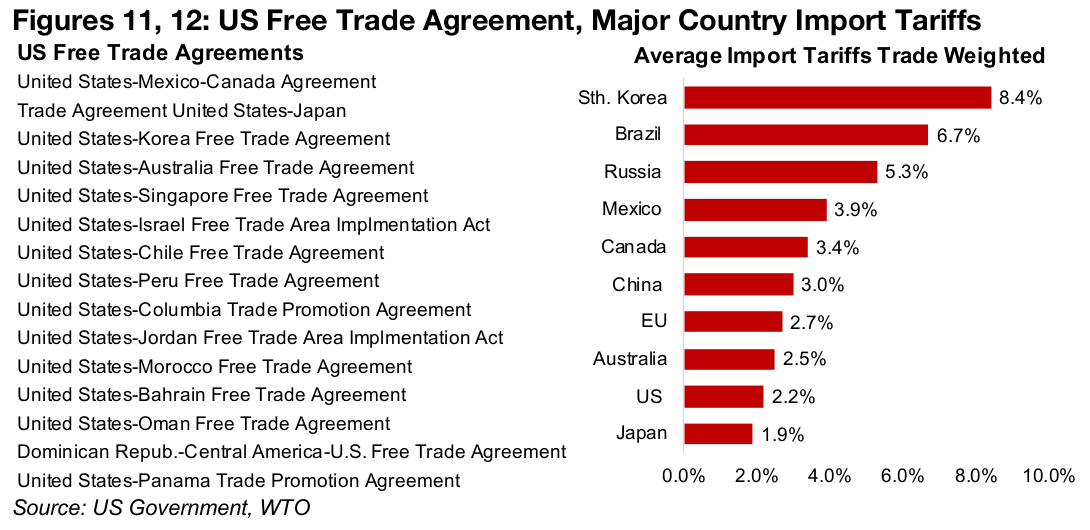

The starting point for negotiations will be the existing trade agreements the US has

with several nations, with the largest being the US-Mexico-Canada Agreement, the

Trade Agreement between the US and Japan, the US-Korea Free Trade Agreement

and the US-Australia Free Trade Agreement. The other free trade agreements are

mainly with smaller-sized economies (Figure 11).

Figure 12 shows the trade weighted average import tariffs for the largest global

economies, with South Korea, Brazil and Russia the highest, at 8.4%, 6.7% and 5.3%,

and with the latter two having no free trade agreement with the US it seems that they

could face major tariff increases. Mexico and Canada, which have been a focus of

the new President regarding trade, have relatively high average tariffs, at 3.9% and

3.4%, although the existing agreements could offset the severity of new tariffs.

Neither China or the EU have particularly high average import tariffs at 3.0% and

2.7%, although with no existing free trade agreements with the US, they could come

under scrutiny of the new US government. Australia, the US itself and Japan have the

lowest average import tariffs of the major economies, at 2.5%, 2.2% and 1.9%. The

low level of tariffs for the US currently therefore does give some scope for hikes

before they reach the average level of many of the other major nations.

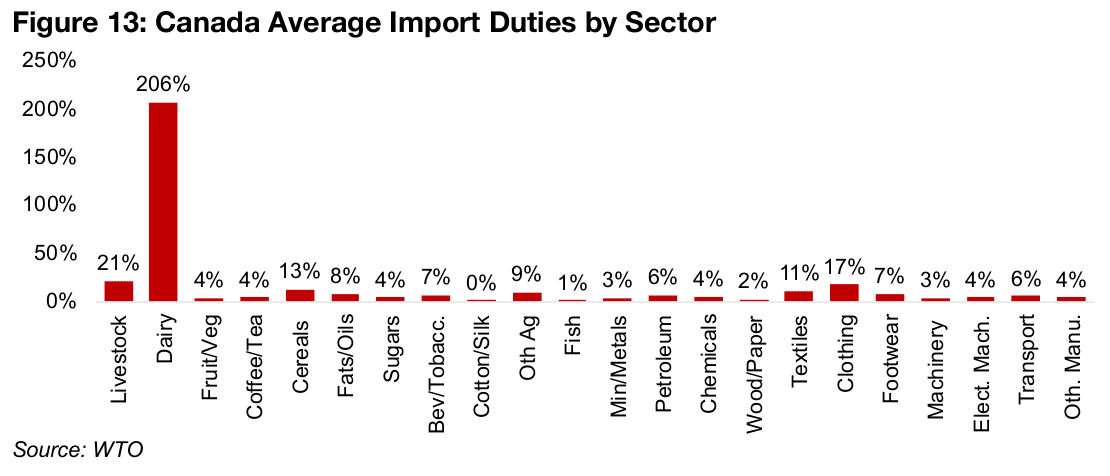

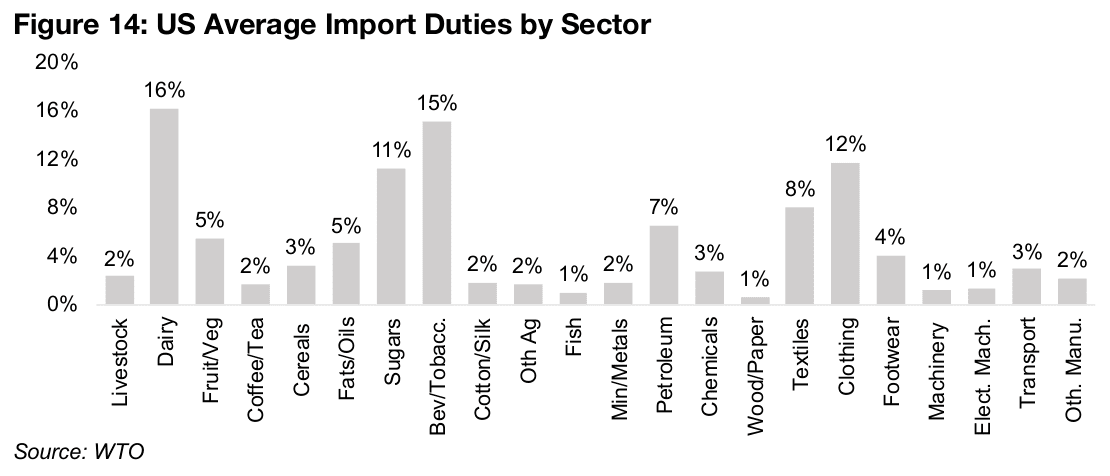

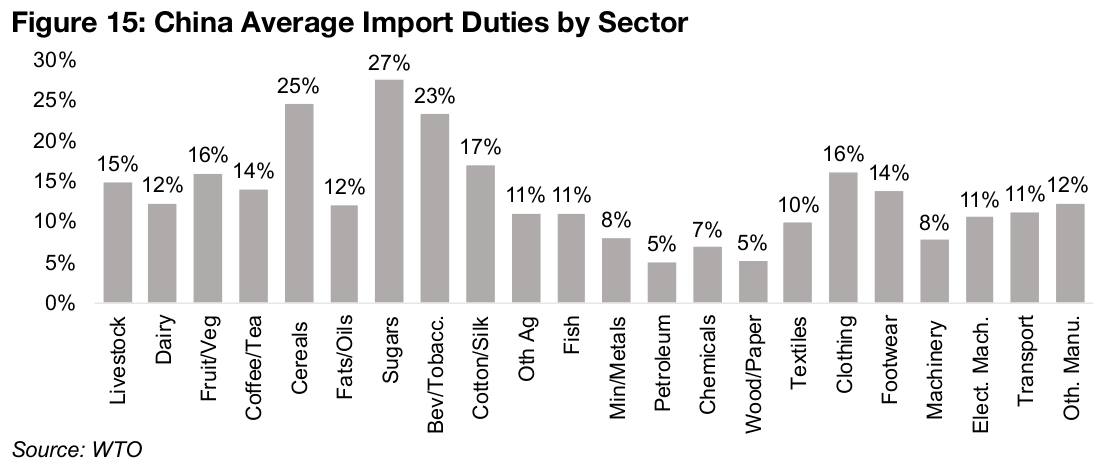

Canada’s highest import tariffs by far on dairy

On a sector basis, Canada’s highest import tariffs by far are for dairy, at a huge 206%, with the next highest at just a tenth of this level, livestock at 21.0% (Figure 13). The US has previously focussed on the extreme tariffs for this industry, although it also has its highest import tariffs on dairy, although at a much lower 16% (Figure 14). For China, most sectors have reasonably high average import tariffs compared to the US and Canada, with dairy an exception, with China at just 12.0% (Figure 15).

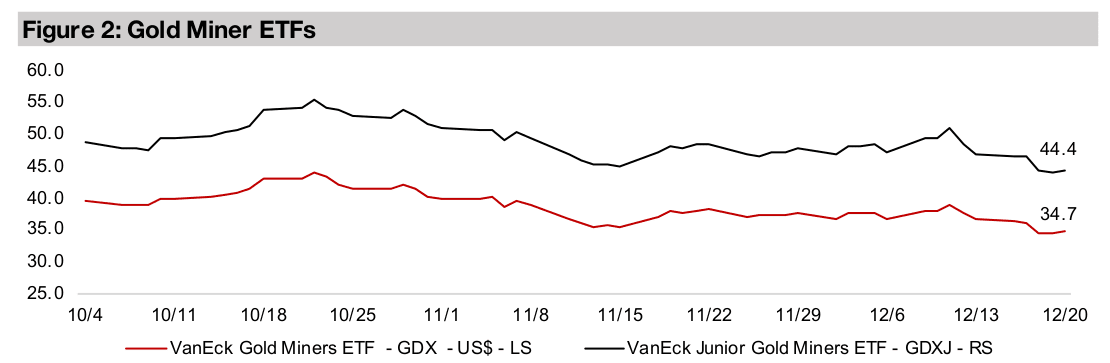

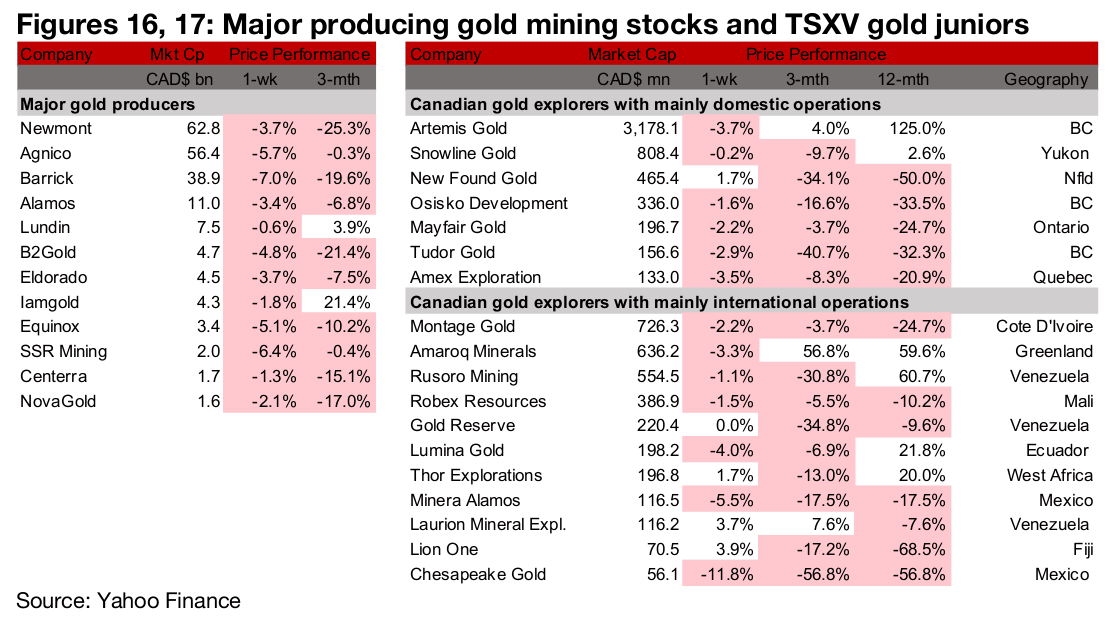

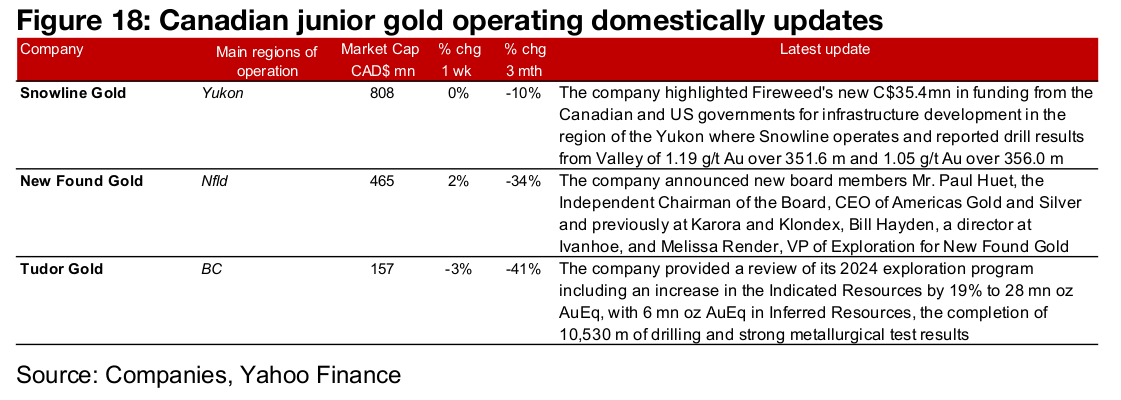

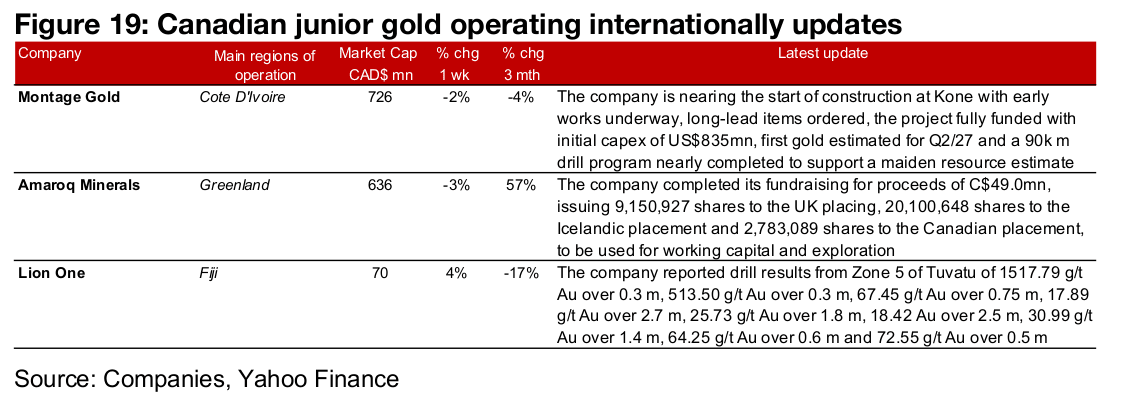

All major gold producers and most large TSXV gold down

All the major gold producers and most of large TSXV gold was down (Figures 16, 17). For the TSXV gold companies operating domestically Snowline Gold highlighted Fireweed’s new government funding for infrastructure in the same region the company operates in the Yukon and drill results from Valley, New Found Gold announced new board members and Tudor Gold provided a review of its 2024 exploration program (Figure 18). For the TSXV gold companies operating internationally Montage reported it was nearing the start of construction at the Kone project, Amaroq Minerals completed its fundraising and Lion One Metals reported drill results from Zone 5 of Tuvatu (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.